Cinemark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cinemark Bundle

Cinemark navigates a competitive landscape shaped by intense rivalry among existing players and the ever-present threat of new entrants disrupting the market. Understanding the bargaining power of both buyers and suppliers is crucial for their strategic positioning.

The full analysis reveals the real forces shaping Cinemark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Film studios hold substantial bargaining power because they are the sole providers of Cinemark's core product: movies. This control over the content pipeline, especially blockbuster releases, directly impacts Cinemark's ability to draw audiences and generate revenue. For example, the 2023 Hollywood guild strikes disrupted film production and release schedules, underscoring this dependency.

The impact of these disruptions is evident in Cinemark's financial performance. The company reported that its total revenue for fiscal year 2024 remained flat compared to fiscal year 2023, highlighting how fluctuations in content availability, driven by studio decisions, directly affect Cinemark's top line.

The bargaining power of movie studios is significantly enhanced by their growing flexibility in distribution, particularly through direct-to-streaming and hybrid release strategies. This allows studios to bypass traditional cinema releases for specific films, especially those with smaller budgets, which can limit Cinemark's access to a full spectrum of content.

In 2023, for instance, a notable number of films experimented with or fully embraced streaming-first or simultaneous releases, demonstrating a clear shift. While theatrical releases remain crucial for major tentpole films, this evolving landscape empowers studios to exert greater control over their distribution channels, potentially impacting the volume and type of films available to exhibitors like Cinemark.

The bargaining power of suppliers for Cinemark is significantly influenced by supplier concentration in key content. A limited number of major Hollywood studios are responsible for producing the majority of blockbuster films that drive significant box office revenue.

While the global market share of the top five U.S. studios saw a slight decrease to 51% in 2024 from over 60% before the pandemic, their continued dominance in creating highly anticipated content means they hold considerable leverage. This concentration allows these studios to dictate terms for licensing agreements and theatrical release windows, impacting Cinemark's operational flexibility and profitability.

Concession Product Suppliers

Suppliers of food and beverages for Cinemark's concessions wield moderate bargaining power. While these suppliers are crucial for a significant revenue stream, evidenced by Cinemark's all-time high food and beverage per capita spending of $5.96 in fiscal year 2024 and reaching $7.98 in the first quarter of 2025, their leverage is tempered by the sheer number of alternative suppliers available for standard concession items.

- Moderate Supplier Power: The availability of multiple vendors for common concession goods prevents any single supplier from dictating terms.

- Revenue Dependence: Cinemark's reliance on concessions for profitability, with strong per capita spending figures, gives suppliers some leverage.

- Product Standardization: The largely standardized nature of many concession products means Cinemark can switch suppliers more easily if terms become unfavorable.

Technology and Equipment Providers

Technology and equipment providers, particularly those offering specialized cinema technology like advanced projectors and premium seating, hold a degree of bargaining power. This power stems from the high capital investment required for their products and the specialized knowledge involved. For instance, Cinemark's adoption of technologies like Barco laser projectors and their own Cinemark XD premium large format auditoriums demonstrates a reliance on these suppliers to deliver a superior customer experience and remain competitive in the market.

The specialized nature of these offerings means that switching costs for Cinemark can be significant, further bolstering supplier leverage. Companies providing essential components for immersive sound systems or luxury seating often face limited direct competition for those specific, high-demand features. This can translate into favorable pricing and contract terms for the suppliers.

- Specialized Offerings: Providers of laser projectors, immersive sound, and luxury seating have leverage due to product specialization.

- Capital Intensity: The significant investment needed for these technologies increases supplier bargaining power.

- Competitive Necessity: Cinemark's investment in premium formats like Cinemark XD and advanced projection systems (e.g., Barco laser) underscores their dependence on these suppliers.

- Switching Costs: High costs associated with changing technology providers can limit Cinemark's flexibility and strengthen supplier positions.

The bargaining power of suppliers for Cinemark is primarily concentrated with film studios, which are the gatekeepers of content. Studios' ability to dictate release windows and their increasing flexibility with streaming services grants them significant leverage. This was evident in 2024 when a notable percentage of films saw hybrid or direct-to-streaming releases, impacting the traditional theatrical model.

While the top five U.S. studios' market share slightly dipped to around 51% in 2024, their control over blockbuster content remains a critical factor. This concentration means studios can negotiate favorable terms for licensing agreements, directly affecting Cinemark's access to must-see films and its revenue potential.

Suppliers for concessions, like those providing popcorn and candy, hold moderate power. Cinemark's strong concession revenue, with per capita spending reaching $7.98 in Q1 2025, highlights their importance. However, the availability of numerous alternative suppliers for these standardized products limits individual supplier leverage.

| Supplier Category | Bargaining Power | Key Factors | 2024/2025 Data Points |

|---|---|---|---|

| Film Studios | High | Content exclusivity, distribution flexibility (streaming), concentration of major players | Top 5 studio share ~51% in 2024; increased hybrid/streaming releases |

| Concession Suppliers | Moderate | Product standardization, availability of alternatives, importance to Cinemark's revenue | Concession per capita spending: $5.96 (FY24), $7.98 (Q1 2025) |

| Technology Providers (e.g., projectors, seating) | Moderate to High | Specialized products, high switching costs, capital intensity of equipment | Cinemark's investment in premium formats like Cinemark XD and Barco laser projectors |

What is included in the product

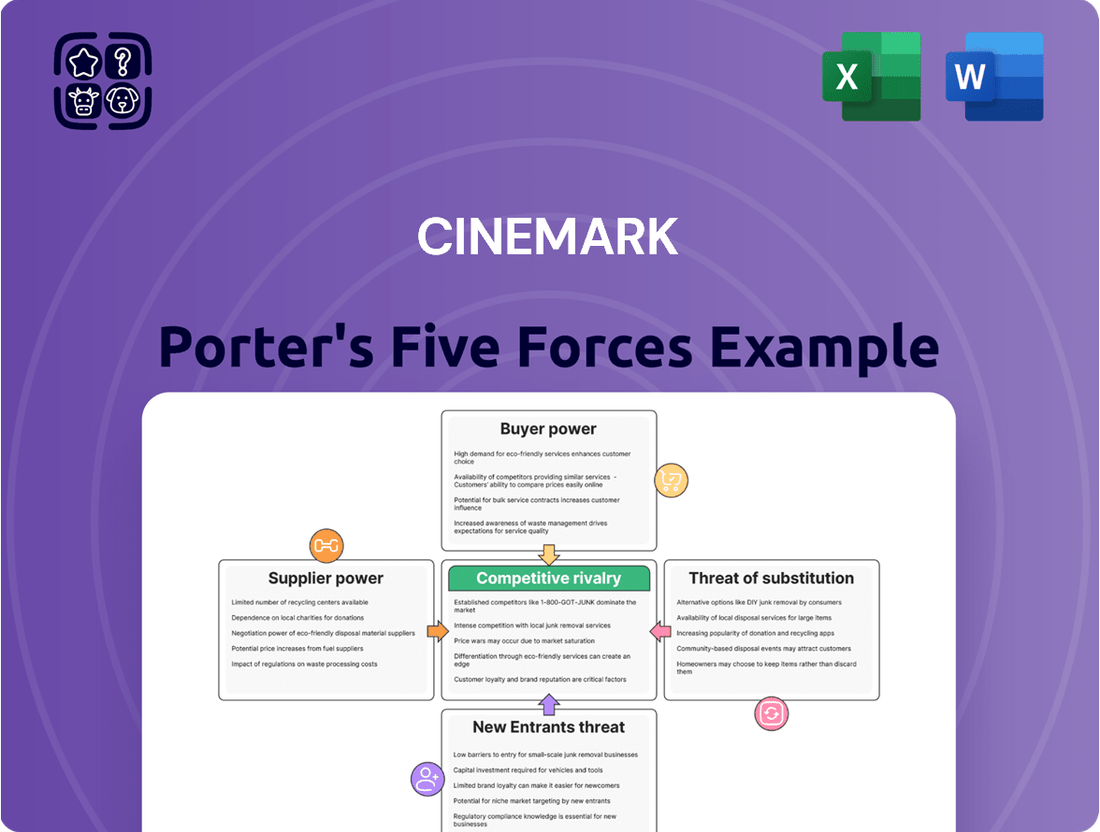

This analysis dissects Cinemark's competitive environment by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cinema industry.

Instantly grasp Cinemark's competitive landscape with a visual breakdown of each force, simplifying complex strategic pressures for informed decision-making.

Customers Bargaining Power

Cinemark's customers demonstrate considerable price sensitivity, weighing ticket costs against the broader entertainment value. This is evident as theater admissions in 2024 reached approximately 800 million, a stark contrast to the 1.3 billion admissions seen before the pandemic, indicating consumers are more carefully evaluating their entertainment budgets.

The sheer volume of entertainment choices available today, particularly the explosive growth of streaming platforms, dramatically shifts power towards consumers. This abundance means customers can easily switch to alternatives if they perceive theatrical releases as too expensive or inconvenient.

By 2024, the streaming market is incredibly saturated, with major players like Netflix, Disney+, and Max offering vast libraries. This competition forces traditional cinema chains like Cinemark to contend with a consumer base that increasingly expects digital access to new content, often much sooner than in the past.

Cinemark actively works to reduce the bargaining power of its customers through well-structured loyalty programs. Initiatives like Cinemark Movie Rewards, Movie Club, and Movie Club Platinum are designed to lock in customers by offering tangible benefits such as discounted concessions and special ticket perks.

These loyalty schemes are proving effective, with a notable 12% increase in new subscriptions observed between 2023 and 2024. Such growth signifies a stronger customer commitment, directly counteracting their ability to demand lower prices or better terms from Cinemark.

Demand for Enhanced Experiences

Customers are increasingly seeking more than just a movie; they want an immersive and memorable experience that makes venturing out worthwhile. This demand for enhanced entertainment is a significant factor influencing the cinema industry.

Cinemark, like its competitors, is investing heavily in premium amenities to meet these evolving customer expectations. These investments include features like luxury recliner seating, state-of-the-art sound systems, and even in-theater dining options.

- Demand for Premium Amenities: Consumers are demonstrating a willingness to pay more for superior comfort and advanced audiovisual technology.

- Industry Investment Trends: Major cinema chains are allocating capital towards upgrades that directly address customer desires for a differentiated experience.

- Impact on Pricing Power: The ability to offer unique, high-quality experiences can strengthen a company's position against substitutes like home entertainment.

Influence of Word-of-Mouth and Social Media

Customer opinions and experiences, amplified through social media and online reviews, can significantly influence the decisions of potential moviegoers. Positive experiences and recommendations can drive attendance, while negative feedback can deter it, underscoring the importance of quality service and facilities for Cinemark.

In 2024, the impact of word-of-mouth and social media on consumer choices continues to grow. A significant percentage of consumers, often exceeding 80%, rely on online reviews and recommendations before making purchasing decisions, including entertainment choices. This trend means that a single viral negative review or a wave of positive social media buzz can have a substantial immediate effect on Cinemark's ticket sales and overall brand perception.

- Amplified Influence: Social media platforms and review sites allow customer opinions to reach a vast audience, directly impacting Cinemark's customer acquisition.

- Reputation Management: Proactive engagement with online feedback is crucial for mitigating negative publicity and leveraging positive sentiment.

- Data Insights: Monitoring social media sentiment provides Cinemark with real-time data on customer satisfaction and emerging trends.

- Competitive Edge: A strong online reputation built on positive customer experiences can differentiate Cinemark from competitors in a crowded market.

Customers hold significant power due to their price sensitivity and the vast array of entertainment alternatives, especially streaming services. In 2024, cinema admissions were around 800 million, a notable drop from pre-pandemic levels, highlighting consumer budget scrutiny. The competitive streaming market, with platforms like Netflix and Disney+ offering extensive libraries, further empowers consumers to seek value and convenience.

Cinemark attempts to mitigate this by offering loyalty programs like Movie Club, which saw a 12% increase in new subscriptions between 2023 and 2024, indicating growing customer commitment. However, customers increasingly demand premium experiences, driving Cinemark to invest in amenities like luxury seating and improved sound systems to justify ticket prices and differentiate from home viewing. Online reviews and social media also amplify customer voices, making reputation management critical for Cinemark.

| Factor | Impact on Cinemark | Data Point (2024) |

|---|---|---|

| Price Sensitivity | Customers are more selective with entertainment spending. | Cinema admissions ~800 million (vs. ~1.3 billion pre-pandemic) |

| Availability of Substitutes | Streaming services offer strong competition. | Saturated streaming market with major players |

| Loyalty Programs | Aims to increase customer commitment and reduce price sensitivity. | 12% increase in new loyalty program subscriptions (2023-2024) |

| Demand for Premium Experience | Customers willing to pay more for enhanced comfort and technology. | Industry investment in luxury seating and advanced AV systems |

| Social Media Influence | Customer reviews and recommendations significantly impact attendance. | >80% of consumers rely on online reviews before purchasing |

Preview the Actual Deliverable

Cinemark Porter's Five Forces Analysis

The document you see here is your deliverable, offering a comprehensive Porter's Five Forces analysis of Cinemark. It’s ready for immediate use, providing deep insights into the competitive landscape without any need for customization or setup. This preview accurately represents the full, professionally formatted analysis you will receive instantly upon purchase, ensuring you get exactly what you need to understand Cinemark's strategic positioning.

Rivalry Among Competitors

The theatrical exhibition industry is highly competitive, with a few major players like AMC Entertainment, Regal Entertainment, and Cinemark Holdings dominating the landscape. This concentration means intense rivalry for moviegoers, premium screen rights, and advantageous theater locations.

These giants actively compete on pricing, the quality of their amenities, and the exclusive content they can offer, directly influencing ticket prices and the overall movie-going experience. For instance, in 2023, AMC reported over $4.8 billion in revenue, showcasing the scale of these operations and the significant resources available for competitive strategies.

Competitive rivalry in the movie theater industry is intensifying, moving beyond just ticket prices to encompass the quality of the viewing experience. Cinemark, for instance, competes by offering premium formats like Cinemark XD and plush Luxury Lounger recliners, aiming to attract patrons seeking enhanced comfort and visual immersion. This focus on premiumization means rivals are also investing in similar upgrades; AMC, a major competitor, has also been rolling out its own recliner seating and premium auditoriums, directly challenging Cinemark's market share in this segment.

Competitive rivalry within the cinema industry is fierce, directly impacting box office performance and market share. Cinemark’s ability to draw audiences is a key indicator of its competitive standing.

Cinemark’s domestic box office performance outpaced the North American industry’s recovery. Specifically, it surpassed the industry recovery by 160 basis points year-over-year in Q1 2025. This trend was even more pronounced in 2024, where Cinemark’s performance was 300 basis points ahead of its 2023 results, highlighting its strength in capturing audience attention.

Strategic Responses to Industry Challenges

Competitors are actively implementing diverse strategies to combat industry challenges like declining attendance and the rise of streaming. This includes investing in technology upgrades, diversifying entertainment offerings beyond movies, and adapting pricing models, intensifying the competitive pressure on Cinemark.

For instance, AMC Theatres has been a significant player in this competitive landscape, focusing on premium experiences and loyalty programs. In 2023, AMC reported a 24% increase in attendance compared to 2022, reaching 208 million guests, demonstrating a strategic push to draw audiences back.

- Technological Investment: Competitors are upgrading projection systems, sound technology, and offering premium seating options to enhance the in-theater experience.

- Diversification: Some rivals are exploring alternative revenue streams, such as hosting live events, e-sports tournaments, or offering dine-in services to broaden appeal.

- Pricing Strategies: Dynamic pricing and subscription models are being tested and refined to attract different customer segments and encourage repeat visits.

- Content Partnerships: Collaborations with content creators and studios for exclusive screenings or events are also being leveraged to create unique draw.

Global and Local Market Dynamics

While Cinemark operates globally, its competitive landscape is shaped by both large cinema chains and a multitude of smaller, independent theaters. This is especially true in international markets where local preferences and smaller operators can significantly influence market share. For instance, in 2024, the U.S. theatrical market saw continued consolidation among major players, but independent cinemas still accounted for a notable portion of screens, offering niche programming and community engagement.

Cinemark's presence in both the United States and Latin America exposes it to a wide array of local market dynamics. Each region presents unique competitive pressures, consumer behaviors, and regulatory environments. In 2024, the Latin American market, while showing signs of recovery, also faced challenges from economic volatility and the continued adaptation of viewing habits post-pandemic, requiring Cinemark to tailor its strategies accordingly.

- Diverse Competition: Cinemark faces rivalry not only from major global cinema chains but also from numerous independent and regional theaters, particularly in its international markets.

- Geographic Nuances: Operating across the U.S. and Latin America, Cinemark must navigate distinct local market conditions and varying competitive intensities in each region.

- Market Share Impact: The presence of smaller players can fragment market share and necessitate differentiated strategies to maintain customer loyalty and profitability in specific territories.

The competitive rivalry within the theatrical exhibition industry remains intense, with major players like AMC and Regal vying for market share alongside Cinemark. This rivalry extends beyond ticket sales to encompass the quality of the viewing experience, with competitors investing heavily in premium seating and advanced technology.

Cinemark's performance in 2024 and early 2025 demonstrates its ability to capture audience attention, outperforming industry recovery rates. Competitors are actively deploying strategies such as technological upgrades, diversified offerings, and dynamic pricing to counter industry headwinds like streaming service growth.

The competitive landscape is further complicated by the presence of independent theaters, particularly in international markets, fragmenting market share and requiring tailored strategies. Cinemark's operations in both the U.S. and Latin America necessitate navigating diverse local market dynamics and varying competitive intensities.

| Competitor | 2023 Revenue (Approx.) | Key Competitive Strategy | Market Share Focus |

|---|---|---|---|

| AMC Entertainment | $4.8 billion+ | Premium experiences, loyalty programs, technology upgrades | North America, Europe |

| Regal Entertainment (Cineworld) | N/A (Part of Cineworld Group) | Broad market reach, diverse offerings | North America |

| Cinemark Holdings | $1.7 billion (2023 est.) | Premium formats (XD, Loungers), international expansion | North America, Latin America |

SSubstitutes Threaten

Streaming services pose the most potent threat of substitutes for Cinemark, offering consumers unmatched convenience and extensive content libraries accessible from home. The global streaming market is on track to reach an impressive $224 billion by 2028, underscoring its massive reach and appeal.

In 2024, a significant 85% of U.S. households subscribe to at least one streaming service, directly challenging the traditional theatrical movie-going experience. This widespread adoption means consumers have readily available alternatives to visiting a cinema.

The growing sophistication and decreasing cost of home entertainment systems present a significant threat to Cinemark. Devices like 8K televisions and immersive soundbars, coupled with streaming services offering vast libraries, allow consumers to replicate a high-quality movie experience at home. This trend is notable as the global home entertainment market was valued at over $200 billion in 2023 and is projected to grow further, making the convenience and perceived value of at-home viewing increasingly attractive.

The threat of substitutes for movie theaters like Cinemark is significant, as consumers have a wide array of alternative out-of-home entertainment options. These include concerts, sporting events, live theater, and even upscale dining experiences, all vying for the same leisure time and discretionary spending. For instance, in 2024, the live entertainment industry continued its robust recovery, with many major sporting events and music festivals seeing record attendance and ticket prices, directly pulling consumers away from other entertainment choices.

Growth of Gaming and Digital Content

The burgeoning video game industry, with projections indicating a market size of $300 billion by 2029, offers a compelling alternative to traditional cinema experiences. This growth is particularly impactful on younger audiences who increasingly view gaming as their primary entertainment.

Furthermore, the pervasive influence of short-form video content on platforms such as TikTok and YouTube diverts significant consumer attention away from longer-form cinematic offerings. This constant stream of easily digestible content competes directly for leisure time.

- Gaming Industry Growth: Projected to reach $300 billion by 2029, offering a strong substitute for moviegoing.

- Demographic Appeal: Gaming and digital content are particularly attractive to younger demographics.

- Short-Form Content Dominance: Platforms like TikTok and YouTube capture substantial consumer attention, fragmenting entertainment choices.

Evolving Consumer Habits and Preferences

Consumer habits are in constant flux, leaning towards on-demand access and tailored content delivery. This shift presents a significant threat as audiences increasingly opt for the convenience and personalization of home entertainment.

The allure of at-home viewing, amplified by the ease of switching between various streaming subscriptions, directly challenges the traditional cinema model. While people still crave shared, offline experiences, the convenience factor of digital platforms is a powerful substitute.

For instance, in 2024, the global streaming market continued its robust growth, with subscription numbers reflecting a strong preference for accessible content. This trend directly impacts Cinemark's ability to maintain consistent attendance, as consumers can access a vast library of films and shows without leaving their homes.

- Growing preference for streaming services over traditional cinema.

- Convenience and personalization of at-home viewing as a key substitute.

- Subscription fatigue is a potential counter-trend, but on-demand access remains dominant.

- The rise of direct-to-consumer streaming models for major studios further intensifies this threat.

The threat of substitutes for Cinemark is substantial, primarily driven by the escalating popularity and accessibility of home entertainment options. Streaming services, in particular, offer a highly convenient and cost-effective alternative, with 85% of U.S. households subscribing to at least one service in 2024.

The increasing sophistication of home theater technology, coupled with the vast content libraries available through streaming, allows consumers to replicate a cinema-like experience at home. This is further amplified by other leisure activities like live events and gaming, which also compete for discretionary spending.

| Substitute Category | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Streaming Services | Convenience, vast libraries, affordability | 85% of US households subscribe |

| Home Entertainment Tech | High-quality displays, immersive audio | Global market > $200 billion (2023) |

| Live Events & Gaming | Shared experiences, interactive engagement | Gaming market projected $300 billion by 2029 |

Entrants Threaten

The cinema industry requires massive initial investments. Building a new, modern multiplex can easily cost tens of millions of dollars. This includes not just the physical structure but also cutting-edge projection technology, immersive sound systems, and comfortable, premium seating, all of which are essential for a competitive offering.

These high capital requirements act as a significant deterrent for potential new players looking to enter the market. For instance, a single screen with premium features can cost upwards of $1 million to equip. Considering that most modern cinemas have multiple screens, the total upfront cost becomes astronomical, creating a formidable barrier to entry for smaller or less capitalized businesses.

New entrants face a significant hurdle in securing distribution deals with major film studios. Cinemark, like other established cinema chains, benefits from long-standing relationships that grant them preferential access to new movie releases, a critical component for attracting audiences.

These established agreements mean that newcomers will struggle to acquire a competitive and appealing selection of films, a necessity for drawing patrons and generating revenue in the highly competitive movie exhibition market.

Incumbent cinema chains like Cinemark leverage strong brand recognition built over decades, a significant barrier for newcomers. Their loyalty programs, such as Cinemark Movie Rewards, are designed to foster repeat business and customer stickiness, making it challenging for new entrants to gain traction without substantial marketing expenditure and a compelling unique selling proposition.

Limited Prime Real Estate Availability

Securing prime real estate for large cinema complexes presents a significant hurdle for new entrants. High-traffic urban areas, crucial for attracting audiences, are often already occupied or prohibitively expensive. For example, in 2024, average commercial real estate prices in major metropolitan areas continued their upward trend, making it difficult for newcomers to acquire suitable sites without substantial capital investment.

This scarcity of desirable locations effectively acts as a natural barrier. Potential competitors face the challenge of finding available, appropriately zoned land or existing structures that can be converted into multiplexes. The cost and time involved in acquiring or leasing such properties can deter many from entering the market.

- Limited Availability: Prime locations are scarce and often already developed.

- High Costs: Acquiring or leasing suitable real estate is a significant capital expenditure.

- Urban Concentration: Competition for sites in high-traffic urban centers is intense.

- Zoning and Development Hurdles: Navigating regulations for large entertainment venues adds complexity.

Industry Challenges and Risks

The movie exhibition industry, including companies like Cinemark, faces significant hurdles that dampen the appeal for potential new entrants. Fluctuating box office revenues, a consistent challenge, were particularly evident in 2023, where global box office receipts reached approximately $26 billion, a notable increase from the pandemic-affected years but still below pre-pandemic levels. This volatility, coupled with the enduring threat posed by streaming services, which continue to capture consumer attention and leisure spending, creates a less inviting landscape for substantial new investment.

Furthermore, evolving consumer habits, such as a preference for in-home entertainment and changing discretionary spending patterns, add another layer of complexity. While some private equity firms have shown interest in funding necessary theater modernizations, the fundamental risks associated with the business model often deter broader, widespread entry by new companies. This cautious approach from potential investors reflects the industry's ongoing structural challenges.

Key deterrents for new entrants include:

- High Capital Requirements: Establishing new, modern cinema complexes demands significant upfront investment in real estate, technology, and amenities.

- Unpredictable Revenue Streams: Dependence on the success of a limited number of film releases creates inherent revenue volatility.

- Intense Competition: Existing players, including Cinemark, already have established market presence and brand recognition.

- Technological Disruption: The ongoing evolution of entertainment delivery, particularly streaming, necessitates continuous adaptation and investment to remain competitive.

The threat of new entrants for Cinemark remains moderate, primarily due to the substantial capital investment required to build and equip modern cinema complexes, often exceeding tens of millions of dollars. This financial barrier, coupled with the difficulty in securing prime real estate in 2024, where commercial property prices in urban centers continued to rise, deters many potential competitors.

Furthermore, established relationships with film studios for distribution rights act as a significant hurdle, limiting access to desirable film slates for newcomers. Cinemark's strong brand recognition and existing loyalty programs also present a challenge for new players attempting to gain market share without considerable marketing investment.

The industry's inherent revenue volatility, exemplified by global box office revenues of approximately $26 billion in 2023, and the persistent competition from streaming services, further dampen the attractiveness for new entrants, making significant widespread entry less likely.

Porter's Five Forces Analysis Data Sources

Our Cinemark Porter's Five Forces analysis is built upon a foundation of robust data, including Cinemark's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.