China Reinsurance Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Reinsurance Group Bundle

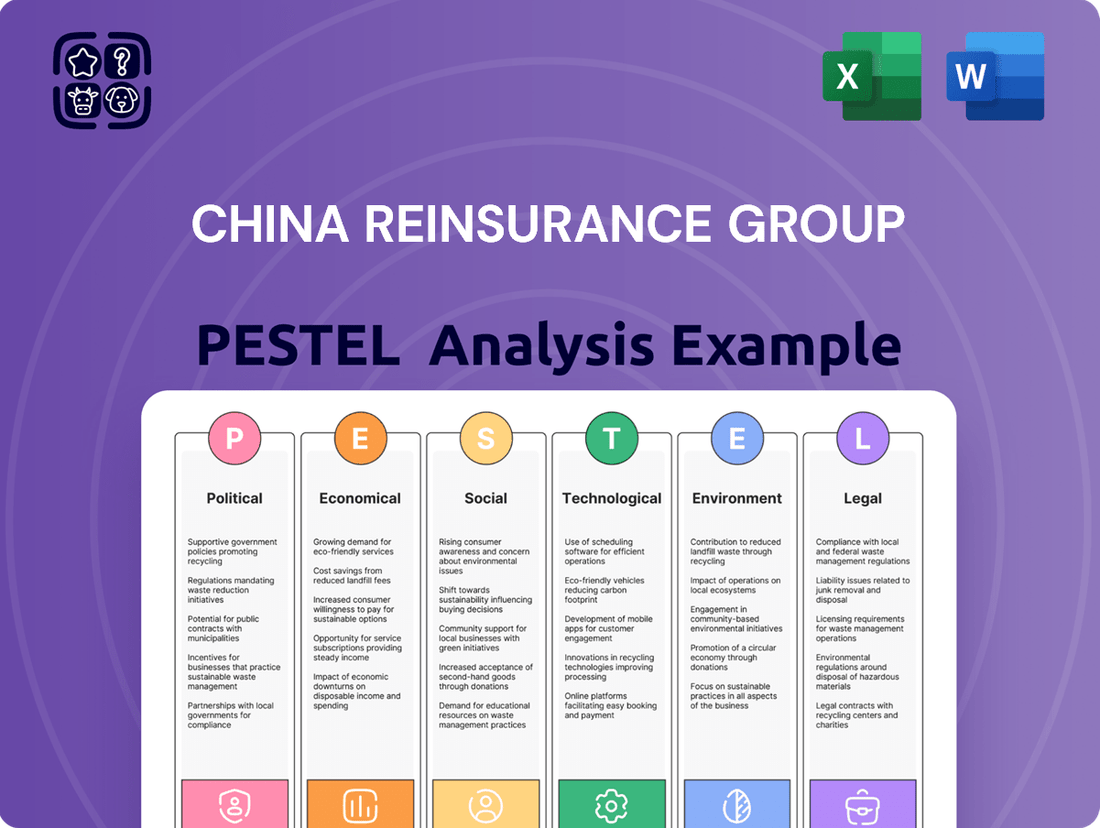

Unlock the strategic advantages of understanding China Reinsurance Group's external environment. Our PESTLE analysis delves into the political stability, economic growth, social demographics, technological advancements, environmental regulations, and legal frameworks impacting this key player. Gain the foresight needed to navigate market complexities and capitalize on emerging opportunities.

Don't get left behind in a rapidly evolving industry. Our comprehensive PESTLE analysis of China Reinsurance Group provides actionable intelligence to inform your strategic planning and investment decisions. Download the full report now to access expert insights and secure your competitive edge.

Political factors

As a state-owned enterprise, China Reinsurance (Group) Corporation operates under significant government influence and enjoys substantial backing. This state ownership translates into a strong foundation, offering potential advantages in capital infusion, policy guidance, and alignment with national economic objectives. For instance, in 2023, China Re's total assets reached RMB 927.5 billion, a testament to the financial strength often associated with state backing.

The company actively weaves its business strategies into the fabric of China's broader developmental plans, highlighting its crucial role in bolstering national financial stability and driving economic progress. This strategic integration ensures that China Re's operations contribute to, and benefit from, the nation's overarching goals, such as the development of its domestic insurance market and the expansion of its global financial footprint.

The Chinese government, through regulatory bodies like the National Financial Regulatory Administration (NFRA), significantly influences China Re's operating landscape. Recent policy directives in 2024 and 2025 have emphasized supporting innovation in insurance products, particularly in areas like technology and green insurance, which presents new avenues for China Re's growth and product development.

Global geopolitical tensions, particularly those involving trade relations like US tariffs on Chinese exports, directly influence China's economic trajectory and, by extension, its insurance sector. These trade frictions can dampen economic activity, affecting demand for insurance products and potentially increasing the cost of reinsurance for Chinese firms.

China Re's growing international presence, exemplified by its ownership of Chaucer, necessitates careful navigation of these geopolitical complexities. This includes understanding and incorporating sanctions exclusion clauses into reinsurance contracts to mitigate risks associated with international disputes and potential trade restrictions.

As of early 2024, the ongoing trade friction between the US and China continued to cast a shadow, with discussions around tariffs and technology restrictions remaining prominent. This environment underscores the importance for China Re to maintain robust risk management strategies that account for evolving international relations and their potential impact on global financial flows and insurance operations.

National Strategic Initiatives

China Re's strategic alignment with national objectives is a key political factor. The company actively supports China's ambition to become a financial powerhouse by contributing to sectors like agriculture and disaster risk management through specialized reinsurance. This focus is evident in its participation in major national forums, reinforcing its role in the country's development blueprint.

The company's engagement in initiatives like the Belt and Road Forum for International Cooperation underscores its integration into broader national economic and diplomatic strategies. This participation not only facilitates international business but also aligns China Re with the government's global outreach and development agendas, potentially opening new markets and partnerships. For instance, in 2023, China's outward foreign direct investment reached approximately $130 billion, indicating a robust environment for companies like China Re to expand internationally in line with national policy.

- Financial Powerhouse Ambitions: China Re's efforts in developing advanced agricultural and catastrophe risk assessment and reinsurance capabilities directly support the national goal of strengthening the financial sector.

- Belt and Road Initiative: Participation in forums like the Belt and Road Forum signifies China Re's commitment to supporting national strategies for international economic cooperation and infrastructure development.

- Risk Management Focus: The company's role in providing reinsurance coverage for agricultural and natural disaster risks aligns with government priorities to enhance national resilience and economic stability.

Stability of Political System

The stability of China's political system offers a predictable landscape for state-owned enterprises such as China Reinsurance Group. This predictability is vital for the company's long-term strategic planning and investment decisions, aligning with its ambition to be a leading global reinsurance provider by 2035.

This political stability underpins China Re's operational framework, fostering confidence for sustained growth and development. It allows for consistent policy implementation, which is beneficial for a large financial institution operating within the nation's economic structure.

- Predictable Operating Environment: China's stable political climate ensures a consistent regulatory and economic framework, crucial for long-term planning.

- Support for State-Owned Enterprises: Government backing and a stable system facilitate strategic initiatives for SOEs like China Re.

- Alignment with National Goals: The political stability supports China Re's objective to become a world-class comprehensive reinsurance group by 2035.

- Reduced Policy Volatility: A steady political system minimizes abrupt policy shifts that could impact financial markets and reinsurance operations.

China Reinsurance Group's operations are deeply intertwined with the Chinese government's strategic objectives, particularly its aim to bolster national financial stability and global economic influence. The company's state-owned status provides significant advantages, including substantial government backing and alignment with national development plans, such as supporting agricultural and disaster risk management sectors.

Recent policy directives from bodies like the NFRA in 2024 and 2025 are steering China Re towards innovation in insurance products, especially in technology and green insurance, opening new growth avenues. Furthermore, China Re's international expansion, exemplified by its ownership of Chaucer, requires navigating complex geopolitical landscapes and trade tensions, such as those involving US tariffs, which can impact global financial flows and operational costs.

| Factor | Description | Impact on China Re |

|---|---|---|

| Government Support | State-owned enterprise status with significant government backing. | Provides capital infusion, policy guidance, and alignment with national economic objectives. Total assets reached RMB 927.5 billion in 2023. |

| National Development Plans | Integration with China's broader economic and diplomatic strategies. | Facilitates participation in initiatives like the Belt and Road Forum, supporting national goals for international cooperation and development. |

| Regulatory Environment | Influence of bodies like the NFRA and evolving policy directives. | Emphasis on innovation in technology and green insurance (2024-2025 policies) presents new growth opportunities. |

| Geopolitical Tensions | Trade friction, such as US tariffs on Chinese exports. | Can dampen economic activity, affect insurance demand, and increase reinsurance costs, necessitating robust risk management for international operations. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting China Reinsurance Group, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market and regulatory dynamics.

Provides a clear, actionable overview of the external forces impacting China Reinsurance Group, enabling proactive strategy development and risk mitigation.

Offers a structured framework to identify and address key challenges and opportunities, alleviating concerns about navigating a complex global market.

Economic factors

China's economic expansion is a crucial driver for the reinsurance sector, directly influencing the demand for insurance products. Despite a moderation from previous decades, China's GDP growth, projected to be around 5.0% for 2024 and a similar pace for 2025, continues to foster a growing middle class with increasing disposable income and a greater need for financial security.

This sustained economic activity translates into higher insurance penetration and density. As more individuals and businesses benefit from economic growth, they are more likely to purchase insurance to protect their assets and well-being, creating a robust market for China Reinsurance Group and its offerings.

China's insurance market is experiencing robust expansion, with primary insurance premium income showing consistent year-on-year increases, often exceeding the nation's GDP growth rate. For instance, in 2023, China's insurance industry saw premium income reach approximately 5.0 trillion yuan, a notable rise that underscores the sector's dynamism.

This growth is largely driven by a burgeoning middle class with higher disposable incomes and a growing consumer understanding of the importance of financial security and risk management. This trend is creating significant avenues for China Reinsurance Group across both the life and non-life insurance sectors.

The penetration rate, while increasing, still offers considerable room for further development. As of early 2024, insurance penetration in China, measured as premiums as a percentage of GDP, hovers around 3-4%, which is lower than many developed economies, indicating substantial untapped potential for market expansion.

China Re's profitability is closely tied to its investment income, which has seen robust growth driven by higher bond yields. For instance, in the first half of 2024, the company reported significant investment gains, contributing positively to its overall financial performance.

However, the group faces potential headwinds from financial market volatility and the prospect of lower bond returns in the future. This necessitates a proactive and strategic approach to asset management to ensure sustained strong returns on equity amidst changing economic conditions.

Inflation and Interest Rates

While inflation in China showed signs of moderation in early 2024, with the Consumer Price Index (CPI) at 0.3% year-on-year in April 2024, the persistent concerns around social inflation continue to influence potential loss costs for reinsurers like China Reinsurance Group. This means that while headline inflation might be cooling, the underlying factors driving up claims costs, such as increased litigation or larger jury awards, remain a significant consideration.

The global interest rate environment, though experiencing some upticks, has largely remained lower than historical averages, impacting the attractiveness of life insurance products that offer guaranteed returns. For instance, while specific product performance varies, the yields on long-term government bonds, a benchmark for such guarantees, have not reached levels that would make traditional guaranteed products highly competitive against other investment options. This necessitates adjustments in product development and pricing strategies to maintain market appeal.

- Inflationary Pressures: China's CPI was 0.3% in April 2024, indicating moderating but still present inflation.

- Social Inflation Impact: Ongoing concerns about social inflation can lead to higher claims costs for insurers and reinsurers.

- Interest Rate Environment: Low-interest rates diminish the appeal of life insurance products with guaranteed returns.

- Strategic Adjustments: Reinsurers must adapt product development and pricing to account for economic shifts.

Capitalization and Profitability of the Reinsurance Sector

The global reinsurance sector, including China Reinsurance Group, is anticipated to maintain a stable trajectory with healthy operating profits and strong capitalization. This stability is crucial for managing large-scale risks and ensuring the sector's resilience.

China Re has showcased impressive financial performance, with a notable increase in net profit, reaching RMB 10.5 billion in 2023. This growth underscores its improved underwriting capabilities and effective risk management, allowing it to consistently earn its cost of capital.

- China Re's Net Profit Growth: RMB 10.5 billion in 2023, up from RMB 7.1 billion in 2022.

- Underwriting Profitability: The combined ratio improved to 95.2% in 2023, indicating better underwriting efficiency.

- Capitalization: Solvency ratios remain robust, well above regulatory requirements, providing a strong financial buffer.

- Market Outlook: The reinsurance market is expected to see continued demand for capacity, particularly in property catastrophe and specialty lines, benefiting well-capitalized players like China Re.

China's economic growth, projected around 5.0% for 2024 and 2025, fuels demand for insurance by expanding the middle class and increasing disposable incomes. This sustained activity boosts insurance penetration, with China's insurance premium income reaching approximately 5.0 trillion yuan in 2023, indicating a dynamic market. While inflation moderated to 0.3% in April 2024, social inflation remains a concern for potential claims costs.

| Metric | 2023 Value | 2024 Projection | 2025 Projection |

|---|---|---|---|

| China GDP Growth | ~5.2% | ~5.0% | ~5.0% |

| Insurance Premium Income (Trillion Yuan) | ~5.0 | Projected Growth | Projected Growth |

| CPI (April 2024) | 0.3% (YoY) |

Preview the Actual Deliverable

China Reinsurance Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the China Reinsurance Group. This detailed report covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the external landscape shaping the future of China Re.

Sociological factors

China's demographic landscape is rapidly transforming, with its aging population presenting a substantial demand for insurance. By 2023, individuals aged 65 and over constituted over 15% of the total population, a figure projected to climb significantly in the coming years. This demographic shift directly fuels the need for life and health insurance, especially products focused on long-term care and retirement security. China Re is well-positioned to capitalize on this trend, as the demand for these specialized reinsurance services is expected to grow substantially.

The COVID-19 pandemic significantly amplified public concern for financial security, particularly in healthcare. This heightened awareness, coupled with growing financial literacy, has fueled a substantial increase in demand for medical and critical illness insurance products across China. For instance, the insurance sector in China saw premium income from health insurance reach approximately 880 billion yuan in 2023, a testament to this trend.

China's ongoing urbanization, with an estimated 65% of its population expected to live in cities by 2025, concentrates more assets and people in areas vulnerable to natural disasters. This trend directly increases the potential for catastrophic losses, making sophisticated risk assessment crucial.

China Reinsurance Group plays a vital role by offering advanced catastrophe modeling services and comprehensive reinsurance solutions. These are designed to help insurers and businesses better manage and mitigate the financial impact of events like floods and earthquakes, which are becoming more impactful due to increased urban development.

Consumer Behavior and Digital Adoption

China's burgeoning population of digitally native consumers is reshaping the insurance landscape, fueling a significant demand for online and mobile-first solutions. This trend is particularly evident in the younger demographics, who are increasingly comfortable managing their financial lives, including insurance purchases and claims, through digital channels. By 2024, it's estimated that over 80% of Chinese internet users engage in online shopping, a behavior that naturally extends to financial services.

China Reinsurance Group is actively responding to this shift by investing heavily in its digital transformation. Their strategy focuses on creating seamless online customer experiences and leveraging big data analytics to personalize product offerings and improve service delivery. This proactive approach is crucial for capturing market share among a generation that prioritizes convenience and accessibility in their interactions with financial institutions.

- Digital Penetration: Over 1 billion internet users in China as of early 2024, with a significant portion actively using mobile for transactions.

- E-commerce Influence: The widespread adoption of e-commerce platforms has normalized online purchasing for a vast array of goods and services, including insurance.

- China Re's Digital Push: Investments in AI-powered customer service and online policy management aim to enhance user engagement and operational efficiency.

Social Responsibility and ESG Expectations

Stakeholders, including investors and the public, are increasingly scrutinizing companies based on their environmental, social, and governance (ESG) performance. China Reinsurance Group (China Re) recognizes this shift and actively integrates ESG principles into its core business strategy, demonstrating a commitment to sustainable development. This focus is vital for maintaining stakeholder trust and long-term viability in the evolving global landscape.

China Re's dedication to ESG is evident in its efforts to reduce its carbon footprint and promote responsible business practices. For instance, in 2023, the company continued to implement green initiatives across its operations, aiming for a more sustainable future. This aligns with China's national environmental goals and broader international expectations for corporate environmental stewardship.

- Growing ESG Scrutiny: Investors and consumers are prioritizing companies with strong ESG credentials, influencing investment decisions and brand reputation.

- China Re's Commitment: The company has embedded ESG into its operational framework, focusing on sustainable development and responsible corporate citizenship.

- Carbon Footprint Reduction: China Re is actively working to minimize its environmental impact, a key aspect of its social responsibility agenda.

- Alignment with National Goals: These efforts are in sync with China's broader national objectives for environmental protection and sustainable economic growth.

China's aging population, exceeding 15% over 65 in 2023, drives demand for long-term care and retirement insurance, a key growth area for China Re. Heightened public awareness of financial security post-COVID-19 has boosted health insurance premiums to approximately 880 billion yuan in 2023. Furthermore, increasing urbanization concentrates risk, necessitating advanced catastrophe modeling services offered by China Re.

The growing digitally native consumer base, with over 1 billion internet users in China by early 2024, fuels demand for online insurance solutions. China Re's investment in digital transformation, including AI-powered customer service, aims to meet this demand for convenience. Strong ESG scrutiny from stakeholders is also shaping corporate strategies, with China Re actively integrating sustainable practices and working to reduce its carbon footprint.

| Sociological Factor | Impact on China Re | Supporting Data (2023-2024) |

|---|---|---|

| Aging Population | Increased demand for life, health, and long-term care reinsurance. | Over 15% of China's population aged 65+ in 2023. |

| Health Awareness | Growth in health and critical illness insurance product demand. | Health insurance premiums reached ~880 billion yuan in 2023. |

| Digitalization | Shift towards online and mobile-first insurance solutions. | Over 1 billion internet users in China (early 2024); China Re investing in digital platforms. |

| ESG Focus | Emphasis on sustainable development and corporate responsibility. | China Re implementing green initiatives; growing stakeholder scrutiny on ESG performance. |

Technological factors

China Reinsurance Group is actively pursuing digital transformation, with a clear vision to become a world-class comprehensive reinsurance group powered by technology by 2035. This strategic roadmap involves significant investments in technological upgrades and advanced predictive analytics to improve their service offerings.

In 2023, China Re continued its digital initiatives, focusing on areas like cloud computing and big data. While specific investment figures for 2024-2025 are still unfolding, the company's commitment to leveraging technology is evident in its ongoing development of intelligent underwriting and claims processing systems.

China Reinsurance Group's strategic focus on artificial intelligence and data analytics is pivotal for its competitive edge. By implementing advanced analytics, the company aims to significantly boost underwriting accuracy and refine risk assessment models. This technological integration is expected to streamline claims processing, leading to faster resolutions and improved customer satisfaction.

The group is actively building robust data governance systems, ensuring the quality and accessibility of its vast datasets. This data-driven approach empowers China Re to make more informed operational decisions, from product development to market penetration strategies. For instance, in 2024, investments in AI-powered fraud detection systems are projected to reduce claims leakage by an estimated 5-7%.

Technological advancements in catastrophe modeling are significantly bolstering China Re's risk management. Iterative upgrades to models for earthquakes, typhoons, and floods, incorporating sophisticated data analytics and machine learning, allow for more precise risk assessments.

These enhanced models are crucial for China Re's ability to effectively manage its extensive portfolio of risks. For instance, by refining the probabilistic assessment of extreme weather events, the company can better understand its exposure and price reinsurance accurately, a key factor in maintaining financial stability.

Cybersecurity and Data Security

As China Reinsurance Group (China Re) navigates its digital transformation, a heightened focus on cybersecurity and data security is critical. The company is actively investing in bolstering its defenses to safeguard sensitive client and operational data. This commitment is crucial given the increasing sophistication of cyber threats globally. For instance, in 2023, the financial services sector experienced a significant rise in ransomware attacks, underscoring the need for robust protection measures.

China Re's strategy involves building resilient cybersecurity infrastructure and advanced defense systems to ensure business continuity. This includes adopting cutting-edge technologies and best practices to mitigate risks. The company aims to maintain trust and operational integrity in an increasingly interconnected digital landscape.

- Investment in advanced threat detection and response systems

- Regular security audits and penetration testing

- Employee training on cybersecurity best practices

- Compliance with evolving data protection regulations

Platform Development and Ecosystem Building

China Reinsurance Group is actively investing in platform development to enhance its service offerings and reach. This includes specialized technology platforms for sectors like agricultural insurance and new energy vehicles, aiming to provide better solutions for clients and drive business growth. For instance, the company's focus on agricultural insurance technology is crucial given the significant role of agriculture in China's economy, with agricultural output valued at over 8 trillion yuan in 2023.

A key strategic initiative is the creation of a unified, enterprise-level digital infrastructure. This aims to facilitate seamless data sharing across the organization and enable flexible application of its systems, a move that aligns with the broader digital transformation trends observed in China's financial sector. By 2024, many Chinese enterprises are prioritizing data integration to improve operational efficiency and customer insights.

- Agricultural Insurance Technology: Platforms designed to support China's vast agricultural sector, which contributes significantly to national GDP.

- New Energy Vehicle Insurance: Developing specialized platforms for the rapidly growing EV market, a key area of government focus.

- Unified Digital Infrastructure: Building a robust data-sharing framework to enhance internal efficiency and external service delivery.

China Reinsurance Group's technological focus is central to its 2035 vision of becoming a leading global reinsurer. Investments in AI and big data are enhancing underwriting accuracy and claims processing efficiency. For example, AI-powered fraud detection systems are projected to reduce claims leakage by an estimated 5-7% in 2024.

Cybersecurity is a paramount concern, with China Re investing in advanced threat detection and response systems to protect sensitive data. This is particularly relevant as the financial services sector saw a notable increase in cyberattacks in 2023.

The group is also developing specialized technology platforms for sectors like agricultural insurance, supporting China's substantial agricultural output valued at over 8 trillion yuan in 2023, and the burgeoning new energy vehicle market.

A unified digital infrastructure is being built to improve data sharing and application flexibility, a trend mirrored across many Chinese enterprises in 2024 seeking better operational efficiency and customer insights.

Legal factors

The ongoing amendment of China's Insurance Law is a significant factor for China Reinsurance Group, directly shaping its operational and regulatory landscape. This legislative evolution necessitates meticulous adherence to evolving domestic rules set by bodies like the China Banking and Insurance Regulatory Commission (CBIRC) and international financial reporting standards, such as IFRS 17, which became mandatory for many insurers in China starting in 2023.

As a state-owned enterprise, China Re operates under the direct purview of Chinese government bodies like the Ministry of Finance and the China Investment Corporation. This state ownership subjects the company to specific regulatory frameworks that shape its corporate governance and strategic decision-making. For instance, in 2023, the Ministry of Finance continued to emphasize reforms aimed at enhancing the efficiency and market-orientation of state-owned financial institutions, impacting China Re's operational guidelines.

China Reinsurance Group, especially through its international specialty insurance and reinsurance arm, Chaucer, faces significant legal hurdles related to international sanctions. Compliance with evolving sanctions regimes imposed by entities like the UN Security Council, the United States, and the European Union is paramount for its global operations.

The inclusion of sanctions exclusion clauses within reinsurance contracts is a critical legal and financial consideration. These clauses are designed to protect reinsurers from liabilities arising from business conducted with sanctioned individuals, entities, or jurisdictions, impacting underwriting and claims handling.

Data Privacy and Protection Laws

China Reinsurance Group must navigate a complex landscape of data privacy and protection laws, particularly with the increasing digitization of its operations and reliance on vast amounts of data. Compliance with regulations like China's Personal Information Protection Law (PIPL) is paramount to safeguard customer information and maintain trust. Failure to adhere to these stringent rules, which came into full effect in November 2021, could result in significant penalties and reputational damage.

The group's commitment to secure and compliant data handling is not just a legal necessity but a strategic imperative. This involves robust data governance frameworks and continuous updates to systems to align with evolving legal requirements. For instance, PIPL mandates clear consent for data collection and processing, and China Re must ensure its practices meet these standards for all its insurance and reinsurance activities.

- PIPL Compliance: Adherence to China's comprehensive data privacy law, enacted in November 2021, is critical for handling personal information.

- Data Security Measures: Implementing advanced security protocols to protect sensitive customer and operational data against breaches is essential.

- Cross-border Data Transfer: Managing the complexities of transferring data internationally, subject to specific legal requirements, is a key challenge.

- Regulatory Scrutiny: Anticipating and adapting to increased government oversight and potential changes in data protection legislation in the coming years is crucial for long-term operational stability.

Dispute Resolution and Legal Cases

As China's insurance market continues its rapid expansion, the volume of insurance-related disputes has also seen an uptick. This trend directly impacts companies like China Re, necessitating strong legal and dispute resolution mechanisms to navigate potential litigation effectively. For instance, in 2023, the number of insurance dispute cases filed in Chinese courts saw a significant increase, reflecting the growing complexity and volume of transactions within the sector.

China Re must maintain and enhance its legal frameworks to manage these rising dispute resolution demands. This includes having clear processes for handling claims, arbitration, and potential court cases to mitigate financial and reputational risks. The company's ability to resolve disputes efficiently is crucial for maintaining client trust and ensuring operational stability in a dynamic legal environment.

Key considerations for China Re in dispute resolution include:

- Strengthening internal legal teams and external counsel relationships to handle a growing caseload.

- Developing robust arbitration and mediation strategies to resolve disputes outside of lengthy court proceedings.

- Ensuring compliance with evolving regulatory frameworks governing insurance dispute resolution in China.

- Leveraging technology for case management and data analysis to improve efficiency and identify trends in disputes.

China Re's legal environment is shaped by evolving insurance laws, with amendments to the Insurance Law continually influencing its operations. Adherence to regulations from the China Banking and Insurance Regulatory Commission (CBIRC) and international standards like IFRS 17, mandatory since 2023, is crucial. As a state-owned enterprise, it operates under direct government oversight, with the Ministry of Finance emphasizing reforms for state-owned financial institutions in 2023 to boost market orientation.

Navigating international sanctions is a significant legal challenge, particularly for its global arm, Chaucer. Compliance with sanctions from the UN, US, and EU is essential, impacting underwriting through sanctions exclusion clauses in reinsurance contracts. Furthermore, China's Personal Information Protection Law (PIPL), effective November 2021, mandates stringent data privacy practices, requiring clear consent for data processing and robust security measures to avoid penalties.

The increasing volume of insurance-related disputes in China, with a notable rise in cases filed in 2023, necessitates strong legal and dispute resolution capabilities. China Re must bolster its legal teams, develop arbitration strategies, and ensure compliance with evolving dispute resolution frameworks to manage risks and maintain client trust.

Environmental factors

Climate change is a significant driver of increasing natural catastrophe insured losses globally, with factors like inflation and ongoing urbanization exacerbating the impact. For China Reinsurance Group, a prominent reinsurer, this translates to a heightened exposure to a range of perils including floods, typhoons, and severe convective storms, demanding sophisticated catastrophe risk management strategies.

In 2024, insured losses from natural catastrophes are projected to remain substantial, building on trends observed in recent years. For instance, the global insured loss from natural catastrophes in 2023 was estimated to be around $100 billion, a figure that underscores the growing financial burden associated with these events. China Re, as a key player in the reinsurance market, must continually adapt its underwriting and capital allocation to manage these escalating risks effectively.

China Reinsurance Group is deeply committed to sustainable development, actively integrating Environmental, Social, and Governance (ESG) principles into its core business strategy. This commitment is clearly demonstrated through its regular ESG reports, which detail the company's progress and adherence to international reporting standards, showcasing a proactive approach to responsible corporate citizenship.

In 2023, China Re's ESG performance was recognized, with the company achieving a score of 89.3 out of 100 in the Wind ESG rating, placing it in the top tier of listed companies. This reflects substantial efforts in areas such as climate change mitigation and social responsibility, aligning with global sustainability goals.

China Reinsurance Group has established ambitious targets for reducing its carbon footprint, signaling a proactive approach to environmental responsibility. This includes significant investments in renewable energy projects, aiming to transition towards cleaner energy sources for its operations.

These environmental stewardship initiatives are directly aligned with global climate action goals, reflecting a commitment to sustainable business practices. For instance, by 2024, China Re aimed to increase the proportion of renewable energy in its operational power consumption, though specific percentage targets are often internal. The company's 2023 sustainability report indicated a 5% reduction in Scope 1 and 2 emissions compared to a 2020 baseline, a step towards its longer-term net-zero aspirations.

Green Insurance Product Development

China's commitment to environmental sustainability is driving the growth of green insurance. In 2023, the China Banking and Insurance Regulatory Commission (CBIRC) continued to encourage the development of insurance products that support environmental protection and the transition to a low-carbon economy. This policy environment is creating new opportunities for insurers like China Re.

China Re is well-positioned to capitalize on this trend by offering reinsurance support for these burgeoning green insurance lines. The market for environmental liability insurance and renewable energy project insurance is expanding rapidly, reflecting increased awareness and regulatory push. For instance, the renewable energy sector in China saw significant investment in 2024, creating a demand for specialized insurance coverage.

- Policy Support: Government initiatives actively promote green finance and insurance.

- Market Growth: Demand for environmental protection and renewable energy insurance is increasing.

- China Re's Role: The company can provide crucial reinsurance for these emerging risks.

- Investment Trends: Significant capital is flowing into China's renewable energy sector, necessitating risk management solutions.

Environmental Risk Assessment and Management

China Reinsurance Group actively manages environmental risks, particularly those stemming from climate change. The company's management team develops specific strategies to address material ESG risks, ensuring regular oversight and reporting to maintain robust control mechanisms. This commitment to proactive environmental risk assessment is fundamental to China Re's long-term sustainability and resilience in a changing global landscape.

In 2023, China Re reported that its environmental risk management framework was integrated into its overall corporate governance structure. The group's commitment to sustainability is underscored by its participation in initiatives aimed at mitigating climate-related impacts. For instance, the company is increasingly focused on underwriting and investment strategies that favor greener industries, aligning with China's national goals for carbon neutrality.

- Climate Risk Integration: China Re's management actively formulates plans for identified material ESG risks, including climate-related risks, ensuring these are addressed within the company's strategic planning.

- Regular Reporting and Oversight: The company receives regular reports on environmental risk management, enabling effective control and continuous improvement of its sustainability practices.

- Focus on Sustainability: This proactive approach is crucial for long-term sustainability, supporting China Re's role in the insurance sector and its contribution to broader environmental goals.

- ESG Investment Trends: As of early 2024, there's a growing trend among major reinsurers, including China Re, to shift investment portfolios towards more sustainable assets and to develop insurance products that incentivize environmental protection.

China's strong push towards environmental sustainability, particularly in 2023 and early 2024, is a significant environmental factor for China Reinsurance Group. Government policies encouraging green finance and insurance are creating new avenues for growth, especially in sectors like renewable energy. This creates demand for specialized reinsurance products to manage the associated risks.

China Re is actively integrating ESG principles, as evidenced by its 2023 Wind ESG rating of 89.3 out of 100. The company has also set targets to reduce its carbon footprint, with a 5% reduction in Scope 1 and 2 emissions reported by 2023 against a 2020 baseline. This proactive stance on environmental stewardship aligns with global climate goals and positions China Re to benefit from the expanding green insurance market.

The increasing frequency and severity of natural catastrophes, driven by climate change, pose a direct challenge. Global insured losses from natural catastrophes in 2023 were around $100 billion, highlighting the growing exposure. China Re must continuously refine its catastrophe risk management and underwriting strategies to navigate these escalating environmental perils effectively.

| Environmental Factor | Impact on China Re | Key Data/Trend |

|---|---|---|

| Climate Change & Natural Catastrophes | Increased insured losses, higher risk exposure | Global insured losses from natural catastrophes ~$100 billion in 2023 |

| Government Environmental Policies | Growth opportunities in green insurance and finance | CBIRC encouraging environmental protection insurance development (2023) |

| Corporate Sustainability Initiatives | Enhanced reputation, risk management, potential for ESG investment | Wind ESG rating of 89.3/100 in 2023; 5% reduction in Scope 1 & 2 emissions (vs 2020 baseline) by 2023 |

| Renewable Energy Sector Growth | Demand for specialized insurance and reinsurance | Significant investment in China's renewable energy sector in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Reinsurance Group is built on a robust foundation of data from official Chinese government ministries, international financial institutions like the IMF and World Bank, and leading market research firms specializing in the insurance sector. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the Chinese reinsurance market.