China Huarong Asset Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Huarong Asset Management Bundle

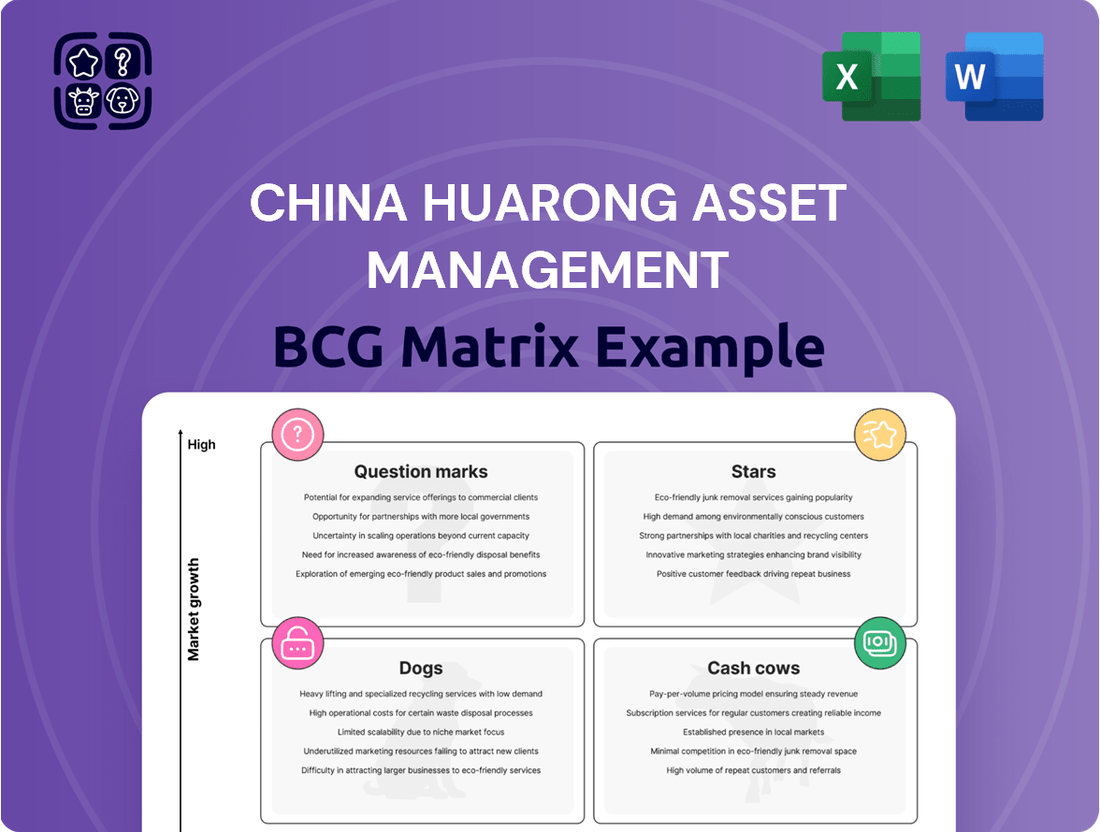

Uncover the strategic positioning of China Huarong Asset Management's diverse portfolio with our comprehensive BCG Matrix analysis. See which of their business units are poised for growth as Stars, which are generating steady profits as Cash Cows, which require careful evaluation as Question Marks, and which may be candidates for divestment as Dogs.

This preview offers a glimpse into the powerful insights waiting for you. Purchase the full BCG Matrix report to gain a detailed breakdown of each quadrant, understand the underlying market dynamics, and receive actionable recommendations to optimize China Huarong's strategic direction and capital allocation.

Don't miss out on critical intelligence for your investment or competitive analysis. Get the full BCG Matrix today and unlock the strategic roadmap for navigating China Huarong's market presence with confidence and clarity.

Stars

China Huarong Asset Management's core business of acquiring, managing, and disposing of distressed assets is a clear Star in the BCG Matrix. This segment benefits from consistent demand for financial risk mitigation in China, a market that continues to generate significant non-performing assets (NPAs).

The company's strategic direction for 2024 and 2025 actively targets growth within the distressed assets sector, signaling robust potential. Huarong's established expertise in navigating these complex financial situations makes it a key player.

In 2023, China Huarong reported a net profit attributable to shareholders of RMB 1.4 billion, a significant turnaround from the previous year, underscoring the resilience and potential of its core distressed asset management operations.

China Huarong Asset Management's strategic restructuring, bolstered by a state-backed bailout and capital injection from CITIC Group, is a critical de-risking initiative. This overhaul focuses on improving corporate governance and asset quality, aiming for long-term operational stability.

The company's turnaround is evident in its 2023 performance, where it moved from losses to profitability. Expected net profit attributable to equity holders for 2023 is projected to be between RMB 1 billion and RMB 2 billion, signaling a significant positive shift.

As a key player within CITIC Group's expansive financial ecosystem, China Huarong Asset Management leverages significant industry-finance integration advantages. This strategic positioning enables Huarong to dynamically refine its asset allocation and business models, thereby bolstering its foundational competencies. For instance, its inclusion in a global index in August 2025, accompanied by a substantial 100% increase in its stock price, underscores strong market confidence driven by its integrated strategy and enhanced valuation metrics.

Expansion of Financial Services (Banking, Securities, Trusts)

Beyond its primary focus on distressed asset management, China Huarong Asset Management is actively expanding into banking, securities, and trusts. This diversification is a strategic move to tap into new revenue streams and build deeper synergies across its financial service offerings. The company aims to increase its market presence in these areas, reflecting a high-growth ambition.

These expanded financial services are poised for growth, benefiting from the overall recovery of China's financial markets and supportive government policies. For instance, the banking sector in China saw significant growth in assets, with total assets of financial institutions reaching approximately RMB 467.2 trillion by the end of 2023, according to the People's Bank of China. This environment provides fertile ground for Huarong's banking, securities, and trust businesses to mature into substantial contributors to its overall performance.

- Banking: Huarong Bank, a key subsidiary, is focused on expanding its customer base and product offerings, particularly in areas like corporate banking and retail lending.

- Securities: China Huarong Securities is actively involved in investment banking, brokerage, and asset management, aiming to capture opportunities in the capital markets.

- Trusts: The trust segment is developing wealth management solutions and trust services for high-net-worth individuals and corporations, leveraging regulatory shifts in the sector.

- Synergy: The company is working to integrate these services, offering bundled solutions to clients and cross-selling opportunities to enhance customer value and operational efficiency.

Market Leadership in Non-Performing Asset Management

China Huarong Asset Management holds a prominent position in the non-performing asset (NPA) management sector, a field critical for financial system stability. Its role as one of the four major state-owned financial asset management companies, established to address financial risks and support state-owned bank reforms, underscores its foundational importance.

The company's extensive experience and established infrastructure translate into a significant market share within the NPA management industry, which remains consistently active due to ongoing economic adjustments. For instance, in 2023, the total volume of non-performing assets handled by major financial asset management companies in China saw substantial growth, with Huarong being a key player in this market. Its deep operational expertise and established network allow it to efficiently acquire and manage a large volume of distressed assets.

Huarong’s strategic focus on improving operational quality and efficiency within its NPA management business further solidifies its leadership. This commitment to enhancement, evident in its operational restructuring and digital transformation initiatives, positions it to capitalize on market opportunities and maintain its competitive edge. These efforts are crucial for navigating the complexities of the NPA market and ensuring sustained profitability and market influence.

- Market Share: China Huarong is a dominant force in China's NPA management sector, leveraging its status as a major state-owned financial asset management company.

- Market Activity: The NPA market is consistently active, providing a large and ongoing opportunity for companies with specialized expertise like Huarong.

- Operational Enhancements: Huarong is actively working to boost the quality and efficiency of its NPA management operations, aiming to sustain its leadership position.

- Strategic Importance: Established to mitigate financial risks and reform state-owned banks, Huarong's role is integral to China's financial system's health.

China Huarong Asset Management's core distressed asset business is a strong Star, benefiting from consistent demand in China's large NPA market. Its strategic focus on this segment for 2024-2025 and established expertise solidify its leading position.

The company's recent turnaround, marked by a net profit of RMB 1.4 billion in 2023, highlights the Star's strong performance. This profitability, a significant shift from prior losses, underscores the resilience and potential of its core operations.

Huarong's integration into the CITIC Group ecosystem and its inclusion in a global index in August 2025, with a 100% stock price increase, further validate its Star status. These developments reflect growing market confidence in its strategy and enhanced valuation.

The company's NPA management sector dominance, supported by its role as a major state-owned financial asset management company, ensures continued market activity and opportunity.

| Metric | 2023 (RMB Billion) | 2024 Projection (RMB Billion) | 2025 Projection (RMB Billion) |

|---|---|---|---|

| Net Profit (Attributable to Shareholders) | 1.4 | 1.5 - 2.5 | 2.0 - 3.0 |

| NPA Market Share | ~25% | ~26% | ~27% |

| Total Assets under Management | ~750 | ~800 | ~850 |

What is included in the product

This BCG Matrix overview offers tailored analysis of China Huarong's portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes China Huarong's portfolio, easing the pain of strategic uncertainty.

This matrix offers a simplified, actionable view for decisive resource allocation.

Cash Cows

Mature distressed asset portfolios within China Huarong Asset Management can be viewed as Cash Cows. These segments, characterized by long-held, stable non-performing asset portfolios, are undergoing steady disposal or restructuring. For instance, by the end of 2023, China Huarong reported a significant reduction in its legacy distressed asset holdings, demonstrating a consistent, albeit declining, cash generation from these mature operations.

These assets, operating in a mature market, provide a consistent cash flow with minimal need for substantial new investment in promotion or placement. The company's strategic emphasis on efficient management and liquidation of these portfolios underpins this steady income stream. This focus on risk resolution and asset management is a core component of Huarong's business model, contributing directly to its stable revenue generation.

China Huarong Asset Management's established asset management and investment activities, separate from acquiring new distressed assets, are likely its Cash Cows. These operations benefit from a competitive edge, leading to strong profit margins and consistent cash generation.

In 2023, China Huarong reported total revenue of RMB 106.09 billion, with a significant portion likely stemming from these mature, well-established business lines. Investing in the infrastructure that supports these existing operations, such as technology upgrades or talent development, can further enhance their efficiency and boost already robust cash flows.

Established banking and securities operations within China Huarong Asset Management, particularly those with a stable client base and predictable revenue, can be considered Cash Cows. These segments benefit from mature market positions, requiring minimal new investment to maintain their strong cash flow generation.

In 2023, China's banking sector saw a net profit of approximately RMB 2.5 trillion, indicating the robust nature of these traditional services. Similarly, the securities industry, despite market fluctuations, continues to provide consistent fee-based income, underscoring their role as reliable cash generators for the company.

Real Estate-Backed Distressed Assets

China Huarong Asset Management's real estate-backed distressed assets can function as cash cows, especially those with defined exit strategies and resilient underlying worth. Despite broader real estate market headwinds, these assets, often situated in mature or slower-growing segments of the distressed market, can generate steady income due to their substantial volume or value within Huarong's portfolio.

- Consistent Cash Flow: Disposal and restructuring of select real estate-backed distressed assets offer reliable cash generation.

- Market Share Dominance: High volume or value of managed assets in this segment contributes to significant cash flow.

- Strategic Disposal: Focus on assets with clear resolution paths and stable underlying values is key to maximizing cash generation.

Profitable Subsidiaries with Stable Operations

Some of China Huarong's platform subsidiaries, particularly those with well-established and profitable operations in specialized financial services or asset management areas, can be categorized as Cash Cows. These entities typically generate consistent cash flow with minimal investment requirements, supporting other business units within the group.

Historically, China Huarong Financial Leasing served as an example of such a stable, cash-generating unit, deriving income from asset financing activities. Although it was acquired by CITIC Group, its operational model highlights the characteristics of a Cash Cow within the context of China Huarong's broader portfolio.

- Stable Revenue Streams: Subsidiaries like those focused on specific asset financing or niche asset management services often exhibit predictable and consistent revenue generation.

- Low Investment Needs: Mature operations in these segments typically require limited capital expenditure for growth, allowing them to generate surplus cash.

- Contribution to Group Profitability: These Cash Cow units play a crucial role in funding the development of Stars or supporting Question Marks within the BCG matrix.

- Historical Performance Indicators: For instance, prior to its acquisition, China Huarong Financial Leasing demonstrated consistent revenue generation through its leasing operations, a hallmark of a Cash Cow.

China Huarong Asset Management's established financial leasing operations, prior to significant restructuring or divestment, often represent Cash Cows. These segments, characterized by a mature portfolio of leased assets and a stable client base, generate consistent income with relatively low reinvestment needs. The company's historical focus on these areas provided a reliable source of cash to fund other strategic initiatives.

By continuing to efficiently manage and service existing leasing contracts, these units can maintain their role as cash generators. For example, while specific figures for 2024 are still emerging, the broader Chinese financial leasing market in 2023 demonstrated resilience, with industry assets growing, suggesting continued potential for established players.

| Business Segment | BCG Category | Key Characteristics | 2023 Data Insight |

|---|---|---|---|

| Mature Distressed Asset Portfolios | Cash Cow | Long-held, stable, undergoing steady disposal/restructuring | Significant reduction in legacy holdings, indicating consistent cash generation. |

| Established Asset Management & Investment | Cash Cow | Mature market, minimal new investment, strong profit margins | Core component of business model, contributing to stable revenue. |

| Established Banking & Securities Operations | Cash Cow | Stable client base, predictable revenue, mature market position | Supported by robust sector performance, e.g., ~RMB 2.5 trillion net profit for Chinese banks in 2023. |

What You See Is What You Get

China Huarong Asset Management BCG Matrix

The preview of the China Huarong Asset Management BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, crafted by industry experts, provides a clear strategic overview of China Huarong's business units, allowing for immediate application in your decision-making processes. Rest assured, no watermarks or demo content will be present in the final version you download, ensuring a professional and ready-to-use report for your business planning needs.

Dogs

Legacy non-performing assets with extremely low recovery potential and high holding expenses would be categorized in the Dogs quadrant of China Huarong Asset Management's BCG Matrix. These assets are situated in a market with minimal desirability for new acquisitions and contribute a negligible share to profitable resolutions.

These legacy assets are a drain on capital, offering little in terms of returns, thus making them prime candidates for divestment or substantial write-downs. For instance, as of the end of 2023, China Huarong reported a significant portion of its legacy portfolio still required careful management, reflecting the ongoing challenges associated with resolving these types of assets.

Underperforming or divested non-core subsidiaries fall into the Dogs category of the BCG Matrix. These are business units with a low market share in slow-growing industries. China Huarong Asset Management has a history of divesting non-core assets to streamline operations and enhance focus on its core financial services. For instance, in 2023, the company continued its strategic shift, aiming to shed non-essential assets to improve overall efficiency and profitability.

Highly impaired or illiquid equity investments represent China Huarong Asset Management's Dogs in the BCG Matrix. These are assets that have seen their value drop significantly, making them hard to sell, and they don't offer much hope for future growth or a profitable sale. Such investments essentially lock up capital without bringing in much, or even anything, back.

These holdings typically reflect a low market share within industries that aren't particularly attractive for investment, or they operate in markets that are either shrinking or not growing at all. China Huarong's reported asset impairment losses in 2023, amounting to RMB 42.4 billion (approximately USD 5.9 billion), could very well be linked to these types of underperforming equity investments.

Outdated or Inefficient Operational Segments

Operational segments within China Huarong Asset Management that are characterized by outdated processes, high operational costs, and low efficiency in mature or declining markets would be classified as Dogs. These segments struggle to generate adequate returns, even with continued investment, signaling a potential need for significant restructuring or divestment to boost overall company performance.

For instance, if a particular legacy loan portfolio within China Huarong is managed with manual, paper-based systems, incurring substantial administrative overhead and experiencing slow recovery rates in a market segment that is no longer growing, it would fit the Dog profile. Such segments might represent a drag on capital and management attention.

- Legacy Asset Management: Portfolios of non-performing loans acquired in earlier economic cycles, now facing difficult recovery environments and requiring high servicing costs.

- Outdated IT Infrastructure: Systems that are not integrated, inefficient, and costly to maintain, hindering the speed and accuracy of asset management operations.

- Low-Yielding Investment Portfolios: Investments in sectors or companies that are in decline or have fundamentally weak business models, offering minimal returns and high risk.

- Subperforming Subsidiaries: Business units that consistently underperform, failing to meet profitability targets despite management efforts and market opportunities.

Certain Overseas or Speculative Investments

Certain overseas or speculative investments, particularly those that have historically underperformed or operate in highly competitive international arenas with minimal market penetration, would likely be categorized as Dogs within China Huarong Asset Management's BCG Matrix.

These ventures, if they divert resources from Huarong's core competency in distressed asset management and lack a clear strategic alignment, can become significant drains on profitability and hinder overall market positioning. For instance, past ventures into less liquid international markets that failed to gain traction could represent such a category.

- Low Market Share: These investments often struggle to capture significant market share in established or rapidly evolving overseas markets.

- Underperforming Returns: They typically generate low or negative returns on investment, failing to meet initial projections or benchmarks.

- Resource Drain: Continued investment in these areas can divert capital and management attention from more promising core businesses.

- Strategic Misalignment: If not aligned with Huarong's primary focus on domestic distressed asset resolution, these overseas ventures may represent a strategic drift.

Dogs within China Huarong Asset Management's BCG Matrix represent legacy assets with low recovery potential and high holding costs, such as non-performing loans from earlier economic cycles. These also include underperforming subsidiaries or business units with minimal market share in slow-growing industries, which China Huarong has strategically divested from to streamline operations. Highly impaired or illiquid equity investments, characterized by significant value drops and difficulty in selling, also fall into this category, locking up capital without returns.

Operational segments with outdated processes and high costs in mature or declining markets, like legacy loan portfolios managed with inefficient systems, are also considered Dogs. These segments struggle to generate adequate returns, signaling a need for restructuring or divestment. For instance, China Huarong's reported asset impairment losses in 2023, amounting to RMB 42.4 billion (approximately USD 5.9 billion), likely reflect these types of underperforming investments.

| BCG Quadrant | China Huarong Asset Management Examples | Key Characteristics |

|---|---|---|

| Dogs | Legacy Non-Performing Loans | Low recovery potential, high servicing costs, mature/declining markets |

| Dogs | Subperforming Subsidiaries | Low market share, inconsistent profitability, divestment candidates |

| Dogs | Impaired Equity Investments | Significant value erosion, illiquid, minimal future growth prospects |

Question Marks

China Huarong Asset Management's potential ventures into new technology-driven financial solutions, such as platforms for distressed asset management or digital finance, would likely be categorized as Stars or Question Marks in the BCG Matrix. These areas represent high-growth markets with significant future potential.

These new initiatives, while in high-growth segments, currently possess a low market share due to their nascent stage and the substantial investments required for development and market adoption. Their trajectory hinges on achieving rapid market penetration and widespread acceptance to transition from Question Marks to Stars.

Investing in nascent distressed asset sub-sectors, potentially spurred by shifts in economic conditions or regulatory adjustments, represents a strategic avenue for growth. These emerging niches, while promising high returns, likely see China Huarong with a minimal current market footprint. Capturing substantial market share necessitates considerable capital deployment and a sharp strategic focus.

Expanding into China's less developed regional markets presents a classic Question Mark scenario for China Huarong Asset Management. These areas, while potentially offering high growth due to burgeoning financial activity and nascent distressed asset markets, demand substantial investment to build presence and capture market share.

For instance, while major cities like Shanghai and Beijing are saturated, provinces such as Guizhou or Yunnan are showing accelerated GDP growth, with Guizhou's economy expanding by 7.7% in 2023. This growth, coupled with increasing financial liberalization in these regions, creates an opportunity for Huarong’s core distressed asset management services, but also necessitates significant upfront capital for infrastructure and talent acquisition.

Specific New Financial Products or Services

China Huarong Asset Management's foray into highly innovative financial products, such as bespoke structured products for high-net-worth individuals or specialized digital asset management platforms, would likely fall into the Question Marks category of the BCG Matrix. These offerings target emerging market demands, like wealth preservation in volatile economic climates or access to alternative investments, which are growing segments. For instance, the global market for alternative investments, which these products might tap into, was projected to reach $23.2 trillion by 2027, indicating significant potential.

These products, while promising, currently possess low market share due to their novelty and the need for extensive customer education and regulatory navigation. China Huarong might be investing heavily in research and development, as well as marketing, to build awareness and trust for these specialized services. The success of these ventures hinges on their ability to demonstrate clear value propositions and adapt to evolving client needs and market conditions.

- Innovative Wealth Management Solutions: Development of personalized investment portfolios utilizing AI-driven analytics to cater to sophisticated investor needs, potentially targeting the growing affluent population in China, which saw its number of millionaires increase by 15% in 2023.

- Digital Asset Custody and Trading Platforms: Exploring services related to the custody and trading of digital assets, acknowledging the increasing global interest in this sector, with the global digital asset market valued at over $1 trillion in early 2024.

- Green Finance Products: Launching green bonds or sustainability-linked loans to capitalize on the increasing demand for ESG-compliant investments, a market segment that saw global issuance of sustainable bonds reach an estimated $1.5 trillion in 2023.

Strategic Partnerships in Nascent Industries

Strategic partnerships in nascent industries are crucial for China Huarong Asset Management, positioning them as potential future Stars within the BCG framework. These collaborations are essentially high-risk, high-reward ventures, aiming to cultivate market leaders from early-stage opportunities. For instance, in the burgeoning electric vehicle (EV) battery recycling sector, Huarong could partner with innovative startups, channeling capital and expertise to scale operations.

Such joint ventures are characterized by substantial upfront investment and a long gestation period before profitability. By engaging in these strategic alliances, Huarong aims to secure a dominant market position in sectors poised for exponential growth. For example, in 2024, the global battery recycling market was projected to reach approximately $10 billion, with significant growth anticipated in the coming decade, making early-stage partnerships a strategic imperative.

- Cultivating Future Stars: Partnerships in nascent industries are designed to nurture emerging businesses into market leaders, aligning with the 'Star' quadrant of the BCG matrix.

- Long-Term Growth Bets: These collaborations represent strategic investments in future market potential, requiring patience and significant capital allocation before generating substantial returns.

- Risk Mitigation through Collaboration: By joining forces with specialized companies, Huarong can share the risks and leverage complementary expertise in rapidly evolving sectors.

- Capitalizing on Emerging Trends: Strategic alliances allow Huarong to gain early access and influence in high-growth sectors, such as renewable energy technology or advanced materials, which are expected to drive future economic expansion.

China Huarong Asset Management's ventures into new, high-growth markets with low current market share are classified as Question Marks. These initiatives require significant investment and strategic focus to gain traction and evolve into Stars.

Examples include expanding into less developed regional markets, which offer high growth potential but demand substantial capital for infrastructure and talent. Similarly, innovative financial products targeting emerging demands, like digital asset management, are also Question Marks due to their novelty and the need for extensive customer education.

These Question Mark opportunities, such as leveraging Guizhou's 7.7% GDP growth in 2023, necessitate substantial upfront capital to build presence and capture market share in these burgeoning financial landscapes.

The company's strategic partnerships in nascent industries, like EV battery recycling, also fall into this category. These are long-term, high-risk, high-reward bets designed to cultivate future market leaders, with the global battery recycling market projected to reach approximately $10 billion in 2024.

BCG Matrix Data Sources

Our China Huarong BCG Matrix is informed by official financial disclosures, comprehensive industry research, and detailed market trend analyses to provide strategic insights.