CHS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

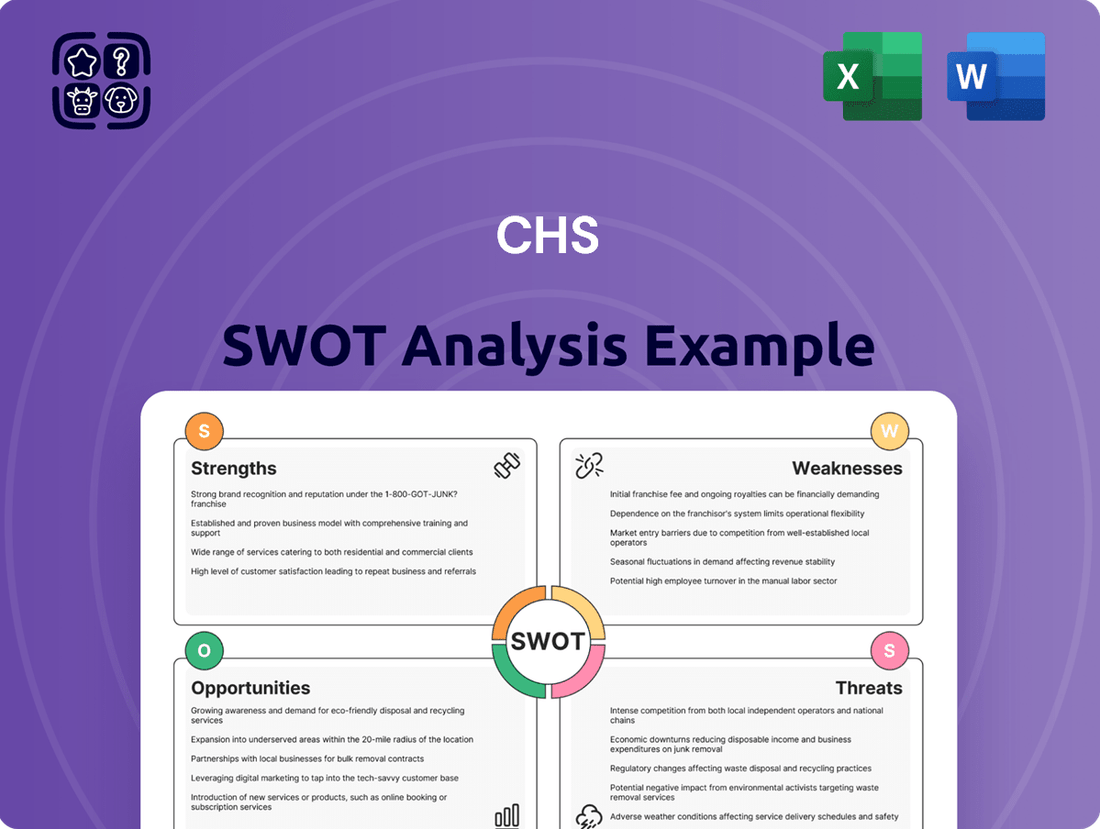

Curious about CHS's competitive edge and potential hurdles? Our preview offers a glimpse into their strengths and weaknesses, but the full SWOT analysis unlocks a comprehensive understanding of their market opportunities and threats.

Want to truly grasp CHS's strategic landscape and future potential? Purchase the complete SWOT analysis to gain access to detailed insights, actionable strategies, and an editable format perfect for informed decision-making.

Strengths

Community Health Systems (CHS) boasts an extensive network, operating 77 hospitals in 15 states as of the first quarter of 2024. This significant market presence, particularly in non-urban and select urban areas, allows CHS to serve a diverse patient population and generate varied revenue streams. Its broad geographical footprint is a key strength, enabling it to cater to a wide array of healthcare needs across the nation.

CHS has been actively implementing a strategic divestiture program, with the goal of generating more than $1 billion in proceeds from selling off hospitals. This initiative is a crucial element of their plan to significantly lower their substantial debt and strengthen their financial standing.

These divestitures allow CHS to shed non-essential assets, freeing up capital. This capital can then be strategically reinvested into their core operations and areas identified for future growth, ultimately bolstering the company's long-term financial health.

CHS has seen impressive same-store volume growth, a key indicator of strong demand for its healthcare services. This is evident in recent reports showing increases in both same-store admissions and adjusted admissions, reflecting a steady influx of patients.

The company achieved record surgical volumes, particularly in outpatient procedures, showcasing its expanding capacity and efficiency. Furthermore, CHS has made significant strides in managing its operational expenses, notably by reducing reliance on costly contract labor.

Focus on Outpatient and Post-Acute Care

Community Health Systems (CHS) is strategically investing in and expanding its outpatient and post-acute care services, a move that directly addresses the healthcare industry's significant shift from inpatient to outpatient settings. This focus includes developing ambulatory surgery centers and freestanding emergency departments. For instance, CHS reported that its outpatient revenue represented a substantial portion of its total revenue, with growth in these segments often outpacing inpatient volume increases in recent fiscal periods, such as those reported in early 2024 and projected for 2025.

By concentrating on these migrating care segments, CHS is positioning itself to capitalize on a growing patient demand that is increasingly occurring outside traditional hospital walls. This strategic alignment not only diversifies its service offerings but also strengthens its revenue streams by tapping into more efficient and patient-preferred care delivery models. The company's commitment to outpatient expansion is a key element in its 2024-2025 growth strategy, aiming to capture market share in these dynamic healthcare areas.

- Strategic Expansion: CHS is actively growing its network of ambulatory surgery centers and freestanding emergency departments.

- Market Alignment: This focus directly corresponds with the healthcare trend of shifting patient care from inpatient to outpatient settings.

- Revenue Diversification: By investing in outpatient services, CHS aims to capture a growing segment of patient care and enhance its revenue streams.

- Future Growth: This strategy is central to CHS's growth plans for 2024 and 2025, targeting areas with increasing patient preference and market demand.

Commitment to Community Health

Community Health Systems (CHS) demonstrates a strong commitment to enhancing community health, a key strength that resonates deeply with local populations. This dedication is evident in their ongoing efforts to provide accessible, quality healthcare services, directly addressing the well-being of the areas where they operate. The company's 2025 Community Impact Report underscores this focus by detailing significant economic contributions and workforce development initiatives within its service regions.

This community-centric philosophy cultivates robust local relationships, fostering patient loyalty and building trust. For instance, CHS hospitals often engage in numerous community health initiatives, such as free health screenings and educational programs, which directly improve public health outcomes. In 2024, CHS hospitals collectively hosted over 5,000 community health events, reaching more than 750,000 individuals with vital health information and services.

- Community Health Focus: CHS prioritizes improving the health and well-being of the communities it serves through accessible healthcare.

- Economic & Workforce Impact: The 2025 Community Impact Report highlights CHS's role in providing economic benefits and strengthening local workforces.

- Relationship Building: A community-centric approach fosters strong local ties, leading to increased patient loyalty and trust.

- Health Initiatives: CHS actively participates in community health events, such as screenings and educational programs, to promote public health.

CHS possesses a substantial and geographically diverse hospital network, operating 77 facilities across 15 states as of Q1 2024. This broad reach allows for varied revenue generation and service to a wide patient base, particularly in non-urban and select urban markets. The company's strategic divestiture of over $1 billion in hospitals aims to reduce debt and bolster its financial health.

Impressive same-store volume growth, including increases in admissions and adjusted admissions, indicates strong demand for CHS services. Record surgical volumes, especially in outpatient procedures, coupled with reduced reliance on contract labor, highlight operational efficiencies and expanding capacity.

CHS is strategically investing in outpatient and post-acute care services, aligning with the industry trend of shifting care away from traditional inpatient settings. This focus includes expanding ambulatory surgery centers and freestanding emergency departments, a key component of their 2024-2025 growth strategy to capture market share in these dynamic areas.

The company demonstrates a strong commitment to community health, evidenced by significant economic contributions and workforce development initiatives detailed in its 2025 Community Impact Report. CHS actively engages in community health events, hosting over 5,000 events in 2024, reaching more than 750,000 individuals with vital health information and services.

What is included in the product

Analyzes CHS’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address CHS's internal and external challenges, turning potential roadblocks into opportunities for growth.

Weaknesses

Community Health Systems (CHS) continues to grapple with a substantial debt burden, a factor that significantly constrains its financial maneuverability. As of the close of 2024, the company reported a staggering $11.4 billion in long-term debt, a figure that raises concerns about its capacity to manage financial obligations and pursue growth opportunities.

This considerable debt load amplifies the financial risk associated with CHS, potentially impacting its credit rating and the cost of future borrowing. While strategic divestitures have been implemented with the goal of alleviating this pressure, the persistent high levels of debt remain a critical point of focus for investors and financial analysts evaluating the company's long-term viability.

CHS has struggled to achieve consistent profitability, a significant weakness. The company reported net losses in both 2023 and 2024, indicating ongoing financial challenges.

While there was a slight improvement with a narrower net loss in Q1 2025 compared to the previous year, CHS still recorded a $13 million net loss for the quarter. This persistent unprofitability highlights a core issue that needs addressing.

Despite various initiatives aimed at boosting financial performance, achieving sustained profitability continues to be a considerable hurdle for CHS.

CHS is experiencing significant pressure from increasing operating expenses, with medical specialist fees alone rising by 9% year-over-year in the first quarter of 2025. This upward trend in costs directly impacts the company's profitability.

Furthermore, CHS faces challenges with payers, as a high volume of claim denials is negatively affecting its financial performance. These denials not only reduce revenue but also create administrative burdens and delays in cash flow.

Impact of Divestitures on Revenue

While shedding non-core assets and reducing debt is a strategic imperative, CHS's divestitures have undeniably impacted its revenue stream. The company has strategically reduced its hospital portfolio over the past decade, a move that, while beneficial for financial health, directly shrinks its operational footprint and top-line revenue potential.

This reduction in owned or leased facilities, a key aspect of CHS's deleveraging strategy, has led to a noticeable decline in overall revenue. For instance, CHS reported total operating revenues of $12.7 billion for the fiscal year ending December 31, 2023, a decrease from previous years, partly attributable to these portfolio adjustments.

- Decreased Operational Footprint: CHS has actively sold hospitals, leading to a smaller network of facilities compared to a decade ago.

- Revenue Loss from Divestitures: The sale of hospitals, while aiding debt reduction, directly removes their associated revenue from the company's consolidated financial statements.

- Impact on Market Share: A reduced number of facilities can also lead to a contraction in market share within certain geographic areas.

Lower Acuity and Unfavorable Payer Mix

Community Health Systems (CHS) faces a challenge with a lower acuity patient mix, meaning more patients require less complex and less profitable medical care rather than higher-margin surgical procedures. This trend was exacerbated by a more severe flu season in 2024, which typically drives up medical admissions.

Compounding this issue is an unfavorable shift in the payer mix. CHS is seeing a greater proportion of its patient base covered by Medicare Advantage plans, which generally offer lower reimbursement rates compared to traditional Medicare. Additionally, commercial payer contracts have seen lower negotiated rates, directly impacting the net revenue generated per adjusted admission.

- Lower Acuity Mix: Increased medical cases, particularly due to a significant flu season in late 2023 and early 2024, have outpaced the growth in more profitable surgical cases.

- Unfavorable Payer Mix: Growth in Medicare Advantage plans, which typically reimburse at lower rates than traditional Medicare, is outpacing growth in traditional Medicare.

- Reduced Reimbursement Rates: Lower negotiated rates with commercial payers further pressure the overall revenue per patient.

- Impact on Net Revenue: These factors combined have led to a decrease in net revenue per adjusted admission, affecting profitability.

CHS faces a significant challenge with its substantial debt, reaching $11.4 billion in long-term debt by the end of 2024. This high leverage limits financial flexibility and increases borrowing costs, despite ongoing divestitures aimed at debt reduction.

Persistent unprofitability is a core weakness, with net losses reported in 2023 and 2024, including a $13 million loss in Q1 2025, indicating ongoing financial struggles despite performance improvement initiatives.

Rising operating expenses, such as a 9% year-over-year increase in medical specialist fees in Q1 2025, directly erode profitability. Additionally, a high volume of claim denials creates administrative burdens and delays cash flow, further impacting financial performance.

CHS's strategic divestitures, while intended to reduce debt, have also shrunk its operational footprint and revenue. The company's total operating revenues were $12.7 billion in fiscal year 2023, reflecting a decrease partly due to portfolio adjustments.

The company is also contending with a less profitable patient mix, characterized by more lower-acuity cases and fewer high-margin surgical procedures, especially following a severe flu season in 2024. This is compounded by an unfavorable payer mix, with Medicare Advantage plans and lower commercial payer rates reducing net revenue per adjusted admission.

| Financial Metric | 2023 | Q1 2025 |

| Long-term Debt | $11.4 billion (End of 2024) | |

| Net Income/Loss | Net Loss | -$13 million |

| Medical Specialist Fees (YoY Increase) | 9% | |

| Total Operating Revenues | $12.7 billion |

Preview the Actual Deliverable

CHS SWOT Analysis

The preview you see is the same document the customer will receive after purchasing, offering a clear glimpse into the comprehensive CHS SWOT analysis.

This is the actual CHS SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The file shown below is not a sample—it’s the real CHS SWOT analysis you'll download post-purchase, in full detail and ready for implementation.

Opportunities

The healthcare industry's strong shift towards outpatient and ambulatory care creates a prime growth avenue for CHS. This trend is driven by patient convenience and cost-effectiveness, making these settings increasingly popular.

CHS is actively investing in its ambulatory surgery centers and freestanding emergency departments, directly responding to these evolving market demands. For instance, in 2023, CHS reported that its ambulatory segment contributed significantly to its revenue growth, reflecting the success of this strategic focus.

By expanding these services, CHS is well-positioned to capture a larger share of the healthcare market as more procedures and treatments move away from traditional hospital stays. This strategic alignment with patient preferences and industry shifts is key to future success.

The United States is experiencing a significant demographic shift, with the population aged 65 and over projected to reach 83.7 million by 2050, nearly doubling from 2012. This aging trend directly translates to a sustained surge in demand for healthcare services, as older individuals typically require more frequent and specialized medical attention. CHS is well-positioned to capitalize on this opportunity, particularly given its strong presence in non-urban markets where access to care can be more critical for this demographic.

CHS can leverage technological advancements like AI and telehealth to boost efficiency and patient care. For instance, AI can automate tasks, freeing up staff for more critical duties. The telehealth market, valued at over $60 billion in 2023, is expected to grow significantly, offering CHS a chance to reach more patients, particularly in underserved rural communities.

Strategic Cost Efficiencies through Operational Improvements

CHS has a significant opportunity to enhance its financial performance by aggressively pursuing strategic cost efficiencies. By insourcing medical specialists, like anesthesiologists, CHS can directly control costs previously absorbed by third-party providers, potentially leading to substantial savings. For instance, a hospital system similar to CHS might see a 10-15% reduction in anesthesia service costs by bringing these functions in-house.

Leveraging technology is another key avenue for cost reduction. CHS's ongoing implementation of its Oracle ERP system, Project Empower, is designed to streamline back-office operations, reduce manual processes, and improve data accuracy. This can translate into lower administrative overhead and more efficient resource allocation across the organization. Early adopters of comprehensive ERP systems often report a 5-10% decrease in operational expenses within the first two years of full implementation.

- Insourcing Medical Specialists: Direct control over anesthesia and other specialist services can yield significant savings compared to outsourced contracts, potentially reducing these specific costs by 10-15%.

- Technology Integration (Oracle ERP): Project Empower aims to automate processes and improve efficiency, targeting a 5-10% reduction in overhead and administrative expenses.

- Supply Chain Optimization: Further analysis and negotiation within the supply chain for medical equipment and pharmaceuticals present opportunities for cost savings.

- Process Standardization: Implementing standardized workflows across departments can minimize waste and improve resource utilization, contributing to overall efficiency gains.

Shift Towards Value-Based Care Models

The healthcare industry's significant shift towards value-based care models presents a key opportunity for CHS. This transition rewards providers for patient outcomes and quality of care rather than the volume of services. By aligning its operations with these evolving payment structures, CHS can improve patient well-being and potentially secure more favorable reimbursement rates.

For instance, Medicare's Value-Based Purchasing (VBP) program, which began in 2013 and continues to evolve, directly incentivizes hospitals to improve patient care quality. As of 2024, these programs are increasingly sophisticated, incorporating measures related to patient experience and clinical outcomes. CHS's ability to demonstrate superior patient outcomes and efficient care delivery within these frameworks can lead to enhanced financial performance.

- Improved Patient Outcomes: Focus on preventative care and chronic disease management can reduce hospital readmissions, a key metric in value-based care.

- Enhanced Reimbursement: Successful performance in value-based purchasing programs can lead to higher payments from government and private payers.

- Market Differentiation: Demonstrating a commitment to quality care can attract patients and referral sources, strengthening CHS's market position.

- Long-Term Financial Stability: Proactive adaptation to value-based care can mitigate risks associated with fee-for-service models and ensure sustainable revenue streams.

CHS can capitalize on the growing demand for outpatient services by expanding its ambulatory surgery centers and freestanding emergency departments. This strategic move aligns with patient preferences for convenience and cost savings, a trend that saw ambulatory care revenue increase significantly for CHS in 2023.

The aging U.S. population, projected to include over 83 million individuals aged 65+ by 2050, presents a sustained demand for healthcare. CHS's presence in non-urban areas positions it to serve this demographic effectively, addressing critical access needs.

Integrating technologies like AI and telehealth offers substantial operational efficiencies and expanded patient reach. The telehealth market, exceeding $60 billion in 2023, provides CHS a clear path to enhance care delivery, especially in rural settings.

By insourcing medical specialists, such as anesthesiologists, CHS can achieve direct cost savings of 10-15% on these services. Furthermore, the ongoing Oracle ERP implementation, Project Empower, aims to reduce operational expenses by 5-10% through process automation and improved data accuracy.

The shift towards value-based care models offers CHS an opportunity to improve patient outcomes and secure better reimbursement rates. Successful participation in programs like Medicare's Value-Based Purchasing, which rewards quality care, can enhance financial performance and market standing.

Threats

The healthcare sector is intensely competitive, with many hospitals and providers aggressively seeking to capture market share. CHS operates in this environment, facing pressure from both local competitors and larger, national healthcare systems. This competition can significantly impact pricing power and overall profitability.

For instance, in 2024, the healthcare industry continued to see consolidation, with larger systems acquiring smaller facilities, thereby intensifying the competitive landscape for independent providers like CHS. This trend necessitates constant innovation and adaptation to meet evolving patient needs and preferences to retain and grow market share.

The healthcare industry, including organizations like CHS, faces significant threats from widespread workforce shortages, particularly among nurses and physicians. This scarcity is intensified by high rates of burnout and an aging healthcare professional population, creating a critical staffing gap.

These shortages directly translate into escalating labor costs. Hospitals are increasingly compelled to utilize costly contract or temporary staff to fill essential roles, placing substantial financial strain on operations and impacting overall efficiency. For instance, in 2023, the average weekly rate for travel nurses in the U.S. remained significantly elevated compared to pre-pandemic levels, a trend expected to persist into 2024.

Effectively managing these staffing challenges is paramount for CHS to maintain the quality of patient care and ensure its long-term financial stability. Failing to address these labor dynamics could compromise service delivery and profitability.

The healthcare sector is subject to a constantly evolving regulatory landscape. Changes to Medicare and Medicaid reimbursement rates, for example, directly impact revenue for providers like CHS. The potential for new legislation, such as hypothetical measures that could reduce government funding for healthcare programs, introduces significant uncertainty for financial planning and stability.

Economic Downturns and Financial Pressures

Economic instability poses a significant threat to CHS, potentially leading to decreased patient volumes and reduced reimbursement rates. The healthcare sector, especially smaller and rural facilities, faces ongoing financial pressures. Even a large organization like CHS could experience impacts on patient affordability and service demand during a widespread economic downturn.

For instance, a national recession could strain household budgets, making elective procedures or even essential care less accessible for some individuals. This could translate to lower utilization of CHS facilities. Furthermore, economic slowdowns often pressure government and private payers, potentially leading to tighter reimbursement policies for healthcare providers.

- Reduced Patient Volumes: Economic hardship can lead individuals to postpone or forgo non-emergency medical care, directly impacting service utilization at CHS facilities.

- Lower Reimbursement Rates: Economic downturns often put pressure on payers (government and private insurance) to control costs, which can result in lower reimbursement rates for healthcare services provided by CHS.

- Increased Bad Debt: As patients face financial difficulties, the likelihood of uncompensated care and increased bad debt for CHS rises, impacting overall profitability.

- Limited Capital Investment: During periods of economic uncertainty, CHS may face challenges securing financing for necessary capital expenditures and facility upgrades, hindering long-term growth and competitiveness.

Cybersecurity Risks and Data Breaches

CHS faces significant cybersecurity risks due to its increasing reliance on interconnected healthcare data. The healthcare sector experienced a surge in cyberattacks, with the Identity Theft Resource Center reporting over 1,300 data breaches in 2023 affecting more than 133 million individuals. These breaches can compromise patient safety, disrupt essential services, and incur substantial financial penalties and reputational harm for organizations like CHS.

The threat landscape for healthcare providers is evolving rapidly, making robust cybersecurity measures critical. Ransomware attacks, in particular, continue to plague the industry, with reports indicating that healthcare organizations are disproportionately targeted. For instance, a 2024 report highlighted that healthcare was one of the most targeted sectors for ransomware, leading to extended operational downtime and significant recovery costs.

- Rising Healthcare Cyberattacks: The healthcare sector saw a notable increase in data breaches and ransomware incidents in 2023 and early 2024.

- Patient Safety and Operational Disruption: Successful cyberattacks can directly impact patient care and lead to significant service interruptions.

- Financial and Reputational Damage: Data breaches can result in hefty fines, legal liabilities, and severe damage to an organization's public image.

- Need for Advanced Security: CHS must invest in and maintain sophisticated cybersecurity protocols to counter these escalating threats.

The increasing reliance on digital systems makes CHS vulnerable to cyberattacks. Healthcare organizations are prime targets for ransomware, with significant data breaches reported throughout 2023 and into 2024, impacting millions of individuals. These attacks can disrupt patient care, leading to operational downtime and substantial recovery costs, alongside severe financial penalties and reputational damage.

CHS must continuously invest in advanced cybersecurity measures to protect sensitive patient data and maintain operational integrity against these evolving threats.

| Threat Category | Description | Impact on CHS | Data Point/Trend |

| Cybersecurity Risks | Increasing reliance on interconnected data systems | Data breaches, operational disruption, financial penalties, reputational damage | Healthcare sector saw over 1,300 data breaches affecting 133 million individuals in 2023. Healthcare remains a top target for ransomware in 2024. |

| Workforce Shortages | Scarcity of nurses and physicians, high burnout rates | Escalating labor costs, reliance on expensive contract staff, potential impact on quality of care | Travel nurse rates remained significantly elevated in 2023, a trend expected to continue into 2024. |

| Regulatory Changes | Evolving healthcare laws and reimbursement policies | Uncertainty in revenue streams, potential reduction in government funding | Changes to Medicare and Medicaid reimbursement rates directly impact provider revenue. |

| Economic Instability | Recessions and economic downturns | Reduced patient volumes, lower reimbursement rates, increased bad debt, limited capital investment | Economic slowdowns pressure payers, potentially leading to tighter reimbursement policies. |

SWOT Analysis Data Sources

This CHS SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research studies, and direct feedback from key stakeholders. These sources provide a well-rounded perspective on both internal capabilities and external market dynamics.