Churchill Downs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Churchill Downs Bundle

Churchill Downs faces significant competitive forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this landscape.

The full Porter's Five Forces Analysis reveals the real forces shaping Churchill Downs’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Churchill Downs' bargaining power of suppliers is influenced by the concentration of its key input providers. For racing horses and jockeys, the market, while specialized, is not overly concentrated, meaning Churchill Downs has options. However, for critical gaming technology and prime land locations, particularly in established markets, the number of suppliers can be limited.

If a few dominant companies control essential gaming software or if prime real estate for tracks is scarce, these suppliers can exert significant leverage. This could translate into higher licensing fees for technology or increased land acquisition and lease costs for Churchill Downs. For instance, in 2024, the specialized nature of high-end thoroughbred breeding and racing talent means that while there are many participants, the truly elite horses and jockeys can command premium rates, impacting Churchill Downs' operational expenses.

The uniqueness of inputs and the associated switching costs significantly influence the bargaining power of suppliers for Churchill Downs. If suppliers provide highly specialized components or services that are difficult to replicate or substitute, their leverage increases. For instance, the expertise of top-tier jockeys or the proprietary nature of certain gaming software used in their operations represent inputs that are not easily replaced, thereby strengthening supplier power. In 2023, Churchill Downs reported total operating expenses of $1.3 billion, a portion of which would include payments to specialized suppliers.

The threat of forward integration by suppliers poses a moderate risk to Churchill Downs. Suppliers of essential goods or services, like technology providers for wagering platforms or feed suppliers for horses, generally lack the capital and brand recognition to effectively operate racetracks or develop competing betting systems. For example, while a technology provider could theoretically build its own platform, the significant regulatory hurdles and established customer base of Churchill Downs make this a challenging endeavor.

Importance of Supplier to Buyer

Churchill Downs' bargaining power with its suppliers is influenced by its size and purchasing volume. If Churchill Downs represents a substantial portion of a supplier's business, that supplier would likely be more accommodating with pricing and terms. Conversely, if Churchill Downs is a minor customer, the supplier holds more sway.

In 2023, Churchill Downs reported total revenue of $1.77 billion. This scale suggests that for many suppliers, Churchill Downs is a significant client. For instance, a supplier of racing surfaces or specialized gaming equipment would likely find Churchill Downs a key customer, potentially giving Churchill Downs leverage.

- Churchill Downs' substantial revenue ($1.77 billion in 2023) indicates it's a key customer for many suppliers.

- Suppliers whose business heavily relies on Churchill Downs are more likely to offer favorable terms.

- Conversely, suppliers with diverse client bases may exert greater influence over Churchill Downs.

- The company's purchasing power can be a significant factor in negotiating costs for essential goods and services.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of Churchill Downs' suppliers. If Churchill Downs can readily find alternative sources for essential goods and services, such as food and beverage providers, technology vendors, or even construction materials for its facilities, the power of any single supplier is reduced. This means suppliers must remain competitive on price and quality to retain Churchill Downs' business.

For instance, if the primary provider of specialized racing track maintenance equipment faces increased competition from new manufacturers offering similar or superior products at lower costs, Churchill Downs’ leverage grows. This dynamic encourages suppliers to offer more favorable terms to maintain their contracts.

- Reduced Supplier Leverage: A wide array of alternative suppliers for key operational inputs, like food and beverage distributors or technology service providers, directly weakens the bargaining power of any single supplier.

- Impact of Innovation: Emerging technologies or new service providers can offer viable substitutes, potentially disrupting existing supplier relationships and forcing current suppliers to be more competitive.

- Cost-Saving Opportunities: The presence of substitutes allows Churchill Downs to negotiate better pricing and terms, as they can switch to more cost-effective alternatives if necessary.

- 2024 Context: In 2024, Churchill Downs, like many large hospitality and entertainment companies, likely benefited from a competitive market for many of its operational supplies, including technology and catering services, due to ongoing economic conditions and a focus on cost optimization across industries.

The bargaining power of Churchill Downs' suppliers is generally moderate, influenced by the concentration of input providers and the availability of substitutes. While specialized inputs like elite horses and jockeys can command higher prices, the broader market for many operational supplies remains competitive.

Churchill Downs' considerable size, evidenced by its $1.77 billion in revenue in 2023, positions it as a significant customer for many suppliers, affording it some leverage in negotiations. However, suppliers with unique or proprietary offerings, such as specialized gaming software, can still exert considerable influence.

| Input Category | Supplier Concentration | Churchill Downs' Leverage | Potential Supplier Power |

|---|---|---|---|

| Racing Horses & Jockeys (Elite) | Low to Moderate | Moderate | High (due to specialization) |

| Gaming Technology | Moderate to High (for proprietary systems) | Moderate | High (due to uniqueness) |

| Operational Supplies (F&B, Maintenance) | Low | High | Low to Moderate |

| Land/Real Estate (Prime Locations) | High (in established markets) | Low | High |

What is included in the product

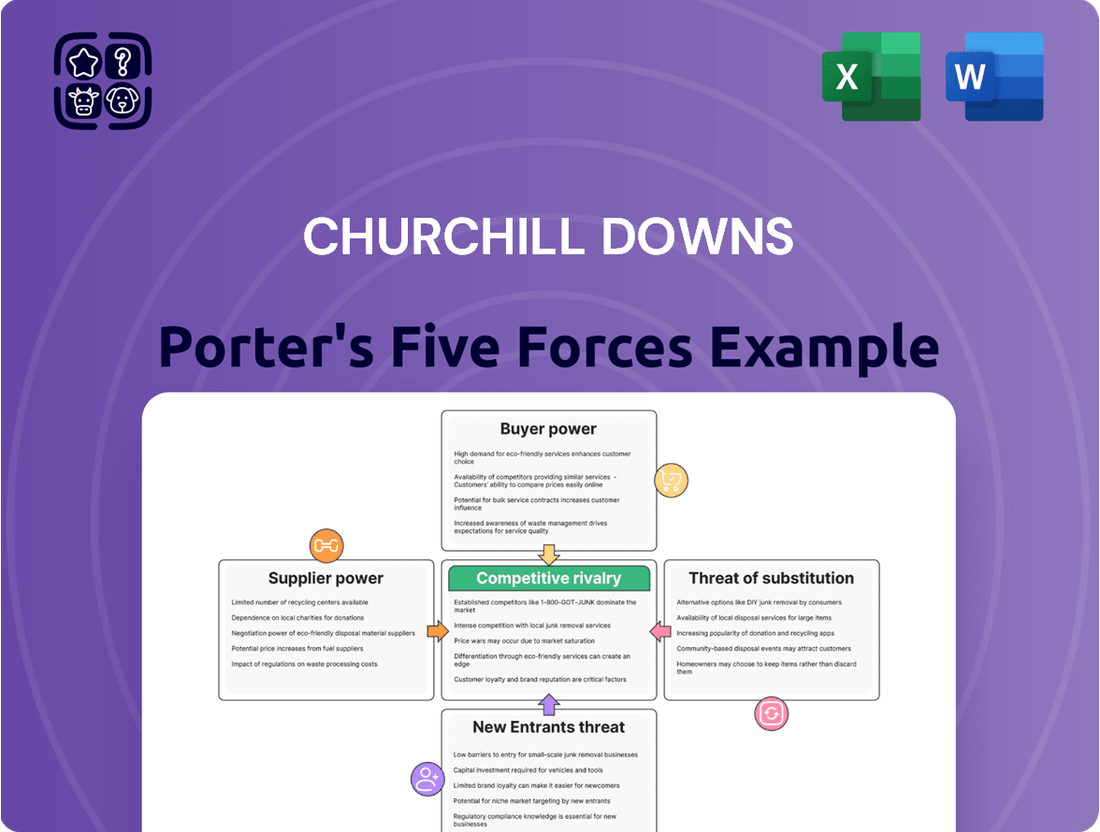

Tailored exclusively for Churchill Downs, this analysis dissects the five forces shaping its competitive environment, from the threat of new entrants to the bargaining power of buyers and suppliers.

Visualize competitive intensity across all five forces with an intuitive dashboard, instantly highlighting key threats and opportunities for Churchill Downs.

Customers Bargaining Power

Churchill Downs' customers exhibit varying degrees of price sensitivity. For horse racing bettors, especially those participating in pari-mutuel pools, the payout odds are a primary driver, making them sensitive to changes that reduce potential winnings. Casino patrons, while often seeking entertainment, can be swayed by competitor pricing for gaming, dining, and lodging. In 2023, Churchill Downs reported total revenue of $1.77 billion, with a significant portion derived from its gaming and racing segments, indicating that pricing strategies in these areas directly impact customer volume and spending.

The perceived value of entertainment plays a crucial role in customer price sensitivity. Churchill Downs offers a multifaceted entertainment experience, from the thrill of live racing to the excitement of casino gaming. However, the availability of numerous alternative entertainment options, including other casinos, live sporting events, and various leisure activities, means that customers can easily shift their spending if Churchill Downs' pricing is perceived as too high relative to the value received. This competitive landscape intensifies customer bargaining power, as they have readily accessible substitutes.

The bargaining power of customers at Churchill Downs is significantly influenced by the availability of substitutes. Customers can easily switch to numerous other entertainment and gambling options. For instance, in 2024, the US casino industry generated over $100 billion in revenue, indicating a vast competitive landscape beyond just horse racing.

The ease of switching is high for many customers, as alternatives like online sports betting, other casino resorts, or even non-gambling entertainment are readily accessible and often have low switching costs. This abundance of choices empowers customers, allowing them to demand better odds, promotions, or overall value from Churchill Downs.

Customers at Churchill Downs, particularly those engaging with pari-mutuel betting, have access to a wealth of information. They can readily compare odds, past performance data, and track records of various horses and jockeys across different races and even different tracks. This transparency empowers them to make more informed decisions, directly impacting their willingness to wager and their expectations for value.

The availability of detailed betting information, including historical data and expert analysis often found on racing forums and specialized websites, significantly boosts customer bargaining power. For instance, in 2023, the total handle for U.S. Thoroughbred racing exceeded $12 billion, indicating a substantial market where informed bettors can exert influence by choosing where and how they place their wagers based on perceived value and transparency.

When customers are well-informed about pricing structures, potential payouts, and the quality of the racing product itself, they can more effectively negotiate their participation. This means they are less likely to accept unfavorable terms and are more inclined to shift their spending to competitors offering better value or more transparent operations, thereby increasing their leverage over Churchill Downs.

Customer Concentration

Churchill Downs' customer base is largely characterized by a highly fragmented group of individual bettors rather than a few large, concentrated clients. This broad distribution of customers significantly dilutes the bargaining power of any single customer or small group of customers. For instance, in 2024, the company's revenue streams are primarily driven by millions of wagers placed across its various racing and gaming properties, making it difficult for any individual bettor to exert significant influence over pricing or terms.

The sheer volume of individual participants means that Churchill Downs does not rely heavily on a small number of large customers. This fragmentation is a key factor in limiting the bargaining power of customers, as no single entity can dictate terms or demand significant concessions. The company's strategy often involves appealing to a wide demographic, further reinforcing this dispersed customer structure.

Consequently, the bargaining power of customers, specifically in relation to customer concentration, is relatively low for Churchill Downs. This is a favorable position, as it allows the company greater flexibility in setting prices, developing new products, and managing its overall business strategy without undue pressure from a concentrated customer segment.

- Customer Base: Churchill Downs serves a vast and fragmented base of individual bettors, not a few large clients.

- Revenue Dependence: No single customer or small group accounts for a significant portion of the company's revenue.

- Bargaining Power Impact: This fragmentation significantly limits the individual bargaining power of customers.

- Strategic Advantage: The low customer concentration provides Churchill Downs with greater operational and pricing flexibility.

Threat of Backward Integration

The threat of backward integration for Churchill Downs' customers is generally low. Individual consumers or small groups are unlikely to develop their own sophisticated wagering platforms or entertainment venues to bypass Churchill Downs. However, for very large betting syndicates or institutional investors, the possibility, while remote, exists. For instance, if a significant portion of high-volume bettors felt unfairly treated or sought greater control, they might explore pooling resources to create alternative, private betting pools or even invest in smaller, niche racing operations. This would directly reduce their reliance on Churchill Downs' established infrastructure and customer base.

While direct backward integration by typical customers is rare, the concept can be viewed through the lens of customers seeking to capture more value. For example, in 2024, the rise of sophisticated data analytics tools accessible to individual bettors could be seen as a form of "knowledge integration," allowing them to perform more of the "analysis" themselves, thereby reducing their reliance on Churchill Downs' proprietary insights or curated information. This empowerment through data, while not physical integration, shifts the power dynamic.

- Low Likelihood of Physical Backward Integration: Individual customers lack the capital and technical expertise to replicate Churchill Downs' extensive operations, such as racetrack management or large-scale event hosting.

- Potential for Large Syndicates: While not a widespread threat, large, organized betting groups with significant financial backing could theoretically explore creating private wagering systems or investing in alternative racing venues to gain more control and potentially better odds.

- "Knowledge Integration" Trend: Advancements in data analytics and information access in 2024 empower individual bettors to conduct more in-depth research and analysis, reducing their reliance on third-party insights and potentially influencing their betting decisions away from Churchill Downs' offerings.

- Limited Impact on Core Business: Even with these trends, the scale and complexity of Churchill Downs' business mean that customer backward integration poses a minimal direct threat to its core revenue streams and market position.

Churchill Downs' customers, particularly individual bettors, have limited bargaining power due to their fragmented nature. The company's revenue, exceeding $1.77 billion in 2023, is derived from millions of transactions, meaning no single customer can significantly influence pricing or terms. This broad customer base allows Churchill Downs considerable flexibility in its strategic and pricing decisions.

Preview Before You Purchase

Churchill Downs Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Churchill Downs, detailing the competitive landscape and strategic positioning of the iconic racetrack. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights without any placeholders or surprises. You're looking at the actual, professionally written analysis, ready for your immediate use and strategic planning the moment your transaction is complete.

Rivalry Among Competitors

Churchill Downs faces a dynamic competitive landscape across its core business segments. In horse racing, beyond other major tracks, it contends with numerous smaller regional tracks and simulcast operations that offer pari-mutuel wagering on races nationwide. This broad base of participants means a constant battle for customer attention and betting handle.

The casino sector presents an even more diverse array of competitors. This includes large, established casino corporations with multiple properties, as well as smaller, regional casinos and even tribal gaming operations. In 2024, the U.S. casino industry is projected to generate over $100 billion in gross gaming revenue, highlighting the intense competition for consumer entertainment dollars.

Furthermore, the burgeoning online wagering market, encompassing sports betting and iGaming, introduces a new layer of competition. Digital-only platforms and app-based services are rapidly gaining traction, often offering aggressive promotions to attract new users. This digital shift means Churchill Downs must compete not only with traditional entertainment providers but also with agile online operators who can reach customers anywhere, anytime.

Churchill Downs operates in several segments, including pari-mutuel wagering, gaming, and media. The overall growth trajectory of these segments is generally positive, though varying by specific market conditions and regulatory environments. For instance, the U.S. gaming industry experienced a robust recovery post-pandemic, with gross gaming revenue reaching an all-time high of $107.7 billion in 2023, indicating a healthy growth environment.

In segments experiencing high growth, like certain areas of online wagering or expanded gaming in specific states, competition can be less about direct confrontation for market share and more about capturing new customers and expanding the overall market. However, even in growing markets, the intensity of rivalry can increase if new entrants are attracted by the growth prospects, or if existing players aggressively pursue market expansion.

The horse racing industry, a core component of Churchill Downs' business, has seen more nuanced growth. While overall handle for pari-mutuel wagering remained strong in 2023, exceeding $12 billion, the growth rate can be influenced by factors like the number of racing days and the popularity of major events. This segment requires continuous innovation and marketing to maintain engagement and attract new audiences, which can intensify rivalry among established tracks and emerging platforms.

Churchill Downs' competitive rivalry is significantly influenced by its product and service differentiation. The Kentucky Derby, a premier event, offers a unique, high-profile experience that competitors struggle to replicate, fostering brand loyalty and commanding premium pricing. TwinSpires, its online wagering platform, differentiates through technology and user experience, aiming to capture a larger share of the online betting market.

However, the casino segment faces more direct competition, where differentiation often relies on amenities, gaming options, and customer service rather than inherently unique offerings. This means that while the Derby provides a strong moat, other aspects of Churchill Downs' business must actively innovate to stand out in a crowded market. In 2023, Churchill Downs Inc. reported net revenue of $1.35 billion, with a significant portion coming from its Gaming segment, highlighting the importance of differentiation in its broader operations.

Exit Barriers

Exit barriers for Churchill Downs are significant due to the substantial investments in specialized physical assets like racetracks and casinos. These large-scale facilities represent high fixed costs and are not easily repurposed or sold, making it difficult for competitors to exit the gaming and racing industry gracefully. For instance, the cost to build a new racetrack can easily run into hundreds of millions of dollars, creating a substantial hurdle for any potential divestment.

These high exit barriers mean that companies may continue operating even when facing financial difficulties, which can prolong and intensify competitive rivalry. This persistence of less profitable firms can put downward pressure on pricing and margins for all players in the market. The emotional attachment to legacy brands and established customer bases also contributes to a reluctance to exit, further solidifying the competitive landscape.

- Specialized Assets: Racetracks and casino facilities are highly specific and difficult to redeploy, creating substantial sunk costs.

- High Fixed Costs: Maintaining and operating these large physical infrastructures involves ongoing, significant expenses.

- Industry Interdependence: The racing industry, in particular, has a complex web of stakeholders whose interests can make exiting a market challenging.

- Brand Loyalty: Established brands and customer relationships can create an emotional attachment that discourages divestment.

Switching Costs for Customers

Switching costs for customers of Churchill Downs, particularly in the online wagering segment, are generally low. This ease of transition between platforms means customers can readily move to competitors offering better odds, promotions, or user experiences, intensifying pressure on Churchill Downs to maintain competitive pricing and service levels. For instance, in 2023, the online pari-mutuel wagering market saw significant growth, with platforms constantly innovating to attract and retain users, highlighting the need for strong customer engagement strategies.

Churchill Downs aims to mitigate these low switching costs through its loyalty programs, such as the TwinSpires Club. These programs incentivize continued engagement by offering rewards, tiered benefits, and exclusive promotions, effectively raising the perceived cost or inconvenience of switching to a rival platform. The success of such programs is crucial, as a high churn rate in online betting can significantly impact revenue stability and market share.

- Low Switching Costs: Customers can easily move between online wagering platforms, increasing competitive pressure on Churchill Downs.

- Competitive Pressure: This ease of switching forces Churchill Downs to focus on competitive pricing and superior service quality to retain customers.

- Loyalty Programs: Initiatives like the TwinSpires Club are designed to increase switching costs by rewarding customer loyalty and engagement.

- Market Dynamics: The online wagering market’s rapid evolution in 2023 underscores the importance of customer retention strategies in the face of low switching barriers.

Churchill Downs faces intense competition across its diverse business segments, from established casino giants to agile online wagering platforms. The sheer number of players in the gaming industry, which generated over $100 billion in gross gaming revenue in 2024, means a constant fight for consumer attention and spending. Even in the horse racing sector, where Churchill Downs holds a unique position with events like the Kentucky Derby, it must contend with numerous regional tracks and simulcast operations, all vying for betting dollars.

The online betting market, in particular, presents a rapidly evolving competitive front. Digital-first operators are aggressively acquiring customers through promotions, forcing traditional players like Churchill Downs to innovate continuously. This dynamic environment necessitates strong differentiation, whether through unique event experiences like the Kentucky Derby or superior technology on platforms like TwinSpires, to maintain market share and profitability.

| Competitive Rivalry Factor | Description | Impact on Churchill Downs |

| Number of Competitors | Numerous established and emerging players across racing, casinos, and online wagering. | High pressure on pricing, marketing, and customer acquisition. |

| Industry Growth Rate | Varies by segment; online wagering and certain gaming markets show strong growth. | Attracts new entrants, intensifying competition in high-growth areas. |

| Product Differentiation | Unique events (Kentucky Derby) vs. more commoditized casino offerings. | Strong events provide a competitive advantage; other segments require constant innovation. |

| Customer Switching Costs | Low in online wagering, necessitating strong loyalty programs. | Requires continuous investment in customer retention and service quality. |

SSubstitutes Threaten

The threat of substitutes for Churchill Downs is significant, primarily stemming from the price-performance trade-off. Customers seeking entertainment and gambling opportunities have numerous alternatives, from other forms of gaming like lotteries and casinos to non-gambling entertainment such as professional sports, concerts, and even streaming services. For instance, in 2024, the global online gambling market is projected to reach over $100 billion, offering a wide array of accessible and often lower-cost entertainment options compared to the traditional, location-specific experience of horse racing.

These substitutes often provide a comparable thrill or payout potential at a more attractive price point. A night at a local casino, for example, might offer a broader range of games and a more immediate payout structure than a day at the races. Similarly, the accessibility and lower price of attending a professional football game or a concert can draw entertainment dollars away from Churchill Downs, especially for consumers prioritizing convenience and a different type of engagement.

This direct comparison of value and cost heavily influences customer choices. If a substitute offers a similar level of excitement or potential reward for less money or with greater convenience, customers are likely to switch. Churchill Downs must continually demonstrate its unique value proposition to retain its customer base against this constant pressure from a diverse and evolving entertainment landscape.

Customers might switch to other entertainment options or gambling avenues. This propensity is shaped by evolving tastes, new technologies, and rival marketing. For instance, the rise of online sports betting, a significant substitute, saw substantial growth in 2024, with projections indicating continued expansion as accessibility increases.

The ease with which consumers can explore and adopt new leisure activities directly impacts Churchill Downs. If alternative entertainment, like esports or new forms of digital gaming, become more appealing or convenient, customers may divert their spending. The low cost and high accessibility of many digital substitutes present a considerable challenge, as seen in the increasing engagement with mobile gaming platforms.

The threat of substitutes for Churchill Downs is significant, primarily due to the widespread availability and accessibility of alternative entertainment and gaming options. Online gaming, including esports and various digital platforms, offers consumers readily available substitutes. In 2023, the global online gambling market was valued at approximately $73.7 billion, showcasing the immense scale of these alternatives.

Perceived Value of Substitutes

Customers often weigh the entertainment and potential financial returns of Churchill Downs' offerings against alternatives. If other forms of gambling, like online sports betting or casino games, are seen as more convenient or offering better odds, the threat of substitutes intensifies.

In 2024, the landscape of entertainment and gambling continues to diversify, presenting potential substitutes for traditional horse racing. The perceived value of these substitutes hinges on factors like accessibility, engagement, and perceived return on investment.

- Online Gambling Platforms: The continued growth and accessibility of online sportsbooks and casino sites offer a readily available alternative for individuals seeking gambling entertainment, often with a wider array of betting options and potentially more favorable odds.

- Esports and Competitive Gaming: The burgeoning popularity of esports provides a form of competitive entertainment and potential financial gain that appeals to a younger demographic, diverting attention and spending from traditional live events.

- Other Live Entertainment: Concerts, professional sports leagues (football, basketball, etc.), and other forms of live entertainment compete for discretionary spending and leisure time, offering alternative experiences to the racetrack.

- Technological Advancements: Innovations in virtual reality and augmented reality could create immersive entertainment experiences that rival the engagement offered by live events, further broadening the spectrum of substitutes.

Innovation in Substitute Industries

Innovation in substitute industries presents a significant threat to Churchill Downs. For instance, the burgeoning esports market, which saw global revenue reach an estimated $1.4 billion in 2023, offers a highly engaging and accessible entertainment alternative. Similarly, advancements in virtual reality gaming continue to create immersive experiences that could draw consumer spending away from traditional forms of entertainment. The rapid pace of technological development in these sectors means new and compelling substitutes can emerge quickly, potentially eroding Churchill Downs' market share.

The threat is amplified by the increasing accessibility and lower perceived cost of many substitutes. Consider the growth of mobile gaming, which has billions of users worldwide and offers a readily available form of entertainment. New lottery formats, often promoted with large jackpots, also compete for discretionary entertainment dollars. These alternatives can capture consumer attention and spending, especially if they offer novelty or perceived higher value compared to the core offerings of companies like Churchill Downs.

- Esports Market Growth: Global esports revenue projected to exceed $1.5 billion in 2024.

- Virtual Reality Advancements: Continued investment in VR hardware and software development.

- Mobile Gaming Dominance: Billions of active mobile gamers worldwide.

- Lottery Ticket Sales: Significant revenue generated annually through various lottery formats.

The threat of substitutes for Churchill Downs is substantial, as consumers have a wide array of entertainment and gambling alternatives. Online gambling platforms, including sports betting and casino games, offer convenience and accessibility. In 2024, the global online gambling market is expected to surpass $100 billion, indicating a massive competitive landscape.

Other forms of entertainment, such as professional sports, concerts, and even digital gaming like esports, directly compete for discretionary spending. The esports industry alone generated approximately $1.4 billion in revenue in 2023, highlighting its growing appeal, particularly among younger demographics.

The perceived value, cost, and convenience of these substitutes heavily influence customer choices. If alternatives provide a comparable or superior experience at a lower price point or with greater ease of access, Churchill Downs faces a significant challenge in retaining its audience.

Churchill Downs must continuously innovate and emphasize its unique value proposition to counter the persistent threat from these diverse substitutes.

| Substitute Category | 2023 Market Size (Approx.) | 2024 Outlook/Growth Factor | Key Competitive Aspects |

| Online Gambling | $73.7 Billion | Projected to exceed $100 Billion | Accessibility, Variety of Games, Potential Odds |

| Esports | $1.4 Billion | Projected to exceed $1.5 Billion | Engagement, Younger Demographic Appeal, Digital Accessibility |

| Other Live Entertainment | Varies widely (e.g., Sports Leagues, Concerts) | Steady Demand, Experiential Value | Social Experience, Brand Loyalty, Different Entertainment Focus |

Entrants Threaten

The capital requirements for entering Churchill Downs' industry are substantial. Building and maintaining modern racetracks, integrated casino resorts, and advanced online betting platforms demands hundreds of millions, if not billions, of dollars. For instance, new casino developments often exceed $1 billion, while significant ongoing investment is needed for technology upgrades and regulatory compliance in online wagering.

The horse racing, casino gaming, and online wagering industries are heavily regulated, creating significant barriers for potential new competitors. Obtaining the necessary licenses alone can be a lengthy and costly process, demanding substantial legal expertise and compliance investments. For instance, in 2024, the average time to secure a new gaming license in a major US jurisdiction often exceeds 18 months and can cost hundreds of thousands of dollars in application and legal fees, effectively deterring many new entrants.

Churchill Downs benefits immensely from the unparalleled brand recognition of the Kentucky Derby, a cornerstone of its customer loyalty. This iconic event fosters deep-seated relationships with fans and participants, making it incredibly difficult for new entrants to replicate that level of trust and engagement.

For any newcomer to the horse racing industry, the hurdle of overcoming Churchill Downs' established brand loyalty is substantial. Significant investments in marketing and a considerable amount of time are necessary to even begin chipping away at the existing customer base and building a comparable level of brand equity.

Access to Distribution Channels/Resources

Newcomers to Churchill Downs' industry face significant hurdles in securing access to vital distribution channels and resources. Established operators often hold exclusive agreements for prime real estate, crucial for developing new casinos or racetracks, and have cultivated deep relationships with horse racing talent and syndicates, making it difficult for new entrants to acquire the necessary racing stock or secure racing dates. For instance, securing prime locations for new gaming facilities in competitive markets often requires substantial capital and navigating complex zoning laws, which established players have already overcome.

The control over scarce resources, particularly prime real estate and established racing circuits, acts as a formidable barrier. Churchill Downs, for example, operates iconic venues like the Kentucky Derby, which benefit from decades of brand building and established customer loyalty, making it challenging for a new entrant to replicate this level of access and recognition.

- Limited Access to Prime Real Estate: High costs and zoning restrictions make acquiring suitable land for new casino or racetrack development exceptionally difficult.

- Exclusive Agreements: Existing operators may have secured exclusive contracts with key suppliers or technology providers, limiting options for new entrants.

- Control Over Racing Talent and Events: Established entities often have preferential access to top jockeys, trainers, and prestigious racing events, creating a competitive disadvantage for newcomers.

- Brand Recognition and Customer Loyalty: Decades of operation have built strong brand equity and customer relationships that new entrants struggle to match.

Economies of Scale and Experience Curve

Churchill Downs benefits significantly from economies of scale and the experience curve. Its extensive operations across multiple tracks and gaming facilities allow for bulk purchasing of supplies, more efficient staffing, and centralized marketing efforts, all contributing to lower per-unit costs. For instance, in 2023, Churchill Downs reported total revenue of $1.73 billion, demonstrating a substantial operational footprint that new entrants would struggle to replicate quickly.

New competitors entering the horseracing and gaming industry face an immediate cost disadvantage. They cannot immediately access the same volume discounts on everything from feed and veterinary services to advertising and technology infrastructure. This lack of established scale means higher initial operating expenses, making it difficult to compete on price with Churchill Downs or achieve comparable profit margins.

- Economies of Scale: Churchill Downs' large operational footprint allows for cost efficiencies in purchasing, marketing, and administration.

- Experience Curve: Decades of operation have refined processes, leading to optimized labor, event management, and customer service, reducing costs over time.

- New Entrant Disadvantage: Start-ups lack the purchasing power and operational expertise to match Churchill Downs' cost structure, hindering their ability to compete on price or profitability.

The threat of new entrants into Churchill Downs' diverse markets remains relatively low, primarily due to the immense capital required for development and operation. Building state-of-the-art casinos or racetracks, coupled with sophisticated online platforms, necessitates investments easily reaching hundreds of millions, if not billions, of dollars. For example, the average cost for a new integrated resort development often surpasses $1 billion, a significant barrier for any aspiring competitor.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High costs for developing and operating racetracks, casinos, and online platforms. | Significant financial hurdle, requiring substantial funding. |

| Regulation & Licensing | Lengthy and costly processes to obtain necessary operating licenses. | Deters new entrants due to time, legal fees, and compliance burdens. |

| Brand Loyalty & Reputation | Established brands like the Kentucky Derby foster deep customer trust. | Difficult for newcomers to replicate brand equity and customer engagement. |

| Access to Distribution & Resources | Exclusive agreements for prime real estate and established relationships with talent. | Limits new entrants' ability to secure key assets and resources. |

| Economies of Scale & Experience Curve | Existing operators benefit from lower per-unit costs and optimized processes. | New entrants face cost disadvantages and operational inefficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Churchill Downs leverages publicly available financial statements, annual reports, and SEC filings, supplemented by industry-specific market research and data from reputable financial news outlets to capture competitive dynamics.