Red Star Macalline Home Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Red Star Macalline Home Group Bundle

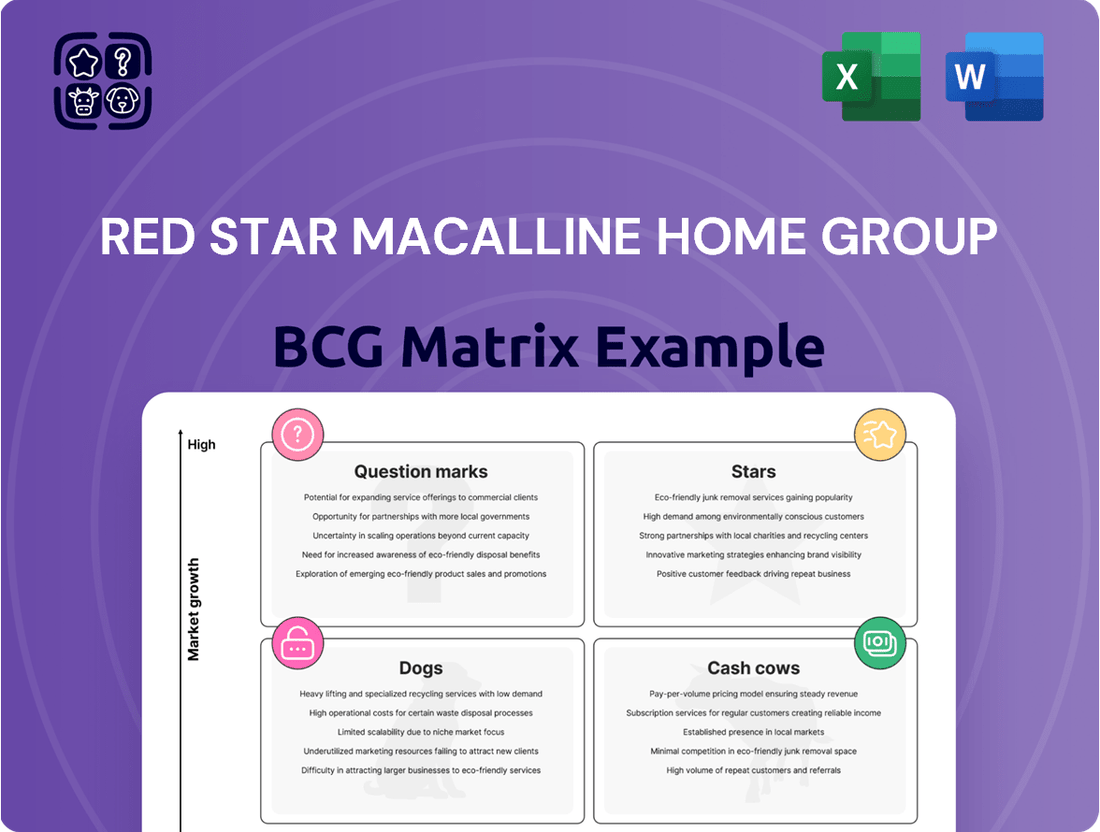

Curious about Red Star Macalline Home Group's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse product portfolio might be categorized, hinting at potential market leaders and areas needing attention.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Red Star Macalline is heavily investing RMB 3 billion in digital transformation for 2024, solidifying its omnichannel platform development as a Star in the BCG matrix. This strategic move is designed to boost online sales, which already grew by 30% in 2023, and to optimize customer engagement through sophisticated CRM systems.

The company's ambition to be recognized as an 'omni-channel platform service provider' underscores the significant potential and strategic importance of this segment. This focus is expected to drive higher sales conversion rates and further enhance the customer experience across all touchpoints.

Red Star Macalline's '3+ Star Ecosystem' strategy focuses on integrating home appliances, furniture, and home decoration into a unified 'Home Consumption Ecosystem Hub'. This approach targets the high-growth potential within China's evolving home furnishing market by offering consumers a convenient, all-in-one solution. By expanding into new product categories and business formats, Red Star Macalline aims to reinforce its market leadership and meet increasing consumer demand for comprehensive home solutions.

M+ High-End Home Improvement Design Centers are a key part of Red Star Macalline's strategy, with 16 centers already established and an ambitious plan to launch 84 more. This expansion targets the growing consumer desire for personalized home improvement experiences and sophisticated design services.

By concentrating on high-end design, Red Star Macalline is positioning itself to capture a lucrative and expanding market segment. The company is actively recruiting leading design professionals to enhance the appeal and service offerings of these premium centers.

Integration with National Trade-in Programs

Red Star Macalline is actively integrating with China's national trade-in programs, a significant growth driver for the home sector. These government initiatives encourage consumers to upgrade appliances and home renovation materials, directly boosting retail spending.

By aligning with these stimulus policies, Red Star Macalline is well-positioned to capture increased consumer demand. For instance, in 2024, China's Ministry of Commerce reported a substantial uptick in consumer spending on home goods as a direct result of these trade-in schemes.

- Government Support: Integration with national trade-in programs leverages government-backed stimulus.

- Retail Spending Boost: These policies directly increase consumer spending in the home sector.

- Capitalizing Demand: Active participation allows Red Star Macalline to benefit from enhanced purchasing power.

Smart Home and Eco-friendly Furnishings Integration

The market for smart home technology and eco-friendly furnishings in China is experiencing significant growth, driven by increasing consumer awareness and demand. Red Star Macalline's strategy to integrate these trends into its product lines and store operations is a key move to capture this expanding segment.

This focus on sustainability and smart living directly addresses evolving consumer preferences, particularly among younger demographics. For example, by 2024, the smart home market in China was projected to reach hundreds of billions of yuan, with eco-friendly building materials and furnishings also seeing robust year-over-year increases in sales.

- Rising Demand: Chinese consumers are increasingly prioritizing health, sustainability, and technological integration in their homes.

- Market Growth: The smart home sector in China is a high-growth area, with significant investment and adoption rates.

- Eco-Conscious Consumers: There's a growing segment of consumers actively seeking environmentally friendly and energy-efficient products.

- Red Star Macalline's Position: By aligning with these trends, Red Star Macalline aims to enhance its market share and brand appeal.

Red Star Macalline's digital transformation, with a RMB 3 billion investment in 2024, positions its omnichannel platform as a Star. This initiative fuels online sales growth, which saw a 30% increase in 2023, and enhances customer engagement through advanced CRM systems.

The company's strategic focus on becoming an 'omni-channel platform service provider' highlights the significant potential in this area, aiming to improve sales conversions and customer experiences across all touchpoints.

The '3+ Star Ecosystem' strategy, integrating appliances, furniture, and decor, targets high growth in China's home furnishing market by offering a unified solution. This expansion into new categories and formats aims to solidify Red Star Macalline's market leadership and meet evolving consumer demand for comprehensive home solutions.

The expansion of M+ High-End Home Improvement Design Centers, with 16 already operating and plans for 84 more, caters to the increasing consumer desire for personalized and sophisticated home improvement experiences.

By integrating with national trade-in programs, Red Star Macalline capitalizes on government stimulus, which significantly boosts home sector spending. In 2024, these programs contributed to a substantial uptick in consumer spending on home goods, as reported by China's Ministry of Commerce.

The company's strategy to incorporate smart home technology and eco-friendly furnishings addresses growing consumer demand in these high-growth segments. China's smart home market was projected to reach hundreds of billions of yuan by 2024, with eco-friendly products also experiencing robust sales increases.

| Category | Strategy Focus | 2023/2024 Data Point | Growth Driver | Market Potential |

| Omnichannel Platform | Digital Transformation & CRM | 30% Online Sales Growth (2023) | Enhanced Customer Engagement | High |

| Home Ecosystem | Product Integration (Appliances, Furniture, Decor) | RMB 3 Billion Digital Investment (2024) | Convenience, All-in-One Solutions | High |

| High-End Design Centers | Expansion & Recruitment | 16 Centers Established, 84 Planned | Personalized Home Improvement | Growing Segment |

| Government Programs | Trade-in Initiatives | Ministry of Commerce Report on Spending Uptick | Stimulated Consumer Spending | Significant |

| Smart & Eco-Friendly | Trend Integration | Smart Home Market Projected to Reach Hundreds of Billions (2024) | Consumer Preference for Health & Tech | Very High |

What is included in the product

The Red Star Macalline Home Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Red Star Macalline's portfolio, easing strategic decision-making and resource allocation pain points.

Cash Cows

Red Star Macalline's extensive network of directly owned and operated portfolio shopping malls represents a significant high-market-share asset. As of the close of 2024, the company managed 77 of these malls. While this marks a small reduction from the 79 malls operated in 2023, the portfolio maintained a robust occupancy rate of 83% throughout 2024.

These established shopping malls are the company's cash cows, consistently generating substantial revenue streams primarily through the leasing of retail space. The stable occupancy rate underscores the enduring demand for these prime locations, contributing significantly to Red Star Macalline's overall financial performance and stability in the competitive retail landscape.

Red Star Macalline's managed shopping malls, totaling 257 at the close of 2024, represent a significant pillar of its operations, demonstrating a high market share within the industry.

Despite a minor decrease in the total number of managed malls, this segment remains a crucial revenue driver, primarily through the collection of management fees.

This operational approach, characterized as asset-light, enables the company to achieve extensive market reach and generate substantial income without the burden of direct property ownership.

Red Star Macalline is a dominant force in China's home furnishing sector, boasting significant brand recognition and a vast network spanning over 200 cities. This leadership position translates into a reliable stream of merchants and customers, solidifying its market share and cash flow.

The company's reputation as a home life authority fuels its consistent revenue generation. For instance, in 2023, Red Star Macalline reported revenue of approximately RMB 10.8 billion, underscoring its stable cash-generating capabilities.

Stable Rental and Management Fee Income

Red Star Macalline Home Group's core business, centered on collecting rental and management fees from its extensive mall network, remains a significant cash generator, even amidst broader property market headwinds. This stable income stream is crucial for the company's financial health.

The company demonstrated strong operational efficiency in its leasing activities, evidenced by a gross profit margin that climbed to 63.8% in 2024. This improvement highlights the resilience and profitability of its established rental and management fee model.

- Stable Revenue Source: Rental and management fees from a large network of malls provide consistent income.

- Operational Efficiency: A gross profit margin of 63.8% in 2024 points to effective cost management in the leasing business.

- Liquidity Provision: This reliable income stream ensures the company has essential liquidity for its operations and investments.

Comprehensive Value-Added Services

Red Star Macalline Home Group's comprehensive value-added services, including design consultation and installation, significantly boost customer satisfaction and open up new revenue avenues beyond its primary leasing operations. These offerings are seamlessly integrated, capitalizing on the company's extensive customer reach and merchant relationships to generate stable, albeit slow, cash flow. For instance, in 2024, the company continued to expand its service offerings, aiming to capture a larger share of the home furnishing market by providing end-to-end solutions.

These well-integrated services are crucial for Red Star Macalline's position as a cash cow. They leverage the existing infrastructure and customer base to generate consistent returns with minimal investment. In 2024, the company reported that its ancillary services contributed a notable percentage to its overall revenue, demonstrating their effectiveness in providing low-growth, high-margin income.

- Enhanced Customer Experience: Design consultation and installation services elevate the customer journey, fostering loyalty and repeat business.

- Additional Revenue Streams: These services diversify income beyond core leasing, creating a more resilient financial model.

- Leveraging Existing Platform: Integration with the established customer base and merchant network ensures efficient service delivery and cost-effectiveness.

- Consistent Cash Flow Generation: The mature nature of these services provides a predictable and stable, low-growth cash flow for the group.

Red Star Macalline's directly owned shopping malls, numbering 77 at the end of 2024, represent its primary cash cows. These established properties consistently generate substantial revenue through leasing, supported by a robust 83% occupancy rate in 2024. The stable income from these assets provides the financial foundation for the company.

The company's leasing business, which includes collecting rental and management fees from its vast mall network, remains a significant cash generator. This core operation, characterized by strong operational efficiency, yielded a gross profit margin of 63.8% in 2024, highlighting its profitability and stability even amidst market fluctuations.

These cash cows are crucial for Red Star Macalline's financial health, providing essential liquidity. Their mature, low-growth, high-margin nature ensures a predictable and reliable income stream, underpinning the company's overall financial stability and capacity for future investments.

| Metric | 2023 | 2024 |

|---|---|---|

| Directly Owned Malls | 79 | 77 |

| Occupancy Rate (Directly Owned) | N/A | 83% |

| Gross Profit Margin (Leasing) | N/A | 63.8% |

Delivered as Shown

Red Star Macalline Home Group BCG Matrix

The Red Star Macalline Home Group BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with industry-standard analysis, will be delivered to you without any watermarks or placeholder content, ensuring immediate usability for your strategic planning.

Dogs

Red Star Macalline's portfolio saw a contraction, with managed shopping malls decreasing from 362 in 2023 to 334 in 2024. This reduction, coupled with several mall closures across different provinces in 2024, signals a strategic divestment of underperforming or low-growth assets.

These actions suggest a focus on optimizing the real estate portfolio by shedding locations that are either not meeting performance expectations or have limited market share, thereby conserving resources and improving overall operational efficiency.

Segments of Red Star Macalline's business that have lagged in adopting digital tools or still depend on older methods could be categorized here. These areas might struggle to keep pace in today's increasingly digital marketplace, potentially facing limited growth and market share against competitors leveraging technology.

For instance, if a significant portion of their traditional brick-and-mortar store operations still rely on manual inventory management or in-person sales without robust online integration, these could be considered low-digital integration segments. In 2024, companies with such operational models often see slower revenue growth compared to digitally native or digitally transformed competitors.

Red Star Macalline's segments heavily reliant on new property sales are particularly vulnerable to the ongoing Chinese property market downturn that began in 2021. With projections indicating a continued fall in new home sales for 2025, these business areas face significant headwinds.

These highly exposed segments, lacking diversification beyond new construction, would likely be classified as Dogs in the BCG matrix. Their growth prospects are dim, directly correlating with the anticipated contraction in the real estate sector.

Inefficient Operational Processes Not Yet Optimized

Red Star Macalline's continued net losses, including a widened loss in 2024 and the first quarter of 2025, highlight persistent inefficiencies in its operational processes. These lingering issues directly impact profitability by increasing costs and reducing overall returns on investment.

These operational bottlenecks consume valuable cash flow without generating proportional revenue, a key indicator of a business unit that requires significant attention and restructuring within the BCG matrix framework. The company's financial performance in early 2025 underscores the urgency of addressing these underlying operational weaknesses.

- Widened Net Loss: Red Star Macalline reported a significant net loss in 2024, with early 2025 figures indicating this trend persisted, suggesting ongoing cost pressures.

- Cash Consumption: Inefficient operations drain cash reserves, hindering the company's ability to invest in growth areas or weather market downturns.

- Profitability Impact: Higher operational costs directly translate to lower profit margins, making it harder to achieve positive financial results.

Declining Occupancy Rates in Certain Malls

While Red Star Macalline's overall occupancy might show resilience, it's crucial to acknowledge that specific malls could be facing headwinds. For instance, if a particular mall is located in a region with declining consumer spending or intense competition from newer retail formats, its occupancy rate might be on a downward trend. This situation is not uncommon in the retail sector, where location and market dynamics play a significant role.

These individual underperforming properties, characterized by a low market share within their specific geographic area and operating in a low-growth market segment, would align with the Dogs quadrant of the BCG Matrix. This classification signals a need for strategic evaluation, potentially leading to decisions about divestment, repositioning, or even closure to reallocate resources more effectively.

For example, while official reports for 2024 might indicate a slight improvement in average occupancy for directly operated malls, this macro view can mask micro-level challenges. If a mall's revenue per square meter has been consistently falling, and foot traffic is down year-over-year, these are indicators of a potential Dog. Such properties require careful consideration to avoid continued financial drain.

- Declining Occupancy: Certain Red Star Macalline malls may experience falling occupancy rates due to localized economic downturns or increased competition.

- BCG Matrix Classification: Underperforming malls with low market share and low growth potential are categorized as Dogs.

- Strategic Implications: Properties in the Dogs quadrant necessitate difficult decisions, such as divestment or significant repositioning strategies.

- Data-Driven Assessment: Continuous monitoring of key performance indicators like revenue per square meter and foot traffic is vital for identifying potential Dogs.

Red Star Macalline's business segments heavily reliant on new property sales are particularly vulnerable to the ongoing Chinese property market downturn. With projections indicating a continued fall in new home sales for 2025, these areas face significant headwinds and are likely classified as Dogs due to their dim growth prospects.

Segments lagging in digital integration or relying on older methods also fall into the Dog category, struggling to keep pace in the digital marketplace. For instance, operations with manual inventory management without robust online integration saw slower revenue growth in 2024 compared to digitally transformed competitors.

Furthermore, specific underperforming malls, characterized by low market share and operating in low-growth markets, are also considered Dogs. These properties require strategic evaluation, potentially leading to divestment or closure to reallocate resources.

The company's continued net losses, including a widened loss in 2024 and early 2025, highlight persistent operational inefficiencies that directly impact profitability and cash flow, further solidifying the Dog classification for affected units.

| BCG Category | Key Characteristics | Red Star Macalline Examples (2024-2025) | Strategic Implication |

| Dogs | Low Market Share, Low Growth Rate | New property sales segments; Malls in declining regions; Digitally lagging operations | Divestment, repositioning, or closure |

| Negative cash flow, high operating costs | Inefficiently managed properties, segments with persistent net losses | Resource reallocation |

Question Marks

Red Star Macalline is actively enhancing its digital presence with new tools like the Red Star Macalline Mini-Program and a new SCRM System. These initiatives are designed to boost customer interaction and drive sales, positioning them as potential high-growth areas for the company.

While these digital engagement tools show promise, their market penetration and user adoption are still in early stages as of 2024. Significant investment is needed to fully develop and capitalize on their potential, indicating a need for continued resource allocation to nurture these developing assets within Red Star Macalline's portfolio.

Red Star Macalline's strategic push into Southeast Asia in 2024 is a classic Question Mark in its BCG Matrix. The company aims for a substantial 10% market share within two years, indicating a high-growth potential market.

However, this ambitious goal is tempered by the reality of Red Star Macalline's current zero market presence in the region. Success hinges on considerable investment and flawless execution, making it a high-risk, high-reward venture.

Red Star Macalline's exploration into emerging niche home furnishing categories like smart home integration and multi-functional furniture presents significant growth opportunities. These segments are driven by evolving consumer needs for convenience and space optimization, particularly in urban environments. For instance, the global smart home market was projected to reach hundreds of billions of dollars by 2024, showcasing the substantial potential for furnishing providers who can integrate technology seamlessly.

While these niches offer high growth potential, Red Star Macalline's current market share within them might be nascent. This necessitates strategic investment to build brand recognition and capture a larger portion of these developing markets. The company's ability to innovate and adapt its product offerings to these specific consumer demands will be crucial for establishing leadership in these emerging areas.

Specific Strategic Cooperation Projects

Red Star Macalline's strategic cooperation projects, which include home furnishing shopping malls and franchised home improvement material outlets, represent a key growth avenue. These collaborations allow the company to expand its footprint efficiently, tapping into new markets and product categories.

While these projects broaden Red Star Macalline's reach, some individual strategic cooperation ventures, particularly those in emerging sectors, may be in nascent stages. They might exhibit high growth potential but haven't yet secured a leading market position, positioning them as question marks within the BCG framework.

For instance, in 2024, Red Star Macalline continued to explore partnerships in innovative smart home solutions and sustainable building materials. These areas are characterized by rapid technological advancements and evolving consumer preferences, suggesting a potential for significant future market share but currently requiring substantial investment and strategic focus to mature.

- Expansion through Partnerships: Red Star Macalline utilizes strategic cooperation to expand its network of home furnishing shopping malls and franchised home improvement material projects.

- Emerging Market Focus: Newer cooperation projects often target high-growth, but less established, market segments.

- Potential for Growth: These ventures, while not yet market leaders, hold promise for future dominance if nurtured effectively.

- Strategic Re-evaluation: The company likely monitors these projects for performance and market traction, deciding whether to invest further or divest.

Experimental Retail Formats and Experiential Concepts

Red Star Macalline is actively experimenting with novel retail formats, including integrating 'Sports + Home Living' into unique shopping festivals. These initiatives are designed to resonate with shifting consumer tastes and stimulate expansion in a competitive market.

These experimental concepts, while innovative, currently represent a small fraction of the overall market share. For instance, in 2024, the home furnishings sector saw a growing trend towards experiential retail, with companies investing in immersive store designs and event-based promotions to attract foot traffic.

The success of these ventures hinges on their ability to adapt and prove their long-term appeal. Careful observation and strategic investment are crucial as Red Star Macalline gauges the market's response to these new experiential offerings.

- Focus on Experiential Retail: Red Star Macalline's move into 'Sports + Home Living' festivals exemplifies a broader industry trend towards creating engaging customer experiences rather than just transactional spaces.

- Market Position: As experimental formats, these concepts likely hold a nascent market share in 2024, necessitating ongoing evaluation of their growth potential and consumer adoption rates.

- Investment Rationale: The company's exploration of these formats signals a proactive strategy to tap into evolving consumer demands and differentiate itself in a crowded retail landscape.

- Future Viability: The long-term success of these experimental retail formats will depend on their ability to consistently attract and retain customers, justifying continued investment and development.

Red Star Macalline's ventures into new international markets, such as Southeast Asia in 2024, and its exploration of niche home furnishing categories like smart home integration, are prime examples of Question Marks. These initiatives possess high growth potential but currently have a low market share, requiring significant investment to establish a strong foothold.

The company's strategic partnerships and experimental retail formats, like the 'Sports + Home Living' festivals, also fall into this category. While they aim to capture evolving consumer trends, their market penetration is still developing, making their future success uncertain and dependent on continued strategic nurturing and resource allocation.

These Question Mark initiatives require careful monitoring and a clear strategy to either grow into Stars or be divested if they fail to gain traction. For instance, the expansion into Southeast Asia in 2024, targeting a 10% market share within two years from a zero base, highlights the high-risk, high-reward nature of these ventures.

The success of these Question Marks is crucial for Red Star Macalline's future growth, as they represent the company's bets on emerging opportunities and evolving consumer preferences in the dynamic home furnishings sector.

BCG Matrix Data Sources

Our BCG Matrix leverages Red Star Macalline's financial statements, market research reports, and industry growth data to accurately position its business units.