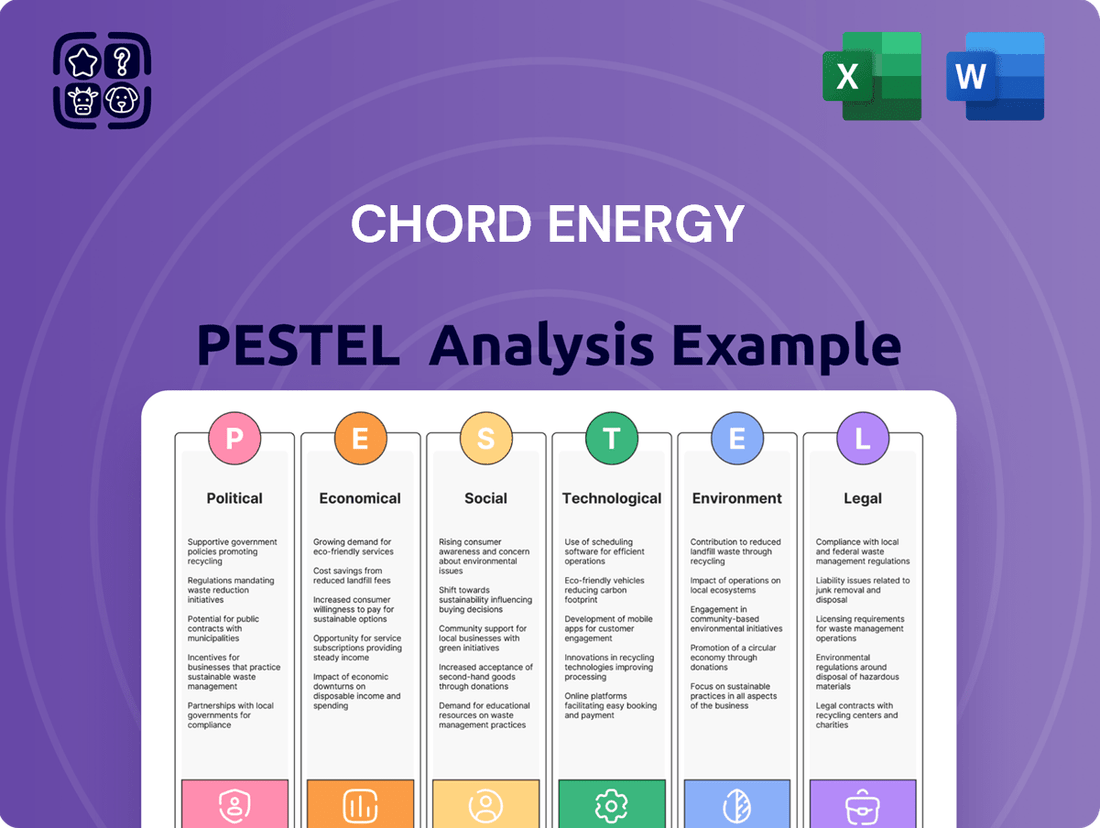

Chord Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chord Energy Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors that are actively shaping Chord Energy's operational landscape. Our meticulously researched PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and identify strategic opportunities. Don't navigate the complexities of the energy sector blind; download the full, actionable report now and gain a decisive advantage.

Political factors

Chord Energy's operations in the Williston Basin are heavily influenced by U.S. federal and state energy policies. A change in administration could alter climate and environmental regulations, potentially opening up more opportunities for oil and gas development on public lands or resuming paused LNG exports, which would likely benefit Chord Energy. For instance, in 2023, the U.S. produced an average of 12.9 million barrels of crude oil per day, showcasing the scale of the industry impacted by these policies.

Conversely, evolving regulations on emissions and environmental stewardship necessitate continuous adaptation and compliance investments from companies like Chord Energy. These regulations can affect operational costs and development strategies. For example, the Inflation Reduction Act of 2022 introduced new tax credits for clean energy but also included provisions that could impact fossil fuel production, creating a complex regulatory landscape.

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to exert significant influence on crude oil and natural gas markets. These events can lead to supply disruptions and price volatility, presenting both potential upside for producers like Chord Energy and considerable downside risks.

Heightened energy security concerns, particularly evident in Europe's efforts to diversify away from Russian supplies, are driving robust demand for U.S. liquefied natural gas (LNG) exports. This trend directly benefits companies operating in key U.S. natural gas basins, including the Williston Basin, impacting their production strategies and pricing power.

International trade policies, such as tariffs and trade agreements, directly influence the global demand and pricing for oil and gas, impacting Chord Energy's revenue streams and strategic planning. For instance, the U.S. exported approximately 8.9 million barrels per day of crude oil in January 2024, showcasing the significance of these policies on its export competitiveness.

Shifts in international trade relations can alter the cost-effectiveness of U.S. energy exports, including crude oil and liquefied natural gas (LNG). In 2023, U.S. LNG exports reached a record high of over 7.3 billion cubic feet per day, underscoring the substantial impact of favorable trade conditions on market access and volume.

Local and Regional Government Relations

Chord Energy's operations in North Dakota and Montana mean that state and local government relations are a significant political factor. This includes navigating regulations, permitting, and fostering good community ties, which are vital for uninterrupted development and operational approvals. For instance, in 2024, North Dakota's oil and gas industry continued to be shaped by state-level policies regarding production taxes and environmental standards, directly impacting Chord's cost structure and expansion plans.

Positive engagement with local authorities and communities is not just beneficial but essential for Chord Energy. These relationships facilitate the approval process for new projects and ensure that the company operates smoothly within the established legal and social frameworks. The company's commitment to community investment and transparent communication in 2024 likely played a role in securing permits and maintaining its social license to operate in key regions.

The regulatory landscape at both the state and local levels can significantly influence Chord Energy's ability to access resources and expand its footprint. Key areas of focus for 2024 and 2025 include environmental regulations, land use policies, and royalty structures, all of which are subject to governmental oversight and potential changes.

- State-Specific Regulations: North Dakota and Montana's evolving environmental and production regulations directly impact operational costs and compliance for Chord Energy.

- Permitting Processes: Timely and favorable permitting from local and regional governments is crucial for project development and expansion, with potential delays impacting production timelines.

- Community Relations: Maintaining strong relationships with local communities in operating areas is key to social license to operate and can influence regulatory support.

- Policy Impact: Changes in state tax policies or royalty rates, such as those potentially reviewed in 2024 legislative sessions, could affect Chord Energy's profitability.

Fiscal Policies and Subsidies

Government fiscal policies, including tax incentives and subsidies for the oil and gas sector, significantly shape Chord Energy's operational landscape and investment strategies. For example, the Inflation Reduction Act (IRA) of 2022 introduced crucial tax credits like the 45Q credit for carbon capture, utilization, and storage (CCUS), which directly impacts the economic viability of emissions reduction projects for energy producers.

These policies can either bolster or hinder profitability. Changes in corporate tax rates or specific industry tax treatments directly influence Chord Energy's bottom line and its capacity for reinvestment. For instance, a favorable tax environment can encourage expansion and technological upgrades, while increased tax burdens might necessitate cost-cutting measures.

- IRA’s 45Q Tax Credit: This credit, enhanced by the IRA, offers up to $85 per metric ton of captured carbon, making CCUS projects more financially attractive.

- Federal Tax Rate: The current federal corporate tax rate in the US, which applies to Chord Energy, is 21%, influencing net income.

- State-Level Incentives: Various states offer additional tax abatements or credits for oil and gas operations, which can vary significantly and impact regional investment decisions.

Political factors significantly shape Chord Energy's operating environment, from federal energy policies affecting production and exports to state-level regulations influencing operational costs and permitting. Geopolitical events and international trade dynamics also play a crucial role in market volatility and demand for U.S. energy products.

Government fiscal policies, including tax incentives like the IRA's 45Q credit for carbon capture, directly impact investment decisions and profitability. Strong relationships with local and state governments are essential for securing approvals and maintaining a social license to operate, especially concerning land use and environmental standards in key basins like the Williston.

| Political Factor | Impact on Chord Energy | Supporting Data/Example (2023-2025) |

|---|---|---|

| Federal Energy Policy | Affects production opportunities, export approvals, and environmental compliance costs. | U.S. crude oil production averaged 12.9 million bpd in 2023; U.S. LNG exports reached over 7.3 bcf/d in 2023. |

| State & Local Regulations | Influences operational costs, permitting timelines, and community relations. | North Dakota's 2024 policies on production taxes and environmental standards directly impact Chord Energy's cost structure. |

| Geopolitical Tensions | Drives oil and gas price volatility and impacts global demand. | Ongoing conflicts in Eastern Europe and the Middle East contribute to market uncertainty. |

| Fiscal Policy & Tax Credits | Shapes investment attractiveness and profitability for projects like CCUS. | IRA's 45Q credit provides up to $85/metric ton for captured carbon, enhancing CCUS project economics. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chord Energy, offering insights into political, economic, social, technological, environmental, and legal influences.

It equips stakeholders with actionable intelligence to navigate the dynamic landscape, identify strategic opportunities, and mitigate potential risks within the energy sector.

A clean, summarized version of the Chord Energy PESTLE Analysis provides easily digestible insights into external factors, alleviating the pain of sifting through lengthy reports during critical decision-making.

Economic factors

Global commodity prices, particularly for crude oil and natural gas, are central to Chord Energy's economic landscape. These price swings directly influence the company's earnings, its ability to fund new projects, and overall financial health. For instance, projections for Brent crude in 2024 and 2025 indicate a volatile environment, with prices potentially moving up or down depending on global supply dynamics and international relations.

The interplay of global oil and gas supply and demand is a critical determinant of market prices and production levels for companies like Chord Energy. In 2024, global gas demand hit a record high, largely fueled by growth in emerging economies.

Looking ahead to 2025, supply growth is anticipated to lag behind demand, which could sustain higher natural gas prices. This dynamic directly impacts Chord Energy's revenue streams and operational planning.

Furthermore, U.S. crude oil production is expected to experience shifts in its growth trajectory during this period, influencing the overall market landscape and Chord Energy's competitive positioning.

Chord Energy's financial health and expansion plans are closely linked to its capital spending and the general investment climate within the energy industry. For 2025, the company anticipates a strategic shift towards optimizing free cash flow by emphasizing capital efficiency. This includes a projected reduction in exploration and production (E&P) and other capital expenditures compared to the levels seen in 2024.

Inflation and Interest Rates

Inflation and interest rates are critical economic factors impacting Chord Energy. Rising inflation can significantly increase operational expenses for energy companies, from labor costs to the price of materials and equipment. For instance, the Producer Price Index (PPI) for crude petroleum and natural gas, a key indicator for upstream costs, saw a notable increase in early 2024, impacting input prices.

Higher interest rates directly affect Chord Energy's cost of capital. This makes financing new exploration, development, and infrastructure projects more expensive. For example, if Chord Energy needs to borrow funds for a significant capital project, a higher Federal Funds Rate, which influences borrowing costs across the economy, would increase the overall expense of that project, potentially delaying or scaling back investment.

The interplay of these factors can create a challenging environment.

- Increased Operational Costs: Inflation directly drives up expenses for materials, services, and labor.

- Higher Financing Expenses: Rising interest rates make borrowing for capital projects more costly.

- Impact on Project Viability: Elevated costs and financing expenses can pressure the profitability and feasibility of new energy ventures.

- Potential for Reduced Investment: When costs rise and financing becomes expensive, companies may scale back capital expenditures.

Economic Growth and Energy Consumption

Global economic expansion is a primary driver for energy consumption, directly influencing the demand for crude oil and natural gas, key commodities for Chord Energy. While global energy demand saw an uptick in 2024, the pace of growth in emerging economies is moderating.

Shifting consumption patterns are also evident, with escalating electricity needs from data centers and the burgeoning artificial intelligence sector increasingly shaping overall energy demand dynamics.

- Global energy demand growth in 2024: Increased, but emerging market growth is slowing.

- Key demand drivers: Industrial activity, transportation, and residential use remain significant.

- Emerging trends: Data centers and AI are creating new, substantial electricity demand.

- Impact on oil and gas: Economic slowdowns can dampen demand, while new electricity needs may shift focus to gas for power generation.

Chord Energy's economic performance is intrinsically tied to global commodity prices, especially for oil and natural gas. Fluctuations in these prices directly impact earnings and investment capacity. For instance, Brent crude prices are anticipated to remain volatile through 2024 and 2025, influenced by geopolitical events and supply-demand balances.

Inflation and interest rates present significant challenges, increasing operational costs and the expense of capital financing. For example, rising producer prices for crude petroleum in early 2024 inflated upstream expenses. Higher interest rates, such as potential Federal Funds Rate adjustments, make borrowing for projects like new exploration more costly, potentially impacting Chord Energy's 2025 capital expenditure plans which aim for efficiency.

Global economic growth fuels energy consumption, but the pace of expansion in emerging economies is moderating in 2024. Simultaneously, new demand drivers like data centers and AI are emerging, requiring substantial electricity, which could influence natural gas demand for power generation.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Chord Energy |

|---|---|---|---|

| Crude Oil & Natural Gas Prices | Volatile; Brent crude prices influenced by supply/demand. | Continued volatility expected; potential for sustained higher natural gas prices due to lagging supply growth. | Directly impacts revenue, profitability, and capital allocation decisions. |

| Inflation & Interest Rates | Rising PPI for crude petroleum and natural gas impacting upstream costs. | Interest rates may remain elevated, increasing cost of capital. | Higher operational expenses and increased financing costs for capital projects. |

| Global Economic Growth | Moderate growth in emerging economies; overall demand up. | Slowing growth in some emerging markets. | Influences overall energy demand; new demand from AI/data centers could shift focus to gas. |

Full Version Awaits

Chord Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Chord Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Public perception of fossil fuels significantly impacts Chord Energy's operations. Growing concerns about climate change and environmental impact are leading to increased scrutiny of oil and gas activities. This can translate into stricter regulations and affect investor confidence. For instance, a 2024 survey indicated that 60% of global respondents believe governments should prioritize renewable energy over fossil fuels, a sentiment that can pressure companies like Chord Energy to adapt.

Chord Energy's operations in the Williston Basin mean its success is tied to strong community ties. Addressing local concerns about land use, infrastructure, and environmental impact is key for smooth operations. For example, in 2023, Chord Energy reported investing $10 million in community development and infrastructure projects across its operating areas, demonstrating a commitment to local stakeholders.

The oil and gas sector, including companies like Chord Energy, faces evolving workforce dynamics. A key sociological factor is the availability of skilled labor, with an ongoing need for experienced engineers, geoscientists, and field technicians. For instance, the U.S. Bureau of Labor Statistics projected a 2% decline in oil and gas extraction jobs between 2022 and 2032, highlighting potential future labor shortages.

Companies are increasingly prioritizing safety and employee development to attract and retain talent. This focus on well-being and continuous training is crucial for operational efficiency and cost management in a high-risk industry. In 2023, the International Association of Oil & Gas Producers reported a continued emphasis on safety performance, with industry-wide initiatives aimed at reducing incident rates and fostering a culture of safety.

ESG (Environmental, Social, and Governance) Expectations

Chord Energy, like many in the energy sector, faces increasing pressure from investors and stakeholders to prioritize Environmental, Social, and Governance (ESG) factors. This shift means companies are being evaluated not just on financial performance, but also on their commitment to sustainability and ethical operations.

This growing emphasis translates into tangible demands for transparency and action on issues like carbon emissions, water management, and community relations. For instance, many institutional investors are now screening companies based on their ESG scores, with a significant portion of assets under management tied to ESG mandates. In 2024, many energy companies are reporting on Scope 1 and Scope 2 emissions, and increasingly, Scope 3, to meet these expectations.

- Investor Scrutiny: A growing number of investment funds are excluding companies with poor ESG ratings, impacting capital availability and valuation.

- Reporting Standards: Companies are expected to report on metrics such as greenhouse gas emissions intensity, water withdrawal and consumption, and workforce diversity. For example, in 2024, many companies are targeting reductions in flaring intensity.

- Social License to Operate: Strong community engagement and a commitment to diversity and inclusion are becoming critical for maintaining a positive public image and operational continuity.

- Governance Practices: Robust board oversight of ESG issues and transparent executive compensation linked to sustainability goals are key governance expectations.

Energy Transition and Consumer Behavior

While Chord Energy operates in the traditional oil and gas sector, evolving consumer preferences and societal trends toward sustainability are indirectly impacting its market. The growing demand for electric vehicles (EVs), for instance, signals a long-term shift away from internal combustion engines, which could eventually dampen demand for gasoline and diesel. In 2024, global EV sales are projected to surpass 17 million units, a significant increase from previous years, highlighting this behavioral change.

Furthermore, a heightened emphasis on energy efficiency across households and industries contributes to reduced overall energy consumption. This trend, driven by both environmental consciousness and cost-saving motivations, can create headwinds for fossil fuel demand. For example, many countries are implementing stricter building codes and offering incentives for energy-efficient appliances, further accelerating this shift.

These sociological factors create a complex landscape for companies like Chord Energy:

- Shifting Consumer Preferences: A growing segment of consumers is actively seeking out and prioritizing products and services with lower environmental footprints, influencing purchasing decisions related to transportation and energy use.

- Electrification of Transportation: The accelerating adoption of electric vehicles, projected to capture a substantial portion of the new car market in key regions by 2030, directly challenges the long-term demand for traditional fuels.

- Energy Efficiency Initiatives: Government policies and consumer awareness campaigns promoting energy conservation and efficiency are leading to a more judicious use of energy resources, potentially reducing the overall demand for oil and gas.

Public perception regarding fossil fuels and climate change directly influences Chord Energy's operational environment. A 2024 survey revealed that 60% of global respondents favor prioritizing renewable energy, indicating a societal shift that can lead to stricter regulations and affect investor confidence in traditional energy sources.

Chord Energy's commitment to community relations is vital, especially in the Williston Basin. Investments in local development, such as the $10 million reported in 2023 for community projects, are crucial for maintaining a social license to operate and ensuring smooth operations by addressing local concerns.

The energy sector faces evolving workforce dynamics, with a notable need for skilled professionals. Projections from the U.S. Bureau of Labor Statistics indicated a 2% decline in oil and gas extraction jobs between 2022 and 2032, highlighting potential future labor shortages that companies must address through retention and development strategies.

Societal trends are increasingly emphasizing Environmental, Social, and Governance (ESG) factors. By 2024, many energy companies are focusing on reporting Scope 1, 2, and 3 emissions to meet investor demands, as a significant portion of assets under management are now tied to ESG mandates.

| Sociological Factor | Impact on Chord Energy | Supporting Data (2023-2024) |

|---|---|---|

| Climate Change Concerns | Increased regulatory pressure, potential impact on investor sentiment | 60% of global respondents favor renewables over fossil fuels (2024 survey) |

| Community Relations | Essential for operational continuity and public image | Chord Energy invested $10 million in community development (2023) |

| Workforce Dynamics | Potential labor shortages for skilled positions | Projected 2% decline in oil & gas extraction jobs (2022-2032) |

| ESG Prioritization | Demand for transparency on emissions, water, and diversity | Increased reporting on Scope 1, 2, and 3 emissions; ESG mandates influence investment |

Technological factors

Innovations like directional and horizontal drilling are significantly boosting oil and gas extraction efficiency, unlocking reserves that were once out of reach. These advanced techniques optimize resource recovery, making previously uneconomical fields viable.

Chord Energy showcased this technological prowess in late 2024 by successfully drilling four-mile laterals. This achievement highlights the company's commitment to adopting cutting-edge methods to maximize production and improve operational performance.

Automation and smart technologies are significantly reshaping oil and gas operations, including those of Chord Energy. The integration of AI, sensors, and robotics is driving unprecedented efficiency gains and cost reductions. For instance, advancements in automated drilling rigs can reduce operational downtime and improve safety by minimizing human exposure to hazardous environments.

Real-time monitoring systems powered by AI are enabling predictive maintenance, which is crucial for optimizing asset performance and preventing costly failures. This technological shift allows for more precise control over exploration and production activities, leading to better resource extraction. The industry saw substantial investment in digital transformation initiatives throughout 2024, with many companies, including those in the upstream sector like Chord Energy, prioritizing these advancements to stay competitive.

Chord Energy, like others in the oil and gas industry, is increasingly leveraging digital transformation. This includes the adoption of the Internet of Things (IoT) for real-time monitoring of wells and infrastructure, cloud computing for scalable data storage, and artificial intelligence (AI) and machine learning for predictive maintenance and optimizing production. These advancements are key to improving operational efficiency and ensuring better regulatory compliance.

Data analytics plays a pivotal role in this transformation. By analyzing vast datasets generated from operations, Chord Energy can gain deeper insights into energy consumption patterns, forecast demand more accurately, and make more informed, data-driven decisions. For example, advanced analytics can help identify the most productive zones in reservoirs, leading to more efficient extraction and reduced waste.

The energy sector's digital shift is not just about efficiency; it's also about resilience and adaptation. In 2024, companies are investing heavily in these technologies. For instance, the global AI in energy market was projected to reach over $10 billion by 2025, highlighting the significant financial commitment and expected returns from these digital initiatives. This trend is expected to continue, with further growth anticipated as more sophisticated AI applications are developed and integrated into core business processes.

Carbon Capture, Utilization, and Storage (CCUS)

Advancements in Carbon Capture, Utilization, and Storage (CCUS) technologies are increasingly critical for the oil and gas sector, including companies like Chord Energy, to address carbon emissions and achieve sustainability goals. The global CCUS market is experiencing substantial growth, with investments aimed at reducing the carbon footprint of operations.

Significant investments are being channeled into CCUS, with projections indicating robust market expansion. For instance, the International Energy Agency (IEA) reported that global investment in CCUS projects reached approximately $20 billion in 2023, a notable increase from previous years, highlighting the growing industry commitment.

- Growing CCUS Investments: Global CCUS investments are on the rise, with the IEA estimating around $20 billion in 2023.

- Market Projections: The CCUS market is expected to see significant growth in the coming years as more companies adopt these technologies.

- Sustainability Targets: CCUS is a key enabler for the oil and gas industry to meet increasingly stringent environmental regulations and corporate sustainability objectives.

- Technological Advancements: Ongoing research and development are improving the efficiency and cost-effectiveness of capture, utilization, and storage methods.

Enhanced Oil Recovery (EOR) Techniques

Technological advancements, especially in Enhanced Oil Recovery (EOR) techniques, are significantly boosting the potential of existing oil fields. CO2 injection, a prominent EOR method, can notably increase the amount of oil extracted from mature reservoirs, making previously uneconomical reserves viable.

The increasing adoption of CO2-EOR is directly fueling the growth of the carbon capture and storage (CCS) market. For instance, by 2024, the global CCS market was projected to reach approximately $10.5 billion, with EOR applications being a key driver.

- CO2-EOR Efficiency: Technologies like supercritical CO2 injection improve oil displacement and sweep efficiency.

- Market Growth: The CO2-EOR sector is a substantial contributor to the expanding carbon capture market.

- Investment Trends: Significant investments are flowing into CO2 infrastructure and EOR project development.

- Resource Maximization: EOR techniques are crucial for maximizing recovery from mature domestic oil assets.

Technological advancements are continuously enhancing extraction efficiency, with innovations like four-mile lateral drilling, as demonstrated by Chord Energy in late 2024, unlocking previously inaccessible reserves. The integration of AI, automation, and IoT is driving significant operational improvements, reducing downtime, and enhancing safety across the industry.

Digital transformation, including cloud computing and advanced data analytics, is enabling more informed decision-making and optimizing production for companies like Chord Energy. Furthermore, the growing adoption of Carbon Capture, Utilization, and Storage (CCUS) and Enhanced Oil Recovery (EOR) techniques, particularly CO2 injection, is crucial for sustainability and maximizing resource recovery.

| Technology Area | Key Advancement | Impact/Example | Industry Trend (2024/2025) |

|---|---|---|---|

| Drilling Techniques | Directional & Horizontal Drilling (e.g., 4-mile laterals) | Increased extraction efficiency, access to new reserves. | Continued focus on optimizing wellbore placement. |

| Automation & AI | Automated rigs, predictive maintenance, real-time monitoring | Reduced downtime, improved safety, cost reduction. | Global AI in energy market projected to exceed $10 billion by 2025. |

| Digital Transformation | IoT, Cloud Computing, Data Analytics | Enhanced operational insights, better forecasting, data-driven decisions. | Significant investment in digital transformation initiatives. |

| Emissions Reduction | CCUS & CO2-EOR | Reduced carbon footprint, increased oil recovery from mature fields. | Global CCUS investment around $20 billion in 2023; CCS market projected at $10.5 billion by 2024. |

Legal factors

Chord Energy operates under strict federal and state environmental laws, focusing on emissions, water use, and waste disposal. These regulations are critical for maintaining operational permits and avoiding penalties.

New Environmental Protection Agency (EPA) rules, implemented in 2024 and continuing into 2025, specifically aim to reduce methane emissions and manage associated gas. Compliance with these updated standards will require significant investment in new technologies and operational adjustments for oil and gas producers like Chord Energy.

Chord Energy's operations are significantly shaped by land use and permitting laws in North Dakota and Montana. Navigating these regulations is crucial for acquiring and developing oil and gas reserves. For instance, in 2023, the average time for obtaining drilling permits in the Williston Basin, where Chord Energy is active, could range from several weeks to months, depending on project complexity and local agency workloads.

These laws directly influence project timelines and overall feasibility. Delays in the permitting process, often due to environmental reviews or community input requirements, can add substantial costs and postpone revenue generation. Understanding and proactively managing these legal frameworks is therefore a key operational consideration for Chord Energy.

Chord Energy, like all players in the oil and gas sector, operates under stringent health and safety regulations designed to safeguard its workforce and surrounding communities. These rules are not merely guidelines; they are legal mandates that dictate everything from equipment standards to emergency response protocols. Failure to adhere can result in significant fines and operational shutdowns.

In 2023, the Occupational Safety and Health Administration (OSHA) continued to enforce its Process Safety Management (PSM) standard, a critical framework for preventing catastrophic chemical releases. While specific incident data for Chord Energy in 2024 is not yet fully reported, the industry as a whole saw a continued focus on reducing lost-time injuries, with many companies aiming for rates below 1.0 per 200,000 hours worked, a benchmark Chord Energy would strive to meet or exceed.

Contract Law and Commercial Agreements

Chord Energy's operations are deeply intertwined with contract law, particularly concerning agreements for land leases, joint ventures, and the sale of crude oil and natural gas. The enforceability and interpretation of these commercial agreements are critical for maintaining stable revenue streams and operational continuity. For instance, in 2023, Chord Energy reported that its revenue from crude oil and natural gas sales was approximately $2.7 billion, underscoring the significance of well-defined sales contracts.

The legal framework surrounding these contracts ensures clarity on pricing, delivery terms, and quality specifications, thereby mitigating risks associated with commodity price volatility and supply chain disruptions. Furthermore, adherence to contract law protects Chord Energy in its dealings with partners in joint ventures, ensuring that obligations and profit-sharing arrangements are clearly stipulated and legally binding.

- Land Lease Agreements: These contracts grant Chord Energy the right to explore and produce oil and gas from specific properties, with terms often including upfront payments and ongoing royalties.

- Joint Venture Contracts: These agreements outline the terms of collaboration with other energy companies, detailing capital contributions, operational responsibilities, and revenue distribution.

- Sales Contracts: Agreements for the sale of crude oil and natural gas specify pricing mechanisms, delivery volumes, and transportation arrangements, crucial for revenue generation.

- Service Agreements: Contracts with third-party service providers for drilling, transportation, and other operational needs ensure the efficient execution of exploration and production activities.

Corporate Governance and Reporting Requirements

As a publicly traded entity, Chord Energy is subject to stringent corporate governance and financial reporting mandates. These include detailed disclosures on environmental, social, and governance (ESG) performance, reflecting growing investor and stakeholder demand for transparency. For instance, in 2023, the Securities and Exchange Commission (SEC) proposed new rules aimed at enhancing climate-related disclosures for public companies, which will impact reporting standards for energy firms like Chord Energy.

This heightened scrutiny necessitates robust internal controls and clear communication channels. Chord Energy’s adherence to regulations like the Sarbanes-Oxley Act (SOX) is critical for maintaining investor confidence and market integrity. The company's 2023 annual report, filed in early 2024, details its compliance efforts and governance structures, providing stakeholders with insights into its operational and ethical framework.

- Regulatory Compliance: Chord Energy must comply with SEC regulations, stock exchange listing requirements, and industry-specific legal frameworks.

- ESG Reporting: Increasing pressure from investors means detailed reporting on ESG metrics, including carbon emissions and social impact, is becoming standard practice.

- Transparency: Greater demand for transparency requires clear and accurate financial reporting, including risk disclosures and executive compensation.

- Corporate Governance Standards: Adherence to best practices in board independence, audit committee oversight, and shareholder rights is paramount.

Chord Energy faces evolving legal landscapes, particularly concerning environmental regulations like methane emission standards, which require significant investment in new technologies for compliance. Navigating land use and permitting laws in North Dakota and Montana is crucial for project timelines, with permit acquisition sometimes taking months in 2023. Furthermore, adherence to health and safety regulations, such as OSHA's Process Safety Management, is paramount to prevent incidents and ensure operational continuity.

Environmental factors

Chord Energy operates within an energy landscape increasingly shaped by climate change policy and ambitious emissions reduction targets. The global imperative to decarbonize places direct pressure on oil and gas companies to curtail their carbon footprint. For instance, the U.S. has rejoined the Paris Agreement and set a target to reduce emissions by 50-52% below 2005 levels by 2030, influencing regulatory frameworks and operational expectations for companies like Chord Energy.

This evolving regulatory environment necessitates strategic adaptation, potentially involving significant investments in technologies such as carbon capture, utilization, and storage (CCUS). Such investments are crucial for Chord Energy to align its operations with broader climate goals and maintain its social license to operate. The company's ability to navigate these environmental factors will be a key determinant of its long-term sustainability and financial performance.

Chord Energy's operations, particularly those involving hydraulic fracturing, are heavily reliant on water. This demand makes effective water management and addressing potential scarcity crucial environmental factors, especially given the company's presence in regions like the Williston Basin, which can experience arid conditions.

In 2023, Chord Energy reported utilizing approximately 1.2 million barrels of water for its fracturing operations. The company's commitment to responsible water management includes a significant focus on recycling and reusing water, with over 70% of the water used in its 2023 fracturing programs being recycled, reducing the need for fresh water sources.

Chord Energy's exploration and production activities inherently involve land disturbance, posing risks to local ecosystems and biodiversity, particularly in the sensitive Williston Basin. The company must actively manage its environmental footprint to comply with increasingly stringent regulations designed to mitigate these impacts.

For instance, in 2023, Chord Energy reported its environmental performance, highlighting efforts to minimize land disturbance through responsible site development and reclamation practices. The company's commitment to biodiversity is demonstrated through programs aimed at protecting sensitive habitats within its operational areas.

Waste Management and Pollution Control

Chord Energy, like all oil and gas producers, faces significant environmental responsibilities concerning waste management and pollution control. The generation of drilling fluids, produced water, and other byproducts necessitates robust systems to prevent contamination of soil, water, and air. Compliance with stringent environmental regulations is paramount to avoid penalties and maintain operational integrity.

The company must implement effective strategies for:

- Drilling Fluid Management: Proper treatment and disposal of drilling fluids, which can contain chemicals and solids, are essential to prevent groundwater contamination.

- Produced Water Handling: Produced water, often saline and containing hydrocarbons, requires advanced treatment or secure disposal methods, such as deep-well injection, to protect surface and subsurface water resources.

- Air Emission Control: Measures to control emissions from equipment and operations, including volatile organic compounds (VOCs) and greenhouse gases, are critical for air quality compliance.

- Regulatory Adherence: Staying abreast of and adhering to evolving environmental standards set by agencies like the EPA and state-level environmental departments is fundamental for sustainable operations.

Renewable Energy Integration and Energy Transition

The global energy sector is undergoing a significant transformation, with a pronounced shift towards renewable energy sources. This transition directly impacts the long-term viability and competitive positioning of traditional oil and gas companies like Chord Energy. For instance, by the end of 2023, renewable energy sources accounted for approximately 30% of global electricity generation, a figure projected to climb steadily in the coming years.

Chord Energy, while primarily focused on oil and gas, must navigate this evolving landscape. The increasing demand for and investment in renewables, which saw global investment reach over $1.7 trillion in 2023, presents both challenges and potential opportunities.

- Market Pressure: Growing societal and governmental pressure to decarbonize the energy sector may lead to stricter regulations on fossil fuel production and consumption.

- Investment Trends: Significant capital is flowing into renewable energy projects, potentially diverting investment away from traditional energy infrastructure.

- Diversification Opportunities: Companies like Chord Energy may explore integrating or diversifying into cleaner energy technologies, such as carbon capture or hydrogen production, to adapt to market shifts and maintain long-term relevance.

- Technological Advancements: Continuous innovation in renewable energy technologies, like solar and wind power efficiency, is making them increasingly cost-competitive with fossil fuels.

Chord Energy must manage its environmental impact, particularly concerning water usage and land disturbance. In 2023, the company used about 1.2 million barrels of water for fracturing, with over 70% being recycled, showcasing a commitment to resource efficiency in arid regions like the Williston Basin.

The company also faces stringent regulations on waste management and pollution control, requiring robust systems for drilling fluids, produced water, and air emissions. Adhering to EPA and state environmental standards is critical for maintaining operations and avoiding penalties.

The global energy transition towards renewables, which attracted over $1.7 trillion in investment in 2023, presents challenges and potential diversification opportunities for Chord Energy. Navigating this shift is key to its long-term viability.

PESTLE Analysis Data Sources

Our PESTLE analysis for Chord Energy is built upon a robust foundation of data from government regulatory bodies, industry-specific trade associations, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the energy sector.