Ciena Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ciena Bundle

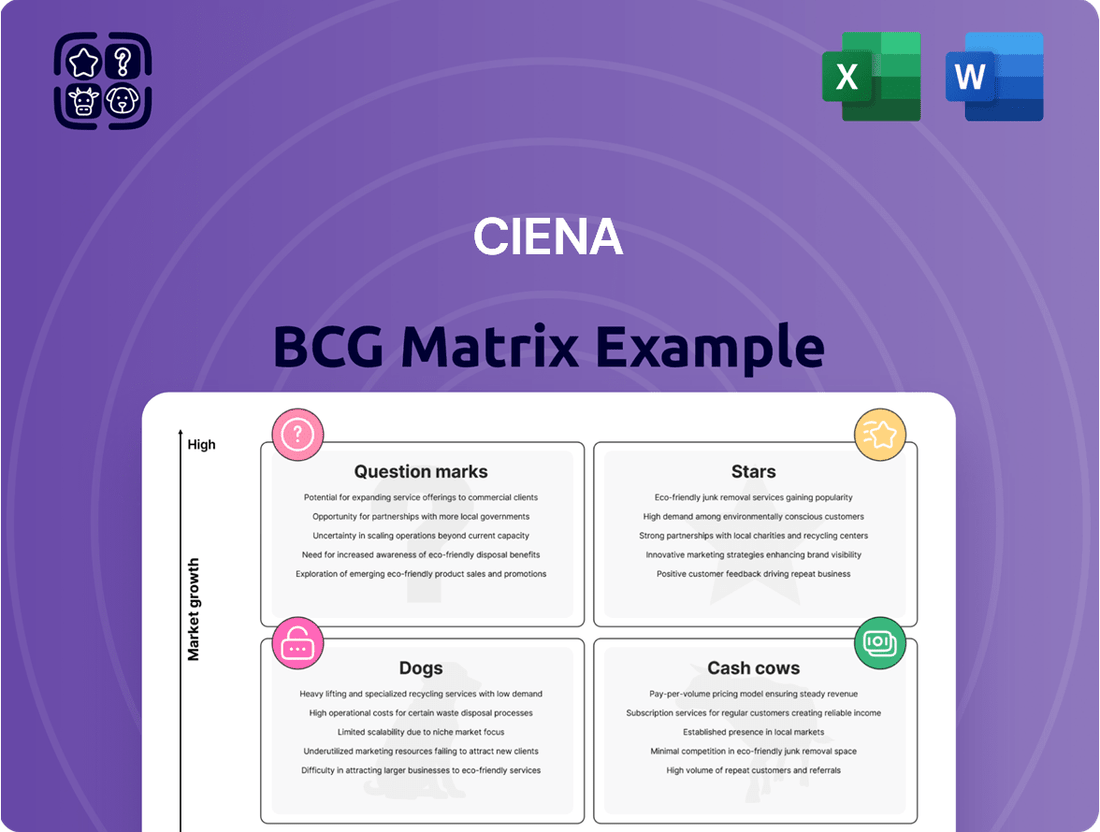

Curious about Ciena's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for actionable insights and a clear path to optimizing Ciena's market position and investment strategies.

Stars

Ciena's WaveLogic 6 Extreme (WL6e) is a prime example of a Star in the BCG matrix. Its industry-leading 1.6 terabit per second coherent optics are driving substantial market growth and capturing significant customer interest.

This advanced technology directly addresses the escalating demand for network capacity, fueled by the expansion of cloud services and artificial intelligence. WL6e's ability to offer unparalleled data transmission speeds positions Ciena favorably against competitors, attracting both new clients and expanding existing relationships.

The strategic importance of WL6e is underscored by its role in enabling service providers and hyperscale cloud operators to efficiently scale their network infrastructure. This makes it a critical component for meeting future bandwidth requirements.

Ciena's direct cloud provider revenue has reached impressive heights, surpassing $400 million in the second quarter of 2025. This represents a substantial 85% increase compared to the same period last year.

This segment is a significant growth driver for Ciena, fueled by the massive investments cloud providers are making in AI infrastructure. Ciena is well-positioned to capitalize on this trend.

The company's strong order pipeline from these key customers suggests that this rapid expansion in the cloud provider segment is likely to continue.

Ciena's Reconfigurable Line Systems (RLS) are experiencing significant adoption, with all major cloud providers and an increasing number of service providers deploying these solutions. This widespread acceptance highlights their critical role in building flexible and scalable network infrastructures, essential for meeting escalating traffic demands and enabling new digital services. The broad deployment underscores the RLS's position as a key enabler in the dynamic networking sector.

Coherent Optical Solutions

Coherent optical solutions are a cornerstone of Ciena's business, positioning the company as a leader in high-speed connectivity. This segment benefits from a rapidly expanding optical networking market, which was valued at approximately $10.8 billion in 2023 and is projected to grow significantly. Ciena's consistent investment in research and development fuels its competitive edge in this dynamic sector.

- Market Growth: The global optical networking market is anticipated to reach $17.35 billion by 2025, demonstrating an impressive 11.8% compound annual growth rate.

- Demand Drivers: This expansion is largely driven by the escalating need for faster internet speeds and robust data services across various industries.

- Ciena's Position: Ciena's ongoing innovation in coherent optics technology solidifies its leadership and ability to capture market share.

- Strategic Advantage: The company's strong competitive advantage in this high-growth area makes its coherent optical solutions a key component of its portfolio.

Intelligent Automation & Software-Defined Networking (SDN)

Ciena's strategic emphasis on intelligent automation and Software-Defined Networking (SDN), prominently showcased through its Blue Planet portfolio, places it squarely in a high-growth market segment. This focus is a key driver of its competitive positioning.

The Blue Planet software solutions are instrumental in enabling network operators to effectively manage increasingly complex multi-layer networks. Their growing importance for AI-driven operations underscores their strategic value.

- Blue Planet Revenue Growth: Achieved its highest-ever quarterly revenue at just under $30 million in Q2 2025.

- Market Positioning: Intelligent automation and SDN are identified as high-growth market areas.

- Operational Efficiency: Software solutions enhance the management of complex, multi-layer networks.

- AI Integration: These capabilities are increasingly vital for supporting AI-driven network operations.

Ciena's WaveLogic 6 Extreme (WL6e) exemplifies a Star in the BCG matrix due to its leading-edge 1.6 Tbps coherent optics, driving significant market growth and demand. This technology directly addresses the escalating need for network capacity, particularly from cloud providers investing heavily in AI infrastructure. Its superior data transmission speeds secure Ciena's competitive advantage, attracting new customers and deepening existing relationships.

| Product/Service | BCG Category | Market Growth | Ciena's Position | Key Metric |

|---|---|---|---|---|

| WaveLogic 6 Extreme (WL6e) | Star | High (Optical Networking Market Growth) | Industry Leader (1.6 Tbps) | 85% YoY growth in Cloud Provider Revenue (Q2 2025) |

| Reconfigurable Line Systems (RLS) | Star | High (Demand for Scalable Networks) | Widely Adopted by Major Cloud Providers | Broad deployment across key customer segments |

| Blue Planet Software | Star | High (Intelligent Automation & SDN) | Enables complex network management | Nearly $30 million quarterly revenue (Q2 2025) |

What is included in the product

The Ciena BCG Matrix analyzes Ciena's product portfolio by market share and growth, guiding strategic decisions for investment or divestment.

A Ciena BCG Matrix offers a clear visual of business unit performance, relieving the pain of unclear strategic direction.

Cash Cows

Ciena's 6500 series optical transport platforms are likely established cash cows, holding a significant market share and consistently generating revenue. While the market growth for these mature technologies may be slower, their proven reliability and extensive deployment ensure a stable income stream for the company.

Ciena's Global Services segment, which includes consulting, network design, installation, deployment, and ongoing maintenance, generally holds a strong position in a well-established service market. This segment is crucial for Ciena's overall strategy, as it directly supports the company's hardware and software offerings.

These services are characterized by their ability to generate consistent, recurring revenue and achieve high profit margins. This is largely due to long-standing customer relationships and reduced need for extensive marketing or promotional spending compared to newer offerings. For instance, in fiscal year 2023, Ciena reported that its Global Services segment contributed significantly to its revenue, highlighting the segment's stability and profitability.

Ciena's Platform Software and Services, excluding Blue Planet, represents a strong Cash Cow. This segment, featuring unified management systems like Navigator NCS, consistently shows robust performance with revenue growth, signaling a stable, high-market-share position within a mature operational software market.

These software tools are indispensable for customers seeking efficient network management, thereby generating predictable and reliable revenue streams. The investment required for growth in this area is typically lower when contrasted with the development of entirely new product lines, further solidifying its Cash Cow status.

North American Service Provider Business

Ciena's North American Service Provider business is a cornerstone of its operations, functioning as a classic cash cow within the BCG matrix. This segment benefits from Ciena's deep-rooted relationships with major Tier 1 service providers across the continent. While this market is mature, showing only gradual shifts in spending, it consistently generates substantial revenue.

This reliable revenue stream is crucial, acting as a financial engine that supports Ciena's investments in higher-growth areas, such as hyperscale cloud infrastructure. For instance, in fiscal year 2023, Ciena reported total revenue of $4.2 billion, with a significant portion attributable to its service provider customers, underscoring the segment's cash-generating power.

- Established Market Position: Ciena holds a strong, long-standing relationship with Tier 1 North American service providers.

- Mature Growth Dynamics: While spending in this segment shows gradual improvement, it represents a relatively mature market compared to emerging growth sectors.

- Consistent Revenue Generation: This business unit provides a stable and significant revenue base, essential for funding other strategic initiatives.

- Cash Cow Status: The predictable cash flow from this segment allows Ciena to invest in innovation and expansion into new, high-growth markets.

Existing Optical Network Deployments

Ciena's extensive existing optical network deployments form a substantial cash cow. This vast installed base, serving numerous global customers, generates consistent, recurring revenue through essential maintenance, upgrades, and support services. The market for these services is mature yet critical, allowing Ciena to focus on maximizing operational efficiency and extracting value from these established assets.

For instance, Ciena reported that its Blue Planet software, which manages network automation and orchestration, saw significant adoption, contributing to the efficiency of existing deployments. In fiscal year 2023, Ciena's total revenue reached $3.6 billion, with a substantial portion stemming from its existing customer base and the services associated with their network infrastructure.

- Mature Market Dominance: Ciena leverages its significant market share in optical networking to provide ongoing services for its deployed equipment.

- Recurring Revenue Streams: Maintenance, support, and upgrade contracts for the installed base create a predictable and stable revenue flow.

- Efficiency Focus: The strategy involves optimizing operations and service delivery to maximize profitability from these established customer relationships.

- Fiscal Year 2023 Performance: Ciena's overall revenue of $3.6 billion underscores the scale of its existing network deployments and the revenue they generate.

Ciena's established optical transport platforms, like the 6500 series, are prime examples of cash cows. These mature technologies, while in a slower growth market, benefit from significant market share and consistent revenue generation due to their proven reliability and widespread deployment.

The Global Services segment, encompassing network design, installation, and maintenance, also functions as a cash cow. This segment leverages long-standing customer relationships and requires less marketing investment, leading to high profit margins and consistent, recurring revenue, as evidenced by its significant contribution to Ciena's fiscal year 2023 revenue.

Ciena's Platform Software and Services, excluding Blue Planet, including tools like Navigator NCS, are strong cash cows. They hold a stable, high-market-share position in the mature operational software market, generating predictable revenue with lower growth investment needs compared to new product lines.

The North American Service Provider business, built on deep relationships with Tier 1 providers, is a classic cash cow. Despite a mature market, it generates substantial and reliable revenue, funding Ciena's investments in growth areas like hyperscale cloud infrastructure, contributing significantly to its fiscal year 2023 revenue of $4.2 billion.

Ciena's extensive installed base of optical networks represents a significant cash cow, generating recurring revenue through maintenance, upgrades, and support. The Blue Planet software's adoption enhances the efficiency of these existing deployments, contributing to the overall revenue stream which, in fiscal year 2023, reached $3.6 billion.

| Segment | BCG Category | Key Characteristics | Fiscal Year 2023 Relevance |

|---|---|---|---|

| 6500 Series Optical Platforms | Cash Cow | High market share, mature market, stable revenue | Core revenue driver |

| Global Services | Cash Cow | Recurring revenue, high margins, strong customer relationships | Significant revenue contributor |

| Platform Software (excl. Blue Planet) | Cash Cow | Stable market share, predictable revenue, low growth investment | Supports operational efficiency |

| North American Service Providers | Cash Cow | Deep customer ties, mature market, reliable cash flow | Funds growth initiatives |

| Existing Optical Deployments | Cash Cow | Large installed base, recurring service revenue, operational efficiency focus | Underpins overall revenue scale |

Full Transparency, Always

Ciena BCG Matrix

The Ciena BCG Matrix document you are previewing is precisely the same comprehensive report you will receive upon purchase. This means the strategic insights, market analysis, and clear visualizations are identical to the final, unwatermarked file ready for your immediate use. You can confidently assess the value and detail, knowing that no further editing or modification is required before integrating it into your business planning. This preview ensures transparency and guarantees you're acquiring a fully polished, actionable tool for strategic decision-making.

Dogs

Older, low-capacity optical line cards from Ciena, particularly those predating their advanced WaveLogic technologies, likely fall into the 'dog' category of the BCG matrix. These products, while potentially still functional, are being overshadowed by newer, higher-bandwidth solutions.

The market for these older cards is shrinking as the telecommunications industry aggressively upgrades to support increasing data demands. Ciena's focus is clearly on its latest WaveLogic 6 Extreme, which offers 1.6 Tbps, a stark contrast to the capabilities of older generations.

Consequently, these low-capacity line cards face minimal growth prospects and may eventually be phased out or relegated to legacy support roles. Their declining market relevance makes them a low priority for investment and development.

Ciena's legacy packet networking solutions, particularly those that haven't evolved with current technological demands or are challenged by nimbler competitors, likely fall into the 'dog' category of the BCG matrix. These offerings may be characterized by declining market share and operate within a stagnant or shrinking market segment.

Such products could represent a financial drain, potentially breaking even at best or becoming cash traps if they require ongoing investment without generating significant returns. For instance, if Ciena reported in its 2024 fiscal year that revenue from certain older packet platforms saw a year-over-year decline of over 10% and held less than 2% of the total packet networking market, these would be strong indicators of a 'dog' status.

Products officially announced by Ciena as end-of-life or discontinued would be classified as 'dogs' in the BCG Matrix. These offerings typically represent a declining market share and minimal to no growth potential, often becoming a drain on resources.

For instance, if Ciena had a legacy optical transport product that was phased out in 2023, it would fit this category. Such products usually incur ongoing maintenance and support costs without contributing to new revenue streams, as customers migrate to newer, more advanced solutions.

The strategic approach for these 'dog' products is to carefully manage existing customer commitments and minimize any further investment. The goal is to gracefully exit these product lines, potentially by offering migration paths to current offerings, thereby freeing up capital and resources for more promising ventures within Ciena's portfolio.

Products with Declining Demand due to Technological Obsolescence

Products facing declining demand due to technological obsolescence, particularly in the fast-evolving telecommunications sector, are prime candidates for the 'dog' quadrant in the Ciena BCG Matrix. These are often legacy hardware components being superseded by more flexible, software-defined networking (SDN) solutions or advanced pluggable optics. Their market share is shrinking, and continued investment offers minimal growth potential.

For instance, older generations of fixed-configuration optical transport equipment are seeing reduced sales as customers shift to modular, upgradeable systems. Ciena’s own portfolio, like many in the industry, has likely seen some product lines transition towards this category as newer, more efficient technologies emerge. The market for these older systems is contracting, with limited prospects for revival.

- Legacy Hardware Components: Specific pieces of telecommunications hardware that are being replaced by newer, more integrated, or software-driven alternatives.

- Declining Market Share: These products experience a steady decrease in their portion of the overall market due to lack of innovation and evolving customer needs.

- Low Return on Investment: Further investment in these 'dog' products is unlikely to generate significant returns, as demand continues to fall.

- Technological Displacement: The primary driver is technological advancement, making older solutions less efficient, less capable, or more costly to maintain relative to newer options.

Underperforming Regional Market Segments

Ciena might identify underperforming regional market segments as potential 'dogs' within its BCG Matrix. These are areas where the company has faced persistent challenges in capturing substantial market share or where growth has stalled, even with strategic initiatives. For instance, if Ciena's optical networking solutions in a specific, less developed Asian market segment have seen minimal adoption and revenue, despite significant investment in sales and marketing, this segment could represent a 'dog'.

Such underperformance might stem from intense local competition, unfavorable regulatory environments, or a mismatch between Ciena's offerings and local demand. For example, in 2024, while global telecom infrastructure spending saw a projected increase, certain emerging markets experienced slower adoption rates due to economic headwinds. If Ciena's market share in these specific regions remained flat or declined, it would signal a 'dog' status.

The implications for Ciena are clear: these segments require a critical strategic review. Options include:

- Re-evaluating market entry strategies: Adapting product portfolios or pricing to better suit local needs.

- Divesting underperforming assets: Selling off operations or product lines in these struggling regions to reallocate capital.

- Focusing on niche opportunities: Identifying specific customer segments within the region that may still offer profitable growth.

Dogs in Ciena's portfolio represent products or market segments with low market share and low growth potential. These are often legacy offerings that have been surpassed by newer technologies or face intense competition in stagnant markets. Continued investment in these areas is generally discouraged, as they are unlikely to yield significant returns and may even become cash drains.

For Ciena, identifying these 'dogs' is crucial for effective resource allocation. The company's strategic approach typically involves minimizing investment, managing existing customer commitments, and planning for graceful product or market exits. This allows Ciena to redirect capital and R&D efforts towards its Stars and Question Marks, fostering future growth.

For example, if Ciena's 2024 annual report indicated that a specific line of older, lower-speed optical transceivers saw a 15% year-over-year revenue decline and held only a 1% market share, this would strongly suggest a 'dog' classification. The focus would then shift to migrating these customers to more advanced solutions.

The telecommunications industry's rapid evolution means that products can quickly become 'dogs' if they don't keep pace. Ciena's commitment to innovation, particularly with its WaveLogic series, aims to prevent its core offerings from falling into this category, while strategically managing those that inevitably do.

Question Marks

Ciena's investment in new pluggable optics like 25GS-PON OLTs and 1.6T Coherent-Lite positions them in a high-growth DCI market fueled by AI and cloud expansion. While this segment shows significant promise, Ciena's ultimate market share and profitability within these emerging technologies are still being established as they focus on increasing adoption.

Ciena is experiencing significant traction with its coherent routing solutions, securing new international service providers and enterprise clients. This growth extends to its Adaptive IP offerings, indicating a positive market reception in a sector fueled by 5G and cloud expansion. Despite this momentum, these solutions are still establishing their market share within these new customer segments, positioning them as question marks.

The telecommunications market, particularly the segment driven by 5G deployment and cloud infrastructure growth, presents a substantial opportunity for Ciena's Adaptive IP and coherent routing technologies. Analysts project the global network transformation market, which includes these solutions, to reach over $100 billion by 2026, highlighting the potential for these Ciena offerings.

Continued strategic investment in research and development, coupled with targeted sales and marketing efforts, will be crucial for Ciena to solidify its position and transition these promising question mark products into market-leading stars. This focus will ensure they capture a larger share of the expanding market demand.

Ciena is actively investing in AI-driven network applications, viewing them as a key driver for future network evolution. These emerging solutions, designed to enhance network operations and management, represent a significant growth opportunity.

While the potential is substantial, these AI-driven applications currently hold a very small market share as they are still in the development and early adoption phases. This necessitates considerable investment to secure a strong position in these nascent, high-growth markets.

Expansion into New Geographic Markets for Specific Solutions

Ciena's strategic push to introduce advanced solutions like WaveLogic 6 into emerging markets presents a classic question mark scenario within the BCG framework. These regions, while holding significant untapped potential, demand tailored approaches and considerable upfront investment to establish a foothold and gain traction.

- Market Entry Challenges: Expanding into markets with a smaller historical Ciena presence requires significant investment in sales, support, and localized marketing efforts to build brand awareness and customer relationships.

- Growth Potential vs. Investment: While these markets offer high growth ceilings for solutions like WaveLogic 6, the immediate return on investment may be uncertain, necessitating careful resource allocation and risk management.

- Strategic Importance: Despite the challenges, successfully penetrating these question mark markets is crucial for Ciena's long-term global market share and competitive positioning against rivals who may already have a stronger presence.

- 2024 Outlook: Ciena's 2024 performance in these nascent markets will be a key indicator of the success of its expansion strategies, with analysts closely watching adoption rates and revenue growth in these specific geographies.

Next-Generation Technologies Beyond WaveLogic 6

Ciena is actively developing technologies beyond its current WaveLogic 6, aiming for significant future advancements in optical networking. These nascent technologies represent a high-growth potential in emerging markets, though their current market presence is nil as they are still in the research and development phase.

Significant investment in research and development is crucial for these next-generation solutions to mature into commercially viable products. For instance, Ciena's commitment to innovation is underscored by its substantial R&D spending, which in fiscal year 2023 reached $656.7 million, a 10.6% increase from the previous year, reflecting a strategic focus on future technological leadership.

- Future WaveLogic Iterations: Ciena is investing in R&D for optical networking technologies that will succeed WaveLogic 6, aiming for enhanced performance and capabilities.

- Early-Stage Development: These next-generation technologies are in their infancy, meaning they have immense future market potential but currently hold no market share.

- High R&D Investment: Bringing these advanced solutions to market requires substantial and ongoing investment in research and development to overcome technical hurdles and ensure viability.

- Strategic Importance: Ciena's focus on these future technologies positions it to capture future market share in an evolving telecommunications landscape.

Ciena's new pluggable optics and AI-driven network applications are in their early stages, representing significant future growth potential but currently holding minimal market share. These "question marks" require substantial investment and strategic focus to mature into market leaders.

The success of these emerging technologies hinges on Ciena's ability to navigate market entry challenges and capitalize on high growth ceilings. Continued R&D investment, as evidenced by their $656.7 million spend in FY2023, is critical for these nascent solutions to gain traction and secure future market share.

| Technology Area | Market Position | Growth Potential | Investment Focus | 2024 Outlook |

|---|---|---|---|---|

| Pluggable Optics (e.g., 25GS-PON OLTs) | Question Mark | High (AI, Cloud DCI) | Increasing Adoption | Key for market share growth |

| AI-Driven Network Applications | Question Mark | High (Network Ops) | Development & Early Adoption | Crucial for future revenue streams |

| Next-Gen Optical Technologies (Post WaveLogic 6) | Question Mark | Very High (Future Networks) | R&D Intensive | Foundation for future leadership |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market research reports, and competitive analysis to provide a clear strategic overview.