Chord Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chord Energy Bundle

Chord Energy navigates a complex landscape shaped by moderate buyer power and significant supplier leverage in the oil and gas sector. The threat of substitutes, while present, is currently less pronounced, but competitive rivalry remains a key force.

The complete report reveals the real forces shaping Chord Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chord Energy, like many in the oil and gas sector, faces a concentrated supplier base for specialized equipment and technology. This means a few key providers often dominate the market for critical components and advanced drilling services. For instance, the market for certain hydraulic fracturing equipment or specialized directional drilling tools might be served by only a handful of companies, giving them considerable pricing power.

Switching suppliers in the oil and gas industry presents significant hurdles for companies like Chord Energy. These challenges extend beyond mere financial costs, encompassing the complexities of integrating new equipment, potential contract penalties, and the disruption to ongoing operations. For instance, a new drilling fluid supplier might require extensive testing and validation, delaying project timelines and incurring additional labor costs.

The operational downtime and the need for retraining staff on new products or processes further amplify these switching costs. This makes it difficult for Chord Energy to readily change providers, even if more attractive terms are offered elsewhere. Such high barriers to switching effectively lock in existing supplier relationships.

Consequently, existing suppliers to Chord Energy wield considerable bargaining power. Knowing that Chord Energy faces substantial costs and operational risks in switching, suppliers can command higher prices or less favorable contract terms. This dynamic is a key factor in the overall supplier power within Chord Energy's operating environment.

Suppliers providing highly differentiated or proprietary technologies, like advanced directional drilling tools or specialized completion fluids, gain significant bargaining power. If these innovations demonstrably boost Chord Energy's operational efficiency or production volumes within the Williston Basin, Chord's dependence on these unique solutions grows, diminishing its negotiation leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while less prevalent, represents a potential shift in power dynamics for Chord Energy. Imagine a major oilfield services company, deeply entrenched in providing essential equipment or specialized drilling services, deciding to move upstream and become an exploration and production (E&P) operator itself. This would mean they are no longer just a supplier but a direct competitor.

Such a move would dramatically alter the supplier's leverage. By entering the E&P market, a service provider would gain direct control over production, potentially leveraging their existing operational expertise and customer relationships. This could disrupt Chord Energy's supply chain and force a re-evaluation of existing contracts, especially if the integrating supplier becomes a significant player in the same E&P basins where Chord operates.

For instance, if a company like Schlumberger or Halliburton, which generated billions in revenue in 2024 from oilfield services, were to strategically invest in E&P assets, it could significantly impact companies like Chord Energy. This hypothetical scenario highlights how a supplier's ability to integrate forward could transform them from a service provider into a formidable competitor, thereby increasing their bargaining power substantially.

- Potential for Service Providers to Enter E&P: Large, integrated oilfield service companies could leverage their expertise and capital to acquire or develop E&P assets.

- Increased Competition for Chord Energy: If a supplier moves into E&P, they would directly compete with Chord Energy for resources, acreage, and market share.

- Shift in Bargaining Power: A supplier becoming a competitor would gain significant leverage, potentially dictating terms or limiting Chord Energy's options.

Impact of Raw Material Prices on Suppliers

The bargaining power of suppliers for Chord Energy is significantly influenced by the volatility of raw material and labor costs within the oil and gas service sector. When these essential inputs become more expensive, suppliers are more inclined to transfer these increased costs to exploration and production (E&P) companies like Chord Energy, thereby enhancing their own leverage.

This dynamic directly impacts Chord Energy's financial performance. Rising upstream cost pressures, such as higher prices for specialized equipment or skilled labor, can compress profit margins for the company. For instance, if the cost of drilling fluids or specialized drilling bits increases substantially, Chord Energy will face higher operational expenses.

- Rising Input Costs: In 2024, the average cost of key raw materials for oilfield services, such as steel for pipes and specialized chemicals, saw an estimated increase of 5-10% compared to 2023 levels, driven by global supply chain adjustments and increased demand.

- Labor Shortages: The oil and gas industry continued to experience a shortage of skilled labor in 2024, leading to wage inflation for specialized roles like experienced rig operators and geologists, which suppliers must factor into their pricing.

- Supplier Concentration: In certain niche service areas, a limited number of suppliers dominate the market, giving them greater pricing power over E&P companies like Chord Energy.

- Impact on Profitability: For Chord Energy, these supplier cost increases can directly reduce earnings per share if they cannot be fully passed on to customers or offset by operational efficiencies.

Chord Energy's suppliers hold significant bargaining power due to industry concentration and high switching costs. Specialized equipment and technology providers often operate in markets with few players, allowing them to dictate terms. The expense and operational disruption involved in changing suppliers, from integrating new technology to retraining staff, further solidify existing relationships and supplier leverage.

This supplier power is amplified by the potential for input cost volatility. In 2024, raw material and skilled labor costs in oilfield services saw increases, which suppliers tend to pass on to E&P companies. For instance, rising steel prices and a continued shortage of experienced rig operators in 2024 contributed to higher service costs for companies like Chord Energy.

| Factor | Impact on Chord Energy | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited competition among suppliers grants them pricing power. | Niche service areas, like specialized directional drilling, often have only a few dominant providers. |

| Switching Costs | High costs and operational risks deter Chord Energy from changing suppliers. | Includes integration challenges, retraining, and potential project delays, making supplier retention favorable. |

| Input Cost Volatility | Rising raw material and labor costs are passed on by suppliers. | Estimated 5-10% increase in key raw material costs for oilfield services in 2024; ongoing skilled labor shortages driving wage inflation. |

| Forward Integration Threat | Suppliers becoming E&P competitors could shift power dynamics. | Large service firms like Halliburton and Schlumberger, with significant 2024 revenues, have the capital and expertise to potentially acquire E&P assets. |

What is included in the product

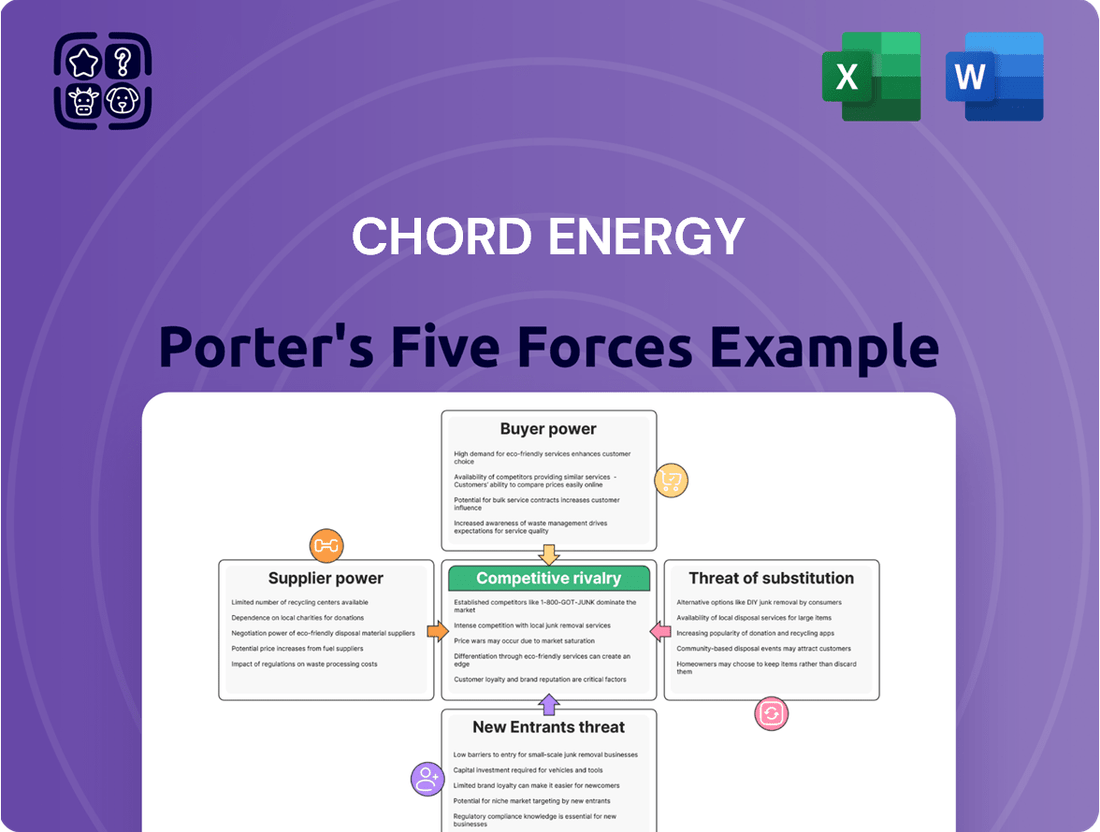

Chord Energy's Porter's Five Forces analysis details the competitive intensity, buyer and supplier power, threat of new entrants, and the availability of substitutes within the oil and gas sector.

Quickly identify and mitigate competitive threats with a visual breakdown of Chord Energy's market landscape.

Customers Bargaining Power

Chord Energy's main customers are large refiners, pipeline operators, utility companies, and commodity traders. Given the vast global market for crude oil, natural gas, and NGLs, no single buyer typically represents a significant percentage of Chord Energy's total sales, which inherently reduces individual customer bargaining power.

While these buyers are substantial, the broad distribution of Chord Energy's production across various customers dilutes the leverage any one of them can exert. For instance, in 2024, Chord Energy's diverse customer base meant that its largest customer likely accounted for a single-digit percentage of its total revenue, underscoring the fragmented nature of its demand.

The standardized nature of Chord Energy's core products—crude oil, natural gas, and natural gas liquids—significantly amplifies customer bargaining power. These commodities are largely undifferentiated, meaning buyers perceive little difference between Chord's output and that of its competitors.

This interchangeability allows customers to easily switch suppliers if Chord Energy's pricing or contract terms are not competitive. In 2024, the global commodity market continues to be a primary driver of pricing, with broad market forces often overriding individual producer influence.

Customers in the energy sector, particularly those buying crude oil and natural gas, are acutely aware of price. Because these are essentially raw commodities with many suppliers, buyers can easily switch if prices aren't competitive. This means even minor shifts in global energy prices directly affect their bottom line, making them very sensitive to cost.

This sensitivity gives customers significant leverage. For instance, in 2024, the average price of West Texas Intermediate (WTI) crude oil fluctuated, impacting purchasing decisions across various industries. When prices are high, customers actively shop around for the best deals, putting pressure on suppliers like Chord Energy to offer lower prices to secure business.

Availability of Alternative Suppliers

The global energy market is characterized by a multitude of crude oil, natural gas, and natural gas liquids (NGLs) producers. This vast landscape offers customers a broad spectrum of alternative suppliers, particularly within liquid and well-connected markets.

Chord Energy's customers benefit from this extensive choice. If Chord Energy's offerings or pricing do not align with customer expectations, buyers can readily switch to other producers, significantly amplifying their bargaining power.

- Abundant Global Supply: The energy sector, especially for commodities like crude oil and natural gas, features numerous players worldwide.

- Customer Choice: In many markets, buyers can select from a wide array of producers, reducing reliance on any single supplier like Chord Energy.

- Price Sensitivity: The availability of alternatives makes customers more sensitive to pricing, as they can easily compare offers and negotiate better terms.

- Market Liquidity: Well-developed and liquid energy markets facilitate easier switching between suppliers, further empowering customers.

Low Switching Costs for Customers

Customers of crude oil and natural gas typically face minimal costs when switching between suppliers. This is largely due to the fungible nature of these commodities, meaning one barrel of oil or cubic foot of natural gas is essentially the same as another from a different producer. This low barrier to switching significantly enhances customer bargaining power.

For instance, in 2024, the global oil market, while subject to geopolitical influences, generally allows buyers to source from various producers without substantial upfront investment or operational disruption. This ease of transition enables customers to negotiate more favorable pricing and delivery terms with Chord Energy.

- Low Switching Costs: Customers can easily change suppliers for crude oil and natural gas due to the commodity's fungible nature.

- Customer Leverage: This ease of switching empowers customers to negotiate better prices and terms with Chord Energy.

- Market Dynamics: In 2024, the global oil market's structure supports this customer leverage, as buyers have access to multiple sources.

- Impact on Chord Energy: Chord Energy must remain competitive in pricing and service to retain customers in this environment.

The bargaining power of Chord Energy's customers is high due to the standardized nature of its products and the abundance of suppliers in the global energy market. Customers face minimal switching costs, allowing them to easily move to competitors if Chord's pricing or terms are unfavorable. This dynamic is evident in 2024, where global commodity prices are heavily influenced by broad market forces rather than individual producer actions, giving buyers significant leverage.

In 2024, Chord Energy's customers, primarily large refiners and traders, benefit from a liquid market with numerous alternative crude oil and natural gas producers. This broad supplier base means no single buyer represents a disproportionately large share of Chord's sales, preventing any one customer from wielding excessive influence. The fungible nature of energy commodities further empowers buyers, as they can readily substitute one supplier for another without incurring significant costs or operational disruptions.

| Factor | Impact on Chord Energy | 2024 Context |

|---|---|---|

| Product Standardization | High (Commodities are undifferentiated) | Buyers easily compare offers and switch suppliers based on price. |

| Supplier Availability | High (Numerous global producers) | Customers have ample choice, reducing reliance on any single supplier. |

| Switching Costs | Low (Minimal costs to change suppliers) | Facilitates price negotiation and supplier flexibility for buyers. |

| Customer Concentration | Low (Fragmented customer base) | No single customer has significant leverage over Chord Energy. |

Preview Before You Purchase

Chord Energy Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Chord Energy, detailing the competitive landscape and strategic positioning within the oil and gas sector. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of substitutes and new entrants.

Rivalry Among Competitors

The Williston Basin, Chord Energy's primary operational area, is a mature and highly competitive oil and gas region. This basin is home to a diverse range of companies, from industry giants to smaller, privately held entities.

Major players such as Continental Resources, Chevron, and ConocoPhillips maintain significant presences, contributing to intense competition. For instance, in 2024, these companies, along with others in the basin, are focused on efficiency and cost management to maintain profitability amidst fluctuating commodity prices.

Chord Energy faces this dynamic landscape, necessitating continuous operational optimization to stay competitive. The presence of numerous operators, both large and small, means market share is hard-won, requiring strategic agility and a focus on production cost per barrel.

The Williston Basin, where Chord Energy primarily operates, is characterized as a mature, cash-generating region rather than a high-growth area. Production levels in this basin are largely stable, hovering near plateau. This maturity means that the industry growth rate is relatively low, intensifying competition.

In such a mature market, companies like Chord Energy face increased rivalry. Instead of expanding into new, untapped territories, the focus shifts to capturing or maintaining existing market share. This competitive dynamic pressures Chord Energy to excel operationally and pursue strategic acquisitions to bolster its position.

Crude oil, natural gas, and natural gas liquids are fundamentally commodity products, meaning there's very little to distinguish one company's output from another's. This inherent lack of product differentiation forces competition to focus heavily on other factors.

Consequently, the battleground for market share and profitability shifts to operational efficiency and rigorous cost control. Companies like Chord Energy must excel in these areas to stand out.

For Chord Energy, a key competitive edge lies in its capacity to extract resources at a lower cost per barrel of oil equivalent (BOE) and to deliver these products to market with maximum efficiency. For instance, in the first quarter of 2024, Chord Energy reported a production cost of approximately $10.50 per BOE, a figure that demonstrates their focus on cost management in a highly competitive landscape.

Exit Barriers for Competitors

The oil and gas sector, including companies like Chord Energy, faces substantial exit barriers. These are primarily driven by the massive capital tied up in specialized infrastructure, such as pipelines, refineries, and drilling equipment, which have limited alternative uses. For instance, the cost to decommission and reclaim a single well pad can run into hundreds of thousands of dollars, making it economically unfeasible for many to simply walk away.

Furthermore, long-term contracts with suppliers and customers, often spanning years, create ongoing obligations that are difficult to terminate without significant penalties. Environmental liabilities, including remediation of past operations and compliance with evolving regulations, also represent substantial costs that must be addressed upon exiting. These factors collectively trap capital and expertise within existing operations, even when profitability wanes.

Consequently, these high exit barriers mean that even struggling competitors may persist, contributing to a persistently oversupplied market and intensifying price competition. This dynamic limits Chord Energy's ability to acquire market share through the natural attrition of weaker players, as they are often compelled to continue operating despite challenging conditions.

- High Capital Investment: The oil and gas industry requires immense upfront capital for exploration, production, and transportation infrastructure.

- Long-Term Contracts: Commitments to suppliers and offtakers create financial and operational dependencies that are costly to break.

- Environmental Liabilities: Decommissioning, site remediation, and ongoing regulatory compliance add significant costs to exiting operations.

- Limited Salvage Value: Specialized, industry-specific assets often have low resale value outside the sector, increasing the cost of exit.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are a significant factor in the competitive rivalry within the Williston Basin. Chord Energy's acquisition of Enerplus in May 2024 for approximately $3.7 billion is a prime example. This move consolidated operations, creating a larger entity with greater operational efficiencies and a more robust inventory of low-cost drilling locations.

This trend of consolidation is driven by a desire for competitive advantages, including economies of scale and the realization of cost synergies. Such transactions reshape the competitive landscape, potentially concentrating market power among fewer, larger players.

- Chord Energy's acquisition of Enerplus in May 2024 for $3.7 billion.

- The deal created a premier Williston Basin operator.

- M&A activity aims to achieve increased scale and synergy realization.

- Consolidation can lead to altered competitive dynamics and increased market power for merged entities.

Competitive rivalry in the Williston Basin, Chord Energy's core operating area, is fierce due to its mature nature and the presence of major players like Continental Resources and Chevron. Companies focus on operational efficiency and cost control, as crude oil and natural gas are undifferentiated commodities. Chord Energy's first quarter 2024 production cost of approximately $10.50 per BOE highlights this focus.

Consolidation, exemplified by Chord Energy's $3.7 billion acquisition of Enerplus in May 2024, is a key strategy to gain scale and synergies, reshaping the competitive landscape. High exit barriers, including significant capital investment in specialized infrastructure and environmental liabilities, mean even struggling competitors persist, intensifying price competition and limiting market share gains through attrition.

SSubstitutes Threaten

The primary substitutes for Chord Energy's core products—crude oil, natural gas, and natural gas liquids (NGLs)—are renewable energy sources such as solar, wind, and hydropower, alongside nuclear energy. These alternatives are experiencing increased adoption driven by growing environmental awareness and ongoing technological improvements.

However, the full-scale implementation and the necessary infrastructure for these substitutes are still under development. The cost-effectiveness of these alternatives compared to traditional fossil fuels is a critical factor in determining the strength of this substitution threat.

As of early 2024, the levelized cost of energy (LCOE) for new utility-scale solar photovoltaic (PV) projects is estimated to be between $25-$40 per megawatt-hour (MWh), and for onshore wind, it's around $25-$50 per MWh. These figures are becoming increasingly competitive with the cost of fossil fuel-generated electricity, particularly when factoring in carbon pricing or emissions regulations.

Ongoing technological advancements are making renewable energy sources like solar and wind more efficient and cost-effective. For instance, solar panel efficiency has steadily increased, with some commercial panels now exceeding 22% efficiency, and costs have plummeted by over 80% in the last decade.

Breakthroughs in battery storage technology, such as solid-state batteries, promise higher energy density and faster charging, which could further accelerate the transition away from traditional energy sources. Grid integration technologies are also improving, allowing for more reliable incorporation of intermittent renewables.

These innovations pose a significant long-term threat to Chord Energy, an exploration and production company. As cleaner, cheaper alternatives become more viable and widespread, the demand for Chord Energy's core products, namely oil and natural gas, is likely to diminish over time, impacting future revenue streams.

Government regulations and environmental policies present a considerable threat of substitution for Chord Energy. Increasingly stringent rules focused on reducing carbon emissions and boosting green energy adoption can make traditional fossil fuels less competitive. For instance, the US Environmental Protection Agency (EPA) continues to refine emissions standards, influencing operational costs and the long-term viability of oil and gas production.

Policies such as carbon taxes or mandates for renewable energy integration directly increase the cost of using fossil fuels, making alternatives more appealing. This shift encourages consumers and industries to explore and invest in cleaner energy sources. Chord Energy's reliance on operations within the Williston Basin means it is directly exposed to these evolving regulatory landscapes, which can impact demand for its products.

Consumer Preferences and Environmental Awareness

A significant factor impacting Chord Energy is the growing consumer preference for environmentally friendly alternatives. As global awareness of climate change intensifies, demand is shifting towards cleaner energy sources. This trend directly challenges the long-term demand for traditional fossil fuels like crude oil and natural gas.

This shift is evident in the increasing adoption of electric vehicles and renewable energy technologies. For instance, global electric car sales in 2023 surpassed 13 million units, a substantial increase from previous years, indicating a clear move away from internal combustion engine vehicles. Chord Energy must remain attuned to these evolving consumer attitudes, as they pose a direct threat to future revenue streams from their core products.

- Consumer Shift: Growing environmental consciousness is driving demand for electric vehicles and renewable energy, impacting fossil fuel consumption.

- Market Data: Global electric car sales exceeded 13 million in 2023, signaling a significant market shift.

- Chord Energy's Challenge: The company must adapt to these changing preferences to mitigate the threat of substitutes.

Infrastructure Development for Substitutes

The expansion of infrastructure supporting alternative energy sources directly impacts the threat of substitutes for companies like Chord Energy. For instance, the growth of the electric vehicle charging network is a key enabler for EV adoption, a direct substitute for gasoline-powered vehicles that utilize fossil fuels. By mid-2024, the U.S. had over 170,000 public EV charging ports, a significant increase that makes EVs a more practical option for a larger segment of the population.

Similarly, advancements in grid modernization and the build-out of hydrogen infrastructure, including production facilities and distribution pipelines, bolster the viability of electric and hydrogen-powered transportation and industrial processes. These developments reduce the reliance on traditional energy sources. As of early 2025, several major projects are underway to expand the U.S. electricity grid's capacity and integrate more renewable sources, further solidifying the competitive position of these alternatives.

- Growing EV Charging Network: Over 170,000 public EV charging ports in the U.S. by mid-2024.

- Grid Modernization Efforts: Ongoing projects to enhance U.S. electricity grid capacity and renewable integration.

- Hydrogen Infrastructure Development: Increasing investment in hydrogen production and distribution for industrial and transportation sectors.

The threat of substitutes for Chord Energy's oil and gas products is growing, driven by advancements in renewable energy and shifting consumer preferences. While infrastructure for these alternatives is still developing, their cost-competitiveness is improving. For example, the levelized cost of energy for solar and wind is becoming comparable to fossil fuels, with solar panel efficiency exceeding 22% and costs dropping significantly.

Government policies, such as emissions standards and carbon taxes, further tilt the playing field towards cleaner alternatives, directly impacting the demand for fossil fuels. This regulatory pressure, coupled with a consumer base increasingly favoring sustainable options, as evidenced by the over 13 million electric cars sold globally in 2023, presents a substantial long-term challenge for Chord Energy.

The expansion of supporting infrastructure, like the over 170,000 public EV charging ports in the U.S. by mid-2024, also strengthens the appeal of substitutes. These developments collectively signal a gradual but persistent erosion of demand for traditional energy sources, necessitating strategic adaptation by Chord Energy.

| Substitute Energy Source | Key Growth Drivers | Impact on Chord Energy |

|---|---|---|

| Solar & Wind Power | Decreasing LCOE (e.g., $25-$40/MWh for solar), increasing efficiency (e.g., >22% for solar panels) | Directly competes with natural gas for electricity generation, reducing demand for Chord's gas products. |

| Electric Vehicles (EVs) | Growing consumer preference, expanding charging infrastructure (e.g., >170,000 U.S. public ports by mid-2024) | Reduces demand for gasoline and diesel, impacting Chord's crude oil segment. |

| Hydrogen Power | Infrastructure development, industrial and transportation applications | Potential long-term substitute for natural gas in certain industrial processes and transportation. |

Entrants Threaten

The oil and gas exploration and production sector is notoriously capital-intensive. Companies need vast sums for acquiring leases, drilling wells, building pipelines, and investing in advanced technology. For instance, a single horizontal well in the Williston Basin, where Chord Energy operates, can cost tens of millions of dollars. This high financial hurdle significantly deters new entrants who may lack the necessary funding or access to capital markets.

New entrants to the oil and gas sector, particularly in regions like the Williston Basin where Chord Energy operates, face substantial hurdles in gaining access to essential distribution channels. Established companies have long-standing relationships and contracts with midstream operators and refiners, creating a significant barrier for newcomers seeking to transport and market their crude oil and natural gas.

Securing capacity on existing pipeline networks and access to refining facilities is a major challenge. For instance, in 2024, the demand for pipeline capacity in key North American basins remained robust, with limited new infrastructure coming online, making it a seller's market for those with existing connections.

Chord Energy benefits from its established presence and existing agreements with midstream providers. This allows for more efficient and cost-effective movement of its production to market, a critical advantage that new entrants would struggle to replicate without significant investment and time.

The oil and gas sector faces a formidable barrier to entry due to stringent and ever-evolving environmental regulations and safety standards. Navigating this complex web of permitting, compliance, and operational requirements demands substantial financial investment and specialized knowledge, effectively deterring potential new players.

Chord Energy, as an established entity, has already made significant investments in meeting these regulatory demands and implementing sustainable operational practices. This existing infrastructure and expertise create a considerable advantage and a high barrier for any newcomer attempting to enter the market.

Proprietary Technology and Expertise

Established E&P companies, including Chord Energy, possess deep expertise in unconventional drilling and reservoir management, particularly within basins like the Williston. This specialized knowledge, honed through years of operational experience, creates a significant barrier to entry.

Continuous innovation in techniques such as extended lateral drilling, with wells reaching 3-mile and even 4-mile lengths, further differentiates these established players. Replicating this level of technical proficiency and operational efficiency is a substantial challenge for newcomers.

- Proprietary Technology and Expertise: Chord Energy and peers have developed advanced operational efficiencies and reservoir management skills, especially in key basins.

- Difficult Replication: New entrants face a steep learning curve and significant investment requirements to match the technical expertise of incumbents.

- Innovation in Drilling: Advancements like extended lateral drilling (3-4 mile laterals) represent a competitive edge that is hard for new companies to quickly match.

Brand Loyalty and Switching Costs for Customers

While oil and gas are largely seen as commodities, customer relationships and existing supply chains can create a subtle barrier to new entrants. Major industrial consumers and refineries often prioritize suppliers with a demonstrated history of dependable delivery and strong operational performance.

Although the cost of the commodity itself is low, building new, trusted supply relationships can be a significant hurdle for customers considering a switch. This can make them hesitant to move away from established, proven partners, even if alternative sources are available.

For Chord Energy, this translates to a moderate threat from new entrants. While it's relatively easy to start producing oil and gas, securing and maintaining the trust of large, industrial customers requires time and consistent performance. For instance, in 2024, major energy consumers like chemical plants or large power generation facilities often renew contracts with established suppliers based on reliability metrics rather than solely on spot prices.

- Established relationships foster loyalty, even with commodity products.

- The cost of establishing new, reliable supply chains deters customer switching.

- Proven track records in consistent supply and operational integrity are key differentiators.

- New entrants face the challenge of building trust with large industrial customers.

The threat of new entrants in the oil and gas sector, particularly for companies like Chord Energy operating in established basins, is generally considered low to moderate. This is primarily due to the immense capital requirements, complex regulatory landscape, and the need for specialized technical expertise that deter most newcomers.

High upfront costs, estimated at tens of millions for a single well in areas like the Williston Basin, create a significant financial barrier. Furthermore, securing access to essential midstream infrastructure and building trust with industrial customers are substantial challenges that take considerable time and investment to overcome, making it difficult for new players to compete effectively.

| Barrier to Entry | Impact on New Entrants | Relevance to Chord Energy |

|---|---|---|

| Capital Intensity | Very High (e.g., $50M+ per well) | Chord Energy benefits from established access to capital. |

| Regulatory Compliance | High (Permitting, environmental standards) | Chord Energy has existing compliance infrastructure. |

| Technical Expertise | High (Unconventional drilling, reservoir management) | Chord Energy possesses deep operational knowledge. |

| Midstream Access | High (Pipeline capacity, refinery contracts) | Chord Energy has established relationships. |

| Customer Relationships | Moderate (Trust, reliability) | Chord Energy benefits from a proven track record. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chord Energy leverages data from their annual reports, investor presentations, and SEC filings, supplemented by industry reports from organizations like the EIA and IHS Markit to provide a comprehensive view of the competitive landscape.