Red Star Macalline Home Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Red Star Macalline Home Group Bundle

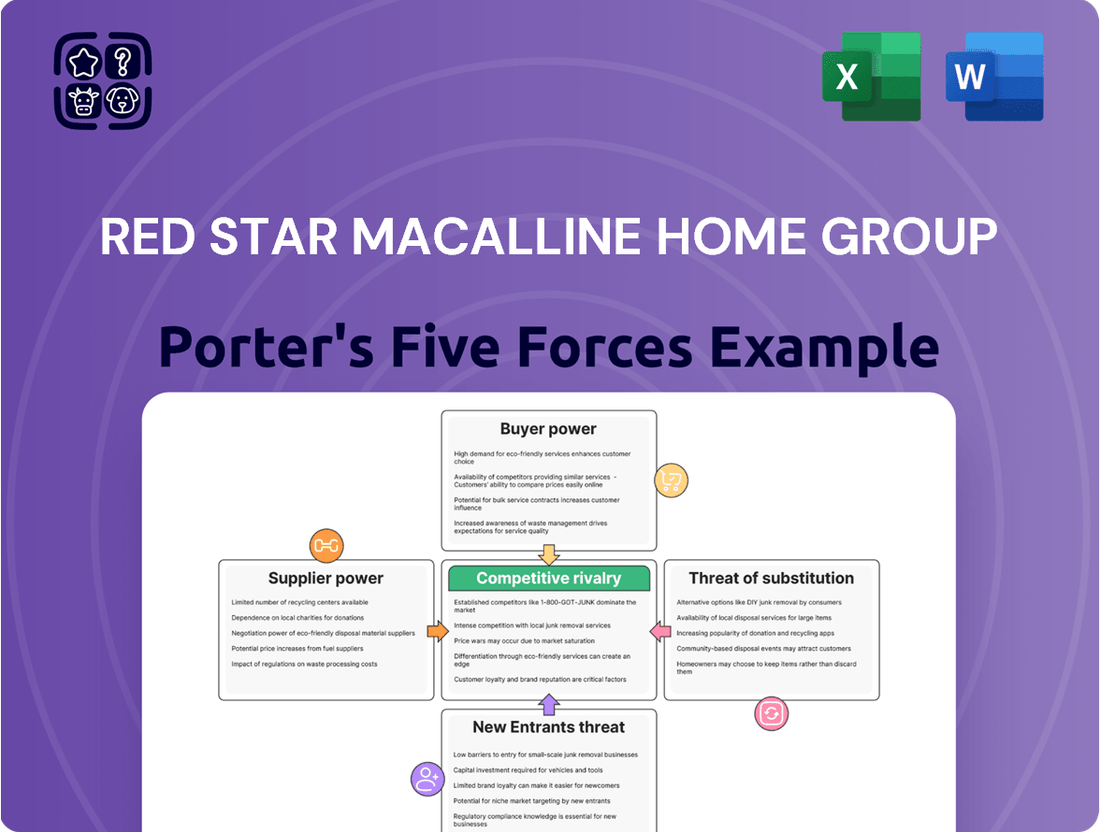

Red Star Macalline Home Group faces moderate buyer power due to the fragmented nature of the home furnishings market, where customers have numerous choices. However, the brand's reputation and loyalty programs can mitigate this. The threat of new entrants is also a significant factor, as the industry is relatively accessible, though high capital investment for large-scale operations can be a barrier.

The complete report reveals the real forces shaping Red Star Macalline Home Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of property owners who supply space to Red Star Macalline is a key factor. For premium locations in sought-after urban areas, this power can lean towards moderate to high, particularly given the limited supply of large commercial spaces suitable for home improvement centers. The overall property market in China, which has seen some downturns, could slightly reduce this leverage for landlords.

Red Star Macalline's operational model, which includes both self-owned and managed properties, provides a degree of flexibility. This diversification in property relationships allows the company to negotiate from a stronger position rather than being solely reliant on external property owners.

While property owners might have other potential tenants, the presence of a major anchor like Red Star Macalline is a significant draw. In 2024, large retail anchors continued to be critical for driving foot traffic and overall mall viability, making them valuable partners for property developers.

Red Star Macalline's established network and specialized focus on home furnishings and building materials attract a diverse range of complementary retailers. This broad appeal makes Red Star Macalline a highly sought-after lessee, potentially reducing a property owner's urgency to offer substantial concessions.

Switching costs for Red Star Macalline to relocate its extensive operations are substantial. These costs include significant capital outlays for setting up new mall infrastructure, managing the complex process of tenant relocation, and rebuilding brand recognition in different geographical markets.

This reliance on established physical locations and the associated setup expenses inherently strengthens the bargaining position of property owners. Red Star Macalline's broad operational footprint, encompassing numerous large-scale malls throughout China, further amplifies these high switching costs, making it challenging to shift operations quickly or economically.

Uniqueness of Supplier Offerings

While standard commercial spaces are often commoditized, property developers can differentiate themselves through unique offerings. Prime locations, state-of-the-art facilities, and integrated urban planning for large-scale retail centers represent such unique selling points. These factors can significantly bolster a supplier's bargaining power, especially within burgeoning or highly contested retail markets.

Red Star Macalline Home Group's strategic emphasis on developing integrated home furnishing shopping environments necessitates securing specific types of properties. This focus means that developers possessing the right kind of land, zoning, and infrastructure for such large-format retail can command greater leverage.

For instance, in 2024, prime retail land prices in major Chinese Tier 1 cities continued their upward trajectory, with some areas seeing year-on-year increases of 5-10% for well-situated commercial plots. This scarcity and premium pricing for desirable locations directly translate to increased bargaining power for the landowners and developers who can offer them.

- Prime Locations: Access to high-traffic areas, good public transport links, and visibility are key differentiators for property developers.

- Modern Facilities: Advanced architectural design, sustainable building practices, and integrated amenities can make a property uniquely attractive to large retailers.

- Strategic Urban Planning: Developers who can secure land in areas designated for significant commercial growth or those with favorable zoning for retail can gain an advantage.

- Competitive Retail Hubs: In markets with high demand for retail space, developers with suitable properties hold stronger negotiating positions.

Economic Conditions in Property Market

The current downturn in China's property market, characterized by declining property values and sales, significantly weakens the bargaining power of suppliers, such as property owners and developers. This economic climate creates a more favorable environment for large tenants like Red Star Macalline. In 2023, Red Star Macalline reported a net loss attributable to shareholders of RMB 1.09 billion, a stark contrast to a profit of RMB 500 million in 2022. This financial pressure led the company to implement measures like reduced rental fees to support tenants and mall owners, demonstrating a clear shift in leverage.

Red Star Macalline's willingness to offer concessions, such as lower rental rates, directly reflects the diminished bargaining power of property suppliers. This strategy aims to secure stable occupancy and mitigate further financial strain. The company's financial performance in 2023, with revenue decreasing by 10.3% year-on-year to RMB 12.04 billion, underscores the challenging market conditions. Consequently, suppliers are more inclined to negotiate favorable terms to retain key tenants and avoid vacant spaces.

- Declining Property Values: The ongoing challenges in China's property sector, with reports of significant price drops in many cities, reduce the leverage of property owners.

- Tenant Support Measures: Red Star Macalline's reported losses and subsequent reduction in rental fees highlight a market where suppliers are more amenable to negotiation.

- Shift in Leverage: The ability of Red Star Macalline to negotiate reduced terms indicates a market where large, established tenants hold greater bargaining power over property suppliers.

The bargaining power of property owners supplying space to Red Star Macalline is currently moderate to low, largely due to the downturn in China's property market. This market shift, evidenced by declining property values and sales throughout 2023 and into early 2024, means landlords are more willing to negotiate favorable terms to retain key tenants like Red Star Macalline. The company's financial performance, including a reported net loss of RMB 1.09 billion in 2023, further underscores this reduced leverage for suppliers, as Red Star Macalline has implemented measures like reduced rental fees to support occupancy.

| Factor | Impact on Red Star Macalline | Supplier Bargaining Power |

|---|---|---|

| China Property Market Downturn (2023-2024) | Reduced rental costs, greater negotiation flexibility | Moderate to Low |

| Red Star Macalline's 2023 Net Loss (RMB 1.09 billion) | Increased need for cost savings, leverage to negotiate lower rents | Low |

| Tenant Support Measures (e.g., reduced rental fees) | Directly indicates suppliers' willingness to concede terms | Low |

| High Switching Costs for Red Star Macalline | Historically favored suppliers, but current market conditions dilute this | Moderate (mitigated by market) |

What is included in the product

This analysis details the competitive forces impacting Red Star Macalline Home Group, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the home furnishings sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Red Star Macalline's core customers are the furniture and building material retailers who rent space within its properties. These retailers operate in a highly competitive market, further intensified by a slowdown in consumer spending across China. This environment makes them particularly sensitive to pricing, directly impacting their willingness to pay for leasing and management services.

The pressure on retailers to control costs, including rent and associated fees, naturally elevates their bargaining power. This leverage is evident in Red Star Macalline's financial performance, with a reported revenue decline in the first quarter of 2025, indicating that retailers are successfully negotiating or reducing their expenditure with the company.

Retailers, including those who might lease space from Red Star Macalline, now have a wider array of options beyond traditional brick-and-mortar malls. They can establish their own direct sales channels, leverage other physical retail locations, or increasingly, tap into the vast reach of online platforms and e-commerce giants. This diversification of sales avenues significantly bolsters their negotiating position with mall operators.

The ongoing digital transformation and the growing trend of omnichannel retail empower retailers with more choices for connecting with consumers. For instance, by 2024, e-commerce sales are projected to reach trillions globally, offering a substantial alternative to physical retail spaces. This expanded digital presence grants retailers greater leverage when considering lease agreements with entities like Red Star Macalline, as they are less dependent on a single mall's foot traffic.

Red Star Macalline's customer base, primarily furniture and building material retailers, is quite fragmented. This means that individually, most tenants have limited power to negotiate terms. For instance, in 2023, Red Star Macalline operated over 90 stores across China, hosting thousands of independent retailers, none of whom likely represent a significant portion of the company's overall revenue.

However, the situation can shift if a few major anchor tenants or highly sought-after brands are present. These key players are crucial for drawing significant foot traffic, giving them a stronger hand in lease negotiations. Their departure could have a more substantial impact on Red Star Macalline's performance than the exit of smaller retailers.

Furthermore, when numerous smaller tenants experience similar market challenges, such as declining consumer spending or increased competition, their collective bargaining power can grow. They might band together or exert pressure through shared grievances, potentially influencing Red Star Macalline's rental policies or service offerings to maintain occupancy and store vitality.

Information Symmetry and Market Transparency

The bargaining power of customers, particularly for a retailer like Red Star Macalline, is significantly influenced by information symmetry and market transparency. As digital tools and readily available market reports proliferate, retailers can now easily compare leasing terms and prevailing market conditions across various shopping centers. This heightened transparency directly empowers them to negotiate more effectively for better rental rates and service agreements.

The current challenges within the Chinese retail sector further amplify these comparisons, making it starkly evident where favorable terms can be secured. For instance, reports from late 2023 and early 2024 indicated a softening rental market in many secondary and tertiary cities in China, with vacancy rates in some malls exceeding 15%. This environment allows astute retailers to leverage data and market trends to their advantage.

- Information Accessibility: Digital platforms and industry reports provide retailers with unprecedented access to leasing data, enabling direct comparison of rental costs and terms across different locations.

- Negotiating Leverage: Enhanced transparency empowers retailers to negotiate from a position of strength, demanding more favorable lease agreements and service packages.

- Market Conditions Impact: A challenging retail climate, characterized by increased competition and evolving consumer spending habits, intensifies the need for cost-effective operational spaces, further boosting retailer bargaining power.

Consumer Spending Trends

The bargaining power of customers, particularly the ultimate consumers in China's retail sector, is a significant factor influencing Red Star Macalline. Weak consumer confidence in 2024 has led to trading-down dynamics, meaning consumers are opting for less expensive goods. This directly pressures the profitability of Red Star Macalline's tenant retailers.

Consequently, these retailers possess stronger bargaining power. They are more likely to negotiate for lower rents and increased support from mall operators like Red Star Macalline to mitigate their own sales challenges. This dynamic is exacerbated by declining foot traffic in department stores, a trend that has persisted and intensified in recent periods.

- Weak Consumer Confidence: Chinese consumer confidence remained subdued in early 2024, impacting discretionary spending.

- Trading-Down Effect: Consumers are increasingly prioritizing value and lower-priced alternatives, affecting sales volumes for many retailers.

- Retailer Negotiation Leverage: Tenant retailers facing these pressures are emboldened to demand concessions from mall operators to maintain viability.

- Foot Traffic Decline: Reduced shopper visits to traditional retail spaces further weaken the position of mall operators and strengthen tenant demands.

Red Star Macalline's primary customers are the retailers leasing space, and their bargaining power is amplified by market conditions and alternative sales channels. The fragmentation of its tenant base means individual retailers have limited sway, but collective challenges can increase their leverage. Transparency in leasing terms, driven by digital access, further empowers retailers to negotiate favorable terms.

| Factor | Impact on Red Star Macalline | Supporting Data/Observation (as of 2024/early 2025) |

|---|---|---|

| Tenant Fragmentation | Lowers individual bargaining power. | Red Star Macalline operates >90 stores with thousands of retailers, many small and independent. |

| Alternative Sales Channels | Increases retailer leverage. | Global e-commerce sales projected to reach trillions by 2024, offering significant alternatives to physical retail. |

| Market Transparency | Empowers retailers in negotiations. | Digital platforms provide easy comparison of leasing terms, increasing retailer negotiating strength. |

| Weak Consumer Confidence | Pressures retailers, increasing their demands. | Subdued consumer confidence in early 2024 led to trading-down, impacting retailer profitability and increasing rent negotiation leverage. |

Preview the Actual Deliverable

Red Star Macalline Home Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Red Star Macalline Home Group's Porter's Five Forces Analysis, offering a comprehensive examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within the home furnishing sector.

Rivalry Among Competitors

Red Star Macalline Home Group navigates a landscape populated by substantial competitors, including other large-scale home improvement and furniture mall operators, alongside traditional department stores and niche furniture retailers. The market is characterized by the presence of multiple significant players, with Red Star Macalline consistently ranking among the top three, which naturally fuels intense rivalry.

This crowded field means Red Star Macalline must constantly innovate and distinguish itself to hold its ground. For instance, in 2023, the Chinese home furnishings market saw significant activity, with major players like China Vanke's home furnishing segment and other regional chains actively expanding and adapting their offerings to capture market share.

The China DIY Home Improvement Retailing Market is growing strongly, which can ease intense competition by offering enough room for everyone. However, this growth also encourages new companies to enter and existing ones to expand, prompting strategic actions to gain market share. In 2023, the market was valued at approximately $130 billion, with projections indicating continued expansion.

Red Star Macalline Home Group distinguishes itself with a broad platform, offering an extensive product selection, engaging shopping experiences, and services like design advice. This comprehensive approach aims to set it apart in a competitive landscape.

Despite these efforts, the broader department store market faces challenges with retailer homogeneity, making sustained differentiation a hurdle. For instance, in 2023, the home furnishings sector saw increased competition as many retailers focused on similar product categories and online presence.

To maintain its edge, Red Star Macalline's continued investment in digital transformation and enhancing the overall customer journey is paramount. This focus on innovation is key to standing out against competitors who may offer similar goods but lack the integrated experience.

High Fixed Costs and Exit Barriers

Red Star Macalline, like other operators of large-scale home furnishing malls, faces intense rivalry driven by high fixed costs. These costs, encompassing property upkeep, extensive management, and ongoing marketing efforts, necessitate a high occupancy rate to achieve profitability. The significant capital investment required for these properties creates substantial exit barriers, making it difficult for companies to simply walk away from underperforming assets.

These high exit barriers compel existing players to compete fiercely for tenants and market share. This competitive pressure often translates into aggressive strategies such as price reductions on rental spaces or enhanced service offerings to attract and retain key retailers. For instance, in 2023, the retail property sector in China, where Red Star Macalline primarily operates, saw a vacancy rate of around 10-15% for prime shopping malls, indicating a challenging leasing environment that fuels this rivalry.

- High Fixed Costs: Operating large shopping malls incurs significant expenses in property maintenance, management, and marketing.

- Exit Barriers: Divesting large commercial properties is challenging, locking companies into long-term commitments.

- Aggressive Competition: High costs and exit barriers force companies to compete intensely for tenants and market share.

- Impact on Strategy: This can lead to price wars or a focus on superior tenant services to maintain occupancy and profitability.

Strategic Objectives of Competitors

Competitors are actively pursuing aggressive market expansion and digital transformation, aiming to become comprehensive omni-channel platform providers, much like Red Star Macalline. This shared strategic direction intensifies the competitive landscape as key players target similar customer bases and strive for market leadership.

The ongoing development of new commercial projects and the renewal of existing ones further fuel this rivalry. For instance, in 2023, China's home furnishings retail market saw significant activity with numerous new mall openings and renovations across major cities, directly increasing the number of competing retail spaces.

- Aggressive Expansion: Competitors are investing heavily in expanding their physical store networks and online presence.

- Digital Transformation: A key focus is on integrating online and offline channels to create seamless customer experiences.

- Market Saturation: The launch of new commercial projects leads to increased density of competing home furnishing retailers in prime locations.

- Customer Acquisition: Intense competition for customer attention and loyalty is driving innovation in marketing and service offerings.

Red Star Macalline Home Group faces robust competition from other large home furnishing mall operators, department stores, and specialized retailers. The market is highly concentrated, with Red Star Macalline consistently ranking among the top three players, intensifying rivalry.

This competitive pressure is exacerbated by high fixed costs associated with operating large retail spaces, including property maintenance, management, and marketing. These costs, combined with significant exit barriers for commercial real estate, compel companies to aggressively compete for tenants and market share, often through price adjustments or enhanced services. For example, in 2023, the vacancy rate for prime shopping malls in China hovered around 10-15%, underscoring a challenging leasing environment that fuels this rivalry.

Competitors are actively pursuing omni-channel strategies, mirroring Red Star Macalline's own digital transformation efforts, leading to increased competition for similar customer bases. The continuous development of new retail projects and renovations in 2023 further intensified this by increasing the density of competing home furnishing spaces in key urban areas.

| Competitor Type | Key Characteristics | Competitive Actions | Market Share (Approx. 2023) |

|---|---|---|---|

| Large Home Furnishing Mall Operators | Extensive product selection, integrated shopping experience | Aggressive expansion, digital transformation, tenant incentives | Top 3 players hold significant combined share |

| Department Stores | Broad retail offerings, established brand recognition | Focus on home goods sections, online presence enhancement | Varying, but significant presence in home |

| Niche Furniture Retailers | Specialized product lines, unique designs | Targeted marketing, online direct-to-consumer sales | Fragmented, but growing |

SSubstitutes Threaten

The most significant threat of substitutes for Red Star Macalline Home Group stems from the booming e-commerce sector in China. These platforms provide unparalleled convenience, often undercut prices, and boast an extensive array of home furnishings and related products accessible from anywhere.

China's deeply ingrained mobile-first culture, coupled with sophisticated payment infrastructures, has made online shopping incredibly seamless and attractive. This digital ecosystem is further amplified by the aggressive growth of players like Temu, SHEIN, TikTok Shop, and AliExpress, which are fundamentally altering consumer purchasing habits and expectations in the home goods market.

The rise of omnichannel retail presents a significant threat of substitutes for Red Star Macalline Home Group. E-commerce players are increasingly blending online and offline experiences, allowing consumers to research online and buy in-store, or vice-versa, directly impacting the need for traditional mall visits for home furnishings. This shift means consumers can fulfill many home furnishing needs without setting foot in a physical mall, a core part of Macalline's business model.

For instance, in 2024, online retail sales in China continued their upward trajectory, with furniture and home goods seeing substantial growth. Many consumers now expect to be able to browse online, customize products, and have them delivered, or pick them up at convenient locations, effectively substituting the full mall experience. Red Star Macalline's own push into omnichannel strategies, such as enhancing its digital platforms and integrating online and offline inventory, directly addresses this evolving consumer behavior and the threat posed by these integrated substitutes.

The threat of substitutes for Red Star Macalline Home Group is amplified by the rise of direct-to-consumer (DTC) models in the furniture and building materials sectors. Manufacturers are increasingly bypassing traditional retail spaces, including malls, to sell directly to customers. This shift, fueled by digital advancements, allows them to potentially offer more competitive pricing or unique services, presenting a viable alternative to shopping at Red Star Macalline's properties.

Specialized Small-Scale Retailers

Specialized small-scale retailers present a significant threat to Red Star Macalline Home Group. Consumers increasingly seek unique, niche products and highly personalized services that large, standardized retail environments may struggle to provide. These smaller outlets, often featuring independent designers or curated selections, cater directly to specific tastes and preferences, offering an alternative shopping experience that can siphon off segments of Red Star Macalline's customer base.

For instance, in 2024, the direct-to-consumer (DTC) furniture market, often dominated by specialized online retailers and smaller boutiques, continued its growth trajectory, capturing a notable share of the home furnishings market. This trend indicates a consumer willingness to bypass traditional large-format stores for more tailored offerings.

- Niche Market Appeal: Smaller, specialized stores can effectively target and serve specific consumer segments with unique product lines.

- Personalized Service: Independent retailers often provide a higher level of personalized customer service and tailored design advice.

- Alternative Shopping Experience: These outlets offer a distinct, often more intimate, shopping environment compared to large malls.

- Market Share Erosion: By catering to unmet needs, specialized retailers can draw away customers, impacting the market share of larger players like Red Star Macalline.

DIY and Home Renovation Services

The burgeoning DIY and home renovation sector in China presents a significant threat of substitutes for Red Star Macalline. Consumers increasingly opt for undertaking their own renovation and decoration projects, sourcing materials from a wider array of channels instead of relying solely on integrated mall solutions. This trend is amplified by the accessibility of online platforms and specialized material suppliers.

Furthermore, independent home decoration and installation service providers act as direct substitutes for the value-added services Red Star Macalline might offer. If consumers choose to procure their building materials from alternative sources, they can then engage these independent service providers for installation and finishing, bypassing the need for Red Star Macalline’s comprehensive mall experience.

- DIY Market Growth: The Chinese home improvement market saw significant growth, with DIY segment gaining traction. In 2024, online sales of home decor and renovation materials continued to rise, indicating a shift in consumer behavior towards self-service.

- Independent Service Providers: The number of independent renovation contractors and specialized installation teams has increased, offering competitive pricing and flexible service packages that can rival integrated offerings.

- Material Sourcing Diversification: Consumers are no longer confined to traditional retail channels, with e-commerce platforms and specialized building material markets offering a vast selection of products, often at lower price points.

The threat of substitutes for Red Star Macalline Home Group is substantial, driven by the increasing prevalence of online retail and direct-to-consumer (DTC) models. Consumers can now easily access a vast array of home furnishings and building materials online, often at competitive prices, bypassing the need for traditional mall visits. This is further compounded by specialized smaller retailers offering unique products and personalized services, and the growing DIY trend where consumers source materials independently.

In 2024, China's e-commerce penetration for home goods continued to expand, with platforms like Taobao and JD.com reporting robust sales in furniture and decor. The DTC furniture market also saw continued growth, with many brands leveraging digital channels to reach consumers directly. This shift means Red Star Macalline faces substitutes that offer convenience, price advantages, and tailored experiences, directly impacting its traditional retail model.

| Substitute Type | Key Characteristics | Impact on Red Star Macalline | 2024 Trend Example |

|---|---|---|---|

| E-commerce Platforms | Convenience, price competitiveness, wide selection | Diverts customer traffic from physical malls | Continued double-digit growth in online home goods sales |

| Direct-to-Consumer (DTC) Brands | Manufacturer-direct sales, potentially lower prices, unique branding | Bypasses traditional retail channels | Expansion of DTC furniture brands online |

| Specialized Small Retailers | Niche products, personalized service, unique shopping experience | Erodes market share by catering to specific consumer tastes | Increased consumer demand for curated and artisanal home goods |

| DIY & Independent Suppliers | Cost savings, customization, self-service | Reduces reliance on integrated mall offerings for materials and services | Rise in online sales of renovation materials and independent contractor services |

Entrants Threaten

Establishing large-scale home improvement and furniture shopping malls, like those operated by Red Star Macalline, demands substantial capital. This includes the costs of acquiring prime real estate, constructing expansive facilities, and developing necessary infrastructure, creating a significant financial hurdle for potential new entrants.

The sheer scale of investment required acts as a powerful deterrent, making it difficult for new companies to compete with established players like Red Star Macalline. While real estate investment is projected to rebound in 2025, the market is still anticipated to face ongoing pricing pressures, further complicating new market entry.

Red Star Macalline Home Group benefits significantly from its vast network of over 100 malls strategically located across China. This extensive footprint, coupled with strong brand recognition as a dominant force in the home improvement retail space, presents a substantial hurdle for potential new entrants.

Establishing a comparable network and building the same level of trust and recognition with both retailers and consumers would require immense capital investment and considerable time, making the threat of new entrants relatively low.

While China aims to open its markets, regulatory hurdles and the need for strong local relationships remain significant barriers for new entrants in the home furnishings sector. For instance, the evolving 'negative list' for market access, though shrinking, still contains restrictions that can impede foreign investment and require considerable effort to navigate. Successfully entering this market necessitates deep understanding of local regulations and established connections, which new players often lack.

Economies of Scale and Experience Curve

Red Star Macalline's extensive history and significant operational scale provide substantial economies of scale. This allows them to secure favorable terms in procurement, conduct more cost-effective marketing campaigns, and operate with greater overall efficiency compared to potential newcomers.

New entrants face a considerable hurdle in replicating Red Star Macalline's established cost advantages and deep operational expertise. Achieving similar purchasing power and streamlined processes would require significant upfront investment and time, placing them at an immediate disadvantage.

- Economies of Scale: Red Star Macalline's large market share, estimated at over 10% of China's home furnishing market in recent years, allows for bulk purchasing discounts and optimized logistics.

- Experience Curve: Years of operation have honed Red Star Macalline's operational processes, from store management to supply chain, leading to lower per-unit costs and higher efficiency.

- Barriers to Entry: The capital required to build a comparable retail footprint and establish brand recognition is substantial, deterring many potential new entrants.

Tenant and Supplier Relationships

Red Star Macalline Home Group benefits from deeply entrenched relationships with a diverse range of furniture and building material retailers. The company also maintains strong ties with property owners and essential service providers, creating a robust ecosystem. Newcomers would find it difficult to replicate these established networks, making it challenging to secure prime retail space and reliable supplier agreements.

These long-standing connections translate into a significant barrier for potential new entrants. Attracting top-tier tenants and forging dependable supplier partnerships requires time and proven reliability, areas where Red Star Macalline already excels. This loyalty and preference within the industry makes market penetration a considerable hurdle.

- Established Tenant Base: Red Star Macalline's success in attracting and retaining a wide variety of home furnishing and building material brands provides a strong foundation that new entrants would struggle to match.

- Supplier Network Strength: The company's history of working with numerous suppliers ensures consistent product availability and favorable terms, a network that takes considerable effort to build.

- Property Owner Alliances: Strong relationships with property owners grant Red Star Macalline access to prime locations, a critical advantage that new competitors would find hard to secure.

The threat of new entrants for Red Star Macalline Home Group is considerably low due to immense capital requirements for establishing large-scale retail operations, estimated to be in the billions of yuan for prime real estate and construction. Furthermore, the company's extensive network of over 100 malls across China, coupled with strong brand recognition, creates a significant barrier. New players would struggle to replicate this scale and build similar trust with consumers and retailers, a process that demands substantial time and financial investment.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building large-scale malls requires significant investment in real estate and construction. | High barrier, deterring many potential entrants. |

| Brand Recognition & Network | Red Star Macalline's established presence and over 100 malls create strong brand loyalty. | Difficult for new entrants to match scale and consumer trust. |

| Economies of Scale | Bulk purchasing and optimized logistics lead to cost advantages. | New entrants face higher per-unit costs initially. |

| Established Relationships | Strong ties with retailers, property owners, and suppliers are critical. | New entrants need time to build comparable networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Red Star Macalline Home Group leverages data from company annual reports, industry-specific market research, and financial news outlets. This ensures a comprehensive understanding of competitive dynamics.