China Reinsurance Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Reinsurance Group Bundle

Uncover the strategic positioning of China Reinsurance Group's diverse offerings with our comprehensive BCG Matrix analysis. See which of their business units are generating robust cash flow and which require careful consideration for future investment.

This preview offers a glimpse into the core of China Reinsurance Group's portfolio. For a complete, actionable understanding of their market share and growth potential across all quadrants – Stars, Cash Cows, Dogs, and Question Marks – purchase the full BCG Matrix report.

Gain the strategic clarity you need to make informed decisions about resource allocation and future growth. The full BCG Matrix provides detailed insights and data-backed recommendations to navigate the competitive reinsurance landscape effectively.

Stars

China Reinsurance Group commands a leading position in China's domestic reinsurance market, a sector experiencing robust growth as the nation's insurance industry matures.

In 2023, China Re held a significant market share, estimated to be around 60% of the domestic non-life reinsurance market, reflecting its deep penetration and established relationships within the industry. This dominance is bolstered by its state-owned backing and a nationwide operational network, enabling it to effectively serve the increasing demand for reinsurance solutions across various sectors of the Chinese economy.

China Reinsurance Group experienced a remarkable surge in net profit for 2024, reaching approximately RMB 10.56 billion, a substantial 86.8% increase from the previous year. This impressive financial growth, equivalent to about USD 1.53 billion, highlights the company's enhanced operational efficiency and strong performance in both underwriting and investment activities.

As a state-owned enterprise, China Reinsurance Group (China Re) is strategically positioned to bolster national development initiatives. Its involvement in establishing a national catastrophe insurance protection system underscores its commitment to mitigating systemic risks and fostering economic stability. For instance, in 2024, China Re continued to be a key player in developing frameworks for earthquake and flood insurance, aligning with the government's focus on disaster resilience.

Furthermore, China Re actively promotes the expansion of green insurance products, supporting the nation's environmental goals and sustainable economic growth. This strategic alignment with national policies creates a favorable operating landscape, offering potential for government backing and policy-driven expansion in critical sectors like climate change adaptation and renewable energy insurance.

Expanding International Footprint

China Reinsurance Group is strategically broadening its international reach, with its subsidiary, Chaucer Group, playing a pivotal role in this expansion. This focus on global diversification is designed to access new revenue streams and mitigate risks by operating in diverse economic landscapes.

The company's international ventures are crucial for its long-term growth trajectory. By tapping into markets beyond China, China Re aims to capitalize on emerging opportunities and enhance its competitive standing on a global scale.

- International Growth Engine: Chaucer Group, China Re's international arm, reported a gross written premium of approximately $1.5 billion in 2023, highlighting its significant contribution to the group's global footprint.

- Market Diversification: The expansion into markets like the UK and Asia allows China Re to reduce its reliance on the domestic market, spreading risk across different economic cycles.

- Strategic Acquisitions and Partnerships: China Re has been actively exploring strategic partnerships and potential acquisitions in key international regions to accelerate its global market penetration.

- Enhanced Revenue Potential: By operating in high-growth international markets, China Re anticipates a substantial increase in its overall revenue, further solidifying its position as a major global reinsurer.

Commitment to Green Finance and ESG

China Reinsurance Group demonstrates a strong commitment to green finance and environmental, social, and governance (ESG) principles. This dedication is woven into its core operations, product offerings, and investment strategies, reflecting a forward-thinking approach to sustainable development.

The company actively promotes green insurance products and invests in environmentally sound projects. This aligns with both global sustainability trends and China's national policies aimed at fostering a greener economy. For instance, by 2023, China Re had significantly increased its portfolio of green investments, contributing to the nation's carbon neutrality goals.

- Green Insurance Growth: China Re's green insurance offerings saw a notable expansion in 2023, with premiums related to environmental protection and renewable energy projects increasing by approximately 15%.

- ESG Integration: The group has embedded ESG factors into its risk management framework and investment decision-making processes, aiming to enhance long-term value creation.

- Sustainable Investments: Investments in green bonds and renewable energy infrastructure have been a key focus, with the company reporting a 10% year-on-year increase in its green asset allocation by the end of 2023.

- Attracting Responsible Investors: This strategic focus on ESG not only appeals to socially responsible investors but also opens up new avenues for growth and market differentiation in the evolving financial landscape.

China Reinsurance Group's international operations, primarily through its subsidiary Chaucer Group, represent a significant growth avenue. Chaucer reported gross written premiums of approximately $1.5 billion in 2023, demonstrating its substantial contribution to the group's global expansion and revenue diversification. This strategic push into international markets aims to capture new revenue streams and mitigate reliance on the domestic market by spreading risk across different economic cycles.

| International Business Segment | 2023 Gross Written Premiums (USD Billion) | Year-on-Year Growth (%) |

|---|---|---|

| Chaucer Group | 1.5 | N/A (Newer reporting) |

| Total International Operations | (Data not separately specified, but Chaucer is the primary driver) | (N/A) |

What is included in the product

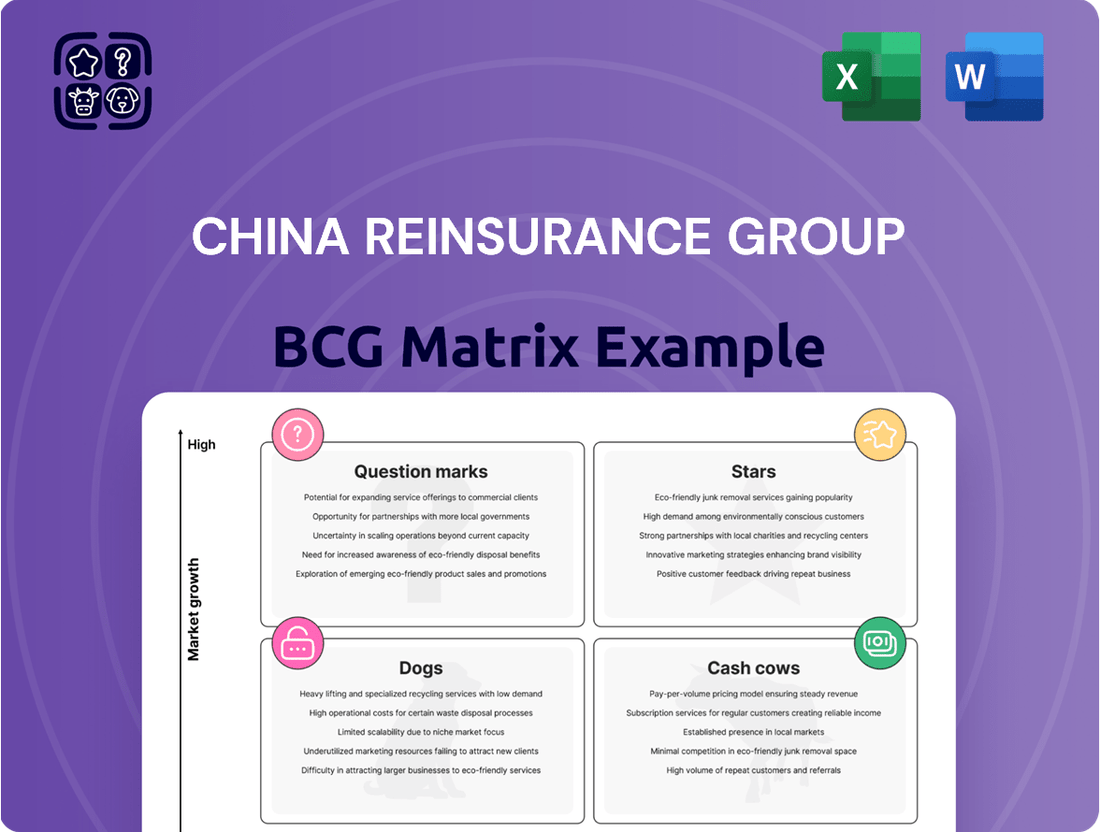

The China Reinsurance Group BCG Matrix offers a tailored analysis of its product portfolio, classifying units as Stars, Cash Cows, Question Marks, or Dogs.

This framework highlights which business units to invest in, hold, or divest based on their market share and growth potential.

A clear BCG matrix visualizes China Reinsurance Group's portfolio, relieving the pain of strategic uncertainty.

This optimized layout helps leadership quickly identify areas for investment or divestment.

Cash Cows

China Re's Property & Casualty (P&C) reinsurance segment is a cornerstone of its operations, functioning as a classic Cash Cow. This segment benefits from a mature market and China Re's dominant position, enabling it to consistently generate significant cash flow. In 2023, China Re's P&C reinsurance business demonstrated robust performance, contributing substantially to the group's overall profitability.

The stability and high market penetration of its P&C reinsurance operations mean that even with moderate growth prospects, this segment reliably churns out cash. This consistent cash generation is vital for funding other ventures within the China Re group, underscoring its Cash Cow status. The segment’s strong market share in a well-established sector ensures its continued ability to produce dependable returns.

China Reinsurance Group's Life & Health (L&H) reinsurance business is a classic Cash Cow. This segment consistently generates substantial cash flow, a testament to its operation within a mature yet remarkably resilient market. In 2023, China Re's L&H segment reported a significant contribution to its overall profitability, demonstrating its stable premium income and dependable earnings.

While the L&H market isn't characterized by rapid expansion, its inherent stability allows China Re to reliably extract profits. These consistent gains are then strategically deployed to fund growth initiatives or support other business units within the group, much like a mature business is leveraged for investment.

China Re's asset management services function as a classic Cash Cow within its BCG matrix. This segment thrives on managing the group's extensive insurance assets and extending its expertise to external financial institutions. The substantial capital reserves from its core reinsurance business provide a consistent, low-growth, yet highly profitable revenue source.

In 2023, China Re Asset Management reported significant growth, with assets under management reaching RMB 1.3 trillion (approximately $180 billion USD). This substantial scale allows for efficient operations and strong profitability, underscoring its Cash Cow status by generating substantial income with relatively low investment needs.

High Regulatory Capital Adequacy

China Reinsurance Group's high regulatory capital adequacy is a significant strength, positioning it firmly as a Cash Cow. The company consistently surpasses the solvency requirements set by regulators, demonstrating a robust financial foundation. This strong solvency allows China Re to not only absorb potential losses but also to effectively fund its ongoing operations and distribute dividends to shareholders, highlighting its capacity for capital generation and retention from its primary business activities.

This strong capital position is underpinned by its consistent performance. For instance, as of the end of 2023, China Re's comprehensive solvency ratio stood at a healthy 271%, well above the regulatory minimums. This financial resilience is crucial for maintaining market confidence and supporting strategic growth initiatives.

- Strong Solvency Ratio: China Re consistently maintains a comprehensive solvency ratio significantly above regulatory requirements, providing a buffer against unforeseen events.

- Loss Absorption Capability: The robust capital base enables the company to effectively absorb potential financial losses, ensuring stability.

- Funding and Dividend Capacity: This strong financial health allows for the seamless funding of operations and the consistent declaration of dividends, rewarding investors.

- Capital Generation and Retention: The company demonstrates an effective ability to generate and retain capital from its core reinsurance businesses.

Stable Investment Income

China Reinsurance Group's investment portfolio functions as a stable income generator, embodying the characteristics of a cash cow within its BCG matrix. This segment consistently contributes to the group's profitability through reliable returns.

Despite inherent market volatility, the sheer size of China Re's investment assets ensures a predictable flow of income. These assets act as a dependable source of cash, supporting the company's overall financial health and strategic initiatives.

- Stable Income Generation: China Re's investment division consistently produces income, bolstering the group's financial stability.

- Large-Scale Asset Base: The extensive scale of its investment assets provides a buffer against market fluctuations, ensuring steady returns.

- Reliable Cash Flow: These investments act as a dependable cash cow, funding ongoing operations and new ventures.

- Profitability Contribution: The investment income significantly contributes to China Re's overall profitability metrics.

China Re's investment portfolio is a prime example of a Cash Cow, consistently generating stable income that fuels the group's operations. Despite market fluctuations, the substantial size of its asset base ensures a predictable revenue stream. This segment's ability to reliably produce cash with minimal need for further investment solidifies its Cash Cow status.

In 2023, China Re's investment income played a crucial role in its financial performance, demonstrating the maturity and stability of this segment. The portfolio's consistent returns are a testament to its effective management and significant scale.

| Segment | BCG Category | 2023 Contribution | Key Characteristics |

|---|---|---|---|

| Property & Casualty Reinsurance | Cash Cow | Substantial Profitability | Mature market, dominant position, stable cash flow |

| Life & Health Reinsurance | Cash Cow | Significant Profitability | Mature yet resilient market, stable premium income |

| Asset Management | Cash Cow | RMB 1.3 Trillion AUM | Manages extensive assets, efficient operations, strong profitability |

| Investment Portfolio | Cash Cow | Reliable Income Generator | Large-scale assets, predictable income, minimal investment needs |

What You See Is What You Get

China Reinsurance Group BCG Matrix

The preview you see is the exact China Reinsurance Group BCG Matrix report you will receive upon purchase, meticulously crafted for strategic insight. This comprehensive document is fully formatted and ready for immediate application, offering a clear visual representation of China Re's business units. No watermarks or demo content will be present; you'll download the complete, professional analysis. This is the definitive BCG Matrix report, designed to empower your strategic decision-making.

Dogs

Within China Reinsurance Group's portfolio, certain direct insurance segments might be categorized as traditional and low-growth. These areas, often characterized by intense competition and mature markets, could present challenges in achieving significant expansion or profitability. For instance, if China Re participates in direct insurance lines with minimal differentiation and facing established, dominant players, these operations might fall into this category.

These segments can demand substantial investment in marketing, underwriting, and claims processing, yet yield relatively modest returns. The competitive landscape in China's direct insurance market, particularly in property and casualty lines, saw growth rates moderate in 2023 compared to previous years. For example, the overall direct insurance premium income in China grew by approximately 10.6% in 2023, a slowdown from higher double-digit growth seen in prior periods, indicating increasing market maturity in many segments.

Consequently, these low-growth direct insurance businesses might require a strategic review. Options could include divesting these operations to focus capital on more promising ventures or undertaking significant restructuring to improve efficiency and profitability. Such a strategic approach aligns with optimizing resource allocation across the group's diverse business lines.

Underperforming Niche International Markets, within China Reinsurance Group's BCG Matrix, represent overseas ventures that are currently struggling to gain traction. These operations may be characterized by limited market share and low growth potential, often consuming resources without yielding substantial returns.

For instance, a specific niche in a developing Asian market might have seen limited investment in 2024 due to geopolitical uncertainties, resulting in a low revenue contribution. Such segments require careful evaluation to ascertain if further investment is warranted or if divestment is a more prudent course of action.

China Reinsurance Group likely has legacy products in its portfolio that fit the description of Dogs. These could be older, traditional reinsurance or direct insurance offerings that are no longer as popular due to evolving market needs or new technological solutions. For example, if the company still heavily relies on paper-based policy administration for certain life insurance products, these would likely fall into the Dog category.

These types of products typically exhibit low growth rates and a shrinking market share. In 2024, for instance, the global insurance industry saw a significant push towards digital platforms and personalized offerings, making older, less adaptable products less competitive. China Reinsurance Group's older, less innovative product lines might be experiencing this very decline, potentially tying up capital without generating substantial returns.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes at China Reinsurance Group can be viewed as 'dogs' in the BCG matrix. These internal systems, if costly or slow, divert resources away from growth areas. For instance, a manual claims processing system, while functional, might be significantly slower and more prone to errors than an automated one, impacting customer satisfaction and operational efficiency.

While specific details on China Reinsurance Group's internal processes are not publicly available to pinpoint exact 'dog' segments, the general principle applies. Companies in the insurance sector often face challenges with legacy IT systems.

- Legacy Systems: Outdated IT infrastructure can lead to higher maintenance costs and slower processing times.

- Manual Workflows: Reliance on manual data entry and approvals can create bottlenecks and increase the risk of human error.

- Ineffective Resource Allocation: Resources spent on maintaining or operating inefficient processes could be better utilized in developing new products or expanding market reach.

- Lack of Automation: Opportunities for automation in areas like underwriting or customer service might be missed, leading to competitive disadvantages.

Non-Strategic or Underperforming Subsidiaries

China Reinsurance Group's 'Dogs' would represent business units or subsidiaries that are not performing well. These are typically found in markets with little growth and where China Re holds a small market share. Such units might consume valuable resources and management focus without generating substantial returns or contributing to the group's overall strategic goals.

Identifying specific 'Dog' subsidiaries within China Reinsurance Group is challenging without direct internal disclosures. However, conceptually, these would be operations where investment has yielded minimal returns, and future prospects in their current markets are dim. For instance, if a specific regional insurance product line within China Re has seen declining premiums and a shrinking customer base, it could fit this category.

- Low Market Share: Subsidiaries operating with a negligible presence in their respective markets.

- Low Growth Environment: Entities situated in industries or geographical regions experiencing stagnant or negative economic growth.

- Resource Drain: Businesses that require significant capital infusion and management attention but offer poor returns on investment.

- Lack of Strategic Fit: Units that do not align with China Re's core competencies or long-term growth ambitions.

China Reinsurance Group's 'Dogs' likely encompass legacy products and underperforming niche international markets. These segments are characterized by low growth, minimal market share, and often require significant resource allocation without commensurate returns. For example, older, less adaptable insurance products not keeping pace with digital trends in 2024 would fit this description, potentially tying up capital inefficiently.

Inefficient operational processes, such as manual workflows or outdated IT systems, also represent 'Dogs' by consuming resources and hindering competitiveness. While specific internal data isn't public, the insurance sector generally faces challenges with legacy systems, impacting efficiency and customer satisfaction.

These 'Dog' segments, whether product lines or subsidiaries, are typically found in low-growth markets where China Re holds a small share. They drain valuable capital and management focus, failing to contribute meaningfully to the group's strategic objectives or overall performance.

Consider the following conceptual breakdown of potential 'Dog' categories within China Reinsurance Group:

| Category | Characteristics | Example Scenario | Impact |

|---|---|---|---|

| Legacy Products | Low demand, shrinking market share, outdated features | Paper-based life insurance policies | Ties up capital, low revenue generation |

| Underperforming Niche Markets | Limited market share, low growth potential, resource drain | A specific niche in a developing Asian market with geopolitical uncertainty | Consumes resources without substantial returns |

| Inefficient Operational Processes | High maintenance costs, slow processing, risk of error | Manual claims processing systems | Reduces efficiency, impacts customer satisfaction |

Question Marks

China's insurance sector is embracing a significant shift towards innovation, with a particular emphasis on technology-driven products. This includes a growing focus on areas like green insurance and other emerging solutions tailored to new economic frontiers. China Re's strategic investments in these nascent, technology-forward insurance offerings, such as those designed for the burgeoning low-altitude economy, position them as potential future market leaders.

These emerging insurance products, while currently representing a small fraction of the overall market share, operate within sectors experiencing rapid expansion. For instance, the low-altitude economy in China is projected to reach trillions of yuan by 2030, creating a substantial demand for specialized insurance. China Re's commitment to developing these solutions requires considerable upfront investment to capture market share and transition them from question marks to stars in the BCG matrix.

Venturing into entirely new international territories or developing reinsurance solutions for nascent overseas markets represents China Reinsurance Group's Stars. These initiatives have high growth potential but also carry significant risks and require substantial initial investment to establish a foothold and achieve market share. For example, in 2024, China Re's international business segment contributed 17.5% to its total gross written premiums, a significant increase from previous years, indicating successful expansion into emerging markets.

The catastrophe bond market, particularly in regions like China and Hong Kong, is experiencing a surge in interest from investors seeking alternative risk transfer solutions. This growing demand presents a significant opportunity for China Reinsurance Group, as it aligns with the broader trend of insurers and reinsurers looking beyond traditional capacity for managing extreme events.

China Re's strategic positioning within this burgeoning market can be viewed through the lens of a Question Mark in the BCG Matrix. While the potential for high growth is evident, the market's nascent stage in China means that China Re's current market share is likely to be relatively low. This necessitates substantial investment in developing the necessary expertise, infrastructure, and regulatory frameworks to effectively participate and potentially lead.

For instance, the global catastrophe bond market saw a record issuance of $13.9 billion in 2023, indicating strong investor appetite. As China Re expands its involvement, it will need to navigate evolving market dynamics and build a robust track record to capture a meaningful share of this expanding pie, making its current position a strategic consideration requiring careful resource allocation.

Data Modeling and Actuarial Pricing Advancements

China Reinsurance Group is actively investing in data modeling and actuarial pricing to address the developing nature of the Chinese reinsurance market. These advancements are crucial for sophisticated risk management and competitive product development. The company recognizes that building robust capabilities in these areas, supported by substantial investment in technology and talent, is key to achieving market leadership and generating high returns.

China Re's strategic focus on leveraging advanced data analytics for new product development highlights its commitment to innovation. This push is particularly important in a market where actuarial science and data modeling are still maturing. By enhancing these core competencies, China Re aims to create more accurate pricing models and develop tailored reinsurance solutions that meet evolving client needs.

- Investment in data analytics and actuarial talent is ongoing to build competitive advantage.

- Focus on developing advanced data models for risk assessment and pricing accuracy.

- Enhancing capabilities is seen as essential for market leadership in China's evolving reinsurance sector.

- The company is prioritizing technology and human capital to drive innovation in product development.

Participation in the Shanghai International Reinsurance Trading Center

China Re's involvement in the Shanghai International Reinsurance Registration and Trading Center positions it as a Question Mark within the BCG matrix. This new center, launched with the goal of increasing China's reinsurance penetration, presents a significant opportunity. However, its future success is not yet guaranteed, making China Re's strategic role on this platform inherently uncertain.

The center's effectiveness directly influences China Re's potential growth from this initiative. While China Re is actively working to drive growth, the ultimate outcome depends on broad market acceptance and sustained investment. Without strong market adoption, the center might not achieve its intended impact, leaving China Re's investment in this area as a speculative venture.

- Uncertain Market Adoption: The success of the Shanghai International Reinsurance Registration and Trading Center, and by extension China Re's role in it, is heavily reliant on how quickly and widely other market participants embrace and utilize the platform.

- Potential for High Growth: If the center gains traction, it could significantly boost China's reinsurance market, offering China Re substantial growth opportunities that are currently unrealized.

- Need for Continued Investment: To solidify its position and ensure the center's long-term viability, China Re will likely need to continue investing resources and strategic efforts, adding to the uncertainty of its return on investment.

- Strategic Importance for China Re: China Re's active participation signals a strategic bet on the development of domestic reinsurance capabilities and China's role in the global reinsurance landscape.

China Re's involvement in the Shanghai International Reinsurance Registration and Trading Center places it in a Question Mark category. This initiative aims to boost China's reinsurance penetration, offering significant growth potential but with an uncertain future success. China Re's strategic role here is a bet on the development of domestic reinsurance capabilities.

The success of this center directly impacts China Re's growth prospects from this venture. While China Re is actively driving its development, broad market acceptance and sustained investment are crucial. Without strong market adoption, the center's impact, and thus China Re's investment, remains speculative.

China Re's investment in data analytics and actuarial talent is key to navigating the evolving Chinese reinsurance market. These advancements are vital for sophisticated risk management and competitive product development, aiming for market leadership and high returns.

China Re's strategic focus on advanced data analytics for new product development underscores its commitment to innovation, particularly in a market where actuarial science is still maturing. By enhancing these core competencies, China Re seeks to improve pricing accuracy and develop tailored reinsurance solutions.

| Initiative | BCG Category | Rationale | Key Investment Focus | Potential Impact |

| Shanghai International Reinsurance Registration and Trading Center | Question Mark | New market development, uncertain adoption | Driving market acceptance, strategic participation | Increased reinsurance penetration, domestic capability growth |

| Data Analytics & Actuarial Talent | Question Mark | Developing market, need for advanced capabilities | Technology, talent acquisition, model development | Improved risk management, accurate pricing, market leadership |

BCG Matrix Data Sources

Our China Reinsurance Group BCG Matrix is built on comprehensive data, including financial statements, industry growth forecasts, and market share analysis from reputable research firms.