CHS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHS Bundle

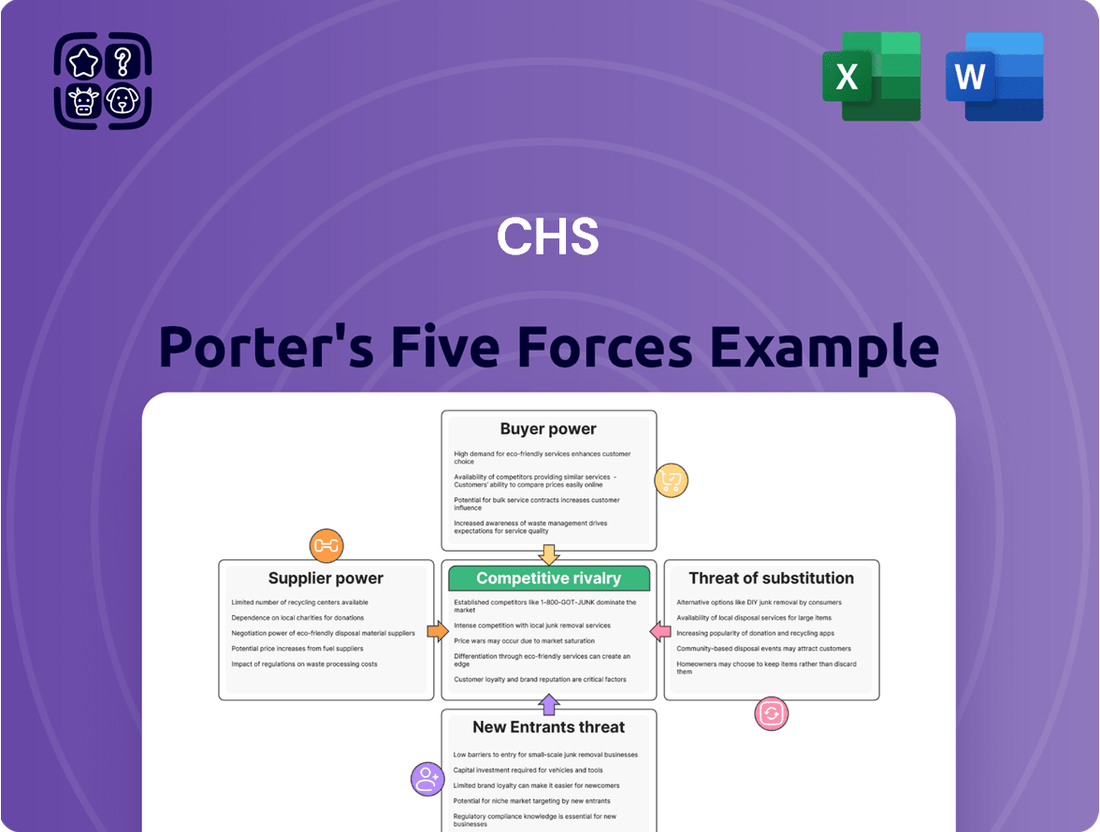

CHS operates within a dynamic agricultural landscape shaped by powerful market forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CHS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The healthcare industry often faces a situation where a small number of specialized medical suppliers hold considerable sway. This is particularly true for high-tech medical equipment and patented drugs, where a few manufacturers dominate the market. For a hospital system like CHS, this concentration means these suppliers have significant bargaining power.

Hospitals frequently find themselves reliant on these few dominant players for critical medical devices and pharmaceuticals. The limited availability of viable alternatives, coupled with the substantial costs associated with switching suppliers, reinforces the suppliers' leverage. For instance, in 2024, the market for advanced robotic surgical systems is largely controlled by a handful of companies, making it difficult for hospitals to negotiate lower prices on these essential, high-cost technologies.

The shortage of skilled healthcare professionals, particularly nurses and physicians, significantly bolsters their bargaining power. This scarcity means healthcare facilities must compete fiercely for talent, often leading to higher compensation packages and improved benefits to attract and retain these vital workers.

In 2024, the U.S. faced a projected deficit of over 100,000 physicians by 2030, and nursing shortages remain critical, with some estimates suggesting millions of unfilled positions by 2027. These numbers directly translate to increased labor costs for hospitals and healthcare systems as they vie for a limited pool of qualified individuals.

Suppliers possessing proprietary technology, such as patents for critical drugs or unique medical devices, wield significant bargaining power. This is particularly true when there are no readily available substitutes for these essential inputs. For instance, a pharmaceutical company holding exclusive patents for a life-saving medication used by CHS hospitals can command premium pricing. In 2024, the average price increase for patented drugs in the US saw a notable jump, with some specialty medications experiencing double-digit percentage hikes, directly impacting healthcare providers like CHS.

High Switching Costs for Integrated Systems

When core IT systems, like electronic health records (EHR) platforms, or specialized medical equipment are deeply integrated, switching to a new provider becomes a significant undertaking. The costs associated with this transition are substantial, encompassing not just the purchase of new technology but also extensive employee training and the inevitable operational disruption during the changeover. For instance, a 2024 report indicated that the average cost for a hospital to switch EHR systems can range from $1 million to over $10 million, depending on the hospital's size and complexity.

These high switching costs effectively lock in customers, giving incumbent technology and equipment suppliers considerable leverage. This power is amplified because the disruption isn't just financial; it impacts patient care continuity and data integrity, making the decision to switch incredibly sensitive. Consequently, suppliers of these integrated systems can often command higher prices and dictate more favorable terms due to the difficulty and expense customers face in finding and implementing alternatives.

- Substantial Financial Investment: Implementing new EHR systems or specialized equipment can cost millions, impacting budgets significantly.

- Extensive Training Requirements: Staff need to be retrained on new platforms, adding to both time and financial burdens.

- Operational Disruption: The transition period can lead to reduced efficiency and potential impacts on patient care delivery.

- Data Migration Challenges: Moving patient data securely and accurately to a new system is complex and costly.

Group Purchasing Organization (GPO) Influence

CHS's participation in Group Purchasing Organizations (GPOs) is a key strategy to bolster its bargaining power with suppliers. These GPOs consolidate the purchasing needs of numerous healthcare providers, creating a larger, more attractive customer base for suppliers. For instance, in 2024, the healthcare GPO market was projected to facilitate billions of dollars in purchasing volume.

However, the actual negotiation strength within a GPO can differ. While GPOs negotiate on behalf of their members, the effectiveness of these deals depends on the GPO's size, the specific product category, and the concentration of suppliers. For highly specialized medical equipment or pharmaceuticals, where supplier options are limited, even a large GPO might find its leverage somewhat diminished, leaving individual hospitals to navigate remaining power imbalances.

- GPO Aggregation: GPOs enhance purchasing power by pooling demand from multiple healthcare organizations like CHS.

- Negotiation Effectiveness: The success of GPO negotiations varies based on market dynamics for specific products.

- Specialized Product Gaps: For niche or high-demand items not fully covered by GPO contracts, individual hospitals may still face supplier leverage.

- Market Data: The broader GPO market in 2024 represented a significant volume of healthcare procurement, influencing supplier terms.

Suppliers in the healthcare sector, especially those providing specialized medical equipment or patented pharmaceuticals, often hold significant bargaining power. This is due to factors like limited competition, high switching costs for providers, and the critical nature of their products. For example, in 2024, the market for advanced diagnostic imaging equipment is dominated by a few global manufacturers, allowing them to dictate terms.

The concentration of suppliers and the proprietary nature of their offerings mean healthcare systems like CHS must often accept prevailing prices and terms. The difficulty and expense involved in transitioning to alternative suppliers, coupled with the potential for operational disruption, further entrenches this supplier leverage. In 2024, the average cost for a hospital to switch core IT systems, like EHRs, was estimated to be between $1 million and $10 million, underscoring these high switching costs.

| Factor | Impact on Supplier Bargaining Power | Example (2024 Data) |

|---|---|---|

| Supplier Concentration | High when few suppliers dominate a market | Robotic surgery systems market controlled by a few key players |

| Switching Costs | High when integration and training are extensive | EHR system transitions costing millions and causing disruption |

| Proprietary Technology | High for patented drugs or unique equipment | Pharmaceuticals with exclusive patents commanding premium prices |

| Essential Nature of Product | High for life-saving or critical care items | Limited alternatives for specialized life-saving medications |

What is included in the product

This analysis dissects the competitive forces impacting CHS, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, enabling proactive strategic adjustments.

Customers Bargaining Power

The bargaining power of customers is amplified by the dominance of large insurance payers in the healthcare landscape. Major private health insurers and government programs like Medicare and Medicaid are significant revenue sources for Community Health Systems (CHS). In 2023, Medicare and Medicaid accounted for approximately 57% of CHS’s net service revenue, highlighting their considerable influence.

These powerful payers possess the ability to steer patient admissions, negotiate reimbursement rates, and dictate the scope of covered medical services. This leverage allows them to exert substantial pressure on hospital pricing and the range of services CHS can offer, effectively limiting the system's pricing flexibility.

Price transparency in healthcare is on the rise, giving patients more power. For instance, in 2024, many hospitals began publishing their prices for common procedures, allowing consumers to shop around. This increased visibility means patients are more likely to choose providers based on both cost and perceived quality, especially for non-emergency services.

For non-emergency procedures, patients increasingly have the ability to choose among various hospitals or specialized outpatient centers within their geographic area. This growing patient mobility, particularly noticeable in competitive urban markets, directly diminishes Community Health Systems (CHS) leverage in dictating prices unilaterally.

In 2024, the healthcare landscape continued to see a rise in patient choice, with many individuals actively comparing providers based on cost, quality, and convenience for elective treatments. This trend is supported by data indicating that patients are more willing to travel for better value or specialized care, putting pressure on established providers like CHS to remain competitive on pricing and service offerings.

Influence of Employer-Sponsored Health Plans

Large employers, leveraging their substantial health plans, wield considerable influence over patient choice and, consequently, hospital revenue. By designing provider networks and offering incentives, they can steer significant patient volumes toward specific healthcare systems. This collective bargaining power compels hospitals like CHS to negotiate competitive pricing and prove their value proposition to maintain preferred provider status within these employer networks.

In 2024, the landscape of employer-sponsored health insurance continues to be a dominant force in healthcare utilization. For instance, data from the Kaiser Family Foundation's Employer Health Benefits Survey in 2023 indicated that approximately 49% of the nonelderly population (under 65) had coverage through an employer. This significant portion of the market means that CHS must actively engage with large employers to secure favorable contract terms.

- Employer Network Dominance: Large employers' health plans often dictate patient flow, impacting hospital admissions and service utilization.

- Rate Negotiation Leverage: The sheer number of covered lives allows employers to negotiate lower reimbursement rates, pressuring providers like CHS.

- Value-Based Care Incentives: Employers increasingly tie reimbursement to quality outcomes and cost-efficiency, requiring CHS to demonstrate superior performance.

- Network Access as a Prerequisite: Inclusion in key employer networks is often a prerequisite for attracting and retaining a substantial patient base.

Severity of Illness and Emergency Needs

In critical care scenarios, the bargaining power of customers, meaning patients and their families, is drastically reduced. The urgency of life-threatening conditions or severe illnesses leaves little room for negotiation or comparison shopping, as immediate treatment is paramount.

CHS (Community Health Systems) likely sees a lower impact from customer bargaining power in its emergency and critical care services. For instance, in 2024, a significant portion of hospital revenue often stems from these high-acuity services, where price sensitivity is minimal due to the life-or-death nature of the need.

- Reduced Negotiation: Patients in emergencies have little leverage to negotiate prices or demand specific terms.

- Lack of Alternatives: The immediate need often means accepting care from the nearest available facility, limiting choices.

- Revenue Mix Impact: CHS’s overall financial health is influenced by the proportion of revenue generated from emergency/critical care versus elective procedures, where customer power is more pronounced.

The bargaining power of customers is a significant factor for Community Health Systems (CHS), particularly with large payers like government programs and private insurers who account for a substantial portion of revenue. For example, in 2023, Medicare and Medicaid represented about 57% of CHS's net service revenue, giving these entities considerable leverage in negotiating reimbursement rates and influencing service offerings.

This power allows major payers to dictate terms, impacting CHS's pricing flexibility and the range of services it can provide. Furthermore, increasing price transparency in 2024, where hospitals began publishing procedure costs, empowers individual patients to compare providers based on cost and quality, especially for elective services, thereby reducing CHS's unilateral pricing control.

Large employers also exert considerable influence by shaping patient choice through their health plans and offering incentives. In 2023, nearly half of the non-elderly population had employer-sponsored insurance, meaning CHS must actively negotiate with these employers to secure favorable contracts and maintain patient volume.

| Customer Group | Influence Factor | Impact on CHS | 2023/2024 Data Point |

|---|---|---|---|

| Government Payers (Medicare/Medicaid) | Significant revenue share, rate negotiation | Limits pricing flexibility, influences service scope | 57% of CHS net service revenue |

| Large Employers | Network design, incentive programs | Drives patient volume, necessitates competitive pricing | ~49% of non-elderly population insured |

| Individual Patients (Elective Services) | Price transparency, choice of providers | Increases competition, requires focus on value | Growing trend in 2024 for cost comparison |

What You See Is What You Get

CHS Porter's Five Forces Analysis

This preview showcases the complete CHS Porter's Five Forces Analysis, providing a detailed examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that this professionally formatted analysis is ready for your immediate use and strategic planning.

Rivalry Among Competitors

CHS faces robust competition from major for-profit health systems such as HCA Healthcare and Tenet Healthcare. These entities, along with large non-profit hospital networks, command significant market presence and financial clout.

In 2024, HCA Healthcare reported revenues exceeding $60 billion, underscoring the scale of its operations and its capacity to invest in market expansion and patient acquisition. This competitive intensity forces CHS to continually innovate and optimize its service offerings to maintain its market position.

Many local and regional healthcare markets are seeing fewer, larger players emerge as consolidation continues. This trend intensifies rivalry, as these dominant entities compete fiercely for patient volume and physician loyalty, sometimes sparking price wars or aggressive marketing campaigns.

Hospitals operate with significant fixed costs, including expensive medical equipment and large facilities, which necessitates a focus on maintaining high patient volumes to spread these costs effectively and achieve profitability. For instance, the average hospital capital expenditure in the U.S. for 2023 was estimated to be around $8.5 billion, highlighting the substantial investment required.

These high fixed costs, coupled with substantial exit barriers such as specialized, non-transferable equipment and strong community ties, mean that existing hospitals are highly motivated to remain operational. This often leads to intense competition as they fight to maintain market share, even when facing economic headwinds or declining patient numbers, as seen in the sustained competitive intensity across many regional healthcare markets.

Service Line Specialization and Differentiation

Competitive rivalry in the healthcare sector, particularly for Community Health Systems (CHS), is heavily influenced by service line specialization and differentiation. Hospitals and health systems actively compete by honing their expertise in specific medical areas such as cardiology, oncology, or orthopedics. This focus allows them to attract patients seeking specialized care and often leads to better patient outcomes.

Advanced technology and a commitment to high-quality patient outcomes are critical differentiators. For instance, a hospital investing in the latest robotic surgery equipment or achieving top-tier accreditation for its cancer center can significantly stand out. Similarly, a superior patient experience, from initial contact to post-treatment follow-up, becomes a powerful competitive advantage. CHS, especially in its non-urban markets where it might be the sole or primary provider, must consistently invest in these differentiating factors to retain its patient base and attract new ones. This is particularly relevant as larger, more specialized health systems can draw patients from further afield.

- Service Specialization: Competitors differentiate by focusing on high-demand service lines like cardiology, oncology, and orthopedics.

- Technological Advancement: Investment in cutting-edge medical technology, such as advanced imaging or robotic surgery, serves as a key differentiator.

- Quality Outcomes: Demonstrable high-quality patient outcomes, often backed by accreditations and performance metrics, attract patients.

- Patient Experience: A focus on patient satisfaction, ease of access, and compassionate care is a crucial element in the competitive landscape.

Physician Alignment and Recruitment

Competitive rivalry for skilled physicians is intense, as these professionals are key drivers of patient referrals and service volume. Hospitals are actively vying for top medical talent, employing strategies like direct employment, strategic affiliations, and collaborative joint ventures. This competition directly shapes market share and a hospital's overall clinical service offerings.

In 2024, the demand for specialized physicians, particularly in areas like cardiology and orthopedics, continued to outstrip supply in many regions. For instance, a 2024 report indicated a national physician shortage projected to worsen, with an estimated deficit of up to 124,000 physicians by 2034 according to the AAMC. This scarcity intensifies the recruitment efforts and associated costs for healthcare systems.

- Physician Demand: High demand for specialists, especially in high-revenue service lines, fuels intense competition.

- Recruitment Costs: Hospitals often offer significant signing bonuses and relocation packages, driving up recruitment expenses. In 2024, average physician recruitment costs were reported to be upwards of $250,000 per physician, varying by specialty.

- Retention Strategies: Beyond compensation, hospitals focus on professional development, work-life balance, and hospital culture to retain physicians.

- Impact on Market Share: A strong physician network directly translates to increased patient volume and a more robust market position.

Competitive rivalry is fierce, with major players like HCA Healthcare and Tenet Healthcare wielding significant market power, as evidenced by HCA's 2024 revenue exceeding $60 billion. This intense competition, driven by high fixed costs and the need for patient volume, forces CHS to continually innovate and optimize its services.

Consolidation is leading to fewer, larger entities dominating local markets, intensifying the battle for patients and physicians, sometimes resulting in price wars. Hospitals must differentiate through service specialization, technological investment, and superior patient experience to maintain their competitive edge.

The competition for skilled physicians is particularly acute, exacerbated by a projected national shortage of up to 124,000 physicians by 2034, according to AAMC data. This scarcity drives up recruitment costs, with average expenses in 2024 exceeding $250,000 per physician, necessitating robust retention strategies beyond compensation.

| Competitor | 2024 Revenue (Est.) | Key Differentiators |

|---|---|---|

| HCA Healthcare | >$60 billion | Scale, Market Presence, Financial Clout |

| Tenet Healthcare | $19.3 billion (2023) | Network Size, Service Line Breadth |

| Large Non-Profit Networks | Varies Significantly | Community Focus, Philanthropic Funding, Brand Reputation |

SSubstitutes Threaten

The increasing prevalence of outpatient and ambulatory care centers presents a substantial threat to Community Health Systems (CHS). Many procedures historically requiring hospital stays are now efficiently and affordably managed in these alternative settings. For instance, data from 2024 indicates a continued upward trend in same-day surgeries, with many common procedures like cataract removal and colonoscopies increasingly shifting away from inpatient hospital care.

This migration directly impacts CHS's core inpatient revenue streams, especially for elective surgeries and less critical medical needs. As these centers grow, they offer patients more convenient and often less expensive options, directly competing with CHS's traditional hospital services and potentially eroding market share for routine procedures.

The growing availability of telehealth and virtual care services presents a significant threat of substitutes for Community Health Systems (CHS). These platforms provide accessible and often more affordable options for routine check-ups, managing ongoing health conditions, and remote patient monitoring, directly competing with traditional in-person visits.

While these virtual services may not fully replicate the comprehensive care offered by hospitals, they can certainly siphon off patient traffic from CHS's emergency rooms and outpatient clinics. For instance, by mid-2024, the telehealth market was projected to reach over $200 billion globally, indicating a substantial shift in how patients seek and receive care, potentially impacting CHS's patient volumes and revenue streams.

The increasing availability and acceptance of home healthcare and post-acute care facilities present a significant threat of substitutes for traditional hospital services. These alternatives offer more cost-effective solutions for patients needing ongoing care following a hospital discharge, aiming to reduce readmission rates and manage chronic conditions outside of the acute care environment. For instance, the U.S. home healthcare market was valued at approximately $136 billion in 2023 and is projected to grow, indicating a strong shift towards these substitute services.

Focus on Preventative Care and Wellness Programs

The increasing focus on preventative care and wellness programs, including population health management, presents a significant threat of substitutes for traditional hospital services. By keeping individuals healthier, these initiatives can reduce the need for acute inpatient care, potentially lowering hospital occupancy rates.

This trend is supported by growing evidence and investment. For instance, in 2024, the global wellness market was projected to reach over $5.6 trillion, indicating a substantial shift in consumer spending towards health maintenance rather than just treatment. Hospitals are increasingly exploring partnerships with wellness providers and developing their own preventative service lines to adapt to this evolving landscape.

- Reduced Demand for Acute Services: As more people engage in preventative measures, the volume of patients requiring emergency or complex inpatient treatments may decline.

- Shift in Healthcare Spending: A greater portion of healthcare budgets is being allocated to wellness and preventative services, diverting funds that might otherwise be spent on hospitalizations.

- Alternative Care Models: Telehealth, urgent care centers, and retail clinics are also emerging as substitutes, offering more convenient and often less expensive alternatives for non-life-threatening conditions, further fragmenting the market.

- Value-Based Care Incentives: Payment models that reward keeping patients healthy rather than treating illness naturally encourage a move away from high-cost, inpatient interventions.

Specialized Diagnostic and Imaging Centers

Freestanding diagnostic and imaging centers pose a significant threat to Community Health Systems (CHS) by offering specialized services like MRIs, CT scans, and laboratory tests outside of a traditional hospital setting. These centers often compete on price and convenience, directly impacting CHS’s ancillary revenue streams.

In 2024, the outpatient diagnostic imaging market continued to grow, with freestanding centers capturing a larger share. For instance, the market for diagnostic imaging services in the U.S. was projected to reach over $100 billion, with a notable portion attributed to non-hospital facilities due to their cost-effectiveness and patient-centric approach.

- Lower Costs: These centers typically operate with lower overhead than hospitals, allowing them to offer services at reduced prices, making them an attractive alternative for cost-conscious patients and insurers.

- Convenience and Accessibility: Many freestanding centers offer more flexible scheduling and easier access, often located in more convenient community settings, enhancing patient experience.

- Technological Advancements: These centers are often quick to adopt the latest imaging technology, ensuring high-quality diagnostics that can rival or even surpass hospital offerings.

The proliferation of outpatient and ambulatory care centers, alongside the expansion of telehealth and virtual care services, presents a substantial threat of substitutes to Community Health Systems (CHS). These alternatives offer more convenient, accessible, and often less expensive options for a range of medical needs, directly competing with CHS's traditional inpatient and clinic-based services.

Data from 2024 indicates a continued shift towards same-day surgeries and virtual consultations, impacting CHS's core revenue streams by siphoning off patient volumes for routine procedures and less critical care.

Furthermore, the growing home healthcare market and increased focus on preventative care and wellness programs also act as substitutes, reducing the demand for acute hospital interventions and diverting healthcare spending towards health maintenance rather than treatment.

| Substitute Type | 2023/2024 Data Point | Impact on CHS |

|---|---|---|

| Ambulatory Care Centers | Continued upward trend in same-day surgeries (2024) | Erodes inpatient revenue for elective procedures. |

| Telehealth/Virtual Care | Global market projected over $200 billion (mid-2024) | Siphons patient traffic from ERs and outpatient clinics. |

| Home Healthcare | U.S. market valued at approx. $136 billion (2023) | Offers cost-effective alternatives for post-acute care. |

| Preventative Care/Wellness | Global wellness market projected over $5.6 trillion (2024) | Reduces demand for acute inpatient care. |

| Freestanding Diagnostic Centers | U.S. diagnostic imaging market projected over $100 billion (2024) | Impacts ancillary revenue streams due to lower costs and convenience. |

Entrants Threaten

Establishing a new general acute care hospital demands substantial capital, often running into hundreds of millions of dollars. For instance, building a new hospital can cost anywhere from $300 million to over $1 billion, depending on size and location. This immense financial requirement for land acquisition, state-of-the-art medical equipment like MRI machines and surgical robots, and sophisticated IT infrastructure presents a formidable barrier to entry.

The healthcare sector presents significant barriers to new entrants due to a labyrinth of state and federal regulations. Obtaining necessary licenses, certifications, and accreditations is a complex and lengthy process, often requiring substantial investment and expertise. For instance, in 2024, navigating these requirements could easily add years to a new healthcare provider's establishment timeline, delaying revenue generation and increasing initial capital outlay.

Furthermore, Certificate of Need (CON) laws, which are active in about 35 states as of mid-2024, act as a formidable gatekeeper. These laws mandate that healthcare providers must demonstrate a public need before expanding services or building new facilities. This regulatory hurdle can effectively block new competitors, as existing providers often lobby against new entrants, highlighting the difficulty of overcoming entrenched interests and bureaucratic processes.

Established hospital systems like Community Health Systems (CHS) benefit from deeply ingrained brand reputations and extensive physician networks. These relationships, cultivated over years, foster significant patient loyalty and make it difficult for new entrants to gain traction. For instance, in 2024, CHS reported operating revenues of $12.9 billion, underscoring the scale and established market presence they command.

Economies of Scale in Purchasing and Operations

Large hospital systems, like HCA Healthcare, leverage significant economies of scale. In 2023, HCA reported total revenues of $62.5 billion, allowing them to negotiate substantial discounts on medical supplies and pharmaceuticals. For instance, bulk purchasing of critical medications can reduce per-unit costs by 10-20% compared to smaller, independent facilities. This purchasing power extends to technology and administrative overhead, creating a cost structure that is difficult for new entrants to replicate.

New hospitals or clinics entering the market face immediate disadvantages in operational costs. They cannot achieve the same per-unit savings on essential supplies or spread fixed administrative costs, such as IT infrastructure and management salaries, across a large patient volume. This disparity means new entrants must absorb higher operating expenses, impacting their pricing flexibility and profitability from the outset.

- Purchasing Power: Major hospital chains can secure lower prices for medical equipment and pharmaceuticals due to high-volume orders.

- Operational Efficiency: Centralized administrative functions and shared services reduce overhead costs per patient for established players.

- Technology Investment: Larger organizations can afford to invest in advanced, cost-saving technologies that are prohibitive for smaller new entrants.

- Negotiating Leverage: Established systems have greater leverage with suppliers, insurers, and service providers, leading to more favorable terms.

Access to Insurance Payer Networks

The threat of new entrants concerning access to insurance payer networks is significant for healthcare providers like CHS. Gaining inclusion and favorable terms within major insurance payer networks is absolutely critical for financial viability. New hospitals or healthcare systems may face considerable hurdles in securing these contracts initially. Payers often demonstrate a preference for established providers who can demonstrate consistent patient volumes and robust quality metrics, making it harder for newcomers to break in.

In 2024, the landscape of healthcare reimbursement continues to be dominated by a few large insurance payers. For instance, in the United States, the top five health insurance companies collectively cover a substantial majority of the insured population, creating concentrated bargaining power. This means that for a new entrant, negotiating favorable rates and network inclusion can be a lengthy and complex process, potentially delaying revenue generation and impacting overall profitability.

- Network Exclusion: New entrants may be excluded from key insurance networks, limiting their patient base and revenue streams.

- Negotiation Leverage: Established providers with proven track records and patient volumes often have stronger negotiating positions with payers.

- Contractual Hurdles: Securing contracts can involve extensive credentialing, quality reviews, and rate negotiations, all of which can be time-consuming and costly for new market participants.

- Market Concentration: The dominance of a few major payers in many regions means that access to a broad patient population is contingent on their approval.

The threat of new entrants in the hospital sector is significantly mitigated by the immense capital required for establishment, with new facilities often costing hundreds of millions of dollars. Regulatory hurdles, including licensing and Certificate of Need laws in many states, further complicate and delay market entry for potential competitors. Established players also benefit from strong brand loyalty, extensive physician networks, and economies of scale in purchasing and operations, making it difficult for newcomers to compete effectively on price or service.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building a new hospital can cost $300 million to over $1 billion. | Prohibitive initial investment |

| Regulations | Licensing, certifications, and CON laws (in ~35 states) create complex approval processes. | Significant delays and increased costs |

| Brand Loyalty & Networks | Established reputation and physician relationships foster patient retention. | Difficulty in attracting patients |

| Economies of Scale | Large systems (e.g., HCA Healthcare's $62.5 billion revenue in 2023) achieve lower per-unit costs. | Cost disadvantage for new entrants |

| Payer Networks | Securing favorable contracts with dominant insurance payers (top 5 cover majority of insured in US) is challenging. | Limited patient access and delayed revenue |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. This includes publicly available company filings, such as annual reports and SEC submissions, alongside industry-specific market research reports and trade publications. We also leverage macroeconomic data and economic indicators to provide a comprehensive understanding of the competitive landscape.