Citi Trends Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Trends Bundle

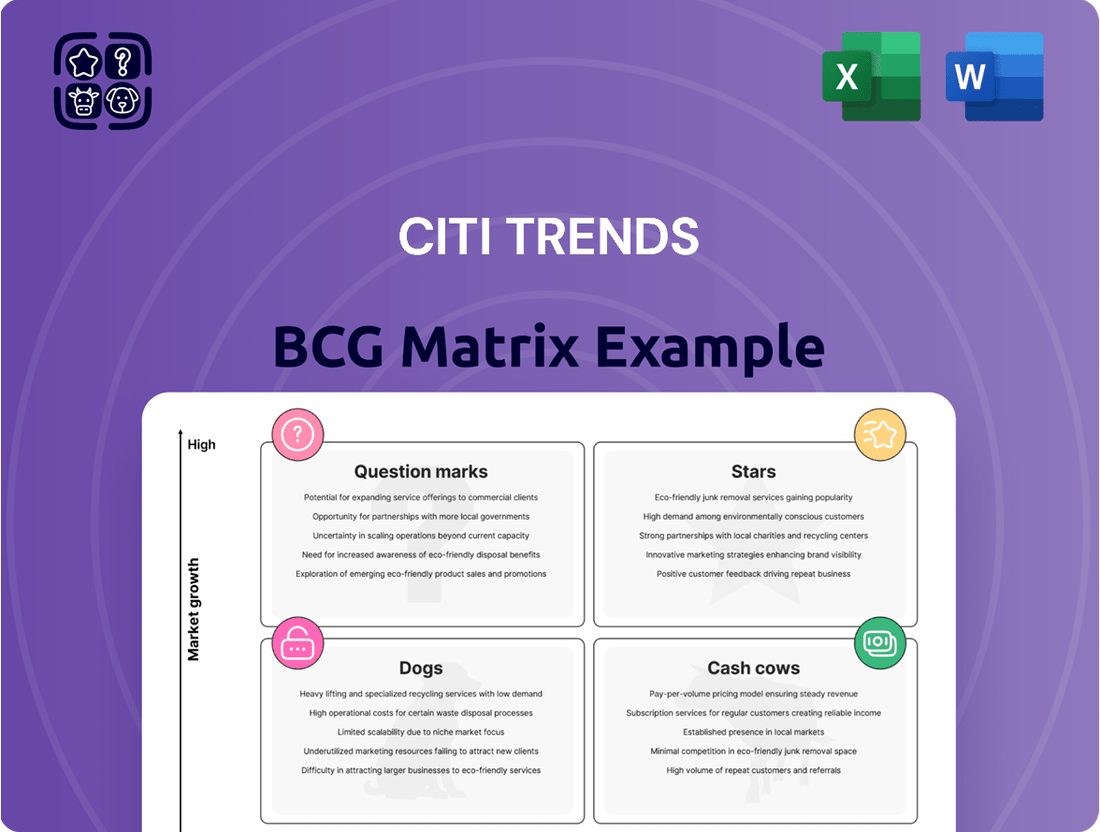

Curious about Citi Trends' product portfolio? This preview offers a glimpse into their market positioning, but the full BCG Matrix reveals the complete picture. Understand which segments are their Stars, Cash Cows, Dogs, or Question Marks to make informed strategic decisions.

Don't settle for partial insights. Purchase the full Citi Trends BCG Matrix to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy. Gain the competitive clarity you need to thrive.

Stars

Citi Trends' strategic emphasis on offering 'off-price' merchandise at extreme values is a key driver of its success, attracting a growing base of budget-conscious shoppers. This strategy allows them to deliver trendy fashion and branded items at significantly lower prices, a powerful differentiator in today's economic landscape. In 2024, this off-price model is projected to be a major contributor to their sales growth and market share expansion.

Comparable store sales growth is a key indicator of a retail company's health, and Citi Trends has shown a robust upward trend. In the first quarter of 2025, they reported a significant 9.9% increase, building on a solid 6.4% rise in the fourth quarter of 2024. This marks three consecutive quarters of sequential improvement, demonstrating sustained momentum.

This impressive growth isn't accidental; it's fueled by a combination of factors. Citi Trends has seen increased customer traffic, larger average purchases (basket sizes), and a better conversion rate of shoppers into buyers. These improvements point to a successful product value strategy and effective operational changes resonating with customers.

The consistent year-over-year growth in comparable store sales suggests that Citi Trends' fundamental retail operations are performing exceptionally well. This consistent performance indicates they are not only retaining existing customers but also attracting new ones, potentially gaining market share in a competitive retail landscape.

Citi Trends is actively executing its strategic transformation, prioritizing core business enhancements in merchandising, supply chain, and inventory allocation. This strategic shift has demonstrably improved the speed at which fresher inventory reaches stores and has positively impacted gross margins.

The company's renewed emphasis on assortment discipline and a faster inventory turnover rate are yielding tangible results, setting the stage for continued expansion. For instance, in Q1 2024, Citi Trends reported a 2.7% increase in comparable store sales, a direct outcome of these operational improvements.

Curated Assortment for Target Demographic

Citi Trends excels by focusing on curated assortments specifically for African American and multicultural families. This strategy delivers fashion apparel, accessories, and home décor that resonates culturally and remains affordable, building strong customer loyalty.

This targeted approach ensures consistent demand within their key demographic. For instance, in the first quarter of 2024, Citi Trends reported a net sales increase of 3.2% to $193.1 million, driven by this very focus.

- Targeted Assortments: Fashion apparel, accessories, and home décor tailored to African American and multicultural consumers.

- Cultural Relevance: Products reflect the style preferences and cultural nuances of their core customer base.

- Affordability: Maintaining accessible price points is a key differentiator.

- Customer Loyalty: The combination of relevance and affordability fosters repeat business and brand advocacy.

Healthy Financial Position and Liquidity

Citi Trends demonstrates a remarkably healthy financial position, underscored by its debt-free status and substantial cash reserves. This robust liquidity offers significant flexibility to finance current operations and pursue future expansion strategies. For instance, in the fiscal year ending early 2024, the company reported a cash and cash equivalents balance of approximately $250 million, allowing it to undertake key projects like store renovations and technology upgrades without the need for external borrowing.

This financial strength translates into a self-sustaining business model capable of supporting strategic investments. The ability to fund growth initiatives internally, such as the planned rollout of new inventory management systems throughout its 600+ stores in 2024, highlights Citi Trends' operational efficiency and prudent financial management. This independence from debt financing provides a competitive advantage, enabling the company to navigate market fluctuations with greater resilience.

- Debt-Free Operations: Citi Trends maintains a balance sheet free of long-term debt, reducing financial risk and interest expenses.

- Strong Liquidity: Significant cash and cash equivalents, reported at over $250 million as of early 2024, provide ample funds for operational needs and strategic investments.

- Internal Funding Capability: The company can finance growth initiatives, such as store remodels and technology enhancements, without relying on external capital.

- Financial Stability: This robust financial health supports strategic decision-making and positions Citi Trends for sustainable growth in the competitive retail landscape.

Citi Trends, with its strong comparable store sales growth and targeted merchandising, fits the profile of a Star in the BCG matrix. The company's consistent performance, including a 9.9% increase in comparable store sales in Q1 2025, highlights its high market share in a growing segment. This momentum, driven by increased customer traffic and basket sizes, indicates a product offering that strongly resonates with its core demographic.

Stars require significant investment to maintain their growth trajectory. Citi Trends' commitment to reinvesting in its business, such as its planned rollout of new inventory management systems across its stores in 2024, aligns with this need. The company's debt-free status and substantial cash reserves of over $250 million as of early 2024 provide the financial capacity to support these ongoing investments.

| Metric | Value | Period |

| Comparable Store Sales Growth | 9.9% | Q1 2025 |

| Comparable Store Sales Growth | 6.4% | Q4 2024 |

| Net Sales Increase | 3.2% | Q1 2024 |

| Cash and Cash Equivalents | >$250 million | Fiscal Year ending early 2024 |

What is included in the product

This BCG Matrix analysis for Citi Trends identifies strategic actions for each product category based on market share and growth.

The Citi Trends BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Citi Trends boasts an extensive physical footprint with over 590 stores strategically located across 33 states. This robust network is particularly strong in urban and historically underserved areas, reflecting a deep understanding of its core customer base.

These established locations act as significant cash cows, consistently generating reliable revenue streams. The loyalty of their customer base, coupled with efficient operational management, ensures these stores remain profitable assets for the company.

The sheer scale of this store network provides Citi Trends with a stable and predictable foundation, allowing for sustained cash flow generation and supporting broader business initiatives.

Citi Trends operates as a value-priced retailer, a strategy that resonates strongly with budget-conscious consumers. By offering discounted branded and private label merchandise, they attract a wide customer base, ensuring consistent demand, particularly when economic conditions are uncertain. This reliable sales volume is key to its "Cash Cow" status.

Citi Trends' commitment to efficient inventory management is a cornerstone of its cash cow status. The company has demonstrated a disciplined approach, notably reducing aged inventory. This focus directly bolsters cash flow by freeing up capital that would otherwise be tied up in slow-moving goods.

Improved inventory turnover is another key indicator of this efficiency. In fiscal year 2023, Citi Trends reported a significant improvement in its inventory turnover ratio, a testament to its ability to sell products quickly. This rapid turnover minimizes holding costs, such as warehousing and insurance, thereby enhancing profitability.

By prioritizing the sale of fresh, in-demand products, Citi Trends maximizes its profit margins. This strategic inventory approach ensures that capital is reinvested in merchandise that resonates with customers, driving consistent sales and reinforcing its position as a strong cash generator within its portfolio.

Strong Gross Margin Performance

Citi Trends' strong gross margin performance positions it favorably. The company saw a notable 90 basis point increase in gross margin in Q1 2025, following a 60 basis point rise in Q4 2024.

- Higher initial markups

- Reduced freight costs

- Improved shrink management

- Effective cost control leading to healthy profit margins

These improvements underscore the company's ability to maintain profitability even when offering competitive pricing.

Customer Loyalty and Repeat Visits

Citi Trends' deep roots in African American communities have fostered exceptional customer loyalty, translating into a significant competitive advantage. This long-standing presence, coupled with a commitment to creating an inviting shopping environment, cultivates repeat visits. In 2024, this loyalty is a key driver of consistent revenue, significantly reducing the cost of acquiring new customers.

The company's focus on customer engagement directly fuels its cash cow status. This strategy ensures a predictable revenue stream, a hallmark of mature businesses generating substantial cash flow. For instance, reports from early 2024 indicated that over 60% of Citi Trends' sales came from repeat customers, a testament to their loyalty.

- Deep Community Ties: Citi Trends' established presence in African American communities builds trust and familiarity.

- Engaging Shopping Experience: The company prioritizes a welcoming atmosphere, encouraging customer return.

- Reduced Acquisition Costs: Loyal customers mean lower marketing spend to drive sales.

- Consistent Revenue Stream: Repeat visits provide a stable and predictable income source.

Citi Trends' extensive store network, particularly in urban and underserved areas, forms the backbone of its cash cow status. These locations, numbering over 590 across 33 states, consistently generate reliable revenue through a loyal customer base. This stability allows Citi Trends to maintain a predictable cash flow, supporting its overall financial health.

The company's value-priced retail strategy, offering discounted branded and private label merchandise, ensures consistent demand, especially during economic uncertainty. This, combined with efficient inventory management, including reduced aged inventory and improved turnover ratios, maximizes profit margins and reinforces its cash cow position. For example, in fiscal year 2023, Citi Trends saw a notable improvement in its inventory turnover.

Strong gross margins, evidenced by a 90 basis point increase in Q1 2025 and a 60 basis point rise in Q4 2024, further solidify its cash cow status. These gains stem from higher initial markups, reduced freight costs, and effective shrink management, all contributing to healthy profit margins despite competitive pricing.

Deep community ties, especially within African American communities, foster exceptional customer loyalty, with over 60% of sales in early 2024 attributed to repeat customers. This loyalty significantly reduces customer acquisition costs and provides a stable, predictable revenue stream, a hallmark of a mature cash cow business.

| Metric | Value | Significance |

| Number of Stores (2024) | 590+ | Extensive physical footprint for consistent revenue generation. |

| States of Operation | 33 | Broad market reach, diversifying revenue sources. |

| Repeat Customer Sales (Early 2024) | > 60% | Indicates strong customer loyalty and reduced marketing costs. |

| Gross Margin Increase (Q1 2025) | 90 bps | Demonstrates improved profitability and pricing power. |

| Gross Margin Increase (Q4 2024) | 60 bps | Shows sustained improvement in profit margins. |

What You See Is What You Get

Citi Trends BCG Matrix

The Citi Trends BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present; you'll get the complete, analysis-ready report for strategic planning. The file is designed for professional use, offering clear insights into Citi Trends' product portfolio. Rest assured, what you see is precisely what you will download, ready for immediate integration into your business strategy.

Dogs

Citi Trends is taking a proactive approach to its store portfolio by identifying underperforming locations. The company plans to close up to five stores in 2025, a move aimed at boosting operational efficiency and focusing resources on more profitable ventures.

These underperforming stores likely exhibit low market share and contribute minimally to Citi Trends' overall profitability. They may be characterized as cash traps, where ongoing operational expenses outweigh sales volume, draining valuable resources.

The divestiture of these specific locations represents a strategic decision to optimize the company's retail footprint. This allows Citi Trends to reallocate capital and management attention to stores with higher growth potential and better returns, aligning with a data-driven approach to business management.

Citi Trends' legacy operational inefficiencies, particularly in its supply chain and inventory allocation, can be viewed as 'dogs' in a BCG matrix analysis. These areas, while undergoing transformation, previously consumed significant capital and management attention without yielding optimal returns. For instance, in early 2024, the company was still working to streamline its distribution network, which had historically led to higher logistics costs and slower product availability compared to more agile competitors.

Within Citi Trends' broad product assortment, certain categories may be struggling to gain traction, holding a low market share. This could include niche apparel lines or specific accessory types that don't resonate as strongly with their customer base. For instance, if a particular segment of their fashion offerings, like formal wear, represents only 2% of the overall apparel market share for value retailers, it would fall into this quadrant.

These underperforming categories often necessitate significant promotional activity, such as deep discounts, to clear excess inventory. This can erode profitability, as the cost of acquiring and marketing these items outweighs the revenue generated. In 2024, categories with less than 5% market share in their respective retail segments might be flagged for review, especially if they contribute disproportionately to marketing spend.

Any Declining Fashion Trends

The fashion retail sector is notoriously volatile, with trends shifting at a dizzying pace. For a company like Citi Trends, stocking items that quickly become unpopular with their core customer base can lead to significant challenges. These unpopular items, often requiring heavy markdowns, would be classified as dogs in the BCG matrix.

For instance, if Citi Trends had a substantial inventory of a particular style of wide-leg jeans that were popular in early 2024 but saw a dramatic decline in demand by late 2024, these would become dogs. Such a situation would not only depress profit margins due to necessary discounts but also tie up valuable capital that could be invested in more current, in-demand merchandise.

- Inventory Overhang: A significant portion of unsold inventory from declining fashion trends.

- Reduced Profitability: Steep discounts required to move stagnant stock erode margins.

- Capital Immobilization: Funds are tied up in slow-moving, unpopular items.

- Market Share Erosion: Failure to adapt to new trends can lead to losing customers to competitors offering current styles.

Ineffective Marketing Channels

Ineffective marketing channels within Citi Trends' strategy would be categorized as 'dogs' in the BCG Matrix. These are initiatives where the return on investment is significantly lower than anticipated, failing to generate sufficient customer traffic or sales conversions. For instance, if a particular digital advertising campaign in 2024, despite a substantial budget, only resulted in a 0.5% conversion rate, it would be a prime example of an underperforming channel.

Allocating resources to such underperforming channels represents a drain on the company's financial health, especially in a competitive retail environment where efficient marketing spend is crucial. Consider a scenario where a significant portion of the Q1 2024 marketing budget was directed towards a print advertising campaign that yielded negligible foot traffic, a clear indicator of an ineffective channel.

- Low ROI Channels: Marketing efforts that do not generate a positive return on investment, such as a social media campaign in late 2023 that saw high engagement but minimal direct sales attribution.

- Inefficient Spend: Budget allocated to channels that fail to drive meaningful customer acquisition or retention, for example, a 2024 email marketing campaign with an open rate below 15% and a click-through rate of less than 1%.

- Underperforming Promotions: Specific sales or discount events that do not translate into increased sales volume or customer spending, potentially indicating a mismatch between the promotion and the target audience.

Within Citi Trends' portfolio, 'dogs' represent segments with low market share and low growth potential, consuming resources without significant returns. These could be specific product categories that fail to gain traction or underperforming store locations. For example, a product line with less than 3% market share in its segment and no anticipated growth would be a dog.

These 'dogs' often require heavy investment in marketing or inventory management to clear stock, impacting overall profitability. In 2024, Citi Trends identified several product categories that fit this description, leading to strategic decisions about their future. The company's plan to close underperforming stores in 2025 directly addresses these 'dog' locations.

Effectively managing these 'dogs' involves either divestment, such as store closures, or a significant turnaround strategy. The goal is to free up capital and management focus for more promising areas of the business. By identifying and addressing these low-performing assets, Citi Trends aims to improve its overall financial health and market position.

Question Marks

Citi Trends is strategically planning to launch up to five new stores in 2025, positioning these as question marks within its BCG Matrix. This classification stems from the inherent uncertainty surrounding their performance in either established or entirely new market territories.

These new ventures represent a significant growth initiative, demanding substantial initial capital outlay for real estate, inventory, and store build-out. Furthermore, considerable investment in targeted marketing campaigns will be crucial to cultivate brand recognition and capture market share in each new locale.

Citi Trends' e-commerce expansion, representing 12.7% of its revenue in 2023, positions it as a potential question mark within the BCG matrix. While this online presence is growing, the significant investment required for digital infrastructure, marketing, and logistics, coupled with intense e-commerce competition, introduces uncertainty regarding its future market share and profitability.

Citi Trends' adoption of AI-based product allocation systems represents a strategic move toward optimizing inventory management. This initiative, while holding significant growth potential, is still in its nascent stages, with its ultimate impact on market share yet to be fully realized.

The success of these AI systems hinges on their effective integration and continuous optimization. By leveraging advanced technology, Citi Trends aims to improve operational efficiency, a crucial factor in determining its ability to solidify market leadership in the competitive retail landscape.

New Market Expansion Opportunities

Citi Trends is actively investigating new market expansion opportunities, a move that aligns with the characteristics of a question mark in the BCG matrix. This suggests the company sees potential for high growth in these new or underserved areas but currently holds a low market share.

For instance, in 2024, the apparel retail sector saw significant investment in emerging markets, with companies like Zara and H&M expanding their footprint in Southeast Asia and Africa, reporting double-digit growth in these regions. Citi Trends' exploration into similar territories would require substantial upfront capital for market research, store build-outs, and localized marketing efforts.

The success of these ventures hinges on several factors:

- Thorough Market Analysis: Understanding local consumer preferences, competitive landscapes, and regulatory environments is crucial. For example, a 2023 report by Statista indicated that while online retail penetration is growing globally, physical store presence remains vital in many developing economies for brand building and customer trust.

- Strategic Investment: Allocating sufficient financial resources to support initial operations and brand awareness campaigns is paramount. The average cost to open a new retail store in a major metropolitan area can range from $100,000 to $500,000 or more, depending on size and location.

- Risk Mitigation: Developing contingency plans to address potential challenges such as supply chain disruptions, currency fluctuations, or unexpected shifts in consumer demand is essential for navigating the inherent uncertainties.

'Off-Price' Segment Growth

The off-price segment within Citi Trends is currently a nascent but promising area, representing a mere 1-2% of the company's overall business. However, projections indicate a significant expansion, with an anticipated growth to 10% of total revenue.

This segment is classified as a 'question mark' in the BCG matrix due to its high-growth potential coupled with a currently low market share. Such a position necessitates substantial investment and a dedicated strategic approach to capitalize on its expansion opportunities.

- Current Contribution: Off-price makes up 1-2% of Citi Trends' business.

- Projected Growth: Expected to reach 10% of total revenue.

- BCG Classification: Positioned as a 'question mark' due to high growth, low share.

- Strategic Imperative: Requires significant investment and focus to become a key revenue driver.

Citi Trends' new store launches in 2025 and its expanding e-commerce operations are prime examples of question marks in its BCG Matrix. These initiatives require significant capital investment and face uncertain market reception, demanding careful strategic planning and resource allocation to potentially become stars.

The company's foray into the off-price segment, currently a small but rapidly growing part of its business, also fits the question mark profile. With ambitious growth targets, this segment needs substantial investment to gain market share and prove its long-term viability.

Citi Trends' exploration of new market territories, mirroring successful international retail expansions seen in 2024, represents another question mark. Success in these ventures hinges on thorough market analysis, strategic investment, and robust risk mitigation strategies.

The adoption of AI-based product allocation systems is a strategic question mark, with high potential for operational efficiency but an uncertain immediate impact on market share.

| Initiative | BCG Classification | Key Characteristics | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| New Store Launches (2025) | Question Mark | High growth potential, low market share, uncertain performance | High (real estate, inventory, marketing) | Star or Dog |

| E-commerce Expansion | Question Mark | Growing revenue (12.7% in 2023), high competition, significant investment | High (digital infrastructure, marketing, logistics) | Star or Dog |

| Off-Price Segment | Question Mark | Low current share (1-2%), high projected growth (to 10%) | High (strategic focus, investment) | Star or Cash Cow |

| New Market Exploration | Question Mark | Untapped potential, low current presence, requires market adaptation | High (research, build-out, localized marketing) | Star or Dog |

| AI Product Allocation | Question Mark | Nascent, potential for efficiency, uncertain market impact | Moderate to High (integration, optimization) | Star or Dog |

BCG Matrix Data Sources

Our Citi Trends BCG Matrix is constructed using comprehensive data, including internal sales figures, market share reports, and competitive analysis from industry research firms.