Ciena Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciena Bundle

Unlock the strategic blueprint behind Ciena's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Ciena crafts its value propositions, identifies key customer segments, and builds vital partnerships to dominate the networking industry. Discover the core activities and revenue streams that fuel their growth and gain actionable insights for your own ventures.

Partnerships

Ciena's strategic alliances with major cloud providers are crucial for expanding market reach and enhancing offerings, especially given the substantial capital expenditures cloud giants are making in AI infrastructure. These partnerships are seeing Ciena deploy its optical systems across extensive global networks.

In 2024, Ciena reported significant progress with its coherent pluggables, a key technology gaining traction among these cloud providers. This momentum is driven by the increasing demand for high-speed, efficient connectivity essential for AI workloads.

Ciena actively collaborates with major global and regional telecommunication service providers. These partnerships are fundamental to deploying Ciena's advanced optical and routing solutions, enabling network evolution and modernization. For instance, Ciena partnered with Telxius in 2024 to enhance transatlantic data transmission capabilities, a critical infrastructure upgrade.

Another significant collaboration in 2024 involved Telefónica Germany, focusing on cloudification and the transformation towards autonomous networks. Such alliances are vital for upgrading existing infrastructure and supporting the expansion of new fiber optic networks, directly impacting service delivery and network efficiency.

Ciena actively collaborates with technology and component ecosystem partners to drive innovation, a key aspect of its business model. For instance, their work with partners on advanced coherent pluggable solutions, incorporating cutting-edge technologies like 3nm CMOS for their WaveLogic processors, underscores this strategy. This partnership model is crucial for Ciena to remain at the forefront of optical networking advancements.

Industry Alliances and Standards Bodies

Ciena actively cultivates relationships with key industry alliances and standards bodies, demonstrating its commitment to collaborative innovation. By participating in forums like the O-RAN Alliance and the Telecom Infra Project (TIP), Ciena helps define the future of open and disaggregated network architectures. This strategic engagement ensures its solutions align with emerging standards, fostering interoperability and accelerating market adoption. For instance, Ciena's contributions to 5G standards are crucial for enabling the high-speed, low-latency services that will power future applications.

These partnerships are vital for driving the widespread adoption of Ciena's advanced networking technologies, particularly in the rapidly evolving telecommunications landscape. By actively shaping industry standards, Ciena ensures its high-speed connectivity solutions remain at the forefront of technological advancement. This proactive approach is essential for navigating the complexities of 5G deployment and the integration of AI into network infrastructure, as seen in the ongoing discussions around network slicing and edge computing within these bodies.

- Industry Event Participation: Ciena regularly showcases its latest innovations at major industry events, fostering dialogue and collaboration.

- Standards Development: Active involvement in organizations like the IEEE and IETF ensures Ciena's technology aligns with global networking standards.

- Alliance Contributions: Participation in groups like the Open Networking Foundation (ONF) drives the development of open software-defined networking solutions.

- 5G and AI Integration: Ciena's engagement in forums focused on 5G and AI integration is critical for shaping the future of intelligent, high-performance networks.

Managed Optical Fiber Network (MOFN) Partnerships

Ciena's Managed Optical Fiber Network (MOFN) partnerships are crucial for enabling cloud providers to build dedicated private optical networks. These collaborations allow cloud giants to expand their infrastructure rapidly, meeting escalating customer demand. For instance, in 2024, the demand for dedicated optical connectivity surged as hyperscalers continued their aggressive expansion, directly benefiting Ciena's MOFN strategy.

These partnerships highlight a symbiotic relationship where service providers build and manage the optical infrastructure, while cloud providers leverage it to extend their reach and enhance service delivery. This model is a significant growth driver for Ciena, capitalizing on the increasing need for high-bandwidth, low-latency connectivity essential for cloud services.

- MOFNs enable cloud providers to establish dedicated, high-performance optical networks.

- Ciena acts as a key technology and solutions provider in these strategic partnerships.

- This model facilitates rapid network expansion for cloud providers, addressing growing market demand.

Ciena's key partnerships with cloud providers are critical for its growth, particularly as these companies invest heavily in AI infrastructure. In 2024, Ciena's coherent pluggable technology saw increased adoption by these hyperscalers, directly supporting their need for high-speed connectivity. These alliances also extend to managed optical fiber networks, allowing cloud giants to rapidly build dedicated private optical links, a trend that accelerated throughout 2024 due to surging demand for high-bandwidth services.

Collaborations with telecommunication service providers remain foundational for Ciena. In 2024, partnerships with entities like Telxius and Telefónica Germany underscored Ciena's role in upgrading global networks and enabling advanced capabilities like autonomous networks. These relationships are vital for deploying Ciena's optical and routing solutions, facilitating network modernization and the expansion of fiber optic infrastructure.

Ciena also actively partners within its technology ecosystem, working with component suppliers to advance innovations like its WaveLogic processors, utilizing technologies such as 3nm CMOS in 2024. Furthermore, engagement with industry alliances and standards bodies, including the O-RAN Alliance and TIP, ensures Ciena's solutions are aligned with emerging open network architectures, crucial for 5G and future network advancements.

| Partner Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Cloud Providers | Deploying optical systems, expanding private networks | Increased adoption of coherent pluggables for AI infrastructure |

| Telecom Service Providers | Network modernization, fiber expansion, autonomous networks | Upgrades with Telxius, Telefónica Germany for enhanced connectivity |

| Technology/Component Ecosystem | Driving innovation in optical networking components | Advancements in WaveLogic processors with 3nm CMOS |

| Industry Alliances/Standards Bodies | Shaping open network architectures, defining standards | Contributions to 5G standards, O-RAN, TIP initiatives |

What is included in the product

A detailed breakdown of Ciena's strategy, covering customer segments, channels, and value propositions, presented within the 9 classic Business Model Canvas blocks.

Simplifies complex network strategy into a clear, actionable framework, easing the burden of strategic planning.

Provides a visual roadmap for Ciena's value proposition, streamlining communication and alignment across departments.

Activities

Ciena's core activities revolve around the relentless research and development of advanced networking technologies. This commitment is evident in their ongoing development of solutions like WaveLogic 6 Extreme and WaveLogic 6 Nano, pushing the envelope in high-speed coherent optics.

These innovations are critical for meeting the exponential growth in bandwidth demand, fueled by cloud computing and the burgeoning AI sector. Ciena's focus on developing industry-first coherent optics and pluggable solutions directly addresses these market needs.

This strategic investment in R&D solidifies Ciena's position as a leader, enabling them to offer cutting-edge solutions that anticipate and respond to evolving network requirements. Their dedication to innovation is a cornerstone of their business model.

Ciena's manufacturing and supply chain optimization is a core activity, focusing on the efficient production of advanced telecommunications networking equipment. This involves managing a complex global network, from sourcing raw materials to delivering finished products. In 2024, Ciena continued to invest in its manufacturing capabilities to ensure high quality and meet the escalating demand for its solutions.

The company's strategy emphasizes lean manufacturing principles and robust supply chain visibility to navigate market fluctuations. Ciena actively monitors inventory levels and adapts production schedules to mitigate potential disruptions, including those related to geopolitical factors and trade policies. This proactive approach is crucial for maintaining competitive lead times and cost-effectiveness.

Ciena's global sales, marketing, and customer engagement strategy is crucial for its success. The company actively connects with a broad customer spectrum, including major service providers, cloud giants, large enterprises, and government entities. This engagement happens through direct sales teams, targeted marketing initiatives, and a strong presence at key industry conferences.

These interactions are vital for showcasing Ciena's cutting-edge networking solutions and building lasting customer partnerships. For instance, in fiscal year 2023, Ciena reported revenue of $3.9 billion, a testament to its effective market reach. Their global footprint ensures robust sales and service support across all major regions.

Software Development and Network Automation

Ciena's key activities prominently feature the development and ongoing enhancement of its Blue Planet automation software. This suite is designed to provide customers with robust multi-domain service orchestration, inventory management, and advanced analytics, all critical for navigating the demands of the cloud and AI-driven network environments.

The primary goal of Blue Planet is to empower clients to automate and streamline their network and service lifecycle operations. This focus on digital transformation has proven highly successful, with Blue Planet achieving record revenue figures, underscoring its value proposition in today's rapidly evolving telecommunications landscape.

- Software Development: Continuous innovation and refinement of the Blue Planet automation platform.

- Network Automation: Enabling customers to automate complex network functions and service delivery.

- Multi-Domain Orchestration: Providing unified control across diverse network domains.

- Revenue Growth: Blue Planet's record revenue highlights its market traction and customer adoption.

Global Services and Support Delivery

Ciena's Global Services and Support Delivery is a cornerstone of its business, offering a full spectrum of support from initial installation and deployment to ongoing maintenance and specialized training. This comprehensive approach ensures customers can maximize the efficiency and lifespan of their complex network infrastructures.

In fiscal year 2023, Ciena's Global Services segment demonstrated robust performance, generating $1.5 billion in revenue. This segment consistently contributes a significant portion to Ciena's total earnings, highlighting the critical role these services play in customer retention and overall profitability.

- Network Design and Consulting: Ciena's experts collaborate with clients to architect and optimize network solutions tailored to specific business needs.

- Installation and Deployment: Professional teams handle the physical and logical setup of Ciena's advanced networking equipment.

- Maintenance and Support: Proactive and reactive support ensures continuous network operation and rapid issue resolution.

- Training and Education: Ciena provides comprehensive training programs to empower customer technical staff with the knowledge to manage and operate their networks effectively.

Ciena's key activities center on the continuous innovation and manufacturing of advanced optical networking hardware and software. This includes the development of high-speed coherent optics, such as the WaveLogic 6 family, and the robust Blue Planet automation software suite. These efforts directly address the escalating demand for bandwidth driven by cloud and AI technologies. In fiscal year 2024, Ciena continued to invest in its manufacturing capabilities to meet this growing demand and maintain product quality.

The company's sales and marketing efforts are crucial, engaging with a diverse customer base including service providers, cloud companies, and enterprises globally. Ciena's Global Services and Support Delivery is also a vital activity, providing installation, deployment, maintenance, and training to ensure customers maximize their network investments. This segment generated $1.5 billion in revenue in fiscal year 2023, underscoring its importance to customer success and Ciena's overall financial performance.

| Key Activity | Description | Impact/Data Point |

|---|---|---|

| R&D - Optical Technology | Developing next-generation coherent optics like WaveLogic 6. | Drives high-speed data transmission capabilities. |

| Software Development - Blue Planet | Enhancing automation and orchestration software. | Achieved record revenue, demonstrating strong market adoption. |

| Manufacturing & Supply Chain | Efficient production of networking equipment. | Investment in capabilities to meet escalating demand in 2024. |

| Sales & Customer Engagement | Connecting with service providers, cloud giants, and enterprises. | Supported $3.9 billion in revenue in FY2023. |

| Global Services & Support | Installation, maintenance, and training for network solutions. | Generated $1.5 billion in revenue in FY2023. |

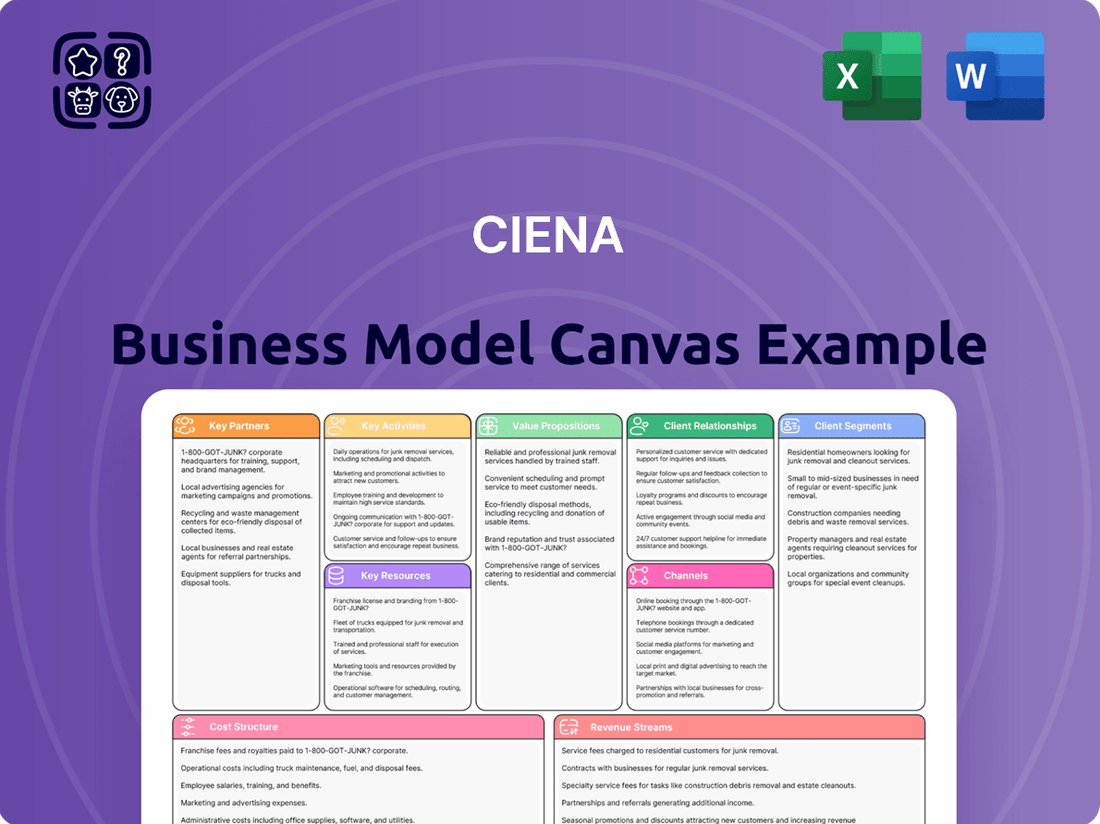

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a clear and comprehensive overview of Ciena's strategic approach. This isn't a sample; it's a direct representation of the finalized deliverable, showcasing the key components of Ciena's operational framework. Once your purchase is complete, you'll gain full access to this identical, ready-to-use document, allowing you to delve into the intricacies of their business strategy without any alterations or omissions.

Resources

Ciena's WaveLogic technology, including the advanced WaveLogic 6 Extreme and WaveLogic 6 Nano, represents a core intellectual asset. This proprietary innovation, often built on cutting-edge 3nm CMOS processes, delivers unparalleled coherent optical performance, setting industry benchmarks.

This technological leadership directly translates into a significant competitive edge for Ciena, particularly in the rapidly expanding market for high-speed, high-capacity networking solutions. The ability to efficiently handle massive data flows is paramount.

The critical role of WaveLogic is underscored by its necessity in meeting the escalating bandwidth demands driven by artificial intelligence (AI) and the continuous growth of cloud computing. For instance, WaveLogic 6 Extreme supports up to 1.6 terabits per second (Tbps) per wavelength, a key enabler for these data-intensive applications.

Ciena's approximately 8,570 professionals, with a significant portion comprising highly skilled engineers and dedicated R&D teams, represent a cornerstone of its innovation engine. These individuals are instrumental in driving the development of Ciena's advanced networking solutions.

The deep expertise of Ciena's workforce in areas like optical and packet networking, intelligent automation, and software-defined networking is directly responsible for the company's capacity to offer state-of-the-art products and services to its clients.

This pool of specialized human capital is essential for the ongoing enhancement and adaptation of Ciena's product portfolio, ensuring it remains at the forefront of technological advancements in the telecommunications industry.

Ciena's global infrastructure is a cornerstone of its business model, featuring manufacturing sites, research and development centers like its Ottawa lab, and sales offices across the world. This extensive network allows Ciena to efficiently serve its diverse international clientele, facilitating product trials and large-scale network deployments.

By maintaining this worldwide operational footprint, Ciena ensures proximity to its customers, enabling quicker response times and localized support. This global presence is crucial for testing and validating new technologies in various real-world conditions, a key aspect of their product development cycle.

In 2024, Ciena continued to invest in its facilities, with a growing emphasis on environmental sustainability. For instance, their manufacturing operations are increasingly designed to minimize energy consumption and waste, aligning with global efforts towards greener technology production and deployment.

Financial Capital and Investment Capacity

Ciena's financial capital and investment capacity are robust, enabling significant strategic maneuvers. As of the first quarter of fiscal year 2024, the company reported over $1.3 billion in cash and marketable securities, coupled with a strong operating cash flow. This financial muscle directly supports Ciena's ability to invest heavily in research and development, pursue strategic acquisitions that enhance its technological portfolio, and engage in share repurchase programs to return value to shareholders.

This financial stability is a critical component of Ciena's business model, offering considerable flexibility. It allows the company to weather market fluctuations and seize opportunities for growth and expansion. The strength of Ciena's balance sheet serves as a key differentiator in a competitive telecommunications infrastructure market.

- Cash and Marketable Securities: Over $1.3 billion as of Q1 FY24.

- Operating Cash Flow: Demonstrates consistent generation of funds from core business activities.

- Investment Capacity: Funds R&D, strategic acquisitions, and share repurchases.

- Financial Flexibility: Enables adaptation to market changes and pursuit of growth opportunities.

Brand Reputation and Established Customer Relationships

Ciena’s brand reputation as a global leader in high-speed networking is a critical asset, underpinning its established customer relationships. This long-standing trust with major service providers and cloud giants is a direct result of consistent performance and a collaborative, consultative approach to business. For instance, in fiscal year 2023, Ciena reported revenue of $4.3 billion, demonstrating its significant market presence and the ongoing demand for its solutions.

These deep-seated relationships are not merely transactional; they are built on a foundation of reliability and proven technological innovation. This allows Ciena to secure new design wins and maintain customer loyalty in a competitive landscape. The company’s commitment to delivering cutting-edge technology, such as its coherent optics advancements, further solidifies its market position and reinforces the value proposition for its partners.

- Global Leadership: Ciena is recognized worldwide for its expertise in optical networking and high-speed connectivity solutions.

- Key Partnerships: The company maintains strong, trust-based relationships with major telecommunications carriers and cloud service providers.

- Consultative Approach: Ciena’s business model emphasizes collaboration and providing tailored solutions, fostering customer loyalty.

- Technological Edge: Continuous innovation in areas like coherent optics strengthens Ciena's market standing and drives new opportunities.

Ciena's key resources include its proprietary WaveLogic coherent optical technology, a highly skilled workforce of approximately 8,570 professionals focused on R&D and engineering, and a robust global infrastructure encompassing manufacturing and R&D centers. The company also leverages significant financial capital, with over $1.3 billion in cash and marketable securities as of Q1 FY24, and a strong brand reputation built on established customer relationships.

| Key Resource | Description | Impact/Data Point |

| WaveLogic Technology | Proprietary coherent optical technology (e.g., WaveLogic 6 Extreme supporting 1.6 Tbps per wavelength). | Drives high-speed, high-capacity networking solutions essential for AI and cloud growth. |

| Human Capital | ~8,570 professionals, including engineers and R&D teams. | Drives innovation in optical and packet networking, intelligent automation. |

| Global Infrastructure | Manufacturing sites, R&D centers (e.g., Ottawa lab), sales offices. | Enables efficient global service, product trials, and validation in diverse conditions. |

| Financial Capital | Over $1.3 billion in cash/marketable securities (Q1 FY24). | Supports R&D investment, strategic acquisitions, and financial flexibility. |

| Brand Reputation | Global leader in high-speed networking. | Underpins trust with major service providers and cloud giants; FY23 revenue of $4.3 billion. |

Value Propositions

Ciena offers industry-leading high-speed connectivity, highlighted by its WaveLogic 6 Extreme and Coherent-Lite pluggables, both capable of 1.6 Tb/s. This technology is crucial for customers building networks that can handle the massive bandwidth increases fueled by cloud computing and artificial intelligence, with Ciena often being the sole provider of such advanced solutions.

Ciena's adaptive and automated network solutions, driven by its Blue Planet software, enable intelligent automation and software-defined networking. This empowers clients to proactively address escalating digital demands with enhanced agility and streamlined operations.

These advanced solutions are revolutionizing how data is transmitted and networks are managed. For instance, Ciena's focus on automation is crucial as global IP traffic is projected to reach 207 exabytes per month by 2024, according to Cisco's Annual Internet Report.

Ciena's enhanced network scalability and flexibility are crucial for modern infrastructure. Their WaveRouter family and coherent pluggables provide robust solutions for metro, data center, and long-haul networks, allowing service providers and cloud operators to adapt to evolving demands.

These advancements are particularly vital for managing network convergence and scaling for AI workloads. Ciena's focus on minimizing infrastructure costs and power consumption directly addresses a key challenge for operators looking to grow efficiently.

For instance, Ciena's 8180 WaveLogic 5 Extreme platform, a key component in their strategy, offers significant improvements in spectral efficiency, enabling higher data rates over existing fiber. This directly translates to better scalability and flexibility without requiring extensive new fiber deployments.

Secure and Resilient Network Operations

Ciena's networking equipment and software are engineered to provide highly secure and resilient network operations. This focus ensures critical data is protected while maintaining uninterrupted service delivery, a non-negotiable for enterprises and government bodies. In 2024, the increasing sophistication of cyber threats underscores the importance of such robust infrastructure.

These solutions are specifically crafted to meet the escalating demand for secure and dependable connectivity across various sectors. Ciena's commitment to network resilience directly addresses the challenges posed by evolving digital landscapes and the growing reliance on constant, secure communication channels.

- Network Security: Ciena's platforms incorporate advanced security features to safeguard data in transit and at rest.

- Service Continuity: Designed for high availability, Ciena's technology minimizes downtime and ensures uninterrupted service delivery.

- Resilience: The architecture supports self-healing capabilities and rapid recovery from network disruptions.

- Scalability: Solutions are built to scale, accommodating increasing data volumes and traffic demands securely.

Sustainable Networking and Operational Efficiency

Ciena's advanced technologies are key to building more sustainable networks. By enabling greater energy efficiency, these solutions directly help reduce the carbon footprint of telecommunications infrastructure. For example, their WaveLogic 6 Extreme technology significantly boosts capacity while simultaneously lowering the power consumed per bit transmitted, a critical factor in operational efficiency.

Beyond product innovation, Ciena actively pursues internal sustainability initiatives. This dual focus on external solutions and internal practices underscores a commitment to environmental responsibility. The company also leverages artificial intelligence to enhance network operational efficiency.

- Energy-Efficient Networks: Ciena's solutions are designed to minimize power consumption, contributing to a greener digital infrastructure.

- Reduced Carbon Footprint: By enabling more efficient data transmission, Ciena helps lower the environmental impact of network operations.

- WaveLogic 6 Extreme: This technology exemplifies efficiency gains, offering higher capacity with reduced power per bit.

- AI for Operational Efficiency: Ciena integrates AI to optimize network performance and resource utilization.

Ciena's value proposition centers on providing high-speed, automated, and resilient networking solutions. Their advanced technologies, like WaveLogic 6 Extreme, enable unprecedented data transmission speeds, crucial for meeting the demands of AI and cloud computing. This focus on performance and efficiency directly addresses the growing need for robust digital infrastructure.

The company's commitment to software-defined networking through Blue Planet software offers clients enhanced agility and streamlined operations, allowing them to proactively manage network demands. This automation is vital as global IP traffic continues its rapid ascent, with projections indicating substantial growth through 2024 and beyond.

Furthermore, Ciena emphasizes network scalability and sustainability, offering solutions that minimize infrastructure costs and power consumption. Their focus on energy efficiency, exemplified by technologies like WaveLogic 6 Extreme, directly contributes to a reduced carbon footprint for network operators.

Ciena's dedication to network security and service continuity ensures critical data protection and uninterrupted operations, a paramount concern for businesses and governments alike, especially given the evolving threat landscape in 2024.

| Value Proposition | Key Technologies/Features | Customer Benefit |

|---|---|---|

| High-Speed Connectivity | WaveLogic 6 Extreme (1.6 Tb/s), Coherent-Lite | Enables massive bandwidth for AI and cloud, sole provider of advanced solutions. |

| Network Automation & Agility | Blue Planet Software, Software-Defined Networking | Proactive management of digital demands, streamlined operations. |

| Scalability & Flexibility | WaveRouter, Coherent Pluggables | Adaptability for metro, data center, and long-haul networks. |

| Sustainability & Efficiency | Energy-efficient designs, WaveLogic 6 Extreme (reduced power per bit) | Reduced carbon footprint, lower operational costs. |

| Security & Resilience | Advanced security features, high availability, self-healing capabilities | Data protection, uninterrupted service delivery, rapid recovery. |

Customer Relationships

Ciena emphasizes a consultative approach, partnering with clients to deeply understand their specific network needs and business objectives. This high-touch model ensures technology solutions are tailored for maximum value creation.

Their collaborative engagements focus on co-creating solutions, as demonstrated by their work with major telecommunications providers. For instance, in 2024, Ciena announced expanded collaborations with several Tier 1 operators to deploy advanced optical and packet networking solutions, highlighting the success of this relationship strategy.

Ciena's Global Services segment is key to its customer relationships, offering extensive post-sales support. This includes vital services like maintenance, installation, and network design, ensuring customers get the most from their complex telecommunication infrastructure.

These dedicated services are designed to maximize network uptime and customer satisfaction, fostering strong, long-term partnerships. For instance, in fiscal year 2023, Ciena's Services revenue contributed significantly to its overall financial performance, underscoring the value customers place on this support.

Ciena fosters strong investor relations through consistent, transparent communication. This includes quarterly earnings calls, detailed annual reports, and a robust investor relations website, ensuring stakeholders have access to critical financial data and strategic updates. For instance, in fiscal year 2023, Ciena reported net sales of $4.1 billion, demonstrating significant market presence.

The company prioritizes accessibility for financially-literate decision-makers by regularly publishing press releases, SEC filings, and other pertinent announcements. This commitment to transparency allows investors and analysts to thoroughly evaluate Ciena's performance and future outlook, supporting informed investment strategies.

Community and Social Responsibility Initiatives

Ciena actively cultivates deeper connections through its corporate social responsibility (CSR) programs, extending its reach beyond typical business interactions. The Ciena Cares program, for instance, mobilizes employees and resources to support community needs, fostering goodwill and strengthening stakeholder relationships.

These initiatives underscore Ciena's dedication to making a positive social impact and promoting environmental sustainability. By investing in digital inclusion efforts, Ciena not only addresses societal needs but also builds trust and loyalty among diverse groups.

- Ciena Cares Program: Supports employee-driven volunteerism and charitable giving, reinforcing community ties.

- Digital Inclusion Efforts: Focuses on expanding access to technology and digital literacy, broadening Ciena's societal footprint.

- Environmental Stewardship: Integrates sustainable practices into operations, aligning with stakeholder values.

- Inclusive Culture: Promotes diversity and belonging within the company and its community engagement.

Customer-Driven Innovation and Feedback Integration

Ciena places a strong emphasis on customer feedback, weaving it directly into its innovation processes. This ensures that new product development is highly relevant, addressing the actual networking challenges faced by its clients.

By actively integrating customer insights, Ciena fosters rapid adoption of its solutions. This customer-centric strategy is a key driver of its market leadership in the telecommunications sector.

Ciena's research and development initiatives are significantly shaped by direct customer requirements and extensive trials. For instance, in fiscal year 2023, Ciena reported a substantial increase in customer engagement on its innovation platforms, highlighting the practical application of this approach.

- Customer Feedback Integration: Ciena's R&D pipeline is heavily influenced by direct input from its customer base, ensuring solutions meet evolving market demands.

- Market Leadership through Relevance: This customer-driven innovation directly contributes to Ciena's strong market position, as its offerings are tailored to address real-world networking needs.

- Rapid Solution Adoption: The focus on customer-centric development leads to quicker uptake of new technologies and services, a critical factor in the fast-paced telecom industry.

- Fiscal Year 2023 Engagement: Ciena saw a significant uptick in customer participation in co-creation and feedback sessions throughout fiscal year 2023, underscoring the ongoing commitment to this strategy.

Ciena's customer relationships are built on a foundation of deep partnership and co-creation, extending beyond transactional sales to become integral to client success. This is supported by a robust Global Services segment offering comprehensive post-sales support, which is crucial for maintaining complex networks and fostering long-term loyalty.

The company actively integrates customer feedback into its innovation pipeline, ensuring its solutions directly address real-world networking challenges and driving rapid adoption. This customer-centric approach is a key differentiator, as evidenced by increased customer engagement in co-creation throughout fiscal year 2023.

Ciena also cultivates relationships with investors through transparent communication and engagement, providing stakeholders with critical financial data and strategic updates to support informed decision-making.

Furthermore, Ciena extends its relationship-building efforts through corporate social responsibility initiatives, such as the Ciena Cares program and digital inclusion efforts, which foster goodwill and strengthen broader stakeholder connections.

| Relationship Aspect | Key Activities | Impact/Focus | 2023 Data Point |

|---|---|---|---|

| Client Partnership | Consultative approach, co-creation | Tailored solutions, maximum value | Expanded collaborations with Tier 1 operators |

| Post-Sales Support | Maintenance, installation, network design | Network uptime, customer satisfaction | Significant contribution of Services revenue to overall performance |

| Innovation Integration | Customer feedback, R&D trials | Relevant product development, rapid adoption | Substantial increase in customer engagement on innovation platforms |

| Investor Relations | Earnings calls, annual reports, website | Transparency, informed stakeholders | Net sales of $4.1 billion reported |

Channels

Ciena's direct sales force is crucial for cultivating relationships with its key clientele, which includes major telecommunications companies, hyperscale cloud providers, large enterprises, and government entities. This approach facilitates the sale of complex, integrated solutions, enabling in-depth technical dialogues and the creation of bespoke proposals that precisely address customer needs.

This direct engagement model is essential for Ciena's strategy of providing high-touch, consultative sales. For instance, in fiscal year 2023, Ciena reported that its largest customers, typically served by this direct sales force, represented a significant portion of its revenue, underscoring the channel's importance in driving substantial business.

Ciena leverages a robust network of strategic channel partners and system integrators to expand its global footprint and tap into diverse customer bases. These collaborators are crucial for providing localized support, value-added services, and enhanced market penetration, enabling Ciena to reach segments it might otherwise miss.

In 2024, Ciena reported that its channel partners played a significant role in driving sales, particularly in emerging markets where local presence and expertise are paramount. For instance, a substantial portion of Ciena's revenue growth in the Asia-Pacific region was attributed to the strong performance of its integrated partner ecosystem.

Ciena's official website, ciena.com, acts as the core information repository, detailing its extensive product portfolio, innovative solutions, investor relations, and company news. This digital presence is crucial for reaching a global audience seeking insights into the company's technological advancements and market position.

Beyond its website, Ciena actively utilizes social media platforms such as LinkedIn, X formerly Twitter, and YouTube. These channels are instrumental for disseminating company updates, engaging with customers and industry professionals, and visually showcasing its cutting-edge networking technologies and customer success stories.

These digital platforms collectively ensure broad accessibility to Ciena's comprehensive offerings and strategic insights, facilitating stakeholder engagement and reinforcing its brand as a leader in the telecommunications industry.

Industry Events, Conferences, and Trade Shows

Ciena leverages industry events like OFC, IMC, and OCP Global Summit to showcase its innovations. These gatherings are vital for demonstrating new technologies and fostering direct engagement with customers, which directly supports lead generation and brand visibility.

Participation in these events allows Ciena to solidify its position as a thought leader in the telecommunications sector. In 2024, OFC alone saw over 10,000 attendees, providing a significant audience for Ciena's presentations and product demonstrations.

- Showcasing Innovation: Live demonstrations at events highlight Ciena's latest advancements in optical networking.

- Customer Engagement: Direct interaction with current and potential clients builds relationships and gathers valuable feedback.

- Business Development: These events serve as a critical channel for identifying and nurturing new business opportunities.

- Thought Leadership: Presenting research and insights at conferences positions Ciena as an industry authority.

Investor Relations Portal and Publications

Ciena's Investor Relations Portal and Publications are vital channels for engaging with its financial stakeholders. This section of their website, alongside their annual reports and financial press releases, ensures transparency by providing direct access to crucial financial and strategic information. These resources are fundamental for investors, analysts, and financial professionals seeking to make informed decisions and conduct thorough research into Ciena's performance and outlook.

These publications offer a deep dive into the company's operational and financial health. For instance, Ciena's 2023 Annual Report detailed significant revenue growth, reaching $4.2 billion, driven by strong demand in its networking solutions. The portal also hosts quarterly earnings calls and webcast replays, allowing stakeholders to stay updated on the latest developments and management insights.

- Website Investor Relations Portal: Provides access to financial reports, SEC filings, investor presentations, and corporate governance information.

- Annual Reports and SEC Filings: Offers comprehensive financial statements, management discussion and analysis, and risk factors. Ciena reported a net income of $456.9 million for fiscal year 2023.

- Financial Press Releases: Delivers timely updates on earnings, acquisitions, and other material events impacting the company's financial performance.

- Investor Presentations and Webcasts: Features insights from Ciena's leadership on strategy, market trends, and financial outlook, often including forward-looking guidance.

Ciena's channels are a blend of direct engagement and strategic partnerships, designed to reach a wide array of customers globally. This multi-faceted approach ensures both deep relationships with major clients and broad market penetration through specialized partners.

The direct sales force is critical for high-value, complex solutions, engaging directly with large telecom operators and cloud providers. Meanwhile, channel partners and system integrators extend Ciena's reach, offering localized support and accessing diverse market segments, which proved instrumental in driving sales growth in regions like Asia-Pacific during 2024.

Digital platforms, including the Ciena website and social media, serve as vital information hubs and engagement tools, disseminating company news and showcasing technological advancements. Industry events further bolster Ciena's presence, facilitating direct customer interaction and positioning the company as a thought leader.

Investor relations are managed through a dedicated portal and publications, offering transparency and detailed financial insights, such as the $4.2 billion revenue reported for fiscal year 2023, crucial for financial stakeholders.

Customer Segments

Global Telecommunication Service Providers, encompassing major Tier 1 carriers and regional operators, represent a cornerstone customer segment for Ciena. These entities demand robust, adaptable, and secure optical and packet networking solutions to support the ever-growing needs for voice, data, and video services. For instance, in 2024, the global telecom services market was projected to reach over $1.6 trillion, highlighting the immense scale of this customer base.

Ciena's offerings are specifically tailored to assist these providers in upgrading their existing infrastructure, effectively managing escalating network traffic, and optimizing their inventory. Their advanced networking platforms and comprehensive services are crucial for enabling these operators to meet evolving customer expectations and maintain a competitive edge in a dynamic market.

Hyperscale cloud providers represent a rapidly expanding and increasingly influential customer base for Ciena. These companies are investing heavily in massive data centers and extensive global network infrastructures to meet the escalating demand for cloud computing, machine learning, and artificial intelligence applications.

Ciena's advanced high-speed interconnects and coherent optical solutions are indispensable for hyperscalers, particularly for their data center interconnect (DCI) requirements and the internal networking within their data centers. These technologies enable the efficient and high-capacity data transfer crucial for these operations.

This segment is a significant contributor to Ciena's revenue growth. For instance, in fiscal year 2023, Ciena reported that its DCI solutions, which are heavily utilized by hyperscalers, saw substantial demand, contributing to the company's overall financial performance and indicating a strong market position.

Large enterprises, including major corporations, financial services firms, and media organizations, represent a core customer segment for Ciena. These businesses have substantial data and connectivity needs, often requiring high-bandwidth, reliable, and secure networking infrastructure to manage their complex operations and digital initiatives.

In 2024, Ciena's focus on these demanding environments is evident in its continued investment in advanced optical and packet networking technologies. For instance, the company's WaveLogic solutions are designed to deliver unprecedented capacity and efficiency, crucial for enterprises undertaking significant digital transformations or managing massive data flows.

These large clients depend on Ciena for solutions that not only support their current high-bandwidth requirements for internal operations and cloud services but also provide the agility needed for future growth and innovation. Ciena's ability to offer secure, scalable, and programmable networks directly addresses the strategic priorities of these enterprises.

Government Organizations

Government organizations, including defense, intelligence, and public safety agencies, represent a crucial customer segment for Ciena. These entities demand highly secure, resilient, and high-capacity communication networks to support critical national infrastructure and operations. Ciena's advanced optical networking solutions are designed to meet these stringent requirements, ensuring reliable data transmission even in challenging environments.

Ciena’s offerings for government clients focus on delivering secure and robust network capabilities. For instance, in 2024, government spending on cybersecurity and secure communication infrastructure continued to rise, with defense budgets globally allocating significant portions to network modernization. Ciena’s technology plays a vital role in enabling these secure networks.

- Secure Network Solutions: Ciena provides encryption and network segmentation capabilities essential for government communications.

- Resilience and Redundancy: Their solutions ensure uninterrupted service, critical for national security and public safety operations.

- High Capacity: Government agencies require vast bandwidth to handle increasing data volumes, which Ciena's optical technology delivers.

- Compliance and Standards: Ciena ensures its products meet the rigorous security and operational standards mandated by government bodies.

Original Design and Equipment Manufacturers (ODMs/OEMs)

Original Design and Equipment Manufacturers (ODMs/OEMs) represent a burgeoning customer segment for Ciena. The company is actively pursuing opportunities to supply its cutting-edge optical components and pluggable solutions directly to these manufacturers. This strategic move significantly broadens Ciena's reach, extending its market beyond the traditional base of network operators and service providers.

By targeting ODMs/OEMs, Ciena is unlocking new avenues to capitalize on its established leadership in optical technology. This emerging customer group allows for innovative applications of Ciena's expertise, potentially integrating its advanced solutions into a wider array of electronic devices and systems.

For instance, the increasing demand for high-speed data transmission in areas like automotive electronics and advanced computing presents a fertile ground for Ciena's optical innovations. In 2024, the global market for optical transceivers, a key area for Ciena's pluggable solutions, was projected to reach approximately $13.5 billion, indicating substantial growth potential within this new segment.

- Emerging Market: ODMs/OEMs are a new focus, expanding Ciena's customer base beyond traditional network operators.

- Leveraging Technology: Ciena aims to utilize its optical component and pluggable solution expertise with these manufacturers.

- Market Expansion: This segment allows Ciena to tap into new addressable markets and applications for its advanced optical technologies.

- Growth Opportunity: The optical transceiver market, relevant to Ciena's pluggable solutions, was estimated to be around $13.5 billion in 2024, highlighting significant potential.

Ciena's customer segments are diverse, primarily focusing on entities requiring advanced networking solutions. These include global telecommunication service providers, hyperscale cloud providers, large enterprises, government organizations, and increasingly, Original Design and Equipment Manufacturers (ODMs/OEMs).

The company's strategy involves catering to the specific, high-bandwidth, and secure connectivity needs of each segment, from upgrading global telecom infrastructure to enabling the rapid data transfer essential for cloud computing and AI. Ciena's focus on innovation, particularly in optical and packet networking, ensures it remains a key partner for these demanding clients.

The growth in hyperscale cloud and the expanding market for optical components, as seen in the projected $13.5 billion optical transceiver market in 2024, underscore the significant opportunities Ciena is pursuing across its customer base.

Cost Structure

Ciena invests heavily in research and development, a significant portion of its cost structure. These expenditures are vital for staying ahead in the competitive telecommunications market, particularly in areas like advanced coherent optical technologies, exemplified by their WaveLogic 6 advancements.

The company's commitment to innovation is further demonstrated through its substantial spending on intelligent automation software, such as the Blue Planet platform. These R&D investments are the bedrock for creating next-generation networking solutions that meet evolving industry demands.

For fiscal year 2023, Ciena reported R&D expenses of $1.1 billion, highlighting the scale of these investments. This figure underscores R&D's role as a primary driver for Ciena's technological leadership and future product development.

Ciena's manufacturing and supply chain costs are substantial, reflecting the complexity of producing advanced telecommunications hardware. These include expenses for raw materials, sourcing specialized components, intricate manufacturing processes, and the logistics of global distribution. For instance, in fiscal year 2023, Ciena reported a Cost of Goods Sold of $3.1 billion, highlighting the significant portion these operational expenses represent.

Managing a worldwide supply chain introduces further costs, such as maintaining optimal inventory levels and navigating the financial implications of international trade policies and tariffs. These elements directly influence the cost of goods sold, impacting Ciena's overall profitability and pricing strategies in the competitive networking market.

Ciena's sales, marketing, and administrative (SM&A) expenses are crucial for its global operations, covering customer outreach and essential corporate functions. These costs encompass sales team compensation, extensive marketing initiatives, and the upkeep of administrative infrastructure. For instance, in fiscal year 2023, Ciena reported $1.1 billion in selling, general, and administrative expenses, reflecting significant investment in these areas.

The company actively manages these overheads. In late 2023, Ciena announced workforce reductions, a strategic move aimed at optimizing operational efficiency and controlling administrative costs amidst evolving market conditions. This focus on cost management is vital for maintaining profitability and competitiveness.

Software Development and Maintenance Costs

Ciena invests heavily in developing, enhancing, and maintaining its comprehensive software offerings, such as the Blue Planet platform and core network software. These costs are crucial for ensuring Ciena's software remains competitive and delivers advanced automation and management features for client networks.

Software development represents a continuously increasing area of investment for Ciena, reflecting the growing importance of intelligent software in telecommunications infrastructure. For instance, in fiscal year 2023, Ciena reported a significant portion of its operating expenses dedicated to research and development, a substantial part of which fuels software innovation.

- Ongoing R&D Investment: Ciena's commitment to software innovation is evident in its substantial research and development spending, which directly supports the evolution of its software portfolio.

- Platform Enhancement: Significant resources are allocated to improving and expanding capabilities within platforms like Blue Planet, ensuring they meet the dynamic needs of network automation and management.

- Competitive Edge: These continuous software investments are vital for Ciena to maintain its competitive position in the market by offering cutting-edge solutions.

- Engineering and Support: The cost structure includes substantial engineering talent and ongoing support required to deliver and maintain complex software solutions for global customers.

Global Services Delivery Costs

Ciena's global services delivery costs are a significant investment, encompassing the expenses associated with its field engineers, support personnel, and the underlying service infrastructure required to deliver installation, maintenance, training, and consulting worldwide. These costs are fundamental to Ciena's strategy of providing value beyond its networking hardware, fostering robust customer loyalty and ensuring the seamless operation of its solutions. In fiscal year 2023, Ciena reported Services revenue of $1.6 billion, highlighting the substantial operational footprint and associated costs of this critical segment.

These expenditures are crucial for maintaining Ciena's competitive edge by offering comprehensive support and expertise. The global nature of these operations means managing a distributed workforce and complex logistical networks, directly impacting the cost structure. For example, the need for specialized, on-site technical support in various regions contributes significantly to personnel and travel expenses.

- Field Engineering Expenses: Costs related to salaries, benefits, travel, and equipment for engineers who install, maintain, and troubleshoot Ciena's network solutions globally.

- Support Staff Costs: Salaries and overhead for customer support centers, technical assistance teams, and professional services personnel who provide ongoing client engagement.

- Service Infrastructure: Investments in technology platforms, tools, and facilities necessary to manage and deliver remote support, training, and consulting services efficiently.

- Training and Development: Costs incurred in educating both Ciena's personnel and customer teams on the latest networking technologies and service best practices.

Ciena's cost structure is heavily influenced by its substantial investments in research and development, particularly in advanced optical technologies and intelligent automation software. These R&D expenditures, reaching $1.1 billion in fiscal year 2023, are critical for maintaining technological leadership and developing next-generation networking solutions. The company also incurs significant costs in manufacturing and supply chain operations, with Cost of Goods Sold at $3.1 billion in FY2023, covering raw materials, component sourcing, and global logistics. Furthermore, Sales, Marketing, and Administrative (SM&A) expenses, totaling $1.1 billion in FY2023, are essential for global outreach and corporate functions, with strategic cost optimization measures like workforce reductions being implemented.

| Cost Category | FY2023 (USD Billions) | Significance |

|---|---|---|

| Research & Development | 1.1 | Drives innovation in optical technologies and software. |

| Cost of Goods Sold | 3.1 | Reflects manufacturing, supply chain, and component costs for hardware. |

| Selling, General & Administrative | 1.1 | Supports global sales, marketing, and operational overhead. |

| Services Revenue | 1.6 | Indicates investment in global services delivery, including field engineers and support. |

Revenue Streams

Ciena's revenue is heavily driven by sales of its advanced networking platforms. This includes critical optical networking systems like the 6500 Packet-Optical Platform and Waveserver, alongside robust routing and switching solutions such as the WaveRouter and 8100 coherent routing platforms. These hardware sales form the backbone of Ciena's financial performance.

In the second quarter of fiscal year 2025, Ciena experienced a significant uptick in its optical networking sales, underscoring the continued demand for high-capacity, efficient network infrastructure. This segment consistently represents the largest portion of Ciena's overall revenue, reflecting its strong market position in telecommunications hardware.

Ciena's Blue Planet revenue streams stem from licensing and subscriptions for its advanced automation software. This software is crucial for managing complex networks, offering capabilities like multi-domain service orchestration, inventory management, and insightful analytics.

The demand for network automation is soaring, and Blue Planet is a key driver of Ciena's growth in this area. In the first quarter of fiscal year 2024, Ciena reported record quarterly revenue for its Blue Planet software, underscoring its strategic importance and market traction.

Ciena generates significant revenue from its Global Services segment, encompassing essential offerings like maintenance support, training, installation, and deployment for its advanced networking solutions. This segment is crucial for fostering recurring revenue streams and bolstering customer retention through enhanced satisfaction and loyalty.

For instance, in the first quarter of fiscal year 2024, Ciena's Global Services revenue reached $602.4 million, representing a notable 10.5% increase year-over-year. This growth underscores the vital role these services play in Ciena's overall financial performance and customer engagement strategy.

Platform Software and Services

Ciena’s platform software and services represent a significant revenue stream, encompassing offerings like the MCP domain controller and OneControl unified management system, alongside planning tools. These solutions are frequently integrated into Ciena's networking hardware, boosting functionality and management efficiency.

This software segment has demonstrated recent growth, reflecting the increasing demand for sophisticated network management capabilities. For instance, in the first quarter of fiscal year 2024, Ciena reported a substantial increase in its software and services revenue, indicating strong market adoption.

- Software and Services Revenue Growth: Ciena's fiscal Q1 2024 saw a notable rise in software and services revenue, driven by demand for advanced network management solutions.

- MCP and OneControl: Key contributors include the MCP domain controller and OneControl unified management system, enhancing network operations.

- Embedded Value: These software solutions are often bundled with Ciena's networking products, providing added value and management features to customers.

- Strategic Importance: The growth in this segment highlights Ciena's strategic focus on delivering intelligent, software-driven networking capabilities.

Data Center Interconnect (DCI) and Emerging Opportunities

Ciena is seeing significant revenue growth from its high-speed interconnect solutions designed for data centers. This surge is largely fueled by the escalating demand for AI infrastructure, which necessitates robust and efficient data transfer capabilities. For example, Ciena's coherent pluggable solutions, like 400ZR and the newer 800ZR and 1.6T Coherent-Lite, are becoming essential components for connecting these facilities.

These solutions are critical for enabling the massive data flows required by artificial intelligence workloads. Cloud providers, in particular, are making substantial investments in their AI infrastructure, directly translating into increased demand for Ciena's DCI and metro data center campus connectivity products. This trend is expected to continue as AI adoption expands across industries.

- Coherent Pluggables: Sales of 400ZR, 800ZR, and 1.6T Coherent-Lite modules are a key revenue driver, supporting high-speed data center interconnects.

- Metro Data Center Connectivity: Solutions enabling efficient connections within and between metro data center campuses are generating substantial revenue.

- AI Infrastructure Demand: The exponential growth in AI workloads and the associated traffic are the primary catalysts for this revenue stream.

- Cloud Provider Investments: Major cloud service providers are investing heavily in AI infrastructure, directly boosting Ciena's DCI and related product sales.

Ciena's revenue streams are diverse, encompassing hardware sales, software licensing, and global services. The company's advanced networking platforms, including optical systems and routing solutions, form the core of its hardware revenue. Software, particularly the Blue Planet automation suite, and comprehensive global services like maintenance and support, contribute significantly to recurring revenue and customer retention.

| Revenue Stream | Description | Key Products/Services | Fiscal Q1 2024 (Millions USD) |

| Networking Platforms | Sales of advanced hardware solutions. | 6500 Packet-Optical Platform, Waveserver, WaveRouter | $793.1 (Optical Networking) |

| Software & Services | Licensing, subscriptions, and support for network management. | Blue Planet, MCP, OneControl | $602.4 (Global Services) |

| High-Speed Interconnects | Solutions for data centers, driven by AI demand. | 400ZR, 800ZR, 1.6T Coherent-Lite | N/A (Segmented within Networking) |

Business Model Canvas Data Sources

The Ciena Business Model Canvas is constructed using a blend of internal financial reports, customer feedback, and competitive landscape analysis. This ensures a comprehensive understanding of market positioning and operational efficiency.