Aluminum Corp of China Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aluminum Corp of China Bundle

The Aluminum Corp of China faces significant competitive pressures, with intense rivalry among existing players and substantial bargaining power from key suppliers impacting profitability. The threat of substitutes, while present, is somewhat mitigated by the unique properties of aluminum in many applications.

The complete report reveals the real forces shaping Aluminum Corp of China’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global bauxite supply, crucial for aluminum production, experienced notable disruptions in 2024, particularly from major exporting nations like Guinea and Brazil. This concentration among key suppliers grants them significant leverage, as seen in the sharp increases in alumina prices during the latter half of 2024.

Aluminum Corporation of China (Chalco) is somewhat insulated from these external pressures due to its vertically integrated operations, which include substantial bauxite mining capacity. This internal resource control helps to lessen its dependence on outside suppliers and mitigates the impact of global supply volatility.

Electricity is a cornerstone of aluminum production, representing a substantial 40% of the total cost. Consequently, any uptick in energy prices directly squeezes profit margins for companies like Aluminum Corp of China (Chalco).

Looking ahead to 2025, global energy prices are expected to see a moderate but steady increase. This trend is fueled by a combination of geopolitical dynamics and the ongoing shift towards renewable energy sources, making energy suppliers increasingly influential.

This rising influence of energy providers amplifies their bargaining power. It necessitates that aluminum manufacturers, including Chalco, proactively invest in energy efficiency measures and explore renewable energy alternatives to mitigate cost pressures and secure future supply.

While Chalco has its own bauxite, switching raw material suppliers for bauxite or alumina incurs substantial logistical and operational costs. These include renegotiating contracts, reconfiguring supply chains, and verifying the quality of new materials, which can bolster the leverage of established, dependable suppliers.

Threat of Forward Integration by Raw Material Suppliers

The threat of forward integration by raw material suppliers, such as bauxite or alumina producers, poses a potential, though often distant, concern for aluminum manufacturers like Chalco. If the profit margins in aluminum smelting become significantly appealing, these suppliers might consider moving into direct aluminum production.

However, the immense capital investment required for aluminum smelting acts as a substantial barrier to entry, making this a less immediate threat. This underlying possibility nonetheless pressures companies like Chalco to remain highly competitive in their pricing and operational efficiency to deter such moves.

For instance, in 2023, the global aluminum market saw significant price volatility, with the London Metal Exchange (LME) aluminum price fluctuating. This volatility can impact the attractiveness of downstream integration for raw material suppliers. Chalco’s 2023 revenue was approximately RMB 225.3 billion, underscoring the scale of operations that would need to be matched by a forward-integrating supplier.

- Bauxite and Alumina Supply Chain: Suppliers of key inputs like bauxite and alumina hold potential leverage if they consider integrating forward into aluminum production.

- Capital Intensity Barrier: The high capital expenditure associated with aluminum smelting significantly limits the feasibility of forward integration for most raw material suppliers.

- Competitive Pressure: The mere possibility of forward integration encourages incumbent aluminum producers like Chalco to maintain cost efficiency and competitive pricing strategies.

- Market Dynamics: Fluctuations in aluminum prices, such as those seen in 2023, can influence the strategic decisions of raw material suppliers regarding downstream integration.

Availability of Substitute Raw Materials

For primary aluminum production, the availability of substitute raw materials for bauxite and alumina is quite limited, granting significant bargaining power to their suppliers. This scarcity means that companies like Chalco (Aluminum Corp of China) often have few alternatives when sourcing these essential inputs.

However, the landscape is shifting with the increasing emphasis on recycled aluminum. This secondary aluminum production requires substantially less energy and fewer raw material inputs compared to primary production.

The growing availability and adoption of recycled aluminum can, over time, dilute the bargaining power of primary raw material suppliers. For instance, in 2024, the global aluminum recycling rate is projected to remain robust, with North America and Europe leading in collection and processing efficiencies, thereby offering a viable alternative for some manufacturers.

- Limited Substitutes for Primary Inputs: Bauxite and alumina have few direct substitutes in primary aluminum smelting, strengthening supplier leverage.

- Rise of Recycled Aluminum: Secondary aluminum production offers a significant alternative, reducing reliance on virgin materials.

- Energy and Resource Efficiency: Recycling aluminum uses up to 95% less energy than primary production, making it economically attractive.

- Market Impact: Increased recycling rates in 2024 and beyond can indirectly curb the bargaining power of bauxite and alumina producers.

Suppliers of bauxite and alumina hold considerable power due to the limited availability of substitutes for primary aluminum production. This scarcity forces companies like Chalco to rely heavily on existing suppliers, increasing their leverage. For example, disruptions in Guinea's bauxite exports in early 2024 led to immediate price hikes, demonstrating this supplier influence.

While Chalco benefits from its own bauxite reserves, the high costs associated with switching raw material suppliers, including logistical and contractual hurdles, further solidify the position of dependable suppliers. The threat of forward integration by these suppliers into aluminum smelting is mitigated by the immense capital investment required for such operations, acting as a significant barrier to entry.

The growing importance of recycled aluminum offers a counter-balance to the bargaining power of primary raw material suppliers. With recycling rates remaining strong in 2024, particularly in regions like North America and Europe, this secondary source of aluminum provides manufacturers with an alternative that reduces dependence on virgin materials and their associated supply chain pressures.

| Factor | Impact on Chalco | Supporting Data/Trend |

|---|---|---|

| Bauxite/Alumina Availability | High Supplier Bargaining Power | Limited substitutes, disruptions in 2024 (e.g., Guinea) caused price spikes. |

| Switching Costs | Reinforces Supplier Leverage | Substantial logistical and operational costs for changing suppliers. |

| Forward Integration Threat | Low Immediate Threat | High capital expenditure for smelting acts as a barrier; observed in 2023 LME price volatility impacting supplier strategy. |

| Recycled Aluminum | Dilutes Supplier Power | Energy efficient (up to 95% less energy); robust recycling rates in 2024 globally. |

What is included in the product

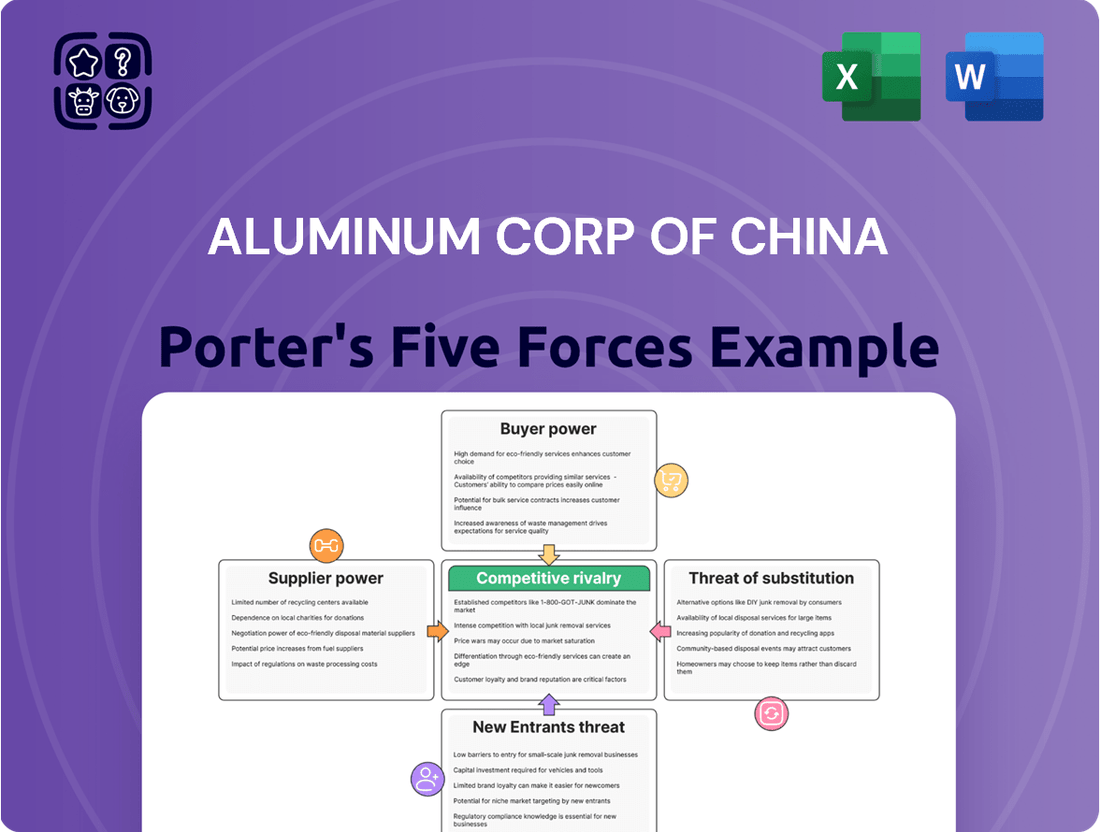

This analysis examines the competitive intensity faced by Aluminum Corp of China by dissecting the bargaining power of its suppliers and buyers, the threat of new entrants and substitutes, and the rivalry among existing players in the global aluminum market.

Instantly visualize competitive pressures on Chalco, enabling proactive strategy adjustments against rivals and suppliers.

Customers Bargaining Power

Chalco's diverse end-use industries, including transportation, construction, packaging, and electrical sectors, significantly dilute customer bargaining power. This broad market reach means that even if one sector experiences a downturn, demand from others can stabilize overall sales. For instance, the burgeoning electric vehicle market, a key consumer of aluminum, saw production increase by over 30% globally in 2023, creating robust demand for Chalco's products.

The price sensitivity of customers significantly impacts Aluminum Corp of China. While demand for aluminum is generally strong, buyers, especially in price-conscious industries, can push for lower prices, particularly during market surpluses or when substitute materials become more economical. For instance, a notable increase in aluminum prices, perhaps driven by rising energy or bauxite costs, could prompt some customers to decrease their consumption, as seen in historical shifts where automotive manufacturers explored lighter plastics or advanced composites to manage costs.

Customers possess significant leverage when readily available substitutes exist for aluminum. For instance, steel, plastics, and various composite materials can often fulfill similar functional requirements across different industries, directly impacting demand for aluminum.

The growing emphasis on environmental responsibility further bolsters this, with recycled aluminum emerging as a compelling alternative to primary aluminum. In 2023, the global recycled aluminum market was valued at approximately $70 billion, demonstrating a strong preference for sustainable options.

Furthermore, the continuous development and expanding market for specialized aluminum alloys provide customers with an even wider array of choices. This proliferation of alternatives directly enhances their bargaining power, allowing them to negotiate more favorable terms or switch suppliers with greater ease.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Aluminum Corp of China (Chalco) is generally low. While large industrial buyers with substantial and consistent aluminum needs might contemplate producing their own aluminum to control supply and costs, the immense capital outlay and specialized knowledge needed for smelting operations present significant hurdles. For instance, establishing a new aluminum smelter can cost billions of dollars, a prohibitive expense for most potential integrating customers.

- High Capital Investment: Building an aluminum smelter requires billions of dollars in upfront capital, deterring most customers.

- Technical Expertise: Operating an aluminum smelter demands specialized knowledge in areas like electrolysis and raw material processing.

- Economies of Scale: Chalco benefits from significant economies of scale in production, making it difficult for individual customers to match cost efficiency through backward integration.

- Supply Chain Complexity: Managing the entire aluminum supply chain, from bauxite mining to finished products, is complex and resource-intensive.

Volume of Purchases and Customer Concentration

The bargaining power of customers is significantly influenced by the volume of their purchases and their concentration within specific industries. For Aluminum Corp of China (Chalco), while its customer base is broad, large-volume buyers, such as major automotive manufacturers or significant players in the packaging sector, can exert considerable influence. These substantial purchasers can leverage their purchasing scale to negotiate more favorable pricing and terms, directly impacting Chalco's profitability.

For instance, in 2024, the automotive industry continued to be a major consumer of aluminum, with global vehicle production expected to reach over 90 million units. A few dominant automotive groups within this market could represent a significant portion of Chalco's sales, giving them enhanced negotiation leverage. Similarly, the packaging industry, driven by consumer demand for lightweight and recyclable materials, also presents concentrated pockets of large-scale buyers.

- Automotive Sector Demand: In 2024, global automotive production is projected to be around 90 million vehicles, with aluminum usage per vehicle steadily increasing.

- Packaging Industry Growth: The demand for aluminum in packaging is robust, driven by sustainability trends and consumer preferences for lightweight materials.

- Leveraging Volume: Large automotive and packaging clients can negotiate better pricing due to their consistent, high-volume orders from Chalco.

- Chalco's Mitigation Strategy: Chalco's extensive global presence and diverse product portfolio help to offset the concentrated bargaining power of individual large customers by diversifying its sales channels and customer base.

The bargaining power of customers for Aluminum Corp of China (Chalco) is moderate, influenced by factors like price sensitivity, availability of substitutes, and purchase volume. While Chalco's diverse product range and broad market reach in 2024, serving sectors from transportation to packaging, help dilute individual customer power, large-volume buyers can still negotiate favorable terms. For instance, the automotive sector, a major aluminum consumer, continued its strong demand in 2024, with global production expected to exceed 90 million units, giving large auto manufacturers significant leverage.

| Factor | Impact on Chalco | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Price Sensitivity | Moderate to High | Rising energy costs in 2023-2024 can increase aluminum production costs, making customers more sensitive to price hikes. |

| Availability of Substitutes | Moderate | Steel, plastics, and composites offer alternatives, particularly in construction and automotive, limiting Chalco's pricing power. |

| Purchase Volume/Concentration | Moderate to High | Large automotive and packaging clients, representing significant portions of Chalco's sales, can leverage their volume for better terms. |

| Backward Integration Threat | Low | The substantial capital investment (billions of dollars) and technical expertise required for aluminum smelting deter most customers. |

Preview the Actual Deliverable

Aluminum Corp of China Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for the Aluminum Corporation of China, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You're looking at the actual, ready-to-use document, providing comprehensive insights into the strategic landscape for Chalco.

Rivalry Among Competitors

The global aluminum market is a crowded space, featuring a significant number of large-scale producers worldwide. China stands out as the dominant force, contributing approximately 58% of the total global aluminum production. Aluminum Corporation of China (Chalco) navigates this intensely competitive environment, contending with a vast array of both domestic Chinese manufacturers and international aluminum companies. This high level of competition directly impacts pricing strategies and the ability to maintain or grow market share.

China's government has actively managed its aluminum sector, implementing a primary aluminum capacity cap. In 2024, this cap, alongside stringent environmental regulations, significantly curtails how much new production can be brought online. This policy aims for sustainable development and resource security, directly impacting how competitive rivalry plays out.

While these controls aim to foster greener practices, they also act as a brake on aggressive capacity expansion by established companies like Aluminum Corp of China. This limitation on new supply can lead to a more stable market environment, but it simultaneously intensifies competition for the existing, permitted production capacity.

The aluminum industry is inherently capital and energy-intensive, meaning companies like Aluminum Corp of China face substantial fixed costs from their operations. This high cost base creates a constant need to maintain production volumes to spread these expenses, intensifying competitive pressures.

Fluctuations in key input costs, such as alumina and electricity, directly impact profitability. For instance, in 2023, global energy prices saw volatility, which, coupled with alumina market dynamics, squeezed margins for many aluminum producers. This cost sensitivity often forces companies to compete aggressively on price to ensure they can cover their significant operating expenses.

When the market experiences oversupply, this price competition becomes particularly fierce. Companies may lower prices to move inventory and maintain capacity utilization, even if it means accepting thinner profit margins. This dynamic is a direct consequence of the high fixed costs inherent in aluminum production.

Product Differentiation and Specialization

While the primary aluminum market largely operates as a commodity, Aluminum Corporation of China (Chalco) can carve out differentiation through specialized aluminum alloy products and value-added services. For instance, Chalco's extensive involvement across the entire aluminum value chain, from bauxite mining to downstream processing, enables them to develop and market a range of specific alloy compositions tailored to industries like automotive and aerospace, offering a degree of uniqueness.

However, the inherent nature of aluminum as a widely used metal presents a significant challenge to achieving high levels of product differentiation across the industry. Even with specialized alloys, the core product remains relatively standardized, making it difficult for any single player to command substantial pricing power solely based on product uniqueness.

- Specialization in Alloys: Chalco's ability to produce advanced aluminum alloys for specific applications, such as high-strength alloys for automotive lightweighting, provides a competitive edge.

- Value-Added Services: Offering services like custom cutting, precision machining, and technical support can differentiate Chalco from competitors focused purely on raw material supply.

- Sustainable Production: In 2023, there was a growing emphasis on green aluminum production. Chalco's investments in renewable energy sources for its smelters, like those in Guizhou province, can be a significant differentiator, appealing to environmentally conscious customers.

Industry Growth and Market Balance

The global aluminum market is expected to see continued growth, fueled by strong demand from sectors like automotive and construction. For instance, the automotive industry's push for lighter vehicles to improve fuel efficiency is a significant driver.

However, this growth doesn't guarantee a perfectly balanced market; shifts between surplus and deficit are common. Looking ahead to 2025, projections indicate a minor surplus in the global aluminum market.

This potential surplus, coupled with uncertainties surrounding supply growth, points to an intensely competitive landscape. Companies like Aluminum Corp of China will need to be highly strategic in managing their production levels and pricing to navigate this environment.

- Projected Market Balance: A minor surplus is anticipated for the global aluminum market in 2025.

- Demand Drivers: Key sectors such as automotive and construction are expected to propel market growth.

- Competitive Intensity: Uncertain supply growth alongside a potential surplus indicates a highly competitive market.

- Strategic Imperative: Companies must focus on efficient production and dynamic pricing strategies.

Competitive rivalry within the aluminum sector is fierce, driven by a large number of global producers, with China accounting for a significant portion of output. Aluminum Corporation of China (Chalco) faces intense competition from both domestic and international players, which directly influences pricing and market share dynamics. China's government-imposed capacity caps and environmental regulations in 2024 further shape this competitive landscape by limiting new production, thereby intensifying competition for existing capacity.

The industry's high capital and energy intensity, coupled with volatile input costs like alumina and electricity, as seen in 2023, forces companies into aggressive price competition to cover substantial operating expenses. This pressure is amplified during periods of oversupply, where companies may lower prices to maintain production volumes and capacity utilization, even at the cost of reduced profit margins.

While aluminum is largely a commodity, Chalco can achieve some differentiation through specialized alloys and value-added services, such as custom machining and technical support. For example, Chalco's integrated value chain allows for tailored alloy development for sectors like automotive and aerospace. However, the standardized nature of the core product limits the extent to which any single company can command significant pricing power solely through product uniqueness.

| Metric | 2023 Data/Projection | Impact on Rivalry |

|---|---|---|

| Global Aluminum Production Share (China) | ~58% | Dominance of Chinese producers intensifies rivalry. |

| China's Capacity Cap | In effect for 2024 | Limits new supply, heightening competition for existing capacity. |

| Energy Cost Volatility | Experienced in 2023 | Drives price competition to cover high operating costs. |

| Projected Market Balance (2025) | Minor Surplus | Indicates a highly competitive market environment. |

SSubstitutes Threaten

Recycled aluminum stands as a potent substitute for primary aluminum, notably demanding about 95% less energy for its production. This significant energy saving makes it an attractive alternative, especially in an era focused on efficiency and sustainability.

The global aluminum sector is actively embracing circular economy principles, projecting the share of secondary aluminum production to reach 42% by 2030. This growing reliance on recycled materials directly challenges the market dominance of primary aluminum by offering a more environmentally friendly and cost-effective option.

In the automotive and construction industries, advanced steel and composite materials pose a significant threat of substitution for aluminum. These alternatives are continuously improving their strength-to-weight ratios and durability, directly competing with aluminum's traditional advantages. For instance, by 2024, the global advanced high-strength steel market is projected to reach $75 billion, reflecting substantial investment and innovation in this area.

Plastics continue to be a formidable substitute for aluminum in packaging, largely due to their inherent versatility and lower production costs. For instance, the global plastic packaging market was valued at approximately USD 300 billion in 2023, highlighting its widespread adoption.

However, aluminum's strong environmental credentials, particularly its high recyclability rate – often cited as over 70% globally for aluminum cans – are increasingly resonating with consumers and brands seeking sustainable options. This growing demand for eco-friendly packaging is a key factor in mitigating the threat of substitution from plastics.

Price-Performance Trade-off

The willingness of customers to switch to substitutes for aluminum is significantly influenced by the price-performance trade-off. If aluminum prices escalate due to factors like increased production costs or tariffs, buyers might explore alternatives that offer better value, even if it means a slight reduction in performance characteristics.

This dynamic makes the pricing of aluminum a critical determinant in assessing the threat of substitutes. For instance, in 2024, fluctuations in global aluminum prices, influenced by energy costs and geopolitical events, directly impacted the attractiveness of materials like steel or advanced plastics in sectors such as automotive and construction.

- Aluminum prices in early 2024 saw volatility, with LME aluminum futures trading around $2,200 per metric ton, impacting its competitiveness against steel, which averaged approximately $750 per metric ton.

- In the automotive sector, a 10% increase in aluminum prices could lead manufacturers to reconsider the use of high-strength steel or composite materials if the performance gap narrows sufficiently.

- The energy-intensive nature of aluminum production means that rising electricity prices in key manufacturing regions directly translate to higher aluminum costs, thereby bolstering the appeal of less energy-dependent substitutes.

Technological Advancements in Substitute Materials

Ongoing research and development in alternative materials, like advanced steel alloys or more cost-effective composites, are enhancing their performance, posing a growing threat to aluminum. These advancements could make them more appealing substitutes, impacting demand for aluminum products.

Chalco needs to stay ahead by continuously innovating its aluminum products and production processes. This innovation is crucial to maintain its competitive edge against these evolving material threats and secure its market position.

- Technological advancements in steel alloys: For instance, advancements in high-strength low-alloy (HSLA) steels offer improved strength-to-weight ratios, potentially competing with aluminum in automotive applications.

- Composite material development: Carbon fiber composites, while often more expensive, are seeing cost reductions and performance improvements, making them viable substitutes in aerospace and high-performance vehicles.

- Chalco's R&D focus: In 2023, Chalco reported significant investment in new material research and development, aiming to enhance the properties of its aluminum products and explore new applications, a trend expected to continue into 2024 and beyond.

The threat of substitutes for aluminum is significant, driven by advancements in competing materials like steel, composites, and plastics. Recycled aluminum also presents a growing alternative, demanding less energy to produce. The price-performance ratio is a key factor influencing customer switching behavior, with aluminum price fluctuations in 2024 directly impacting its competitiveness against steel and advanced plastics.

| Substitute Material | Key Applications | Competitive Advantage | 2024 Market Data/Trend |

|---|---|---|---|

| Recycled Aluminum | Packaging, Construction, Automotive | Lower energy consumption (95% less than primary), circular economy appeal | Projected 42% share of secondary production by 2030 |

| Advanced Steel | Automotive, Construction | Improving strength-to-weight, durability | Global advanced high-strength steel market projected to reach $75 billion in 2024 |

| Composites | Aerospace, Automotive | High strength-to-weight, potential cost reduction | Ongoing R&D improving performance and reducing costs |

| Plastics | Packaging | Versatility, lower production costs | Global plastic packaging market valued at ~$300 billion in 2023 |

Entrants Threaten

Establishing new primary aluminum production facilities demands colossal capital outlays, encompassing mining, refining, and smelting. For instance, a new greenfield aluminum smelter project can easily cost billions of dollars, with recent estimates for large-scale facilities often exceeding $5 billion. This substantial financial commitment acts as a significant deterrent for prospective entrants.

Stringent environmental regulations and capacity caps significantly deter new entrants in China's aluminum sector. The government's 2025-2027 development program mandates strict emissions standards and limits primary aluminum production capacity.

New aluminum facilities are expressly forbidden in areas already facing significant pollution. Furthermore, any expansion of existing capacity must be balanced by the retirement of an equivalent amount of older capacity, creating a formidable barrier for any new domestic players aiming to enter the market.

New entrants into the aluminum industry face considerable hurdles in securing essential raw materials like bauxite. Established giants, including Aluminum Corporation of China (Chalco), often possess vertically integrated supply chains, giving them a significant advantage in cost and reliability over newcomers attempting to build their own from the ground up.

Economies of Scale and Cost Advantages of Incumbents

Existing giants in the aluminum industry, such as Aluminum Corporation of China Limited (Chalco), leverage substantial economies of scale. This means they can produce aluminum at a lower cost per unit compared to smaller, newer operations. For instance, Chalco's massive production facilities allow for optimized resource utilization and bulk purchasing of raw materials, contributing to their cost leadership.

New entrants face a significant hurdle in matching these incumbent cost advantages. Starting at a smaller scale, they simply cannot achieve the same per-unit efficiencies. This price disadvantage makes it exceedingly difficult for them to attract customers and gain a foothold in the market. For example, in 2023, the average cost of production for major Chinese aluminum producers was reported to be significantly lower than that of smaller, independent smelters.

- Economies of Scale: Chalco's large-scale operations in 2024 provide a substantial cost advantage over potential new entrants.

- Cost Disadvantage for Newcomers: New entrants would initially operate at smaller scales, leading to higher per-unit production costs.

- Market Entry Barrier: The inability to compete on price due to scale differences acts as a significant deterrent for new companies entering the aluminum market.

Technological Barriers and Innovation Pace

The aluminum industry's reliance on advanced technologies like AI, IoT, and robotics presents a significant barrier to new entrants. These technologies are crucial for optimizing production efficiency and improving sustainability practices.

Newcomers must make substantial investments in cutting-edge research and development to match the capabilities of established players. For instance, companies adopting Industry 4.0 principles in aluminum smelting can see energy consumption reductions of up to 15%.

- High R&D Investment: Significant capital is required to develop and implement advanced manufacturing technologies in aluminum production.

- Intellectual Property: Patents on proprietary processes and technologies create a competitive moat for incumbent firms.

- Skilled Workforce: Operating advanced machinery and AI systems necessitates a highly skilled and trained workforce, which is a challenge for new entrants to acquire quickly.

The threat of new entrants into China's aluminum sector, particularly concerning primary aluminum production, is considerably low. This is primarily due to the immense capital requirements for establishing new facilities, with greenfield smelter projects often exceeding $5 billion. Furthermore, stringent government regulations, including capacity caps and strict environmental standards, significantly limit new market participation. For example, new facilities are prohibited in polluted areas, and capacity expansion requires retiring equivalent older capacity.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Establishing primary aluminum production facilities costs billions of dollars. | Extremely High Barrier |

| Government Regulations | Strict environmental standards and capacity caps limit new entrants. | High Barrier |

| Economies of Scale | Incumbents like Chalco benefit from lower per-unit costs due to large-scale operations. | High Barrier |

| Raw Material Access | Vertically integrated supply chains provide incumbents with cost and reliability advantages. | Significant Barrier |

| Technology & R&D | Advanced manufacturing technologies and proprietary processes require substantial investment. | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aluminum Corp of China (Chalco) is built upon a foundation of publicly available information, including Chalco's annual reports and SEC filings, alongside industry-specific data from research firms like CRU Group and Metal Bulletin.