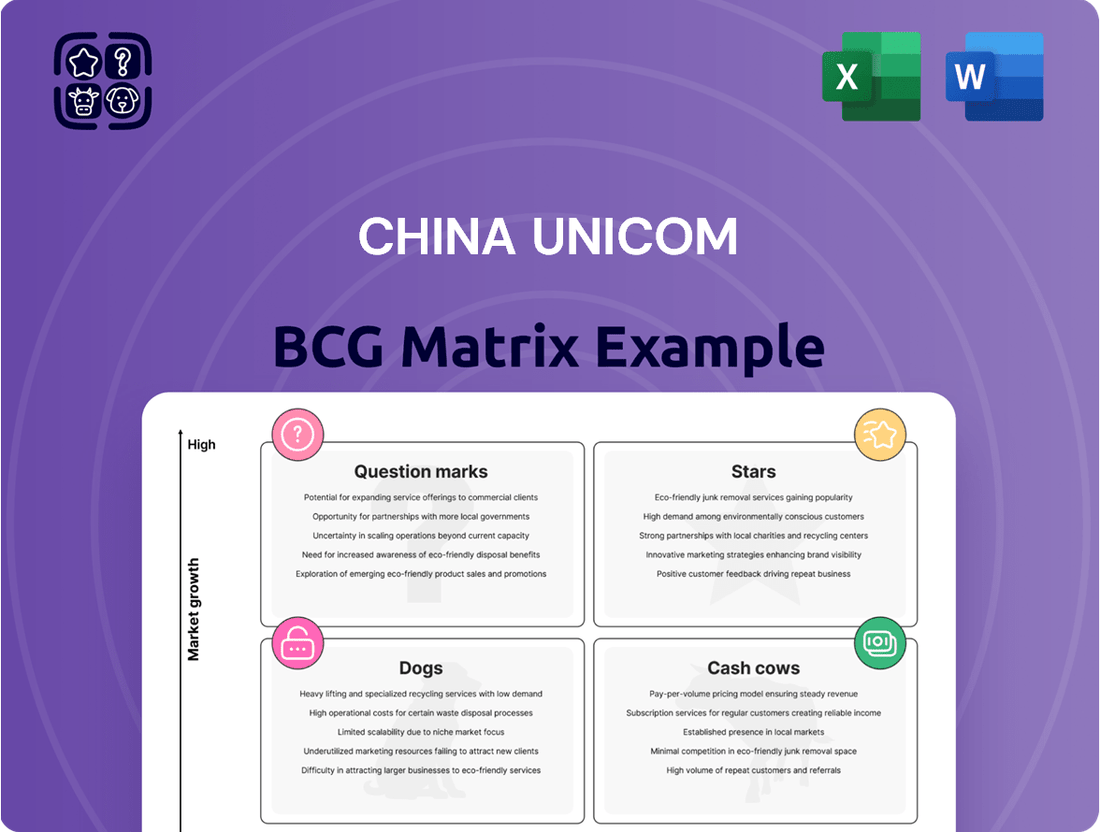

China Unicom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Unicom Bundle

Curious about China Unicom's strategic positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their product portfolio. Understand which segments are driving revenue and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete China Unicom BCG Matrix. Gain detailed insights into each quadrant, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic clarity this report offers. Get the full BCG Matrix to see where China Unicom truly stands and how you can leverage this knowledge for your own business advantage.

Stars

China Unicom is making a significant push into 5G-Advanced services, a move that places it squarely in the Stars category of the BCG Matrix. By the close of 2025, the company aims to have this advanced 5G coverage available in more than 300 cities. This aggressive rollout is supported by strategic collaborations, such as the one with Huawei, to integrate artificial intelligence into their 5G infrastructure, signaling a strong commitment to future growth and technological leadership.

China Unicom is heavily investing in its computing power and AI infrastructure, with a planned 28% increase in capital expenditure for 2025. This significant investment underscores their commitment to building a robust AI ecosystem.

The company is set to deploy a massive 100,000-GPU cluster and aims to achieve 45 EFLOPS of computing power by the end of 2025. These are crucial steps in meeting the escalating demand for generative AI and large language model capabilities.

These strategic upgrades are designed to transform existing internet data centers into AI-optimized facilities. This initiative positions China Unicom to capitalize on the rapid growth and transformative potential of AI technologies.

Unicom Cloud, a key player in China Unicom's CDSA segment, demonstrated impressive financial performance in 2024. Its revenue climbed by 17.1% year-on-year, reaching CNY 68.6 billion. This substantial increase underscores its solid standing in China's rapidly growing cloud market.

The company is strategically focusing on integrating artificial intelligence into its cloud offerings. This move is designed to provide customers with comprehensive, adaptable, and unified AI services, further solidifying its competitive edge.

Enterprise Digital Transformation Solutions

China Unicom's Computing and Digital Smart Applications (CDSA) business, a key component of its enterprise digital transformation solutions, saw a robust 9.6% revenue increase in 2024. This growth highlights the increasing demand for digital solutions across various sectors.

The company is actively deploying intelligent solutions tailored for industries like government, education, healthcare, and transportation. This strategic focus reflects a broader trend of digital transformation adoption within these critical public and private sectors.

- Enterprise Digital Transformation Solutions: China Unicom's CDSA segment, crucial for its B2B offerings, experienced a 9.6% revenue surge in 2024.

- Industry Focus: The company is actively providing intelligent solutions to government, education, healthcare, and transportation sectors, indicating strong market penetration.

- Growth Drivers: Integration of computing power, platform services, and AI models for businesses is a primary driver behind this expansion.

Internet of Things (IoT) and Internet of Vehicles (IoV)

China Unicom's Internet of Things (IoT) and Internet of Vehicles (IoV) segments represent significant growth areas within its business portfolio. By the end of 2024, the company reported an impressive milestone, surpassing 620 million IoT connections, with a substantial net addition of 130 million new connections. This robust expansion underscores the increasing demand for connected devices and smart solutions across various sectors.

Within this broader IoT landscape, the Internet of Vehicles (IoV) has emerged as a particularly strong performer. China Unicom's IoV connections reached 76 million in 2024, solidifying its leading position in this rapidly evolving market. The company is strategically focusing on developing advanced IoT and smart mobility services tailored for businesses and large enterprises.

- IoT Connections: Exceeded 620 million by the end of 2024, with 130 million net additions.

- IoV Connections: Reached 76 million in 2024, marking a leading industry position.

- Strategic Focus: Development of IoT and smart mobility services for enterprise and large business clients.

- Market Opportunity: High growth potential in connected devices and smart applications, particularly within transport and urban infrastructure integration.

China Unicom's investment in 5G-Advanced and AI infrastructure positions its advanced computing and cloud services as Stars in the BCG Matrix. The company's commitment to enhancing computing power, evidenced by a planned 28% capital expenditure increase in 2025 and the deployment of a 100,000-GPU cluster, directly supports these high-growth areas. Unicom Cloud's impressive 17.1% revenue growth in 2024 to CNY 68.6 billion further solidifies its Star status, driven by AI integration and strong demand in the cloud market.

| Business Segment | BCG Category | Key Growth Indicators (2024/2025 Projections) | Strategic Focus |

|---|---|---|---|

| 5G-Advanced & AI Infrastructure | Stars | 300+ cities with 5G-Advanced coverage by end of 2025; 100,000-GPU cluster deployment; 45 EFLOPS computing power target by end of 2025. | AI integration in 5G, enhanced computing power for generative AI. |

| Unicom Cloud (CDSA) | Stars | 17.1% YoY revenue growth in 2024 (CNY 68.6 billion); 9.6% revenue increase in CDSA segment. | AI-optimized cloud services, comprehensive AI solutions for clients. |

| IoT & IoV | Stars | Over 620 million IoT connections by end of 2024 (130 million net additions); 76 million IoV connections in 2024. | Advanced IoT and smart mobility services for enterprises. |

What is included in the product

China Unicom's BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes China Unicom's portfolio, easing strategic decision-making by highlighting growth opportunities and areas needing divestment.

Cash Cows

China Unicom's traditional mobile communications, encompassing its extensive 4G and growing 5G networks, are a cornerstone of its business. This segment operates in a mature market where the company holds a significant share.

As of 2024, China Unicom boasted 470 million mobile and broadband subscribers, a testament to its established presence. By the first quarter of 2025, this figure had expanded to include 203.83 million 5G network subscribers, demonstrating continued user adoption.

While the core connectivity business experienced a moderate 1.5% year-on-year growth in 2024, its substantial scale and deep market penetration ensure a reliable and substantial generation of cash flow, positioning it firmly as a Cash Cow.

China Unicom's fixed-line broadband services are a classic Cash Cow within its BCG Matrix. The company commands a significant portion of the market, evidenced by a 5% year-on-year increase in broadband network ports during 2024.

This mature segment offers a stable and consistent revenue stream, largely due to the company's strong, entrenched market position. The overwhelming majority of these broadband connections utilize fibre optic technology, effectively meeting the high-speed internet demands of millions of Chinese households.

The Connectivity and Communications (CC) business, which includes essential mobile and broadband services, was the backbone of China Unicom's revenue in 2024, accounting for a significant 76% of its total service revenue. This segment, while experiencing a modest 1.5% growth compared to the previous year, remains the company's most substantial cash generator due to its sheer size and stability. It forms the fundamental infrastructure upon which all of China Unicom's other services are built.

Traditional Data Center (IDC) Services

China Unicom's traditional Data Center (IDC) services are firmly positioned as Cash Cows within its business portfolio. In 2024, these services generated a substantial CNY 25.9 billion in revenue, marking a respectable 7.4% year-on-year growth. This steady performance underscores the enduring demand for established data center infrastructure, even as the company strategically invests in next-generation AI-optimized facilities.

These mature IDC assets leverage China Unicom's extensive existing client base and robust network resources, ensuring a consistent and reliable revenue stream. The continued financial contribution from these services provides a stable foundation for the company's broader strategic initiatives.

- Revenue: CNY 25.9 billion in 2024.

- Growth: 7.4% year-on-year increase.

- Positioning: Mature asset generating significant, stable revenue.

- Strengths: Benefits from established client relationships and network resources.

Local Telephone Services

Local telephone services for China Unicom, while facing a declining market due to mobile phone prevalence, still represent a cash cow. The company maintains a substantial legacy customer base for these fixed-line services. In 2023, China Unicom reported that its fixed-line subscriber base remained relatively stable, indicating the enduring nature of this segment despite overall market trends.

These services generate a consistent, albeit shrinking, revenue stream with low capital expenditure needs for upkeep. This stability allows China Unicom to allocate resources to more dynamic growth areas. The existing infrastructure and established customer loyalty are key factors in sustaining this revenue.

- Declining Market, Stable Base: Despite the shift to mobile, China Unicom's fixed-line services benefit from a loyal, long-term customer segment.

- Consistent Revenue: These services provide a predictable, though diminishing, income source.

- Low Investment Needs: Maintenance costs are minimal, freeing up capital for other ventures.

- Leveraging Legacy: Existing infrastructure and customer relationships are key assets for this cash cow.

China Unicom's core mobile and broadband services are its undisputed Cash Cows. These segments benefit from a massive, established subscriber base and significant market share, ensuring consistent and substantial cash generation. Despite moderate growth rates, their sheer scale makes them the company's primary revenue drivers.

The company's traditional Data Center (IDC) services also operate as Cash Cows, contributing significantly to revenue with steady growth. These mature assets leverage existing infrastructure and client relationships to provide a reliable income stream, underpinning China Unicom's financial stability.

Even legacy local telephone services, while in a declining market, function as Cash Cows due to a stable, loyal customer base and minimal reinvestment needs, freeing up capital for growth initiatives.

| Business Segment | 2024 Revenue (CNY Billions) | 2024 Growth YoY | BCG Matrix Position | Key Characteristics |

| Mobile & Broadband Connectivity | Significant portion of total service revenue (76% in 2024) | 1.5% | Cash Cow | Large subscriber base, mature market, stable cash flow |

| Data Center (IDC) Services | 25.9 | 7.4% | Cash Cow | Established infrastructure, existing clients, consistent revenue |

| Local Telephone Services | Not explicitly detailed, but stable base | Stable (despite market decline) | Cash Cow | Legacy customer base, low capex, predictable income |

Delivered as Shown

China Unicom BCG Matrix

The China Unicom BCG Matrix you are currently previewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing China Unicom's business units across the BCG Matrix framework, is ready for immediate strategic application without any watermarks or demo content. You are seeing the actual, professionally crafted report designed to provide clear insights into market share and growth potential, ensuring you get exactly what you need for informed decision-making.

Dogs

China Unicom's 2G/3G mobile services are firmly in the 'Dogs' quadrant of the BCG Matrix. These legacy technologies are experiencing a consistent decline in subscriber numbers as customers increasingly adopt 4G and 5G networks. For instance, by the end of 2023, the number of 2G users continued its downward trend, with many actively porting to newer, faster services.

Consequently, China Unicom's strategic focus and investment capital are being redirected from these older standards. This makes 2G/3G services a declining product with a minimal and shrinking market share, offering very limited future growth prospects. The company is actively managing the phase-out of these services, treating them as diminishing assets.

Segments of China Unicom's older network infrastructure, particularly those not yet upgraded for 5G or advanced digital services, can be seen as inefficient assets. These legacy components still incur maintenance costs but offer minimal revenue potential or a diminished competitive edge in today's rapidly evolving telecommunications landscape.

For instance, by the end of 2023, China Unicom was still managing a significant portion of its network on older 4G and even 3G technologies, representing a substantial portion of its operational expenditure without proportional revenue generation. This underinvestment in modernization means these parts of the network are a prime candidate for strategic review, potentially leading to decommissioning or a targeted upgrade to prevent them from becoming a financial drain.

Non-strategic Niche Data Communication Services within China Unicom's portfolio represent areas that haven't kept pace with market evolution or serve a very limited, shrinking customer base. These services often demand more operational resources than the revenue they bring in, rendering them inefficient.

For instance, legacy dedicated leased line services for specific industries that have largely migrated to more flexible cloud-based solutions would fit here. In 2023, China Unicom's revenue from traditional leased lines, while still a component, saw a slower growth trajectory compared to newer IP VPN or cloud connectivity services, indicating a shift in demand.

Underperforming Regional Operations

China Unicom's underperforming regional operations represent a critical challenge within its BCG matrix. These are specific geographic areas or smaller subsidiaries that consistently lag behind in market share and profitability. Despite being part of the larger, more successful China Unicom network, these units often consume resources without generating commensurate returns or contributing to the company's broader strategic goals.

For instance, in 2023, certain less developed provincial branches might have shown a decline in subscriber growth, with some reporting net losses. These operations could be struggling with intense local competition or an inability to adapt their service offerings to regional demand effectively. The company's 2024 strategy likely involves a thorough review of these underperformers to determine if they can be revitalized or if divestment is a more prudent course of action.

- Low Market Share: Regions where China Unicom's subscriber base is significantly smaller than competitors, potentially below 15% in some areas.

- Declining Profitability: Operations that have experienced a year-over-year decrease in net profit, with some reporting negative margins in the last fiscal year.

- Resource Drain: Units that require substantial capital investment for infrastructure upgrades or marketing campaigns but yield minimal returns on investment.

- Strategic Mismatch: Areas where the company's core services are not resonating with the local demographic, leading to low adoption rates.

Legacy Value-Added Services with Low Adoption

China Unicom's legacy value-added services, once staples for earlier mobile and fixed-line customers, now face a steep drop in usage. This decline is largely attributed to the emergence of more advanced and appealing alternatives in the market. For instance, services like basic SMS alerts or older ringtone customization options, while still technically available, attract minimal new subscribers and contribute very little to overall revenue. These offerings often become a drain on resources, requiring maintenance without generating a proportional return.

These underperforming services can be categorized as Dogs in the BCG Matrix. They typically exhibit low market share and operate in a slow-growing or declining market segment.

- Declining User Base: Adoption rates for services like legacy content downloads or older mobile advertising platforms have fallen significantly.

- Minimal Revenue Generation: These services contribute a negligible portion to China Unicom's overall revenue streams, often less than 1% of total ARPU from these specific offerings.

- Resource Drain: Maintaining the infrastructure and support for these outdated services diverts valuable resources that could be allocated to more profitable or innovative areas.

- Low Growth Potential: With the market shifting towards digital streaming, advanced app ecosystems, and integrated digital services, these legacy offerings have virtually no prospect for future growth.

China Unicom's 2G/3G mobile services and legacy value-added services are prime examples of 'Dogs' in the BCG Matrix. These offerings are characterized by low market share and operate within declining market segments, demanding resources without significant revenue generation. By the end of 2023, the company's focus shifted away from these older technologies, with a notable decrease in 2G user numbers as customers migrated to 4G and 5G.

These legacy segments, including certain niche data communication services and underperforming regional operations, represent inefficient assets. They incur maintenance costs but offer minimal future growth prospects, often contributing less than 1% to overall revenue streams. The company's 2024 strategy likely involves a review of these units to assess their viability or potential divestment.

The financial performance of these 'Dog' categories reflects their status. For instance, while specific figures for 2G/3G revenue are often consolidated, the overall trend shows a decline, with operational expenditures on these legacy networks outweighing their diminishing returns. China Unicom's strategic allocation of capital in 2024 prioritizes 5G and advanced digital services, further marginalizing these older offerings.

Question Marks

China Unicom is aggressively pursuing 5G private networks for businesses, recognizing this as a key driver for industrial digital transformation. This strategic focus positions them to capitalize on the growing demand for dedicated, high-performance connectivity in sectors like manufacturing and logistics.

By Q1 2025, China Unicom reported serving 17,941 customers with virtual 5G industry private networks. This figure highlights the early but promising stage of this market, signaling substantial future growth opportunities as more enterprises adopt private 5G solutions.

Despite this growth, the 5G private network customer base represents a small fraction of China Unicom’s total subscriber numbers. Significant capital investment will be necessary to scale these operations and secure a dominant market position in this evolving enterprise segment.

China Unicom is aggressively expanding beyond its foundational cloud services by pouring resources into AI-driven application and platform development. A prime example is their Yuanjing Wanwu AI Agent Development Platform, which aims to foster a new ecosystem of AI solutions.

These innovative AI offerings are currently in their nascent stages of market penetration, navigating a highly dynamic and competitive AI sector. While these ventures demand substantial capital for research, development, and rollout, they represent a significant future growth avenue for the company.

China Unicom's New Digital Smart Life Products, such as Unicom Cloud Drive and Unicom UHD, are positioned as question marks in the BCG matrix. While Unicom Cloud Drive boasts 180 million subscribers and Unicom UHD has 50 million subscribers as of 2024, their market penetration in the broader digital lifestyle sector may still be developing. These offerings are in high-growth markets, demanding substantial investment to capture significant market share and transition into stars.

International Business Expansion into New Markets

China Unicom's international business expansion into new markets can be viewed as a strategic move, potentially positioning these ventures as Stars or Question Marks within the BCG framework, depending on their specific market share and growth potential. The company's commitment to this area is evident, with international business revenue reaching RMB 12.5 billion in 2024, marking a significant 15.2% increase. This growth underscores the high-potential nature of these emerging markets, which often demand considerable investment to build brand presence and infrastructure.

These international markets, while offering substantial growth opportunities, are characterized by intense competition from established global players. China Unicom's strategy likely involves significant capital allocation to gain traction and market share in these diverse regions. The substantial revenue growth indicates positive momentum, but the relative market share outside of China remains a key factor in determining their exact position in the BCG matrix.

- International Revenue Growth: China Unicom's international business revenue surged by 15.2% in 2024, reaching RMB 12.5 billion.

- Market Opportunity: Expansions into new global markets represent high-growth potential areas for the company.

- Investment Requirement: Establishing a strong foothold in these competitive international markets necessitates substantial investment.

- Competitive Landscape: The global telecommunications market is highly competitive, impacting market share acquisition for new entrants.

Emerging Technologies (e.g., 6G and Quantum Communications)

China Unicom, as a leading state-owned telecommunications provider, is actively investing in the foundational research and development of emerging technologies such as 6G networks and quantum communications. These areas represent the cutting edge of technological advancement, promising substantial future growth but currently possess negligible commercial market penetration.

The significant capital expenditure required for research and development in these nascent fields, coupled with the inherent uncertainty of long-term returns, firmly places 6G and quantum communications within the question mark quadrant of the BCG matrix. For instance, China's 6G technology research is projected to see substantial government funding, with estimates suggesting billions of dollars allocated towards its development in the coming years, reflecting the high-risk, high-reward nature of these initiatives.

- 6G Development: China Unicom is participating in global efforts to define 6G standards, focusing on enhanced capabilities like terahertz communication and AI integration.

- Quantum Communications: The company is exploring quantum key distribution (QKD) and quantum entanglement for secure communication networks, a field with immense potential for data security.

- Investment Profile: These ventures demand considerable R&D investment with long payback periods, characteristic of question mark assets.

- Market Position: While holding minimal current market share, success in these areas could redefine China Unicom's competitive landscape in the future.

China Unicom's New Digital Smart Life Products, like Unicom Cloud Drive and Unicom UHD, are classified as question marks. While Unicom Cloud Drive has 180 million subscribers and Unicom UHD has 50 million as of 2024, their market penetration in the broader digital lifestyle sector suggests they are in high-growth markets requiring significant investment to gain market share and transition into stars.

| Product Category | BCG Status | Key Metrics (2024) | Market Context | Strategic Consideration |

| New Digital Smart Life Products | Question Mark | Unicom Cloud Drive: 180M subscribers; Unicom UHD: 50M subscribers | High-growth digital lifestyle market, developing penetration | Requires substantial investment to capture market share and become a Star |

| International Business | Question Mark/Star Potential | Revenue: RMB 12.5B (15.2% growth) | Emerging markets with high growth potential but intense competition | Significant investment needed to build brand and infrastructure; success could lead to Star status |

| Emerging Technologies (6G, Quantum) | Question Mark | Negligible current commercial penetration; substantial R&D investment planned | Cutting-edge technology fields with high future potential but uncertain returns | High-risk, high-reward ventures requiring significant capital for R&D |

BCG Matrix Data Sources

Our China Unicom BCG Matrix is meticulously constructed using official company financial statements, comprehensive market research reports, and expert analyses of the telecommunications industry.