Churchill Downs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Churchill Downs Bundle

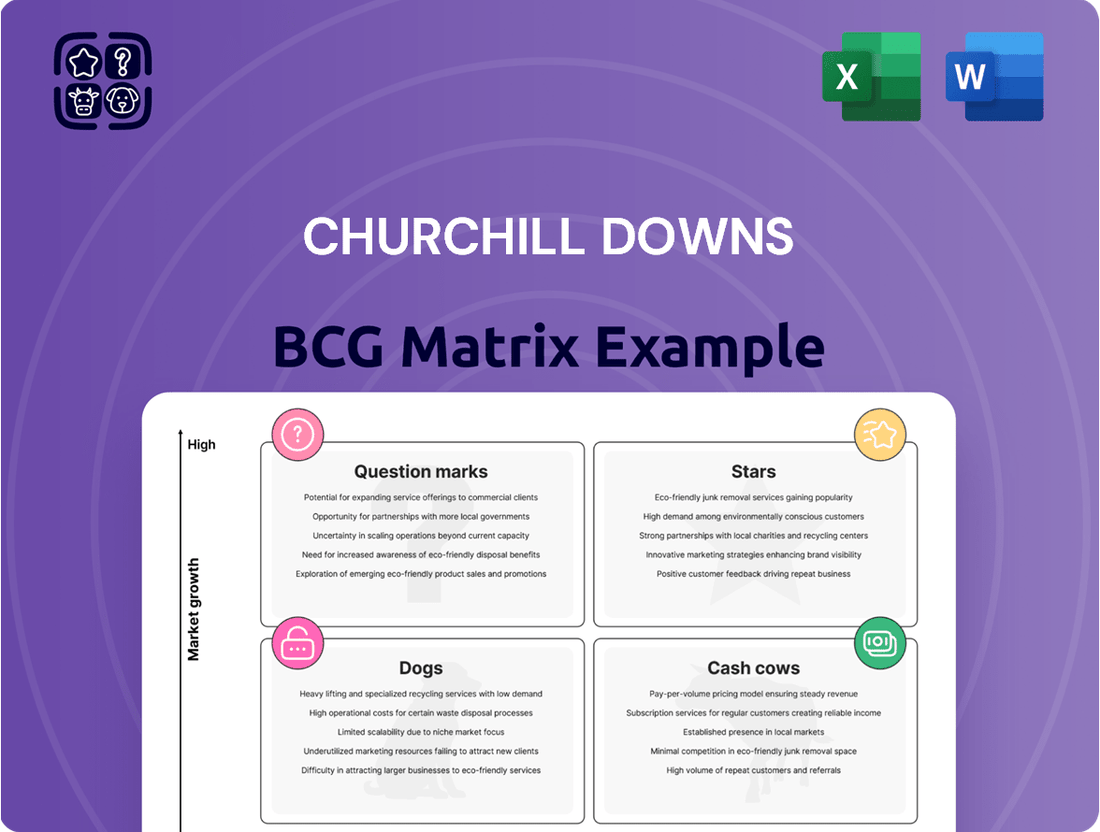

Curious about Churchill Downs' product portfolio performance? This glimpse into their BCG Matrix reveals the potential for growth and areas needing strategic attention. Understand where their racing and gaming ventures fit as Stars, Cash Cows, Dogs, or Question Marks.

Don't miss out on the full picture! Purchase the complete Churchill Downs BCG Matrix for a detailed breakdown of each segment, actionable insights, and a clear roadmap for optimizing their business strategy and maximizing returns.

Stars

Churchill Downs' Historical Racing Machines (HRMs) are a clear star in their BCG Matrix, boasting a dominant market position. The company captured roughly 60% of the US HRM market in 2023, showcasing significant market share. This segment is experiencing robust growth, further solidified by recent strategic expansions.

New facilities like The Rose Gaming Resort in Virginia, which opened in November 2024, and Owensboro Racing & Gaming in Kentucky, operational since February 2025, have been instrumental in driving revenue and profitability. These additions underscore the company's commitment to expanding its footprint in this high-growth area.

Substantial investments and ongoing organic growth strategies are fueling the HRM segment's success. This allows Churchill Downs to maintain its leadership in a sector that is rapidly gaining traction and generating substantial returns.

The Kentucky Derby is a shining Star for Churchill Downs. Its 150th running in 2024 shattered records, with a staggering $312.1 million wagered, and the entire Derby Week generated an Adjusted EBITDA of $102.9 million. This iconic event continues to dominate the horse racing landscape, attracting a growing audience and significant social media buzz.

Further solidifying its Star status, Churchill Downs announced a new seven-year media rights deal with NBC starting in 2026. This agreement, coupled with ongoing investments in premium experiences at the track, is poised to fuel sustained growth and profitability for this flagship asset.

Churchill Downs' aggressive expansion of HRM venues in Virginia, exemplified by The Rose Gaming Resort's November 2024 launch and ongoing projects in Richmond and Henrico County, positions it in a high-growth, high-potential market.

These new facilities are a key driver for the Live and Historical Racing segment's substantial revenue increases, with Virginia's contribution expected to be significant.

Industry projections indicate substantial additional EBITDA generation from capacity enhancements in Virginia, underscoring the state's strategic value to Churchill Downs.

Kentucky HRM Growth

Kentucky's Historical Racing Machine (HRM) venues are a powerhouse for Churchill Downs (CDI). The February 2025 opening of Owensboro Racing & Gaming, alongside existing successful locations, fuels significant revenue growth in the Live and Historical Racing segment. This expansion solidifies CDI's dominant market share in Kentucky's pari-mutuel wagering landscape, promising robust future prospects.

- HRM Revenue Contribution: HRMs now represent a substantial portion of Kentucky's pari-mutuel wagering, directly boosting CDI's financial performance.

- Market Position: The continued investment and operational success of HRM facilities have cemented CDI's strong and growing market presence within the state.

- Growth Engine: These venues are a key growth driver for Churchill Downs, demonstrating a clear strategy for expansion and revenue generation.

- Future Outlook: The success of HRMs in Kentucky provides a strong foundation for future growth and investment opportunities for CDI.

Pari-Mutuel Wagering Technology (Exacta)

Churchill Downs' acquisition of Exacta Systems in August 2023 positioned the company as a significant force in the burgeoning B2B Historical Racing Machine (HRM) technology sector. This move taps into a high-growth industry, allowing Churchill Downs to expand its technological footprint beyond its traditional pari-mutuel operations.

Exacta's performance, driven by new HRM installations in states like Virginia and New Hampshire, is already showing promise. For example, in the first quarter of 2024, Exacta contributed significantly to Churchill Downs' adjusted EBITDA, highlighting its immediate impact and future revenue-driving potential. This suggests Exacta is well-positioned to continue gaining market share within the historical racing segment.

- Market Position: Exacta Systems' technology is a key asset for Churchill Downs in the growing Historical Racing Machine market.

- Growth Drivers: Incremental HRM installations in Virginia and New Hampshire are fueling Exacta's revenue and market penetration.

- Strategic Advantage: The acquisition allows Churchill Downs to leverage its expertise into a broader technology offering, fostering diversification and future growth opportunities.

- Financial Impact: Exacta's contributions are expected to bolster Churchill Downs' financial performance, particularly in adjusted EBITDA, as seen in early 2024 reporting.

Churchill Downs' Historical Racing Machines (HRMs) are a clear star, dominating the US market with approximately 60% share in 2023. Strategic expansions, including The Rose Gaming Resort in Virginia (opened November 2024) and Owensboro Racing & Gaming in Kentucky (opened February 2025), are driving significant revenue and profitability. These substantial investments fuel the HRM segment's success and leadership in a rapidly growing sector.

| Segment | Market Share (2023) | Key Growth Drivers | Financial Highlight (2024/2025) |

|---|---|---|---|

| Historical Racing Machines (HRMs) | ~60% (US Market) | New venues (VA, KY), technology expansion (Exacta Systems) | Significant revenue and EBITDA contribution |

| Kentucky Derby | Dominant in horse racing | Record wagers, media rights deal (NBC, 2026) | $312.1M wagered (150th running, 2024), $102.9M Adjusted EBITDA (Derby Week) |

What is included in the product

This analysis identifies Churchill Downs' racing operations as a Star, its casinos as Cash Cows, and new ventures as Question Marks.

The Churchill Downs BCG Matrix provides a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

The core Churchill Downs racetrack operations, excluding the Kentucky Derby, are a significant cash cow for the company. These operations hold a dominant market share within the horse racing sector, generating consistent and reliable cash flow through regular race meets and facility rentals.

In 2023, Churchill Downs reported total revenue of $1.99 billion, with its TwinSpires segment, which includes online wagering, contributing significantly. While specific figures for the core racetrack operations outside of the Derby are not always broken out separately, their stability is a key driver of overall financial performance, underpinning the company's ability to invest in growth areas.

TwinSpires, Churchill Downs' online horse racing wagering platform, is a prime example of a Cash Cow within their BCG Matrix. It commands a leading market share in a mature industry, consistently generating substantial revenue and Adjusted EBITDA, even with minor year-over-year shifts due to factors like race day changes. For instance, in 2023, Churchill Downs reported that TwinSpires' net revenue from racing operations was $510.2 million, demonstrating its stable financial contribution.

The platform's established brand and dedicated customer base allow Churchill Downs to effectively leverage its existing success. This translates into predictable and reliable cash flows, enabling the company to 'milk' the mature gains from TwinSpires to fund investments in other areas of the business. The consistent performance underscores its role as a reliable generator of funds for the broader Churchill Downs portfolio.

Churchill Downs' established regional casino properties, despite facing regional economic headwinds and heightened competition, remain significant cash generators. These assets, often holding dominant market positions in their respective mature gaming territories, deliver reliable and steady revenue streams.

For instance, in 2023, Churchill Downs reported that its TwinSpires segment, which includes its historical racing machines and other gaming operations outside of Kentucky, generated $617.9 million in revenue. While not solely regional casinos, this figure showcases the substantial cash-generating capability of their mature, non-Kentucky gaming assets.

The strategic approach for these properties centers on optimizing operational efficiency and essential maintenance to preserve their existing productivity and profitability. This focus ensures these mature assets continue to contribute robustly to Churchill Downs' overall financial health.

Consistent Dividend and Share Repurchase Programs

Churchill Downs' consistent dividend and share repurchase programs highlight its 'Cash Cows'. The company's ongoing commitment to returning capital to shareholders, evidenced by 14 consecutive years of dividend increases, signals a mature business model with stable, predictable earnings. This approach effectively 'milks' its established assets for maximum shareholder value.

- Consistent Shareholder Returns: Churchill Downs initiated a new $500 million share repurchase program, complementing its long history of dividend payouts.

- Financial Strength Indication: The ability to sustain and grow dividends for 14 consecutive years points to robust and consistent cash flow generation from its core businesses.

- Mature Asset Exploitation: This strategy reflects a deliberate effort to maximize value from high-market-share, stable business segments within its portfolio.

- Shareholder Value Maximization: By returning significant capital, the company demonstrates a focus on rewarding investors from its most reliable revenue streams.

Select Gaming Properties with Stable Contributions

Within Churchill Downs' diverse gaming portfolio, select properties operate as robust cash cows, consistently generating stable revenue and Adjusted EBITDA. These established venues benefit from loyal customer bases and highly efficient operational frameworks, ensuring predictable financial contributions.

These cash cow segments are characterized by their mature market positions and optimized cost structures. Their primary strategic focus remains on maximizing profitability and operational efficiency, rather than pursuing high-risk, high-reward growth initiatives in nascent markets.

- Stable Revenue Streams: Properties like the flagship Louisville track and certain regional casinos provide a reliable income base, underpinning the company's financial stability.

- Consistent Profitability: These operations consistently deliver positive Adjusted EBITDA, contributing significantly to Churchill Downs' overall earnings.

- Optimized Operations: Mature operational models and experienced management teams ensure high levels of efficiency and cost control within these segments.

- Strategic Focus on Efficiency: The emphasis is on maintaining and enhancing existing profitability rather than aggressive expansion into new or unproven markets.

The core Churchill Downs racetrack operations, excluding the Kentucky Derby, represent a significant cash cow. These operations, holding a dominant market share in horse racing, consistently generate reliable cash flow through regular race meets and facility rentals.

TwinSpires, Churchill Downs' online wagering platform, is a prime example of a cash cow. It commands a leading market share in a mature industry, consistently generating substantial revenue and Adjusted EBITDA. In 2023, TwinSpires' net revenue from racing operations was $510.2 million, demonstrating its stable financial contribution.

Established regional casino properties also act as cash cows, delivering steady revenue streams despite competition. In 2023, Churchill Downs' TwinSpires segment, including historical racing machines and other gaming outside Kentucky, generated $617.9 million in revenue, showcasing the cash-generating capability of these mature assets.

Churchill Downs' consistent dividend and share repurchase programs highlight its cash cows, signaling a mature business with stable earnings. The company's commitment to returning capital to shareholders, including 14 consecutive years of dividend increases, effectively leverages these established assets for shareholder value.

| Segment | 2023 Revenue (Millions USD) | Key Characteristics |

|---|---|---|

| TwinSpires (Online Wagering) | 510.2 | Mature market, high market share, stable EBITDA |

| Regional Gaming (Excl. KY) | 617.9 | Dominant regional positions, operational efficiency |

| Core Racetrack Operations | (Not explicitly broken out, but significant contributor) | Consistent cash flow from racing and rentals |

Preview = Final Product

Churchill Downs BCG Matrix

The Churchill Downs BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, analysis-ready strategic report ready for your immediate business planning and decision-making needs.

Dogs

Churchill Downs has strategically exited the retail sports betting market at its Louisville track in February 2025. This move was driven by consistent unprofitability and a clear shift in consumer behavior towards mobile betting platforms. The company found that this brick-and-mortar segment struggled to gain significant market share and was a drain on resources, despite handling a certain volume of bets.

The decision to divest from retail sports betting underscores a commitment to shedding underperforming assets. In 2024, this segment failed to generate substantial adjusted gross revenue, highlighting its lack of a clear path to sustained profitability. Churchill Downs is prioritizing its resources on more lucrative and consumer-preferred betting channels.

Certain wholly-owned gaming properties within Churchill Downs' portfolio have seen a dip in their performance, with both Adjusted EBITDA and revenue experiencing declines. This underperformance is largely due to broader regional gaming softness and increased competition in those specific markets. For instance, in 2023, some of these properties reported a year-over-year decrease in net revenue, impacting overall profitability.

These underperforming assets typically hold a low market share within mature or even declining local markets. Their struggle to maintain profitability makes them prime candidates for a strategic re-evaluation. If efforts to revitalize these properties don't yield positive results, Churchill Downs may consider divesting them to focus resources on more promising ventures.

Churchill Downs' Historical Racing Machine (HRM) operations in Louisiana have been categorized as a 'Dog' within its BCG Matrix. The company's decision to close these operations and relocate around 500 machines to markets such as Virginia and Kentucky clearly indicates that the Louisiana segment was an underperforming asset. This strategic move signals a low-growth, low-market-share segment that was not contributing effectively to Churchill Downs' broader business strategy, representing a divestment of unprofitable ventures.

Equity Investment in Rivers Des Plaines

Churchill Downs' equity investment in Rivers Des Plaines is exhibiting characteristics of a 'dog' in their BCG Matrix. The property has seen a decline in Adjusted EBITDA, a key profitability metric. For instance, during the first quarter of 2024, Rivers Des Plaines reported a decrease in its Adjusted EBITDA compared to the prior year period, impacted by broader regional gaming market challenges.

Factors contributing to this underperformance include a general softness in the regional gaming market, heightened competitive pressures from new entrants, and escalating operational expenses, particularly labor costs. These headwinds collectively point to a low-growth, low-return investment that is facing significant market headwinds.

- Rivers Des Plaines Adjusted EBITDA Trend: Showing a downward trajectory, indicating reduced profitability.

- Market Conditions: Facing regional gaming softness and increased competition, limiting growth potential.

- Cost Pressures: Rising labor costs are further eroding margins.

- BCG Matrix Classification: Its current performance suggests it fits the 'dog' category, characterized by low market share and low growth.

Lower-Tier Kentucky Derby Ticketing

Within Churchill Downs' broader portfolio, the lower-tier Kentucky Derby ticketing segment, specifically those priced at $1,000 and above, is showing signs of weakness. Churchill Downs itself acknowledged a softening in demand for these higher-priced, yet considered lower-tier, tickets for the 2025 event. This is largely attributed to a decline in consumer confidence impacting discretionary spending.

This specific segment, while not a standalone product, represents a portion of the Kentucky Derby's revenue stream that is experiencing reduced demand. Unlike premium ticketing options that may retain stronger sales, these lower-tier, higher-priced tickets are exhibiting characteristics of a potential 'dog' within the overall Derby revenue mix. If this trend of decreased demand and potentially lower profitability continues, it would solidify its position as a less desirable asset.

- Market Trend: Softness in sales for higher-priced, lower-tier Kentucky Derby tickets for the 2025 event.

- Attributed Cause: Waning consumer confidence impacting discretionary spending.

- BCG Classification: Potential 'dog' within the Derby's revenue mix due to reduced demand and profitability.

- Financial Implication: Lower profitability compared to premium ticketing offerings.

Churchill Downs' Historical Racing Machine (HRM) operations in Louisiana are a clear example of a 'dog' in their BCG Matrix. The company's decision to close these operations and relocate approximately 500 machines to other markets like Virginia and Kentucky demonstrates that the Louisiana segment was underperforming. This strategic move highlights a low-growth, low-market-share segment that wasn't contributing effectively to Churchill Downs' overall business strategy.

The equity investment in Rivers Des Plaines also exhibits 'dog' characteristics, evidenced by a decline in its Adjusted EBITDA. For example, in Q1 2024, Rivers Des Plaines saw a decrease in Adjusted EBITDA year-over-year, facing challenges from regional gaming softness and increased competition, which are further exacerbated by rising labor costs.

Furthermore, the higher-priced, lower-tier Kentucky Derby ticketing segment for the 2025 event shows signs of weakness due to softening demand. This segment, representing a portion of the Derby's revenue stream, is experiencing reduced consumer spending, positioning it as a less desirable asset within the overall revenue mix.

| Asset | BCG Classification | Key Performance Indicator | Trend/Issue | Reasoning |

| Louisiana HRMs | Dog | Contribution to overall strategy | Closed and relocated | Low growth, low market share, underperforming |

| Rivers Des Plaines | Dog | Adjusted EBITDA | Decreasing (Q1 2024 vs. prior year) | Regional gaming softness, competition, rising labor costs |

| Kentucky Derby (Higher-Priced, Lower-Tier Tickets) | Potential Dog | Ticket Sales (2025 Event) | Softening demand | Declining consumer confidence impacting discretionary spending |

Question Marks

Churchill Downs' strategic expansion into new casino markets, exemplified by the Terre Haute Casino Resort and its stake in Casino Salem, places these ventures squarely in the Question Marks category of the BCG Matrix. The Terre Haute Casino Resort, which opened its doors in April 2024, represents a significant investment in a market Churchill Downs aims to capture. Similarly, the acquisition of a 90% interest in Casino Salem in New Hampshire signals a calculated move into another territory with perceived growth potential.

These developments, while promising, are in their nascent stages and require substantial capital outlay. Their current market share is minimal as they work to establish a customer base and operational efficiency. The success of these new casinos hinges on their ability to gain traction and demonstrate consistent revenue generation, which will ultimately dictate whether they evolve into Stars or Cash Cows within Churchill Downs' portfolio.

Churchill Downs' potential re-entry or expansion into online sports betting, beyond existing partnerships, positions it as a Question Mark within the BCG Matrix. This is due to the sector's high competition and the significant investment required to carve out market share.

The global sports betting market is anticipated to grow robustly, with an estimated compound annual growth rate (CAGR) of around 10% between 2025 and 2030. This presents an attractive, albeit challenging, landscape for potential expansion.

Churchill Downs' expansion of Historical Racing Machines (HRMs) into new states, like the ongoing discussions in Minnesota, signifies a pursuit of high-growth market opportunities. These ventures are crucial for diversifying revenue streams beyond traditional pari-mutuel wagering.

These expansion efforts, however, are characterized by significant regulatory and political challenges, alongside substantial upfront capital investment. For instance, the legislative process for HRM legalization can be lengthy and uncertain, impacting the speed of market entry and profitability.

Given these factors, Churchill Downs' HRM expansion into new states can be categorized as Question Marks within the BCG Matrix. The potential for high growth exists, but the uncertainty of legislative approval and market adoption, coupled with the risk of failure, makes them a strategic area requiring careful management and significant investment.

Future Churchill Downs Racetrack Infrastructure Projects

Churchill Downs has put several significant infrastructure upgrades at its flagship track on hold. These include The Skye, Conservatory, and Infield General Admission enhancements, which were intended to elevate the Kentucky Derby experience and boost future revenue. The indefinite pause, coupled with the substantial capital needed to resume them, casts a shadow over their future market impact and profitability, placing them in the question mark category of the BCG matrix.

These paused projects represent substantial investments, with their future viability dependent on evolving economic conditions and cost management. For instance, the company reported in its 2023 annual report that capital expenditures for property and equipment were $252.8 million, a significant increase from $148.8 million in 2022, reflecting ongoing development and planned improvements that are now subject to review.

- The Skye: A planned premium seating area and hospitality space, designed to offer an enhanced viewing and entertainment experience for the Kentucky Derby.

- Conservatory: This project aimed to create a new, upscale viewing area and premium amenities, potentially attracting higher-paying customer segments.

- Infield General Admission Enhancements: Improvements to the popular general admission areas, intended to increase capacity and overall attendee satisfaction.

Diversification into New Gaming Offerings

Churchill Downs is strategically looking to expand its gaming portfolio by introducing new products, such as electronic table games, into its Historical Racing Machine (HRM) venues. This initiative is designed to create a comprehensive range of gaming options for customers, tapping into a segment exhibiting strong growth potential and leveraging the existing infrastructure of their properties.

The company's objective is to offer an end-to-end suite of products, which signifies a move towards capturing a larger share of the gaming market by catering to diverse player preferences. This diversification aims to enhance customer engagement and potentially increase revenue streams by broadening the appeal of their gaming facilities.

While these new gaming offerings represent a promising avenue for growth, they are still in the early stages of market penetration. Churchill Downs faces the challenge of establishing widespread adoption and proving significant revenue generation capabilities for these products. Substantial investment will be necessary to secure a solid market position and achieve profitability in these nascent ventures.

- Diversification Strategy: Churchill Downs is exploring new gaming products like electronic table games to complement its existing HRM offerings.

- Market Expansion: The goal is to create an end-to-end suite of gaming products, targeting high-growth areas within the gaming sector.

- Investment and Risk: These new offerings require significant investment to establish market share and profitability, as widespread adoption and revenue generation are not yet proven.

Churchill Downs' new ventures, like the Terre Haute Casino Resort opened in April 2024 and its stake in Casino Salem, are classified as Question Marks. These require substantial capital and are in early stages, aiming to build market share and prove profitability.

The company's potential expansion into online sports betting also falls into this category due to intense competition and high investment needs, even as the global market is projected for strong growth.

Expansion of Historical Racing Machines (HRMs) into new states, facing regulatory hurdles and significant upfront costs, are also Question Marks, offering high growth potential but carrying considerable risk.

Paused infrastructure upgrades at the Kentucky Derby, such as The Skye and Conservatory, represent investments now uncertain due to economic conditions and cost management, placing them as Question Marks.

Introducing new gaming products like electronic table games into HRM venues is a strategic move into a high-growth area, but requires significant investment to establish market share and prove revenue generation.

| Venture | Category | Rationale | Investment Needs | Market Share Potential |

|---|---|---|---|---|

| Terre Haute Casino Resort | Question Mark | New market entry, establishing customer base. | High | Developing |

| Casino Salem (Stake) | Question Mark | Entry into a new territory, requires market penetration. | Significant | Nascent |

| Online Sports Betting Expansion | Question Mark | Highly competitive market, substantial investment required. | Very High | Challenging |

| HRM Expansion to New States | Question Mark | Regulatory and political uncertainty, high upfront capital. | High | Dependent on legislation |

| Paused Infrastructure Upgrades | Question Mark | Future viability uncertain due to economic conditions and costs. | Substantial | Uncertain |

| New Gaming Products (e.g., Electronic Table Games) | Question Mark | Early stage of market penetration, requires adoption and revenue proof. | Significant | Untested |

BCG Matrix Data Sources

Our Churchill Downs BCG Matrix is built on robust financial disclosures, industry growth forecasts, and comprehensive market analytics to provide a clear strategic overview.