Chord Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chord Energy Bundle

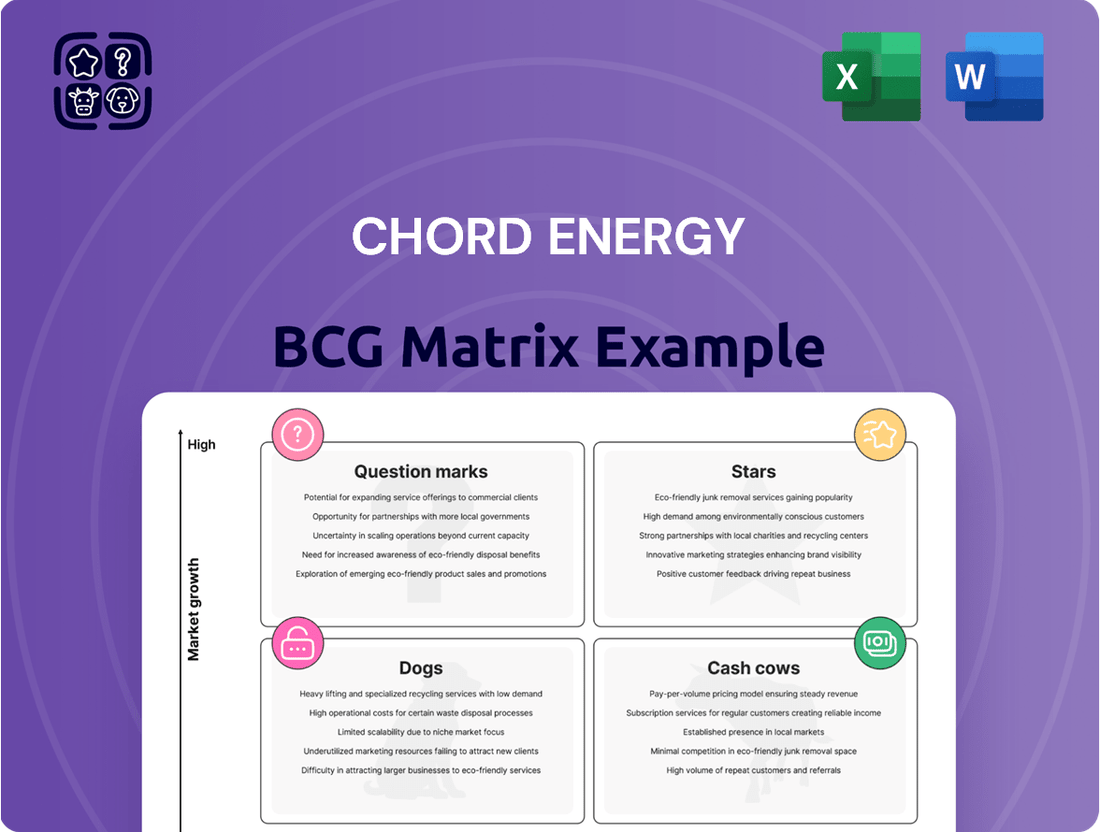

Uncover the strategic positioning of Chord Energy's portfolio with our insightful BCG Matrix preview. See which assets are driving growth and which require careful management.

This glimpse into Chord Energy's market standing is just the beginning. Purchase the full BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategic recommendations.

Don't miss out on the complete picture of Chord Energy's competitive landscape. Get the full BCG Matrix report for detailed quadrant analysis and a clear roadmap to optimizing your investments and product strategies.

Stars

Chord Energy's Williston Basin operations are a clear star in their portfolio. This region is a prime growth area for oil, natural gas, and natural gas liquids. The May 2024 acquisition of Enerplus was a game-changer, adding significant proved reserves and greatly increasing Chord's operational scale in the basin.

This expanded footprint, coupled with consistent development, solidifies the Williston Basin as a core growth engine for Chord Energy. Their dominant market share here, supported by strategic investments, positions these assets to deliver substantial future value and drive overall company performance.

Chord Energy's extended lateral drilling program, particularly the successful execution and planned expansion of 4-mile laterals, is a significant growth driver. This strategy aims to boost Estimated Ultimate Recovery (EUR) by an impressive 90-100%.

The capital expenditure increase for these longer wells is projected to be a more modest 40-60%. This efficiency gain is expected to substantially lower breakeven costs for Chord Energy.

As this innovative approach continues to scale across their operational inventory, it highlights Chord Energy's high growth potential and leadership in drilling efficiency within the basin.

Chord Energy's dedication to enhancing drilling and completion efficiencies is a key driver of its strategic positioning. For 2025, the company has lowered its capital guidance, yet it anticipates maintaining production targets. This suggests a significant improvement in capital efficiency, meaning more output for less investment.

This operational advancement directly translates into maximized returns from their development activities. It highlights a high-growth product that is becoming increasingly cost-effective, a hallmark of a strong performer in a BCG matrix. For instance, if Chord Energy previously spent $10 million for 1,000 barrels of oil equivalent (BOE) and now spends $8 million for the same 1,000 BOE, their capital efficiency has improved by 20%.

Production Per Share Growth

Chord Energy's production per share growth is a strong indicator of its success in the Star quadrant of the BCG matrix. This metric reflects not just increased output, but also how efficiently that growth translates into value for shareholders.

The company has demonstrated impressive growth, achieving a 12% compounded annual growth rate in oil production per share over the past three years. This performance is a direct result of their strategic share repurchase programs, which reduce the number of outstanding shares, and consistent operational outperformance.

- Production per Share Growth: Chord Energy has seen a 12% compounded annual growth rate in oil production per share over the last three years.

- Share Repurchases: Strategic buybacks have played a key role in boosting this per-share metric.

- Operational Outperformance: Consistent execution in operations further fuels this growth.

- Shareholder Value: This metric directly translates operational success into enhanced per-share value for investors, signifying a high-growth product.

Synergistic Integration from Acquisitions

Chord Energy's acquisition of Enerplus is a prime example of synergistic integration, a key driver for enhancing market position and financial performance. This strategic move is projected to unlock substantial value, with over $200 million in annual synergies anticipated. These savings and efficiencies stem from combining operational best practices and optimizing resource allocation.

This integration significantly strengthens Chord Energy's standing in the Williston Basin, solidifying its market leadership. The combined entity benefits from enhanced financial robustness and expanded operational scale. Such strategic acquisitions are crucial for bolstering market share and paving the way for sustained future growth.

- Synergy Target: Over $200 million in annual synergies expected from the Enerplus acquisition.

- Integration Benefits: Combining best practices and optimizing operations to drive efficiency.

- Market Impact: Enhances Chord Energy's financial strength and market leadership in the Williston Basin.

- Strategic Goal: Bolsters market share and future growth prospects through strategic acquisition.

Chord Energy's Williston Basin assets, bolstered by the Enerplus acquisition, are a clear Star. This segment exhibits high market share and strong growth potential, driven by efficient operations and strategic expansion. The company's focus on longer lateral drilling, increasing Estimated Ultimate Recovery (EUR) by 90-100% while only raising capital expenditure by 40-60%, exemplifies this Star status.

The 12% compounded annual growth rate in oil production per share over the last three years, supported by share repurchases and operational excellence, further cements the Williston Basin as a Star. Anticipated annual synergies exceeding $200 million from the Enerplus integration also highlight the exceptional performance and future prospects of these operations.

| Metric | Value/Description | Significance |

|---|---|---|

| Williston Basin Operations | High Market Share, Strong Growth Potential | Core Growth Engine |

| Longer Lateral Drilling | +90-100% EUR increase, +40-60% CapEx increase | Enhanced Efficiency & Profitability |

| Production Per Share Growth | 12% CAGR (3-year) | Shareholder Value Driver |

| Enerplus Acquisition Synergies | >$200 million annually | Financial & Operational Enhancement |

What is included in the product

Chord Energy's BCG Matrix offers a strategic framework to analyze its oil and gas assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

Visualize Chord Energy's portfolio, instantly identifying growth opportunities and areas needing divestment.

Cash Cows

Chord Energy's Williston Basin operations are a prime example of a cash cow. They hold a significant market share in a mature oil and gas market that, while not experiencing rapid growth, offers stability. This established production base is key to their consistent cash generation.

These assets boast a low base decline rate, meaning they require less ongoing investment to maintain production levels. This efficiency directly translates into substantial and predictable cash flow, providing a reliable revenue stream for the company.

In 2024, Chord Energy reported that its Williston Basin assets were a significant contributor to its overall production, averaging approximately 150,000 barrels of oil equivalent per day. This consistent output underpins its cash cow status.

Chord Energy demonstrates a consistent ability to generate substantial adjusted free cash flow, a hallmark of a cash cow. In the first quarter of 2025, the company reported $291 million in adjusted free cash flow, and it projects this figure to reach approximately $860 million for the entirety of 2025.

This strong and reliable cash generation significantly surpasses the company's operational requirements. Such robust cash flow provides Chord Energy with considerable financial flexibility, enabling it to effectively fund shareholder returns, including dividends and buybacks, and to support other key strategic initiatives without relying heavily on external financing.

Chord Energy is a prime example of a Cash Cow, consistently returning 100% of its adjusted free cash flow to shareholders. This commitment is executed through a balanced approach of base dividends and share repurchases, showcasing its strong cash-generating capabilities.

The company recently boosted its base dividend to $1.30 per share, a clear indicator of its financial health and shareholder-friendly policies. Furthermore, Chord Energy actively engaged in share repurchases, spending $216.5 million in the first quarter of 2025 alone, which directly benefits its investors.

Disciplined Capital Reinvestment Rate

Chord Energy's strategic emphasis on capital discipline is evident in its projected reinvestment rate, anticipated to be around 60% for 2025. This measured approach to deploying capital means that a substantial portion of the cash generated by its assets is not immediately put back into the business. Instead, it's directed towards enhancing shareholder returns or bolstering the company's financial stability.

This conservative capital allocation strategy is particularly effective for Chord Energy's Cash Cow assets, allowing the company to efficiently extract value. By not over-reinvesting, Chord Energy can effectively 'milk' these mature, high-market share assets, ensuring they continue to generate strong cash flows. This focus on disciplined reinvestment is key to maximizing returns from its established operations.

- Projected 2025 Reinvestment Rate: Approximately 60%.

- Capital Allocation Strategy: Prioritizes shareholder returns and balance sheet strength over aggressive reinvestment.

- Benefit for Cash Cows: Enables efficient extraction of value from high-market share, mature assets.

Strong Financial Health and Low Leverage

Chord Energy demonstrates exceptional financial fortitude, a key characteristic of a Cash Cow. Its net debt-to-Adjusted EBITDA ratio stands impressively low at 0.3x, underscoring minimal reliance on borrowed funds. This robust financial position is further solidified by over $1.9 billion in available liquidity, providing significant operational flexibility.

The company's financial stability was further recognized with a credit rating upgrade in March 2025, a testament to its strong performance and low leverage. This financial health signifies a mature and stable business, well-equipped to navigate market volatility and consistently generate substantial cash flow.

- Low Leverage: Net debt-to-Adjusted EBITDA of 0.3x.

- High Liquidity: Over $1.9 billion in available funds.

- Credit Strength: Recognized with a credit rating upgrade in March 2025.

- Financial Stability: Indicates a mature and resilient business model.

Chord Energy's Williston Basin operations are a quintessential cash cow, characterized by a dominant market share in a stable, mature market. These assets consistently generate predictable cash flow with minimal reinvestment needs due to low base decline rates.

The company's financial performance in 2024 and early 2025 highlights this cash cow status, with substantial adjusted free cash flow generation supporting significant shareholder returns. Chord Energy's commitment to capital discipline ensures these mature assets are efficiently managed to maximize value.

Chord Energy's financial strength, evidenced by low leverage and high liquidity, further solidifies its cash cow position. The company's strategy of returning nearly all free cash flow to shareholders through dividends and buybacks underscores the reliability of these operations.

| Metric | Value (Q1 2025) | Projected (2025) |

|---|---|---|

| Adjusted Free Cash Flow | $291 million | ~$860 million |

| Reinvestment Rate | N/A | ~60% |

| Net Debt to Adjusted EBITDA | 0.3x | N/A |

| Available Liquidity | Over $1.9 billion | N/A |

What You’re Viewing Is Included

Chord Energy BCG Matrix

The Chord Energy BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase, ready for immediate strategic application. This comprehensive analysis, showcasing Chord Energy's portfolio across the Stars, Cash Cows, Question Marks, and Dogs quadrants, is precisely what you'll download. You can confidently use this preview as a direct representation of the high-quality, actionable BCG Matrix report that will be yours to edit, present, or integrate into your business planning. No surprises, just a professionally formatted and insightful tool for understanding Chord Energy's market position.

Dogs

Chord Energy's non-operated Marcellus Shale assets are classified as a Dog in the BCG Matrix. These assets are not central to the company's strategic direction, which is heavily weighted towards the Williston Basin.

In the first quarter of 2025, these Marcellus assets contributed 128.5 million cubic feet per day (MMcf/d) of natural gas production. However, their low market share and minimal strategic importance make them prime candidates for divestment.

Chord Energy is actively seeking buyers for these non-core holdings, signaling a clear intent to streamline its portfolio and concentrate resources on its primary operational areas. This divestiture aligns with shedding assets that do not fit the company's core strategy and growth objectives.

Legacy high-operating cost wells, while not specifically itemized in Chord Energy's public disclosures, represent older or less efficient assets. These might not leverage advanced techniques like extended lateral drilling, leading to higher lease operating expenses (LOE) and reduced netbacks compared to newer wells. For instance, in 2023, the average LOE per barrel for the industry generally hovered around $10-$15, and older wells often sit at the higher end of this spectrum.

Marginal development opportunities within Chord Energy's portfolio might include areas with a limited number of high-return drilling locations or those facing challenging geological conditions. These prospects could demand significant capital expenditure for modest returns, diverging from Chord's strategic emphasis on capital efficiency and low-breakeven inventory. Consequently, such areas would likely be deprioritized or avoided in their development strategies.

Assets with Accelerated Decline Rates

Dogs in Chord Energy's BCG Matrix would represent legacy asset groups or regions experiencing steep production declines. These areas lack significant new drilling prospects to counter the natural depletion, meaning capital is continuously needed just to keep production from falling further. For instance, if a specific mature basin within Chord Energy's portfolio saw its production decline by over 15% year-over-year in 2024 without a robust development plan, it could be classified as a dog.

These assets typically generate minimal or even negative net cash flow because the capital expenditure required to maintain production outweighs the revenue generated. This situation is common in the upstream oil and gas sector as fields mature and become more expensive to extract from. For example, if a particular legacy field requires $50 million in capital to maintain production in 2024, but only generates $40 million in revenue, it represents a negative cash contribution.

- Legacy Assets with High Decline Rates: Areas where production naturally falls off rapidly.

- Limited New Drilling Opportunities: Lack of viable prospects to replace declining output.

- Continuous Capital Drain: Ongoing investment needed to simply maintain existing production levels.

- Low or Negative Net Cash Contribution: Capital expenditure exceeds revenue generated, impacting overall profitability.

Non-Strategic Minor Acreage Positions

Non-strategic minor acreage positions represent Chord Energy's smaller, scattered landholdings. These are typically located outside their primary Williston Basin focus or are fragmented within the basin itself. Crucially, these parcels don't offer the scale needed for efficient drilling operations or possess a substantial inventory of future drilling locations.

These holdings are often the result of past acquisitions, where smaller, non-core tracts were acquired. Given Chord Energy's strategic emphasis on consolidating and maximizing efficiency within its core Williston Basin assets, these minor acreage positions are unlikely to be prioritized for future capital investment. Consequently, the company may explore opportunities to divest these parcels.

For instance, while specific figures for these minor positions aren't publicly detailed, Chord Energy's 2024 operational focus has been on optimizing its existing, larger acreage blocks. This strategy aims to leverage economies of scale, which these minor positions inherently lack. The company's stated commitment to disciplined capital allocation further supports the idea that resources will be concentrated on assets with higher potential returns and operational synergies.

- Small, fragmented acreage: These are parcels that do not contribute significantly to drilling inventory or operational efficiency.

- Lack of economies of scale: The size and location of these holdings prevent cost-effective development.

- Historical remnants: Many are likely legacy assets from past, broader acquisition strategies.

- Potential for divestment: Chord Energy may seek to sell these non-core assets to sharpen its strategic focus.

Dogs within Chord Energy’s portfolio represent assets with low market share and low growth potential, often requiring significant capital just to maintain production. These are typically legacy assets or non-strategic minor acreage that do not align with the company's core focus, such as the Williston Basin. For example, in 2024, assets with steep production declines and limited new drilling opportunities would fit this classification, potentially draining resources without offering substantial returns.

These segments often generate minimal or even negative cash flow, as the costs to operate and maintain them exceed the revenue they produce. Chord Energy's strategy involves identifying and potentially divesting these underperforming assets to concentrate capital and management attention on higher-return opportunities. This streamlining aims to improve overall portfolio efficiency and profitability.

The non-operated Marcellus Shale assets are a clear example of a Dog, contributing 128.5 MMcf/d in Q1 2025 but lacking strategic importance and a significant market share. Chord Energy is actively seeking buyers for these holdings, underscoring their classification as non-core and expendable.

Similarly, small, fragmented acreage positions outside the core Williston Basin lack the scale for efficient operations and future development, making them candidates for divestment. These holdings, often remnants of past acquisitions, do not benefit from economies of scale and are unlikely to receive future capital investment.

| BCG Category | Asset Example | Characteristics | Strategic Implication | 2024/2025 Data Point |

| Dog | Non-operated Marcellus Shale Assets | Low market share, low growth potential, not core to strategy | Potential for divestment | 128.5 MMcf/d production (Q1 2025) |

| Dog | Legacy Assets with High Decline Rates | Steep production declines, limited new drilling prospects | Continuous capital drain, low net cash flow | >15% year-over-year production decline in a mature basin (hypothetical 2024) |

| Dog | Non-strategic Minor Acreage Positions | Small, fragmented holdings, lack of economies of scale | Potential for divestment, low capital allocation | Focus on optimizing larger acreage blocks (2024 strategy) |

Question Marks

Chord Energy's extensive undeveloped inventory of four-mile laterals currently sits in the question mark category of the BCG matrix. While existing four-mile laterals are performing exceptionally well, akin to stars, the sheer volume of untapped locations presents a significant opportunity, albeit one requiring substantial capital to realize.

These question mark assets boast high growth potential due to their inherently superior economics and estimated ultimate recovery (EUR) compared to shorter laterals. However, transforming this potential into tangible production and increasing their share of Chord's output necessitates continued, considerable investment in drilling and completion activities.

The company's commitment to this segment is evident in its plan to spud seven four-mile wells within the next 8-9 months. This strategic move underscores Chord Energy's focus on developing these high-potential areas, aiming to convert these question marks into future production stars.

The 2023 acquisition of XTO Energy's assets brought roughly 62,000 net acres to Chord Energy, with a significant 77% of this acreage remaining undeveloped. This substantial undeveloped land bank represents a classic 'question mark' in the BCG matrix, possessing considerable future potential.

This acreage is strategically located within or bordering Chord's established Williston Basin development areas, suggesting strong operational synergies and a clear path for future exploitation. However, its 'question mark' status stems from the considerable capital investment and successful execution required to transform it from undeveloped land into revenue-generating wells.

Chord Energy's 2024 focus on gas capture and emissions reduction, including piloting new technologies to minimize flaring and methane, positions these efforts as potential Stars or Question Marks in a BCG matrix. The company's dedicated team signals a commitment to innovation in these areas, aiming to align with ESG objectives.

While the long-term commercial benefits, such as cost savings from reduced waste or new revenue from carbon credits, are still materializing, these initiatives represent significant growth potential. Continued investment is crucial for these technologies to mature and potentially become cash cows or high-growth Stars.

Diversification in Well Shape Designs

Chord Energy is actively investigating and piloting diverse wellbore designs to bolster operational resilience and efficiency. This strategic move suggests a commitment to research and development, exploring novel drilling configurations that could yield significant economic advantages.

These innovative well shape designs are currently in their nascent stages of widespread implementation, representing a potential growth area with high upside but also inherent early-stage uncertainty. This positions them as a 'question mark' within the Chord Energy portfolio, requiring further evaluation to determine their long-term impact and scalability.

- Exploration of Novel Designs: Chord Energy's focus on varied well shape designs, such as extended reach laterals or complex multi-well pads, aims to optimize resource extraction and reduce operational costs.

- R&D and Pilot Phase: The company is investing in the research and development of these new configurations, with pilot projects underway to assess their technical feasibility and economic viability.

- High Growth Potential: Successful implementation of these diversified well designs could lead to substantial improvements in production rates and a lower cost per barrel, indicating significant future growth potential.

- Early Stage Adoption: While promising, these advanced well designs are not yet standard practice across all Chord Energy operations, placing them in the 'question mark' category as their broader impact is still being determined.

Potential for Further Basin Consolidation

The Williston Basin has seen considerable activity in terms of companies combining, and Chord Energy has been a key player in this trend, notably with its acquisition of Enerplus. This ongoing consolidation suggests a potential for further strategic moves by Chord Energy within the basin.

Future acquisitions, while offering substantial growth and increased market presence, carry inherent uncertainties and demand significant financial commitment. These potential, unannounced opportunities represent high-growth avenues with currently undefined impacts on market share.

For instance, Chord Energy's acquisition of Enerplus in early 2024 for approximately $3.8 billion significantly expanded its footprint. This deal highlights the company's strategy of pursuing consolidation to enhance its competitive position and operational efficiencies in the Williston Basin.

- Active Participation: Chord Energy has demonstrated a commitment to consolidation, exemplified by its 2024 acquisition of Enerplus.

- Growth Potential: Future acquisitions could lead to significant expansion in market share and operational scale within the Williston Basin.

- Capital Requirements: Pursuing further consolidation will necessitate substantial capital investment and careful financial planning.

- Strategic Uncertainty: The exact nature and impact of future consolidation opportunities remain speculative, presenting both risks and high-reward possibilities.

Chord Energy's extensive undeveloped inventory of four-mile laterals currently sits in the question mark category of the BCG matrix. While existing four-mile laterals are performing exceptionally well, akin to stars, the sheer volume of untapped locations presents a significant opportunity, albeit one requiring substantial capital to realize.

These question mark assets boast high growth potential due to their inherently superior economics and estimated ultimate recovery (EUR) compared to shorter laterals. However, transforming this potential into tangible production and increasing their share of Chord's output necessitates continued, considerable investment in drilling and completion activities.

The company's commitment to this segment is evident in its plan to spud seven four-mile wells within the next 8-9 months. This strategic move underscores Chord Energy's focus on developing these high-potential areas, aiming to convert these question marks into future production stars.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Chord Energy's financial statements, investor presentations, and industry-specific market research to accurately assess business unit performance and growth potential.