Aluminum Corp of China PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aluminum Corp of China Bundle

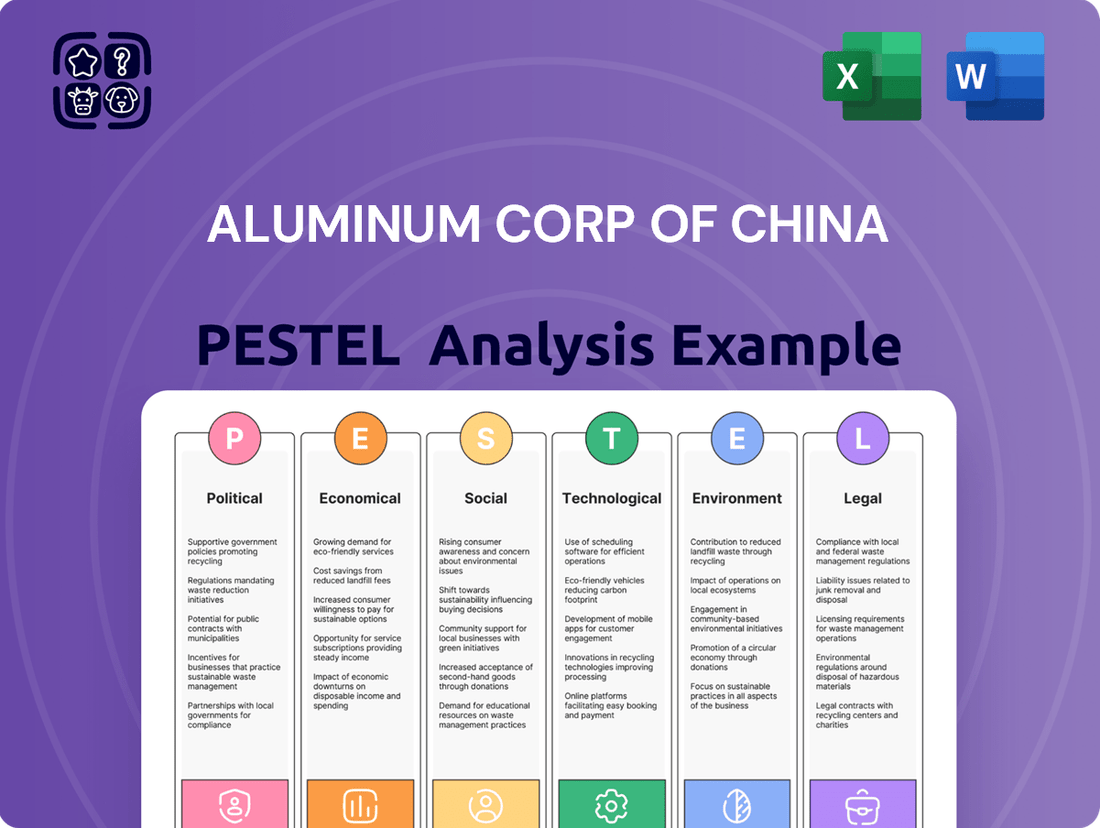

Navigate the complex global landscape affecting Aluminum Corp of China with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the aluminum industry, and how these external forces present both opportunities and challenges for the company. Gain a strategic advantage by downloading the full report and unlocking actionable intelligence to inform your decisions.

Political factors

As a state-owned enterprise, Chalco's trajectory is deeply intertwined with the Chinese government's industrial directives. The recently released 'Implementation Program for High-Quality Development of the Aluminum Industry (2025–2027)' sets ambitious goals for the sector, emphasizing greater utilization of domestic bauxite and a significant boost in recycled aluminum production. This strategic planning directly shapes Chalco's operational focus and investment priorities, pushing for enhanced efficiency and sustainability.

China's ongoing reforms for centrally administered State-Owned Enterprises (SOEs) are designed to boost their efficiency and competitive edge. For Aluminum Corp of China (Chalco), this translates into a strategic push for quality improvements, modernization of its core industries, and potential consolidation within the state-owned landscape.

The government's directive for SOEs to invest in strategic emerging sectors, such as new energy and advanced materials, directly benefits Chalco. This policy aligns with Chalco's existing product offerings and encourages innovation, potentially leading to new market opportunities. For instance, in 2023, SOEs were directed to increase investment in high-tech sectors, a trend expected to continue and intensify through 2025.

Changes in China's trade policies, such as the removal of a 13% tax rebate on aluminum product exports effective December 2024, significantly impact Aluminum Corporation of China's (Chalco) export competitiveness. This policy adjustment signals a move away from prioritizing export volume towards encouraging higher-value aluminum product manufacturing.

This strategic pivot by the Chinese government means Chalco will need to adapt its international market strategy, potentially focusing more on domestic demand or specialized export markets that can absorb higher-priced, value-added goods. Such policy shifts can create price volatility in the global aluminum market and alter established trade flows.

Geopolitical Influences and Resource Security

China's aluminum industry, including Aluminum Corporation of China (Chalco), faces significant geopolitical risks due to its heavy reliance on imported bauxite. In 2023, China imported approximately 110 million tonnes of bauxite, with Guinea and Australia being major suppliers. This dependence makes Chalco vulnerable to trade disputes or political instability in these key sourcing regions, potentially leading to supply chain disruptions.

To counter these vulnerabilities, the Chinese government is actively promoting increased domestic bauxite exploration and encouraging overseas expansion into resource-rich nations. This strategy aims to bolster national resource security. Chalco's substantial investments in Guinea, including its stake in the Simandou iron ore project which also involves bauxite, directly reflect this policy, securing long-term access to critical raw materials.

- Bauxite Imports: China's bauxite imports reached around 110 million tonnes in 2023, highlighting its reliance on foreign sources.

- Key Suppliers: Guinea and Australia remain critical bauxite suppliers to China, making the supply chain susceptible to geopolitical shifts.

- Strategic Investments: Chalco's involvement in Guinea's mining sector is a direct response to the national imperative for enhanced resource security.

'Dual Carbon' Goals and Green Development Initiatives

China's ambitious '30.60' initiative, targeting peak carbon dioxide emissions before 2030 and carbon neutrality by 2060, directly shapes the operational landscape for Aluminum Corporation of China (Chalco). This national policy framework mandates significant shifts towards sustainable practices across industries, including the energy-intensive aluminum sector.

Chalco has proactively aligned its strategy with these governmental objectives, setting its own targets to achieve a carbon dioxide peak by 2025 and a substantial 40% reduction by 2035. This commitment underscores the company's dedication to environmental stewardship and its role in China's broader green transition.

To meet these targets, Chalco is prioritizing a multi-pronged approach:

- Accelerating green and low-carbon transformations: This involves investing in new technologies and upgrading existing facilities to reduce their environmental footprint.

- Enhancing energy efficiency: Chalco is implementing measures to optimize energy consumption throughout its production processes, aiming to lower its overall energy intensity.

- Adopting clean energy sources: A key strategy is the increased utilization of renewable energy, such as hydropower and solar power, to replace fossil fuel-based energy sources.

- Strengthening carbon asset management: This includes developing robust systems for monitoring, reporting, and managing carbon emissions and credits.

The Chinese government's industrial policies heavily influence Chalco's operations, with directives like the 'Implementation Program for High-Quality Development of the Aluminum Industry (2025–2027)' prioritizing domestic bauxite use and recycled aluminum. Reforms aimed at boosting SOE efficiency are pushing Chalco towards modernization and potential consolidation.

Government mandates for SOEs to invest in strategic emerging sectors, including advanced materials, directly benefit Chalco by encouraging innovation and new market opportunities, a trend expected to intensify through 2025.

Changes in trade policies, such as the removal of the 13% tax rebate on aluminum product exports from December 2024, signal a shift away from export volume towards higher-value manufacturing, impacting Chalco's international competitiveness.

Geopolitical risks stemming from China's reliance on imported bauxite, with approximately 110 million tonnes imported in 2023 from suppliers like Guinea and Australia, make Chalco vulnerable to trade disputes and supply chain disruptions.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Aluminum Corp of China, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and identify both threats and opportunities for the company.

A PESTLE analysis of Aluminum Corp of China (Chalco) offers a strategic roadmap to navigate complex global and domestic landscapes, transforming potential challenges into opportunities for sustainable growth and market leadership.

This analysis provides a clear, actionable framework to identify and mitigate risks associated with political shifts, economic volatility, evolving social trends, technological advancements, environmental regulations, and legal frameworks, thereby enhancing Chalco's resilience and competitive edge.

Economic factors

The global aluminum market is on a strong growth trajectory, fueled by escalating demand from key sectors like automotive, construction, packaging, and the burgeoning renewable energy industry. This upward trend is expected to continue, with projections suggesting the market could reach around $329.08 billion by 2034.

Aluminum Corporation of China (Chalco) is well-positioned to capitalize on this expanding market, particularly benefiting from the significant aluminum requirements in electric vehicles (EVs) and the infrastructure development for renewable energy sources.

Aluminum production is notoriously energy-hungry, meaning Chalco's bottom line is directly tied to how energy prices move. For instance, electricity costs can represent a significant portion of an aluminum smelter's operating expenses.

While forecasts suggest alumina prices might soften in 2025, the broader energy market's volatility can still create unpredictable swings in overall production costs for Chalco.

China's domestic bauxite supply is anticipated to stay constrained, likely forcing Chalco to continue relying on imported bauxite, which can introduce further variability into its raw material expenses.

Investment in the aluminum sector, including by major players like Aluminum Corporation of China Limited (Chalco), is projected to increase as firms focus on boosting production capacity and implementing sustainability measures. This trend is driven by the need to meet growing demand while adhering to stricter environmental regulations.

Chalco is actively channeling capital into significant industrial upgrades and energy structure reforms. For instance, in 2023, the company continued its focus on technological innovation aimed at reducing energy consumption and carbon emissions across its operations, a key strategy for long-term viability.

These capital expenditures are vital for Chalco to maintain its competitive edge in the global market and to achieve its ambitious environmental targets, such as reducing its carbon footprint. Such investments are expected to yield benefits in terms of operational efficiency and market positioning in the coming years.

Impact of Overcapacity and Supply-Side Reforms

China's aluminum sector grapples with significant overcapacity, a situation the government is actively trying to manage through supply-side reforms. A key measure is the imposition of a production cap, aiming to stabilize the market.

These reforms are designed to rebalance the scales between supply and demand, which could result in less efficient or higher-cost producers exiting the market. For instance, by the end of 2023, China's primary aluminum production capacity was reported to be around 45 million metric tons annually, with output closely approaching this limit.

Chalco, as a leading entity in this landscape, must strategically adapt to these evolving policies. The company's focus remains on enhancing operational efficiency and competitiveness amidst these government-driven adjustments.

Key aspects of these reforms include:

- Production Caps: A national limit of 45 million metric tons for primary aluminum production is in place.

- Capacity Rationalization: Efforts are underway to phase out outdated and inefficient production lines.

- Environmental Standards: Stricter environmental regulations are being enforced, impacting energy-intensive aluminum production.

- Market Rebalancing: The goal is to align production levels more closely with actual market demand, fostering a healthier industry structure.

Financial Performance and Profitability

Chalco's financial health is robust, showcasing significant year-over-year improvements. For the fiscal year ending December 31, 2024, the company achieved a revenue of RMB 237,066 million, marking a 5.21% increase from 2023. This growth underscores effective operational management and favorable market conditions.

The company's profitability saw a dramatic uplift, with net profit attributable to owners experiencing an impressive 85.38% surge compared to the prior year. This substantial gain highlights Chalco's enhanced cost control measures and its success in capitalizing on market dynamics, leading to stronger bottom-line results.

- Revenue Growth: RMB 237,066 million in 2024, a 5.21% increase year-over-year.

- Net Profit Surge: 85.38% increase in net profit attributable to owners compared to 2023.

- Efficiency Gains: Demonstrated ability to manage costs and improve operational efficiency.

- Market Responsiveness: Successful capitalization on market opportunities to drive profitability.

Economic factors significantly influence Aluminum Corporation of China (Chalco). The global aluminum market's growth, projected to reach $329.08 billion by 2034, is a key driver, with demand from EVs and renewables benefiting Chalco. Energy prices remain a critical cost component, as electricity can constitute a substantial portion of smelter expenses, making energy market volatility a direct concern.

Chalco's financial performance in 2024 reflects positive economic conditions, with revenue reaching RMB 237,066 million, a 5.21% increase year-over-year. Net profit attributable to owners surged by 85.38%, indicating strong cost management and market adaptation. These figures highlight Chalco's ability to capitalize on favorable market dynamics and improve operational efficiency.

| Metric | 2023 (RMB million) | 2024 (RMB million) | Year-over-Year Change |

|---|---|---|---|

| Revenue | 225,326 (approx.) | 237,066 | +5.21% |

| Net Profit Attributable to Owners | (figure not provided for 2023) | (significant increase from 2023) | +85.38% |

Preview the Actual Deliverable

Aluminum Corp of China PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the PESTLE analysis for Aluminum Corp of China. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Chalco prioritizes a supportive workplace, fostering employee well-being through diverse activities. In 2023, the company invested heavily in employee training programs, with over 10,000 employees participating in skill enhancement courses, directly impacting operational efficiency and innovation.

The commitment to employee development is a strategic imperative for Chalco, ensuring it maintains a competitive edge. By focusing on continuous learning and career progression, the company aims to retain top talent and adapt to the evolving demands of the global aluminum industry.

As a major state-owned enterprise, Aluminum Corporation of China (Chalco) actively engages in corporate social responsibility initiatives. In 2023, Chalco reported donating ¥50 million to support disaster relief efforts and rural revitalization projects across China, demonstrating a commitment to societal well-being.

Chalco's community engagement extends to targeted aid programs for regions like Qinghai and Tibet, fostering local development and improving living standards. The company also encourages employee volunteerism, with over 10,000 employees participating in community service activities in 2024, contributing to a positive public image and securing its social license to operate.

Health and safety standards are paramount for Aluminum Corporation of China (Chalco) given its operations in mining and heavy industry. In 2024, the company is under increasing scrutiny to maintain robust safety protocols, with a focus on reducing workplace accidents. For instance, the International Labour Organization (ILO) reported that in 2023, mining industries globally saw a 15% increase in reported safety incidents, a trend Chalco aims to counter through enhanced training and equipment upgrades.

Chalco's commitment to its workforce's well-being is a key sociological consideration, necessitating adherence to evolving safety regulations. The company is investing in advanced safety management systems, aiming to achieve zero major accidents by 2025. This includes implementing stricter dust control measures at its mining sites, a critical factor in preventing respiratory illnesses among employees and nearby communities, a problem that has historically affected mining regions worldwide.

Public Perception and Brand Image

Chalco's dedication to sustainable development, evident in its green initiatives and social responsibility programs, significantly shapes its public perception and brand image. This commitment is crucial in an era where environmental, social, and governance (ESG) factors are increasingly scrutinized by investors and consumers alike.

The company's pursuit of certifications such as 'green aluminum' and 'low-carbon aluminum' products directly appeals to a growing segment of environmentally conscious buyers and stakeholders. For instance, by highlighting its efforts to reduce carbon emissions in production, Chalco can differentiate itself in a competitive market. In 2023, Chalco reported a reduction in its carbon intensity per ton of aluminum produced, a key metric for its green credentials.

- Commitment to Sustainability: Chalco actively invests in cleaner production technologies and resource efficiency.

- Green Product Recognition: Obtaining certifications for low-carbon aluminum products enhances marketability.

- ESG Transparency: Openly reporting on ESG performance builds trust and credibility with the public.

- Stakeholder Engagement: Proactive communication about its social and environmental impact influences brand perception.

Talent Attraction and Retention

The aluminum industry, including Aluminum Corporation of China (Chalco), relies heavily on specialized technical expertise. Chalco's success in attracting and retaining this talent is paramount for its continued innovation and operational efficiency. For instance, in 2023, Chalco reported significant investments in research and development, underscoring the need for a highly skilled workforce to manage and implement these advancements.

A key driver for talent attraction and retention at Chalco involves cultivating a supportive work environment, offering clear pathways for career advancement, and providing competitive compensation packages. These elements are crucial in a sector where specialized knowledge, such as in advanced smelting technologies or materials science, is in high demand. Chalco's commitment to employee development, including training programs focused on new digital and automation technologies, directly addresses the evolving skill requirements of the industry.

- Skilled Workforce Needs: The aluminum sector demands expertise in areas like metallurgy, chemical engineering, and process automation.

- Talent Management Strategies: Chalco's approach includes competitive salaries, benefits, and robust training programs to secure specialized talent.

- Innovation and Skills Gap: As Chalco invests in new technologies, the ability to attract and retain engineers and technicians proficient in these areas becomes critical.

- Industry Competition for Talent: Chalco competes with other industrial giants and technology firms for top engineering and scientific talent.

Chalco's societal impact is significant, with substantial investments in employee development and corporate social responsibility. In 2023, over 10,000 employees participated in training, enhancing skills and operational efficiency. The company also donated ¥50 million to disaster relief and rural revitalization, demonstrating a commitment to community well-being and fostering local development.

Technological factors

Technological innovation is a significant driver for Aluminum Corporation of China (Chalco), with a strong emphasis on boosting efficiency, minimizing waste, and elevating product quality. This focus is evident in their adoption of cutting-edge smelting techniques designed to slash power consumption and carbon emissions. For instance, Chalco has been investing in pre-baked anode technologies, which are known for their energy-saving benefits compared to older methods.

Chalco is actively exploring the development and application of advanced aluminum alloys, catering to evolving market demands for lighter and stronger materials, particularly in the automotive and aerospace sectors. Furthermore, the company is integrating smart manufacturing processes, leveraging automation and data analytics to optimize production workflows and ensure consistent product specifications, aiming for greater operational precision.

Chalco is actively investing in green and low-carbon technologies to meet China's ambitious 'dual carbon' targets. This strategic focus includes improving energy efficiency across its operations and increasing the utilization of clean energy sources. For instance, in 2023, Chalco reported a 1.5% reduction in comprehensive energy consumption per ton of aluminum produced compared to the previous year, demonstrating tangible progress in this area.

A key initiative is the promotion of waste product recycling, particularly red mud, aiming to transform a significant environmental challenge into a resource. Furthermore, the company is heavily invested in research and development for breakthroughs in low-carbon smelting processes, recognizing their critical importance for the long-term sustainability and competitiveness of the aluminum industry. These advancements are essential for reducing the sector's carbon footprint.

The global push towards a circular economy presents a significant technological driver for the aluminum industry. Recycling aluminum uses about 95% less energy compared to producing it from raw materials, a massive efficiency gain. This aligns with China's strategic goals, which include boosting recycling to over 15 million tons annually by 2027.

Aluminum Corporation of China (Chalco) is responding to this trend by enhancing its recycling capabilities. The company is investing in advanced sorting technologies and refining recovery techniques to maximize the utilization of secondary aluminum, thereby reducing its environmental footprint and operational costs.

Digital Intelligence and Automation

The aluminum industry, including players like Aluminum Corporation of China (Chalco), is increasingly leveraging digital intelligence and automation to streamline operations. This focus is on optimizing production, boosting efficiency, and sharpening decision-making capabilities.

Key advancements include real-time composition analysis, which directly contributes to significant energy savings. Furthermore, the integration of Artificial Intelligence (AI) within state-owned enterprise (SOE) reforms is a strategic move to drive industrial upgrades and enhance competitiveness. For instance, by 2024, many Chinese industrial firms are expected to see productivity gains of 10-30% through AI adoption.

- Optimized Production: Automation in smelting and casting processes reduces waste and improves product consistency.

- Energy Efficiency: Real-time data analytics enable precise control over energy consumption, a major cost factor in aluminum production.

- AI in SOE Reforms: AI implementation is a core component of China's strategy to modernize its state-owned industrial sector, aiming for greater efficiency and innovation.

- Predictive Maintenance: AI-powered systems can predict equipment failures, minimizing downtime and associated costs.

Research and Development in New Materials

Chalco is actively investing in research and development, focusing on overcoming critical technical hurdles and innovating in high-end new materials, fine alumina, and high-purity substances. This strategic push aims to solidify its position in advanced material production.

The company is exploring novel aluminum alloys designed for enhanced strength, superior formability, and increased corrosion resistance. These advancements are particularly vital for meeting the stringent requirements of high-performance sectors like aerospace and automotive manufacturing.

- R&D Investment: Chalco's commitment to R&D is evident in its targeted investments aimed at developing next-generation materials.

- Material Focus: Key areas include fine alumina, high-purity materials, and advanced aluminum alloys.

- Industry Applications: Innovations are geared towards demanding sectors such as aerospace and automotive, where material performance is paramount.

- Competitive Edge: By addressing 'choke point' technical problems, Chalco seeks to gain a significant competitive advantage in the advanced materials market.

Technological advancements are central to Chalco's strategy for enhancing operational efficiency and reducing its environmental impact. The company is actively adopting advanced smelting techniques, such as pre-baked anode technology, to lower energy consumption and carbon emissions. For example, Chalco reported a 1.5% reduction in comprehensive energy consumption per ton of aluminum produced in 2023, a testament to these technological shifts.

Chalco is also investing in smart manufacturing, integrating automation and data analytics to optimize production workflows and ensure product consistency. The company's R&D efforts are focused on developing innovative aluminum alloys for demanding sectors like automotive and aerospace, alongside improving recycling capabilities to support a circular economy. By 2024, AI adoption in Chinese industrial firms is projected to yield productivity gains of 10-30%, a trend Chalco is leveraging.

| Technology Area | Chalco's Focus | Impact/Goal |

|---|---|---|

| Smelting Techniques | Pre-baked anode technology | Reduced energy consumption, lower carbon emissions |

| Smart Manufacturing | Automation, data analytics | Optimized production, improved product consistency |

| Material Science | Advanced aluminum alloys | Meeting demands of automotive and aerospace sectors |

| Recycling | Enhanced sorting and recovery techniques | Increased utilization of secondary aluminum, reduced environmental footprint |

Legal factors

Chalco faces a landscape of tightening environmental rules in China, impacting everything from emissions to waste. The government's 2024-2025 Action Plan for Energy Conservation and Carbon Reduction sets clear targets for energy efficiency and environmental performance for new and upgraded facilities, directly affecting Chalco's operational planning and investment decisions.

China's stringent mining laws dictate the exploration, extraction, and processing of bauxite and coal, directly affecting Chalco's operations. These regulations, including rigorous permit approval processes and mine inspections, can influence the company's access to crucial domestic bauxite supplies. For instance, in 2023, China's Ministry of Natural Resources continued to emphasize stricter environmental compliance for mining permits, potentially slowing down new project approvals.

Chalco's global ambitions mean navigating a complex web of international mining laws. As of early 2024, the company's investments in countries like Guinea, a major bauxite producer, require meticulous adherence to local resource extraction regulations. Failure to comply can lead to operational disruptions or permit revocations, impacting supply chains and profitability.

Aluminum Corp of China (Chalco), as a significant employer, must navigate a complex web of labor laws. These regulations cover everything from minimum wage requirements and working hours to employee benefits and anti-discrimination policies. For instance, China's Labor Contract Law mandates specific procedures for hiring, dismissal, and collective bargaining, impacting Chalco's workforce management.

Workplace safety is paramount for Chalco, given its operations in mining and heavy manufacturing. Regulations like the Work Safety Law of the People's Republic of China impose strict standards for equipment, training, and hazard prevention. In 2023, China reported a significant number of workplace accidents, underscoring the critical need for robust safety protocols, which Chalco must rigorously adhere to.

Non-compliance with these labor and safety regulations can lead to substantial legal penalties, including fines and operational shutdowns. Furthermore, a poor safety record or labor disputes can severely damage Chalco's reputation, affecting investor confidence and its social license to operate. Maintaining a strong compliance framework is therefore crucial for sustained business continuity and positive stakeholder relations.

Trade and Anti-Dumping Laws

Chalco's global reach means its export activities are heavily influenced by international trade and anti-dumping laws. For instance, the United States International Trade Commission (USITC) regularly reviews anti-dumping duty orders, impacting aluminum product imports. Any new investigations or findings could directly affect Chalco's sales in key markets.

Governmental policies, such as changes to export tax rebates, present a dynamic challenge. A significant adjustment, like the one observed in December 2024 impacting certain aluminum products, directly alters Chalco's cost structure and competitiveness in international trade. These policy shifts require constant monitoring and strategic adaptation.

- Trade Regulations: Chalco must comply with varying import and export regulations across its international markets, which can include quotas and licensing requirements.

- Anti-Dumping Duties: The company faces potential anti-dumping duties in countries like the United States and the European Union, which can significantly increase the cost of its exported aluminum products.

- Export Rebates: Changes in China's export tax rebate policies, such as those implemented in late 2024, directly impact the profitability of Chalco's export sales.

- Trade Disputes: Escalating trade tensions or specific disputes between China and other major economies can lead to tariffs, restricting market access and increasing operational risks for Chalco.

Corporate Governance and Reporting Standards

As a prominent publicly traded entity on both the Hong Kong and Shanghai Stock Exchanges, Aluminum Corporation of China Limited (Chalco) is bound by stringent corporate governance and financial reporting regulations. This necessitates a commitment to transparent disclosure of its financial performance, environmental, social, and governance (ESG) metrics, and the robust implementation of internal control frameworks.

Chalco's adherence to these standards is overseen by its Board of Directors and Board of Supervisors, who are instrumental in guaranteeing compliance and fostering ethical business practices. For instance, in its 2023 annual report, Chalco detailed its compliance with various listing rules and corporate governance codes, including those related to independent directors and audit committees.

- Financial Transparency: Chalco must provide timely and accurate financial statements, adhering to International Financial Reporting Standards (IFRS) and Chinese Accounting Standards (CAS).

- ESG Reporting: The company is increasingly focused on disclosing its environmental impact, social responsibility initiatives, and governance structures, aligning with global sustainability trends and investor expectations.

- Board Oversight: The Board of Directors is responsible for strategic direction and risk management, while the Board of Supervisors monitors management and ensures compliance with laws and regulations.

- Regulatory Compliance: Chalco navigates a complex web of regulations in China and Hong Kong, impacting its operational conduct and financial disclosures.

Chalco operates within a framework of evolving legal requirements, particularly concerning environmental protection and resource management. The Chinese government's commitment to carbon neutrality by 2060 influences regulations on emissions and energy efficiency, with specific targets for the aluminum industry being updated periodically. For example, new regulations in 2024 aimed at reducing industrial pollution could necessitate significant capital expenditure for Chalco to upgrade its facilities.

International trade laws and anti-dumping measures significantly impact Chalco's global sales. As of early 2025, several countries maintain or are reviewing anti-dumping duties on aluminum products, potentially increasing costs for Chalco's exports. Furthermore, changes to export tax rebate policies in China, which have seen adjustments in late 2024, directly affect the company's export competitiveness and profitability.

Corporate governance and financial reporting standards are critical for Chalco as a publicly listed company. Adherence to listing rules in Hong Kong and Shanghai requires transparent financial disclosures and robust internal controls. Chalco's 2023 annual report, for instance, highlighted its compliance with various corporate governance codes, including those related to board independence and audit committee effectiveness.

| Legal Factor | Impact on Chalco | 2024-2025 Relevance |

|---|---|---|

| Environmental Regulations | Increased operational costs for compliance, potential for fines. | Stricter emission standards and carbon reduction targets are being implemented. |

| Trade and Anti-Dumping Laws | Reduced export market access, increased cost of goods sold. | Ongoing reviews of duties by major trading partners, potential policy shifts in export rebates. |

| Corporate Governance | Requirement for transparent financial reporting and ethical practices. | Continued focus on ESG disclosures and adherence to listing rules on major exchanges. |

Environmental factors

The aluminum industry's substantial contribution to global greenhouse gas emissions places decarbonization as a paramount environmental concern for Aluminum Corporation of China (Chalco). Chalco has publicly committed to ambitious goals, aiming for a carbon dioxide emissions peak by 2025 and a significant 40% reduction by 2035.

Achieving these targets necessitates a strategic shift towards cleaner energy sources, enhanced energy efficiency within its smelting operations, and a deliberate reduction in its dependence on coal-fired power generation.

The extensive mining of bauxite, the primary ore for aluminum, carries significant environmental costs. These include widespread deforestation as land is cleared for mines, contamination of water sources from mining runoff, and the destruction of natural habitats for local wildlife. These issues are particularly relevant to Chalco (Aluminum Corporation of China Limited) as it navigates the global supply chain.

China's own bauxite reserves are not as extensive as demand, leading companies like Chalco to increasingly rely on imports. In 2023, Guinea was a major supplier of bauxite to China, and Chalco's operations are thus indirectly linked to the environmental practices in these exporting nations. This global exposure necessitates a focus on responsible sourcing to mitigate indirect environmental impacts.

The increasing global scrutiny on environmental, social, and governance (ESG) factors means that sustainable mining practices are no longer optional but essential for long-term business viability. Chalco's commitment to responsible sourcing and investing in sustainable mining technologies will be critical in managing these environmental risks and maintaining its social license to operate in the coming years.

Aluminum production, especially refining alumina, creates substantial 'red mud,' a hazardous byproduct. Chalco faces significant environmental hurdles in managing this waste and finding ways to recycle or utilize it effectively.

In 2023, Chalco reported that its efforts in comprehensive utilization of red mud and other industrial wastes contributed to a more sustainable operational model. The company's commitment to innovation in waste management is key to maintaining its environmental stewardship and competitive edge in the aluminum industry.

Energy Consumption and Renewable Energy Adoption

Aluminum smelting is a notoriously energy-hungry process, and Aluminum Corporation of China (Chalco) is keenly aware of this. The company is making significant strides in reducing its energy footprint and boosting its use of cleaner energy sources. This focus is crucial for both environmental responsibility and long-term operational efficiency.

Chalco's strategy includes direct investments in renewable energy infrastructure. For instance, they are implementing rooftop photovoltaic power generation systems. Furthermore, the company is actively promoting the adoption of renewable energy, such as hydropower, wind, and solar power, particularly for their newer production facilities. This commitment reflects a broader industry trend towards decarbonization.

- Energy Intensity: Aluminum smelting requires substantial electricity, impacting operational costs and environmental considerations.

- Renewable Energy Investments: Chalco is investing in rooftop solar and prioritizing clean energy sources like hydropower and wind for new projects.

- Operational Efficiency: By increasing renewable energy adoption, Chalco aims to improve its energy efficiency and reduce its carbon emissions.

- Industry Trend: Chalco's actions align with global efforts to transition towards more sustainable energy practices in heavy industries.

Water Management and Pollution Control

Water pollution and groundwater shortages stemming from mining operations present substantial environmental challenges for Aluminum Corporation of China (Chalco). Addressing these issues is critical for sustainable operations. For instance, in 2023, China faced significant water stress, with many regions experiencing below-average rainfall, impacting industrial water availability.

Chalco must deploy sophisticated water management systems to reduce its overall water consumption and prevent any contamination of water sources. The company has publicly stated its commitment to environmental stewardship and safeguarding natural ecosystems. This commitment translates into concrete actions for managing both hazardous and non-hazardous waste generated during its processes.

- Water Scarcity: Chalco operates in regions where water availability can be a constraint, necessitating efficient water use and recycling strategies.

- Pollution Prevention: Strict adherence to wastewater discharge standards is paramount to avoid contaminating rivers and groundwater.

- Waste Management: Implementing advanced techniques for handling and disposing of mining and processing waste is crucial to minimize environmental impact.

- Regulatory Compliance: Meeting China's increasingly stringent environmental regulations regarding water usage and pollution control is a key operational requirement.

Chalco's environmental strategy centers on reducing its substantial carbon footprint, with a goal to peak CO2 emissions by 2025 and achieve a 40% reduction by 2035. This involves transitioning to cleaner energy sources and improving energy efficiency in its smelting operations, a critical step given the energy-intensive nature of aluminum production.

The company faces significant challenges managing red mud, a hazardous byproduct of alumina refining, and is actively seeking innovative solutions for its utilization and recycling. Furthermore, Chalco must address water pollution and scarcity issues stemming from bauxite mining, implementing advanced water management systems to ensure responsible resource use and prevent contamination.

| Environmental Focus | Chalco's Actions & Goals | Context & Data |

|---|---|---|

| Carbon Emissions | Peak CO2 by 2025, 40% reduction by 2035 | Aluminum production is energy-intensive; Chalco investing in renewables like solar and hydropower. |

| Waste Management (Red Mud) | Comprehensive utilization and recycling efforts | Red mud is a significant hazardous byproduct; innovation in management is key for sustainability. |

| Water Management | Reducing water consumption, preventing pollution | China faced water stress in 2023; Chalco must implement efficient water use and recycling. |

| Bauxite Sourcing | Focus on responsible sourcing | Reliance on imports (e.g., Guinea in 2023) links Chalco to global environmental practices. |

PESTLE Analysis Data Sources

Our Aluminum Corp of China PESTLE Analysis is built on a robust foundation of data from leading global financial institutions, official Chinese government reports, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.