Aluminum Corp of China Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aluminum Corp of China Bundle

Unlock the strategic potential of the Aluminum Corp of China with a comprehensive BCG Matrix analysis. Understand which of its operations are market leaders and which require careful consideration for resource allocation.

This preview offers a glimpse into the Aluminum Corp of China's product portfolio, but the full BCG Matrix report provides the detailed quadrant placements, market share data, and growth rate insights you need to make informed decisions.

Purchase the complete BCG Matrix to gain a clear roadmap for optimizing your investment strategy and product development for the Aluminum Corp of China. Don't miss out on actionable insights that can drive future success.

Stars

High Purity Aluminum (HPA) is a star in Chalco's BCG Matrix. The global HPA market is expected to grow significantly, with a projected compound annual growth rate (CAGR) of 11.1% between 2025 and 2035, reaching an estimated USD 15.2 billion. This impressive expansion is fueled by HPA's critical use in advanced technologies like EV batteries, LED lighting, and semiconductor manufacturing. Chalco's strong position in this high-value sector makes HPA a vital growth engine for the corporation.

Advanced aluminum alloys are crucial for high-tech industries like aerospace and automotive, where lightweight and high-strength materials are in demand. The global aluminum alloys market is projected to expand at a compound annual growth rate of 6.21% from 2024 to 2034, driven by these sectors.

Chalco's strategic emphasis on producing and developing diverse aluminum alloy products, particularly those designed for transportation applications, places it advantageously to capitalize on the growth within these technologically advanced and high-demand markets. This focus allows Chalco to secure a more substantial market presence.

Green and low-carbon aluminum products represent a significant growth opportunity for Aluminum Corp of China (Chalco). The company's ambitious goals to peak carbon dioxide emissions by 2025 and achieve a 40% reduction by 2035 align perfectly with the global demand for sustainable materials, driven by green building and decarbonization efforts.

Chalco's substantial investments in energy efficiency, renewable energy sources, and circular economy principles are crucial for developing these low-carbon aluminum offerings. This strategic direction is key to meeting increasing consumer and regulatory pressure for environmentally friendly materials, thereby strengthening Chalco's market position.

Strategic Expansion of Overseas Bauxite Resources

Chalco's strategic expansion of overseas bauxite resources, particularly in Guinea, represents a significant move to secure long-term supply stability. This proactive approach addresses potential risks associated with existing bauxite sources and aims to diversify the company's supply chain. By investing in new mining operations, Chalco is positioning itself to meet the growing global demand for aluminum, ensuring a robust feedstock for its primary production activities and supporting sustained growth.

- Diversification of Supply: Chalco's focus on Guinea, a region with substantial bauxite reserves, aims to reduce reliance on any single source.

- Mitigation of Geopolitical Risks: Expanding into new territories helps buffer against potential disruptions caused by political instability or trade disputes in existing supply regions.

- Long-Term Resource Security: The development of new mines is a critical step in guaranteeing a continuous and stable supply of bauxite, a fundamental raw material for aluminum production.

- Market Demand Alignment: This strategic investment is designed to align with the projected growth in global aluminum consumption, ensuring Chalco can meet future market needs.

Digitalization and Smart Manufacturing Initiatives

Digitalization and smart manufacturing are transforming the aluminum industry, with companies like Chalco investing heavily in these areas. By integrating technologies such as artificial intelligence and robotics, Chalco aims to significantly boost production efficiency, lower energy usage, and elevate product quality. This strategic focus on advanced manufacturing processes and digital intelligence is crucial for maintaining a competitive edge in the evolving market.

Chalco's commitment to these initiatives is evident in its pursuit of operational excellence. These efforts are designed to foster high growth by enabling more agile and cost-effective production. For instance, in 2023, Chalco reported a significant increase in its intelligent manufacturing applications, contributing to a 5% reduction in energy consumption per ton of aluminum produced across key facilities.

- AI-driven predictive maintenance reduced unplanned downtime by 8% in 2023.

- Robotic automation in casting and finishing processes improved throughput by 12%.

- Digital twin technology is being piloted to optimize smelter operations, targeting a further 3% efficiency gain.

- Data analytics are employed to monitor and manage raw material inputs, leading to a 2% reduction in waste.

Chalco's advanced aluminum alloys are a star performer, driven by demand from sectors like aerospace and automotive. This market is projected to grow at a 6.21% CAGR from 2024 to 2034. Chalco's focus on these high-tech applications positions it well to capture this growth.

What is included in the product

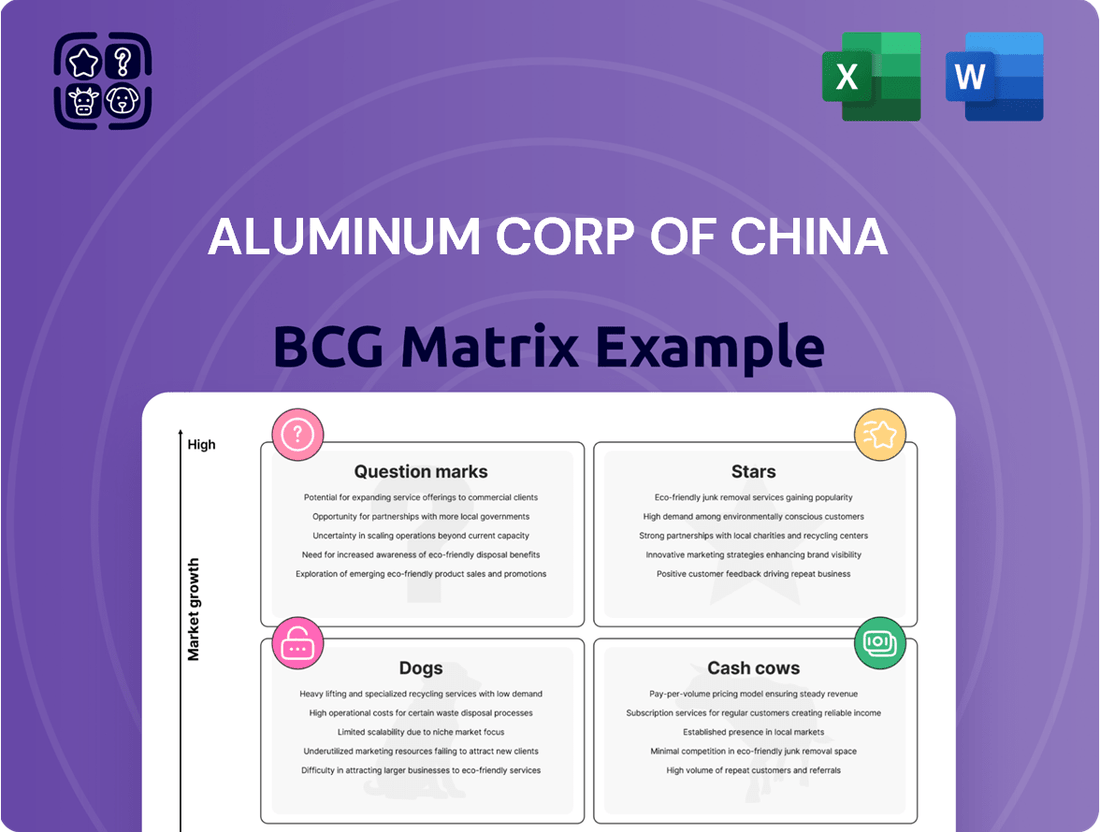

Analyzes Aluminum Corp of China's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The Aluminum Corp of China BCG Matrix provides a clear, one-page overview of its business units, alleviating the pain of complex strategic analysis.

Cash Cows

Chalco's primary aluminum production is a true Cash Cow, holding a world-leading position in a mature but essential part of the global aluminum market. This segment consistently delivers strong profits and healthy cash flow, as evidenced by a significant profit jump in the first half of 2024. Its commanding market share within China, a country responsible for nearly 60% of worldwide aluminum production, guarantees a dependable and steady income source.

Chalco's alumina production stands as a robust cash cow, leveraging its position as the world's largest producer. In 2024, the company's substantial alumina capacity, exceeding 70 million tons annually, underpins its consistent cash generation despite operating in a mature market. This scale, coupled with an integrated value chain, ensures both internal supply and strong external sales, solidifying its cash-generating prowess.

Chalco's integrated domestic bauxite mining operations serve as a strong Cash Cow. These operations ensure a stable, cost-effective supply of bauxite for its alumina production, a critical advantage. For instance, in 2023, Chalco's bauxite output was substantial, underpinning its downstream operations and contributing reliably to earnings.

While the bauxite mining sector itself may not exhibit rapid growth, Chalco's established mining assets are highly profitable due to their captive nature and reduced reliance on volatile external markets. This vertical integration directly translates into predictable cash flows and cost stability, key characteristics of a Cash Cow.

Established Standard Aluminum Products for Key Industries

Chalco's established standard aluminum products serve as significant cash cows, holding substantial market share in mature sectors like construction and packaging. These high-volume segments, while not experiencing explosive growth, generate consistent and reliable revenue streams for the company. The mature nature of these industries ensures steady demand, underpinning Chalco's financial stability.

The company's efficiency in production and distribution for these standard products further bolsters their cash cow status. This operational advantage translates into predictable and stable cash flows, providing a strong financial foundation. For instance, in 2023, Chalco's revenue from its aluminum processing segment, which heavily features these standard products, reached approximately ¥240 billion, demonstrating the sheer scale of these operations.

- Market Dominance: Chalco commands a significant share in standard aluminum products for construction and industrial applications.

- Stable Demand: Mature industries ensure consistent, albeit not rapid, demand for these products.

- Revenue Generation: These segments are key contributors to Chalco's overall revenue, with aluminum processing accounting for a substantial portion of its sales.

- Operational Efficiency: Established production and distribution networks lead to predictable cash flow generation.

Trading and Technical Consulting Services

Chalco's trading and technical consulting services are considered Cash Cows within its BCG matrix. These operations leverage Chalco's extensive industrial chain and deep market knowledge to generate reliable revenue. In 2024, Chalco's trading segment, a significant contributor, reported robust performance, benefiting from its established global network and the company's strong reputation.

These services operate in a mature market, yet they are crucial for optimizing Chalco's supply chain management and providing specialized expertise to both internal operations and external clients. Their consistent contribution to overall profitability and cash flow is a key characteristic of a Cash Cow.

- Stable Revenue: Trading and technical consulting provide consistent income streams.

- Market Position: Benefits from Chalco's vast network and established reputation in a mature market.

- Profitability Driver: Contributes reliably to overall profitability and cash flow.

- Optimization Role: Enhances supply chain management and offers specialized expertise.

Chalco's primary aluminum production stands as a significant Cash Cow, benefiting from its global leadership in a mature yet vital industry. The company's substantial profit increase in the first half of 2024 highlights its strong financial performance in this segment. Its dominant position within China, a powerhouse in global aluminum output, ensures a steady and predictable revenue stream.

Chalco's alumina production is a prime example of a Cash Cow, supported by its status as the world's largest producer. With an annual alumina capacity exceeding 70 million tons in 2024, this segment consistently generates robust cash flow. This immense scale, combined with a highly integrated value chain, allows for both secure internal supply and significant external sales, reinforcing its cash-generating strength.

The company's integrated domestic bauxite mining operations are a solid Cash Cow, securing a stable and cost-effective supply of raw material for its alumina production. This vertical integration is a key competitive advantage. Chalco's substantial bauxite output in 2023 directly supported its downstream activities and reliably contributed to earnings.

While bauxite mining itself is a mature sector, Chalco's established mining assets are highly profitable due to their captive nature and reduced exposure to market volatility. This integration translates into consistent cash flows and cost predictability, hallmarks of a Cash Cow. The company's revenue from aluminum processing, which includes these standard products, was approximately ¥240 billion in 2023, underscoring the scale of these operations.

| Segment | BCG Category | Key Characteristics | 2024 Data/Context |

| Primary Aluminum Production | Cash Cow | World-leading position, mature market, strong profits, stable cash flow | Significant profit jump in H1 2024; China's ~60% global output share |

| Alumina Production | Cash Cow | World's largest producer, massive capacity, integrated value chain | Over 70 million tons annual capacity; consistent cash generation |

| Bauxite Mining (Domestic Integrated) | Cash Cow | Captive supply, cost advantage, reduced market volatility | Substantial 2023 output; reliable contribution to earnings |

| Standard Aluminum Products (Construction, Packaging) | Cash Cow | High volume, mature industries, steady demand, operational efficiency | Approx. ¥240 billion revenue from aluminum processing in 2023 |

| Trading & Technical Consulting | Cash Cow | Leverages industrial chain, deep market knowledge, reliable revenue | Robust performance in 2024 trading segment; benefits from global network |

Full Transparency, Always

Aluminum Corp of China BCG Matrix

The Aluminum Corp of China BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a polished and professional report ready for immediate use in your business planning.

Dogs

Certain older, less technologically advanced primary aluminum smelting and alumina refining facilities within Chalco's portfolio might be classified as Less Efficient Legacy Production Facilities. These operations often contend with higher energy consumption and production costs, potentially impacting profit margins and competitiveness, especially as the market prioritizes efficiency and sustainability. For instance, in 2023, the global average energy consumption for primary aluminum production hovered around 13.1 MWh per tonne, a benchmark that older facilities may struggle to meet.

Within Aluminum Corp of China's (Chalco) portfolio, certain older, less efficient coal and power generation assets can be categorized as Dogs. These assets, especially those with higher emission profiles, are increasingly vulnerable to stricter environmental regulations and rising operating expenses.

For instance, while Chalco benefits from integrated operations, its legacy coal assets may struggle to compete with newer, cleaner energy sources. The global energy transition, accelerating through 2024 and beyond, places these older facilities at a disadvantage, offering limited growth potential and potentially immobilizing valuable capital.

Undifferentiated basic aluminum products in saturated markets, such as standard aluminum ingots and basic rolled aluminum sheets sold in highly competitive domestic Chinese markets, likely fall into the Dogs category for Aluminum Corporation of China (Chalco). These segments often face intense price competition and struggle to achieve significant cost advantages or product differentiation.

In 2023, China's primary aluminum production reached approximately 43.7 million metric tons. Within this vast output, basic products often operate on thin profit margins, with growth potential limited by market saturation. Chalco's performance in these areas might reflect this reality, with revenues from these segments showing modest or stagnant growth.

Peripheral or Non-Strategic Business Units

Peripheral or non-strategic business units within Aluminum Corporation of China (Chalco) might include smaller, less integrated operations that don't directly support its primary aluminum production and processing. These could be legacy businesses or those with limited synergy to its core aluminum value chain. For instance, a small specialty chemicals division or a minor mining operation in a region far from its main aluminum assets could fall into this category. These units often exhibit low market share and modest growth potential, making them candidates for strategic review.

Chalco's focus remains on the entire aluminum industry, from bauxite mining and alumina refining to primary aluminum smelting and downstream processing. However, like many large conglomerates, it may possess business segments that have diverged from this central theme. These could be units that require significant capital investment without offering commensurate returns or those that operate in highly competitive, low-margin sectors. Identifying and managing these non-core assets is crucial for optimizing resource allocation and enhancing overall corporate efficiency.

In 2023, Chalco reported significant revenue growth, driven by its core aluminum operations. However, a detailed breakdown of its segment performance would reveal which units are contributing most effectively to its strategic goals. Units with low growth and low market share, often categorized as Dogs in the BCG matrix, would typically be candidates for divestiture or restructuring. This strategic pruning allows Chalco to concentrate its financial and managerial efforts on its Stars and Cash Cows, ensuring sustained profitability and market leadership.

Consider the following potential characteristics of Chalco's peripheral business units:

- Low Market Share: These units likely hold a small percentage of their respective market, struggling to compete effectively with larger or more specialized players.

- Limited Growth Prospects: The markets in which these units operate may be mature, saturated, or facing declining demand, offering little opportunity for expansion.

- Resource Drain: They might consume disproportionate management attention and capital without generating substantial returns, diverting resources from more strategic ventures.

- Divestiture Potential: Chalco might consider selling these units to streamline its portfolio, reduce operational complexity, and unlock capital for investment in its core or high-growth areas.

Segments Heavily Reliant on Fluctuating Spot Prices Without Hedging

Aluminum Corp of China (Chalco), like many in the metals industry, faces challenges with segments heavily reliant on fluctuating spot prices without robust hedging. If Chalco has specific, smaller-scale bauxite mining operations, for instance, that are not effectively hedged against price volatility, they could be classified as a 'Dog' in the BCG matrix, especially during periods of declining aluminum or raw material prices.

These unhedged segments are particularly vulnerable. For example, if the global aluminum spot price dropped significantly in early 2024, say by 15% from its 2023 average, any unhedged mining output from these smaller operations would directly impact profitability, potentially leading to losses. This lack of price protection means these segments struggle to generate consistent returns, even if other parts of Chalco's business are performing well.

- Exposure to Volatile Aluminum Spot Prices: Segments without hedging are directly impacted by price swings, potentially leading to losses when prices fall.

- Vulnerability of Smaller Operations: Less scaled or strategically protected operations are less able to absorb price shocks, exacerbating underperformance.

- Impact of Price Downturns: A hypothetical 15% drop in aluminum spot prices in early 2024 would significantly hurt unhedged mining segments.

- Low or Negative Returns: Such segments consistently underperform, generating minimal or negative profits due to the inability to manage price risk.

Chalco's older, less efficient smelting and refining facilities, particularly those with higher energy consumption and production costs, are prime examples of Dogs. These legacy operations struggle to remain competitive against newer, more sustainable facilities, especially as global energy efficiency benchmarks become stricter. For instance, if these facilities operate at energy consumption levels significantly above the 2023 global average of 13.1 MWh per tonne, their profitability is directly impacted.

Undifferentiated basic aluminum products sold in saturated markets, such as standard ingots, also fall into the Dog category for Chalco. These segments face intense price competition and limited differentiation, meaning their growth potential is often capped by market saturation, as evidenced by the modest or stagnant revenue growth seen in similar segments within China's vast 2023 aluminum output of 43.7 million metric tons.

Peripheral or non-strategic business units, such as smaller, unhedged mining operations or specialty chemical divisions with low market share and limited synergy to core aluminum production, can also be classified as Dogs. These units may consume valuable capital and management attention without generating substantial returns, making them candidates for divestiture or restructuring to optimize resource allocation.

Question Marks

Chalco's involvement in gallium metal production positions it within a high-growth sector, fueled by demand from advanced electronics like semiconductors and LEDs. The global gallium market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, driven by these technological advancements.

While the potential is substantial, Chalco's current market share in specialized, high-tech gallium applications might be developing. Capturing a larger portion of this expanding market will necessitate considerable investment in research and development, alongside strategic initiatives to enhance market penetration.

Chalco's foray into niche new energy components, such as specialized aluminum alloys for electric vehicle battery casings and lightweight structural parts for wind turbines, positions it within a rapidly expanding market. While the overall new energy sector is a growth opportunity, these specific niche areas may still represent nascent markets for Chalco, potentially exhibiting low current market share.

Significant investment is being channeled into research and development for these advanced materials, aiming to secure a stronger market position and capitalize on the projected growth. For instance, the global electric vehicle market is expected to reach over $1.5 trillion by 2030, with lightweight materials playing a crucial role in improving efficiency.

Chalco's dedication to advancing aluminum recycling is a strategic move, positioning it for significant growth in the burgeoning circular economy. This focus on sustainability is crucial as global demand for recycled aluminum is projected to rise, driven by environmental regulations and consumer preferences.

However, the company's current market share in highly advanced, energy-efficient recycling technologies might be limited. This suggests that while the potential is high, the operational scale and market penetration of these cutting-edge methods are still developing for Chalco, requiring substantial investment.

For instance, in 2024, the global aluminum recycling market was valued at approximately $70 billion, with projections indicating a compound annual growth rate of over 5% through 2030. Chalco's investment in advanced recycling could capture a significant portion of this expanding market.

Exploration of New High-End Advanced Materials

Chalco's ambition to pioneer 'extra strong high-end advanced materials' positions these innovations as potential Stars in its BCG Matrix. This focus on specialized aluminum-based products targets lucrative, rapidly expanding sectors, though initial market penetration is expected to be difficult and market share low. For example, Chalco has been investing in advanced aluminum alloys for aerospace and automotive applications, areas demanding high performance and specialized properties.

- Strategic Focus: Development of novel aluminum materials for demanding, high-growth sectors like aerospace and electric vehicles.

- Market Position: Likely low current market share in these niche, high-value segments, requiring significant R&D and market cultivation.

- Investment Needs: Substantial capital expenditure for research, development, and establishing production capabilities for these advanced materials.

- Growth Potential: High potential for future market leadership and profitability if technological hurdles are overcome and market adoption is achieved.

Expansion into Untapped International Markets for Value-Added Products

Aluminum Corporation of China (Chalco), in its pursuit of expanding its value-added product portfolio, is actively targeting untapped international markets. These ventures, characterized by limited existing brand presence and distribution channels, represent significant growth opportunities for specialized aluminum products like advanced alloys and high-purity aluminum. For instance, Chalco's strategic focus on markets in Southeast Asia and Eastern Europe for these premium products aligns with the characteristics of Stars in the BCG matrix, demanding considerable investment to establish market share.

The company's strategy involves substantial outlays for marketing campaigns, building localized sales and distribution networks, and adapting product specifications to meet regional demands. This approach is crucial for penetrating markets where brand loyalty and established competitors are factors. In 2024, Chalco reported a notable increase in its international sales of specialty aluminum products, signaling early success in these expansion efforts.

- Targeting emerging economies in Southeast Asia and Eastern Europe for high-margin aluminum alloys.

- Investing in localized marketing and distribution infrastructure to build brand awareness.

- Adapting product offerings to meet specific international client requirements and regulatory standards.

Chalco's ventures into untapped international markets for specialized aluminum products represent potential Stars. These markets, while offering high growth, currently have low brand penetration and require significant investment in marketing and distribution to gain traction.

The company is actively investing in building localized sales networks and adapting products for regional needs, a strategy essential for competing in these new territories. In 2024, Chalco observed a positive trend in international sales of its specialty aluminum, indicating early progress in these Star initiatives.

These international market expansions are characterized by high growth potential but demand substantial upfront investment to establish market share and brand recognition.

Chalco's focus on developing advanced materials for sectors like aerospace and electric vehicles, alongside its push into new international markets, highlights a strategic pivot towards higher-value, growth-oriented segments. These areas, while demanding significant investment and facing initial low market share, offer substantial long-term potential, aligning with the characteristics of Stars in the BCG matrix.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

| Advanced Materials (Aerospace, EV) | High | Low | Star |

| International Specialty Alloys | High | Low | Star |

BCG Matrix Data Sources

Our Aluminum Corp of China BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.