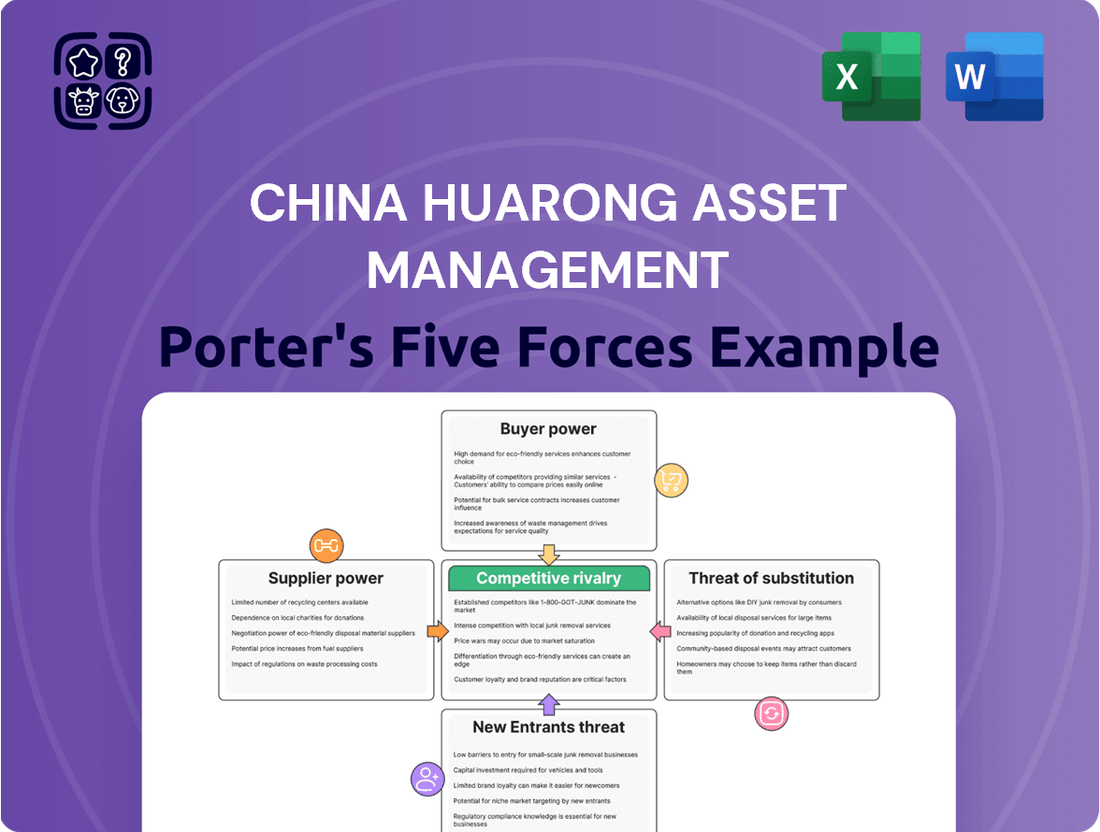

China Huarong Asset Management Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Huarong Asset Management Bundle

China Huarong Asset Management navigates a complex landscape shaped by intense rivalry and significant buyer power within the financial services sector. The threat of new entrants is moderate, while supplier power is relatively low. However, the looming threat of substitutes demands constant strategic adaptation.

The complete report reveals the real forces shaping China Huarong Asset Management’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for China Huarong Asset Management (now China CITIC Financial Asset Management) is largely determined by financial institutions, primarily banks, looking to offload non-performing assets (NPAs). The sheer volume of these NPAs available directly impacts the leverage these banks hold. As of early 2024, Chinese banks reported at-risk loans reaching significant multiyear highs, suggesting a robust supply of distressed assets.

China's evolving regulatory landscape significantly influences supplier power for asset management companies like China Huarong. Recent reforms have broadened the types of distressed assets Huarong can acquire, including special mention loans and assets from non-bank financial institutions and corporations. This expansion offers Huarong more choices, potentially reducing the leverage of individual asset sellers.

For instance, the growing distressed debt market in China, which saw significant activity in 2023 and is projected to continue expanding through 2024, means Huarong has a larger universe of potential suppliers. This increased supply of distressed assets can dilute the bargaining power of any single seller, as Huarong can more easily find alternative sources for its investment needs.

The bargaining power of suppliers for China Huarong Asset Management (AMC) is influenced by government policy and the stability of the banking sector. While AMCs generally receive consistent funding liquidity from domestic banks, the government's efforts to manage property sector stress and the broader economic slowdown can affect bank asset quality. This, in turn, might increase the demand for Non-Performing Loan (NPL) disposals, potentially strengthening the position of banks as suppliers of distressed assets.

Supplier Power 4

Providers of capital, including investors and bondholders, are a crucial supplier group for China Huarong Asset Management. As a state-owned enterprise, Huarong benefits from implicit government backing, which often translates to lower borrowing costs and easier access to funding. This government support can significantly diminish the bargaining power of individual capital providers, as they may perceive less risk and therefore demand lower returns.

In 2023, China Huarong’s total liabilities stood at approximately RMB 1.3 trillion, illustrating the substantial reliance on capital markets for its operations. The perceived stability afforded by state ownership can lead to more favorable terms from lenders and investors compared to privately held entities, thereby reducing the suppliers’ leverage.

- Government Backing: China Huarong's status as a state-owned financial asset management company provides a strong implicit guarantee from the Chinese government.

- Access to Capital: This backing facilitates easier and often cheaper access to funding from both domestic and international capital markets.

- Reduced Refinancing Risk: The implicit support mitigates refinancing risks, giving Huarong more control over its funding costs and terms.

- Investor Confidence: Investors and bondholders may exhibit lower bargaining power due to increased confidence in the company's financial stability and government commitment.

Supplier Power 5

The bargaining power of suppliers for China Huarong Asset Management, particularly in the distressed asset sector, is generally moderate. While specialized services like legal restructuring and advanced data analytics for asset valuation can command some leverage due to unique expertise, the broader market for many supplier needs remains competitive. This competition limits the ability of most suppliers to exert significant pricing power over a large, state-owned entity like Huarong. For instance, in 2024, the global market for financial advisory services, a key supplier category, saw continued growth, indicating a robust supply side that can absorb demand without excessive price increases.

However, specific niche providers might possess greater influence. For example, firms with proven track records in handling complex cross-border debt restructuring or those offering proprietary AI-driven valuation tools could negotiate more favorable terms. The ability of Huarong to switch suppliers for these specialized services might be limited by the scarcity of comparable expertise. This dynamic is crucial as Huarong navigates the complexities of its vast asset portfolio, requiring specialized external support.

In 2023, China's financial sector experienced regulatory shifts aimed at enhancing risk management and operational efficiency, which could indirectly influence supplier relationships by standardizing certain service requirements. This environment suggests that while specialized skills are valued, a broader push for efficiency might temper extreme supplier power. The overall trend points towards a balanced negotiation landscape, where Huarong's scale and market position are significant counterweights to supplier influence.

Key factors influencing supplier power for Huarong include:

- Specialized Expertise: Niche service providers in restructuring and advanced analytics can hold moderate bargaining power.

- Market Competition: The availability of multiple providers for standardized services limits supplier leverage.

- Huarong's Scale: As a large state-owned entity, Huarong's purchasing power is a significant factor.

- Regulatory Environment: Evolving financial regulations in China can impact supplier service standards and pricing.

The bargaining power of suppliers for China Huarong Asset Management (now China CITIC Financial Asset Management) is generally moderate, influenced by the vast supply of distressed assets from Chinese banks. As of early 2024, significant multiyear highs in at-risk loans reported by Chinese banks indicate a robust supply, diluting individual seller leverage.

Government policies and banking sector stability also play a key role. Efforts to manage property sector stress and economic slowdown can increase demand for non-performing loan disposals, potentially strengthening banks' supplier positions.

Specialized service providers, such as those in complex debt restructuring or AI-driven valuation, may hold more influence due to scarce expertise, though the competitive market for many standardized services limits overall supplier leverage.

| Factor | Impact on Supplier Power | Rationale |

| Volume of Distressed Assets | Decreased | High supply from banks (e.g., multiyear highs in at-risk loans reported early 2024) limits individual seller leverage. |

| Government Policy & Sector Stability | Variable | Property sector stress can increase NPL disposals, potentially strengthening banks as suppliers. |

| Specialized vs. Standardized Services | Moderate to High for Specialized; Low for Standardized | Niche expertise (e.g., cross-border restructuring) commands more power; competitive markets for standard services limit it. |

| Huarong's Scale and State Ownership | Decreased | Large purchasing power and implicit government backing reduce supplier negotiation leverage. |

What is included in the product

This analysis unpacks the competitive forces impacting China Huarong Asset Management, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within its sector.

Gain immediate clarity on competitive pressures within China's asset management sector, allowing for swift strategic adjustments to navigate industry challenges.

Customers Bargaining Power

China Huarong's customers, primarily investors and enterprises seeking restructured assets or financial services, hold moderate bargaining power. This power is influenced by the availability of comparable investment opportunities and financial service providers in the market. For instance, in 2023, the Chinese financial sector continued to see robust growth in alternative asset managers, offering clients more choices and thus increasing their leverage when negotiating terms with Huarong.

Sophisticated investors, such as private equity firms and other asset managers, who acquire distressed assets from China Huarong Asset Management wield considerable bargaining power. These buyers often target specific return profiles and have a range of alternative investment opportunities available to them, which pressures Huarong to offer attractive pricing and favorable terms on asset portfolios.

The bargaining power of customers for China Huarong Asset Management is influenced by China's overall economic conditions and market sentiment. As of early 2024, while there are indications of economic recovery, ongoing uncertainties, particularly in the real estate sector, can impact the perceived value and pricing of distressed assets. This can shift leverage towards buyers who may have more options or face fewer immediate needs.

Customer Power 4

China Huarong's financial services, including banking, securities, and trusts, contend with numerous domestic and growing foreign competitors. This extensive market choice significantly amplifies customer bargaining power, as clients can readily switch based on service quality, fees, and available products.

For instance, in China's highly competitive banking sector, customers have a plethora of options. By the end of 2023, there were over 4,000 banking institutions in China, including large state-owned banks, joint-stock commercial banks, and city commercial banks, providing ample alternatives for consumers and businesses alike.

- High Market Saturation: The sheer number of financial service providers in China grants customers considerable leverage.

- Price Sensitivity: Customers can easily compare fees and interest rates across different institutions, driving down margins for providers like China Huarong.

- Product Differentiation Challenges: In many core financial services, offerings can be similar, making switching costs low for customers.

- Digitalization Impact: Online platforms and fintech innovations have further reduced switching costs and increased price transparency, empowering consumers.

Customer Power 5

China Huarong Asset Management's customer power is influenced by its unique policy role. As an entity tasked with mitigating financial risks and optimizing resource allocation, certain 'customers,' such as government-backed entities or strategic enterprises involved in risk resolution, possess diminished direct bargaining power. Their participation is often dictated by national economic objectives rather than solely commercial negotiations.

This dynamic limits the ability of these key stakeholders to dictate terms, as their engagement aligns with broader systemic stability goals. For instance, during periods of economic stress, Huarong's involvement in resolving non-performing loans for state-owned enterprises may not be subject to the same price sensitivity as a typical commercial transaction.

- Policy-Driven Engagement: Customers involved in national risk mitigation efforts have less leverage due to alignment with broader economic objectives.

- Reduced Price Sensitivity: Strategic importance often outweighs purely commercial considerations for these key stakeholders.

- Limited Negotiation Scope: Terms are frequently shaped by regulatory frameworks and national economic priorities, not just market forces.

China Huarong Asset Management faces customers with moderate to high bargaining power, largely due to market saturation and increasing client sophistication. The availability of numerous financial service providers in China means clients can readily compare offerings and switch, putting pressure on Huarong to provide competitive pricing and terms. This is particularly true for sophisticated investors seeking distressed assets, who have alternative investment avenues and specific return expectations.

| Customer Segment | Bargaining Power Influence | Key Factors |

|---|---|---|

| General Investors/Enterprises | Moderate | Availability of comparable opportunities, market sentiment |

| Sophisticated Investors (PE Firms) | High | Targeted return profiles, alternative investment options, price sensitivity |

| Policy-Driven Entities | Low | Alignment with national economic objectives, reduced price sensitivity |

Same Document Delivered

China Huarong Asset Management Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of China Huarong Asset Management, detailing the competitive landscape and strategic positioning within the financial sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

China Huarong Asset Management faces intense competition within China's financial asset management sector. The market is heavily concentrated, with four dominant state-owned entities, including China Cinda, China Great Wall, and China Orient, holding substantial sway. This oligopolistic environment fuels significant rivalry as these major players vie for distressed asset acquisitions and expanded market share across various financial services.

The property sector downturn and broader macroeconomic headwinds in China have significantly intensified competitive rivalry among Asset Management Companies (AMCs). This challenging environment puts pressure on asset quality and profitability for all players, including China Huarong. Fitch Ratings' early 2024 downgrade of the four national AMCs, citing weakened government support and property market challenges, underscores this heightened competitive landscape.

Regulatory reforms in China's financial sector are significantly intensifying competitive rivalry for companies like China Huarong Asset Management. These changes are designed to attract foreign investment, which in turn brings new players and strategies into the market.

Foreign asset managers are actively expanding their presence in China, often through wholly foreign-owned enterprises or joint ventures. This influx of international expertise and capital introduces novel approaches and potentially greater competition for established domestic firms.

For instance, by the end of 2023, foreign institutions had increased their holdings in Chinese financial assets, reflecting this growing interest and operational expansion, directly impacting the competitive landscape.

Competitive Rivalry 4

Beyond the dominant 'Big Four' asset management companies (AMCs) in China, a more fragmented competitive environment exists with numerous provincial-level AMCs. These local players, along with commercial banks increasingly managing distressed assets in-house, intensify rivalry, especially for smaller asset portfolios. This diffusion of competition means China Huarong faces a broader array of potential competitors than just its national peers.

The presence of these numerous smaller AMCs and internal bank capabilities creates a more challenging landscape for China Huarong, particularly when bidding for or managing less substantial distressed asset portfolios. This competition can impact pricing and deal flow, requiring Huarong to be agile and efficient in its operations.

- Fragmented Market: Local AMCs and commercial banks contribute to a fragmented competitive landscape for distressed assets.

- Increased Pressure: This fragmentation, especially for smaller portfolios, heightens competitive pressure on China Huarong.

- Impact on Strategy: Huarong must adapt its strategies to compete effectively against a wider range of players.

Competitive Rivalry 5

Competitive rivalry for China Huarong Asset Management (Huarong) is intensifying as the landscape of asset management companies (AMCs) evolves. Beyond traditional distressed debt, AMCs are diversifying into a wider array of financial services.

This diversification means Huarong now faces competition not only from other AMCs but also from a broader spectrum of financial institutions. These include banks, securities firms, and trust companies, all vying for market share in areas like wealth management, investment banking, and lending.

For instance, by 2024, the Chinese financial sector saw increased cross-industry competition. Banks are expanding their asset management arms, and securities firms are actively participating in non-performing asset disposal, directly challenging Huarong's traditional business lines and its newer ventures.

- Diversified Competition: Huarong competes with banks, securities firms, and trusts, not just other AMCs.

- Expanded Service Offerings: Competition now spans banking, securities, and trust services, moving beyond distressed debt.

- Market Share Battles: This diversification leads to direct competition for market share across various financial service segments.

Competitive rivalry is escalating for China Huarong Asset Management due to a more fragmented market and increased cross-industry competition. Beyond the four major state-owned asset management companies (AMCs), numerous provincial AMCs and commercial banks managing distressed assets in-house intensify competition, particularly for smaller portfolios. This broader competitive set, including banks and securities firms expanding into areas like wealth management and investment banking, challenges Huarong across its service spectrum.

| Competitor Type | Key Characteristics | Impact on Huarong |

|---|---|---|

| National AMCs (e.g., Cinda, Great Wall, Orient) | Dominant state-owned entities, significant market share in distressed assets. | Direct competition for large-scale distressed asset acquisitions and market influence. |

| Provincial AMCs | Numerous smaller players, focus on regional distressed assets. | Fragmented competition, especially for smaller or localized portfolios, can affect deal flow and pricing. |

| Commercial Banks | Increasingly managing distressed assets internally, expanding asset management arms. | Direct competition in asset management and lending, challenging traditional AMC business lines. |

| Securities Firms & Trust Companies | Diversifying into wealth management, investment banking, and NPL disposal. | Cross-industry rivalry, competing for market share in broader financial services beyond distressed debt. |

| Foreign Asset Managers | Expanding presence via wholly foreign-owned enterprises or joint ventures. | Introduction of new strategies, capital, and expertise, potentially increasing overall market competition. |

SSubstitutes Threaten

The most direct substitutes for China Huarong's core distressed asset management business involve financial institutions handling their non-performing assets internally. Banks might opt to manage and resolve their bad loans through their own specialized departments, thereby diminishing the reliance on external asset management companies (AMCs) like Huarong.

This internal resolution trend is significant as it directly impacts the volume of distressed assets available for AMCs. For instance, in 2023, Chinese banks continued to increase their efforts in direct NPL disposal, with some reporting improved NPL ratios through in-house workout programs, reducing the need for external sales.

Direct debt restructuring between debtors and creditors, bypassing Asset Management Companies (AMCs) like China Huarong, presents a significant threat. Companies in financial distress may opt to negotiate directly with their lenders, especially for less complex debt situations, thereby avoiding the fees and processes associated with AMC involvement. This trend is amplified as financial markets mature and communication channels between borrowers and lenders improve.

China Huarong's diversified financial services, including banking, securities, and trusts, face a considerable threat from substitutes within China's dynamic financial landscape. Numerous commercial banks, investment banks, and independent securities firms offer comparable products and services, directly competing in these segments.

The presence of many trust companies also presents a significant substitution risk, particularly in wealth management and asset management areas where Huarong operates. This broad availability of alternatives means customers can easily switch to competitors if Huarong's offerings are not perceived as superior or cost-effective.

4

Private equity funds and other investment vehicles focusing on distressed debt or special situations represent a significant threat of substitutes for China Huarong Asset Management. These entities actively compete for non-performing loans and distressed assets, directly challenging Huarong's acquisition strategies and market position.

These specialized funds can offer swift and flexible deal execution, often outmaneuvering traditional financial institutions. For instance, in 2023, global distressed debt funds raised billions, indicating a robust appetite for acquiring troubled assets, which directly impacts the pool of opportunities available to Huarong.

- Competition for Distressed Assets: Private equity and distressed debt funds are direct competitors for acquiring non-performing loans and troubled corporate assets.

- Alternative Acquisition Channels: These funds provide alternative avenues for banks and corporations to offload distressed assets, bypassing traditional asset management companies like Huarong.

- Market Dynamics: The increasing presence and capital availability of these specialized investors can drive up acquisition prices for distressed assets, potentially reducing Huarong's profit margins.

5

The development of a more mature and transparent secondary market for distressed assets in China could significantly increase the threat of substitutes for China Huarong Asset Management (Huarong). As of early 2024, the Chinese government has been actively promoting the growth of this secondary market, aiming to improve the efficiency of non-performing asset (NPA) disposal. This trend suggests that banks and other financial institutions may find it increasingly feasible to trade NPAs directly or through emerging online platforms, bypassing traditional asset management companies (AMCs) like Huarong.

This shift could reduce the reliance on AMCs as primary intermediaries for NPA resolution. For instance, in 2023, the volume of distressed debt transactions in China saw a notable increase, with more direct sales and securitization efforts being explored. If this trend accelerates, Huarong might face greater competition from these alternative channels, potentially impacting its market share and fee-based income from NPA management services.

- Secondary Market Growth: Increased trading volumes and transparency in China's distressed asset secondary market could offer direct selling opportunities for banks.

- Online Platforms: The rise of digital platforms for NPA trading may provide alternative, potentially more efficient, avenues for asset disposal.

- Reduced AMC Reliance: Banks may increasingly opt for direct sales or securitization, lessening their dependence on traditional AMCs like Huarong.

- Competitive Pressure: This evolving landscape presents a growing threat of substitutes, potentially impacting Huarong's market position and revenue streams.

The threat of substitutes for China Huarong Asset Management is substantial, stemming from both internal asset resolution by banks and the growing efficiency of secondary markets. As banks increasingly manage non-performing loans (NPLs) in-house, the pool of assets available to AMCs like Huarong shrinks. For example, by the end of 2023, many Chinese commercial banks reported progress in direct NPL disposal, enhancing their internal workout capabilities.

Furthermore, the rise of private equity and distressed debt funds introduces strong substitutes. These funds can execute deals swiftly and flexibly, directly competing for distressed assets. In 2023, global distressed debt funds collectively raised billions, signaling a robust market for acquiring troubled assets, which directly impacts Huarong's acquisition opportunities.

The development of China's secondary market for distressed assets, actively promoted by the government as of early 2024, offers another significant substitution threat. This growth facilitates direct trading of NPAs, potentially bypassing traditional AMCs. In 2023, China witnessed increased distressed debt transactions, including direct sales and securitization efforts, suggesting a trend towards reduced reliance on intermediaries like Huarong.

| Substitute Type | Description | Impact on Huarong | 2023/2024 Trend Highlight |

|---|---|---|---|

| Internal Bank Resolution | Banks managing NPLs through in-house departments. | Reduces asset supply for AMCs. | Increased bank success in direct NPL disposal. |

| Private Equity/Distressed Funds | Specialized funds acquiring troubled assets. | Direct competition for asset acquisition. | Billions raised globally for distressed debt acquisition. |

| Secondary Market Trading | Direct trading of NPAs via platforms. | Bypasses traditional AMC intermediaries. | Growth in direct sales and securitization of distressed debt. |

Entrants Threaten

The threat of new entrants into China's distressed asset management sector, where China Huarong operates, is generally low. Historically, high regulatory hurdles and the necessity for specialized licenses created significant barriers. While foreign ownership restrictions have eased since 2020, navigating the complex approval processes and regulatory landscape still presents a substantial challenge for newcomers.

The threat of new entrants for China Huarong Asset Management is moderate. Significant capital requirements, such as the minimum paid-in capital mandated by regulators for asset management firms, can deter new players. For instance, in 2024, regulatory bodies continue to emphasize robust capital buffers, making it challenging for smaller or less capitalized entities to compete effectively against established firms like Huarong.

The threat of new entrants in China Huarong Asset Management's distressed asset sector is relatively low. This is primarily due to the significant barriers to entry, such as the critical need for deep local market knowledge and extensive, well-established networks. New players would struggle to replicate the years of experience Huarong possesses in navigating China's complex legal frameworks and property markets, essential for effective distressed asset management.

4

The threat of new entrants for China Huarong Asset Management is relatively low, primarily due to the entrenched dominance of the existing 'Big Four' state-owned asset management companies (AMCs). These established players, including Huarong itself, benefit significantly from implicit and explicit government support, which translates into preferential access to capital and regulatory advantages. For instance, as of the end of 2023, the total assets managed by the four major AMCs represented a substantial portion of the financial sector, creating high barriers to entry for any new, unproven entity.

Newcomers face considerable hurdles in replicating the scale, established networks, and policy-driven mandates that the 'Big Four' possess. Their deep-rooted relationships with state-owned banks are crucial for acquiring distressed assets and facilitating financial system stability, a role that new entrants cannot easily assume. This unique policy function, coupled with substantial government backing, effectively shields the incumbents from disruptive competition.

- Dominant 'Big Four' AMCs: China Huarong, Cinda, Orient, and Great Wall AMCs hold a commanding position.

- Government Backing: State ownership provides implicit guarantees and easier access to funding.

- Established Relationships: Long-standing ties with state-owned banks facilitate asset acquisition and financial stability operations.

- Policy Role: AMCs play a critical role in managing systemic financial risks, a function difficult for new entrants to replicate.

5

Despite China's market liberalization, the threat of new entrants for China Huarong Asset Management remains moderate. Foreign firms encounter significant hurdles, including intricate regulatory landscapes and intense competition from well-entrenched domestic entities. For instance, while foreign ownership limits in the financial sector have been eased, navigating the specific approval processes and compliance requirements can still be a substantial barrier.

Established domestic players, including state-backed institutions, often benefit from preferential policies and a deeper understanding of local market dynamics. This can translate into an uneven playing field for newcomers. In 2024, the Chinese financial sector continued to emphasize domestic champions, making it challenging for foreign asset managers to gain substantial market share quickly.

- Regulatory Complexity: Foreign firms must contend with evolving rules and licensing requirements in China's financial services industry.

- Domestic Competition: Local asset managers possess established networks and often enjoy implicit or explicit government backing.

- Economic Volatility: Short-term economic pressures and market fluctuations can deter new entrants, especially those unfamiliar with the Chinese economic cycle.

The threat of new entrants into China's distressed asset management sector is low, largely due to the dominance of the established "Big Four" state-owned asset management companies (AMCs), including China Huarong. These incumbents benefit from significant government backing, preferential access to capital, and deep-rooted relationships with state-owned banks, creating substantial barriers for newcomers. For instance, as of 2023, the combined assets under management for these major AMCs represented a significant portion of the financial system, underscoring their entrenched market position.

New entrants face considerable challenges in replicating the scale, established networks, and policy-driven mandates that the Big Four possess. Their critical role in managing systemic financial risks and facilitating financial stability is a function that new players cannot easily assume. This unique policy function, coupled with substantial government support, effectively shields incumbents from disruptive competition, making entry difficult.

Despite market liberalization, foreign firms encounter intricate regulatory landscapes and intense domestic competition, further limiting new entrants. Navigating China's complex approval processes and compliance requirements remains a substantial hurdle. In 2024, the emphasis on domestic champions in the Chinese financial sector continued to present challenges for foreign asset managers seeking significant market share.

| Factor | Impact on New Entrants | China Huarong Relevance |

| Dominant 'Big Four' AMCs | High Barrier | Huarong is one of the Big Four |

| Government Backing & Policy Role | High Barrier | Huarong benefits significantly |

| Capital Requirements | Moderate Barrier | Requires substantial capital to compete |

| Local Market Knowledge & Networks | High Barrier | Huarong possesses deep expertise |

| Regulatory Complexity (Foreign Firms) | Moderate to High Barrier | Huarong operates within this framework |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Huarong Asset Management is built upon a foundation of publicly available financial statements, regulatory filings from Chinese authorities, and reports from reputable financial data providers such as Bloomberg and S&P Capital IQ.

We also incorporate insights from industry-specific research from firms like Fitch Ratings and Moody's, alongside macroeconomic data from sources like the World Bank and the People's Bank of China to provide a comprehensive view of the competitive landscape.