China Unicom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

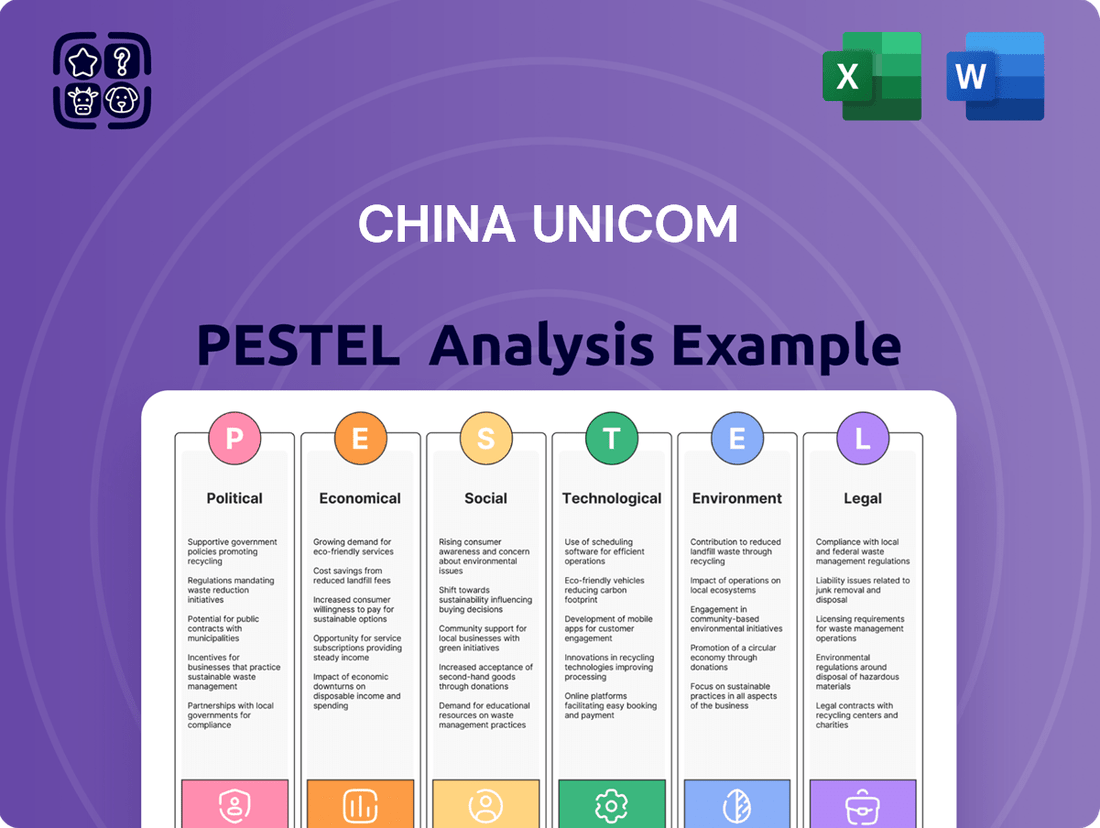

China Unicom operates within a dynamic global landscape, influenced by shifting political alliances, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable insights to navigate the complexities of the telecommunications sector. Download the full version now and gain the clarity needed to make informed decisions.

Political factors

As a significant state-owned enterprise, China Unicom's strategic direction and operational framework are intrinsically linked to the directives of the Chinese government. This government oversight is particularly evident in national development blueprints like the 14th Five-Year Plan (2021-2025), which prioritizes the enhancement of the digital economy and infrastructure, directly impacting China Unicom's investment and expansion plans.

The government's substantial ownership stake means China Unicom's activities are aligned with national strategic interests, such as promoting 5G deployment and ensuring cybersecurity. For instance, by the end of 2023, China had built over 3.377 million 5G base stations, a testament to the government's push for advanced telecommunications infrastructure, a sector where China Unicom is a key player.

This close relationship provides China Unicom with advantages like access to capital and favorable regulatory treatment, but it also implies a degree of operational autonomy that is less pronounced than in privately held telecommunications firms. The government's influence shapes market access, pricing strategies, and the adoption of new technologies.

The Ministry of Industry and Information Technology (MIIT) is the primary regulator for China's telecommunications industry, significantly influencing companies like China Unicom. MIIT's directives shape everything from network infrastructure to the rollout of new technologies.

MIIT actively promotes infrastructure sharing and co-construction among telecom operators, aiming for greater efficiency and reduced costs. This policy directly affects how China Unicom invests in and expands its network capabilities, especially for 5G deployment.

In 2024, China continued its aggressive push for 5G, with MIIT setting targets for base station expansion and user adoption. China Unicom, as a key player, must align its strategies with these national objectives, impacting its capital expenditure and service development plans.

China's evolving data security and privacy landscape, marked by the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL), presents significant compliance challenges. New Network Data Security Management Regulations, effective January 1, 2025, further tighten rules on data handling and cross-border transfers, especially for sensitive information.

China Unicom, as a telecommunications giant, faces substantial operational and financial implications from these stringent regulations. Ensuring compliance with requirements for data localization and security audits will necessitate considerable investment in infrastructure and cybersecurity measures throughout 2024 and into 2025.

Opening-up of Value-Added Telecom Services

The Chinese government's recent pilot programs, launched in late 2024, are cautiously opening up value-added telecom services (VATS) to foreign investment in key economic zones. This includes potential for 100% foreign ownership in areas like Internet Data Centers (IDC) and Content Delivery Networks (CDN) in cities such as Beijing, Shanghai, Hainan, and Shenzhen.

This liberalization, while directly affecting foreign players, creates a more competitive landscape for domestic operators like China Unicom. Increased foreign participation could drive innovation and efficiency but also pressure existing market share in specific VATS segments. For instance, the IDC market in China was projected to reach over $20 billion in 2024, indicating a significant area of potential competition.

- Increased Competition: Foreign investment in VATS, particularly IDC and CDN, will likely intensify competition for China Unicom.

- Market Liberalization Signal: The pilot programs signal a broader trend towards opening China's telecom sector, potentially impacting future regulatory frameworks.

- Focus on Specific Services: The initial focus on IDC and CDN suggests these are priority areas for foreign investment and where China Unicom might face the most immediate competitive pressure.

- Innovation Driver: Greater foreign involvement could spur technological advancements and service improvements across the VATS market.

National Digital Transformation Initiatives

China's national strategy, often referred to as 'Digital China,' is a significant political driver for China Unicom. This initiative prioritizes the development of the digital economy, channeling substantial government resources into areas like 5G, artificial intelligence, big data, and the Internet of Things. By 2024, China had already deployed over 3.3 million 5G base stations, a figure expected to continue its rapid expansion, directly benefiting infrastructure providers like China Unicom.

China Unicom is strategically positioned to capitalize on these government-backed digital transformation efforts. The company is a key player in national projects, particularly those integrating 5G technology with industrial applications, often termed '5G + industrial internet.' This alignment ensures that China Unicom's business development is intrinsically linked to the nation's overarching digital ambitions and investment priorities.

- Digital China Strategy: Government-led push for digital economy development.

- Infrastructure Investment: Massive spending on 5G, AI, big data, and IoT.

- 5G Deployment: Over 3.3 million 5G base stations in China by 2024, fueling demand for network services.

- Industrial Internet Integration: China Unicom's active participation in '5G + industrial internet' projects.

Government policy heavily influences China Unicom's operational landscape, with directives from bodies like the Ministry of Industry and Information Technology (MIIT) shaping its strategic direction. The 'Digital China' initiative, a key national strategy, is driving significant investment in areas like 5G and AI, directly benefiting infrastructure providers such as China Unicom, which had over 3.377 million 5G base stations deployed by the end of 2023.

Stringent data security and privacy laws, including the Cybersecurity Law, Data Security Law, and Personal Information Protection Law, impose substantial compliance burdens, requiring significant investment in infrastructure and cybersecurity measures throughout 2024 and into 2025. Pilot programs initiated in late 2024 are cautiously opening value-added telecom services to foreign investment, potentially increasing competition for China Unicom in segments like Internet Data Centers (IDC), a market projected to exceed $20 billion in 2024.

What is included in the product

This PESTLE analysis thoroughly examines the political, economic, social, technological, environmental, and legal factors influencing China Unicom.

It provides actionable insights into market dynamics and regulatory landscapes to inform strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of China Unicom's external landscape to mitigate strategic uncertainties.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, legal, and environmental factors impacting China Unicom's operations.

Economic factors

China Unicom demonstrated robust financial health in 2024, with operating revenue climbing 4.6% year-on-year to RMB 389.6 billion. This upward trend continued into early 2025, with Q1 operating revenue showing a 3.9% year-on-year increase.

The company’s profitability also saw a substantial boost, with profit attributable to equity shareholders rising by 10.1% in 2024. This consistent growth underscores the strength of its core businesses, including connectivity, communications, and digital smart applications.

China Unicom's capital expenditure strategy is clearly evolving, with a significant pivot towards computing power. In 2024, the company spent RMB 61.37 billion on capital expenditures, a notable 17% decrease from the previous year. However, this reduction was accompanied by a substantial increase in investment directed towards computing power infrastructure.

Looking ahead to 2025, this trend is set to accelerate. China Unicom plans a considerable 28% surge in capital expenses specifically for computing power. This includes a dedicated 'special budget' to support critical AI infrastructure projects, underscoring a strategic commitment to advanced technologies that will shape its future growth and digital transformation initiatives.

China Unicom's Computing and Digital Smart Applications (CDSA) business is a key growth engine, representing 24% of its service revenue in 2024. This segment saw a robust 9.6% year-on-year increase, highlighting strong market demand.

The CDSA segment, encompassing cloud services and intelligent computing, is crucial for China Unicom's strategy. It directly benefits from the accelerating digitalization across various industries and the expansion of the digital economy.

Competitive Pricing in Mobile Data

China Unicom, like its peers in the Chinese telecommunications sector, operates within a highly competitive pricing landscape for mobile data. Significant price reductions per gigabyte have become a norm, driven by intense market rivalry. This aggressive pricing directly influences the average revenue per user (ARPU) for operators, potentially squeezing margins.

Despite the pressure on ARPU, this competitive pricing strategy is a key enabler for broader digital inclusion. By making data more affordable, it encourages greater adoption of online services across a wider population. This expansion of access fuels a virtuous cycle, leading to increased overall data consumption, which can partially offset per-gigabyte revenue declines.

- Data price per GB in China has seen substantial decreases, impacting ARPU for major carriers.

- The competitive pricing environment is a major factor influencing China Unicom's revenue streams.

- Lower data costs are instrumental in driving digital service adoption and overall market connectivity.

- Increased data consumption is a direct consequence of more affordable mobile data plans.

Impact of Digital Economy on GDP

The digital economy is a significant growth engine for China's GDP. Mobile technologies and the ongoing digital transformation are poised to inject substantial value into the nation's economic output. For instance, 5G technology alone is projected to contribute nearly $260 billion to China's economy by 2030, representing a significant 23% of the total economic impact attributed to mobile technologies in the country.

China Unicom, as a frontrunner in telecommunications and a critical enabler of 5G infrastructure, is directly positioned to benefit from this burgeoning digital landscape. The company's investments and operations in 5G deployment not only contribute to this economic expansion but also allow it to capitalize on the increasing demand for digital services and connectivity.

- Projected 5G Contribution: Nearly $260 billion by 2030.

- 5G's Share of Mobile Impact: 23% of the overall economic impact of mobile in China.

- China Unicom's Role: Key player in 5G deployment and a direct beneficiary of digital economy growth.

- Digital Transformation Impact: Driving substantial economic value through mobile technologies.

China's economic growth trajectory, particularly its emphasis on digital transformation and AI, directly fuels demand for China Unicom's services. The nation's commitment to developing its digital economy is a significant tailwind, with mobile technologies projected to contribute substantially to GDP. For example, 5G is expected to add nearly $260 billion to China's economy by 2030.

China Unicom's strategic shift towards computing power, with a planned 28% surge in related capital expenditure for 2025, aligns perfectly with these national economic priorities. This focus on AI infrastructure and cloud services positions the company to capitalize on the accelerating digitalization across industries.

The competitive landscape, characterized by decreasing data prices per gigabyte, presents a dual impact. While it pressures ARPU, it simultaneously drives broader digital inclusion and increased data consumption, creating a larger overall market for connectivity services.

China Unicom's financial performance in 2024, with a 4.6% rise in operating revenue to RMB 389.6 billion, reflects its ability to navigate these economic factors. The company's Computing and Digital Smart Applications segment, a 24% revenue contributor, grew by 9.6%, underscoring the demand for digital solutions.

| Metric | 2024 Value | Year-on-Year Change | 2025 Outlook | Key Driver |

|---|---|---|---|---|

| Operating Revenue | RMB 389.6 billion | +4.6% | Continued growth expected | Digitalization, 5G adoption |

| Profit Attributable to Equity Shareholders | N/A | +10.1% | N/A | Core business strength |

| Capital Expenditure (Total) | RMB 61.37 billion | -17% | Increase expected | Shift to computing power |

| Capital Expenditure (Computing Power) | Significant increase | N/A | +28% planned | AI infrastructure investment |

| CDSA Segment Revenue | 24% of service revenue | +9.6% | Continued growth | Cloud services, intelligent computing demand |

What You See Is What You Get

China Unicom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of China Unicom.

This is a real screenshot of the product you’re buying—delivered exactly as shown, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Unicom.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

China's digital landscape is booming, with internet user numbers soaring. This growth is largely thanks to more accessible and affordable mobile and broadband services. By 2024, China had already surpassed 1 billion 5G connections, a remarkable figure that accounts for roughly half of all 5G connections worldwide.

This massive adoption rate directly translates into increased demand for China Unicom's services. It highlights how deeply integrated telecommunications infrastructure has become in the daily lives of Chinese citizens, impacting everything from work and education to social interaction and entertainment.

Chinese society exhibits a robust and growing appetite for high-speed fixed broadband and cutting-edge mobile services, including 5G and its successor, 5G-Advanced. This societal trend fuels the demand for faster, more reliable connectivity, pushing the boundaries of digital interaction and entertainment.

China Unicom is strategically positioned to capitalize on this demand, with plans to roll out 5G-Advanced services to more than 300 cities by the close of 2025. These advanced services promise unprecedented capabilities, such as 10 Gbps connectivity, seamless multi-channel HD live streaming, and immersive VR broadcasting, directly addressing the evolving digital consumption patterns of the population.

China Unicom's commitment to digital inclusion is evident in its Digital Village platform, which has successfully connected 260,000 administrative villages. This initiative directly supports rural revitalization efforts by providing essential communication infrastructure and services to previously underserved areas.

By bridging the digital divide, China Unicom plays a crucial role in ensuring that rural communities benefit from the digital economy, aligning with national strategies for balanced development. This focus on rural connectivity is vital for economic growth and social equity across China.

Changing Consumer Behavior and Digital Lifestyles

The pervasive adoption of smartphones and mobile internet in China has fundamentally reshaped consumer behavior, driving an insatiable demand for mobile data and a diverse range of digital services. By the end of 2023, China had over 1.1 billion mobile internet users, with smartphone penetration exceeding 85%. This digital shift directly fuels China Unicom's strategic focus on innovative offerings.

China Unicom is actively catering to these evolving digital lifestyles by emphasizing forward-thinking services. Their portfolio includes AI-powered applications and digital smart solutions designed to integrate seamlessly into daily routines. For instance, the company is a key player in promoting AI integration across various sectors, from smart home ecosystems to the burgeoning intelligent connected vehicles market, reflecting a deep understanding of modern consumer demands.

Key aspects of this changing behavior include:

- Increased reliance on mobile data: Consumers are spending more time online, necessitating higher data allowances and faster network speeds.

- Demand for digital services: This encompasses everything from streaming entertainment and online shopping to digital payments and cloud-based applications.

- Growth in smart device adoption: The proliferation of smart home devices and connected cars creates new avenues for service provision and data consumption.

- Preference for personalized experiences: Consumers expect tailored content and services, often delivered through AI-driven platforms.

Societal Expectations for Cybersecurity and Data Privacy

Societal expectations in China are increasingly focused on robust cybersecurity and data privacy. This heightened awareness, driven by recent regulations, places significant pressure on companies like China Unicom to safeguard user information. Failure to meet these expectations can result in substantial fines and a significant erosion of public confidence.

The Network Data Security Management Regulations, implemented in 2021, underscore this shift. These regulations mandate stricter data handling practices, directly influencing how China Unicom must operate. A key sociological factor is the public's demand for transparency and accountability regarding data usage.

- Increased public scrutiny of data handling practices

- Demand for transparency in cybersecurity measures

- Expectation of swift and effective response to data breaches

- Growing awareness of digital rights and privacy

Chinese society's increasing digital literacy and demand for advanced connectivity directly benefit China Unicom. By the end of 2024, China had over 1.1 billion mobile internet users, with smartphone penetration exceeding 85%, fueling the need for high-speed data and innovative services.

The company's focus on rural digital inclusion, connecting 260,000 administrative villages by early 2025, addresses societal equity concerns and unlocks new markets. This strategy aligns with national goals for balanced development and improved quality of life in underserved areas.

Heightened societal expectations around data privacy and cybersecurity, reinforced by regulations like the Network Data Security Management Regulations (2021), are critical. China Unicom must ensure robust data protection and transparency to maintain public trust and avoid penalties.

China Unicom is actively expanding its 5G-Advanced network, aiming for coverage in over 300 cities by the end of 2025, catering to the growing demand for immersive digital experiences like VR and high-definition streaming.

| Sociological Factor | Description | Impact on China Unicom | 2024/2025 Data Point |

|---|---|---|---|

| Digital Literacy & Demand | Growing proficiency and desire for digital services. | Increased adoption of mobile and broadband services. | Over 1.1 billion mobile internet users (end of 2023). |

| Rural Digital Inclusion | Government and public push for equitable access. | Opportunity to expand services to underserved regions. | 260,000 administrative villages connected by early 2025. |

| Data Privacy & Security Awareness | Heightened public concern and regulatory focus. | Necessity for stringent data protection and transparency. | Network Data Security Management Regulations (2021). |

| Demand for Advanced Connectivity | Appetite for faster speeds and new digital experiences. | Drives investment in 5G and future network technologies. | Target of 300+ cities for 5G-Advanced by end of 2025. |

Technological factors

China Unicom is aggressively expanding its 5G and 5G-Advanced (5G-A) networks, aiming for 5G-A service availability in over 300 cities by the end of 2025. This strategic push leverages their existing infrastructure, which already includes more than 2 million 5G base stations, representing over 40% of the global 5G base station count.

This substantial network build-out positions China Unicom to capitalize on emerging technologies like enhanced mobile broadband, ultra-reliable low-latency communication, and massive machine-type communication. The extensive 5G infrastructure is a critical technological enabler for future innovation and service development.

China Unicom is making substantial investments in computing power, with a notable 19% increase in 2024 and a projected 28% rise for 2025, specifically earmarking funds for AI infrastructure. The company's ambition is to reach 45 EFLOPS of computing power by the close of 2025, alongside exploring the deployment of a massive 100,000-GPU cluster.

China Unicom is significantly expanding its Computing and Digital Smart Applications (CDSA) segment, a strategic move that encompasses cloud services and intelligent computing capabilities. This focus positions the company to cater to the growing demand for digital solutions across various sectors.

The company's commitment to this area is reflected in its financial performance, with cloud revenue reaching RMB 68.6 billion in 2024, marking a robust year-on-year growth of 17.1%. This substantial increase underscores the market's positive reception to China Unicom's cloud offerings.

By developing these digital applications and cloud platforms, China Unicom is now equipped to provide integrated enterprise solutions. This capability is crucial for driving digital transformation initiatives for businesses, enabling them to leverage advanced technology for improved efficiency and innovation.

Advancements in Network Innovation and Infrastructure

China Unicom is aggressively pursuing network innovation, notably with its commitment to ultra-high-speed technologies like 800G and 1.2T bandwidth. This focus is crucial for supporting the increasing data demands of modern digital services and applications.

The company is developing a 'Computing Power Intelligence Network,' integrating AI to automate network operations. This aims for self-configuring, self-optimizing, and self-healing capabilities, significantly boosting efficiency and reliability.

- Network Upgrade: China Unicom is investing in 800G and 1.2T bandwidth technologies, pushing the boundaries of network speed.

- AI Integration: The company is embedding AI into network operations for enhanced automation and performance.

- Operational Efficiency: These advancements are designed to improve network efficiency, reliability, and the capacity to handle high-demand services.

Exploration of Future Technologies (6G and IoT)

China is aggressively pursuing 6G technology, aiming for trials of 10-gigabit optical networks, signifying a commitment to staying at the forefront of mobile communication beyond current 5G capabilities. This strategic push is crucial for unlocking the full potential of the Internet of Things (IoT) and enabling advanced applications.

China Unicom is actively engaged in this technological evolution, championing 5G RedCap (Reduced Capability) technology. This initiative is designed to optimize 5G for a wider range of IoT devices, making connectivity more efficient and cost-effective for various industrial applications.

The company's focus on the '5G + industrial internet' strategy underscores its dedication to integrating next-generation mobile networks with industrial processes. This synergy is expected to drive significant advancements in automation, data analytics, and operational efficiency across multiple sectors.

Key initiatives and developments include:

- 6G Technology Development: China's national strategy includes the innovative development of 6G, with planned trials for 10-gigabit optical networks.

- 5G RedCap Promotion: China Unicom is actively promoting 5G RedCap to enhance IoT connectivity and efficiency.

- Industrial Internet Integration: The company is a key player in the '5G + industrial internet' initiatives, fostering digital transformation in industries.

- IoT Expansion: These technological advancements are foundational for the widespread adoption and sophisticated capabilities of the Internet of Things.

China Unicom is at the forefront of network infrastructure upgrades, aiming for 5G-Advanced (5G-A) service availability in over 300 cities by the end of 2025, building on its existing 2 million+ 5G base stations. The company is also heavily investing in computing power, projecting a 28% increase for 2025 to reach 45 EFLOPS, with a significant focus on AI infrastructure and a potential 100,000-GPU cluster deployment.

Technological advancements are central to China Unicom's strategy, including the development of ultra-high-speed 800G and 1.2T bandwidth technologies and the integration of AI for network automation, aiming for self-configuring and self-healing capabilities. Furthermore, the company is actively involved in promoting 5G RedCap for efficient IoT connectivity and is a key player in the national '5G + industrial internet' initiative, aligning with China's broader ambitions in 6G development.

| Technology Focus | Key Initiatives & Targets | 2024/2025 Data/Projections |

|---|---|---|

| 5G & 5G-A Expansion | Expanding 5G-A service availability | Target: 300+ cities by end of 2025 |

| Network Infrastructure | Upgrading bandwidth | Investment in 800G and 1.2T technologies |

| Computing Power & AI | Increasing computing capacity and AI infrastructure | 2024: 19% increase; 2025 Projection: 28% increase; Target: 45 EFLOPS by end of 2025; Exploring 100,000-GPU cluster |

| IoT & Industrial Applications | Enhancing IoT connectivity and industrial integration | Promoting 5G RedCap; Key player in '5G + industrial internet' |

| Future Mobile Tech | Research and development for next-generation networks | Involvement in 6G development, including 10-gigabit optical network trials |

Legal factors

China's data protection framework, encompassing the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL), is being further strengthened by the Network Data Security Management Regulations, effective January 1, 2025. These laws mandate stringent protocols for data handling, including collection, processing, storage, and cross-border transfers, with a particular focus on personal information and 'important data'.

China Unicom faces significant legal obligations to adhere to these comprehensive data protection mandates. Non-compliance can result in severe penalties, including substantial fines and operational restrictions, underscoring the critical need for robust data governance and security measures across its operations.

China Unicom, as a major telecommunications provider in China, operates under strict licensing and regulatory frameworks overseen by the Ministry of Industry and Information Technology (MIIT). This means adhering to specific guidelines for service quality, network build-out, and fair market competition. For instance, MIIT's directives on 5G deployment, such as the accelerated rollout targets announced in late 2023, directly impact China Unicom's infrastructure investment strategies.

Compliance with these regulations is not a one-time event but an ongoing necessity for China Unicom to maintain its operational licenses and its standing in the competitive Chinese market. Failure to meet evolving standards, such as data privacy regulations or network security mandates, could result in penalties or even the suspension of services, impacting its revenue streams and market share.

China's telecommunications sector, while historically state-controlled, is seeing a measured opening to foreign investment. Pilot programs launched in late 2024 are permitting increased foreign ownership in specific value-added telecom services (VATS).

This regulatory shift, allowing up to 50% foreign ownership in VATS, could foster a more competitive landscape for China Unicom, especially in high-growth segments like data centers and cloud computing.

These evolving regulations signal a trend towards greater market liberalization, potentially attracting foreign capital and expertise, which could spur innovation and service improvements within the sector.

Cybersecurity Law and Critical Information Infrastructure Protection

China's Cybersecurity Law (CSL) categorizes specific networks and information systems as Critical Information Infrastructure (CII). China Unicom, as a leading telecom provider, almost certainly falls under this CII designation. This means the company must comply with stringent cybersecurity mandates, including regular risk assessments and detailed incident reporting. In 2023, China's Ministry of Industry and Information Technology (MIIT) continued to emphasize stricter enforcement of cybersecurity standards across critical sectors.

Adherence to these regulations impacts China Unicom's operational costs and strategic planning. Failure to meet CII requirements can result in significant penalties, as outlined in the CSL, which can include fines and even business suspension. The ongoing evolution of cybersecurity threats necessitates continuous investment in advanced security technologies and personnel training for companies like China Unicom.

- CSL Designation: China Unicom's infrastructure is likely classified as Critical Information Infrastructure (CII).

- Compliance Requirements: Strict adherence to enhanced security measures, risk assessments, and incident reporting is mandatory.

- Enforcement Focus: MIIT's continued emphasis on cybersecurity standards in 2023 highlights regulatory scrutiny.

- Financial Implications: Non-compliance can lead to substantial fines and operational disruptions.

Intellectual Property Rights Protection

Intellectual property rights are paramount for China Unicom, especially given its deep involvement in cutting-edge fields like 5G and artificial intelligence. The company must diligently protect its own technological innovations while also ensuring it respects the intellectual property of others, particularly when utilizing third-party technologies. This careful navigation of intellectual property laws is fundamental to its research and development efforts, the integrity of its product and service offerings, and the success of its strategic partnerships, especially as it operates on a global scale.

China's commitment to strengthening intellectual property protection has been evident in recent years. For instance, the country's Supreme People's Court reported a significant increase in IP-related cases handled, indicating a more robust enforcement environment. In 2023, the number of civil cases involving patent disputes and trademark infringements saw continued growth, underscoring the importance of compliance for companies like China Unicom operating within this framework.

- Protecting Innovation: China Unicom's advancements in 5G network infrastructure and AI-driven services necessitate strong IP protection to safeguard its competitive edge.

- Third-Party Licensing: The company's reliance on various technologies means it must manage licensing agreements and avoid infringement claims, a common challenge in the tech sector.

- Global Standards: Adherence to international IP standards is crucial for China Unicom's global expansion and collaboration efforts, ensuring its innovations are recognized and protected worldwide.

China Unicom must navigate a complex web of data privacy and cybersecurity laws, including the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL), with new Network Data Security Management Regulations effective January 1, 2025. These regulations impose strict requirements on data handling, particularly for personal and sensitive information, and carry significant penalties for non-compliance, impacting operational continuity and financial health.

The company's operations are governed by strict licensing and regulatory oversight from the Ministry of Industry and Information Technology (MIIT), dictating standards for service quality and network development, such as the accelerated 5G deployment targets from late 2023. Continuous compliance with these evolving mandates is essential for maintaining operational licenses and market position.

China Unicom's infrastructure is likely designated as Critical Information Infrastructure (CII) under the CSL, necessitating rigorous security measures, regular risk assessments, and detailed incident reporting, with MIIT intensifying enforcement in 2023. Failure to meet these stringent cybersecurity standards can lead to substantial fines and even service suspension.

The company must also diligently protect its intellectual property in areas like 5G and AI, while respecting third-party IP rights, a critical aspect underscored by the increasing number of IP-related cases handled by China's Supreme People's Court in 2023.

Environmental factors

China Unicom is deeply committed to green development, aligning its strategies with China's ambitious carbon peaking by 2030 and carbon neutrality by 2060 targets. This commitment translates into tangible actions, such as the innovative application of energy-saving and carbon-reduction technologies across its vast network infrastructure and data centers. For instance, in 2023, the company reported a significant reduction in energy consumption per unit of traffic, demonstrating its progress in operational efficiency.

China Unicom's commitment to sustainable infrastructure is evident in its co-building and co-sharing initiatives with other major operators like China Telecom. This collaboration aims to curb redundant construction of 4G and 5G base stations, a critical step in environmental stewardship.

By sharing infrastructure, China Unicom significantly boosts the efficiency of existing base stations. This approach directly translates to lower consumption of land, energy, and raw materials, thereby minimizing the company's overall environmental footprint.

For instance, in 2023, China Unicom reported a substantial reduction in energy consumption per base station through these sharing agreements, contributing to the national goal of carbon neutrality. This strategy not only offers environmental benefits but also improves cost-effectiveness.

China Unicom is actively merging its digital intelligence capabilities with ecological environmental protection initiatives. For instance, the company leverages its technology to support river and lake governance, showcasing a dedication to environmental stewardship through its core competencies. This approach underscores a commitment to using innovation for broader conservation goals.

The company also prioritizes robust waste management practices and actively promotes recycling programs across its operations. These efforts are designed to significantly reduce China Unicom's environmental footprint, demonstrating a tangible commitment to sustainable operational management. In 2023, China Unicom reported a 5% year-on-year increase in its green energy consumption, reaching 28% of its total energy usage.

Climate Change and Carbon Footprint Reduction

China Unicom, as a major infrastructure provider, faces environmental scrutiny regarding its carbon emissions. The company’s commitment to energy efficiency and sustainable practices is a direct response to China's national climate change mitigation goals. For instance, by the end of 2023, China Unicom had achieved a 10% reduction in energy consumption per unit of business compared to 2020 levels, demonstrating progress in its green development initiatives.

Key environmental strategies for China Unicom include optimizing network infrastructure for lower energy usage and increasing the adoption of renewable energy sources to power its operations. This focus extends to data center efficiency, a significant energy consumer in the telecom sector. In 2024, the company planned to increase its renewable energy usage by an additional 15% across its major operational hubs.

- Energy Efficiency: China Unicom aims to reduce energy consumption per unit of business by 15% by 2025, building on its 2023 achievements.

- Renewable Energy Adoption: The company is targeting 40% of its electricity consumption from renewable sources by the end of 2025.

- Green Network Design: Implementation of energy-saving technologies in base stations and network equipment is ongoing, with a projected 5% reduction in network energy intensity in 2024.

- Data Center Optimization: Efforts to improve Power Usage Effectiveness (PUE) in data centers are a priority, aiming for a PUE of 1.3 or lower across new facilities by 2025.

E-waste Management and Recycling

The telecommunications sector, including giants like China Unicom, faces a growing environmental challenge with electronic waste (e-waste). Discarded network equipment, mobile phones, and other devices contribute significantly to this issue. China Unicom's commitment to professional waste management and the public auction of waste demonstrates a proactive approach to resource recovery and recycling, aiming to mitigate the environmental impact of its operations.

In 2023, China's e-waste generation was estimated to be around 5.3 million tons, highlighting the scale of the problem. China Unicom's initiatives, such as its focus on professional e-waste handling and the utilization of public auctions for waste disposal, are crucial steps in addressing this. These practices not only aim to recover valuable materials but also ensure that hazardous components are managed responsibly, aligning with stricter environmental regulations.

- E-waste Volume: China's e-waste generation is projected to reach 7.5 million tons by 2030, underscoring the urgency for effective management strategies.

- Resource Recovery: China Unicom's waste management efforts contribute to recovering precious metals like gold, silver, and copper from discarded electronics.

- Circular Economy: Promoting public auctions of waste aligns with circular economy principles, extending the lifecycle of materials and reducing the need for virgin resource extraction.

- Regulatory Compliance: These initiatives help China Unicom comply with China's increasingly stringent environmental protection laws and corporate social responsibility expectations.

China Unicom's environmental strategy is strongly aligned with national goals, aiming for carbon peaking by 2030 and carbon neutrality by 2060. The company is actively reducing its energy consumption per unit of traffic, with a 10% decrease achieved by the end of 2023 compared to 2020 levels. By 2025, China Unicom targets a 15% reduction in energy consumption per business unit and aims to source 40% of its electricity from renewables.

Infrastructure sharing with peers like China Telecom is a key environmental initiative, significantly reducing redundant construction and improving the efficiency of base stations. This collaborative approach lowers land, energy, and raw material usage. Furthermore, China Unicom is integrating digital intelligence with environmental protection, using its technology for initiatives like river and lake governance.

The company is also tackling the growing challenge of electronic waste through professional management and public auctions for resource recovery. In 2023, China's e-waste generation was approximately 5.3 million tons, making China Unicom's efforts to recover valuable materials and manage hazardous components crucial for regulatory compliance and corporate social responsibility.

| Environmental Target | 2023 Status/Achievement | 2025 Target | 2030 Target |

| Energy Consumption per Unit of Business | 10% reduction (vs. 2020) | 15% reduction | |

| Renewable Energy Usage | 28% of total energy consumption | 40% of electricity consumption | |

| Network Energy Intensity | Projected 5% reduction (2024) | ||

| Data Center PUE | 1.3 or lower (new facilities) | ||

| E-waste Management | Focus on professional handling & auctions | China's e-waste projected at 7.5 million tons |

PESTLE Analysis Data Sources

Our China Unicom PESTLE Analysis is built upon a comprehensive review of data from official Chinese government ministries, regulatory bodies, and national statistics bureaus. We also incorporate insights from reputable industry associations, leading financial news outlets, and international economic organizations to ensure a well-rounded perspective.