Citi Trends PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Trends Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Citi Trends's market. Our comprehensive PESTLE analysis provides the strategic foresight you need to navigate this dynamic retail landscape. Download the full report now to gain actionable intelligence and make informed decisions.

Political factors

Government regulations significantly shape the retail landscape, directly influencing Citi Trends' operations. For instance, evolving rules on product safety, like those updated by the Consumer Product Safety Commission (CPSC) in 2024 regarding flammability standards for children's apparel, can necessitate costly compliance measures and product redesigns. Changes in store operating hours or local zoning laws can also affect foot traffic and sales opportunities.

Furthermore, policies surrounding consumer protection and advertising, such as the Federal Trade Commission's (FTC) ongoing scrutiny of influencer marketing practices in 2024, may require Citi Trends to adapt its promotional strategies. These adjustments aim to ensure transparency and prevent deceptive advertising, potentially impacting marketing budgets and creative approaches for campaigns by Citi Trends.

Citi Trends, as a retailer with a broad merchandise mix, is sensitive to shifts in global trade policies. For instance, changes in import tariffs on apparel and accessories from key manufacturing regions like Asia could directly impact their cost of goods sold. In 2024, the U.S. maintained tariffs on many goods imported from China, a significant sourcing hub for many retailers, potentially increasing operational expenses for Citi Trends if they rely heavily on these imports.

Fluctuations in international trade agreements and potential new restrictions on goods from specific countries can disrupt supply chains. This disruption can affect not only the cost but also the timely availability of products. For a retailer catering to budget-conscious consumers, maintaining competitive pricing and consistent stock levels is crucial, making these trade policy shifts a significant concern for operational stability and customer satisfaction.

Minimum wage legislation presents a direct cost challenge for Citi Trends. For instance, the federal minimum wage in the United States remained at $7.25 per hour as of July 2024, but many states and cities have enacted significantly higher rates. California, for example, has a phased-in minimum wage that reached $16.00 per hour statewide by January 2024, impacting Citi Trends' operational expenses in those regions.

These varying wage mandates directly affect Citi Trends' labor costs, a critical component for a retail chain with many brick-and-mortar stores. The company must absorb these increases, potentially impacting its ability to offer competitive pricing to its value-conscious customer base. Balancing higher payroll expenses with the need to remain affordable is a key strategic consideration for Citi Trends' management.

Political Stability and Social Unrest

Political instability or localized social unrest in the urban communities Citi Trends serves can disrupt store operations, impacting consumer confidence and potentially leading to property damage or reduced foot traffic. For instance, during periods of heightened civil unrest, retail sales can see a noticeable decline. Ensuring employee safety and business continuity in such environments is a key consideration for Citi Trends.

Citi Trends' operational resilience is tested by these factors. In 2024, several urban areas experienced localized protests that temporarily affected retail foot traffic. A study by the National Retail Federation indicated that such disruptions can lead to an average 15% drop in daily sales for affected businesses. Therefore, proactive risk management and contingency planning are crucial for maintaining consistent performance.

- Employee Safety Protocols: Implementing robust safety measures and communication channels to protect staff during any unrest.

- Supply Chain Diversification: Ensuring that disruptions in one area do not halt the entire flow of goods to stores.

- Community Engagement: Building positive relationships with local communities can foster goodwill and potentially mitigate the impact of unrest.

- Insurance and Security: Adequate insurance coverage and enhanced security measures at store locations to protect assets.

Taxation Policies

Changes in corporate tax rates directly impact Citi Trends' bottom line. For instance, the Tax Cuts and Jobs Act of 2017 significantly reduced the U.S. federal corporate tax rate from 35% to 21%. While this was enacted prior to 2024, its ongoing effects continue to influence profitability and capital allocation strategies for retailers like Citi Trends.

State and local sales taxes also play a crucial role. Fluctuations in these taxes, which vary widely across the jurisdictions where Citi Trends operates, can affect consumer spending patterns and the company's net revenue. For example, a state increasing its sales tax on apparel could lead to reduced demand for Citi Trends' products in that specific market.

Favorable tax incentives can offer significant advantages. Many states and municipalities offer tax credits or abatements for businesses investing in new retail locations or creating jobs. These incentives, if leveraged by Citi Trends, could lower operational costs and encourage expansion, thereby boosting financial flexibility and growth potential.

- Federal Corporate Tax Rate: Remains at 21% following the 2017 Tax Cuts and Jobs Act, providing a stable, albeit lower, baseline for corporate taxation.

- State-Level Tax Variations: Sales tax rates on apparel differ significantly by state, impacting consumer purchasing power and regional sales performance for Citi Trends.

- Tax Incentives for Retail: Opportunities exist through state and local programs offering credits for job creation and capital investment in retail development.

Government policies directly influence Citi Trends' operational costs and market access. For instance, evolving consumer protection laws, like those from the FTC in 2024 concerning advertising transparency, necessitate adaptive marketing strategies. Furthermore, import tariffs on apparel, such as those maintained on Chinese goods in 2024, directly impact Citi Trends' cost of goods sold, especially given the reliance on global sourcing.

Labor costs are significantly shaped by minimum wage legislation, with states like California reaching $16.00 per hour by January 2024, increasing operational expenses for Citi Trends in those regions. Political instability in urban centers can also disrupt sales and operations, with NRF data indicating potential daily sales drops of up to 15% during such periods in 2024.

Corporate tax rates, such as the stable 21% federal rate established by the 2017 Tax Cuts and Jobs Act, impact profitability. Variations in state sales taxes on apparel also affect consumer spending, while tax incentives for job creation and investment offer potential cost-saving opportunities for retailers like Citi Trends.

| Factor | Impact on Citi Trends | 2024/2025 Data Point |

|---|---|---|

| Consumer Protection Laws | Requires adaptive marketing strategies, potentially increasing compliance costs. | FTC's ongoing scrutiny of influencer marketing practices. |

| Import Tariffs | Increases cost of goods sold, impacting pricing strategy. | Continued U.S. tariffs on goods imported from China. |

| Minimum Wage Laws | Directly raises labor costs, affecting profitability. | California's statewide minimum wage reached $16.00/hour in Jan 2024. |

| Political Instability | Can disrupt store operations and reduce foot traffic. | NRF data suggests up to 15% drop in daily sales for affected businesses during unrest. |

| Corporate Tax Rate | Affects net profit and capital allocation decisions. | Federal rate remains at 21% post-2017 Tax Cuts and Jobs Act. |

| State Sales Taxes | Influences consumer spending and regional revenue. | Significant variations exist across states on apparel taxation. |

What is included in the product

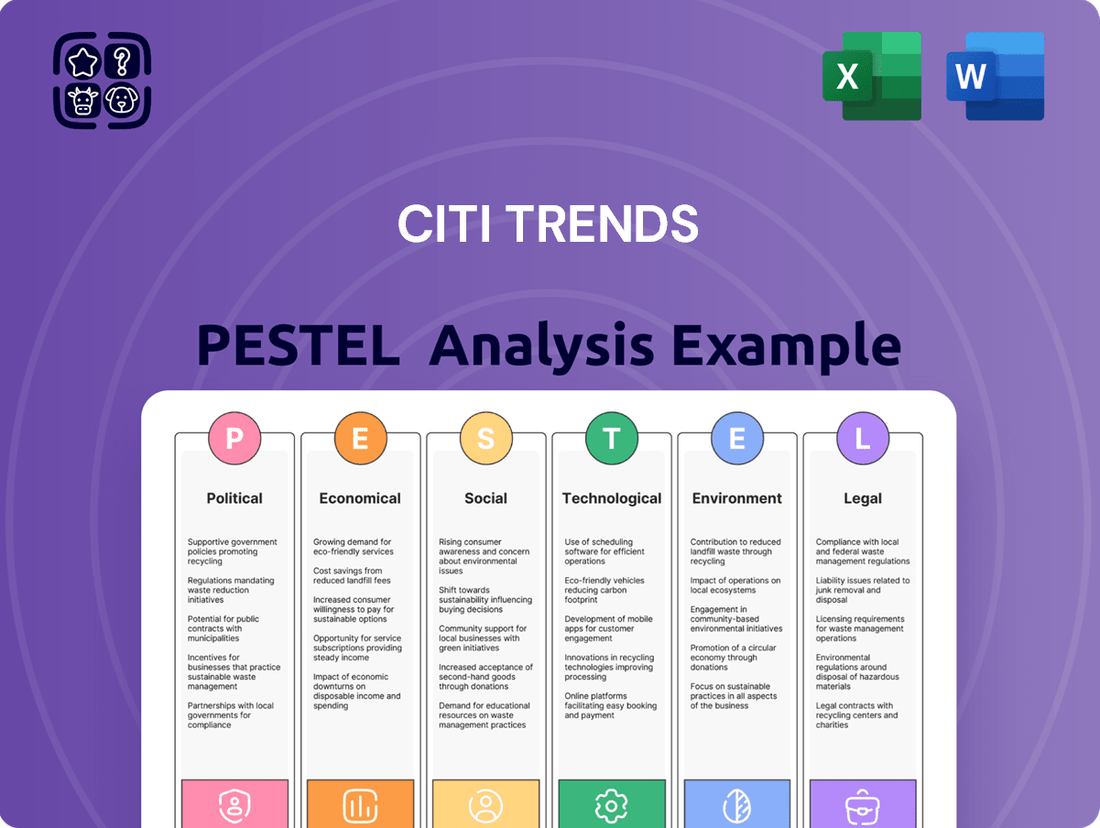

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Citi Trends, providing a comprehensive understanding of the external landscape.

This Citi Trends PESTLE Analysis offers a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Consumer spending power is a huge factor for retailers like Citi Trends. For their target audience, who are often looking for value, the amount of money left after essential bills are paid really matters. If inflation is high or wages aren't keeping up, people tend to cut back on non-essential purchases, which directly hits sales.

In 2024, we're seeing inflation moderating but still present, impacting how much consumers can buy. For instance, the U.S. inflation rate hovered around 3.4% in early 2024, a decrease from previous peaks but still a concern for budget-conscious shoppers. This means that even small price increases can make a noticeable difference in what people can afford to spend at stores like Citi Trends.

Rising inflation presents a significant challenge for Citi Trends, directly impacting the cost of acquiring merchandise and the expenses associated with operating stores and managing its supply chains. For instance, the Consumer Price Index (CPI) in the US saw a notable increase throughout 2023 and into early 2024, with specific categories like apparel and transportation experiencing price hikes.

While Citi Trends focuses on value-priced goods, persistent inflation can put pressure on profit margins. If the company cannot fully pass on increased costs to consumers without compromising the affordability that attracts its customer base, its profitability could be negatively affected. This delicate balance is crucial for maintaining sales volume in their target market.

Unemployment rates significantly impact Citi Trends' core customer base. In urban and underserved areas, where Citi Trends has a strong presence, elevated unemployment directly curtails consumer confidence and shrinks the pool of individuals with discretionary income, leading to weaker sales. For instance, as of May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months, indicating a potential headwind for retailers reliant on consumer spending in these specific demographics.

Conversely, periods of lower unemployment generally translate to improved consumer sentiment and a greater capacity for discretionary spending, which benefits retailers like Citi Trends. A robust job market means more people have stable incomes, increasing their willingness and ability to purchase apparel and accessories. The trend towards lower unemployment in prior years had supported retail sales, a positive indicator that investors will watch closely as economic conditions evolve through 2025.

Interest Rates and Credit Availability

Interest rate fluctuations directly impact Citi Trends' operational costs. For instance, if the Federal Reserve continues its rate hikes through 2024 and into 2025, the cost of borrowing for inventory and potential expansion will increase. This could strain margins, especially for a retailer reliant on consumer spending.

The availability and cost of consumer credit are crucial for Citi Trends. When credit is tight or interest rates on credit cards are high, consumers are less likely to make discretionary purchases, particularly for items like home furnishings or apparel that might be considered non-essential. As of early 2024, credit card interest rates have remained elevated, a trend that could persist, impacting Citi Trends' sales volume.

- Borrowing Costs: Higher interest rates increase the expense of financing inventory and capital expenditures for Citi Trends.

- Consumer Spending: Restricted consumer credit access or higher borrowing costs for individuals can dampen demand for Citi Trends' products.

- Economic Sensitivity: Retailers like Citi Trends are particularly sensitive to shifts in interest rates and credit availability, which affect both their cost structure and their customer base's purchasing power.

Economic Growth and Recession Cycles

The overall economic climate significantly impacts retail, including companies like Citi Trends. During periods of economic growth, consumer spending generally rises, benefiting retailers. Conversely, economic downturns or recessions can lead to shifts in consumer behavior.

Citi Trends, with its focus on affordable fashion, is positioned to potentially benefit from consumers trading down during economic slowdowns. For instance, if inflation remains elevated or unemployment rises, shoppers might seek out more budget-friendly options. The U.S. economy, while showing resilience, has navigated inflationary pressures and interest rate hikes throughout 2023 and into 2024, creating a mixed environment for consumer spending.

- Economic Growth: The U.S. GDP growth rate was 2.5% in 2023, indicating a period of expansion, though forecasts for 2024 suggest a moderation.

- Inflation: While inflation has cooled from its 2022 peaks, it remained a factor influencing consumer purchasing power into early 2024, with the Consumer Price Index (CPI) showing a year-over-year increase of 3.4% as of April 2024.

- Consumer Spending: Retail sales, a key indicator of consumer spending, saw a modest increase of 3.0% year-over-year in April 2024, reflecting cautious but present consumer demand.

- Recession Risk: While a recession was a concern in late 2023, many economists revised their outlooks, predicting a softer landing or continued, albeit slower, growth through 2024.

Economic factors significantly shape Citi Trends' operating environment, influencing both consumer demand and company costs. Inflation, while moderating, continues to affect purchasing power, with the U.S. CPI at 3.4% year-over-year in April 2024, impacting the affordability of non-essential goods for their value-conscious customer base.

Unemployment rates also play a crucial role; a 4.0% U.S. unemployment rate in May 2024 suggests a segment of the population may have reduced discretionary income, directly affecting sales for retailers like Citi Trends. Conversely, a strong job market historically supports increased consumer spending on apparel and accessories.

Interest rates and credit availability directly impact Citi Trends' borrowing costs for inventory and operations, with elevated credit card rates in early 2024 potentially dampening consumer spending on discretionary items. The overall economic climate, including GDP growth of 2.5% in 2023, creates a dynamic where Citi Trends might benefit from consumers seeking value during economic shifts.

| Economic Factor | Key Data Point (Early 2024/2025) | Impact on Citi Trends |

|---|---|---|

| Inflation (CPI) | ~3.4% YoY (April 2024) | Reduces consumer purchasing power for non-essentials. |

| Unemployment Rate | 4.0% (May 2024) | Can limit discretionary spending for target demographics. |

| Interest Rates | Elevated Credit Card Rates | Increases borrowing costs and may curb consumer credit use. |

| GDP Growth | 2.5% (2023), moderating forecasts for 2024 | Influences overall consumer confidence and spending capacity. |

Preview the Actual Deliverable

Citi Trends PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Citi Trends covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy. Understand the external forces shaping Citi Trends' market landscape.

Sociological factors

Citi Trends' success hinges on its ability to capture the fast-paced evolution of urban fashion. In 2024, the resale market for streetwear, a key urban fashion segment, was projected to reach $80 billion globally, highlighting the significant demand for trend-driven apparel.

The company's responsiveness to these shifting preferences is crucial; a misstep in anticipating styles could lead to substantial inventory markdowns. For instance, the rapid rise of Y2K fashion in 2023 demonstrated how quickly specific aesthetics can dominate consumer choices, impacting retailers who failed to adapt.

Demographic shifts are significantly reshaping Citi Trends' market. As of 2024, the U.S. population continues to diversify, with growing Hispanic and Asian populations, particularly in urban centers where Citi Trends often operates. This evolving customer profile necessitates a keen understanding of varying cultural preferences and spending habits to effectively tailor merchandise.

Population growth in specific urban and underserved communities presents both opportunities and challenges. For instance, areas experiencing rapid growth in younger demographics, aged 18-34, represent a key target for fashion-forward apparel. Conversely, an aging population might require a different product mix. Citi Trends' success hinges on its ability to adapt its inventory and store placement to these dynamic demographic landscapes.

Consumer lifestyles are shifting, with a pronounced emphasis on convenience and value. This means Citi Trends must adapt its engagement strategies to meet these evolving expectations. For instance, a significant portion of consumers, around 60% in late 2024, indicated that convenience is a primary driver in their purchasing decisions.

The ongoing digital transformation significantly impacts shopping habits. While 70% of consumers still prefer some form of in-store experience, there's a clear upward trend in online browsing and purchasing, with e-commerce sales expected to grow by another 8% in 2025. This necessitates a robust omnichannel approach for retailers like Citi Trends.

Social Awareness and Ethical Consumption

Consumers are increasingly aware of social issues, including fair labor and sustainable practices. This growing consciousness can sway purchasing choices, even for value-focused retailers like Citi Trends.

While Citi Trends emphasizes affordability, a significant portion of its customer base, especially younger shoppers, may consider a brand's social responsibility. For instance, a 2024 survey indicated that 65% of Gen Z consumers consider a company's ethical practices when making purchasing decisions.

This trend suggests that Citi Trends might need to increasingly highlight its commitment to social awareness, even within its accessible price points, to resonate with a broader and more ethically-minded consumer segment.

- Growing Ethical Consumerism: Data from 2024 shows a significant uptick in consumers prioritizing brands with ethical sourcing and labor practices.

- Youth Influence: Younger demographics, a key target for Citi Trends, are particularly vocal about social responsibility, with studies showing over 60% factoring it into their buying habits.

- Affordability vs. Ethics: While price remains a driver, the challenge for Citi Trends is balancing affordability with demonstrating a commitment to social good to meet evolving consumer expectations.

Community Engagement and Brand Perception

Citi Trends' success hinges on its ability to connect with the specific communities it serves. Their local engagement, from supporting community events to fostering positive relationships with residents, directly shapes how people perceive the brand. A strong sense of commitment to these areas can build significant customer loyalty and trust.

For instance, in 2023, retailers that actively participated in local initiatives often saw higher foot traffic and increased sales within those neighborhoods. This community-centric approach acts as a powerful differentiator in a crowded retail landscape, providing a competitive edge that goes beyond price or product alone.

- Community Investment: Retailers investing in local job creation and supporting neighborhood initiatives often experience a positive uplift in brand perception.

- Local Partnerships: Collaborations with local organizations or charities can enhance a brand's image and foster deeper community ties.

- Customer Feedback: Actively listening to and responding to community feedback demonstrates a brand's commitment and can build trust.

- Brand Advocacy: Positive community engagement often translates into organic brand advocacy, with local residents becoming vocal supporters.

Sociological factors significantly influence Citi Trends' market positioning and consumer engagement. The company's focus on value-driven fashion resonates with a broad demographic, but understanding evolving social norms and community dynamics is paramount for sustained growth.

The increasing emphasis on social responsibility among consumers, particularly younger demographics, presents a key consideration. By 2024, a substantial portion of Gen Z shoppers, over 60%, were factoring a brand's ethical practices into their purchasing decisions, indicating a growing demand for transparency and responsible business operations.

Citi Trends' ability to connect with and invest in the local communities it serves is a critical differentiator. Retailers demonstrating strong community ties and local support, as seen in 2023 with increased foot traffic for engaged businesses, often foster greater customer loyalty and positive brand perception.

| Sociological Factor | 2024/2025 Trend | Impact on Citi Trends |

| Ethical Consumerism | Growing, with ~65% of Gen Z considering ethics (2024) | Need to highlight social responsibility alongside affordability. |

| Community Engagement | Positive correlation between local investment and brand loyalty (2023 data) | Strengthen community ties to build trust and drive traffic. |

| Demographic Shifts | Increasing diversity in urban centers | Tailor merchandise to diverse cultural preferences and spending habits. |

Technological factors

The escalating shift towards online shopping means Citi Trends must prioritize a strong e-commerce platform and digital marketing. This online presence is crucial for reaching customers beyond their brick-and-mortar stores and adapting to evolving consumer behaviors.

In 2024, e-commerce sales are projected to continue their upward trajectory, with global retail e-commerce sales expected to reach approximately $7.0 trillion. For Citi Trends, this highlights the critical need to invest in user-friendly websites and targeted digital advertising to capture a larger share of this growing market.

Citi Trends' ability to offer value-priced apparel hinges on advanced supply chain technologies. Implementing sophisticated inventory management systems, like real-time tracking and demand forecasting, helps minimize overstock and stockouts. For instance, companies in the retail sector have seen inventory carrying costs decrease by as much as 15% through better technology adoption.

Automated warehousing and efficient logistics are also key. These technologies streamline the movement of goods from distribution centers to stores, reducing labor costs and speeding up delivery times. In 2024, the global warehouse automation market was projected to reach over $40 billion, indicating a strong trend towards efficiency gains through technology.

Optimizing these supply chain processes directly supports Citi Trends' value proposition by lowering operational expenses. This cost reduction can then be passed on to consumers, maintaining the competitive edge of its price points while ensuring products are available when and where customers want them.

Citi Trends can significantly boost customer satisfaction and operational efficiency by integrating advanced in-store technologies. Think about faster checkout with modern POS systems or the convenience of self-checkout kiosks, which are becoming increasingly popular. Digital signage can also offer dynamic product information and promotions, creating a more engaging environment.

The retail sector saw a notable shift towards digital integration in 2024. For instance, a significant percentage of consumers now expect seamless omnichannel experiences, meaning the lines between online and physical shopping are blurring. By investing in these in-store tech upgrades, Citi Trends can meet these evolving customer expectations and potentially see a positive impact on sales conversion and loyalty.

Data Analytics and Personalization

Citi Trends can significantly enhance its operations by leveraging data analytics to understand customer purchasing patterns, preferences, and demographics. This deep dive into customer behavior allows for the optimization of merchandise assortment, ensuring the right products are available at the right time. For instance, in 2024, retailers leveraging advanced analytics saw an average increase of 10-15% in sales conversion rates by tailoring product recommendations.

Personalization, driven by these data insights, is key to fostering customer loyalty and improving inventory management. By offering tailored promotions and product suggestions, Citi Trends can build stronger relationships with its customer base. Studies in 2024 indicated that personalized marketing campaigns can yield up to six times higher transaction rates compared to generic ones. This data-driven approach also helps in reducing excess inventory and minimizing stockouts, leading to greater efficiency and profitability.

- Optimized Merchandise Assortment: Data analytics helps align product offerings with demonstrated customer demand, reducing markdowns and improving sell-through rates.

- Enhanced Marketing Campaigns: Personalization allows for targeted promotions, increasing engagement and conversion rates by speaking directly to individual customer needs.

- Improved Inventory Management: Predictive analytics can forecast demand more accurately, leading to better stock levels and reduced carrying costs.

- Increased Customer Loyalty: Tailored experiences and relevant offers foster stronger customer relationships and repeat business.

Cybersecurity and Data Privacy

Cybersecurity is paramount for Citi Trends as a retailer managing customer data and financial transactions. In 2024, the retail sector continued to face significant cyber threats, with data breaches costing an average of $4.53 million globally, according to IBM's Cost of a Data Breach Report. Protecting sensitive information from these evolving threats is crucial.

Adherence to data privacy regulations, such as the California Consumer Privacy Act (CCPA) and its upcoming amendments, is vital for Citi Trends. Non-compliance can lead to substantial fines, impacting profitability and brand reputation. For instance, in 2023, companies faced millions in penalties for privacy violations.

Maintaining customer trust hinges on Citi Trends' ability to prevent data breaches and ensure privacy. A strong cybersecurity posture not only safeguards customer information but also reinforces brand loyalty in an increasingly digital marketplace.

Key considerations for Citi Trends include:

- Implementing advanced threat detection and prevention systems.

- Ensuring compliance with evolving data privacy laws.

- Providing regular cybersecurity training for employees.

- Establishing robust incident response plans.

The increasing reliance on technology necessitates a robust e-commerce infrastructure for Citi Trends, with global retail e-commerce sales projected to exceed $7 trillion in 2024. Advanced supply chain technologies, such as real-time inventory tracking, are vital for cost efficiency, with retailers seeing up to a 15% reduction in inventory carrying costs through better tech. In-store tech, like self-checkout, enhances customer experience, a crucial factor as consumers increasingly expect seamless omnichannel interactions.

Data analytics offers Citi Trends significant advantages in understanding customer behavior, leading to optimized merchandise assortments and personalized marketing. Retailers using advanced analytics saw sales conversion rates increase by 10-15% in 2024, while personalized marketing campaigns can yield up to six times higher transaction rates. Cybersecurity is also paramount, with data breaches costing retailers an average of $4.53 million globally in 2024, making data privacy compliance and robust security measures essential for maintaining customer trust.

Legal factors

Citi Trends operates under a stringent framework of federal, state, and local labor laws. These regulations cover critical areas such as minimum wage, overtime pay, workplace safety, and equal employment opportunities. For instance, the Fair Labor Standards Act (FLSA) dictates many of these requirements, and keeping abreast of its updates is crucial.

Any shifts in these legal landscapes, such as an increase in the federal minimum wage or new mandates on employee benefits, can directly influence Citi Trends' operational expenses and HR strategies. The U.S. Department of Labor actively enforces these laws, and non-compliance can lead to significant penalties, impacting profitability and brand reputation.

Consumer protection regulations significantly shape Citi Trends' operations. Laws covering product safety, advertising truthfulness, pricing fairness, and return policies directly influence how the company markets and sells its apparel. For instance, the Federal Trade Commission (FTC) actively enforces regulations against deceptive advertising, which could impact Citi Trends' promotional campaigns and potentially lead to penalties if not adhered to.

Maintaining strict compliance with these consumer protection mandates is paramount for Citi Trends. Failure to do so can result in substantial financial penalties, costly litigation, and severe damage to its brand image. In 2023, the Consumer Financial Protection Bureau (CFPB) reported over 170,000 complaints related to unfair, deceptive, or abusive practices, highlighting the regulatory landscape retailers navigate.

Citi Trends, as a retailer of both branded and private label goods, must meticulously adhere to intellectual property laws. This includes safeguarding against infringement of trademarks, copyrights, and design patents used by others, while also protecting their own proprietary designs. In 2024, the global apparel market, where Citi Trends operates, continues to see significant investment in brand protection technologies, highlighting the importance of IP in this sector.

Data Privacy and Security Laws

Citi Trends must navigate a complex landscape of data privacy and security laws, including California's Consumer Privacy Act (CCPA) and the emerging potential for federal privacy legislation in the United States. Failure to comply with regulations governing how customer data is collected, stored, and utilized can lead to significant financial penalties and damage brand reputation. Maintaining robust data security measures is paramount to safeguarding sensitive customer information and fostering trust, especially as data collection practices become more sophisticated.

Key considerations for Citi Trends include:

- Data Collection Transparency: Ensuring clear communication with customers about what data is collected and for what purposes.

- Consent Management: Implementing mechanisms for obtaining and managing customer consent for data processing.

- Data Minimization: Collecting only the data that is necessary for specific business functions.

- Security Protocols: Investing in advanced cybersecurity to protect against data breaches and unauthorized access.

Lease and Real Estate Laws

Citi Trends' reliance on physical retail locations makes it highly susceptible to real estate and leasing laws. These regulations dictate commercial lease terms, zoning permissions, and adherence to building codes, directly influencing the cost and feasibility of opening new stores or maintaining existing ones. For instance, zoning laws can restrict store placement in certain areas, while building codes and accessibility standards, such as the Americans with Disabilities Act (ADA), require ongoing investment in store infrastructure. In 2024, the retail real estate market continued to see varying rental rates across different regions, with some urban centers experiencing slight upticks due to demand, while suburban and secondary markets offered more competitive leasing opportunities.

Navigating these legal frameworks is crucial for Citi Trends' operational strategy and expansion plans. Compliance with accessibility standards, like ADA, ensures inclusivity but also necessitates capital expenditures for store modifications. For example, the cost of retrofitting older stores to meet current ADA requirements can range from tens of thousands to hundreds of thousands of dollars per location, depending on the scope of work. Furthermore, zoning regulations can significantly impact site selection, potentially limiting expansion into desirable markets or requiring costly variances.

- Commercial Lease Regulations: Laws governing lease duration, rent escalation, and landlord/tenant responsibilities directly affect Citi Trends' occupancy costs and long-term planning.

- Zoning Laws: These dictate where retail establishments can operate, influencing site selection and potentially restricting expansion into key demographic areas.

- Building Codes and Accessibility Standards: Compliance with safety regulations and accessibility mandates like ADA requires continuous investment in store maintenance and upgrades, impacting capital expenditure budgets.

- Property Taxes: Fluctuations in local property tax rates can impact the overall cost of operating physical stores, affecting profitability.

Citi Trends must navigate a complex web of labor laws, from minimum wage requirements to workplace safety standards, impacting operational costs and HR strategies. For instance, the Fair Labor Standards Act (FLSA) sets many of these benchmarks, and staying current with its amendments is vital for compliance. Failure to adhere to these regulations can result in substantial penalties, affecting the company's financial health and public image.

Consumer protection laws, enforced by bodies like the Federal Trade Commission (FTC), govern everything from advertising claims to product safety and return policies, directly influencing how Citi Trends markets its merchandise. Non-compliance, such as deceptive advertising, can lead to significant fines and reputational damage. In 2023, consumer protection agencies handled numerous complaints regarding unfair business practices, underscoring the critical need for retailers to maintain strict adherence.

Intellectual property laws are paramount for Citi Trends, as they must protect their own designs and avoid infringing on others' trademarks and copyrights in the competitive apparel market. The global apparel sector in 2024 continues to emphasize brand protection, highlighting the value of intellectual property. Data privacy regulations, such as California's CCPA, also demand careful management of customer information, with breaches leading to severe financial and reputational consequences.

Real estate and zoning laws significantly affect Citi Trends' ability to operate and expand physical stores, dictating lease terms, site selection, and building code compliance. Adhering to accessibility standards like the Americans with Disabilities Act (ADA) requires ongoing investment in store infrastructure. In 2024, retail leasing costs varied regionally, with urban locations generally seeing higher rents than suburban markets.

Environmental factors

Citi Trends, like many retailers, faces growing consumer and regulatory pressure to ensure its products are sourced responsibly. This includes examining the environmental impact of materials used, such as cotton farming or synthetic fabric production. For instance, the fashion industry's water footprint is substantial; estimates suggest it takes around 2,700 liters of water to produce one cotton t-shirt, a figure that highlights the need for sustainable sourcing practices.

Developing a more sustainable supply chain can significantly boost Citi Trends' brand reputation. A 2024 survey indicated that over 60% of consumers consider a brand's environmental commitment when making purchasing decisions. By prioritizing eco-friendly materials and ethical manufacturing, Citi Trends can attract and retain environmentally conscious shoppers, potentially leading to increased sales and loyalty in the competitive retail landscape.

The retail sector, including companies like Citi Trends, faces scrutiny over its substantial waste generation, from excess packaging to unsold merchandise. Effective waste management and robust recycling initiatives are becoming crucial for operational efficiency and regulatory adherence. For instance, in 2023, the U.S. retail sector's contribution to municipal solid waste was a significant concern, highlighting the need for sustainable practices.

Citi Trends' operational energy consumption across its retail stores, distribution centers, and transportation network directly impacts its carbon footprint. For instance, in 2023, the retail industry's energy use for heating, cooling, and lighting represented a significant portion of its environmental impact, with many companies exploring ways to mitigate this.

The company's commitment to reducing energy usage, potentially through energy-efficient store designs or optimizing delivery routes, can yield substantial cost savings. Furthermore, adopting renewable energy sources or improving logistics efficiency aligns with growing consumer and investor demand for corporate environmental responsibility, a trend that gained further momentum throughout 2024.

Climate Change Impact on Operations

Climate change presents tangible risks to Citi Trends' operations. Extreme weather events, like the increased frequency of hurricanes and severe storms observed in recent years, can directly disrupt supply chains, potentially delaying inventory or increasing transportation costs. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the growing threat to infrastructure and logistics.

These events can also impact physical store locations. Damage to properties from flooding or high winds can lead to temporary or permanent closures, affecting sales and requiring costly repairs. Furthermore, extreme heat or cold can deter shoppers from visiting brick-and-mortar stores, impacting foot traffic and overall consumer spending in affected areas. Citi Trends must actively assess and build resilience against these physical climate risks to maintain operational continuity.

- Supply Chain Disruptions: Increased frequency of extreme weather events can lead to delays and higher costs in transporting goods.

- Property Damage: Stores face risks from severe storms, flooding, and other climate-related events, potentially causing closures and repair expenses.

- Consumer Traffic Impact: Adverse weather conditions can reduce customer visits to physical stores, affecting sales performance.

Consumer Demand for Eco-Friendly Products

While Citi Trends' core customer base often prioritizes affordability, there's a discernible shift in consumer consciousness, particularly within urban demographics. This growing awareness of environmental impact is leading a segment of shoppers to actively seek out retailers demonstrating a commitment to sustainability. This presents an opportunity for Citi Trends to differentiate itself by incorporating more eco-friendly or ethically sourced product lines, potentially attracting a new customer segment.

The market for sustainable goods is expanding. For instance, in 2024, the global market for sustainable fashion was projected to reach hundreds of billions of dollars, indicating a significant consumer appetite for environmentally responsible choices. Retailers that can authentically integrate these values into their offerings may see increased brand loyalty and market share.

- Growing Consumer Awareness: A notable percentage of consumers, especially younger demographics and urban dwellers, are increasingly factoring environmental impact into their purchasing decisions.

- Market Opportunity: Offering eco-friendly or ethically produced apparel can tap into a burgeoning market segment, potentially driving new sales and enhancing brand perception.

- Competitive Advantage: Early adoption of sustainable practices can provide Citi Trends with a competitive edge against rivals who have not yet addressed this evolving consumer demand.

Citi Trends must navigate increasing environmental regulations concerning waste management and product lifecycle. For example, in 2024, several regions introduced stricter rules on textile recycling and packaging, impacting operational costs. The company's efforts in reducing its carbon footprint, such as optimizing logistics, are crucial for compliance and brand image.

Climate change poses direct risks, with extreme weather events in 2023 and 2024 causing supply chain disruptions and potential property damage to stores. These events can affect inventory flow and necessitate costly repairs. Furthermore, changing weather patterns can influence consumer foot traffic, impacting sales at physical locations.

The growing consumer demand for sustainable products, evident in the expanding market for eco-friendly fashion, presents both challenges and opportunities for Citi Trends. By embracing sustainable sourcing and transparent practices, the company can attract environmentally conscious shoppers, a segment that showed significant growth in purchasing power throughout 2024.

| Environmental Factor | Impact on Citi Trends | Data/Trend (2023-2025) |

|---|---|---|

| Regulatory Pressure | Compliance costs, operational adjustments | Increased regulations on waste, packaging, and carbon emissions in key markets. |

| Climate Change Risks | Supply chain disruptions, property damage, reduced foot traffic | 28 billion-dollar weather disasters in the US in 2023; increased frequency of extreme weather events impacting logistics. |

| Consumer Demand for Sustainability | Brand reputation, market share opportunities | Global sustainable fashion market projected to reach hundreds of billions by 2024; over 60% of consumers consider environmental commitment (2024 survey). |

| Resource Scarcity (e.g., Water) | Sourcing costs, supply chain resilience | 2,700 liters of water to produce one cotton t-shirt, highlighting need for sustainable material sourcing. |

| Waste Generation | Operational efficiency, regulatory fines | Retail sector's significant contribution to municipal solid waste (2023 data) necessitates better waste management and recycling initiatives. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Citi Trends draws from a comprehensive blend of data sources, including official government economic reports, industry-specific market research from firms like Statista, and analyses of consumer spending patterns. We also incorporate updates on relevant legislation and environmental regulations to ensure a well-rounded view.