China Reinsurance Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Reinsurance Group Bundle

China Reinsurance Group operates in a dynamic landscape shaped by intense competition, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for navigating the reinsurance sector effectively.

The complete report reveals the real forces shaping China Reinsurance Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Capital providers, such as equity investors and debt holders, exert moderate to high bargaining power over China Reinsurance Group. This power fluctuates with global economic conditions, interest rate environments, and the availability of competing investment avenues.

China Re's strong financial standing in 2024, marked by a substantial rise in net profit and solid capital adequacy ratios, generally improves its attractiveness to investors. This enhanced appeal can, in turn, temper the immediate bargaining power of these capital providers.

Specialized data and analytics providers, particularly those focusing on advanced risk modeling for natural catastrophes and emerging threats, are gaining significant leverage. As climate change intensifies and complex risks like cyber threats become more prevalent, the demand for precise and up-to-the-minute data is paramount for effective underwriting and pricing strategies.

China Re's dependence on sophisticated modeling capabilities to manage its broad and varied insurance portfolio, which includes property and casualty reinsurance, directly translates into increased bargaining power for these critical data suppliers. For instance, during 2024, the global reinsurance market saw a significant uptick in demand for catastrophe modeling services, with some providers reporting a 15-20% increase in client inquiries for enhanced climate-related risk assessments.

Technology and software vendors, especially those offering core insurance and AI-powered Insurtech solutions, hold considerable bargaining power. The substantial costs associated with implementing, customizing, and migrating these specialized systems make switching providers a significant undertaking for companies like China Reinsurance Group.

As the reinsurance industry accelerates its digital transformation, the reliance on these advanced technologies for operational efficiency and maintaining a competitive edge grows. This increasing dependence amplifies the leverage of key software and AI vendors in their negotiations.

Talent and Expertise

The bargaining power of suppliers is significantly influenced by the availability of highly skilled professionals in specialized fields like underwriting, actuarial science, risk management, and investment management. These individuals are crucial for China Reinsurance Group's operations. The scarcity of talent, especially those with experience in intricate global reinsurance markets and novel risks, can embolden these professionals to demand higher compensation and benefits, thereby increasing their leverage.

China Re, aiming to sustain its market leadership, must actively compete for and retain top-tier talent. This competition for expertise directly translates into enhanced bargaining power for these skilled professionals. For instance, in 2023, the global shortage of actuaries continued, with demand outstripping supply in many regions, a trend expected to persist.

- Talent Scarcity: A persistent global shortage of actuaries and specialized risk managers grants these professionals greater negotiating power.

- Compensation Demands: The need to attract and retain top talent in these critical areas can drive up salary and benefits packages for China Re.

- Expertise in Emerging Risks: Professionals adept at underwriting and managing novel risks, such as cyber threats or climate change impacts, command premium compensation due to their unique skills.

Retrocessionaires

While China Re operates as a reinsurer, it also offloads a portion of its accepted risks to other reinsurers, known as retrocessionaires. The leverage these retrocessionaires hold is directly tied to the overall capacity available within the global retrocession market and their specific willingness to underwrite particular types of risk. For instance, in 2024, the retrocession market experienced continued capacity constraints, particularly for catastrophe-exposed business, allowing retrocessionaires to negotiate more favorable terms and pricing with cedents like China Re.

This dynamic significantly impacts China Re's risk retention capabilities and overall profitability. When the retrocession market tightens, characterized by reduced capacity or a heightened aversion to certain perils, retrocessionaires can command higher premiums and impose more stringent terms and conditions. This forces China Re to either retain more risk, potentially increasing its exposure, or accept less favorable retrocession terms, thereby impacting its profitability and strategic risk management.

- Market Capacity: In 2024, global reinsurer capacity for certain lines, like property catastrophe, remained constrained, giving retrocessionaires greater pricing power.

- Risk Appetite: Retrocessionaires' willingness to accept specific risks, such as cyber or climate-related events, directly influences their bargaining strength.

- Pricing Power: During periods of market hardening, retrocessionaires can demand higher retrocession rates from primary reinsurers like China Re.

- Terms and Conditions: Increased retrocessionaire bargaining power often translates into stricter terms, including higher deductibles and narrower coverage scopes.

Specialized data providers, particularly those offering advanced catastrophe and emerging risk modeling, hold significant bargaining power over China Reinsurance Group. This leverage stems from the increasing demand for precise, real-time data to manage complex portfolios, a trend evident throughout 2024 with some providers seeing a 15-20% rise in client inquiries for enhanced climate risk assessments.

Technology and AI software vendors also wield considerable influence due to the high costs and complexity associated with implementing and migrating their core insurance solutions. As China Re accelerates its digital transformation, its reliance on these vendors for efficiency and competitive advantage grows, amplifying their negotiating leverage.

The bargaining power of suppliers is also shaped by the availability of highly skilled professionals. A persistent global shortage of actuaries and specialized risk managers, a situation continuing into 2024, empowers these individuals to demand higher compensation, directly impacting China Re's talent acquisition and retention strategies.

| Supplier Type | Bargaining Power Driver | Impact on China Re | 2024 Trend/Data Point |

|---|---|---|---|

| Data & Analytics Providers | Demand for specialized risk modeling | Increased costs for essential data | 15-20% rise in inquiries for climate risk data |

| Technology & Software Vendors | High switching costs, digital transformation reliance | Negotiating leverage on pricing and terms | Growing dependence on AI/Insurtech solutions |

| Skilled Professionals (e.g., Actuaries) | Talent scarcity, expertise in emerging risks | Higher compensation and benefits demands | Continued global shortage of actuaries |

What is included in the product

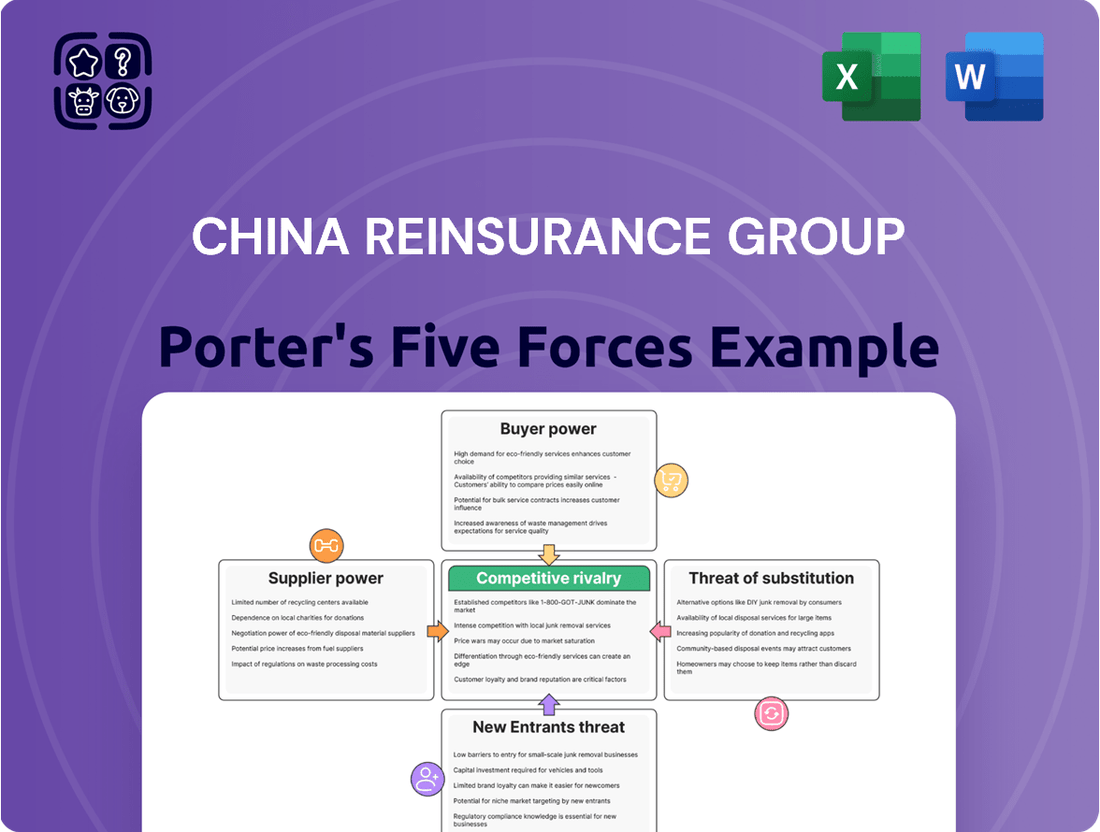

This analysis unpacks the competitive forces shaping China Reinsurance Group's market, detailing threats from new entrants, substitutes, buyer/supplier power, and rivalry, to inform strategic positioning.

Instantly understand competitive pressures on China Reinsurance Group with a clear, visual representation of each of Porter's Five Forces, enabling faster, more informed strategic adjustments.

Customers Bargaining Power

China Re's primary customers are other insurance companies, and these large, sophisticated primary insurers can wield significant bargaining power. Their substantial premium volumes and robust internal risk management mean they can negotiate better terms and pricing, especially when they have options from various reinsurers. For instance, in 2023, the global reinsurance market saw increased competition, potentially amplifying this customer power.

China Re's diversified client base significantly tempers customer bargaining power. By serving a broad spectrum of insurance companies across property and casualty, life and health, and direct insurance sectors, both within China and globally, the group avoids over-reliance on any single large client. This wide reach, exemplified by its extensive network of over 3,000 clients as of recent reporting, means no individual customer can dictate terms due to their sheer size.

The bargaining power of customers, primarily primary insurers in China Reinsurance Group's case, is amplified by the market's capacity and the intensity of competition among reinsurers. As of early 2025, the global reinsurance market is experiencing a surge in capital, with capacity expanding significantly across various lines of business. This oversupply creates a more favorable environment for primary insurers, enabling them to negotiate more advantageous terms and pricing from reinsurers like China Re.

Regulatory Influence

In China, regulatory shifts can subtly alter the bargaining power of customers for reinsurers like China Re. For instance, government initiatives aimed at bolstering specific insurance sectors, such as agricultural or disaster coverage, can lead to more stable and predictable demand for reinsurance. This increased stability can, in turn, reduce the leverage individual clients might otherwise wield when negotiating terms.

China Re's status as a state-owned enterprise also plays a role. This backing can foster a perception of reliability and long-term commitment among its clients, potentially dampening their inclination to push for significantly more favorable terms compared to dealing with a purely private entity. This inherent stability can be a key factor in managing customer relationships within the Chinese market.

- Market Stability Initiatives: Regulations promoting stability in China's insurance market, particularly in areas like property and casualty, can reduce the volatility of demand for reinsurance.

- Sector-Specific Support: Government encouragement for specialized insurance, such as those covering natural disasters or rural development, can create a more captive market for reinsurers.

- State-Owned Enterprise Advantage: China Re's state-owned background offers a degree of implicit guarantee and long-term partnership assurance, which can moderate customer bargaining power.

Access to Alternative Risk Transfer

The availability of alternative risk transfer (ART) mechanisms significantly impacts the bargaining power of customers, particularly large primary insurers. These sophisticated buyers can increasingly turn to options like catastrophe bonds or insurance-linked securities (ILS) as substitutes for traditional reinsurance capacity.

This growing interest in ART products, especially catastrophe bonds, offers primary insurers more avenues for risk management. For instance, the ILS market saw substantial growth, with gross issuance of catastrophe bonds reaching approximately $10 billion in the first half of 2024, providing alternative capacity that can put pressure on traditional reinsurers.

- Increased Options for Primary Insurers: ART provides primary insurers with a broader spectrum of risk financing tools beyond traditional reinsurance.

- Potential for Lower Costs: By accessing capital markets through ILS, primary insurers may find more cost-effective ways to transfer risk compared to traditional reinsurance treaties.

- Diversification of Risk Transfer: ART allows for the diversification of risk transfer, reducing reliance on a single source of capacity and enhancing negotiating leverage.

- Market Dynamics in 2024: The continued development and acceptance of ILS in 2024 suggest a sustained trend where ART influences the competitive landscape for reinsurers.

The bargaining power of China Re's customers, primarily large primary insurers, is influenced by market capacity and competition. As of early 2025, the global reinsurance market has seen increased capital and expanded capacity, creating an oversupply environment. This situation allows primary insurers to negotiate more favorable terms and pricing, as they have multiple options for reinsurance coverage.

Alternative Risk Transfer (ART) mechanisms, such as catastrophe bonds and Insurance-Linked Securities (ILS), also empower customers. The ILS market experienced significant growth, with catastrophe bond issuance reaching approximately $10 billion in the first half of 2024. This trend provides primary insurers with more avenues for risk management, potentially reducing their reliance on traditional reinsurers and enhancing their negotiating leverage.

| Customer Type | Influencing Factors | Impact on Bargaining Power |

|---|---|---|

| Primary Insurers (Large) | Market capacity, competition, ART availability | High; can negotiate better terms due to multiple options and alternative risk transfer solutions. |

| Primary Insurers (Small/Medium) | Market capacity, competition, regulatory support | Moderate; less leverage than large insurers but benefit from overall market conditions and regulatory stability. |

| Brokers | Market access, client relationships | Indirect; facilitate customer negotiations by aggregating demand and sourcing capacity. |

Full Version Awaits

China Reinsurance Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of China Reinsurance Group, detailing the competitive landscape and strategic positioning within the global reinsurance market. You're looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted analysis, ready for immediate use.

Rivalry Among Competitors

China Reinsurance Group's leading domestic position in China's reinsurance market is a substantial barrier to entry for new competitors. Its role as a state-owned enterprise grants it preferential treatment and access to government-backed initiatives, particularly in areas like catastrophe insurance, where it underwrites a significant portion of the national risk pool.

China Reinsurance Group faces intense rivalry from global giants like Munich Re, Swiss Re, and Hannover Re, all competing for a share of the international reinsurance market. This global landscape is characterized by substantial capital and capacity, which is expected to foster more stable renewal processes and potentially temper price increases in 2025.

China Re's strategy of diversifying its business lines, encompassing property and casualty, life and health, asset management, and direct insurance, directly combats intense competition. This broadens their revenue streams, making them less vulnerable to downturns in any single sector. For instance, their robust asset management arm provides a stable income source even when core insurance markets face volatility.

Furthermore, China Re's international expansion, exemplified by its acquisition of Chaucer Group, significantly sharpens its competitive edge against global players. This move not only diversifies geographic risk but also brings in new expertise and market access. By strengthening its global footprint, China Re can better compete with established international reinsurers on a more even playing field.

Profitability and Underwriting Discipline

The competitive rivalry within the reinsurance sector is heavily shaped by reinsurers' commitment to profitability and stringent underwriting discipline. China Reinsurance Group has demonstrated a notable uplift in its net profit and overall underwriting performance throughout 2024, mirroring a positive industry-wide shift towards enhanced combined ratios.

- Profitability Focus: Reinsurers are increasingly prioritizing profitable growth over market share, leading to more selective underwriting.

- Underwriting Discipline: A disciplined approach to pricing and risk selection is paramount for long-term success in a competitive market.

- China Re's Performance: China Re reported a significant improvement in its net profit for the first half of 2024, with its comprehensive income reaching RMB 7.3 billion, a 25.4% increase year-on-year, underscoring its enhanced underwriting capabilities.

- Industry Trend: The industry's combined ratio has seen improvement, reflecting a collective effort towards better risk management and pricing.

Sustaining this disciplined approach is vital for China Re to maintain its competitive edge, especially as it navigates evolving risk environments and persistent pricing pressures from global competitors.

Regulatory and Economic Environment in China

China's insurance and reinsurance sectors are actively evolving, with government policies and technological advancements fostering high-quality growth. This dynamic environment presents both challenges and opportunities for players like China Re.

The broader economic slowdown in China could temper growth in the primary insurance market. However, this economic shift is simultaneously spurring increased demand for specialized insurance products.

- Increased Demand for Specific Coverages: The market is seeing a rise in demand for agricultural insurance and coverage for natural catastrophes.

- Growth Opportunities for Reinsurers: These specialized needs create significant growth avenues for reinsurers like China Re, who can provide capacity and expertise.

- Policy Guidance Driving Innovation: Regulatory frameworks are actively encouraging innovation and the adoption of new technologies within the insurance industry.

The competitive rivalry within China Reinsurance Group's market is intense, driven by both domestic giants and formidable global players like Munich Re and Swiss Re. China Re's dominant domestic position, bolstered by its state-owned enterprise status, provides a significant advantage, especially in government-backed initiatives such as catastrophe insurance.

China Re's strategic diversification across various insurance lines and its international expansion, including the acquisition of Chaucer Group, are key strategies to counter this rivalry. The company's commitment to underwriting discipline and profitability is evident in its improved financial performance, with a 25.4% year-on-year increase in comprehensive income to RMB 7.3 billion in the first half of 2024.

| Competitor | Market Position | Key Strengths |

|---|---|---|

| China Reinsurance Group | Leading domestic reinsurer in China | State-owned status, diversified business, international expansion (Chaucer Group) |

| Munich Re | Global leader | Extensive global network, strong capital base, innovation |

| Swiss Re | Global leader | Risk expertise, client relationships, focus on sustainability |

| Hannover Re | Global leader | Specialized insurance knowledge, strong financial ratings, growth in emerging markets |

SSubstitutes Threaten

Self-insurance and the establishment of captive insurance companies represent a significant threat of substitutes for China Reinsurance Group. Large corporations with robust financial health and advanced risk management can opt to retain more risk internally, thereby diminishing their need for traditional reinsurance services. This trend was evident in 2024, with many multinational corporations exploring captive structures to optimize their insurance costs and gain greater control over their risk portfolios.

The increasing availability and sophistication of alternative risk transfer (ART) mechanisms, like catastrophe bonds and insurance-linked securities (ILS), pose a growing substitute threat to traditional reinsurance. These capital market instruments provide direct access to funding for risk, often at competitive pricing compared to conventional reinsurance.

For instance, the ILS market saw significant growth, with gross issuance reaching approximately $15 billion in 2023, demonstrating its expanding capacity and appeal as an alternative to traditional reinsurance capacity. This trend is expected to continue as investors seek diversification and insurers look for efficient ways to manage their risk portfolios.

The threat of substitutes for China Reinsurance Group is amplified by direct capital market access. Large primary insurers and sophisticated corporate clients increasingly bypass traditional reinsurance by directly accessing capital markets to hedge or transfer risks. This trend is particularly pronounced for quantifiable and securitizable risks, such as catastrophe bonds or other insurance-linked securities. For instance, the global catastrophe bond market issuance reached a record $17.4 billion in 2023, signaling a growing appetite for direct risk transfer solutions outside the reinsurance sector.

Government-Backed Schemes and Pools

Government-backed schemes and industry pools present a significant threat of substitutes for traditional reinsurance, particularly for large-scale catastrophic events and agricultural risks. These initiatives can offer coverage that may be more affordable or accessible than private reinsurance markets. For instance, China's agricultural insurance subsidies, which have seen continuous growth, aim to bolster food security and rural development, potentially reducing the reliance on reinsurers for certain agricultural perils.

China Re's unique position as a state-owned enterprise means its participation in or operation of such government-backed schemes can blur the lines between commercial reinsurance and public-private partnerships. This can lead to situations where government initiatives directly compete with or supplement the core reinsurance business. In 2023, China's central government continued to emphasize disaster risk management and agricultural support, reinforcing the role of these state-led programs.

- Government agricultural insurance subsidies in China have seen consistent year-on-year increases, aiming to protect farmers and ensure national food security.

- State-backed disaster relief funds and catastrophe bonds can absorb or transfer risk that would otherwise be placed with reinsurers.

- The Chinese government's focus on developing national risk-sharing mechanisms for major events like earthquakes or floods can reduce the demand for private reinsurance capacity.

- These government initiatives, often driven by social and economic stability objectives, can offer coverage at potentially lower costs due to implicit or explicit state backing.

Improved Primary Insurer Underwriting and Capital

If primary insurers enhance their underwriting, risk diversification, and capital reserves, they might retain more risk internally. This improved financial resilience and risk selection could lessen their reliance on traditional reinsurance.

For instance, in 2024, several major global primary insurers reported stronger solvency ratios, partly due to improved risk modeling and capital management strategies. This trend suggests a potential shift where they absorb a larger portion of their own risk exposures.

- Enhanced Underwriting: Primary insurers are investing in advanced analytics and AI to refine their risk assessment, leading to more accurate pricing and selection.

- Capital Strength: Higher retained earnings and access to capital markets allow primary insurers to absorb greater losses.

- Risk Diversification: Primary insurers are diversifying their portfolios across geographies and lines of business, reducing the impact of single catastrophic events.

- Reduced Reinsurance Demand: As primary insurers become more self-sufficient, the demand for certain types of traditional reinsurance may decline, impacting reinsurers like China Reinsurance Group.

The threat of substitutes for China Reinsurance Group is significant, encompassing self-insurance, captive insurance, and alternative risk transfer (ART) mechanisms like insurance-linked securities (ILS). These alternatives allow large corporations and primary insurers to manage risk more directly and potentially at a lower cost. For example, the ILS market saw substantial growth, with gross issuance reaching approximately $15 billion in 2023, indicating a clear preference for capital market solutions over traditional reinsurance for certain risks.

Government-backed schemes and industry pools also serve as substitutes, particularly for catastrophic and agricultural risks. These initiatives, often subsidized, can offer more affordable coverage than the private reinsurance market. China's ongoing emphasis on agricultural insurance subsidies and national disaster risk management in 2023 underscores the growing role of these state-led programs in potentially reducing demand for traditional reinsurance capacity.

Furthermore, primary insurers are increasingly retaining more risk internally due to enhanced underwriting capabilities and stronger capital reserves. Many global primary insurers reported improved solvency ratios in 2024, driven by advanced risk modeling and capital management, suggesting a trend towards greater self-sufficiency and reduced reliance on reinsurers.

| Substitute Type | Description | 2023/2024 Data Point |

|---|---|---|

| Self-Insurance/Captives | Corporations retaining risk internally. | Multinational corporations actively exploring captive structures in 2024. |

| Alternative Risk Transfer (ART) / ILS | Capital market solutions for risk transfer. | ILS gross issuance reached ~ $15 billion in 2023. |

| Government Schemes | State-backed risk pools and subsidies. | China's agricultural insurance subsidies saw continuous growth in 2023. |

| Primary Insurer Retention | Increased internal risk absorption by primary insurers. | Several global primary insurers reported stronger solvency ratios in 2024. |

Entrants Threaten

The reinsurance industry, especially for a major player like China Reinsurance Group, requires immense capital to underwrite significant and unpredictable risks. This necessity for substantial financial reserves, coupled with stringent regulatory solvency mandates, presents a formidable hurdle for any aspiring new entrants. Indeed, the global reinsurance dedicated capital stood at an impressive $769 billion by the end of 2024, underscoring the sheer scale of investment needed to compete effectively.

The reinsurance sector is a minefield of regulations, demanding intricate licensing procedures, stringent compliance, and constant oversight. For any new player looking to enter China's market, navigating these complexities is a significant hurdle. While there have been moves to ease access for foreign insurance intermediaries, setting up a complete reinsurance operation still requires substantial engagement with regulatory bodies and obtaining crucial approvals, particularly within a state-controlled economic landscape.

Reinsurance thrives on deep-seated trust and a history of reliable claims handling. China Re, having cultivated these bonds over many years, benefits from established relationships with primary insurers, a crucial factor in this industry.

For new companies, replicating the decades of trust and proven performance that China Re possesses is a significant hurdle. This makes it challenging for them to quickly gain traction and secure a substantial client base against established, reputable players.

Specialized Expertise and Data

Success in the reinsurance sector hinges on profound underwriting acumen, advanced risk modeling, and comprehensive historical data. Newcomers must make substantial investments to build or acquire this specialized knowledge and data, presenting a significant hurdle.

The barrier to entry is amplified by the need for substantial capital reserves to underwrite large risks and the intricate regulatory compliance required across diverse jurisdictions. For instance, as of late 2024, major reinsurers maintain solvency ratios well above regulatory minimums, demonstrating the capital intensity of the business.

- Specialized Expertise: Reinsurers need deep knowledge of actuarial science, catastrophe modeling, and complex financial instruments.

- Data Requirements: Access to and analysis of vast historical loss data across multiple lines of business and geographies is crucial.

- Capital Intensity: Significant capital is required to absorb large potential losses and meet regulatory solvency requirements.

- Regulatory Hurdles: Navigating diverse and stringent regulatory frameworks in different countries adds complexity and cost.

State Ownership and Market Dominance

China Re's position as a state-owned enterprise (SOE) significantly erects a barrier to new entrants. This ownership structure grants China Re implicit government backing and a commanding presence within the Chinese reinsurance market, particularly in its core domestic offerings.

New, independent companies face considerable hurdles in challenging China Re's established dominance. The inherent advantages of an SOE, such as preferential regulatory treatment and access to capital, create an uneven playing field.

- State Ownership Advantage: China Re's SOE status provides implicit government guarantees and support, making it a more stable and trusted partner for domestic clients.

- Market Dominance: As of 2024, China Re holds a substantial share of the domestic reinsurance market, making it difficult for new players to gain traction.

- Regulatory Environment: The regulatory landscape in China often favors established SOEs, creating additional challenges for new entrants seeking licenses and market access.

The threat of new entrants into China Reinsurance Group's market is considerably low due to the industry's extreme capital intensity and stringent regulatory requirements. The sheer volume of capital needed to underwrite significant risks, coupled with complex licensing and solvency mandates, acts as a substantial deterrent. For instance, by the close of 2024, the global reinsurance dedicated capital was approximately $769 billion, highlighting the immense financial commitment required.

| Factor | Impact on New Entrants | China Re Advantage |

|---|---|---|

| Capital Requirements | Extremely High | Established financial strength and access to capital markets. |

| Regulatory Hurdles | Complex and Costly | Experience navigating China's specific regulatory landscape. |

| Brand Reputation & Trust | Difficult to Build | Long-standing relationships and proven track record with primary insurers. |

| Expertise & Data | Requires significant investment | Deep underwriting acumen and extensive historical data access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Reinsurance Group is built upon a foundation of robust data, including the company's annual reports, filings with regulatory bodies like the China Banking and Insurance Regulatory Commission (CBIRC), and industry-specific research from reputable sources such as AM Best and Fitch Ratings.