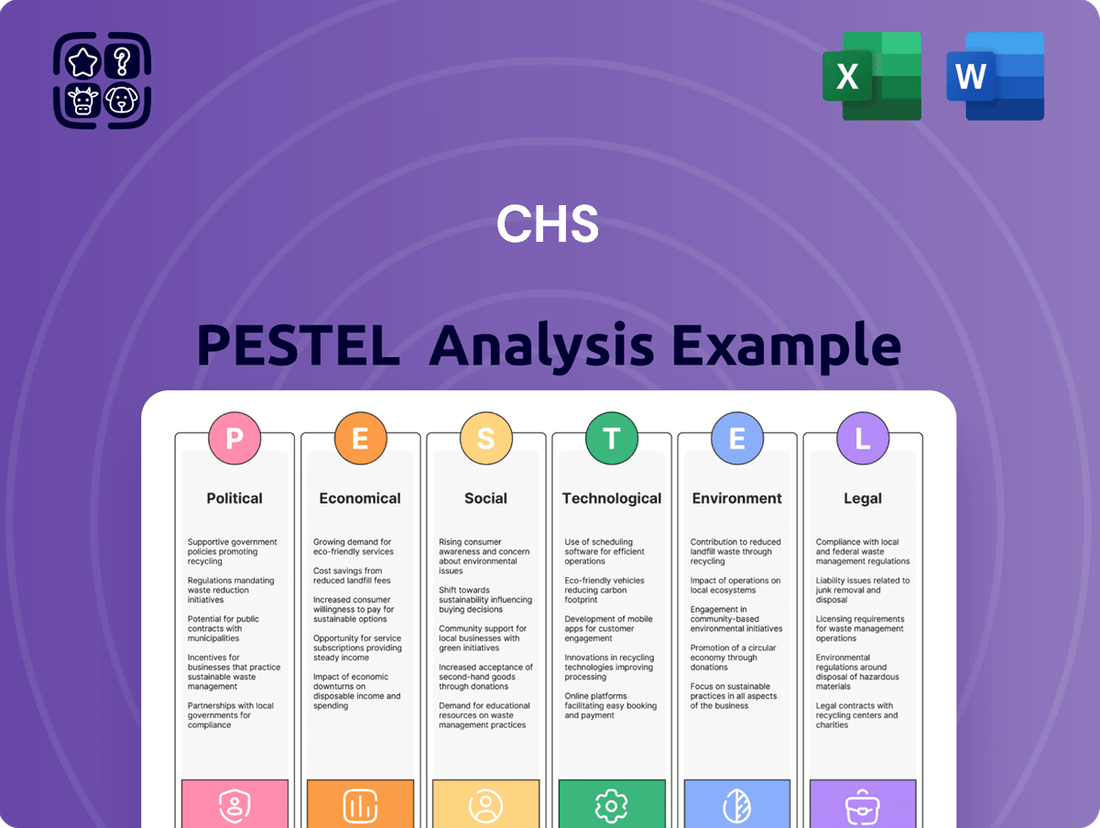

CHS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CHS's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities. Equip yourself with actionable intelligence—download the full report now and gain a decisive competitive advantage.

Political factors

Government healthcare policies significantly shape hospital operations and financial viability. For instance, ongoing debates and potential modifications to the Affordable Care Act (ACA) in 2024 and 2025 could alter insurance coverage rates and patient volumes. Changes in Medicare and Medicaid reimbursement rates, which are subject to annual adjustments, directly impact a hospital's revenue streams.

Government healthcare funding, particularly Medicare and Medicaid reimbursement rates, directly impacts Community Health Systems (CHS). For instance, in 2024, Medicare reimbursement rates saw a modest increase, but the long-term stability remains a concern for providers like CHS. Proposed changes to these payment systems, including shifts towards value-based care models, could alter revenue streams significantly. CHS's financial health is closely tied to these government programs, which represent a substantial portion of its patient mix.

The regulatory environment for hospitals, overseen by agencies like the Centers for Medicare & Medicaid Services (CMS) and state health departments, significantly impacts operations. In 2024, CMS continued to emphasize value-based care models, with programs like the Hospital Value-Based Purchasing (VBP) program adjusting payments based on quality metrics. Hospitals face ongoing scrutiny regarding patient safety protocols and operational compliance, with potential increases in administrative complexity and associated costs.

Political Stability and Elections

Political stability significantly impacts healthcare policy, and upcoming elections can introduce uncertainty. For instance, the 2024 US presidential election could lead to shifts in healthcare regulations, affecting insurance markets and provider reimbursements. Changes in political leadership often bring about new legislative priorities, potentially altering the landscape for healthcare organizations.

The political climate directly influences the probability of substantial policy changes. In the UK, for example, the upcoming general election in 2024 might see differing approaches to the National Health Service (NHS) from major parties, impacting funding models and service delivery. This can make long-term strategic planning difficult for healthcare providers who must adapt to potential policy pivots.

- 2024 US Presidential Election: Potential for significant changes in healthcare legislation, impacting Affordable Care Act (ACA) provisions and Medicare/Medicaid policies.

- UK General Election 2024: Expected policy debates around NHS funding, privatization, and service expansion, creating an evolving operational environment for healthcare providers.

- Legislative Uncertainty: Political transitions can lead to unpredictable regulatory changes, affecting everything from drug pricing to telehealth services.

Public Health Initiatives and Preparedness

Government-led public health initiatives directly shape demand for healthcare services. For instance, campaigns promoting vaccination or preventative screenings can alter patient volumes for specific services within a hospital system. In 2023, the CDC reported that routine health screenings, like mammograms and colonoscopies, saw a rebound post-pandemic, indicating the impact of public health messaging on service utilization.

National emergency preparedness strategies, particularly those related to pandemic response, significantly influence resource allocation and operational readiness for hospital systems. The U.S. Department of Health and Human Services (HHS) continues to invest in public health infrastructure, with a focus on pandemic preparedness, as highlighted by its fiscal year 2024 budget proposals, which include substantial funding for infectious disease surveillance and response capabilities. This preparedness directly impacts how hospitals manage surge capacity and supply chains.

The government's role in managing pandemics has a profound effect on hospital operations. During the COVID-19 pandemic, federal and state governments implemented public health measures that led to unprecedented patient surges and altered service demands. For example, the CARES Act provided billions in relief to healthcare providers, demonstrating the direct financial impact of government pandemic management on hospital systems.

- Impact on Patient Volumes: Public health campaigns encouraging screenings can increase demand for diagnostic services.

- Resource Allocation: Emergency preparedness funding influences a hospital's ability to manage surges during health crises.

- Pandemic Response: Government mandates and funding during pandemics directly affect hospital staffing, supply chain, and financial stability.

- Service Demand Shifts: Preventative care initiatives can shift demand away from acute care towards outpatient and preventative services.

Political factors significantly influence healthcare policy and funding, directly impacting Community Health Systems (CHS). The 2024 US presidential election, for instance, carries the potential for substantial shifts in healthcare legislation, affecting the Affordable Care Act (ACA) and reimbursement rates for Medicare and Medicaid. This political uncertainty necessitates adaptive strategies for CHS to navigate evolving regulatory landscapes and funding streams.

| Political Factor | Impact on CHS | 2024/2025 Data/Outlook |

|---|---|---|

| Government Healthcare Policy (ACA, Medicare/Medicaid) | Shapes insurance coverage, patient volumes, and revenue streams. | Ongoing debates around ACA modifications in 2024/2025 could alter patient mix. Medicare reimbursement rate adjustments are a constant factor. |

| Electoral Cycles (e.g., US Presidential Election 2024) | Introduces uncertainty regarding future healthcare regulations and funding. | Potential for significant legislative changes impacting provider reimbursement and market dynamics. |

| Regulatory Environment (CMS, State Health Depts.) | Dictates operational compliance, quality metrics, and administrative burden. | Continued emphasis on value-based care models (e.g., Hospital VBP) influences payment adjustments based on performance. |

What is included in the product

This CHS PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization, providing a strategic framework for understanding its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Healthcare spending is a significant economic driver, and its trends directly impact hospital systems. In 2023, U.S. healthcare spending reached an estimated $4.7 trillion, representing about 17.3% of the nation's GDP. This growth, driven by factors like an aging population and advancements in medical technology, generally signals robust demand for healthcare services, positively affecting patient volumes.

Economic conditions play a crucial role in healthcare expenditures. During economic downturns, individuals might postpone elective procedures or opt for less expensive treatments, potentially reducing patient volumes for some services. Conversely, economic booms can lead to increased discretionary spending on healthcare, benefiting hospital financial performance. For instance, the U.S. experienced a dip in elective procedures during the initial phases of the COVID-19 pandemic, impacting revenue streams for many hospitals.

Rising wages for healthcare professionals, especially nurses and specialized technicians, are a significant economic pressure point for hospital operators. For instance, the U.S. Bureau of Labor Statistics reported that the median annual wage for registered nurses was $81,220 in May 2023, a figure that has been steadily increasing. This upward trend in labor costs directly impacts profit margins.

Compounding the wage issue is the persistent problem of workforce shortages across the healthcare sector. The American Hospital Association highlighted in late 2024 that many hospitals are operating with critical staffing gaps, leading to increased recruitment costs and reliance on expensive temporary staff. These shortages can also necessitate operational adjustments, potentially reducing service capacity and efficiency.

Inflation significantly impacts CHS's operational expenses, affecting everything from essential medical supplies and pharmaceuticals to utilities. For instance, the Producer Price Index for medical supplies saw a notable increase in late 2023 and into 2024, directly squeezing hospital budgets.

Supply chain disruptions, a persistent issue since 2020, continue to drive up costs for critical goods. This means CHS faces higher prices for items like personal protective equipment and specialized medical devices, diminishing its purchasing power and overall profitability.

Effectively managing these inflationary pressures is paramount for CHS to maintain its financial stability and continue providing quality healthcare services. The ability to forecast and mitigate rising costs will be a key determinant of its financial health throughout 2024 and 2025.

Interest Rates and Capital Access

Interest rates significantly impact a hospital company's ability to access capital for essential investments. For instance, the Federal Reserve's benchmark interest rate, the federal funds rate, influences borrowing costs across the economy. As of mid-2024, the federal funds rate has remained elevated, making it more expensive for companies like CHS to finance major capital expenditures such as facility upgrades, new equipment purchases, or strategic acquisitions. This increased cost of debt service can directly affect profitability and limit the capacity for growth and infrastructure modernization.

Affordable capital is a cornerstone for any hospital system aiming to expand its services or update its aging infrastructure. Fluctuations in interest rates, driven by monetary policy and market conditions, create a dynamic environment for capital access.

- Federal Funds Rate: The Federal Reserve maintained its target range for the federal funds rate between 5.25% and 5.50% through early 2024, a level that increases borrowing costs.

- Corporate Bond Yields: For companies like CHS, the cost of issuing corporate bonds is directly tied to prevailing interest rates. Higher yields mean higher interest payments on new debt.

- Impact on CAPEX: Elevated borrowing costs can deter or delay capital expenditure projects, potentially hindering a hospital's ability to adopt new technologies or expand capacity.

- Access to Credit Markets: Beyond interest rates, the general availability of credit in the market also plays a crucial role in a hospital company's financial flexibility.

Payer Mix and Reimbursement Rates

The payer mix for Community Health Systems (CHS) is a crucial economic factor, directly influencing its revenue streams. A higher proportion of patients covered by commercial insurance, which typically offers higher reimbursement rates than government programs, is financially advantageous. Conversely, an increasing reliance on Medicare and Medicaid, or a rise in uninsured patients, can depress average revenue per patient.

Negotiations with commercial insurers are paramount for CHS to secure favorable reimbursement rates. These rates can vary significantly, impacting the profitability of services rendered. For instance, in 2024, the average inpatient reimbursement rate for commercial insurance can be substantially higher than that for Medicare or Medicaid, creating a direct correlation between payer mix and overall financial performance.

The growing prevalence of high-deductible health plans (HDHPs) also complicates the payer mix. While these plans may shift more responsibility to patients, they can also lead to increased uncompensated care if patients struggle to meet their deductibles. This dynamic requires CHS to adapt its collection strategies and potentially offer more financial assistance programs.

- Payer Mix Impact: A shift towards government payers (Medicare/Medicaid) or uninsured patients can decrease average revenue per patient for CHS.

- Commercial Rate Negotiation: CHS's ability to negotiate higher reimbursement rates with commercial insurers is vital for its financial health.

- HDHP Influence: High-deductible plans can increase patient responsibility but also pose a risk of higher uncompensated care for CHS.

- Reimbursement Variance: Reimbursement rates differ significantly across payer types, with commercial plans generally offering higher rates than government programs.

Economic growth directly influences healthcare demand and CHS's revenue. A robust economy generally translates to higher patient volumes and increased spending on healthcare services. Conversely, economic slowdowns can lead to reduced elective procedures and greater financial strain on patients, impacting hospital revenues.

Inflationary pressures continue to affect operational costs for CHS, impacting everything from medical supplies to labor. For instance, the Consumer Price Index (CPI) for medical care services saw an increase of approximately 3.1% in the 12 months ending April 2024, highlighting the persistent cost challenges.

Interest rates remain a critical factor for CHS's capital expenditures and debt management. With the Federal Reserve maintaining elevated rates through early 2024, borrowing costs for new investments and refinancing existing debt are higher, potentially impacting profitability and growth initiatives.

The payer mix remains a key determinant of CHS's financial performance, with commercial insurance payers typically offering higher reimbursement rates than government programs like Medicare and Medicaid. A favorable shift in payer mix towards commercial plans can significantly boost revenue per patient.

| Economic Factor | 2023/2024 Data Point | Impact on CHS |

|---|---|---|

| Healthcare Spending (US GDP) | ~17.3% in 2023 | Indicates strong demand for services, supporting patient volumes. |

| Inflation (Medical Care Services CPI) | ~3.1% increase (12 months ending April 2024) | Increases operational costs for supplies, labor, and utilities. |

| Federal Funds Rate | 5.25%-5.50% range (early 2024) | Elevates borrowing costs for capital investments and debt servicing. |

| Payer Mix Advantage | Commercial insurance reimbursement rates are significantly higher than government programs. | A higher proportion of commercial patients boosts average revenue per patient. |

Same Document Delivered

CHS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CHS PESTLE Analysis covers all critical external factors impacting the organization. You'll gain immediate access to this detailed report, enabling informed strategic planning.

Sociological factors

The aging demographic is a significant driver for healthcare demand. In the US, the population aged 65 and over is projected to reach 80.8 million by 2040, nearly doubling from 2012. This surge directly translates to increased need for chronic disease management, specialized geriatric care, and long-term care facilities, areas where CHS can strategically expand its service offerings.

Furthermore, CHS's focus on rural markets means understanding specific demographic trends in these areas. Many rural communities are experiencing population declines, but often with a disproportionately higher percentage of older residents. For instance, while national population growth continues, some rural areas saw a decline in their working-age population between 2010 and 2020, exacerbating the demand for healthcare services from a smaller, older base.

The increasing prevalence of chronic diseases like diabetes, heart disease, and obesity is a significant sociological factor impacting healthcare. For instance, in 2024, an estimated 38.4 million Americans, or 11.5% of the population, had diabetes, with a substantial portion being undiagnosed. This growing burden demands specialized programs and a greater emphasis on outpatient services and integrated care models for hospitals, directly influencing their service offerings and how resources are allocated.

Societal expectations are increasingly focused on health equity, pushing hospitals to ensure everyone, especially those in underserved communities, can access quality care. This translates into pressure and often incentives for healthcare systems to actively reduce health disparities.

For example, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based care models that reward providers for improving health outcomes and reducing costs, which inherently encourages addressing access for all patient populations. Hospitals are responding by expanding telehealth services to rural areas and investing in community health worker programs, aiming to bridge gaps in care. These efforts directly shape how hospitals engage with their communities and design their service offerings.

Consumer Expectations and Patient Experience

Consumer expectations in healthcare are rapidly shifting towards greater transparency and convenience. Patients now anticipate seamless digital access to health records and appointment scheduling, mirroring experiences in other service industries. For instance, a 2024 survey indicated that over 70% of patients prefer online portals for managing their healthcare, influencing their choice of providers.

The emphasis on patient experience is paramount, with satisfaction scores and online reviews acting as significant drivers of reputation and patient acquisition. Hospitals are increasingly judged not just on clinical outcomes but on the overall journey, from initial contact to post-treatment follow-up. In 2025, patient testimonials and star ratings on platforms like Healthgrades are becoming as influential as physician referrals for many individuals.

- Digital Engagement: Over 70% of patients in 2024 preferred digital platforms for healthcare management.

- Reputation Influence: Patient satisfaction scores and online reviews significantly impact provider choice.

- Personalized Care: Growing demand for tailored healthcare solutions and communication.

- Transparency: Consumers expect clear information on pricing and treatment options.

Lifestyle Trends and Public Health Behaviors

Lifestyle trends significantly impact public health, directly influencing the demand for healthcare services. For instance, rising rates of obesity and sedentary lifestyles in many developed nations, including the US, are driving an increase in chronic conditions like diabetes and cardiovascular disease. In 2023, the CDC reported that approximately 42.4% of US adults had obesity, a figure that has been steadily climbing.

These shifts in public health behaviors necessitate adjustments in healthcare provision and preventative strategies. Hospitals are seeing a greater influx of patients requiring management for these lifestyle-related illnesses, prompting a focus on community outreach programs promoting healthy eating and physical activity. The economic burden of these conditions is substantial, with the CDC estimating that obesity-related healthcare costs reached $177 billion in 2022.

- Rising Obesity Rates: US adult obesity prevalence was 42.4% in 2023, up from 41.9% in 2020, according to the CDC.

- Increased Chronic Disease Burden: Lifestyle factors contribute to conditions like type 2 diabetes, heart disease, and certain cancers, requiring ongoing medical management.

- Shift in Healthcare Demand: An aging population combined with lifestyle-driven illnesses is increasing the demand for services like cardiac care, diabetes management, and rehabilitation.

- Public Health Interventions: Growing awareness of these trends spurs investment in preventative health campaigns and wellness programs, aiming to curb future healthcare costs.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and patient empowerment. This shift means individuals are more proactive in managing their health, seeking information and engaging with healthcare providers earlier. For example, by 2025, wearable health tech adoption is expected to further fuel this trend, providing users with real-time health data that influences their healthcare decisions and demands more personalized interventions from providers.

Technological factors

The surge in telehealth and virtual care is fundamentally reshaping healthcare delivery. By 2024, it's projected that telehealth utilization will remain significantly elevated compared to pre-pandemic levels, with an estimated 30% of all healthcare services potentially delivered virtually. This trend directly impacts Community Health Systems (CHS) by offering new avenues to serve patients, especially in its rural markets, potentially lowering the need for some in-person visits.

This digital shift necessitates substantial investment in robust IT infrastructure and ongoing staff training to ensure seamless virtual consultations and effective remote patient monitoring. For CHS, adapting to this technological advancement is crucial for maintaining competitive access and operational efficiency in an evolving healthcare landscape.

The widespread adoption of Electronic Health Records (EHR) is fundamentally reshaping healthcare operations, with an estimated 90% of US physicians using certified EHR technology as of 2023. This digital transformation enhances patient data management and interoperability, crucial for seamless care coordination and improved clinical decision-making.

Leveraging data analytics from these EHR systems offers significant opportunities for operational optimization and identifying population health trends. For instance, in 2024, healthcare organizations are increasingly using predictive analytics to identify at-risk patient populations, leading to more targeted interventions and potentially reducing hospital readmissions by up to 15% in pilot programs.

However, the increasing reliance on EHRs necessitates robust cybersecurity measures. The healthcare sector continues to be a prime target for cyberattacks, with data breaches in 2024 exposing millions of patient records, underscoring the critical importance of investing in advanced security protocols to protect sensitive health information.

Technological advancements in medical devices are rapidly reshaping healthcare delivery. Innovations like AI-powered diagnostic tools, minimally invasive surgical robots, and high-resolution imaging equipment are becoming standard. For instance, the global surgical robotics market was valued at approximately $6.8 billion in 2023 and is projected to reach $19.4 billion by 2030, indicating substantial investment and adoption.

Hospitals and healthcare providers must continually invest in these cutting-edge technologies to maintain a competitive edge and offer superior patient care. This integration often requires significant capital outlay for new equipment and extensive training for medical staff to ensure effective utilization. Staying abreast of these developments is no longer optional but a necessity for operational excellence.

Artificial Intelligence (AI) and Machine Learning in Healthcare

Artificial Intelligence (AI) and machine learning are rapidly transforming healthcare. Predictive analytics, powered by AI, are showing promise in forecasting patient outcomes, with some studies suggesting improved accuracy in identifying high-risk patients. For instance, AI algorithms are being developed to predict sepsis onset days in advance, potentially saving lives.

Personalized medicine is another key area where AI is making strides. By analyzing vast datasets of genetic information, lifestyle factors, and treatment responses, AI can help tailor treatments to individual patients, leading to more effective therapies and fewer side effects. This approach is particularly impactful in oncology, where AI assists in selecting the most appropriate treatment regimens.

Administrative tasks within hospitals are also being automated by AI, freeing up healthcare professionals to focus more on patient care. This includes streamlining appointment scheduling, managing medical records, and processing insurance claims. The global healthcare AI market is projected to grow significantly, with estimates suggesting it could reach tens of billions of dollars in the coming years, reflecting the substantial investment and expected returns.

Furthermore, AI is accelerating drug discovery and development. Machine learning models can analyze molecular structures and biological pathways to identify potential drug candidates much faster than traditional methods. This has the potential to reduce the time and cost associated with bringing new treatments to market.

- AI in healthcare is projected to reach $100 billion by 2028, according to some market reports.

- AI can reduce hospital readmission rates by up to 15% in certain patient populations through predictive analytics.

- Drug discovery timelines could be shortened by as much as 40% with the effective use of AI.

- Administrative automation via AI could save the US healthcare system billions annually in operational costs.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for CHS, especially given the increasing sophistication of cyber threats targeting healthcare. Protecting sensitive patient information from breaches is not just a regulatory necessity, like adhering to HIPAA, but also crucial for maintaining patient trust and operational continuity. The healthcare sector experienced a significant rise in ransomware attacks, with a reported 76% increase in attacks targeting healthcare organizations in 2023 compared to 2022, leading to substantial financial and operational disruptions.

CHS must continuously invest in advanced security infrastructure to safeguard against these evolving threats. Failure to do so can result in severe consequences, including hefty fines, reputational damage, and loss of patient confidence. For instance, the average cost of a healthcare data breach reached $10.93 million in 2023, a figure that underscores the financial imperative for robust cybersecurity.

- Growing Threat Landscape: Cyberattacks on healthcare organizations are becoming more frequent and severe, with ransomware and data breaches posing significant risks.

- Regulatory Compliance: Strict adherence to regulations such as HIPAA is mandatory, requiring comprehensive data protection measures to avoid penalties.

- Financial and Reputational Impact: Data breaches can lead to substantial financial losses, including regulatory fines, legal costs, and remediation expenses, alongside severe damage to an organization's reputation.

- Investment in Security: Continuous investment in cybersecurity infrastructure, including advanced threat detection, data encryption, and employee training, is essential for mitigating these risks.

Technological advancements are rapidly transforming healthcare delivery, with telehealth and AI becoming integral components. By 2024, telehealth is expected to remain a significant part of healthcare, potentially accounting for 30% of services. AI is also revolutionizing the field, with the global healthcare AI market projected for substantial growth, potentially reaching tens of billions of dollars. These innovations demand significant investment in IT infrastructure and staff training to ensure effective implementation and patient care.

| Technology Area | 2023/2024 Data Point | Projected Impact/Growth |

|---|---|---|

| Telehealth Utilization | Remains significantly elevated compared to pre-pandemic levels; potentially 30% of services delivered virtually in 2024. | Expands patient access, especially in rural areas, and can lower some in-person visit needs. |

| Electronic Health Records (EHR) Adoption | Approximately 90% of US physicians used certified EHR technology in 2023. | Enhances data management, interoperability, and clinical decision-making; predictive analytics can reduce readmissions by up to 15%. |

| Surgical Robotics Market | Valued at approximately $6.8 billion in 2023. | Projected to reach $19.4 billion by 2030, indicating significant adoption of advanced medical devices. |

| AI in Healthcare | Global market projected for significant growth, potentially reaching tens of billions of dollars. | AI can improve diagnostic accuracy, personalize medicine, automate administrative tasks, and accelerate drug discovery by up to 40%. |

| Cybersecurity Threats | 76% increase in ransomware attacks on healthcare organizations in 2023 vs. 2022. | Average cost of a healthcare data breach reached $10.93 million in 2023, necessitating robust security investments. |

Legal factors

Healthcare providers like Community Health Systems (CHS) must navigate a dense network of federal and state regulations. This includes ensuring compliance with standards for licensing, quality of care, and patient privacy under laws like HIPAA. For instance, in 2023, the Centers for Medicare & Medicaid Services (CMS) finalized rules impacting reimbursement and operational requirements for hospitals.

Failure to adhere to these complex rules can result in severe penalties. CHS, like other hospital systems, faces risks of substantial fines, potential loss of accreditation crucial for patient services, and costly legal battles stemming from non-compliance. These regulatory challenges demand constant vigilance and adaptation.

The healthcare regulatory environment is dynamic, requiring continuous monitoring and strategic adjustments. As of early 2024, ongoing discussions and proposed legislation around healthcare pricing transparency and data security are key areas that will likely shape future compliance efforts for organizations like CHS.

The Health Insurance Portability and Accountability Act (HIPAA) and similar state privacy laws are critical legal considerations for any healthcare organization, including Community Health Systems (CHS). These regulations govern the collection, storage, and sharing of patient health information, demanding strict adherence to protect sensitive data.

Failure to comply with HIPAA can result in substantial financial penalties; for instance, violations in 2023 alone led to over $3.7 million in HIPAA settlements. CHS must maintain robust data security protocols to prevent breaches and safeguard patient trust, a paramount concern in the digital age.

Anti-Kickback and Stark Laws are pivotal federal regulations aimed at curbing fraud and abuse within government healthcare programs. These statutes strictly forbid offering or accepting remuneration to induce referrals of services paid for by federal healthcare programs and restrict physicians from referring patients for certain designated health services to entities with which they or their immediate family members have a financial relationship. For instance, the Centers for Medicare & Medicaid Services (CMS) actively enforces these laws, and violations can lead to substantial civil monetary penalties and criminal prosecution. In 2023 alone, the Department of Justice announced numerous settlements related to kickback allegations, highlighting the ongoing scrutiny.

Antitrust and Competition Laws

Antitrust and competition laws significantly shape strategic growth for large hospital systems like Community Health Systems (CHS). Regulators closely examine mergers and acquisitions to prevent undue market concentration that could lead to higher prices or reduced quality of care for patients. For instance, in 2024, the Federal Trade Commission (FTC) continued its robust scrutiny of healthcare consolidation, issuing guidance that signals a heightened focus on transactions that could harm competition.

These legal frameworks require CHS to carefully consider the competitive landscape when pursuing growth through acquisitions or partnerships. Failure to comply can result in blocked deals or divestitures, impacting long-term strategic objectives. The ongoing enforcement actions underscore the importance of proactive legal review for any proposed consolidation.

- Regulatory Scrutiny: Antitrust laws empower agencies like the FTC and Department of Justice to review and potentially block mergers that could create monopolies.

- Consumer Protection: The primary goal is to ensure fair competition, which ultimately benefits consumers through lower prices and better service options.

- Impact on Growth: CHS must integrate antitrust considerations into its M&A strategy to navigate potential legal challenges and ensure successful expansion.

- 2024 Enforcement Trends: Increased regulatory focus on healthcare deals in 2024 means CHS must be particularly diligent in assessing the competitive impact of its proposed transactions.

Malpractice and Liability Risks

Malpractice and liability risks are a significant concern for hospitals, directly stemming from medical errors, negligence, and patient harm. These incidents can trigger costly malpractice lawsuits, impacting both financial stability and reputation. For instance, in 2023, the average medical malpractice jury award reached approximately $1.2 million, highlighting the substantial financial exposure.

To counter these threats, robust risk management programs and stringent quality assurance protocols are essential. Hospitals must also maintain adequate liability insurance coverage. In 2024, healthcare organizations are increasingly investing in advanced patient safety technologies and training to minimize preventable errors.

- Medical Malpractice Claims: The US Tort Claims Act governs claims against federal healthcare providers, with reported settlements often in the millions.

- Liability Insurance Costs: Premiums for medical malpractice insurance can represent a significant operational expense for healthcare facilities, often running into hundreds of thousands or millions annually depending on size and specialty.

- Patient Safety Impact: A direct correlation exists between enhanced patient safety measures and reduced legal liability; hospitals with lower rates of adverse events typically face fewer malpractice claims.

- Regulatory Scrutiny: Government agencies like the Centers for Medicare & Medicaid Services (CMS) impose penalties for patient safety failures, indirectly increasing liability concerns.

Legal factors significantly influence Community Health Systems (CHS) operations, particularly concerning compliance with healthcare regulations. Laws like HIPAA mandate strict patient data privacy, with violations in 2023 resulting in over $3.7 million in settlements. Additionally, federal statutes such as the Anti-Kickback and Stark Laws are actively enforced by CMS, aiming to prevent fraud and abuse in government healthcare programs, with numerous DOJ settlements occurring in 2023 related to these statutes.

Antitrust laws, enforced by agencies like the FTC, are critical for CHS's growth strategies, especially regarding mergers and acquisitions. The FTC's heightened scrutiny in 2024 signals a strong focus on preventing market concentration that could harm consumers. CHS must integrate these antitrust considerations into its M&A planning to navigate potential legal challenges and ensure successful expansion.

Malpractice and liability risks are inherent in healthcare. The average medical malpractice jury award in 2023 was approximately $1.2 million, underscoring the financial exposure. CHS must invest in patient safety technologies and robust risk management programs to mitigate these risks and reduce liability. Continued investment in advanced patient safety technologies in 2024 aims to minimize preventable errors.

| Legal Area | Key Regulations/Laws | 2023/2024 Impact/Data | CHS Relevance |

|---|---|---|---|

| Patient Privacy | HIPAA | Over $3.7M in HIPAA settlements in 2023 | Mandates strict data protection and privacy protocols |

| Fraud & Abuse | Anti-Kickback Statute, Stark Law | Active DOJ enforcement, numerous settlements in 2023 | Requires strict adherence to prevent illegal referrals and financial relationships |

| Market Competition | Antitrust Laws (FTC/DOJ) | Heightened FTC scrutiny on healthcare deals in 2024 | Impacts M&A strategy and potential for market concentration |

| Medical Liability | State Tort Laws, Malpractice Insurance | Average malpractice jury award ~$1.2M in 2023 | Necessitates robust risk management and patient safety initiatives |

Environmental factors

Climate change is increasingly impacting public health, a critical consideration for hospitals. We're seeing a rise in heat-related illnesses, with the World Health Organization reporting that between 2030 and 2050, climate change is expected to cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea and heat stress. Hospitals must adapt their services to treat these conditions, which may present as new or more frequent patient cases.

Beyond direct heat impacts, deteriorating air quality, often linked to climate change-induced wildfires and pollution, exacerbates respiratory problems. This means a greater demand for services treating asthma, COPD, and other lung conditions. For instance, in 2023, wildfire smoke from Canada led to significant air quality alerts across the US, increasing emergency room visits for respiratory issues.

Furthermore, shifting weather patterns can expand the geographical range of disease-carrying insects, leading to an increase in vector-borne diseases like West Nile virus and Lyme disease. Hospitals need robust public health surveillance and preparedness plans to manage these evolving infectious disease threats. Disaster preparedness for extreme weather events, such as hurricanes and floods, is also paramount, requiring updated emergency response protocols and resource allocation.

Healthcare facilities face increasing pressure to become more sustainable. For example, the U.S. healthcare sector's carbon footprint is significant, estimated to be around 8.5% of total U.S. greenhouse gas emissions as of 2023. This drives a need to reduce energy consumption, water usage, and waste generation.

Adopting green initiatives offers tangible benefits. Many hospitals are seeing cost savings through energy efficiency upgrades; Kaiser Permanente, for instance, reported saving millions annually on energy costs through their sustainability programs. Improved public image and compliance with evolving environmental regulations, such as those related to medical waste disposal, are also key drivers.

Responsible resource management is central to these efforts. This includes optimizing water use, which can be particularly impactful in facilities with high water demands for sterilization and laundry. Furthermore, effective waste reduction strategies, including recycling and proper disposal of hazardous materials, are critical for both environmental protection and operational efficiency in the healthcare industry.

Waste management and disposal regulations are a significant environmental factor for healthcare companies like CHS. These rules dictate the proper handling and disposal of medical waste, including hazardous and biohazardous materials, to prevent contamination and safeguard public health.

Compliance often necessitates specialized disposal services, which can represent a substantial operational cost. For instance, the U.S. Environmental Protection Agency (EPA) oversees regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste management. In 2023, the healthcare industry continued to grapple with the rising costs of medical waste disposal, with some estimates suggesting it can add 5-10% to overall operating expenses.

Natural Disasters and Emergency Preparedness

The increasing frequency and intensity of natural disasters, such as the record-breaking hurricane season in 2020 which saw 30 named storms, pose a significant threat to hospital infrastructure and operations. These events can disrupt power, water, and transportation, directly impacting a hospital's ability to provide continuous care. For instance, Hurricane Ida in 2021 caused widespread power outages across Louisiana, severely testing the resilience of healthcare facilities.

Robust emergency preparedness is therefore critical for hospitals. This involves developing comprehensive plans for patient and staff safety, maintaining essential supplies, and establishing clear communication protocols. In 2024, many hospitals are investing in backup power systems and redundant supply chains to mitigate the impact of such disruptions. Resilience and recovery planning are key components, ensuring that facilities can quickly resume operations after an event.

- Record Hurricane Season: 2020 saw 30 named storms, highlighting an upward trend in severe weather events.

- Infrastructure Impact: Natural disasters can cripple hospital services by damaging facilities and disrupting utilities.

- Preparedness Investment: Hospitals are enhancing backup power and supply chain resilience to ensure continuity of care.

- Recovery Planning: Effective recovery strategies are crucial for minimizing downtime and restoring services post-disaster.

Community Environmental Health Concerns

Hospitals increasingly recognize their role in addressing local environmental health concerns, such as air and water quality, which directly impact community well-being. For instance, in 2024, several urban hospitals partnered with local environmental agencies to monitor and mitigate air pollution hotspots, recognizing that respiratory illnesses are a significant driver of emergency room visits. This proactive engagement not only improves public health but also bolsters the hospital's image as a responsible community partner.

By actively participating in or leading environmental health initiatives, healthcare systems can foster stronger community ties and enhance their reputation. A 2025 survey indicated that 70% of patients consider a hospital's community involvement, including environmental stewardship, when choosing a healthcare provider. This commitment extends beyond direct patient care, reflecting a dedication to the overall welfare of the populations they serve.

- Mitigating Pollution: Hospitals can invest in renewable energy sources and waste reduction programs to lessen their environmental footprint, impacting local air and water quality.

- Water Quality Initiatives: Supporting or implementing local water purification projects can directly address a critical health determinant for surrounding communities.

- Community Partnerships: Collaborating with local government and non-profits on environmental clean-ups or advisories enhances public health and hospital reputation.

- Health Impact Assessments: Conducting assessments to understand how local environmental factors affect patient health can guide targeted interventions and community support.

Environmental factors significantly influence healthcare operations and public health outcomes. Climate change drives an increase in heat-related illnesses and respiratory conditions due to poor air quality, as seen with wildfire smoke impacting emergency room visits in 2023. Shifting weather patterns also expand the range of vector-borne diseases, necessitating robust preparedness plans for hospitals. The healthcare sector's substantial carbon footprint, estimated at 8.5% of U.S. greenhouse gas emissions in 2023, compels a move towards sustainability for cost savings and regulatory compliance.

Waste management and disposal regulations, governed by bodies like the EPA, are critical. These rules impact operational costs, with medical waste disposal potentially adding 5-10% to expenses in 2023. Natural disasters, like the record 30 named storms in 2020, pose threats to infrastructure, driving investments in resilient systems and emergency preparedness for 2024. Hospitals are also engaging in local environmental health initiatives, with 70% of patients in a 2025 survey considering environmental stewardship when choosing a provider.

| Environmental Factor | Impact on Hospitals | Data Point/Example |

|---|---|---|

| Climate Change & Health | Increased demand for treating heat-related and respiratory illnesses. | WHO: 250,000 additional deaths annually from climate-related causes (2030-2050 projection). |

| Air Quality | Exacerbates respiratory problems, leading to higher ER visits. | 2023 wildfire smoke incidents caused significant air quality alerts and increased respiratory ER visits. |

| Vector-Borne Diseases | Expansion of disease-carrying insect ranges requires better surveillance. | Increased incidence of West Nile virus and Lyme disease. |

| Sustainability & Carbon Footprint | Pressure to reduce energy, water, and waste; potential cost savings. | U.S. healthcare sector's carbon footprint: ~8.5% of total U.S. greenhouse gas emissions (2023). |

| Waste Management Regulations | Compliance costs for hazardous and biohazardous materials. | Medical waste disposal costs can add 5-10% to hospital operating expenses (2023 estimate). |

| Natural Disasters | Disruption of infrastructure and operations; need for resilience. | 2020 saw 30 named storms, highlighting increased severe weather frequency. |

| Community Environmental Health | Reputational enhancement and patient preference for environmentally conscious providers. | 70% of patients consider environmental stewardship when choosing a hospital (2025 survey). |

PESTLE Analysis Data Sources

Our CHS PESTLE Analysis draws from a comprehensive blend of official government publications, reputable economic databases, and leading industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in accurate and current data.