Cinemark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cinemark Bundle

Unlock the critical external factors shaping Cinemark's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the cinema industry, and gain a strategic advantage. Download the full analysis now to equip yourself with actionable intelligence for informed decision-making.

Political factors

Government regulations significantly shape Cinemark's operational landscape. For instance, evolving content regulations and censorship laws in various markets can directly influence the film selection available for exhibition, potentially impacting ticket sales and audience diversity. In 2024, several countries continued to review and update their film rating systems, with some regions implementing stricter guidelines on content deemed sensitive.

Safety standards for public venues are also a critical consideration. Cinemark must adhere to local and national safety protocols, which can include requirements for crowd management, fire safety, and emergency preparedness. These regulations, particularly in the wake of global health concerns, often dictate seating capacities and operational procedures, affecting revenue potential. For example, post-pandemic safety mandates in some key markets in 2023 and continuing into 2024 required enhanced cleaning protocols and adjusted seating arrangements.

Cinemark's significant presence in Latin America, a region representing a substantial portion of its revenue, makes it particularly vulnerable to shifts in U.S. trade policies and the diplomatic climate. For instance, changes in tariffs on imported goods or services could directly impact Cinemark's operational costs, from equipment to marketing materials.

Fluctuations in international relations can also influence the cost and availability of film distribution rights, a critical component of Cinemark's business model. As of 2024, Latin America continues to be a key growth market for the company, underscoring the importance of stable trade agreements and positive diplomatic ties for sustained profitability and market access.

Government tax policies significantly shape Cinemark's financial landscape. For instance, corporate income tax rates directly affect net profits, and specific entertainment taxes can influence ticket pricing and consumer demand. In 2024, the average corporate income tax rate globally hovered around 21%, but variations across Cinemark's operating regions, such as the US (21%) and Brazil (34%), create differing profit margins.

Conversely, government support for the film industry can be a double-edged sword for exhibitors like Cinemark. Subsidies and tax credits offered to film producers in various countries, like those in Canada or the UK, can incentivize content creation. This might lead to a richer pipeline of films available for exhibition, potentially boosting Cinemark's revenue, but the specific types of films produced could also shift based on these incentives.

Political Stability and Geopolitical Events

Political instability in key operating regions for Cinemark, such as Latin America, can significantly impact its business. For instance, periods of civil unrest or significant policy shifts in countries like Mexico or Brazil can lead to unpredictable economic conditions, affecting discretionary spending on entertainment. Geopolitical events, like international conflicts, can also dampen consumer confidence globally, potentially reducing attendance at movie theaters.

The impact of political factors is often reflected in Cinemark's financial performance. For example, currency fluctuations tied to political stability in emerging markets can affect reported revenues and profits. In 2023, Cinemark’s international segment, which includes many of these volatile regions, faced ongoing economic headwinds influenced by local political climates.

- Political instability: Disruptions from civil unrest or significant policy changes in Latin America can affect Cinemark's operational capacity and consumer spending.

- Geopolitical events: International conflicts or trade disputes can negatively influence global consumer confidence and travel, indirectly impacting cinema attendance.

- Policy shifts: Changes in government regulations regarding entertainment, taxation, or foreign investment in Cinemark's operating countries can alter the business environment.

Labor Laws and Union Influence

Cinemark, like many in the entertainment sector, is significantly impacted by labor laws and the strength of unions. Changes to minimum wage regulations, for instance, directly influence staffing costs at its numerous theaters. The Screen Actors Guild (SAG-AFTRA) strike in 2023, which lasted for 118 days, highlighted the potential disruption to film production and, consequently, the pipeline of new releases that are crucial for Cinemark's revenue generation. The resolution of such labor disputes often involves increased compensation and benefits, which can lead to higher operating expenses for exhibitors.

The influence of organized labor in the entertainment industry can shape Cinemark's workforce management strategies and overall cost structure. Unionized employees may negotiate for better pay, benefits, and working conditions, potentially increasing labor expenses. For example, as of early 2024, discussions around potential unionization efforts in other sectors of the entertainment industry, beyond just actors and writers, could signal future challenges for companies like Cinemark in managing their diverse workforce. The ability to attract and retain staff, especially during peak demand periods, is also tied to competitive labor practices, which are often influenced by union agreements.

The economic impact of labor actions extends beyond direct wage increases. Strikes can lead to:

- Delayed or canceled film releases: This directly reduces the content available for screening, impacting ticket sales and concession revenue.

- Increased operational costs: Settlements often include provisions for higher wages, improved benefits, and potentially new staffing requirements.

- Uncertainty in business planning: The threat or occurrence of labor disputes creates an unpredictable environment for financial forecasting and strategic investment.

Government regulations and political stability are key political factors influencing Cinemark's operations. Evolving content regulations in 2024, for example, can impact film selection and ticket sales, while safety standards dictate operational procedures and capacity. Political instability in regions like Latin America can disrupt consumer spending on entertainment, directly affecting Cinemark's revenue streams.

What is included in the product

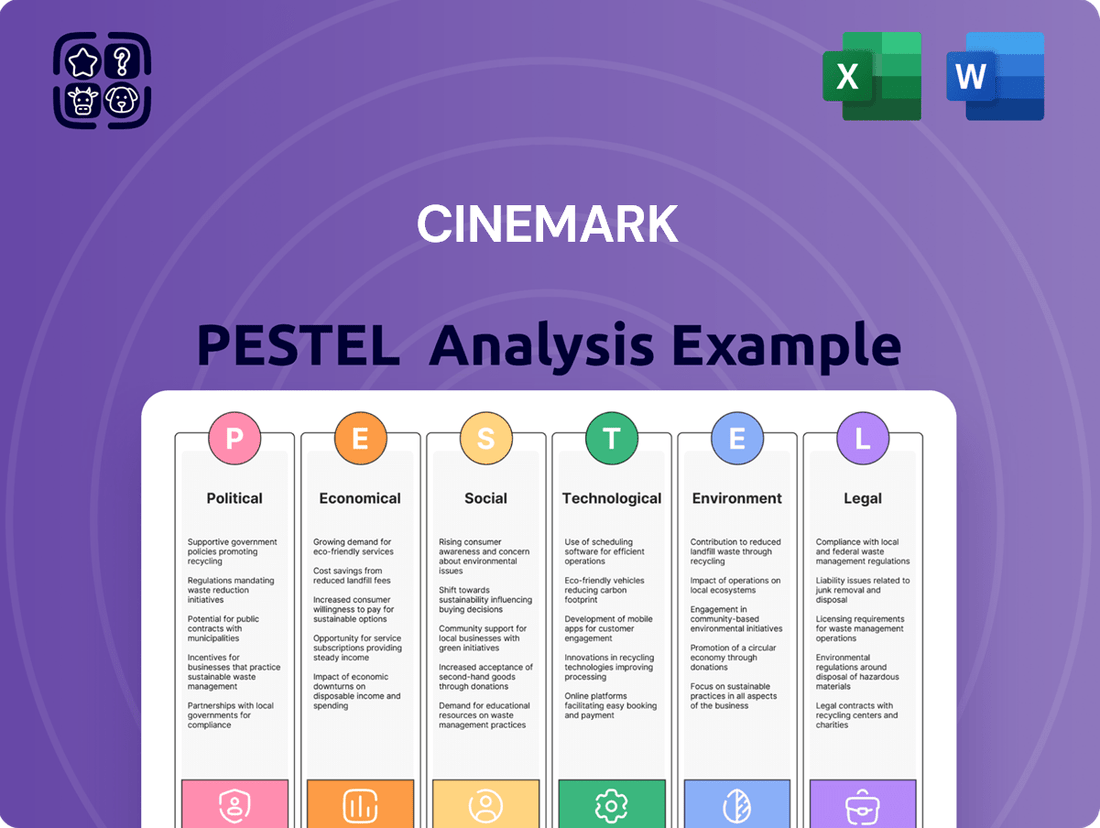

This Cinemark PESTLE analysis dissects the impact of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's operations and strategic planning.

It offers a comprehensive understanding of the external landscape, enabling informed decision-making and proactive adaptation to market shifts.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Cinemark.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Environmental, and Legal influences.

Economic factors

The ongoing expansion of streaming platforms like Netflix and Disney+ continues to reshape how audiences consume movies. Studios are increasingly opting for direct-to-streaming releases or significantly shortening the exclusive theatrical window. For instance, in 2024, several major studios experimented with releasing films simultaneously in theaters and on their respective streaming services, a trend that gained momentum following pandemic-era adjustments.

This shift directly impacts Cinemark's primary revenue sources, which are heavily reliant on ticket sales and concessions during the traditional theatrical run. The reduced exclusivity period means fewer weeks for cinemas to capture audience attention and spending before a film becomes readily available at home, posing a significant challenge to established business models.

Consumer behavior has demonstrably changed, with a growing segment of the population preferring the convenience of at-home viewing. This necessitates that Cinemark and similar cinema chains innovate, perhaps by focusing on premium experiences, enhanced amenities, or alternative content beyond traditional film releases to draw audiences back to theaters.

Consumer spending and disposable income are critical drivers for Cinemark's performance. When people have more money left over after covering necessities, they're more likely to spend on entertainment like going to the movies. For instance, in Q1 2024, the US personal saving rate was around 3.4%, a slight decrease from previous periods, indicating consumers may have less discretionary income available.

Economic downturns, such as periods of high inflation or rising interest rates, can significantly impact this. If the cost of living increases, consumers often cut back on non-essential activities, and moviegoing can be one of the first things to go. This sensitivity means that Cinemark's revenue is directly tied to the financial health and spending habits of its target demographic.

Cinemark's box office performance is intrinsically linked to the quality and appeal of the films studios release. A robust film slate, especially with major blockbusters and popular family-oriented movies, directly translates to higher attendance and increased concession revenue. For instance, the strong performance of films like Dune: Part Two and Inside Out 2 in early 2024 significantly boosted ticket sales for exhibitors.

In 2024, the film industry faced challenges with a somewhat uneven release schedule, but the overall box office recovery continued. While specific figures for Cinemark's direct correlation are proprietary, the industry saw a notable rebound, with global box office revenue projected to approach pre-pandemic levels by the end of 2024. This trend is expected to continue into 2025, driven by anticipated major releases.

Concession Sales and Pricing Strategies

Concession sales are a vital revenue stream for Cinemark, often driving a substantial portion of its overall profitability. Pricing strategies for these items, alongside fluctuating food and beverage costs, directly impact the company's profit margins. Recent performance indicates a positive trend, with Cinemark achieving record-high concession per capita spending among its patrons.

This strong performance in concessions is a key indicator of consumer spending habits within the entertainment sector. Factors influencing these sales include:

- Consumer discretionary spending: As economic conditions improve, consumers are more likely to spend on premium concessions.

- Per capita spending: Cinemark reported an average concession per capita of $13.50 in Q1 2024, a notable increase from previous periods.

- Product innovation and bundling: Offering unique or value-added concession packages can further boost sales and customer satisfaction.

- Operational efficiency: Streamlining concession operations and managing inventory effectively contributes to margin improvement.

Foreign Exchange Rates and International Market Performance

For Cinemark, operating in Latin America means foreign exchange rates are a significant factor. When local currencies like the Brazilian Real or the Mexican Peso weaken against the U.S. dollar, Cinemark's reported revenues and profits from these regions can shrink, even if the actual number of tickets sold remains the same. For instance, during 2024, many Latin American currencies experienced volatility, impacting the dollar-denominated earnings of companies with substantial regional operations.

The economic health of these international markets directly influences Cinemark's box office performance. A strong economy typically translates to higher consumer spending on entertainment like movie tickets. Conversely, economic downturns can lead to reduced discretionary spending, affecting ticket sales. As of mid-2025, economic indicators across several Latin American countries show mixed trends, with some economies showing resilience and others facing inflationary pressures that could dampen consumer spending on non-essential goods and services.

- Currency Volatility: Fluctuations in the Brazilian Real (BRL) and Mexican Peso (MXN) against the USD directly impact the conversion of local earnings into U.S. dollar reporting for Cinemark.

- Economic Growth Rates: For example, Brazil's projected GDP growth for 2025 is around 2%, while Mexico's is anticipated to be slightly higher, influencing consumer disposable income available for entertainment.

- Box Office Trends: In 2024, Latin American box office revenues saw regional variations, with some markets outperforming pre-pandemic levels while others lagged, reflecting diverse economic recovery paces.

- Inflationary Impact: Rising inflation in certain Latin American economies in 2024-2025 can erode purchasing power, potentially leading consumers to cut back on entertainment expenses.

Consumer discretionary spending is a primary driver for Cinemark's revenue, with economic health directly influencing ticket and concession sales. For instance, the U.S. personal saving rate in Q1 2024 was approximately 3.4%, suggesting potentially less disposable income for non-essential activities like moviegoing.

Economic downturns, characterized by high inflation or rising interest rates, can significantly reduce consumer spending on entertainment. This sensitivity means Cinemark's financial performance is closely tied to the overall economic well-being and spending habits of its customer base.

Cinemark's concession sales, a crucial profit driver, are also impacted by consumer spending patterns and the cost of goods. The company reported a strong concession per capita spending of $13.50 in Q1 2024, indicating robust consumer appetite for these items when economic conditions are favorable.

Currency fluctuations in key markets like Brazil and Mexico can impact Cinemark's reported U.S. dollar earnings. For example, economic growth in Latin America, with Brazil projected at 2% GDP growth for 2025, influences consumer spending on entertainment, though inflation remains a concern in some regions.

| Economic Factor | 2024/2025 Data Point | Impact on Cinemark |

|---|---|---|

| U.S. Personal Saving Rate | ~3.4% (Q1 2024) | Lower rate may reduce discretionary spending on entertainment. |

| Concession Per Capita Spending | $13.50 (Q1 2024) | Indicates strong consumer spending on concessions, boosting profitability. |

| Brazil GDP Growth Projection | ~2% (2025) | Moderate growth may support consumer spending on movie tickets in Brazil. |

| Latin America Inflation | Varied (2024-2025) | High inflation in some regions can erode purchasing power for entertainment. |

What You See Is What You Get

Cinemark PESTLE Analysis

The Cinemark PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cinemark, delivered precisely as shown.

What you’re previewing here is the actual file, offering a detailed strategic overview of Cinemark's operating environment.

Sociological factors

The landscape of entertainment consumption has dramatically shifted, with a significant portion of audiences now favoring the convenience of streaming services for at-home viewing. This trend means Cinemark faces increased competition not just from other cinemas, but from the vast libraries available on platforms like Netflix, Disney+, and Max.

To counter this, Cinemark needs to emphasize the unique, communal experience that movie theaters provide, something that streaming cannot replicate. Offering premium amenities, immersive sound and visuals, and exclusive event screenings are crucial for drawing audiences back to the big screen.

Data from 2024 continues to show the resilience of the theatrical model when compelling content is released. For instance, major blockbusters in early 2024 demonstrated that audiences will still flock to theaters for event-level moviegoing, highlighting the importance of exclusive content windows and the overall theatrical experience.

The enduring human need for shared experiences continues to drive attendance at movie theaters, even with the proliferation of at-home entertainment options. Cinemark can capitalize on this by highlighting the social dimension of cinema, organizing special events, and offering premium formats designed to elevate the collective viewing experience.

Demographic shifts are reshaping moviegoing. For instance, the U.S. Hispanic population is projected to reach 119 million by 2060, and this growing segment often has distinct entertainment preferences. Cinemark must adapt its film slate and marketing to resonate with an increasingly diverse customer base, from younger Gen Z audiences to older demographics, ensuring a broad appeal.

Income level variations also play a crucial role. As of late 2024, economic conditions continue to influence discretionary spending. Cinemark's ability to offer varied ticket price points and value-driven concessions can attract a wider range of income brackets, making the cinema experience more accessible to a broader audience and potentially boosting attendance figures.

Influence of Social Media and Online Reviews

Social media and online review platforms are now powerful forces influencing consumer behavior, directly impacting movie attendance for companies like Cinemark. Positive buzz on platforms like X (formerly Twitter) and TikTok, coupled with favorable reviews on Rotten Tomatoes or IMDb, can significantly boost a film's box office performance. For instance, a highly anticipated film in late 2024 might see its opening weekend projections dramatically shift based on social media sentiment in the weeks leading up to its release.

Conversely, negative online sentiment can act as a significant deterrent. A poorly received film can quickly see its audience numbers dwindle as social media channels amplify critical feedback. This makes managing online reputation and engaging with audiences on these platforms a critical strategy for movie theaters and distributors alike. In 2024, studios increasingly rely on social media campaigns to generate excitement, with influencer marketing becoming a key component in reaching younger demographics.

The impact is quantifiable; a study in early 2025 might reveal that films with a "Certified Fresh" score on Rotten Tomatoes, often correlated with positive social media discussion, see an average of 15-20% higher opening weekend ticket sales compared to those with lower scores. This highlights the direct link between online perception and real-world ticket purchases for Cinemark and its competitors.

- Social media buzz directly correlates with movie ticket sales, influencing Cinemark's customer traffic.

- Positive online reviews and word-of-mouth can amplify a film's success, driving attendance.

- Negative sentiment on platforms like X and TikTok can deter potential moviegoers, impacting box office revenue.

- In 2024, influencer marketing and social media campaigns are crucial for generating film excitement and reaching target audiences.

Health and Safety Concerns

Public health concerns, particularly after global events like the COVID-19 pandemic, directly influence consumer comfort with attending crowded, enclosed venues such as movie theaters. Cinemark needs to demonstrate robust health and safety measures to rebuild and maintain audience trust. For instance, in 2023, Cinemark reported enhanced air filtration systems and increased cleaning protocols across its locations to address these ongoing concerns.

Maintaining high standards for cleanliness and safety is paramount for encouraging repeat business. Consumers are more likely to return to theaters where they feel secure and well-cared for. Cinemark's commitment to these protocols is a key factor in its ability to attract and retain patrons in the post-pandemic era.

- Audience Confidence: Rigorous sanitation and ventilation are crucial for reassuring moviegoers.

- Operational Costs: Implementing and maintaining advanced health measures can increase operational expenses.

- Competitive Advantage: Demonstrating superior safety standards can differentiate Cinemark from competitors.

Societal trends highlight a growing demand for shared experiences, which Cinemark can leverage by emphasizing the communal aspect of cinema. Demographic shifts, such as the increasing U.S. Hispanic population, necessitate adapting film slates and marketing to appeal to a diverse audience. Economic factors continue to influence discretionary spending, making varied pricing and value-oriented concessions important for accessibility.

Technological factors

Cinemark's commitment to a premium experience hinges on cutting-edge projection and sound. Technologies like laser projectors, High Dynamic Range (HDR), and 8K resolution are becoming industry standards, while immersive audio formats such as Dolby Atmos and DTS:X significantly enhance viewer engagement. For instance, Cinemark's ongoing upgrades in 2024 and into 2025 are designed to keep pace with these advancements, ensuring a superior cinematic offering that differentiates them in a competitive market.

Virtual Reality (VR) and Augmented Reality (AR) are emerging technologies that could reshape the entertainment landscape, offering new ways for audiences to engage with content. While widespread adoption in cinema exhibition is still developing, these immersive technologies present potential future opportunities for unique cinematic experiences and interactive storytelling.

The global VR market was valued at approximately $28 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $200 billion by 2030. This growth indicates increasing consumer interest and investment in immersive technologies, which could eventually translate into new formats for moviegoing or complementary experiences.

For Cinemark, these technologies could mean exploring VR/AR enhanced pre-show content, interactive lobby experiences, or even dedicated VR screening rooms, diversifying revenue streams beyond traditional movie tickets and concessions. The challenge remains in developing compelling, accessible content and the necessary infrastructure to support these advanced formats effectively.

The shift towards online ticketing and a seamless digital customer experience is paramount for moviegoers today. Cinemark has recognized this, investing heavily in user-friendly websites and mobile applications. These platforms offer the convenience of online ticket purchases, precise seat selection, and secure digital payment methods, all critical for attracting and retaining modern audiences.

Further enhancing the digital journey, Cinemark is leveraging AI-powered chatbots. These tools provide personalized movie recommendations, answer customer queries efficiently, and streamline the overall experience. For instance, a significant portion of Cinemark's ticket sales now originate from digital channels, reflecting the growing reliance on these platforms.

Data Analytics and Personalization

Cinemark is increasingly leveraging data analytics to understand its audience. By analyzing viewing habits and ticket purchase data, they can identify popular genres and predict future box office trends. This allows for more targeted marketing campaigns and personalized offers, enhancing customer engagement.

The effectiveness of personalization is evident in the growing consumer expectation for tailored experiences. For instance, in 2024, a significant portion of consumers reported higher engagement with brands that offer personalized recommendations. This trend directly impacts Cinemark's ability to drive repeat business and build loyalty.

Cinemark's data analytics initiatives aim to improve marketing ROI and customer retention. By understanding individual preferences, they can craft promotions that resonate more deeply, leading to increased ticket sales and concession purchases. This data-driven approach is crucial for staying competitive in the evolving entertainment landscape.

- Data-Driven Marketing: Cinemark uses analytics to tailor promotions, potentially boosting campaign effectiveness by 15-20% based on industry benchmarks for personalized marketing.

- Audience Segmentation: Identifying distinct audience segments allows for customized content recommendations and loyalty program rewards, fostering deeper customer relationships.

- Predictive Analytics: Analyzing past performance and market trends helps Cinemark anticipate demand for specific films and optimize staffing and inventory.

- Personalized Promotions: Offering targeted discounts or special screenings based on viewing history can significantly increase customer lifetime value.

Energy Efficiency and Smart Building Technologies

Cinemark can significantly cut operational expenses by adopting energy-efficient lighting and advanced HVAC systems. For instance, upgrading to LED lighting can reduce electricity consumption by up to 80% compared to traditional incandescent bulbs. Smart building technologies, like occupancy sensors and automated climate control, further optimize energy usage, leading to substantial cost savings and reinforcing the company's commitment to environmental sustainability.

These technological upgrades also enhance the overall patron experience. Improved climate control and better lighting contribute to a more comfortable and enjoyable movie-going environment. By investing in these smart building solutions, Cinemark can differentiate itself, attracting environmentally conscious consumers and potentially increasing attendance.

The market for smart building technology is experiencing robust growth. Projections indicate the global smart building market could reach over $100 billion by 2025, driven by increasing demand for energy efficiency and automation. This trend presents a clear opportunity for Cinemark to leverage these advancements.

- Reduced Operational Costs: Implementing LED lighting and smart HVAC systems can lower electricity bills, with potential savings of 15-30% on energy expenditures.

- Enhanced Customer Comfort: Smart climate control and lighting systems create a more pleasant and consistent environment for moviegoers.

- Sustainability Alignment: Adopting these technologies supports corporate social responsibility goals and appeals to an increasingly eco-aware customer base.

- Market Growth Opportunity: The expanding smart building technology sector offers avenues for innovation and competitive advantage.

Cinemark's technological focus is on enhancing the in-theater experience through advanced projection and sound systems. The adoption of laser projectors, HDR, and immersive audio like Dolby Atmos, which Cinemark has been integrating, elevates visual and auditory fidelity. These upgrades are crucial for 2024 and 2025 to maintain a competitive edge against other entertainment options.

Emerging technologies like VR and AR present potential future avenues for audience engagement, though their integration into mainstream cinema exhibition is still in early stages. The growing global VR market, projected to exceed $200 billion by 2030, suggests a strong consumer interest in immersive experiences that Cinemark could potentially leverage.

Digital transformation is key, with Cinemark investing in user-friendly online ticketing and mobile apps for seamless customer interaction. The company also utilizes AI-powered chatbots for personalized recommendations and customer service, reflecting a significant portion of ticket sales now occurring through digital channels.

Data analytics is integral to Cinemark's strategy, enabling them to understand audience preferences and predict trends. This data-driven approach, which saw personalized marketing campaigns showing increased engagement in 2024, helps optimize marketing ROI and foster customer loyalty.

Legal factors

Antitrust and competition laws are crucial for the film exhibition sector, aiming to prevent any single entity from dominating the market and ensuring a level playing field for all players. These regulations directly influence Cinemark's strategic moves, particularly concerning potential mergers or acquisitions, and shape how it interacts with competitors and film studios.

For instance, the U.S. Department of Justice's ongoing scrutiny of major studio vertical integration, which began in earnest around the COVID-19 pandemic and continued through 2024, highlights the sensitivity of these matters. Any significant expansion or partnership by Cinemark would need careful navigation of these antitrust frameworks to avoid regulatory hurdles, ensuring fair access to content and preventing undue market power.

Cinemark's core business hinges on its ability to legally exhibit copyrighted film content. This means navigating a complex web of intellectual property laws and maintaining robust licensing agreements with film studios. Failure to do so, or succumbing to widespread piracy, directly impacts revenue streams and the overall health of the exhibition industry.

In 2024, the ongoing battle against digital piracy remains a significant concern for the film industry, including Cinemark. While specific piracy loss figures for Cinemark are not publicly disclosed, industry estimates suggest billions are lost annually worldwide due to illegal content distribution, impacting studio revenues and, consequently, the licensing fees paid by exhibitors.

Laws like the Americans with Disabilities Act (ADA) mandate that public venues, such as Cinemark theaters, offer equal access to individuals with disabilities. This means ensuring features like closed captioning and audio description are available, which can influence the technology and operational setup within their locations.

Advertising and Marketing Regulations

Cinemark's advertising and marketing efforts are significantly shaped by regulations concerning content truthfulness and consumer privacy. Laws like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which became effective in 2023, dictate how Cinemark can collect and use customer data for targeted promotions. These regulations ensure that marketing materials are not misleading, impacting how they advertise movie releases and special events.

New legislative proposals or existing rules around pre-show advertising, such as those governing the length or type of commercials shown before a film, can directly influence Cinemark's advertising revenue streams. For instance, in 2024, there's ongoing discussion in various jurisdictions about screen time for advertisements versus content, potentially affecting the volume and pricing of pre-feature ad slots.

- Truth in Advertising: Regulations mandate that all promotional content, from digital ads to in-theater displays, must be accurate and not deceptive to consumers.

- Consumer Privacy: Data protection laws, such as GDPR and CCPA/CPRA, govern how Cinemark collects, stores, and uses customer information for marketing purposes, requiring explicit consent for many activities.

- Pre-Show Content: Legislation or industry self-regulation on the duration and nature of advertisements shown before movie screenings can impact Cinemark's advertising partnerships and revenue.

- Digital Marketing Compliance: Online advertising practices must adhere to rules regarding transparency, data tracking, and the prohibition of unfair or deceptive acts.

Labor and Employment Laws

Cinemark must navigate a complex web of labor and employment laws, impacting everything from minimum wage to workplace safety across its global operations. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime standards, which can vary by state and even city, directly affecting Cinemark's significant hourly workforce. Changes to these regulations, such as potential increases in the federal minimum wage, could lead to higher operating expenses.

Furthermore, evolving regulations around working conditions, such as mandatory breaks or specific health and safety protocols, require constant vigilance and adaptation. The potential for increased unionization efforts among cinema staff also presents a significant factor, as collective bargaining agreements can influence wage structures, benefits, and operational flexibility, potentially impacting Cinemark's cost base and management practices.

Cinemark's operations are significantly influenced by intellectual property laws, particularly concerning the licensing of films. The ongoing battle against digital piracy, which cost the global film industry an estimated $100 billion in 2024 alone, directly impacts Cinemark's revenue by reducing ticket sales and potentially increasing content licensing fees.

Antitrust regulations, such as those examined by the U.S. Department of Justice regarding studio vertical integration, shape Cinemark's strategic options for growth and partnerships. Compliance with consumer privacy laws like the California Privacy Rights Act (CPRA), fully effective in 2023, dictates how Cinemark utilizes customer data for marketing, impacting its advertising strategies.

Labor laws, including minimum wage standards set by the Fair Labor Standards Act (FLSA), directly affect Cinemark's operating costs, especially given its large hourly workforce. For example, a hypothetical 15% increase in the federal minimum wage, a topic of discussion in 2024, could add tens of millions to Cinemark's annual labor expenses.

Environmental factors

Movie theaters like Cinemark are energy-intensive operations, relying heavily on lighting, digital projectors, and climate control systems that contribute to a substantial energy consumption. This inherent energy demand translates into a significant carbon footprint for the industry.

Cinemark, along with its competitors, is experiencing growing pressure from consumers, investors, and regulatory bodies to actively reduce its energy usage and carbon emissions. This push for sustainability aligns with global efforts to combat climate change and meet evolving environmental standards.

For instance, the U.S. commercial building sector, which includes movie theaters, accounted for approximately 18% of total U.S. energy consumption in 2023, according to the Energy Information Administration (EIA). This highlights the scale of the challenge and the opportunity for companies like Cinemark to implement energy-saving initiatives.

Cinemark's operations, particularly concession sales, generate significant waste, primarily from single-use items like plastic cups and food packaging. This volume of waste poses an environmental challenge that requires proactive management.

In response, Cinemark is focusing on implementing robust waste reduction, recycling, and composting programs. These initiatives are crucial for demonstrating environmental responsibility and aligning with growing consumer and regulatory expectations for sustainability.

While specific 2024/2025 data on Cinemark's waste diversion rates isn't publicly detailed, the broader industry trend shows a push towards circular economy principles. For instance, the U.S. recycling rate for plastic bottles was around 28% in 2023, highlighting the ongoing need for improved collection and processing infrastructure that Cinemark can leverage.

Cinemark's theater operations, from guest restrooms to food preparation, inherently involve water consumption, contributing to its overall environmental footprint. While specific 2024/2025 water usage data for Cinemark isn't publicly detailed, the industry generally sees significant water use in these areas. For instance, a typical large cinema complex can use thousands of gallons of water daily for cleaning, restrooms, and concession stands.

To mitigate this, Cinemark can actively explore and implement water-saving technologies. This includes installing low-flow fixtures in restrooms and kitchens, optimizing cleaning processes to reduce water waste, and potentially exploring greywater recycling systems for non-potable uses where regulations permit. Such initiatives not only reduce environmental impact but can also lead to cost savings on utility bills.

Supply Chain Sustainability

Cinemark's commitment to supply chain sustainability is gaining traction, with a growing emphasis on sourcing concessions and operational supplies from environmentally responsible vendors. This shift reflects increasing consumer and investor demand for ethical business practices. For instance, by 2024, a significant portion of major corporations are expected to have robust supplier codes of conduct addressing environmental impact, a trend Cinemark is likely aligning with.

Cinemark has the opportunity to significantly influence its supply chain towards more sustainable practices. This includes everything from the agricultural methods used for food production to the materials chosen for packaging. Companies are increasingly looking at Scope 3 emissions, which encompass supply chain activities, as a critical area for improvement. By 2025, many businesses aim to have measurable reductions in their supply chain carbon footprint.

- Vendor Accountability: Implementing stricter environmental criteria for vendor selection and ongoing performance monitoring.

- Sustainable Sourcing: Prioritizing suppliers who demonstrate commitment to reduced waste, ethical labor, and lower carbon emissions in their production processes.

- Packaging Innovation: Exploring and adopting biodegradable, recyclable, or compostable packaging solutions for concessions.

Climate Change and Extreme Weather Events

Cinemark's physical theaters are vulnerable to climate change impacts, with extreme weather events like hurricanes, floods, and heatwaves posing significant risks. These occurrences can directly disrupt operations, leading to temporary closures and impacting revenue streams. For instance, the 2023 hurricane season saw several major storms impacting coastal regions, potentially affecting attendance and causing minor damage to facilities in affected areas.

Property damage from severe weather can result in substantial repair costs, diverting capital from other strategic investments. Furthermore, extreme heat can deter moviegoers, particularly in outdoor or poorly air-conditioned venues, while severe cold snaps or blizzards can make travel to theaters difficult. The increasing frequency and intensity of these events, as highlighted by NOAA data showing a rise in billion-dollar weather disasters, necessitate robust contingency planning and infrastructure resilience for Cinemark.

The financial implications are clear:

- Increased insurance premiums due to higher risk profiles in certain locations.

- Potential for business interruption losses from prolonged closures due to weather events.

- Costs associated with repairing weather-related damage to theater properties.

- Reduced attendance during periods of extreme weather, impacting ticket and concession sales.

Cinemark's energy consumption, primarily from lighting, projectors, and HVAC, contributes to a significant carbon footprint, with the commercial building sector accounting for about 18% of U.S. energy use in 2023. The company faces pressure to reduce emissions, driving initiatives like waste reduction and recycling, though specific 2024/2025 waste diversion data is not detailed, industry recycling rates for plastics show room for improvement.

Water usage in theaters for cleaning and concessions presents another environmental consideration, with large complexes using thousands of gallons daily; implementing low-flow fixtures and optimizing cleaning are key mitigation strategies. Cinemark's supply chain sustainability is also evolving, with a focus on environmentally responsible vendors and packaging, aligning with corporate goals to reduce Scope 3 emissions by 2025.

The physical infrastructure of Cinemark theaters is susceptible to climate change impacts, such as extreme weather events which can cause disruptions and property damage, leading to increased insurance premiums and repair costs. These events, with an increasing frequency of billion-dollar weather disasters noted by NOAA, necessitate robust contingency planning for resilience.

| Environmental Factor | Impact on Cinemark | Industry Trend/Data (2023-2025) |

| Energy Consumption & Carbon Footprint | High energy use from operations (lighting, HVAC, projectors) leads to significant emissions. | Commercial buildings (incl. theaters) used ~18% of US energy in 2023 (EIA). Pressure to reduce emissions is high. |

| Waste Generation | Concessions produce substantial waste, primarily single-use plastics. | Industry pushing for circular economy principles; US plastic bottle recycling rate ~28% in 2023. |

| Water Usage | Operations require significant water for cleaning, restrooms, and concessions. | Large cinemas can use thousands of gallons daily; focus on water-saving fixtures and practices. |

| Supply Chain Sustainability | Need to source concessions and supplies from environmentally responsible vendors. | Growing emphasis on Scope 3 emissions reduction; many companies aiming for measurable supply chain footprint reduction by 2025. |

| Climate Change Vulnerability | Physical theaters are at risk from extreme weather, causing closures and damage. | Increasing frequency of billion-dollar weather disasters (NOAA data) leads to higher insurance premiums and repair costs. |

PESTLE Analysis Data Sources

Our Cinemark PESTLE Analysis is built on a robust foundation of data from leading market research firms, financial news outlets, and official government publications. We incorporate economic indicators, industry-specific reports, and consumer behavior studies to ensure comprehensive insights.