Cinemark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cinemark Bundle

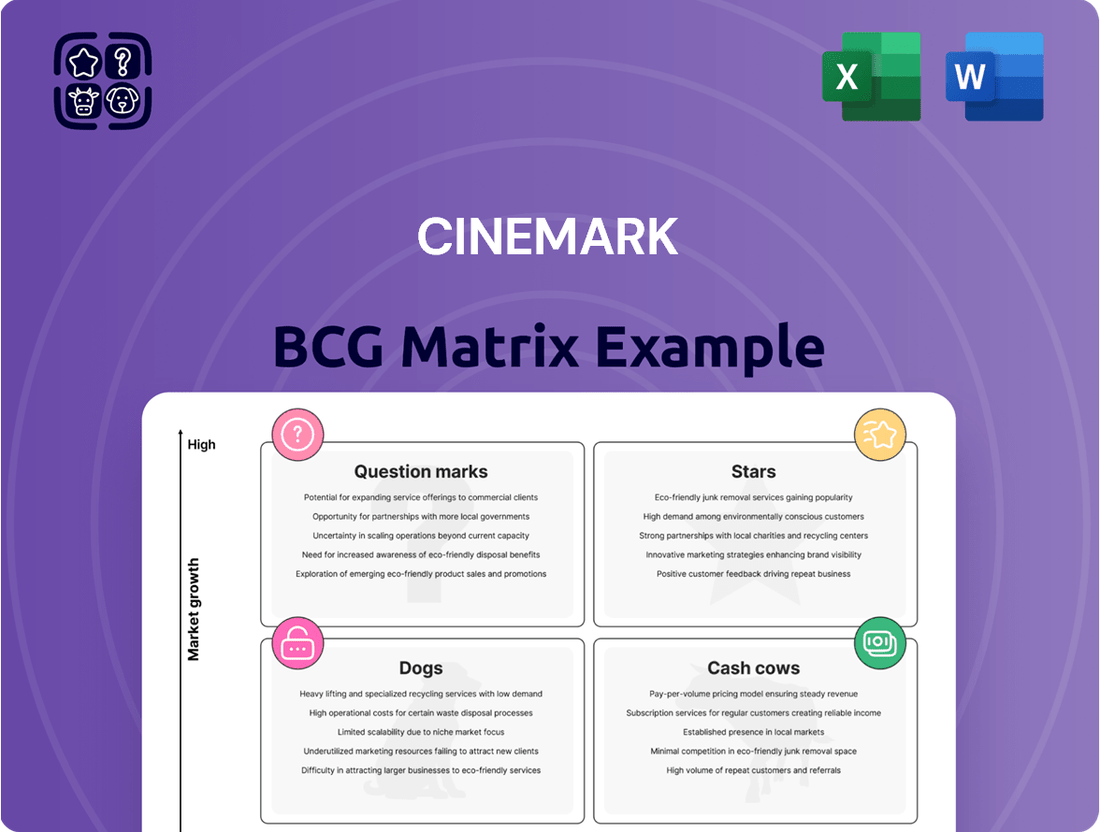

Explore the strategic positioning of Cinemark's offerings with a glimpse into its BCG Matrix. Understand which ventures are generating significant returns and which require careful consideration.

This preview only scratches the surface of Cinemark's portfolio dynamics. Unlock the full BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies for optimizing their business.

Don't miss out on the detailed quadrant analysis and data-driven insights that will empower your decision-making. Purchase the complete Cinemark BCG Matrix report today and chart a course for future growth and profitability.

Stars

Cinemark's investment in Premium Large Formats (PLF), such as Cinemark XD, and Luxury Lounger recliner seats is a strategic move targeting a high-growth segment. These premium offerings cater to consumers looking for an elevated movie-watching experience, which translates to higher average ticket prices and a stronger competitive position.

The company's commitment to these amenities is evident, with a substantial 92% of its theaters equipped with them. This high penetration rate not only meets but often exceeds industry standards, indicating a strong focus on delivering quality and comfort to attract and retain customers in a discerning market.

The Cinemark Movie Club loyalty program, alongside the free Movie Fan tier, is a significant growth driver for the company. Its expanding membership base directly fuels box office revenue, demonstrating its importance in Cinemark's overall strategy.

Loyalty initiatives are paramount for Cinemark, accounting for roughly half of its box office income. Between 2023 and 2024, the program saw a notable 12% increase in new subscriptions, highlighting its growing appeal and effectiveness in attracting and retaining customers.

Cinemark's strategic market share gains are a testament to its robust performance in a recovering industry. The company has seen its North American market share climb from 13.3% in fiscal year 2019 to 14.8% by fiscal year 2024. This growth outpaces the overall industry's rebound, highlighting Cinemark's strong competitive footing.

In Latin America, Cinemark has also solidified its position, with market share increasing from 22.6% in FY19 to 24.8% in FY24. These figures underscore Cinemark's effectiveness in capturing a larger slice of the market, demonstrating its ability to thrive even as the broader entertainment sector navigates its recovery.

Enhanced Concession Offerings

Cinemark's enhanced concession offerings are a key driver of its success, as evidenced by record per-capita spending. In Q1 2025, this figure hit an all-time high of $7.98, following a strong $6.15 in Q4 2024. This growth is directly attributable to strategic menu expansions and sophisticated sales optimization techniques.

These high-margin food and beverage sales are crucial for Cinemark's financial performance. The company is actively innovating in this space, introducing features like mobile ordering and a wider selection of hot food items. These value-added services are designed to encourage greater customer spending and, consequently, boost overall revenue streams.

- Record Per-Capita Spending: Achieved $7.98 in Q1 2025 and $6.15 in Q4 2024.

- Menu Expansion and Optimization: Successfully broadened offerings and refined sales strategies.

- High-Margin Sales Growth: Food and beverage revenue significantly contributes to profitability.

- Innovation in Services: Introduction of mobile ordering and hot food options enhances customer experience and spending.

Robust 2025 Film Slate

Cinemark's robust 2025 film slate, anticipated to feature 115-120 wide releases, positions the company for significant growth. This strong content pipeline is vital for boosting attendance and enabling premium ticket pricing as the industry continues its recovery. A diverse and appealing movie lineup directly fuels admissions revenue and contributes to overall market expansion for cinema exhibitors.

This projected volume of releases in 2025 is a key driver for Cinemark's potential to capture market share and enhance profitability. The exhibition industry's reliance on a steady stream of blockbuster and diverse content means that Cinemark's ability to attract these titles is paramount. For instance, the success of major franchises in 2024, such as Dune: Part Two which grossed over $711 million globally, demonstrates the power of a strong film slate to drive significant box office performance.

- Projected 2025 Wide Releases: 115-120 films

- Impact on Cinemark: High-growth opportunity, increased attendance

- Industry Benefit: Supports rebound, drives premium pricing

- Revenue Driver: Higher admissions revenue and market growth

Cinemark's strong market share gains in both North America and Latin America, coupled with record per-capita concession spending, position it as a "Star" in the BCG matrix. The company's strategic investments in premium experiences and a robust loyalty program are driving significant revenue growth. The projected strong film slate for 2025 further solidifies its leading position.

| Metric | FY2019 | FY2024 | Change |

|---|---|---|---|

| North America Market Share | 13.3% | 14.8% | +1.5 pp |

| Latin America Market Share | 22.6% | 24.8% | +2.2 pp |

| Q4 2024 Concession Spend/Capita | N/A | $6.15 | N/A |

| Q1 2025 Concession Spend/Capita | N/A | $7.98 | N/A |

| Loyalty Program Subscription Growth (2023-2024) | N/A | 12% | N/A |

What is included in the product

The Cinemark BCG Matrix offers a strategic overview of its cinema locations, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear Cinemark BCG Matrix overview helps prioritize investments, relieving the pain of resource allocation confusion.

Cash Cows

Cinemark's extensive network, boasting roughly 500 theaters worldwide, especially in the U.S. and Latin America, forms its bedrock for revenue through ticket sales. This established presence consistently delivers substantial admissions income, even with industry cycles.

In 2024, Cinemark's commitment to its core theater business remains paramount. The company's strategic focus on maximizing attendance and optimizing the in-theater experience at its established locations is key to sustaining its financial health.

Cinemark's mature Latin American operations, particularly in Brazil and Argentina, represent a significant Cash Cow. These established markets benefit from Cinemark's strong market leadership and consistent operational history, contributing substantially to the company's overall revenue and cash flow. The lower competitive intensity in these regions compared to more developed markets allows these operations to generate a steady, reliable stream of cash with minimal new investment needs.

Theater advertising revenue, encompassing on-screen ads and lobby displays, represents a significant cash cow for Cinemark. This segment generates consistent, high-margin income by capitalizing on the captive audience present before movie screenings. In 2023, Cinemark reported advertising revenue of $206.5 million, a notable increase from $151.1 million in 2022, underscoring its growing importance as a stable income supplement.

Standard Concession Sales

Standard concession sales, encompassing popcorn, soda, and candy, are a bedrock of Cinemark's revenue. These high-margin items are crucial for stable cash flow across all theaters, forming an integral part of the traditional moviegoing experience.

In 2023, Cinemark reported that concessions accounted for a significant portion of its total revenue, often exceeding 40%. This highlights the enduring profitability of these traditional offerings, even as the company explores newer revenue streams.

- Concessions represent a high-margin revenue stream for Cinemark.

- These sales are a stable source of cash flow for all theater operations.

- They are considered a fundamental part of the overall moviegoing experience.

- In 2023, concessions comprised over 40% of Cinemark's total revenue.

Operational Efficiencies and Cost Discipline

Cinemark's commitment to operational efficiencies and cost discipline is a cornerstone of its success, particularly evident in its ability to generate strong Adjusted EBITDA margins. This focus ensures that its extensive circuit of theaters operates profitably, consistently producing significant cash flow.

Leveraging advanced tools like AI-driven scheduling and ongoing cost optimization initiatives allows Cinemark to maintain a lean and effective operational structure. For instance, in 2023, the company reported an Adjusted EBITDA of $597.1 million, demonstrating the financial benefits of these disciplined practices.

- Disciplined Execution: Cinemark consistently prioritizes efficient operations across its vast network of cinemas.

- AI-Powered Scheduling: The integration of artificial intelligence helps optimize movie showtimes and staffing, reducing waste and improving resource allocation.

- Cost Optimization: Continuous efforts to manage and reduce operational expenses directly contribute to higher profitability.

- Strong Cash Generation: These efficiencies translate into robust cash flow, reinforcing its position as a cash cow within its portfolio.

Cinemark's established Latin American markets, particularly Brazil and Argentina, are prime examples of Cash Cows. These regions benefit from Cinemark's strong market presence and consistent performance, generating reliable revenue with minimal need for new investment. Their mature status and lower competitive pressures allow them to consistently contribute significant cash flow to the company.

Theater advertising is another key Cash Cow for Cinemark, providing high-margin, consistent income from a captive audience. In 2023, this segment saw substantial growth, reaching $206.5 million in revenue, up from $151.1 million in 2022. This upward trend highlights its increasing importance as a stable income generator.

Concessions, including popcorn and beverages, remain a fundamental Cash Cow, offering high margins and stable cash flow across all Cinemark locations. In 2023, concessions represented over 40% of Cinemark's total revenue, underscoring their enduring profitability and central role in the moviegoing experience.

| Revenue Stream | Description | 2023 Revenue (Approx.) | Cash Flow Contribution | Investment Needs |

|---|---|---|---|---|

| Latin America Operations | Mature, established markets with strong market leadership. | Significant portion of total revenue | High and stable | Low |

| Theater Advertising | On-screen and lobby advertisements capitalizing on captive audience. | $206.5 million | High margin, consistent | Low |

| Concessions | High-margin sales of popcorn, drinks, and snacks. | Over 40% of total revenue | Stable and significant | Low |

What You’re Viewing Is Included

Cinemark BCG Matrix

The Cinemark BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously prepared with industry-standard analysis, is ready for immediate integration into your strategic planning processes. You can confidently use this preview as a direct representation of the professional, actionable insights you’ll gain.

Dogs

Underperforming older theaters, often those not recently renovated or situated in less populated areas, can be categorized as Dogs within Cinemark's portfolio. These locations may experience consistently low attendance, making their revenue generation insufficient to cover operational expenses and necessary upkeep. For instance, in 2024, Cinemark has continued its strategy of evaluating underperforming assets, with a focus on optimizing its real estate footprint.

Cinemark's theaters still relying on older projection and sound systems, lacking upgrades like 4K laser projection or immersive audio, are likely to see reduced customer draw. This outdated technology offers a less engaging experience compared to modern multiplexes, directly impacting attendance and market share for these specific locations.

Cinemark's standard auditoriums, offering a basic moviegoing experience without premium seating or advanced sound systems, represent its "Dogs" in the BCG Matrix. These segments, while essential for broad accessibility, face increasing pressure in a market prioritizing enhanced entertainment. For instance, in the first quarter of 2024, Cinemark reported total revenue of $479.5 million, a slight increase from the previous year, but the growth in premium experiences is likely outpacing that of standard offerings.

Impact of Piracy on Box Office

The pervasive issue of illegal streaming and digital piracy represents a significant 'Dog' within the broader theatrical exhibition sector, directly diminishing potential box office earnings.

This ongoing challenge actively erodes revenue streams for all film distributors and exhibitors.

Estimates suggest that piracy costs the film industry upwards of $1 billion annually, a figure that translates into reduced attendance across the spectrum of movie releases, impacting even the most anticipated blockbusters.

While piracy is not a direct product or service offered by Cinemark, it functions as a critical external force that siphons off potential market share and significantly hampers the profitability of the core cinema business.

- Piracy's Financial Drain: The global film industry loses over $1 billion each year due to illegal streaming and digital copying.

- Impact on Attendance: Piracy directly contributes to lower ticket sales, affecting the overall box office performance of films.

- Erosion of Market Share: This external factor reduces the potential customer base for theatrical releases, impacting Cinemark's revenue.

- Profitability Squeeze: The loss of potential revenue due to piracy directly impacts the profitability of cinema operations.

Films with Limited Theatrical Appeal

Films with limited theatrical appeal, often referred to as 'Dogs' in the BCG Matrix context, represent a segment of Cinemark's offerings that struggle to gain significant traction with the general public. These movies, while released, typically garner low box office revenue, consuming screen time and operational resources without yielding substantial returns.

For instance, in 2024, a significant number of independent films and foreign-language productions, while artistically valuable, fell into this category. These films often accounted for less than 1% of a typical multiplex's total weekly gross, despite occupying prime screening slots. Their limited audience reach means they contribute minimally to Cinemark's overall financial performance, often highlighting an underutilization of screen capacity.

- Low Box Office Contribution: These films rarely exceed a few hundred thousand dollars in domestic gross, a stark contrast to blockbuster hits that can reach hundreds of millions.

- Resource Drain: They require marketing support and staffing, similar to more popular films, but with a disproportionately lower return on investment.

- Screen Time Allocation: Their presence can sometimes displace films with higher audience demand, impacting overall profitability.

- Niche Audience Focus: While catering to specific demographics, their overall market share within the broader cinema-going public remains negligible.

Cinemark's "Dogs" represent underperforming theaters or film segments that generate low revenue and struggle to cover costs. These often include older, unrenovated locations or films with limited audience appeal.

In 2024, Cinemark continued to assess its real estate, focusing on optimizing underperforming assets. The company's standard auditoriums, lacking premium features, also fall into this category, facing pressure from enhanced entertainment experiences.

The financial impact of piracy, costing the film industry over $1 billion annually, exacerbates the challenges faced by these "Dog" segments by reducing overall box office potential.

These underperforming assets, including films with minimal box office returns, consume resources without contributing significantly to Cinemark's overall financial health.

| Category | Characteristics | Financial Implication |

|---|---|---|

| Underperforming Theaters | Older, unrenovated, low attendance | Insufficient revenue to cover operational costs |

| Standard Auditoriums | Basic seating, no premium amenities | Lower customer draw compared to enhanced experiences |

| Low-Appeal Films | Limited theatrical audience, low box office gross | Minimal return on investment, screen time utilization |

| External Factor (Piracy) | Illegal streaming and digital copying | Industry-wide revenue loss exceeding $1 billion annually |

Question Marks

Cinemark's integration of new technologies, such as AI for optimizing showtime scheduling and staff allocation, falls into the question mark category of the BCG matrix. These advancements aim to boost operational efficiency and potentially increase profitability.

The company is investing in these forward-looking solutions, recognizing their potential to enhance customer experience through more convenient showtimes and streamlined operations. However, the significant upfront costs and the nascent stage of widespread AI adoption mean the return on these investments is still uncertain, placing them squarely in the question mark quadrant.

Cinemark's strategy to expand into underserved domestic markets is indeed a classic Question Mark in the BCG Matrix. This means these new theater builds have the potential for significant growth by tapping into previously unreached customer bases. For example, in 2024, Cinemark announced plans to open several new locations, focusing on mid-sized cities with limited existing multiplex options, aiming to capture a larger share of the U.S. movie-going population.

However, this expansion requires substantial upfront investment, a hallmark of Question Marks. The capital expenditure for each new build can range from $10 million to $20 million, depending on size and amenities. This investment carries inherent risks, including the uncertainty of local market reception and the potential for intense competition from established entertainment venues or even emerging digital platforms.

The success of these new ventures is critical. If these underserved markets respond positively, leading to high attendance and profitability, these locations could transition into Stars, generating significant returns for Cinemark. Conversely, if adoption is slow or competition proves too fierce, they might remain Question Marks or even decline, consuming valuable resources without delivering expected growth.

Cinemark's exploration into non-film events like live sports, concerts, and esports tournaments is a prime example of a Question Mark in its BCG Matrix. These ventures aim to diversify revenue beyond traditional moviegoing, tapping into potentially high-growth markets. For instance, the global esports market was projected to reach $1.8 billion in revenue by 2024, showcasing a significant opportunity.

While these alternative content offerings present exciting growth prospects, they also carry inherent risks and are still in their early stages of development for Cinemark compared to their established film exhibition business. Success hinges on effectively attracting new demographics and establishing these events as regular draws, a challenge that requires significant investment and strategic execution.

Advanced Food and Beverage Concepts (Beyond Core Concessions)

While basic concessions are Cinemark's Cash Cows, the company is exploring advanced food and beverage concepts to boost revenue. This includes expanding into more sophisticated offerings like hot foods and premium dining experiences in select theaters, aiming to significantly increase per-patron spending.

These innovative F&B options have the potential to differentiate Cinemark from competitors. However, their widespread adoption and consistent profitability across the entire circuit are still in the development phase, positioning them as potential Stars or Question Marks depending on their performance.

- Innovation in F&B: Cinemark is moving beyond traditional popcorn and candy.

- Premium Experiences: Hot foods and dine-in options are being tested in certain locations.

- Revenue Potential: These advanced offerings aim to increase average guest spend.

- Development Stage: Widespread profitability and adoption are still being evaluated.

Potential for Virtual Reality (VR) / Augmented Reality (AR) Experiences

The broader trend towards immersive content, including virtual reality (VR) and augmented reality (AR) experiences, positions these as a 'Question Mark' for cinema operators like Cinemark. While these technologies are still developing within the theatrical context, they hold significant potential for novel, interactive entertainment. For instance, in 2023, the global AR/VR market was valued at approximately $30 billion, with projections indicating substantial growth.

Cinemark might consider integrating VR/AR to offer distinctive guest experiences, potentially drawing in new audiences. However, the current low market penetration of VR/AR in cinemas and the substantial upfront investment required for hardware and content development make this a speculative venture. By the end of 2024, it's anticipated that only a small fraction of cinemas will have invested in dedicated VR installations.

- High Growth Potential: VR/AR offers a pathway to entirely new forms of interactive cinematic entertainment.

- Emerging Technology: Adoption in the theatrical space is still nascent, making it a speculative investment.

- Investment Requirements: Significant capital is needed for technology and content creation.

- Market Share: Current market share for VR/AR in cinemas is negligible, indicating a high risk.

Cinemark's strategic investments in emerging technologies, such as AI for optimizing operations and the exploration of VR/AR experiences, represent classic Question Marks. These initiatives hold the promise of future growth and competitive advantage but require significant upfront capital and face market uncertainties, making their future success a question mark.

The company's expansion into new domestic markets and its foray into non-film events like concerts and esports also fall into this category. While these ventures aim to diversify revenue streams and capture new audiences, their profitability and market acceptance are not yet guaranteed, necessitating careful monitoring and strategic adjustments.

The success of these Question Mark initiatives is crucial for Cinemark's long-term growth. For example, the esports market was projected to reach $1.8 billion in revenue by 2024, presenting a substantial opportunity if effectively leveraged. Similarly, the global AR/VR market was valued at approximately $30 billion in 2023, indicating a significant potential market if cinema integration proves viable.

These ventures require substantial investment, with new theater builds costing between $10 million and $20 million. The return on these investments is uncertain, as market reception and competitive landscapes are still being evaluated. By the end of 2024, it's anticipated that only a small fraction of cinemas will have invested in dedicated VR installations, highlighting the speculative nature of such projects.

| Initiative | BCG Category | Potential Upside | Associated Risks | 2024 Data/Projections |

|---|---|---|---|---|

| AI for Operations | Question Mark | Increased efficiency, improved customer experience | High upfront costs, uncertain ROI | AI adoption in entertainment sector growing |

| VR/AR Experiences | Question Mark | Novel entertainment, attract new demographics | Low market penetration, high hardware/content costs | Global AR/VR market valued at ~$30B (2023) |

| Expansion into Underserved Markets | Question Mark | Capture new customer base, market share growth | Uncertain local reception, competition | Plans for several new U.S. locations in 2024 |

| Non-Film Events (Esports, Concerts) | Question Mark | Revenue diversification, new audience engagement | Early stage for Cinemark, requires strategic execution | Esports market projected to reach $1.8B revenue (2024) |

| Advanced F&B Concepts | Question Mark/Potential Star | Increased per-patron spending, differentiation | Widespread adoption and consistent profitability uncertain | Testing premium dining in select locations |

BCG Matrix Data Sources

Our Cinemark BCG Matrix is built on robust data, incorporating financial statements, box office performance metrics, and industry growth forecasts to accurately position each business unit.