China Unicom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

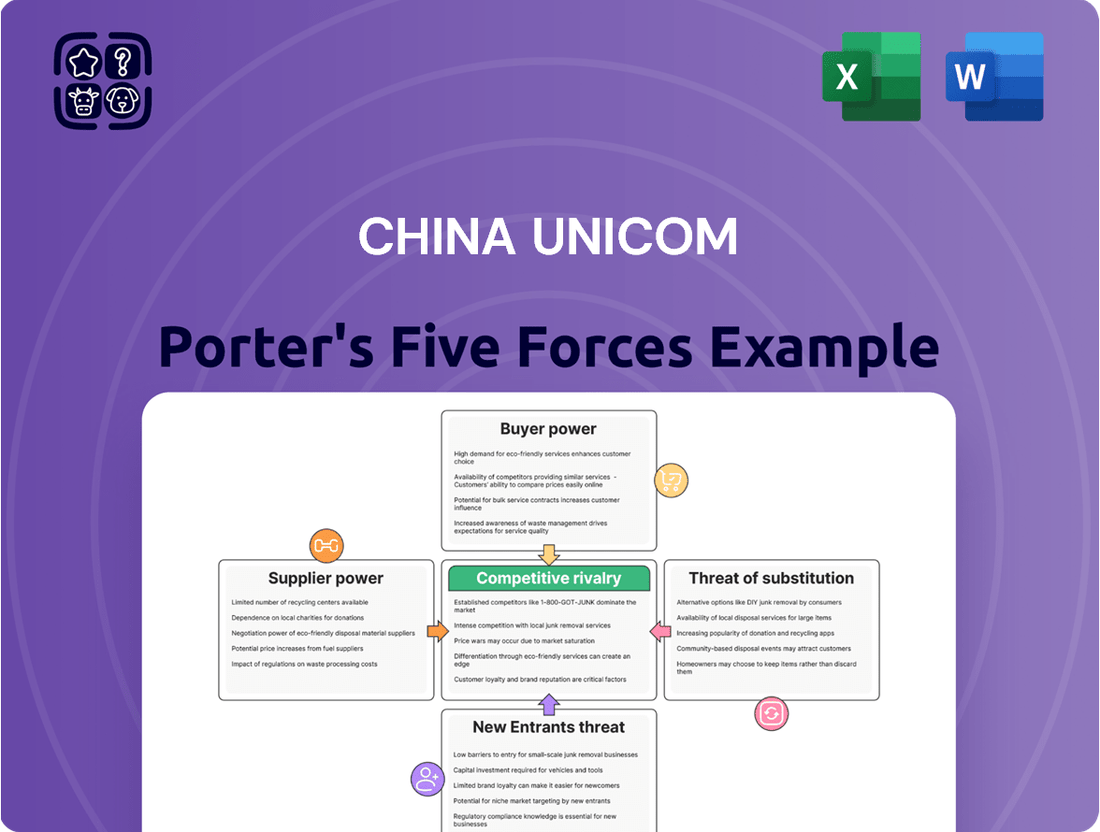

China Unicom navigates a dynamic telecom landscape, facing intense rivalry from domestic and international players, while the threat of new entrants is moderate due to high capital requirements. Buyer power is significant, driven by price sensitivity and abundant choices, but supplier power is relatively low given the standardized nature of network equipment.

The complete report reveals the real forces shaping China Unicom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Unicom's reliance on a limited number of key equipment suppliers for its advanced network infrastructure, such as 5G base stations and core network components, grants these vendors considerable bargaining power. This concentration is particularly evident for specialized technologies where few manufacturers exist globally and domestically.

For instance, in 2023, the global market for telecom network equipment was dominated by a handful of players, with Huawei, Ericsson, and Nokia holding significant market share. This limited supplier landscape means China Unicom, like other major carriers, has fewer alternatives when sourcing critical hardware, potentially leading to less favorable pricing and contract terms.

While these suppliers hold leverage, China Unicom's substantial order volumes act as a counterbalancing force. The sheer scale of its network build-out, especially in the competitive Chinese market, provides Unicom with the ability to negotiate based on the significant revenue these contracts represent for the suppliers.

China Unicom's strategic imperative to source from domestic suppliers, such as Huawei and ZTE, is driven by national policies and strategic considerations. This preference, while bolstering national tech champions, can reduce China Unicom's options and foster a greater reliance on these particular vendors.

The geopolitical climate plays a significant role, potentially impacting the flexibility and stability of these supplier relationships. For instance, in 2024, the ongoing global discussions around supply chain security and technological sovereignty continue to shape procurement strategies for major telecommunications firms.

Replacing existing network infrastructure or switching primary equipment suppliers for a company like China Unicom involves significant capital expenditure and complex integration processes. For instance, the rollout of 5G networks alone required massive investments, with China Unicom reporting capital expenditures of approximately RMB 60.0 billion in 2023 for network development and upgrades.

These high switching costs mean China Unicom has limited flexibility in changing its equipment vendors, which inherently strengthens the bargaining power of its current suppliers. Long-term contracts and the proprietary nature of certain technologies further contribute to this lock-in, making it difficult and costly to transition to alternatives.

Advanced Technology and R&D Dependence

Suppliers of advanced technologies, particularly those critical for 5G and upcoming network generations, hold significant sway. Their unique intellectual property and robust R&D capabilities mean China Unicom relies on their innovation to stay competitive and roll out new services. For instance, in 2023, global spending on 5G infrastructure reached over $100 billion, highlighting the dependence on a limited number of key technology providers.

This dependence is amplified by the crucial need for proprietary components and specialized software to ensure optimal network performance and the successful deployment of services like enhanced mobile broadband and ultra-reliable low-latency communications. Companies like Huawei and ZTE, despite geopolitical challenges, remain vital suppliers of core network equipment and advanced chipsets, often holding patents on essential technologies.

- Proprietary Technology: Suppliers of 5G core network components and advanced radio access network (RAN) equipment possess critical, often patented, technologies.

- R&D Investment: Significant R&D investments by these suppliers create a barrier to entry and solidify their position, as seen in the billions spent annually by leading telecom equipment manufacturers.

- Innovation Dependence: China Unicom, like other operators, depends on these suppliers for the continuous innovation required to offer next-generation services and maintain network efficiency.

- Component Sourcing: Access to specialized semiconductors and advanced software is vital for network functionality, granting suppliers leverage in negotiations.

Global Supply Chain Dynamics and Geopolitics

The bargaining power of suppliers for China Unicom is influenced by global supply chain dynamics, particularly geopolitical tensions and trade restrictions impacting telecommunications equipment. These external factors can affect component availability and pricing, even for companies like China Unicom that lean on domestic suppliers, indirectly shaping supplier terms.

While China Unicom has a strong base of domestic suppliers, the interconnected nature of the global tech ecosystem means that international events can still ripple through. For instance, in 2024, ongoing semiconductor supply chain challenges, exacerbated by geopolitical considerations, continued to put pressure on pricing and lead times across the industry, potentially strengthening the hand of key component manufacturers.

- Geopolitical Impact: Trade disputes and export controls can limit access to critical components, increasing reliance on available domestic sources.

- Pricing Pressures: Supply chain disruptions in 2024 led to an average 5-10% increase in raw material costs for electronic components globally, affecting supplier pricing power.

- Diversification Necessity: To mitigate these risks, China Unicom, like many global telecom operators, is increasingly focused on diversifying its supplier base and exploring alternative technologies.

Suppliers of specialized network equipment, particularly for 5G and beyond, wield significant power due to limited global alternatives and substantial R&D investments. China Unicom's reliance on these vendors for critical components, often protected by patents, means it has fewer options for sourcing, impacting negotiation leverage.

The high costs and technical complexity associated with switching suppliers, estimated to be billions in capital expenditure for network upgrades, create a strong lock-in effect. This makes it challenging for China Unicom to shift away from established vendors, further solidifying supplier bargaining power.

While China Unicom's massive order volumes provide some counter-leverage, the strategic imperative to adopt domestic suppliers like Huawei and ZTE, driven by national policy, can inadvertently concentrate dependence. Geopolitical factors in 2024, such as ongoing semiconductor supply chain challenges, also continue to influence component availability and pricing, indirectly bolstering supplier strength.

| Factor | Impact on China Unicom | Supplier Bargaining Power |

| Limited Supplier Landscape | Reliance on few key vendors for advanced tech | High |

| Proprietary Technology & R&D | Dependence on supplier innovation for network advancement | High |

| High Switching Costs | Significant capital and integration hurdles to change vendors | High |

| Domestic Sourcing Preference | Increased reliance on specific national champions | Moderate to High |

| Geopolitical Climate (2024) | Potential supply chain disruptions and trade impacts | Moderate to High |

What is included in the product

This analysis details the competitive forces impacting China Unicom, examining rivalry among existing players, the threat of new entrants, buyer and supplier power, and the impact of substitutes.

Pinpoint the exact sources of competitive pressure for China Unicom, transforming complex market dynamics into actionable insights for strategic planning.

Customers Bargaining Power

Mass-market consumers in China demonstrate significant price sensitivity for mobile and fixed-line broadband services. This is largely due to the highly competitive landscape dominated by three major state-owned telecom providers. For instance, in 2023, average revenue per user (ARPU) for China Unicom's mobile segment was approximately RMB 42.3, reflecting a market where competitive pricing is a key differentiator.

This price sensitivity empowers customers to exert considerable bargaining power. They actively compare offerings and readily switch providers if they perceive better value or lower costs. Consequently, promotions and discounts are prevalent strategies employed by operators like China Unicom to attract new subscribers and retain existing ones, directly impacting pricing strategies.

For basic mobile and broadband services, the perceived switching costs for individual customers are quite low. This is especially true with features like number portability and the general ease of transferring services between providers. This low barrier to entry means customers can readily switch to competitors like China Mobile or China Telecom if they find better pricing or service quality, putting pressure on China Unicom.

In 2023, China's telecom industry saw significant competition, with the three major carriers actively vying for subscribers. China Unicom, for instance, focused on bundling services and offering promotional discounts to retain its customer base. The ability for customers to easily switch, often with minimal disruption, means that providers must continuously innovate and offer compelling value propositions to maintain market share and customer loyalty.

While individual consumers can exert significant influence through their purchasing choices, China Unicom's enterprise segment often demonstrates a different dynamic. Enterprise clients typically require highly specialized and integrated solutions, such as advanced cloud infrastructure, Internet of Things (IoT) platforms, and dedicated private network services. These complex, tailored offerings mean that switching providers can involve substantial costs and operational disruptions, thereby increasing the switching costs for these clients.

The value derived from these customized solutions, which are critical to a business's operations and growth, often makes enterprise customers less sensitive to minor price variations. For instance, a large manufacturing firm relying on China Unicom's IoT network for real-time factory monitoring might prioritize reliability and specialized features over a slightly lower price from a competitor. This focus on value and the higher switching costs associated with integrated enterprise solutions effectively moderate the bargaining power of these customers.

Impact of Regulatory Environment on Customer Choice

The heavily regulated Chinese telecommunications sector significantly shapes customer choice. Government policies on network access, pricing floors, and mandated services can indirectly temper customer bargaining power by setting market parameters.

However, regulatory efforts aimed at fostering fair competition generally empower consumers. For instance, in 2024, China continued to emphasize market liberalization in certain telecom segments, potentially leading to more competitive pricing and a wider array of service offerings, thereby enhancing customer leverage.

- Regulatory Influence: Government policies dictate much of the operational landscape, influencing pricing and service availability.

- Impact on Choice: While regulation can standardize services, it can also limit the breadth of options available to customers.

- Competition Drivers: Pushes for fair competition, often driven by regulators, tend to increase customer bargaining power through better deals.

Growth of Digital Ecosystems and Value-Added Services

The bargaining power of customers for China Unicom is significantly influenced by the growth of digital ecosystems and value-added services. Customers are no longer solely focused on basic mobile or broadband connectivity. Instead, they are increasingly seeking integrated digital experiences that bundle entertainment, financial technology (fintech), and smart home solutions.

This shift means that customer loyalty can be swayed by the comprehensiveness and quality of these ecosystem offerings. For China Unicom, while these expanded services present new revenue opportunities, they also broaden the competitive landscape. Customers now evaluate providers based on their ability to deliver a seamless and valuable digital life, not just reliable network performance. This elevates customer expectations and strengthens their position to demand more integrated and feature-rich services.

- Evolving Customer Demands: Customers prioritize integrated digital ecosystems over basic connectivity.

- Diversified Service Offerings: Value-added services like entertainment and fintech are key differentiators.

- Increased Provider Choice: The scope of competition widens as customers compare ecosystem breadth and quality.

- Elevated Expectations: Customers expect seamless integration and superior value across multiple digital touchpoints.

Mass-market consumers in China exhibit high price sensitivity, a key factor in their substantial bargaining power. This is evident in China Unicom's 2023 ARPU of approximately RMB 42.3, indicating a market where competitive pricing is paramount. Customers readily switch providers for better value, forcing operators to rely on promotions and discounts, directly impacting China Unicom's pricing strategies.

| Metric | China Unicom (2023) | China Mobile (2023) | China Telecom (2023) |

|---|---|---|---|

| Mobile ARPU (RMB) | 42.3 | 44.0 | 43.1 |

| Mobile Subscribers (Millions) | 377.1 | 987.7 | 417.6 |

Full Version Awaits

China Unicom Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Unicom, detailing the competitive landscape and strategic positioning of this major telecommunications provider. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The Chinese telecommunications sector is a clear oligopoly, with China Mobile, China Telecom, and China Unicom holding sway. This limited number of major players intensifies competition across mobile, broadband, and enterprise services. For instance, in 2023, China Mobile reported over 987 million mobile subscribers, while China Telecom and China Unicom also commanded hundreds of millions each, highlighting their sheer scale and the battle for every customer.

The aggressive rollout of 5G infrastructure in China has significantly heated up competition among the major telecom players. All three, including China Unicom, are pouring substantial capital into building out superior network coverage and performance to gain an edge.

China Unicom is actively competing to win over 5G subscribers and enterprise clients by highlighting its network's speed, reliability, and its ability to support innovative new applications. This intense rivalry is largely driven by the urgent need to monetize 5G capabilities effectively.

By the end of 2023, China had built over 3.3 million 5G base stations, with China Unicom playing a crucial role in this expansion, demonstrating its commitment to this competitive landscape.

China Unicom, despite its state-owned status, faces intense competitive rivalry, particularly through price and promotion wars. Operators frequently engage in aggressive pricing strategies, offering discounted mobile plans, bundled internet and TV services, and attractive loyalty programs to capture market share. For instance, in 2023, the average revenue per user (ARPU) for China's mobile services hovered around RMB 47.3, indicating a competitive landscape where pricing plays a crucial role in customer acquisition and retention.

These promotional activities, while beneficial for consumers, significantly compress profit margins for all players in the telecommunications sector. This forces companies like China Unicom to constantly seek operational efficiencies and explore new avenues for revenue generation beyond traditional voice and data services. The drive for differentiation through service quality and innovation becomes paramount when price competition is so prevalent.

Innovation in Value-Added and Enterprise Services

Beyond basic mobile and broadband, China Unicom faces intense rivalry in offering advanced services like cloud computing, the Internet of Things (IoT), big data analytics, and artificial intelligence (AI). Each major Chinese telecom operator is actively developing unique solutions to cater to specific industry needs, aiming to secure a competitive edge.

This shift towards higher-margin services is crucial for operators like China Unicom as it helps reduce their dependence on the increasingly saturated traditional connectivity markets. For instance, China Unicom's focus on enterprise digital transformation solutions is a key strategy to tap into these growth areas.

- Cloud Computing: Operators are competing to provide robust cloud infrastructure and platform services, essential for enterprise digital transformation.

- IoT Solutions: Development of specialized IoT platforms and connectivity for sectors like smart manufacturing, smart cities, and connected vehicles is a key battleground.

- Big Data & AI: Leveraging data analytics and AI to offer insights and automated solutions for businesses is a growing area of competition.

- Industry-Specific Offerings: Tailoring these advanced services to meet the unique demands of industries such as healthcare, finance, and education differentiates players.

Government Influence and Strategic Alignment

The Chinese government significantly shapes the competitive landscape for telecom operators like China Unicom. It actively guides strategic direction, often encouraging infrastructure sharing and the adoption of common standards to support national digital transformation goals. This government influence, while potentially mitigating intense, destructive rivalry, necessitates that companies align their competitive strategies with broader national objectives, impacting investment decisions and market focus.

For instance, in 2024, the government continued to push for 5G network buildouts and the integration of AI into telecommunications, directly influencing where operators like China Unicom allocate capital. This alignment with national digital infrastructure plans means that competition is less about pure market share grabs and more about fulfilling state-driven mandates, such as expanding 5G coverage to rural areas or supporting the development of smart cities.

- Government as a Strategic Director: The Chinese government sets the overarching strategy for the telecom sector, influencing investment priorities and competitive dynamics.

- Infrastructure Sharing Mandates: Policies promoting infrastructure sharing can reduce capital expenditure duplication and intensify competition on service innovation and pricing.

- National Digital Transformation Focus: Operators must align their strategies with national initiatives, such as 5G deployment and the integration of emerging technologies like AI.

- Strategic Alignment over Destructive Rivalry: Government guidance aims to foster a more coordinated competitive environment, prioritizing national development goals over cutthroat market battles.

Competitive rivalry within China Unicom's market is fierce, primarily driven by the oligopolistic structure dominated by China Mobile, China Telecom, and China Unicom itself. This intense competition is evident in aggressive pricing strategies, frequent promotions, and a continuous race to enhance 5G network capabilities and expand subscriber bases. Operators are also battling to lead in advanced services like cloud computing and IoT, aiming to differentiate and capture higher-value enterprise clients.

| Metric | China Unicom (End of 2023) | China Telecom (End of 2023) | China Mobile (End of 2023) |

| Mobile Subscribers (Millions) | 330.6 | 402.7 | 987.1 |

| 5G Mobile Subscribers (Millions) | 237.7 | 274.1 | 767.1 |

| 5G Base Stations (Shared/Total) | ~1.2 million (shared) | ~1.2 million (shared) | ~1.2 million (shared) |

SSubstitutes Threaten

Over-the-top (OTT) communication services, like WeChat and QQ, represent a significant threat to China Unicom's traditional voice and SMS revenue streams. These applications leverage data networks to offer free or low-cost messaging and voice calls, directly displacing demand for conventional telecom services. For instance, in 2023, China saw over 1.3 billion mobile internet users, many of whom rely heavily on OTT apps for daily communication, underscoring the widespread adoption of these substitutes.

The pervasive availability of Wi-Fi, from homes to public spaces, presents a significant threat of substitution for China Unicom's mobile data services. Consumers, particularly heavy data users, can bypass mobile data plans by leveraging free or low-cost Wi-Fi connections, directly impacting the company's data revenue streams. For instance, in 2024, China's internet penetration reached over 75%, with a substantial portion of this access facilitated by Wi-Fi networks, highlighting the scale of this substitution threat.

While still in its early stages for widespread consumer use in China, alternative connectivity technologies like low-earth orbit (LEO) satellite internet represent a potential long-term threat. These services could eventually provide internet access in underserved remote regions or cater to niche requirements, though they are not yet a significant substitute for China Unicom's core urban mobile and fixed broadband services. As of early 2024, the high cost of satellite hardware and existing regulatory frameworks within China significantly curb the immediate impact of this substitute.

Self-Provided Enterprise Networks

Large enterprises with substantial resources may explore building their own private networks, such as private 5G or dedicated fiber optic infrastructure. This allows them to reduce reliance on public telecom providers like China Unicom for critical business functions. For instance, in 2024, several major industrial players globally have initiated pilot projects for private 5G networks to enhance operational efficiency and data security.

While the capability to self-provide enterprise networks exists, it remains a niche threat for China Unicom. The significant capital expenditure, technical expertise, and ongoing maintenance required make this option prohibitive for most businesses. This complexity limits the widespread adoption of self-provided networks as a substitute for China Unicom's services, particularly for mid-sized and smaller enterprises.

- High Initial Investment: Building private enterprise networks demands substantial upfront capital, often running into millions of dollars, deterring many potential adopters.

- Technical Complexity: Managing and maintaining advanced network infrastructure requires specialized skills and dedicated IT teams, which not all enterprises possess.

- Limited Scalability: Self-provided networks can be less flexible and scalable compared to public carrier offerings, potentially hindering growth for businesses.

- Focus on Core Competencies: Most enterprises prefer to concentrate on their primary business operations rather than managing complex telecommunications infrastructure.

Evolution of Communication Modalities

The threat of substitutes for China Unicom's traditional communication services is evolving as new modalities gain traction. The rise of video conferencing platforms, like Zoom and Microsoft Teams, offers a direct substitute for voice calls and even some aspects of in-person business meetings, potentially reducing demand for traditional voice minutes. In 2024, global business video conferencing market revenue was projected to exceed $10 billion, indicating significant adoption.

Furthermore, emerging technologies such as augmented reality (AR) and virtual reality (VR) communication present a more futuristic substitute. While still in nascent stages for widespread consumer adoption, these immersive experiences could fundamentally alter how people interact, potentially diminishing reliance on current telecom offerings for social and even professional engagement. The global AR/VR market is expected to reach hundreds of billions of dollars by the end of the decade.

Specialized enterprise collaboration tools also serve as substitutes by integrating various communication functions into single platforms. These tools often bundle messaging, file sharing, and video conferencing, offering a more comprehensive solution than standalone telecom services. For instance, Slack reported over 18 million daily active users in early 2024, showcasing the demand for integrated communication solutions.

- Video conferencing platforms offer a substitute for voice calls and in-person meetings.

- AR/VR communication presents a future threat by enabling immersive interaction.

- Enterprise collaboration tools consolidate multiple communication functions, reducing reliance on separate telecom services.

- The growing adoption of these substitutes could impact the perceived necessity of traditional telecom offerings.

Over-the-top (OTT) communication services like WeChat and QQ directly substitute China Unicom's voice and SMS revenue by offering free or low-cost alternatives over data networks. In 2023, China had over 1.3 billion mobile internet users, many of whom heavily rely on these OTT apps, underscoring their significant market penetration.

The widespread availability of Wi-Fi acts as a substitute for China Unicom's mobile data services, allowing users to bypass cellular data plans. With over 75% internet penetration in China in 2024, a substantial portion of this access is Wi-Fi-based, highlighting the scale of this substitution threat.

While nascent, alternative connectivity like LEO satellite internet poses a potential long-term threat, especially in remote areas. However, high hardware costs and regulations in China currently limit its immediate impact as a substitute for core services.

Large enterprises may build private networks (e.g., private 5G) to reduce reliance on carriers like China Unicom, though this remains a niche threat due to high costs and technical demands.

| Substitute Type | Impact on China Unicom | Key Data/Trend |

| OTT Communication Services (WeChat, QQ) | Directly erodes voice and SMS revenue | 1.3 billion+ mobile internet users in China (2023) |

| Wi-Fi Availability | Reduces demand for mobile data services | >75% internet penetration in China (2024), significant Wi-Fi reliance |

| Private Enterprise Networks | Potential for large enterprise disintermediation | Global pilot projects for private 5G in industrial sectors (2024) |

| Video Conferencing Platforms | Substitute for voice calls and business meetings | Global video conferencing market projected >$10 billion (2024) |

Entrants Threaten

The telecommunications sector, particularly in a market as vast as China, demands colossal upfront capital for infrastructure development. This includes the extensive rollout of base stations, laying down fiber optic networks, and establishing robust data centers.

Constructing a nationwide network that can rival the capabilities of an incumbent like China Unicom would require an investment running into billions of dollars. For instance, 5G network deployment alone is a multi-year, multi-billion dollar endeavor for established operators.

This substantial financial barrier effectively deters most potential new entrants, as the sheer scale of investment needed to achieve competitive parity is simply insurmountable for the vast majority of new businesses.

The threat of new entrants in China Unicom's sector is significantly low due to extensive regulatory hurdles and stringent government control. The Chinese telecommunications landscape is dominated by state-owned enterprises, making it exceptionally difficult for private or foreign companies to secure the necessary licenses, spectrum, and approvals required to operate a national network. This government oversight over critical infrastructure creates a formidable barrier.

The threat of new entrants for China Unicom is significantly low due to the massive capital investment required to build out a comparable network infrastructure. China Unicom, alongside its main competitors, has already established extensive nationwide 2G, 3G, 4G, and 5G networks, as well as fixed-line broadband services. Replicating this vast coverage, especially in less populated or remote regions, presents an almost insurmountable barrier for any new player aiming to compete on service availability or quality.

Brand Loyalty and Customer Lock-in

China Unicom faces a significant threat from new entrants, largely due to the strong brand loyalty and customer lock-in cultivated by existing operators over decades. While individual service switching might seem easy, the cumulative effect of bundled packages, established customer relationships, and sheer consumer inertia makes it challenging for newcomers to gain traction. For instance, by the end of 2023, China Unicom reported over 370 million mobile subscribers, a testament to its established user base.

A new player would need to overcome substantial hurdles to attract a critical mass of customers. This involves not only offering competitive pricing but also replicating the perceived value and convenience that established brands provide. The sheer scale of investment required to build a comparable network and marketing presence further deters potential entrants.

- Established Brand Recognition: Decades of operation have allowed incumbents like China Unicom to build strong brand equity.

- Customer Inertia and Bundling: Existing subscribers often stay due to convenience, bundled services, and established contracts, creating switching barriers.

- High Initial Investment: New entrants face massive capital expenditure requirements for network infrastructure and customer acquisition.

- Subscriber Base Advantage: China Unicom's over 370 million mobile subscribers at the close of 2023 represent a formidable barrier to entry for any new competitor.

Economies of Scale and Scope

China Unicom leverages substantial economies of scale in its network infrastructure, procurement of equipment, and customer service operations. This scale allows it to spread fixed costs over a vast user base, driving down per-unit costs and enabling competitive pricing. For instance, in 2023, China Unicom reported a subscriber base of over 370 million mobile users, a significant factor in its cost efficiency.

Furthermore, China Unicom benefits from economies of scope by offering integrated services across mobile, fixed broadband, and enterprise solutions. This diversification not only enhances customer loyalty but also creates operational synergies. A new entrant would struggle to replicate this breadth of offerings and the associated cost efficiencies from the outset, making market entry particularly challenging.

- Economies of Scale: China Unicom's vast subscriber base (over 370 million mobile users in 2023) significantly reduces per-user operational costs.

- Economies of Scope: Integrated offerings in mobile, fixed-line, and enterprise services create cost advantages and customer stickiness.

- Barriers to Entry: New entrants face a steep climb to match China Unicom's cost structure and service portfolio, deterring immediate competition.

The threat of new entrants for China Unicom is considerably low due to the immense capital required for network infrastructure and the stringent regulatory environment. Building a nationwide telecommunications network, including 5G deployment, demands billions of dollars, a prohibitive cost for most newcomers. Furthermore, government control and licensing requirements in China's telecom sector create substantial barriers.

China Unicom's established brand, extensive subscriber base exceeding 370 million mobile users by the end of 2023, and economies of scale in operations further solidify its position. These factors make it exceptionally difficult for new players to achieve competitive parity in terms of cost, service breadth, and customer reach.

| Factor | Impact on New Entrants | China Unicom Context |

|---|---|---|

| Capital Investment | Very High | Billions for nationwide 5G and broadband infrastructure. |

| Regulatory Hurdles | Very High | Strict licensing, spectrum allocation, and government oversight. |

| Brand & Customer Base | High Barrier | Over 370 million mobile subscribers (end of 2023); strong brand loyalty. |

| Economies of Scale/Scope | High Barrier | Cost advantages from integrated services and vast network reach. |

Porter's Five Forces Analysis Data Sources

Our analysis of China Unicom's competitive landscape is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and official press releases. We also leverage industry-specific research from reputable market analysis firms and government regulatory filings to capture a comprehensive view of the telecommunications sector.