Red Star Macalline Home Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Red Star Macalline Home Group Bundle

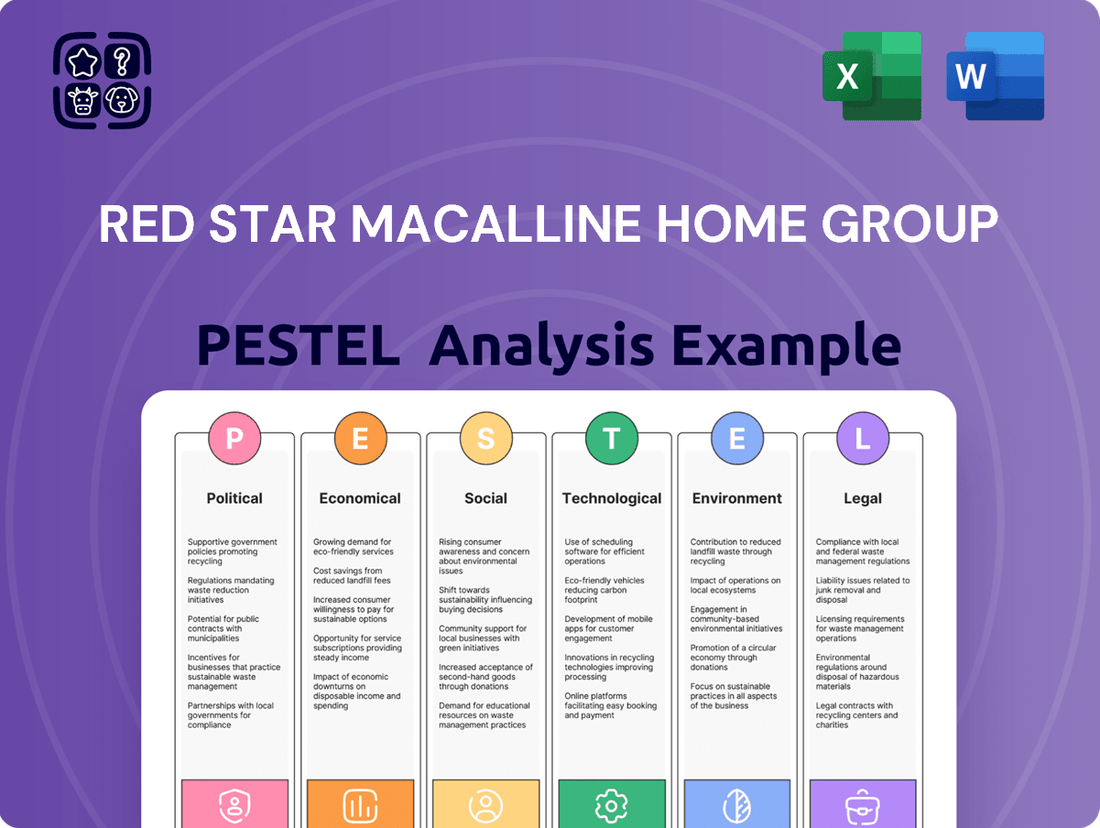

Navigate the complex landscape of Red Star Macalline Home Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping its future. Gain a critical edge by uncovering these external forces. Download the full version now for actionable intelligence that empowers your strategic decisions.

Political factors

Chinese government policies on real estate, such as housing purchase restrictions and mortgage lending, directly influence demand for new homes, impacting the home improvement and furniture market. For instance, in 2024, China continued to implement measures to stabilize the property market, which could lead to fluctuating consumer spending on home furnishings. Any shifts in these regulations, like adjustments to down payment requirements or interest rates, can significantly alter Red Star Macalline's tenant occupancy and foot traffic.

Government initiatives aimed at stimulating domestic consumer spending, such as tax incentives for home renovations or subsidies for certain home goods purchases, can significantly boost demand for products sold within Red Star Macalline's malls. For instance, in 2024, China's central government continued to implement policies encouraging consumption, including potential tax breaks on durable goods, which directly impacts the home furnishings sector. These measures directly influence the purchasing power and willingness of consumers to invest in home furnishings.

The regulatory environment significantly shapes Red Star Macalline's commercial real estate ventures. Stringent fire safety codes and evolving building standards, for instance, directly influence construction costs and renovation expenses. In 2024, China's Ministry of Housing and Urban-Rural Development continued to emphasize stricter enforcement of building safety regulations, potentially increasing capital expenditure for compliance.

Land use policies, particularly zoning laws and development approvals, are crucial for the expansion and operational efficiency of Red Star Macalline's mall network. Delays or changes in these policies can impact project timelines and the strategic placement of new developments. For example, local government initiatives aimed at urban revitalization or environmental protection can alter land availability and development feasibility, as seen in various pilot programs across major Chinese cities throughout 2024.

Trade Policies and Import/Export Regulations

China's evolving trade policies, particularly concerning import tariffs on furniture and building materials, directly impact Red Star Macalline's operational costs and the competitiveness of its tenants. For instance, in 2024, the ongoing trade dialogues between China and major furniture exporting nations could lead to adjustments in import duties, affecting the landed cost of goods. These policy shifts can ripple through the supply chain, influencing the pricing strategies of retailers operating within Macalline's centers and ultimately impacting consumer prices.

Fluctuations in international trade relations also pose a significant consideration for Red Star Macalline's diverse product offerings. Stability in global supply chains is crucial for ensuring a consistent flow of raw materials and finished home furnishing products. Any disruptions, perhaps stemming from geopolitical tensions or new trade agreements, can affect product availability and introduce price volatility for the numerous brands that rely on international sourcing.

- Tariff Impact: Potential increases in tariffs on imported furniture components in 2024 could raise costs for Macalline's tenants, potentially impacting their profit margins.

- Supply Chain Stability: Red Star Macalline's reliance on a global network for various home furnishing items means that trade policy shifts can influence the availability and cost of goods for its diverse tenant base.

- Export Regulations: Changes in export regulations from countries supplying China with home furnishings can also affect the supply chain dynamics for businesses operating within Red Star Macalline centers.

Political Stability and Governance

China's political landscape, particularly its commitment to stability and effective governance, is a critical factor for major retailers like Red Star Macalline. A predictable policy environment and a robust legal system are essential for attracting and retaining investment, enabling companies to plan for the long term.

Political uncertainties can create significant headwinds. For instance, shifts in economic policy or trade relations, while not directly impacting Red Star Macalline's day-to-day operations, can influence consumer spending habits and overall market confidence in the home goods sector. The Chinese government's focus on domestic consumption and supply chain resilience, as seen in policies promoting internal circulation, is a key consideration for strategic planning.

- Government Stability: The continuity of leadership and policy direction in China directly impacts the predictability of the business environment for large domestic retailers.

- Regulatory Framework: Evolving regulations concerning e-commerce, consumer protection, and environmental standards require constant adaptation by companies like Red Star Macalline.

- Economic Policy: Government stimulus measures or austerity drives can significantly influence consumer disposable income and spending on home furnishings.

- International Relations: Trade disputes or geopolitical tensions can indirectly affect supply chains and consumer sentiment, impacting the broader retail market.

Government policies on real estate directly impact Red Star Macalline by influencing housing demand and consumer spending on home furnishings. For example, China's continued efforts in 2024 to stabilize the property market, including adjustments to mortgage lending, directly affect the purchasing power for home improvements.

Government initiatives to stimulate domestic consumption, such as potential tax incentives for home renovations or subsidies for home goods, can boost sales within Red Star Macalline's centers. In 2024, China's focus on boosting internal circulation and consumption directly benefits the home furnishings sector.

Regulatory frameworks, including building safety codes and environmental standards, influence operational costs and compliance requirements. China's emphasis on stricter building safety regulations in 2024 adds to capital expenditure for businesses like Red Star Macalline.

Trade policies, particularly tariffs on imported furniture and materials, affect tenant costs and product competitiveness. In 2024, ongoing trade dialogues could lead to adjustments in import duties, impacting the landed cost of goods for retailers in Macalline's malls.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Red Star Macalline Home Group, covering political, economic, social, technological, environmental, and legal dimensions to identify strategic opportunities and threats.

This PESTLE analysis provides a concise overview of the external factors impacting Red Star Macalline, serving as a valuable tool to identify and address potential market challenges and opportunities.

By breaking down the external environment into Political, Economic, Social, Technological, Legal, and Environmental factors, this analysis offers a clear framework for understanding and navigating the complexities of the home furnishings market.

Economic factors

China's economic performance is a critical factor for Red Star Macalline. In 2023, China's GDP grew by 5.2%, indicating a healthy expansion. This growth directly influences consumer disposable income and their capacity to spend on home improvement and furnishings, which are essential for Red Star Macalline's sales.

A strong GDP growth generally fuels demand for new housing and renovations, directly benefiting furniture and home decor retailers like Red Star Macalline. For instance, the ongoing urbanization and a growing middle class continue to support demand for better quality home goods.

Conversely, any economic slowdown or recessionary pressures in China could significantly impact Red Star Macalline. Reduced consumer confidence and tighter budgets often lead to decreased spending on non-essential items, including higher-end furniture and extensive home renovations.

In 2024, China's economic landscape saw shifts in disposable income, directly influencing consumer spending on big-ticket items like home furnishings. While specific figures for Red Star Macalline's direct impact are still emerging for the full year, broader economic indicators suggest a cautious consumer. For instance, retail sales growth, a proxy for consumer spending, has shown moderate but not explosive growth, indicating that while people have income, confidence plays a crucial role in their willingness to commit to home improvement projects.

Consumer confidence, a key driver for discretionary spending, remained a focal point throughout 2024. Factors such as employment stability and future income expectations heavily weigh on household decisions regarding furniture and renovation. A dip in confidence, perhaps due to global economic uncertainties or domestic policy adjustments, can lead to postponed purchases, directly impacting foot traffic and sales performance for retailers like Red Star Macalline.

Inflation directly impacts Red Star Macalline by escalating operational expenses like utilities and property maintenance. Furthermore, it influences the cost of goods and services that its retail tenants offer, potentially affecting their sales and ability to pay rent.

For instance, if consumer inflation in China hovers around 2.5% to 3% as projected for late 2024 and early 2025, this general price increase will filter through to building materials and furniture, raising costs for Red Star Macalline's tenants and potentially for the company's own renovation projects.

This dynamic forces Red Star Macalline to navigate a delicate balance: absorbing some cost increases to support tenant viability and maintain competitive retail pricing, while also passing on necessary adjustments that could temper consumer spending on home furnishings and renovations.

Interest Rates and Mortgage Policies

Interest rates, especially those tied to mortgages, are a significant driver for the housing market and consequently, for companies like Red Star Macalline. When mortgage rates are low, it becomes more affordable for people to buy homes, which often sparks demand for renovations and new furniture. For instance, in early 2024, the US Federal Reserve maintained its benchmark interest rate, but expectations of future cuts influenced mortgage rates, which remained elevated compared to previous years, averaging around 6.6% for a 30-year fixed mortgage as of February 2024. This environment can create a mixed picture for home improvement retailers.

Conversely, when interest rates climb, the cost of borrowing for homebuyers increases, potentially slowing down the housing market. This slowdown can translate to reduced consumer spending on discretionary items like home furnishings and renovations. For example, if mortgage rates were to rise significantly in 2024 or 2025, it could dampen consumer confidence and their willingness to undertake large home improvement projects, directly impacting Red Star Macalline's sales volume.

The Federal Reserve's monetary policy decisions, including adjustments to the federal funds rate, have a ripple effect on mortgage rates. These policy shifts are closely watched by the real estate and home improvement sectors.

- Impact of Mortgage Rates: Lower rates stimulate home buying and renovation, boosting demand for furniture and decor.

- Economic Sensitivity: Red Star Macalline's sales are directly tied to the health of the housing market, which is sensitive to interest rate fluctuations.

- 2024/2025 Outlook: While specific future rates are uncertain, the trend of interest rates in 2024, with rates generally higher than the pandemic lows, presents a cautious environment for the home improvement sector.

Urbanization and Housing Market Trends

China's ongoing urbanization continues to fuel household formation, creating a consistent demand for housing. This trend is a primary driver for Red Star Macalline, as more new homes translate to increased opportunities for home improvement and furnishing.

Housing market dynamics, including new home construction and existing home transactions, directly impact Red Star Macalline's customer base. For instance, in 2024, China's property market saw fluctuations, with new home sales in major cities experiencing varied performance depending on regional policies and economic sentiment.

- Urbanization Rate: China's urbanization rate reached approximately 66.16% by the end of 2023, indicating a continued migration to cities and sustained housing demand.

- New Home Completions: While the pace of new home completions may adjust based on market conditions, the underlying need for housing in urban centers remains robust.

- Property Price Trends: Monitoring average property prices in key urban areas provides insight into consumer purchasing power for home furnishings and renovation services.

- Existing Home Sales: A healthy secondary housing market also contributes to demand, as homeowners often renovate or redecorate when moving or updating their properties.

The economic climate in China significantly shapes Red Star Macalline's performance. China's GDP growth, projected to be around 5% for 2024, provides a baseline for consumer spending. However, shifts in disposable income and consumer confidence are critical. For instance, while retail sales growth showed moderate gains in early 2024, consumer sentiment remains a key determinant for discretionary purchases like home furnishings.

What You See Is What You Get

Red Star Macalline Home Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Red Star Macalline Home Group covers Political, Economic, Social, Technological, Legal, and Environmental factors, providing a thorough strategic overview.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain insights into market trends and competitive landscapes impacting Red Star Macalline Home Group.

The content and structure shown in the preview is the same document you’ll download after payment. It details the critical external forces shaping the future of the home furnishings retail giant.

Sociological factors

Chinese consumers are increasingly prioritizing personalized and aesthetically pleasing home environments. This shift, evident in evolving lifestyles, fuels demand for a wider range of home improvement and furniture options, moving beyond basic functionality to embrace comfort and style. For instance, by early 2024, online searches for "smart home" solutions and "minimalist interior design" saw significant year-over-year increases, indicating a growing consumer interest in sophisticated living spaces.

Red Star Macalline is well-positioned to capitalize on these changing preferences through its expansive platform. The company offers a diverse selection of products and brands that cater to these varied and sophisticated tastes, from high-end designer furniture to customizable renovation services. This comprehensive approach allows them to meet the nuanced demands of consumers seeking to create unique and comfortable homes.

China's middle class is a powerhouse, with its size and spending power continuing to grow. By the end of 2023, estimates suggest the middle-income group in China comprised over 400 million people, a number that has been steadily increasing. This expanding demographic directly translates to higher disposable income and a greater appetite for quality home furnishings.

As affluence rises, consumers are increasingly seeking premium and branded home décor solutions. This trend is evident in the growing demand for imported goods and designer labels within the home furnishings sector. For Red Star Macalline, this represents a substantial opportunity to capture market share by offering a diverse portfolio of high-quality products and curated shopping experiences that cater to these evolving consumer preferences.

Demographic shifts are significantly reshaping consumer needs within the home furnishings market. Globally, and particularly in China where Red Star Macalline operates, we're seeing a trend towards smaller family units and an increase in single-person households. For example, China's birth rate has continued to decline, with just 6.39 births per 1,000 people in 2023, indicating smaller future family sizes. This directly impacts the demand for larger, family-oriented furniture sets, pushing demand towards more compact and multi-functional pieces suitable for smaller living spaces and individual lifestyles.

The aging population is another critical demographic factor influencing purchasing decisions. As more individuals enter their senior years, there's a growing need for furniture that prioritizes comfort, safety, and accessibility. This could translate into demand for adjustable chairs, beds with easier access, and furniture with rounded edges. Red Star Macalline must consider how to integrate these specialized needs into its product lines to capture this expanding market segment, which is expected to grow as China's elderly population continues to expand, projected to reach over 300 million by 2025.

Urbanization and Migration Patterns

China's ongoing urbanization, with an increasing percentage of its population moving to cities, directly translates into sustained demand for home furnishings. By mid-2024, it's estimated that over 65% of China's population resides in urban areas, a figure projected to climb further. This demographic shift significantly expands Red Star Macalline's potential customer base, particularly in rapidly developing urban centers.

Internal migration patterns within China are crucial for Red Star Macalline's expansion strategy. As people relocate to new cities for economic opportunities, they require new housing and, consequently, home furnishings. For instance, the continued influx of people into tier-one and new tier-one cities in 2024 and 2025 presents prime opportunities for the company to establish or enhance its retail presence.

- Urban Population Growth: China's urban population reached approximately 930 million by the end of 2023, indicating a consistent trend of rural-to-urban migration.

- New Home Demand: The construction of new residential units, driven by urbanization, directly correlates with the need for furniture and home decor.

- Market Expansion: Understanding migration flows allows Red Star Macalline to strategically site new stores in areas experiencing population growth and increased disposable income.

Consumer Awareness of Home Design and Quality

Chinese consumers are increasingly discerning about home aesthetics and the quality of materials used in their living spaces. This heightened awareness extends to environmental considerations, pushing demand for sustainable home furnishings. For instance, a 2024 survey indicated that over 60% of urban Chinese households prioritize eco-friendly materials when renovating.

This trend fuels a growing appetite for professional interior design services and products that offer both durability and sophisticated styling. Consumers are no longer satisfied with basic functionality; they seek homes that reflect personal taste and offer long-term value. This shift directly benefits companies like Red Star Macalline that integrate design consultation and showcase high-quality, enduring products within their retail environments.

Red Star Macalline's strategic focus on creating integrated platforms that include design studios and curated product selections directly addresses this evolving consumer demand. By offering a holistic approach to home furnishing, the company caters to a market segment actively seeking expert guidance and premium, sustainable solutions for their homes. This positions them well to capitalize on the increasing sophistication of the Chinese consumer.

Key consumer preferences influencing the home design market include:

- Emphasis on Durability: Consumers are investing in products built to last, reducing the need for frequent replacements.

- Aesthetic Appeal: Modern and personalized design trends are highly sought after, moving beyond generic styles.

- Environmental Consciousness: A significant portion of consumers actively seek out sustainable and non-toxic materials.

- Demand for Expertise: Professional design advice is increasingly valued to achieve desired home outcomes.

Chinese consumers are increasingly prioritizing personalized and aesthetically pleasing home environments, driving demand for a wider range of home improvement and furniture options that emphasize comfort and style. This trend is supported by growing affluence, with China's middle class, exceeding 400 million people by late 2023, demonstrating a greater appetite for quality and branded home décor solutions.

Demographic shifts, including smaller family units and an aging population, are also reshaping consumer needs, favoring more compact, multi-functional, and accessible furniture. Furthermore, a growing emphasis on environmental consciousness means consumers are actively seeking sustainable and non-toxic materials, with over 60% of urban households in a 2024 survey prioritizing eco-friendly options.

Red Star Macalline is strategically positioned to meet these evolving demands by offering diverse product selections, integrated design services, and a focus on high-quality, sustainable furnishings. The company's ability to cater to sophisticated tastes and provide expert guidance allows it to capitalize on these significant societal and demographic trends in the Chinese home furnishings market.

Technological factors

The burgeoning e-commerce landscape in China, with online retail sales reaching an estimated ¥15.42 trillion in 2023, compels Red Star Macalline to deepen its digital integration. A sophisticated omni-channel approach, encompassing virtual showrooms and streamlined online-to-offline fulfillment, is essential to capture market share and satisfy evolving consumer demands. This digital pivot not only boosts customer convenience but also broadens the company's accessibility beyond its physical store footprint.

The increasing adoption of smart home technology, including automated lighting, climate control, and security systems, offers Red Star Macalline a significant opportunity to showcase and market these innovations within its retail spaces. By partnering with smart home solution providers and displaying integrated smart home concepts, the company can attract technologically inclined consumers and distinguish its product assortment.

This trend is supported by market growth projections; for instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is anticipated to reach over $200 billion by 2028, indicating substantial consumer interest and spending in this sector.

Red Star Macalline can further enhance its appeal by offering installation and consultation services for these sophisticated systems, thereby providing a comprehensive customer experience and capturing a larger share of this expanding market.

Red Star Macalline is increasingly leveraging big data analytics to deeply understand its customers. By analyzing purchasing patterns and mall traffic, the company can offer personalized recommendations and tailor marketing campaigns. For instance, in 2024, data insights helped identify key demographic segments for targeted promotions, leading to a reported 8% increase in engagement for specific retail categories.

These data-driven insights are crucial for optimizing operational aspects of the malls. Red Star Macalline uses this information to refine tenant mix, improve mall layouts for better customer flow, and enhance promotional activities. This focus on data allows for more precise business strategies, aiming to boost customer satisfaction and operational efficiency, which is vital in the competitive retail landscape.

Virtual and Augmented Reality for Design

Virtual and augmented reality (VR/AR) are transforming how consumers interact with home furnishings. By allowing customers to visualize furniture in their own spaces, these technologies significantly enhance the shopping experience. Red Star Macalline can leverage VR/AR to offer immersive design consultations, leading to more confident purchasing decisions and potentially fewer returns. This innovation aligns with a growing consumer demand for personalized and interactive retail experiences.

The adoption of VR/AR in the home furnishings sector is gaining momentum. For instance, in 2024, a significant percentage of furniture retailers reported exploring or implementing AR features to improve online sales. This trend is driven by the ability of VR/AR to bridge the gap between online browsing and in-store visualization, a critical factor for large purchases like furniture. Red Star Macalline's strategic integration of these tools could position it as a leader in digital home design solutions.

- Enhanced Visualization: VR/AR allows customers to see how furniture looks and fits in their actual homes, reducing purchase uncertainty.

- Improved Customer Engagement: Interactive virtual showrooms and design tools create a more compelling and memorable shopping journey.

- Reduced Returns: By enabling better pre-purchase visualization, these technologies can lead to a decrease in product returns, saving costs and improving satisfaction.

- Market Differentiation: Early adoption of VR/AR can provide Red Star Macalline with a competitive edge in the increasingly digitized home goods market.

Logistics and Supply Chain Digitization

Red Star Macalline is leveraging advanced logistics technologies to digitize its supply chain, aiming to boost efficiency in product delivery and inventory management. This digital transformation is crucial for reducing operational costs for both the company and its tenants. For instance, by mid-2024, companies in the retail sector reported an average of 15% reduction in delivery times through the implementation of real-time tracking and route optimization software.

The adoption of real-time tracking, automated warehousing, and optimized delivery routes directly enhances the customer experience by ensuring consistent and timely product availability. This improved reliability is particularly important for the home furnishings sector, where timely delivery and installation are key components of customer satisfaction. By 2025, it's projected that 70% of consumers will expect real-time updates on their orders, making these technological advancements a competitive necessity.

- Enhanced Efficiency: Digitization of logistics can lead to significant improvements in delivery speed and inventory accuracy.

- Cost Reduction: Automation and route optimization contribute to lower operational expenses across the supply chain.

- Improved Customer Experience: Real-time tracking and reliable delivery meet evolving consumer expectations.

- Support for Value-Added Services: Streamlined logistics directly support the provision of services like installation, adding further value for customers.

Red Star Macalline is increasingly integrating digital technologies to enhance customer engagement and operational efficiency. The company is leveraging big data analytics to understand consumer behavior, with 2024 data showing an 8% increase in engagement for targeted promotions. This data-driven approach optimizes tenant mix and mall layouts, boosting customer satisfaction.

Virtual and augmented reality (VR/AR) are transforming the shopping experience by allowing customers to visualize furniture in their homes, reducing purchase uncertainty. This trend is supported by a growing number of furniture retailers exploring AR features in 2024 to improve online sales, with VR/AR offering a competitive edge.

Advanced logistics technologies are being adopted to digitize the supply chain, aiming for improved delivery efficiency and inventory management. By mid-2024, retail companies reported an average 15% reduction in delivery times through real-time tracking and route optimization, a crucial factor for customer satisfaction by 2025.

Legal factors

Red Star Macalline's business, centered on operating and leasing commercial real estate, is deeply intertwined with China's property and real estate legislation. This includes regulations governing land use rights, property ownership structures, and stringent building codes that dictate development and renovation standards. For instance, in 2024, China continued to refine its urban planning laws, impacting how large-scale commercial developments like those operated by Red Star Macalline can be sited and constructed.

Adherence to these evolving legal frameworks is critical for Red Star Macalline's strategic growth and daily operations. This means ensuring all new site acquisitions, mall developments, and the ongoing management of existing properties strictly comply with national and local property laws. Failure to do so could lead to significant penalties or project delays, as seen in past instances where developers faced challenges with land use permits in rapidly urbanizing areas.

Any shifts or amendments to China's property and real estate laws can have a direct and substantial effect on Red Star Macalline's expansion strategies and overall operational expenditures. For example, new regulations on commercial property taxation or zoning changes introduced in late 2024 could influence the company's investment decisions and the profitability of its existing portfolio.

China's robust consumer protection framework, encompassing product quality, return policies, warranty provisions, and advertising integrity, directly influences Red Star Macalline's tenants and the brand perception of its shopping centers. For instance, the Consumer Rights Protection Law of the People's Republic of China mandates clear information disclosure and prohibits misleading advertising, impacting how tenants present their offerings.

Red Star Macalline must actively ensure its retail partners comply with these stringent regulations to safeguard consumer confidence and circumvent potential legal entanglements. A 2023 report indicated a 15% increase in consumer complaints related to online sales of home furnishings in China, highlighting the critical need for vigilant oversight across all sales channels.

China's environmental protection laws are becoming more rigorous, impacting sectors like building materials and waste disposal. For Red Star Macalline, this means a heightened focus on ensuring its commercial spaces and the products sold within them meet these evolving standards, particularly concerning energy efficiency and sustainable sourcing.

Compliance with these regulations is crucial. For instance, China's "14th Five-Year Plan for Ecological and Environmental Protection" (2021-2025) emphasizes reducing carbon emissions and promoting green building practices, directly influencing how Red Star Macalline and its tenants operate and source materials.

Labor Laws and Employment Regulations

Red Star Macalline, as a major employer in China, must navigate a complex web of labor laws. These regulations dictate minimum wages, standard working hours, mandatory employee benefits such as social insurance, and stringent workplace safety standards. For instance, China's Labor Contract Law requires employers to establish formal contracts with employees, outlining terms of employment and responsibilities. Failure to comply can lead to significant penalties and operational disruptions.

Adhering to these labor laws directly influences Red Star Macalline's operational costs and its human resource management strategies. The company's commitment to fair labor practices is essential not only for maintaining a motivated workforce but also for safeguarding its reputation and avoiding costly legal disputes. For example, in 2023, China saw increased enforcement of labor laws, with a particular focus on gig economy workers, highlighting the evolving regulatory landscape.

Key aspects of China's labor regulations impacting Red Star Macalline include:

- Minimum Wage Compliance: Ensuring all employees receive at least the legally mandated minimum wage, which varies by province.

- Working Hour Limits: Adhering to regulations on standard working hours and overtime pay, which are critical for mall operations.

- Social Insurance Contributions: Contributing to mandatory social insurance schemes for employees, covering pensions, medical care, unemployment, and work-related injuries.

- Workplace Safety: Implementing and maintaining safety protocols to prevent accidents and ensure a secure working environment for staff and mall visitors.

Intellectual Property Rights (IPR) Protection

Intellectual property rights are crucial for Red Star Macalline Home Group, given its extensive range of home furnishing products. Protecting design patents and trademarks is paramount. For instance, in 2024, China's Supreme People's Court reported a significant increase in intellectual property cases, highlighting the growing importance of robust IPR enforcement.

Red Star Macalline needs to ensure its tenants adhere to IPR laws. This involves monitoring the products sold within its malls to prevent infringement on existing patents or trademarks. Failure to do so can lead to legal challenges and reputational damage.

Furthermore, strong IPR protection is a strategic asset for Red Star Macalline itself. Safeguarding its own brand identity and any innovative service models it develops can provide a competitive advantage in the market. This is particularly relevant as the company expands its digital platforms and unique retail experiences.

- Design Patents: Protecting unique furniture and decor designs sold within Macalline malls.

- Trademarks: Ensuring brand names of both Macalline and its tenant brands are not infringed upon.

- Enforcement: Implementing policies to prevent the sale of counterfeit or infringing goods by tenants.

- Brand Value: Leveraging strong IPR to enhance the perceived value and trustworthiness of the Red Star Macalline brand.

China's evolving legal landscape significantly shapes Red Star Macalline's operations, particularly concerning property development and leasing regulations. In 2024, continued refinement of urban planning laws impacted site acquisition and construction standards for large commercial projects. Strict adherence to national and local property laws is vital to avoid penalties and project delays, as seen with past land use permit challenges.

Shifts in real estate legislation can directly affect expansion strategies and operational costs; for instance, new commercial property taxation or zoning changes implemented in late 2024 could influence investment decisions and portfolio profitability. Furthermore, intellectual property rights are crucial, with China's Supreme People's Court reporting a rise in IPR cases in 2024, underscoring the need for robust enforcement against design patent and trademark infringement by tenants.

Environmental factors

The global market for green building materials is experiencing significant growth, driven by both consumer preference and stricter environmental regulations. For instance, the global green building materials market was valued at approximately USD 250 billion in 2023 and is projected to reach over USD 450 billion by 2030, indicating a robust compound annual growth rate.

Red Star Macalline can capitalize on this by actively encouraging its retail partners to showcase sustainable home furnishing options and by prioritizing eco-friendly materials in its own property development projects. This strategic approach not only resonates with environmentally conscious consumers but also bolsters the company's commitment to corporate social responsibility.

Operating large shopping malls like those managed by Red Star Macalline is inherently energy-intensive. For instance, in 2024, the retail real estate sector globally continued to grapple with rising energy costs, with some regions experiencing double-digit percentage increases in electricity prices year-over-year.

This reality places significant pressure on Red Star Macalline to adopt energy-efficient technologies. Implementing solutions such as LED lighting retrofits, which can reduce lighting energy consumption by up to 70%, and upgrading to smart HVAC systems that optimize temperature control based on occupancy, are becoming crucial. The company is also exploring renewable energy sources, like rooftop solar installations, to mitigate both its environmental impact and operational expenses.

Meeting evolving energy consumption targets and cultivating a strong green image are vital for Red Star Macalline's long-term viability and market appeal. By 2025, many jurisdictions are expected to tighten regulations on commercial building energy performance, making proactive investment in sustainability a strategic imperative rather than an option.

Red Star Macalline's commitment to effective waste management and recycling is vital for meeting evolving environmental regulations and showcasing its corporate responsibility. This encompasses handling diverse waste streams, from construction debris during mall upgrades to the daily operational waste from tenants and the packaging waste generated by consumers. For instance, in 2023, China's national recycling rate for municipal solid waste reached 41.1%, highlighting a growing societal expectation for businesses to participate actively in waste reduction efforts.

Climate Change and Extreme Weather Events

Climate change poses significant physical risks to Red Star Macalline. The increasing frequency and intensity of extreme weather events, such as floods and heatwaves, can directly disrupt mall operations by impacting foot traffic and potentially damaging property. For instance, China experienced a record-breaking number of extreme weather events in 2023, including severe floods in northern regions, which could affect supply chains and consumer access to stores.

These disruptions extend to Red Star Macalline's supply chains, potentially leading to delays and increased costs for inventory and merchandise. Furthermore, water scarcity in certain regions presents an operational challenge, particularly for facilities management and maintaining comfortable environments for shoppers. The company must proactively integrate climate resilience into its infrastructure planning and operational strategies to ensure business continuity and minimize the impact of these environmental shifts.

- Increased frequency of extreme weather events in China: Reports indicate a notable rise in events like heavy rainfall and heatwaves across various provinces in 2023 and early 2024.

- Supply chain vulnerability: Extreme weather can halt transportation networks, impacting the timely delivery of goods to Red Star Macalline's retail locations.

- Infrastructure resilience: Investing in climate-resilient building designs and operational continuity plans is crucial for mitigating physical damage and operational downtime.

- Water scarcity concerns: Regions facing water stress may require enhanced water management systems for mall operations, impacting utility costs and sustainability efforts.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly and healthy home products is on the rise in China, with a growing segment of consumers actively seeking items free from harmful chemicals. This trend presents a significant opportunity for Red Star Macalline Home Group. By strategically curating tenants that offer certified green products and actively promoting these healthier alternatives, the company can effectively tap into this evolving market preference.

This focus on sustainability not only caters to current consumer desires but also enhances Red Star Macalline's brand image as a responsible and forward-thinking retailer. For instance, a 2024 report indicated that over 60% of Chinese millennials are willing to pay a premium for sustainable products.

- Growing Green Market: A significant portion of Chinese consumers, particularly younger demographics, are prioritizing health and environmental impact in their purchasing decisions for home goods.

- Tenant Curation: Red Star Macalline can leverage its platform to attract and highlight brands offering certified eco-friendly and non-toxic home furnishings and building materials.

- Brand Enhancement: Aligning with consumer demand for sustainability strengthens Red Star Macalline's reputation and can lead to increased customer loyalty and market share.

- Market Data: In 2024, the market for green building materials in China was valued at approximately $180 billion, with a projected annual growth rate of 8-10% through 2025.

Red Star Macalline must navigate increasing environmental regulations and the growing demand for sustainable products. The company's large-scale operations necessitate a focus on energy efficiency and waste management to meet evolving standards and consumer expectations, with China's national recycling rate reaching 41.1% in 2023.

Extreme weather events, a growing concern in China as seen in 2023's record number of occurrences, pose physical risks to infrastructure and supply chains, requiring proactive climate resilience planning.

Consumer preference is shifting towards eco-friendly and healthy home products, with over 60% of Chinese millennials in 2024 willing to pay more for sustainable goods, presenting a key opportunity for Red Star Macalline to curate and promote such offerings.

| Environmental Factor | Impact on Red Star Macalline | Relevant Data (2023-2025) |

|---|---|---|

| Green Building Materials Demand | Opportunity for tenant curation and product promotion | Global green building materials market projected to exceed $450 billion by 2030. Chinese market valued at $180 billion in 2024, growing 8-10% annually through 2025. |

| Energy Consumption | Operational cost pressure and need for efficiency | Global retail real estate sector saw double-digit percentage increases in electricity prices in some regions during 2024. |

| Waste Management & Recycling | Regulatory compliance and corporate responsibility | China's municipal solid waste recycling rate reached 41.1% in 2023. |

| Climate Change & Extreme Weather | Physical risks to property and supply chain disruption | China experienced a record number of extreme weather events in 2023. |

| Consumer Demand for Sustainability | Market preference for eco-friendly and healthy products | Over 60% of Chinese millennials willing to pay a premium for sustainable products (2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Red Star Macalline Home Group is built upon a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and factual data.