China National Nuclear Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China National Nuclear Power Bundle

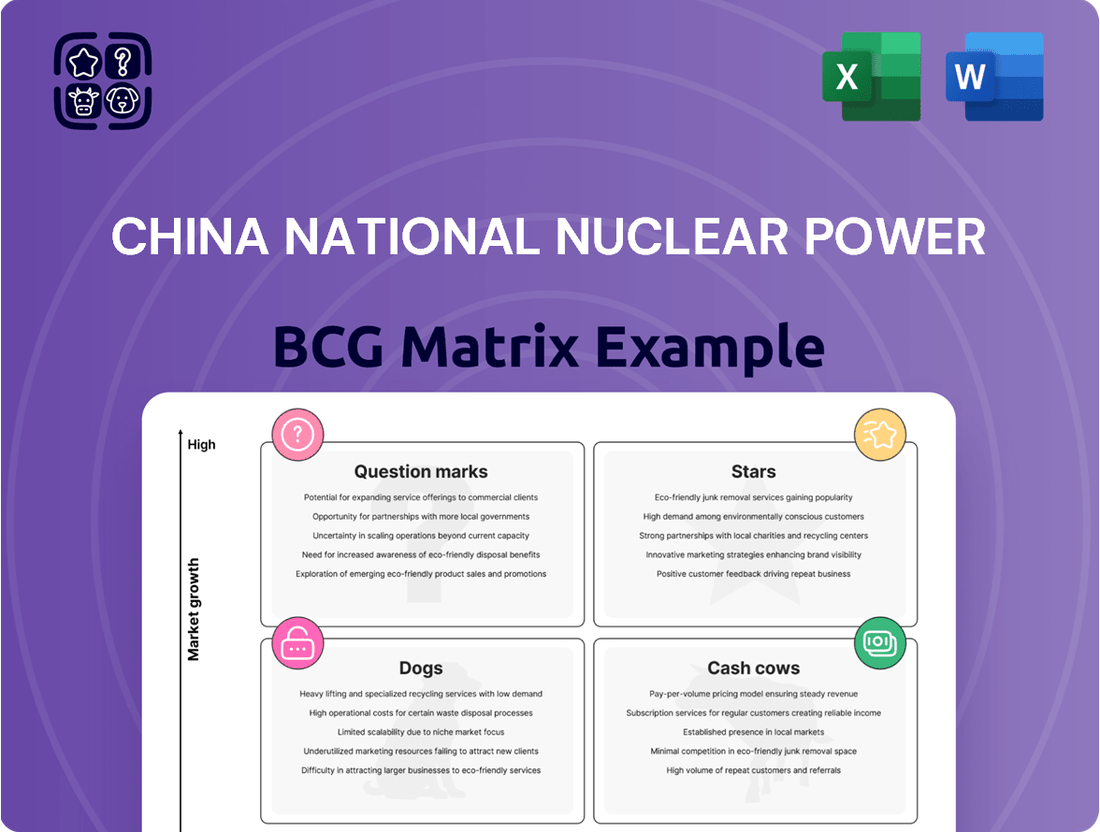

Curious about China National Nuclear Power's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock the strategic advantage, dive into the full BCG Matrix report. It provides a comprehensive quadrant-by-quadrant analysis, revealing actionable insights and a clear roadmap for optimizing their nuclear power assets and future investments.

Don't miss out on the complete picture. Purchase the full China National Nuclear Power BCG Matrix today for data-backed recommendations and the strategic clarity you need to make informed decisions.

Stars

China National Nuclear Power's (CNNP) ongoing deployment of the Hualong One reactor is a clear Star in its BCG matrix. These advanced, domestically developed units are the backbone of China's ambitious nuclear power growth, securing a dominant position in new reactor construction projects.

The Hualong One's success is underscored by its significant electricity generation capabilities. Each operational Hualong One reactor is capable of producing over 10 billion kilowatt-hours of clean electricity annually, directly supporting China's aggressive clean energy targets and demonstrating its market leadership.

China National Nuclear Power (CNNP) is aggressively expanding its nuclear power capacity, positioning its new plant construction as a Star in the BCG Matrix. This segment benefits from strong government support and a rapidly growing energy demand. In April 2025, China approved 10 new reactors, underscoring the rapid pace of development.

With over 27 million kilowatts of projects currently under construction in 2025, CNNP is a dominant player in this high-growth sector. The company's extensive pipeline and operational expertise solidify its Star status, indicating significant future revenue potential and market leadership.

China National Nuclear Power (CNNP) is a key player in China's ambitious nuclear power expansion, a sector experiencing substantial growth. The nation's target of 200 GW of nuclear capacity by 2035 underscores the strategic importance of CNNP's role in this national energy transition.

Technological Self-Reliance in Nuclear Equipment

Technological self-reliance in nuclear equipment is a cornerstone of China National Nuclear Power's (CNNP) strategy, placing it firmly in the Star category of the BCG matrix. By 2024, China has achieved full localization for critical nuclear plant components, meaning they control the technology for essential parts independently. This independence is crucial for maintaining a competitive edge in a sector with significant growth potential both domestically and internationally.

This self-sufficiency translates into tangible benefits for CNNP.

- Independent Control: CNNP can now design, manufacture, and maintain key nuclear equipment without reliance on foreign suppliers, reducing geopolitical risks and supply chain vulnerabilities.

- Cost Efficiency: Localized production often leads to lower manufacturing costs and improved operational efficiency, enhancing profitability.

- Market Dominance: With a strong domestic foundation and advanced technology, CNNP is well-positioned to capture a larger share of the rapidly expanding global nuclear energy market, projected to see substantial growth in the coming years as nations seek cleaner energy solutions.

Strategic Contribution to National Energy Security and Decarbonization

China National Nuclear Power (CNNP) plays a pivotal role in bolstering the nation's energy security and driving its decarbonization efforts. Nuclear power is a cornerstone of China's strategy to achieve carbon neutrality by 2060, positioning CNNP's core operations as a high-growth and strategically crucial sector.

This direct alignment with national priorities ensures robust government backing and consistent investment for CNNP. In 2023, China's installed nuclear capacity reached approximately 55.5 GW, with CNNP being a dominant player. The country plans to add significantly more nuclear power capacity in the coming years, underscoring the strategic importance of CNNP's contributions.

- Energy Security Pillar: Nuclear power reduces reliance on imported fossil fuels, enhancing China's energy independence.

- Decarbonization Engine: CNNP's operations are critical for meeting China's ambitious climate targets, contributing to a cleaner energy mix.

- Government Support: The strategic importance of nuclear energy guarantees sustained policy support and financial investment for CNNP.

- Growth Trajectory: CNNP's core business is positioned for substantial expansion, driven by national energy and climate objectives.

China National Nuclear Power's (CNNP) new plant construction and its Hualong One reactor technology are firmly positioned as Stars in its BCG matrix. These represent high-growth, high-market-share segments for the company.

The company's strategic focus on domestically developed technology, like the Hualong One, coupled with robust government support for nuclear expansion, fuels this Star status. By 2024, China achieved full localization of critical nuclear components, enhancing CNNP's control and efficiency.

CNNP's active role in meeting China's energy security and decarbonization goals further solidifies these segments. The nation's target of 200 GW of nuclear capacity by 2035 highlights the significant growth runway for CNNP's core operations.

| Segment | Market Growth | Market Share | BCG Status |

|---|---|---|---|

| New Plant Construction | High | High | Star |

| Hualong One Technology | High | High | Star |

| Domestic Component Localization | N/A (Enabler) | High | Enabler for Star Status |

What is included in the product

This BCG Matrix analysis provides a tailored view of China National Nuclear Power's portfolio, identifying units for investment, holding, or divestment.

The China National Nuclear Power BCG Matrix provides a clear, strategic overview, easing the pain of complex portfolio decisions.

Cash Cows

China National Nuclear Power's established operational nuclear power plants, primarily its Pressurized Water Reactor (PWR) fleet, are classic cash cows. As of late 2024, CNNC operates 25 reactors with a substantial installed capacity of 23.75 GWe, securing a dominant and stable market share within China's mature nuclear energy sector.

These facilities consistently deliver electricity, generating predictable and robust cash flows. The operational efficiency and long-term contracts associated with these plants ensure a reliable income stream, a hallmark of any successful cash cow business unit.

Consistent baseload electricity generation from operational nuclear power plants is a cornerstone of China National Nuclear Power's (CNNP) portfolio, fitting squarely into the Cash Cows quadrant of the Boston Consulting Group (BCG) matrix. These plants provide a reliable, uninterrupted power supply, essential for grid stability and meeting the constant energy needs of China's burgeoning industrial and urban centers.

This steady output translates into predictable and substantial revenue streams for CNNP. For instance, in 2023, China's nuclear power generation reached approximately 430 billion kilowatt-hours, a significant portion of which is attributed to state-owned enterprises like CNNP, highlighting the consistent demand and operational success of these assets.

Nuclear reactors consistently achieve high capacity factors, often exceeding 80%, showcasing their robust and dependable electricity generation capabilities. For China National Nuclear Power (CNNP), this operational efficiency in its mature assets translates directly into sustained high profit margins and strong, predictable cash flows.

In 2024, CNNP's operational reactors demonstrated this reliability, with many achieving capacity factors well above the industry average. This consistent high performance ensures a steady revenue stream, solidifying their position as cash cows within the company's portfolio and supporting ongoing investments.

Long-Term Power Purchase Agreements with the National Grid

China National Nuclear Power (CNNP) leverages long-term Power Purchase Agreements (PPAs) with the National Grid, a key element in its strategy. These agreements are crucial for integrating its nuclear-generated electricity into the national infrastructure.

As a state-owned enterprise, CNNP's PPAs are designed to ensure stable and predictable revenue streams. This stability is a hallmark of a cash cow, providing a reliable income base for the company.

- Stable Revenue: Long-term PPAs guarantee a consistent income, insulating CNNP from short-term market price fluctuations.

- Predictable Cash Flows: These agreements provide predictable cash flows, essential for long-term financial planning and investment.

- Market Dominance: CNNP's role as a major nuclear power provider grants it significant leverage in negotiating these essential grid integration contracts.

Proven Operational and Management Expertise

China National Nuclear Power (CNNP) benefits from extensive experience in operating and managing nuclear facilities. This deep-seated expertise translates into highly efficient operations and cost-effective maintenance for its current power generation assets. For instance, in 2023, CNNP reported a net profit attributable to equity holders of 15.58 billion yuan, showcasing the profitability of its established operations.

This mature operational capability is a key driver of CNNP's cash cow status. It allows for sustained high profit margins on its existing fleet with minimal need for substantial new capital expenditure to maintain or enhance output. The company's commitment to safety and operational excellence ensures reliable electricity generation, contributing to its strong financial performance.

- Decades of operational experience

- Optimized performance and cost-effective maintenance

- Continued high profit margins

- Relatively low new investment required for growth

China National Nuclear Power's (CNNP) established fleet of operational nuclear power plants are its core cash cows, consistently generating substantial and predictable revenue. These facilities, primarily utilizing Pressurized Water Reactor (PWR) technology, benefit from high capacity factors, often exceeding 80% in 2024, underscoring their reliable electricity output. The company’s 2023 net profit of 15.58 billion yuan highlights the profitability of these mature assets.

| Asset Type | BCG Category | Key Characteristics | 2023 Financial Highlight | 2024 Outlook |

| Operational Nuclear Power Plants (PWR Fleet) | Cash Cows | Stable electricity generation, high capacity factors (>80%), long-term PPAs | 15.58 billion yuan net profit | Continued strong cash flow generation, supporting investments |

What You’re Viewing Is Included

China National Nuclear Power BCG Matrix

The preview you are currently viewing is the exact China National Nuclear Power BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked analysis. This comprehensive document has been meticulously prepared by industry experts, ensuring it is ready for immediate strategic application without any need for further editing or revision. You can confidently expect to download the fully formatted, professional-grade BCG Matrix that will empower your decision-making processes. This is not a sample or demo; it is the final, actionable report designed to provide deep insights into China National Nuclear Power's portfolio.

Dogs

Older, less efficient legacy reactor designs within China's nuclear fleet, while still operational, represent a category that could be viewed as 'dogs' in a BCG matrix analysis. These reactors, predating the advanced Hualong One technology, often possess lower power output and may incur higher operational and maintenance costs. For instance, while specific divestiture plans aren't publicly detailed, reactors with significantly lower capacity factors or higher upkeep demands than the newer, more efficient designs would naturally fall into a low-growth, low-share segment as the fleet modernizes.

The strategic challenge with these legacy units lies in their diminishing competitive advantage. As China aggressively pursues the deployment of its domestically developed Hualong One reactors, which boast enhanced safety features and improved economics, the relative attractiveness of older designs wanes. The ongoing investment in and expansion of Hualong One, aiming for a substantial portion of the future nuclear energy mix, further marginalizes the long-term strategic importance of older, less efficient models.

China National Nuclear Power (CNNP) has explored several niche nuclear applications that, while promising, haven't yet achieved substantial commercial success or significant market share. These ventures often represent experimental or developmental technologies with limited current market penetration. For instance, research into advanced radioisotope production for medical imaging or specialized industrial applications falls into this category, demonstrating CNNP’s broad technological reach but also highlighting areas with low growth and low market share.

Reactors facing extended outages or underperforming units would be classified as Dogs within China National Nuclear Power's (CNNP) BCG Matrix. These units, despite being part of the nuclear sector, contribute minimally to overall output and growth due to their operational challenges. CNNP's nuclear generation experienced a slight decrease in 2024, partly due to an increase in outage days across its fleet, highlighting the impact of such underperforming assets.

Limited International Market Penetration for Non-Strategic Technologies

In the context of China National Nuclear Power's (CNNP) global ambitions, technologies beyond the flagship Hualong One that struggle to secure international contracts represent the 'Dogs' in the BCG matrix. These are older or less competitive reactor designs where CNNP's market penetration remains minimal, indicating low growth and market share in the global nuclear export arena.

While Hualong One has seen success, for instance, with its involvement in the Hinkley Point C project in the UK, other CNNP offerings have not achieved similar traction. This limited international success for less advanced technologies highlights a strategic challenge. For example, if CNNP attempted to export older Generation II reactors, and these failed to gain significant orders compared to more modern designs from international competitors, they would fall into the 'Dog' category.

- Limited Export Deals: Older CNNP reactor technologies have secured very few international sales in recent years, reflecting a lack of global demand.

- Low Market Share: In the global nuclear export market, these less competitive technologies hold a negligible market share, often overshadowed by more advanced or cost-effective alternatives.

- Focus on Hualong One: CNNP's strategic emphasis and resources are overwhelmingly directed towards the Hualong One, leaving less competitive technologies with minimal development and marketing support for international markets.

Divested or Mothballed Minor Assets

China National Nuclear Power (CNNP) likely categorizes certain minor assets or projects as 'dogs' within its Business Growth-Share Matrix (BCG). These are typically smaller ventures or older facilities that are no longer strategically important or are experiencing declining profitability.

These assets consume resources, such as capital and management attention, without contributing significantly to CNNP's overall growth or market share. Their divestment or mothballing is a strategic move to reallocate resources to more promising areas of the business.

- Low Profitability: These assets generate minimal returns, often failing to cover their operational costs or provide a meaningful contribution to CNNP's bottom line.

- Limited Future Prospects: The market for the products or services offered by these assets is either stagnant or declining, with little potential for future growth or innovation.

- Resource Drain: They tie up capital and management bandwidth that could be better utilized in CNNP's star or question mark business segments.

- Strategic Non-Alignment: These assets may no longer fit with CNNP's long-term strategic objectives or core competencies.

Older, less efficient legacy reactor designs within China's nuclear fleet, while still operational, represent a category that could be viewed as 'dogs' in a BCG matrix analysis. These reactors, predating the advanced Hualong One technology, often possess lower power output and may incur higher operational and maintenance costs. For instance, while specific divestiture plans aren't publicly detailed, reactors with significantly lower capacity factors or higher upkeep demands than the newer, more efficient designs would naturally fall into a low-growth, low-share segment as the fleet modernizes.

The strategic challenge with these legacy units lies in their diminishing competitive advantage. As China aggressively pursues the deployment of its domestically developed Hualong One reactors, which boast enhanced safety features and improved economics, the relative attractiveness of older designs wanes. The ongoing investment in and expansion of Hualong One, aiming for a substantial portion of the future nuclear energy mix, further marginalizes the long-term strategic importance of older, less efficient models.

Reactors facing extended outages or underperforming units would be classified as Dogs within China National Nuclear Power's (CNNP) BCG Matrix. These units, despite being part of the nuclear sector, contribute minimally to overall output and growth due to their operational challenges. CNNP's nuclear generation experienced a slight decrease in 2024, partly due to an increase in outage days across its fleet, highlighting the impact of such underperforming assets.

In the context of China National Nuclear Power's (CNNP) global ambitions, technologies beyond the flagship Hualong One that struggle to secure international contracts represent the 'Dogs' in the BCG matrix. These are older or less competitive reactor designs where CNNP's market penetration remains minimal, indicating low growth and market share in the global nuclear export arena.

Question Marks

While China National Nuclear Power (CNNP) has achieved a milestone with the Linglong One, the commercialization of diverse Small Modular Reactor (SMR) designs is still in its nascent stages. This sector presents a high-growth opportunity both domestically and internationally, yet CNNP's current market share within this emerging SMR landscape is still being established.

The global SMR market is projected for substantial expansion, with estimates suggesting it could reach hundreds of billions of dollars by the 2030s. For instance, the International Atomic Energy Agency (IAEA) reported in 2024 that over 70 SMR designs were in various stages of development worldwide, indicating a strong pipeline of future projects.

China National Nuclear Power (CNNP) is actively investing in advanced fourth-generation reactor technologies, notably High-Temperature Gas-cooled Reactors (HTGRs). These innovative designs hold significant promise for a high-growth future market due to their enhanced safety features and potential for process heat applications.

While CNNP's commitment to HTGRs positions them for future market leadership, their current commercial market share in these advanced reactor types remains low. This is primarily because these technologies are still in demonstration or early deployment phases, with commercialization efforts ongoing.

China National Nuclear Power (CNNP) is making substantial investments in nuclear fusion research, a field poised to revolutionize energy production. This commitment reflects a long-term vision for a clean, virtually limitless power source.

Nuclear fusion is currently in the research and development phase, positioning it as a Question Mark in the BCG matrix. While the potential for future growth is enormous, commercial viability and widespread market adoption are still many years, if not decades, away.

As of 2024, China's investment in fusion energy research is significant, with projects like the Experimental Advanced Superconducting Tokamak (EAST) contributing to global progress. The nation's dedication to this frontier technology underscores its strategic importance for future energy security and technological leadership.

New International Nuclear Power Project Exports

New international nuclear power project exports represent a significant growth opportunity for China National Nuclear Power (CNNP), positioning these ventures as potential Stars in a BCG Matrix analysis. While CNNP has achieved success with its Hualong One technology exports, establishing a dominant market share in these new, developing foreign markets requires substantial upfront investment and carries considerable risk.

The global nuclear power market is poised for expansion, with a projected compound annual growth rate (CAGR) of 5.2% from 2024 to 2030, reaching an estimated value of $130.5 billion by 2030. This growth is driven by increasing demand for low-carbon energy solutions and government initiatives to bolster energy security.

- High Growth Potential: Emerging markets are actively seeking nuclear energy solutions to meet rising electricity demands and decarbonization goals.

- Market Entry Challenges: CNNP faces competition from established international nuclear vendors and must navigate complex regulatory environments and local content requirements in new territories.

- Investment Requirements: Securing contracts for new international projects demands significant capital for bidding, project development, and potential co-investment.

- Risk Factors: Geopolitical instability, project financing challenges, and public perception of nuclear safety are key risks associated with these nascent foreign markets.

Integration of Nuclear Power with Emerging Industrial Applications

Exploring new applications for nuclear energy, such as powering data centers and AI infrastructure, presents significant growth opportunities for China National Nuclear Power (CNNP). These emerging sectors are projected to see substantial demand increases in the coming years. For instance, the global data center market was valued at approximately $200 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030, driven by AI and cloud computing.

While these are high-potential markets, CNNP's current market share in these specific, emerging applications is notably low. This positions these ventures as question marks within the BCG matrix, requiring strategic investment and development to capture future market share. The challenge lies in adapting existing nuclear capabilities to meet the unique power demands and regulatory frameworks of these new industrial sectors.

- High Growth Potential: Emerging applications like data centers and AI infrastructure offer substantial future market expansion for nuclear power.

- Low Current Market Share: CNNP's presence in these new sectors is minimal, indicating a need for strategic entry and development.

- Investment Required: Significant capital and technological adaptation will be necessary to establish a competitive position in these nascent markets.

- Strategic Focus: CNNP must prioritize research, development, and pilot projects to integrate nuclear power effectively into these evolving industrial landscapes.

Nuclear fusion research represents a significant long-term investment for China National Nuclear Power (CNNP), currently categorized as a Question Mark. While the potential for a clean, abundant energy future is immense, commercial viability remains distant, requiring substantial ongoing R&D investment.

China's commitment to fusion, exemplified by projects like EAST, highlights its strategic importance for future energy security. However, the path to commercialization is long, with widespread adoption likely decades away, making it a high-risk, high-reward endeavor.

The exploration of new applications for nuclear energy, such as powering data centers and AI infrastructure, also falls into the Question Mark category for CNNP. These sectors offer substantial growth potential, but CNNP's current market share is minimal, necessitating strategic investment and adaptation to capture future opportunities.

The global data center market's rapid expansion, projected to grow significantly through 2030, underscores the opportunity. Yet, integrating nuclear power into these specialized, regulated environments presents challenges requiring dedicated development efforts from CNNP.

| Category | CNNP's Position | Market Growth | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| Nuclear Fusion | Question Mark | Potentially Infinite | High (R&D intensive) | Long-term, high-risk/reward |

| New Energy Applications (e.g., Data Centers) | Question Mark | Very High (e.g., Data Center CAGR >15%) | Significant (Adaptation & Market Entry) | Strategic focus needed for market penetration |

BCG Matrix Data Sources

Our China National Nuclear Power BCG Matrix is built on comprehensive data, incorporating financial reports, industry analyses, government publications, and expert forecasts for a robust strategic overview.