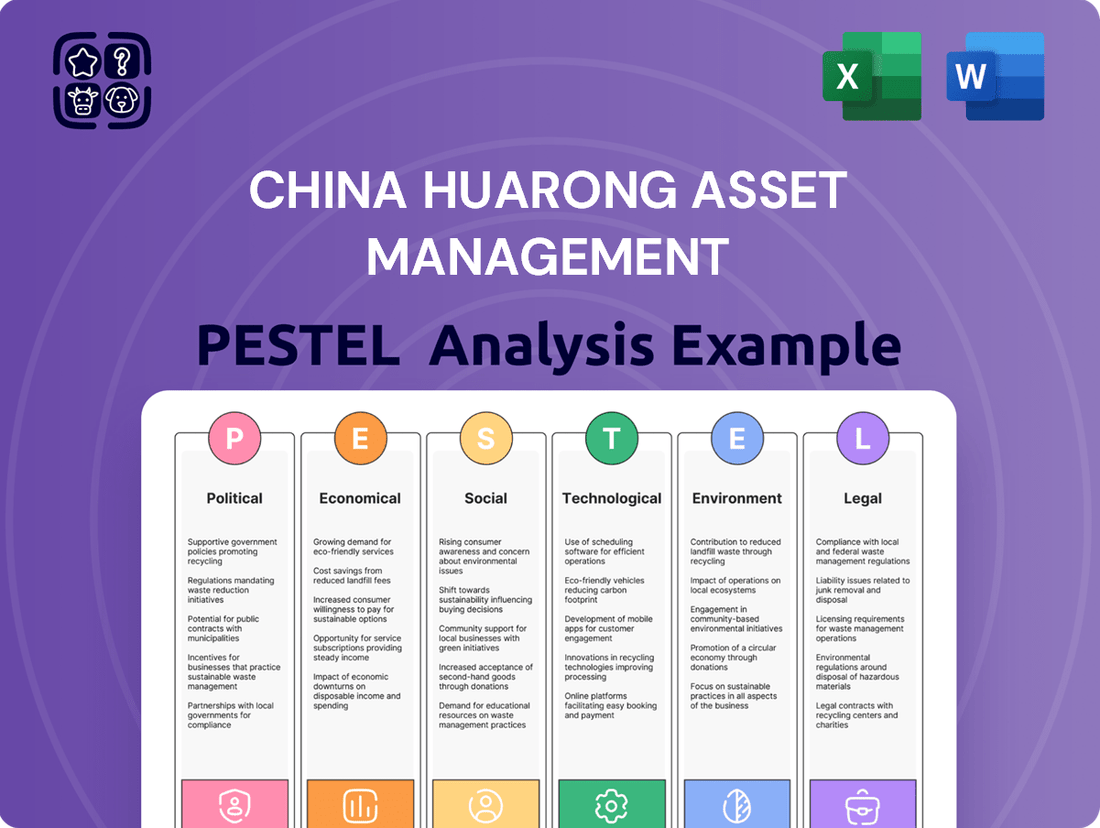

China Huarong Asset Management PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Huarong Asset Management Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping China Huarong Asset Management's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to navigate this dynamic landscape. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

As a prominent state-owned entity, China Huarong Asset Management's strategic direction is heavily shaped by the Chinese government's commitment to financial stability. The government's ongoing efforts to de-risk the financial system, particularly by addressing issues in smaller financial institutions and the property market, directly impact Huarong's operational mandate and asset acquisition strategies.

China Huarong, as a state-owned enterprise (SOE), is navigating significant SOE reforms designed to boost efficiency and strengthen corporate governance. These reforms often mandate strategic realignments and specialization, impacting how Huarong operates and expands its financial service offerings beyond its traditional distressed asset focus.

The government's directive for SOEs to concentrate on core strengths and pursue high-quality development directly shapes Huarong's strategic trajectory. For instance, the State Council's 2023 guidelines emphasized market-oriented reforms for SOEs, aiming to create more competitive and resilient entities, which could lead to Huarong divesting non-core assets or seeking strategic partnerships.

The People's Bank of China (PBOC) actively manages monetary policy, adjusting reserve requirement ratios and interest rates to ensure market liquidity and foster economic expansion. A projected moderately loose monetary stance for 2025 should benefit financial institutions like China Huarong Asset Management by facilitating increased support for emerging industries and potentially reducing borrowing expenses.

Fiscal policy also plays a crucial role, with anticipated fiscal expansion and specific support measures for sectors such as real estate presenting both avenues for growth and potential complexities for Huarong's operations.

Regulatory Environment and Oversight

China Huarong Asset Management operates within a dynamic regulatory landscape shaped by bodies like the National Financial Regulatory Administration (NFRA) and the China Securities Regulatory Commission (CSRC). These agencies are actively refining rules concerning compliance, data protection, and risk assessment for financial firms. Huarong must adapt to these changes, which are designed to bolster legal adherence, safeguard public interests, and maintain financial stability. For instance, the CSRC's ongoing efforts to enhance disclosure requirements and investor protection, as seen in recent updates to listing rules in 2024, directly influence how Huarong manages its public market operations.

The evolving regulatory framework also imposes stricter controls on industrial capital entering the financial sector. This means Huarong faces increased scrutiny on its investment strategies and partnerships, particularly as it seeks to diversify its capital base. The government's emphasis on preventing systemic financial risks, a key objective since the 2023 financial sector reforms, directly impacts Huarong's ability to engage in certain types of asset acquisition and restructuring. For example, directives issued in late 2024 aimed at curbing speculative capital flows into real estate financial products require careful navigation.

- Enhanced Compliance Management: Huarong must adhere to updated regulations on anti-money laundering (AML) and know-your-customer (KYC) procedures, with penalties for non-compliance escalating.

- Data Security and Privacy: New cybersecurity laws in China, effective from 2024, mandate stringent data handling protocols, impacting how Huarong manages sensitive client and operational information.

- Risk Classification Standards: The NFRA's revised guidelines for classifying financial risks, implemented in early 2025, require more granular reporting and capital adequacy adjustments for institutions like Huarong.

- Industrial Capital Restrictions: Stricter approval processes for non-financial enterprises investing in financial institutions, introduced in late 2024, limit Huarong's options for strategic capital injections from certain industrial players.

International Relations and Trade Policies

Geopolitical tensions and a global trend towards protectionism present significant headwinds for China's economic trajectory and its financial industry. For instance, shifts in international trade policies, such as potential tariff adjustments, could dampen China's export performance and overall economic expansion, thereby elevating financial risks that China Huarong Asset Management might need to navigate.

Despite China's commitment to fostering international cooperation in sustainable finance, the resurgence of protectionist sentiments globally could precipitate trade disputes. These frictions carry implications for cross-border investment flows and the broader financial stability landscape, potentially impacting asset valuations and the demand for financial services.

- Trade Tensions: The US-China trade war, which saw tariffs imposed on hundreds of billions of dollars worth of goods, continued to cast a shadow over global trade in 2024, impacting supply chains and investment decisions.

- Global Protectionism Index: The OECD's measure of G20 trade restrictiveness, while fluctuating, indicated persistent challenges in global trade liberalization efforts throughout 2024.

- Foreign Direct Investment (FDI): In 2024, FDI into China experienced shifts, with certain sectors seeing reduced inflows due to geopolitical concerns and regulatory scrutiny, affecting the capital available for financial institutions.

The Chinese government's proactive stance on financial regulation, particularly concerning systemic risk reduction and the property sector, directly influences China Huarong Asset Management's operational scope and strategic priorities. Government directives for state-owned enterprises (SOEs) to enhance efficiency and focus on core competencies, as emphasized in 2023 guidelines, are reshaping Huarong's business model. Furthermore, the People's Bank of China's monetary policy, projected to remain moderately loose in 2025, alongside anticipated fiscal expansion, creates a supportive environment for financial institutions like Huarong.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing China Huarong Asset Management, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive assessment of how these forces create both threats and opportunities, aiding strategic decision-making.

A PESTLE analysis of China Huarong Asset Management offers a clear, summarized version of external factors for easy referencing during meetings, helping to alleviate the pain point of complex market understanding.

Economic factors

China Huarong's core business revolves around managing non-performing assets, making the volume and quality of non-performing loans (NPLs) in China's financial system a critical economic factor. The health of the real estate market and the financial stability of small and medium-sized enterprises (SMEs) directly impact these NPL levels.

While Chinese commercial banks experienced a modest uptick in their NPL ratios during the first quarter of 2025, there's a concurrent push for aggressive bad loan resolution strategies. For instance, by the end of Q1 2025, the NPL ratio for commercial banks stood at approximately 1.60%, a slight increase from late 2024, yet resolution efforts are showing progress in reducing the overall burden.

China's property sector downturn remains a persistent economic challenge, impacting financial stability. Huarong, as an asset management company, frequently handles distressed real estate assets, directly linking its operations to the sector's health.

Government initiatives aimed at stabilizing the property market, such as the urban real estate financing coordination mechanisms introduced in late 2023, are crucial. These policies influence the volume and nature of non-performing loans that Huarong might acquire or manage, presenting both opportunities and risks.

The ongoing efforts to foster a new development model for real estate, moving away from excessive leverage, will shape the long-term landscape for distressed asset opportunities. For instance, by early 2024, several major cities had reported increased activity in these coordination mechanisms, indicating a shift in how property developers access financing.

China's economic growth trajectory is a key factor for China Huarong Asset Management. Projections indicate a GDP growth rate of approximately 5% for 2025, which directly impacts the demand for financial services and the broader investment landscape.

The nation experienced a V-shaped economic recovery in 2024, with expectations for sustained growth into 2025. This positive momentum, bolstered by supportive government policies aimed at economic expansion and a rebound in domestic consumption, creates a more conducive environment for Huarong's core business of resolving distressed assets and growing its financial services offerings.

Interest Rate Environment and Liquidity

China's monetary policy is expected to remain moderately accommodative through 2024 and into 2025, aiming to support economic growth. This includes the potential for further cuts to the benchmark lending rates and reserve requirement ratios (RRR) for banks. For instance, the People's Bank of China (PBOC) has already made several adjustments, with the one-year loan prime rate (LPR) seeing reductions in late 2023 and early 2024, signaling a commitment to lower borrowing costs.

This easing environment directly impacts financial institutions like China Huarong Asset Management by influencing their net interest margins and the cost of capital. Lower financing costs can boost Huarong's profitability, especially when acquiring distressed assets, as the cost of funds for these acquisitions decreases. Conversely, a persistently low-rate environment can compress margins if asset yields do not keep pace with funding costs.

- Monetary Policy Stance: Moderately loose, with potential for further interest rate and RRR cuts in 2024-2025.

- Impact on Liquidity: Expected to maintain reasonable market liquidity, facilitating financing.

- Financing Costs: Lower overall borrowing costs for financial institutions, including Huarong.

- Profitability Influence: Affects net interest margins and asset acquisition funding costs for entities like Huarong.

Capital Market Development and Investment Trends

China's capital markets are evolving, with significant growth in its multi-tier bond market. By the end of 2024, the total outstanding volume of bonds in China was projected to exceed 150 trillion yuan, offering Huarong expanded avenues for debt financing and investment. This development, coupled with increased financial resource allocation towards asset-light sectors like technology and services, presents new opportunities for Huarong to diversify its investment portfolio.

Efforts to bolster the stock market, including policies aimed at injecting medium-to-long term capital, are creating a more favorable environment for equity investments. Investor sentiment in 2024 and early 2025 shows a continued appetite for high-yield instruments, alongside growing interest in private market investments and ESG-focused funds. These trends necessitate that Huarong adapt its strategies to capitalize on emerging investor preferences and market dynamics.

- Bond Market Growth: China's bond market, a key component of its capital market development, is expected to continue its expansion, providing Huarong with more diverse debt instruments for investment and funding.

- Sectoral Investment Shifts: A notable trend is the increasing allocation of financial resources to asset-light sectors, which aligns with Huarong's potential to explore new growth areas beyond traditional asset management.

- Stock Market Support: Government initiatives to encourage sustained capital inflows into the stock market are creating opportunities for Huarong to engage in strategic equity investments.

- Investor Trend Adaptation: Huarong must remain attuned to evolving investor preferences, including the demand for high-yield products, private market access, and sustainable (ESG) investment options, to refine its investment strategies effectively.

China's economic landscape in 2024-2025 is characterized by a projected GDP growth of around 5%, demonstrating resilience and sustained expansion. This growth underpins the demand for financial services and creates a generally favorable environment for asset management firms like China Huarong.

The property sector, while facing a downturn, is subject to government stabilization efforts, including urban real estate financing coordination mechanisms, which directly influence the types of distressed assets Huarong may encounter. Monetary policy remains moderately accommodative, with potential for rate cuts, lowering financing costs for institutions and impacting their profitability margins.

Capital markets are expanding, particularly the bond market, offering Huarong more avenues for financing and investment. Investor sentiment shows a preference for high-yield and private market instruments, requiring Huarong to adapt its strategies to these evolving trends.

| Economic Indicator | 2024 Projection/Status | 2025 Projection | Impact on China Huarong |

|---|---|---|---|

| GDP Growth | ~5% (2024) | ~5% (2025) | Supports demand for financial services, stable operating environment. |

| NPL Ratio (Commercial Banks) | ~1.60% (Q1 2025) | Expected to stabilize with resolution efforts | Indicates ongoing need for distressed asset management. |

| Property Market | Downturn with stabilization initiatives | Ongoing structural adjustments | Directly impacts asset quality and acquisition opportunities. |

| Monetary Policy | Moderately accommodative | Expected to remain so | Lowers financing costs, affects net interest margins. |

| Bond Market Size | > 150 trillion yuan (end 2024) | Continued expansion | Provides more funding and investment avenues. |

Full Version Awaits

China Huarong Asset Management PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the China Huarong Asset Management PESTLE Analysis. This comprehensive report covers all Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

Public confidence in China's financial institutions remains a vital underpinning for economic stability, particularly in the wake of past difficulties experienced by entities such as China Huarong Asset Management. Huarong's operational performance and its strategic maneuvers in managing non-performing assets directly influence this trust, especially as it aims to stabilize the financial sector and bolster economic growth.

The Chinese government's ongoing efforts to reform state-owned enterprises, including Huarong, are designed to enhance transparency and accountability, thereby rebuilding and strengthening public faith. For instance, Huarong's successful restructuring and recapitalization, which saw significant capital injections in 2021, were critical steps in demonstrating the system's resilience and commitment to resolving financial vulnerabilities.

China's rapidly aging population, projected to see its elderly dependency ratio climb significantly, coupled with a pension system facing funding gaps, is creating a strong impetus for higher investment returns. This demographic reality is pushing individuals and the government to seek more robust capital market engagement.

Consequently, there's a growing demand for sophisticated, long-term investment products and asset management services. For China Huarong Asset Management, this societal trend presents a strategic opportunity to expand its offerings and capital-raising efforts to meet the needs of an aging populace seeking to secure their financial future.

Consumer confidence and spending habits are crucial for China's economic health, directly impacting the volume of non-performing loans (NPLs) that asset management companies like China Huarong deal with. For instance, during the first half of 2024, China's retail sales saw a steady increase, indicating a generally positive consumer sentiment, though growth moderated in later months. This trend influences the overall demand for goods and services, affecting the financial stability of businesses and, by extension, their ability to repay debts.

Government initiatives to stimulate consumption, such as the nationwide consumer goods trade-in programs launched in 2024, aim to boost spending and support economic activity. These programs encourage consumers to replace older appliances and vehicles with newer, more energy-efficient models, injecting capital into various sectors. Such policies can indirectly bolster the financial ecosystem by improving corporate performance and reducing the likelihood of NPLs, creating a more favorable operating environment for financial institutions.

Talent Acquisition and Retention

The financial asset management sector in China, especially concerning distressed assets, demands specialized expertise. Huarong's success hinges on its capacity to draw in and keep professionals skilled in areas like financial analysis, risk management, and increasingly, digital transformation.

Attracting and retaining top talent is paramount for Huarong's operational effectiveness and strategic growth. In 2023, China's financial services sector saw a significant demand for talent in specialized areas, with compensation packages for experienced distressed asset managers rising by an estimated 15-20% compared to the previous year, reflecting the competitive landscape.

- Skilled Workforce Needs: The industry requires professionals proficient in distressed asset workout, financial modeling, and regulatory compliance.

- Talent Competition: Huarong faces intense competition for skilled professionals from both domestic and international financial institutions operating in China.

- Impact on Performance: The quality of talent directly influences Huarong's ability to manage complex portfolios and execute turnaround strategies effectively.

Social Responsibility and ESG Awareness

Societal expectations in China are increasingly pushing companies, including financial institutions like China Huarong, to prioritize Environmental, Social, and Governance (ESG) factors. This growing awareness, supported by government initiatives, means that Huarong's investment decisions and overall operations must align with national sustainability targets. For instance, China's commitment to carbon neutrality by 2060 is a significant driver for green finance, and Huarong's engagement in this area directly impacts its public perception and investment attractiveness.

As a major state-owned enterprise, China Huarong faces heightened scrutiny regarding its adherence to ESG principles. This includes adopting robust ESG disclosure standards, which are becoming more prevalent. In 2023, the Shanghai Stock Exchange and Shenzhen Stock Exchange continued to refine their ESG reporting guidelines, encouraging more comprehensive disclosures from listed companies. Huarong's ability to demonstrate strong ESG performance can therefore influence its access to capital and its reputation among domestic and international investors.

- Growing ESG Investment: Global ESG assets were projected to reach $50 trillion by 2025, influencing Chinese market trends.

- Green Finance Push: China's green bond market saw significant growth, with issuance expected to continue expanding in 2024-2025.

- Regulatory Evolution: Expect further development of ESG disclosure requirements for Chinese listed firms in the coming years.

- State-Owned Enterprise Responsibility: Huarong, as a SOE, is expected to lead by example in aligning with national sustainability goals.

Societal expectations are increasingly emphasizing Environmental, Social, and Governance (ESG) principles, influencing financial institutions like China Huarong. This trend is driven by national sustainability goals, such as China's commitment to carbon neutrality by 2060, which promotes green finance and affects investment attractiveness.

As a state-owned enterprise, Huarong faces scrutiny regarding its ESG adherence, necessitating robust disclosure standards. In 2023, Chinese stock exchanges refined ESG reporting guidelines, pushing listed firms toward more comprehensive disclosures, impacting Huarong's capital access and reputation.

The growing demand for skilled professionals in distressed asset management, with compensation for experienced managers rising by 15-20% in 2023, highlights intense talent competition. Huarong's ability to attract and retain such talent is crucial for its operational effectiveness and strategic growth.

China's aging population, with a rising elderly dependency ratio, fuels demand for higher investment returns and sophisticated long-term financial products. This demographic shift presents a strategic opportunity for China Huarong to expand its services and capital-raising efforts.

| Societal Factor | Impact on China Huarong | Supporting Data/Trend |

|---|---|---|

| ESG Awareness | Increased pressure for sustainable operations and investments. | Global ESG assets projected to reach $50 trillion by 2025. China's green bond market saw significant growth in 2023-2024. |

| Talent Demand | Intense competition for skilled financial professionals. | Compensation for experienced distressed asset managers rose 15-20% in 2023. |

| Demographics (Aging Population) | Growing demand for investment products and higher returns. | Elderly dependency ratio in China is projected to climb significantly. |

| Public Trust in Financial Institutions | Need for transparency and accountability in operations. | Huarong's 2021 recapitalization aimed to bolster confidence in the financial sector. |

Technological factors

China's financial sector is rapidly embracing digital transformation, a trend that significantly impacts companies like China Huarong Asset Management. This push involves integrating advanced technologies to streamline operations and enhance service delivery across various financial functions, including Huarong's core business of distressed asset management.

Leveraging digitalization offers Huarong substantial benefits, such as improved data analytics for better risk assessment and more efficient processing of complex financial transactions. The adoption of new technologies directly contributes to operational efficiency, a critical factor in the competitive landscape of financial services.

China's commitment to this digital evolution is underscored by initiatives like the Fintech Development Plan for 2022-2025, which aims to further accelerate the integration of technology within the financial industry. This plan is expected to foster innovation and create new opportunities for digital-first financial solutions.

Artificial Intelligence and Machine Learning are transforming how asset managers in China operate. Huarong can leverage these tools for deeper insights into investment opportunities and risks.

For instance, AI can enhance distressed asset valuation by identifying subtle patterns in vast datasets, potentially improving recovery rates. By late 2024, the adoption of AI in China's financial sector was accelerating, with many firms investing heavily in predictive analytics for market forecasting and risk management, aiming for efficiency gains.

Furthermore, automating routine tasks like data processing and report generation through ML can free up Huarong's analysts for more strategic work, boosting overall operational efficiency and decision-making accuracy.

Big data analytics is fundamental to China Huarong Asset Management's operations, particularly in managing non-performing assets. The capacity to process and analyze vast datasets allows Huarong to gain a granular understanding of asset quality and emerging market trends.

By leveraging big data, Huarong can identify potential risks with greater precision, informing more strategic acquisition and disposition decisions. For instance, sophisticated analytical tools can help predict recovery rates on distressed debt portfolios, a critical factor in optimizing returns.

In 2024, the financial sector's increasing reliance on AI and big data for risk assessment and operational efficiency is a significant trend. Huarong's ability to harness these technologies will be key to navigating the complexities of the Chinese financial landscape and enhancing its competitive edge in asset management.

Fintech Adoption and Innovation

China's fintech landscape is booming, with a significant portion of the population actively using online banking and investment platforms. This widespread adoption presents a prime opportunity for China Huarong Asset Management to enhance its service offerings. By integrating advanced fintech solutions, Huarong can streamline transaction processing, broaden its reach to new customer segments, and elevate the overall customer experience.

The rapid evolution of fintech is a key driver of innovation within China's financial sector. This technological advancement allows for the creation of more personalized and efficient investment products. For Huarong, embracing these innovations means developing tailored solutions that meet the dynamic needs of its diverse client base, potentially leading to increased market share and improved operational efficiency.

- Widespread Fintech Use: By the end of 2023, China's digital payment penetration reached over 86%, demonstrating a strong consumer preference for online financial services.

- Customer Experience Enhancement: Fintech allows for seamless onboarding, personalized financial advice, and 24/7 access to services, directly impacting customer satisfaction.

- Market Access and Efficiency: Online platforms can reduce operational costs for Huarong while simultaneously expanding its product distribution to a wider, digitally-connected audience.

- Innovation in Investment Solutions: Emerging technologies like AI and big data analytics enable the development of sophisticated, data-driven investment strategies and risk management tools.

Cybersecurity and Data Security

As China Huarong Asset Management (Huarong) increasingly digitizes its financial operations, the imperative for robust cybersecurity and data security measures escalates. The company must navigate a landscape where safeguarding sensitive financial data is paramount to maintaining customer trust and operational integrity.

Huarong is subject to stringent data security management mandates for banking and insurance entities. These regulations encompass critical areas such as data classification, establishing comprehensive security governance frameworks, and implementing robust personal information protection protocols. For instance, in 2023, Chinese regulators continued to emphasize stricter data handling practices following the implementation of the Personal Information Protection Law (PIPL) in late 2021, impacting how financial institutions manage customer data.

Key technological factors influencing Huarong's cybersecurity and data security posture include:

- Adherence to evolving data protection laws: Compliance with regulations like PIPL, which mandates consent for data collection and processing, is crucial.

- Investment in advanced security technologies: Implementing solutions for threat detection, prevention, and incident response is essential to counter sophisticated cyberattacks.

- Data governance and classification: Establishing clear policies for how data is categorized, stored, and accessed ensures sensitive information remains protected.

- Employee training and awareness: Human error remains a significant vulnerability; continuous training on cybersecurity best practices is vital.

Technological advancements are reshaping China's financial sector, directly impacting China Huarong Asset Management. The nation's push for digitalization, supported by initiatives like the Fintech Development Plan for 2022-2025, encourages the integration of AI, machine learning, and big data analytics. These technologies are crucial for Huarong to enhance risk assessment, streamline operations, and improve asset valuation, especially in managing non-performing assets.

By late 2024, AI adoption in China's financial industry was accelerating, with firms heavily investing in predictive analytics for market forecasting and risk management. Huarong's ability to leverage these tools for deeper insights into investment opportunities and risks, and to automate routine tasks, will be key to its competitive edge.

The widespread use of fintech in China, evidenced by over 86% digital payment penetration by the end of 2023, offers Huarong opportunities to expand its reach and improve customer experience through online platforms and personalized services.

However, this digital transformation necessitates robust cybersecurity measures, with Huarong needing to comply with evolving data protection laws like PIPL, which was implemented in late 2021 and continued to influence stricter data handling practices in 2023. Investment in advanced security technologies and employee training is vital to protect sensitive financial data.

| Technology Area | Impact on Huarong | Key Data/Trends (2023-2024) |

|---|---|---|

| Digitalization & Fintech | Streamlined operations, enhanced customer experience, wider market access | 86%+ digital payment penetration (end 2023); Fintech Development Plan (2022-2025) |

| Artificial Intelligence (AI) & Machine Learning (ML) | Improved risk assessment, asset valuation, operational efficiency | Accelerating AI adoption in finance (late 2024); predictive analytics investment |

| Big Data Analytics | Granular understanding of asset quality, risk identification, strategic decision-making | Essential for non-performing asset management; predicting recovery rates |

| Cybersecurity & Data Security | Maintaining customer trust, operational integrity, regulatory compliance | PIPL compliance (ongoing since late 2021); stricter data handling mandates (2023) |

Legal factors

China's financial regulatory environment is in constant flux, marked by significant reforms. The recent establishment of the National Financial Regulatory Administration (NFRA) signifies a concerted effort to bolster oversight across the financial sector. This new body is tasked with enhancing legal compliance and mitigating systemic risks, crucial for fostering high-quality financial development.

China Huarong Asset Management, as a key player, navigates this dynamic landscape. The reforms introduce stringent new rules, particularly impacting areas like loan management, data security, and overall compliance frameworks. For instance, regulations emphasizing robust data protection and stricter loan origination processes are reshaping operational requirements for asset management firms.

China is actively developing comprehensive legislation focused on financial stability and risk resolution. This new legal framework is expected to offer a clear roadmap and financial backing for managing systemic financial risks, directly benefiting entities like China Huarong Asset Management.

The impending law will solidify Huarong's role in resolving distressed assets, particularly in light of the ongoing property market challenges and local government debt issues. It aims to establish clear responsibilities and robust mechanisms for tackling these significant financial vulnerabilities, enhancing the stability of the broader financial system.

China has been actively enhancing corporate governance regulations, particularly for state-owned enterprises (SOEs), aiming to boost transparency and accountability. This regulatory push directly impacts Huarong, requiring it to adopt more rigorous governance frameworks.

For Huarong, this translates to adapting to potentially altered board compositions and strengthened shareholder rights, all designed to foster more robust management practices and informed decision-making. These changes are crucial for maintaining investor confidence and ensuring operational integrity within the evolving SOE landscape.

Non-Performing Asset Disposition Laws

China Huarong Asset Management's core business heavily relies on the legal framework surrounding non-performing asset (NPA) disposition. This includes laws governing acquisition, management, and ultimately, selling off these troubled assets. Recent developments and clarifications in these regulations are crucial for Huarong's success.

Changes in laws related to bankruptcy, debt restructuring, and how assets are valued can significantly affect Huarong's efficiency and profitability. For instance, streamlined bankruptcy procedures can speed up the disposal process, while clearer asset valuation guidelines reduce uncertainty.

- NPA Acquisition: Legal frameworks dictate how Huarong can acquire NPAs from banks and other financial institutions, influencing deal structures and pricing.

- Debt Restructuring: Laws enabling debt-to-equity swaps or debt forgiveness directly impact Huarong's ability to recover value from distressed loans.

- Asset Disposal: Regulations governing auctions, securitization, and direct sales of NPAs determine the channels and success rates for Huarong's divestments.

- Valuation Standards: Clear and consistent asset valuation standards are essential for accurate financial reporting and effective negotiation during disposals.

Cross-Border Investment and Capital Flow Regulations

China's evolving regulations on foreign investment in its financial sector directly influence China Huarong Asset Management's international engagement. For instance, the gradual opening of the financial market, allowing greater foreign ownership in securities firms and asset managers, presents both opportunities and challenges. As of early 2024, China continued to ease restrictions, permitting wholly foreign-owned financial institutions, which could impact Huarong's competitive landscape and potential for foreign partnerships.

Cross-border capital flow regulations are also critical. These rules govern how money can move in and out of China, affecting Huarong's ability to attract foreign capital for its operations or to invest abroad. The State Administration of Foreign Exchange (SAFE) regularly updates guidelines, and adherence to these is paramount for Huarong's global financial activities. For example, policies introduced in 2023 aimed to facilitate cross-border RMB settlement for investment, potentially easing some capital flow complexities.

- Foreign ownership limits in financial services: While previously restrictive, China has been progressively increasing foreign equity caps in sectors like asset management and securities, creating a more open environment.

- Capital account convertibility: Gradual reforms to make the Renminbi more convertible impact cross-border investment flows, affecting Huarong's access to international funding and investment opportunities.

- Strategic investment rules: Changes in regulations concerning foreign strategic investments in Chinese listed companies can alter the landscape for Huarong's potential partnerships and equity stakes.

China's legal framework for asset management, particularly concerning non-performing assets (NPAs), is undergoing significant evolution. New legislation is being developed to manage systemic financial risks, which will solidify China Huarong Asset Management's role in resolving distressed assets, especially given ongoing property market and local government debt challenges.

Enhanced corporate governance regulations for state-owned enterprises are also in effect, requiring Huarong to adopt more rigorous frameworks, potentially impacting board structures and shareholder rights to boost transparency and accountability.

The legal environment for NPA acquisition, management, and disposition is critical for Huarong's operations. Streamlined bankruptcy procedures and clearer asset valuation standards, as seen in reforms impacting debt restructuring and asset disposal, are vital for the firm's efficiency and profitability.

China's progressive easing of foreign investment restrictions in its financial sector, allowing wholly foreign-owned institutions as of early 2024, presents a more competitive landscape and potential for foreign partnerships for Huarong.

Environmental factors

China's dedication to green development is robust, evidenced by policies fostering green financial systems through instruments like green bonds, green loans, and a burgeoning carbon market. By the end of 2023, the outstanding balance of green loans in China reached RMB 29.55 trillion, a 33.4% increase year-on-year, demonstrating significant market growth.

As a major player in the financial sector, China Huarong Asset Management is anticipated to integrate these national environmental objectives into its operations. This alignment could translate into a greater emphasis on green asset acquisition and sustainable financing strategies, reflecting the evolving regulatory landscape and market demand for environmentally conscious investments.

China Huarong Asset Management, like other Chinese corporations, is navigating an evolving landscape of ESG disclosure requirements. New sustainability reporting guidelines and climate disclosure regulations are being introduced, reflecting a growing emphasis on environmental, social, and governance practices within the Chinese market.

This increased scrutiny means Huarong will likely face greater pressure to report transparently on its environmental footprint, social impact, and governance structures. Such disclosures are becoming crucial for shaping investor perception and can directly influence the company's access to capital in both domestic and international markets.

China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 is reshaping its economic landscape. This presents Huarong with avenues to finance green infrastructure and renewable energy projects, aligning with national environmental goals. For instance, by the end of 2023, China's installed renewable energy capacity surpassed 1.5 billion kilowatts, a significant portion of its total power generation.

Huarong must also navigate the financial implications of these targets. This includes evaluating climate-related risks within its existing asset portfolio, particularly in sectors heavily reliant on fossil fuels. Proactive risk management and strategic investments in sustainable industries will be crucial for Huarong to adapt and capitalize on the green transition.

Climate Change and Physical Risks

Climate change presents significant physical risks to China Huarong Asset Management's portfolio. The increasing frequency and intensity of extreme weather events, such as floods and typhoons, can directly damage physical assets, reducing their market value and recovery potential. For instance, China experienced a severe flood season in 2023, with provinces like Hebei and Heilongjiang reporting substantial economic losses, impacting various industries that Huarong might have exposure to.

Huarong, as a manager of distressed assets, must meticulously assess how these physical climate risks affect the long-term viability and salvage value of the assets it holds. This is particularly crucial for assets located in coastal regions or those reliant on climate-sensitive industries like agriculture and real estate. The economic impact of climate-related disasters in China in 2023 was estimated to be in the tens of billions of USD, underscoring the tangible financial implications.

- Increased Asset Impairment: Physical climate risks can lead to direct damage or obsolescence of assets, necessitating higher provisions for loan losses and write-downs.

- Sectoral Vulnerability: Sectors like agriculture, real estate, and infrastructure are particularly susceptible to climate impacts, posing concentrated risks within Huarong's distressed asset pool.

- Recovery Value Erosion: The ability to recover value from distressed assets can be significantly diminished if the underlying collateral is physically damaged or its economic utility is compromised by climate change.

Environmental Regulations and Compliance

China's commitment to environmental protection is intensifying, with stricter regulations impacting various sectors. For China Huarong Asset Management, this means a heightened need to evaluate the environmental compliance of its acquired assets, as non-compliance can lead to significant financial liabilities. For instance, the nation's push for green finance and carbon neutrality goals, as outlined in its 14th Five-Year Plan (2021-2025), necessitates a thorough assessment of environmental risks within its portfolio.

Huarong must proactively manage potential environmental liabilities embedded within the non-performing assets it acquires. This includes understanding the costs associated with pollution control, remediation, and potential fines. As of recent reports, environmental penalties in China have been on the rise, underscoring the financial risks of non-compliance for businesses and, by extension, their creditors.

- Increased Scrutiny on Polluting Industries: Huarong must assess assets in sectors facing stringent environmental enforcement, such as heavy manufacturing and energy, where compliance costs can be substantial.

- Green Finance Initiatives: The growing emphasis on green finance may influence the valuation and future marketability of assets with poor environmental track records.

- Potential for Stranded Assets: Assets that fail to meet evolving environmental standards risk becoming stranded, impacting their recovery value for Huarong.

- Operational Compliance: Huarong's own operations must also align with national environmental laws to avoid direct penalties and maintain its reputation.

China's environmental policies are increasingly stringent, impacting industries and financial institutions. The nation's commitment to carbon neutrality by 2060, alongside policies promoting green finance, means Huarong must assess environmental risks in its asset portfolio. By the end of 2023, China's outstanding green loans reached RMB 29.55 trillion, highlighting a significant shift towards sustainable finance.

Physical climate risks, such as extreme weather events, pose direct threats to asset values. For instance, the severe floods in China during 2023 caused billions of dollars in economic losses, potentially impairing assets Huarong holds. This necessitates careful evaluation of climate vulnerability in sectors like real estate and agriculture.

| Environmental Factor | Impact on China Huarong | Relevant Data (2023/2024) |

| Green Development Policies | Opportunities in green asset acquisition; need for sustainable financing strategies. | RMB 29.55 trillion outstanding green loans (33.4% YoY growth). |

| Climate Change Targets (Carbon Neutrality by 2060) | Financing green infrastructure; managing climate-related risks in portfolios. | China's renewable energy capacity surpassed 1.5 billion kilowatts. |

| Physical Climate Risks (Extreme Weather) | Increased asset impairment; erosion of recovery value for distressed assets. | 2023 flood season caused tens of billions USD in economic losses. |

| Environmental Regulations & Enforcement | Need to assess environmental compliance of acquired assets; potential liabilities. | Growing trend of environmental penalties for non-compliant businesses. |

PESTLE Analysis Data Sources

Our China Huarong Asset Management PESTLE Analysis is built on a comprehensive foundation of data from official Chinese government publications, reports from international financial institutions like the IMF and World Bank, and leading economic and industry research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.