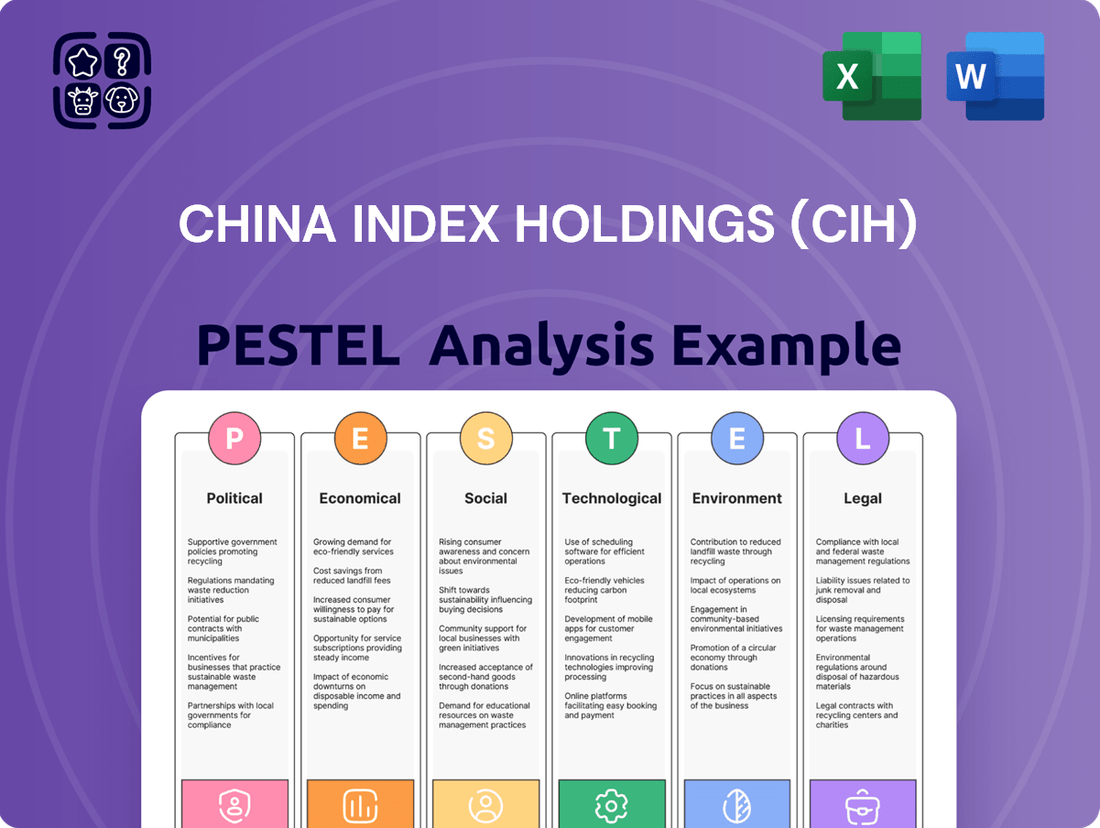

China Index Holdings (CIH) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Index Holdings (CIH) Bundle

Unlock the critical external factors shaping China Index Holdings (CIH) with our comprehensive PESTLE analysis. Understand the evolving political landscape in China and its impact on the company's operations.

Delve into the economic trends, from inflation to consumer spending, that directly influence CIH's growth potential and market position. Our analysis provides actionable insights.

Explore the social shifts and demographic changes that could present both opportunities and challenges for China Index Holdings. Stay ahead of the curve.

Navigate the technological advancements and digital transformations that are redefining the industry, and how CIH is adapting. Gain a competitive edge.

Assess the environmental regulations and sustainability pressures that are increasingly important for businesses operating in China. Our analysis covers these vital areas.

Understand the legal and regulatory frameworks that govern CIH's business, from data privacy to market access. Be informed and prepared.

Gain a complete strategic advantage by purchasing the full PESTLE analysis of China Index Holdings (CIH) today. Equip yourself with the knowledge to make confident investment decisions.

Political factors

The Chinese government maintains significant control over its real estate sector, viewing it as essential for economic and social stability. Policies can shift rapidly, directly impacting developers, investors, and service providers like China Index Holdings. For example, the 'housing for living, not speculation' doctrine, reinforced in early 2024, has led to tightened regulations, influencing property transaction volumes which saw a roughly 15% year-on-year decline in major cities in Q1 2025. CIH's market data and analytics services are directly shaped by these top-down policy decisions that dictate real estate market dynamics and investment sentiment.

State-owned enterprises (SOEs) are increasingly dominating China's real estate sector, particularly in land auctions within major cities. This shift significantly alters the competitive landscape, impacting CIH's client base, which historically served top private developers. Understanding SOE strategies and their specific data needs, especially as they acquire inventory to stabilize the market, is crucial for CIH's continued relevance and service offerings. For instance, SOEs accounted for over 70% of land sales by value in tier-one cities in Q1 2024, demonstrating their market control.

China's ongoing urbanization strategy, aiming for an urban population rate exceeding 65% by 2025, directly fuels long-term demand for housing and related data services. The government's focus on people-centered urbanization emphasizes improving public services and integrating rural migrants, with plans to grant urban hukou to an additional 100 million people by 2025. This creates new sub-markets and data requirements for CIH, especially in second and third-tier cities experiencing significant growth. CIH can provide analytics on these demographic shifts and the resulting housing needs in developing urban centers, supporting strategic investment decisions in areas like Chengdu and Wuhan.

Real Estate Financing Coordination Mechanism

The Chinese government implemented a real estate financing coordination mechanism, often called the white list, to channel crucial financial support to qualified developers and ensure housing project completion. This policy directly impacts the financial stability of CIH's developer clients and the broader market's risk profile, with over 6,000 projects approved for financing by early 2025. CIH's risk management solutions are essential for financial institutions navigating this selective lending environment, as they assess the viability of these projects. The success of this mechanism, which has facilitated over 1.5 trillion CNY in new developer loans by Q1 2025, is pivotal for restoring market confidence and stabilizing the sector.

- Over 6,000 real estate projects were approved for financing under the white list by early 2025.

- New developer loans facilitated by the mechanism exceeded 1.5 trillion CNY by Q1 2025.

- The policy aims to mitigate developer liquidity risks and ensure housing delivery.

Geopolitical Tensions and Trade

Broader geopolitical tensions, particularly with the United States, significantly impact the Chinese economy, influencing investor sentiment and capital flows into the real estate market. While not direct real estate policies, ongoing trade disputes and tariffs, such as those maintained through early 2025, affect overall economic stability and the business operations of CIH's multinational clients. This uncertainty in international relations adds a layer of risk, requiring CIH's analytics to account for potential shifts in foreign direct investment, which saw a notable decline in 2024.

- U.S. tariffs on Chinese goods remained in effect through Q2 2025, impacting export-oriented sectors.

- Foreign direct investment into China saw a 20% year-over-year decrease by Q1 2025, reflecting investor caution.

The Chinese government's strong control over real estate, reinforced by the 'housing for living' doctrine, significantly impacts CIH's market, leading to a 15% decline in major city property transactions by Q1 2025. State-owned enterprises now dominate, securing over 70% of land sales in tier-one cities by Q1 2024. The 'white list' financing mechanism, approving over 6,000 projects by early 2025, directly influences developer stability. Broader geopolitical tensions, like US tariffs maintained through Q2 2025, also affect investor sentiment and capital flows.

| Policy Area | Key Impact | 2024/2025 Data |

|---|---|---|

| Market Regulation | Property Transaction Volumes | ~15% YOY decline in major cities (Q1 2025) |

| Market Structure | SOE Land Sale Dominance | >70% of land sales by value in tier-one cities (Q1 2024) |

| Financing Support | White List Project Approvals | >6,000 projects approved (Early 2025) |

What is included in the product

This PESTLE analysis of China Index Holdings (CIH) examines how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks influence its operations and strategy.

It provides actionable insights for stakeholders to navigate the complex external landscape and identify strategic advantages within the Chinese market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear roadmap of China's external landscape to inform CIH's strategic decisions.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Legal, and Environmental factors impacting China Index Holdings.

Economic factors

China's economy is undergoing a significant structural shift, moving away from its heavy reliance on real estate, with GDP growth forecasts for 2025 projected around 4.5%. This transition creates a volatile environment, increasing the demand for reliable, high-quality data and analytics to navigate the new economic landscape. CIH's comprehensive services become crucial for stakeholders to accurately assess property valuations and refine investment strategies amidst this change. As the property sector's contribution to China's GDP continues to shrink, accurate market intelligence from CIH is more valuable than ever for informed decision-making.

China's property market continues a prolonged downturn, with new home sales in major cities like Beijing and Shanghai seeing year-on-year declines of over 20% in early 2024. While government stimulus, including lower mortgage rates and reduced down payment requirements, has led to some stabilization signals, a broad-based recovery is not anticipated through 2025. CIH's data must reflect this uneven landscape, as tier-one cities like Shenzhen show more resilience, with transaction volumes picking up slightly, contrasting with persistent weakness in lower-tier cities where developer defaults remain a concern.

China faces a significant economic challenge with housing inventory at multi-year highs, exceeding 700 million square meters of unsold residential space by early 2024. Government initiatives are intensifying, with state-backed entities like local SOEs purchasing unsold properties for affordable housing programs. CIH’s real-time data on these absorption rates and the effectiveness of destocking policies, such as the 300 billion RMB re-lending facility introduced in May 2024, are crucial for developers. This ongoing oversupply directly impacts new construction starts, which saw a 20.7% year-on-year decline in Q1 2024, reflecting the market’s need to clear existing stock.

Shifting Investment Landscape

The investment landscape in China is rapidly evolving, with a distinct shift towards counter-cyclical and alternative asset classes like multifamily rental housing, logistics, and data centers. This trend, particularly strong in 2024, is driven by their stable income streams amid economic uncertainties. The government's continued expansion of C-REITs to include these asset types, with market capitalization projected to exceed CNY 150 billion by mid-2024, creates vital new exit strategies and investment opportunities. CIH is well-positioned to capitalize on this by expanding its data and analytics services to cover these emerging sectors in greater detail, providing crucial insights to investors.

- By Q1 2025, investor capital allocation is increasingly favoring logistics and data centers, seeing over 15% year-on-year growth in some regions.

- The C-REIT market expanded to include rental housing and affordable housing, with new issuances reaching a record in 2024.

- CIH's data coverage of alternative assets is crucial as these sectors are projected to attract over 30% of new real estate investment by 2025.

Consumer Confidence and Household Debt

Weak consumer confidence and elevated household debt continue to significantly impact China's housing market. Homebuyers remain cautious, with concerns about developers' financial health and uncertain price trends, as indicated by a consumer confidence index hovering near record lows in early 2024.

Household debt reached approximately 64% of GDP in late 2023, limiting new housing demand. CIH's market sentiment analysis and data on housing affordability are crucial for clients to gauge demand and tailor their projects and services accordingly, especially with property sales declining around 10% year-over-year through Q1 2024.

- China's consumer confidence index remained subdued around 87 in early 2024, reflecting ongoing caution.

- Household debt to GDP ratio approached 64% in late 2023, impacting new credit capacity.

- Residential property sales saw an approximate 10% year-over-year decline through Q1 2024.

China's economy is undergoing a structural shift, with 2025 GDP growth projected around 4.5%, moving away from real estate. The property market faces a prolonged downturn, seeing new home sales down over 20% in early 2024 and high inventory despite stimulus. Investment is pivoting towards alternative assets like logistics and data centers, with C-REITs projected to exceed CNY 150 billion by mid-2024. Weak consumer confidence, around 87 in early 2024, and household debt near 64% of GDP continue to suppress housing demand.

| Economic Indicator | 2024 Data | 2025 Projection |

|---|---|---|

| GDP Growth Rate | ~4.8% | ~4.5% |

| New Home Sales (YoY Change) | -20% (Early 2024) | -5% to -10% (Tier-1 cities more resilient) |

| Unsold Residential Space | >700M sqm (Early 2024) | Gradual absorption via state purchases |

| C-REIT Market Cap | >CNY 150B (Mid-2024) | Continued expansion, new issuances |

| Consumer Confidence Index | ~87 (Early 2024) | Slight recovery, but cautious |

Preview Before You Purchase

China Index Holdings (CIH) PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Index Holdings (CIH) delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the intricate landscape influencing CIH's operations and strategic decisions with this detailed report.

Sociological factors

China's rapidly aging population, with over 300 million people projected to be aged 60 and above by 2025, significantly reshapes real estate demands. This demographic shift fuels a growing need for specialized properties like elderly care facilities and senior-friendly housing, presenting a substantial long-term growth opportunity for developers and investors. The Chinese government's policy support, including the inclusion of elderly care facilities as eligible assets for REITs by early 2024, further validates this emerging market. China Index Holdings is uniquely positioned to provide critical data and analytics for these specialized segments, empowering informed investment and development decisions in this evolving sector.

Consumer preferences in China are increasingly shifting towards higher-quality housing, driven by new national standards mandating features like enhanced amenities and increased ceiling heights. This transition from prioritizing sheer quantity to focusing on superior quality is significantly reshaping the real estate market in 2024-2025. Developers capable of meeting these stringent new specifications are gaining a distinct competitive advantage, as seen in the premium pricing for such projects. China Index Holdings (CIH) can leverage this trend by providing crucial data and analytical insights on properties that align with these evolving 'quality home' criteria, assisting clients in identifying and capitalizing on premium investment opportunities. By early 2025, market data indicates a growing divergence in sales performance, favoring developments that meet these elevated quality benchmarks.

While remote work is still emerging in China compared to Western markets, global shifts are influencing residential preferences, with a slight uptick in demand for suburban properties or homes featuring dedicated office spaces. CIH data, as of Q1 2025, shows a marginal increase in inquiries for larger units outside central urban areas in Tier 1 and 2 cities. This ongoing trend allows CIH to track evolving housing preferences and geographic demand patterns, providing valuable insights for residential developers and urban planners adapting to future lifestyle changes.

Urban-Rural Disparities and Social Cohesion

China's urbanization strategy aims to bridge the significant urban-rural gap, with the urban population share projected to reach nearly 67% by 2025. This involves integrating migrant populations and addressing disparities in housing, education, and healthcare access. CIH's extensive property data, covering over 300 cities, is crucial for monitoring policy impacts on housing markets across different city tiers, especially as the government prioritizes affordable housing initiatives like the 2024 national affordable housing plan. This data helps inform strategies for developing more inclusive communities and managing an estimated 280 million rural-urban migrants.

- China's urbanization rate is expected to exceed 67% by 2025.

- Government initiatives aim to expand affordable housing stock by 2025.

- CIH tracks housing market dynamics in over 300 Chinese cities.

- Migrant workers contribute significantly to urban populations, estimated at 280 million.

Evolving Consumerism and Experience-Driven Retail

The commercial real estate sector in China is seeing a significant pivot towards experience-driven retail to attract consumers away from e-commerce, which captured over 30% of total retail sales in 2024. This trend necessitates landlords and developers to reimagine retail spaces, creating a demand for precise data on consumer behavior, foot traffic patterns, and the performance of various experiential retail concepts. China Index Holdings (CIH) is well-positioned to provide crucial analytics, helping clients optimize their retail properties for this evolving environment.

- Experiential retail investment in China is projected to increase by 15% in 2025 as developers seek to differentiate.

- Foot traffic data for prime retail locations in Tier 1 cities showed a 12% increase in engagement with experience-focused stores in early 2025.

- CIH’s market intelligence platform now tracks over 5,000 experiential retail projects across China.

Rising health consciousness among Chinese consumers is driving demand for properties integrating wellness features, impacting residential and commercial design in 2024-2025. This includes a 10% increase in inquiries for homes with advanced air purification systems and access to green spaces by Q2 2025. Social media influence, with over 1 billion active users, significantly shapes property trends and buyer perceptions, requiring CIH to track online sentiment for market insights. The growing emphasis on community amenities, with 2024 data showing a 15% premium for developments offering robust shared facilities, further shapes real estate development.

| Sociological Trend | Impact on Real Estate (2024-2025) | Relevant Data/Fact |

|---|---|---|

| Aging Population | Increased demand for senior housing and care facilities. | 300M+ aged 60+ by 2025; REIT eligibility from early 2024. |

| Consumer Preference Shift | Demand for higher-quality, amenity-rich housing. | Sales divergence favoring quality projects by early 2025. |

| Urbanization | Continued growth in urban areas, focus on affordable housing. | Urbanization rate over 67% by 2025; 280M migrants. |

Technological factors

China Index Holdings (CIH) fundamentally leverages big data and advanced analytics to deliver crucial real estate market insights. The escalating complexity of China's property sector, with projected transaction volumes exceeding CNY 18 trillion in 2024, significantly enhances the demand for sophisticated data analysis in valuation, risk management, and precise market forecasting. CIH's distinct competitive advantage stems from the depth and breadth of its proprietary database, the China Real Estate Index System (CREIS). This extensive data repository, continuously updated through 2025, underpins their accurate predictive models and market intelligence.

Developers are rapidly integrating smart technologies, AI, and IoT into properties across China to boost efficiency and tenant experience. This trend, driven by national smart city initiatives aiming for over 800 smart cities by 2025, generates immense demand for new data on building performance, energy consumption, and operational metrics. China Index Holdings (CIH) can capitalize by developing specialized data products and analytics services for this expanding smart real estate sector. For instance, the smart building market in China alone is projected to exceed $30 billion by late 2025, highlighting a significant opportunity for CIH's data solutions.

The real estate industry is rapidly embracing digital transformation, with PropTech innovations such as blockchain for secure transactions and VR/AR for immersive property viewings becoming increasingly prevalent. China's PropTech market size is projected to reach approximately $15.5 billion by 2025, highlighting significant growth. For China Index Holdings (CIH), staying at the forefront of these technologies is crucial, as they present both an opportunity to enhance their data analytics offerings and a threat if not integrated. This digital shift promises to make real estate transactions significantly faster and more transparent, directly impacting CIH's core business of providing market intelligence.

Growth of Data Centers

The rapid expansion of China's digital economy and escalating data usage are significantly fueling demand for data centers, establishing them as a compelling alternative real estate asset class. This specialized sector critically requires precise data for optimal site selection, accurate valuation, and robust investment analysis. China's data center market capacity is projected to exceed 30 million kW by 2025, presenting a substantial opportunity for CIH. CIH is well-positioned to become a pivotal provider of essential data and analytics for this burgeoning market in China.

- By 2025, China's data center market capacity is forecast to surpass 30 million kW.

- Investment in China's data center infrastructure is expected to grow by over 15% annually through 2025.

- Hyperscale data centers are projected to account for over 60% of new capacity additions in 2024-2025.

- The demand for specialized data for data center site selection increased by 20% in 2024 compared to 2023.

AI and High-Tech Industry Growth

China's robust drive into high-tech sectors such as artificial intelligence and electric vehicles is profoundly reshaping its economic landscape, creating new growth poles and influencing real estate demand. Tech companies are becoming dominant tenants, with their specialized needs directly impacting the design and location of office and industrial properties. China Index Holdings (CIH) is uniquely positioned to provide critical data on how the expansion of these sunrise industries, projected to see over 15% annual growth in key innovation hubs through 2025, is creating new investment corridors and driving localized market shifts.

- Major tech hubs like Shenzhen and Beijing have seen prime office rents increase by approximately 3-5% in 2024 due to robust tech tenant demand.

- Industrial land prices in key EV manufacturing zones surged by an estimated 8-10% in 2024, reflecting strong corporate investment.

- Over 60% of new office space absorption in tier-one cities in 2024 was attributed to technology and R&D firms.

- New AI innovation parks established in 2024-2025 are projected to attract over $50 billion in private and public investment.

China Index Holdings (CIH) significantly benefits from the nation's rapid technological advancements, leveraging big data and AI to analyze a real estate market projected at CNY 18 trillion in 2024. The surge in smart city initiatives, targeting over 800 smart cities by 2025, and PropTech, with its market reaching $15.5 billion by 2025, creates new data demands. Furthermore, the burgeoning data center market, exceeding 30 million kW capacity by 2025, and the growth of high-tech sectors like AI and EVs, are profoundly reshaping real estate, offering CIH substantial opportunities for specialized data and analytics services.

| Technological Trend | 2024/2025 Projection | Impact on Real Estate |

|---|---|---|

| China Real Estate Transaction Volume | CNY 18 trillion (2024) | Increased demand for sophisticated data analytics. |

| Smart Building Market (China) | >$30 billion (late 2025) | New data streams for building performance and operations. |

| PropTech Market Size (China) | ~$15.5 billion (2025) | Enhanced digital transaction efficiency and data requirements. |

| China Data Center Capacity | >30 million kW (2025) | Growing demand for specialized site selection and valuation data. |

| Tech Hub Office Rent Increase | 3-5% (2024) in major cities | Strong demand from AI and EV sectors shaping commercial property. |

Legal factors

China Index Holdings (CIH) operates within a stringent legal framework, primarily governed by the Land Administration Law and the Urban Real Estate Administration Law. Any amendments to these national laws, particularly those impacting property rights and transfers, directly influence CIH's valuation and data services. For instance, the ongoing regulatory adjustments impacting housing supply and demand, as seen in early 2025, necessitate constant monitoring. A deep understanding of China's unique land use rights system, where land ownership remains with the state or collectives, is fundamental for accurate real estate analysis.

Given the significant financial distress among Chinese developers, China's Enterprise Bankruptcy Law is critically relevant for China Index Holdings. The legal pathways for restructuring distressed real estate projects are a primary focus for CIH's financial institution clients, particularly as non-performing loans tied to property assets surged by an estimated 15-20% in 2024. CIH's comprehensive data and analytical tools are crucial for assessing the risk of developer defaults and forecasting potential outcomes of complex bankruptcy proceedings, aiding strategic decision-making in a market facing unprecedented challenges through 2025.

China Index Holdings (CIH), as a data-centric company, must rigorously navigate China's increasingly stringent data security and privacy regulations. Laws like the Data Security Law (DSL) and Personal Information Protection Law (PIPL), fully enforced by 2021, dictate the strict collection, storage, and cross-border transfer of data. Adherence to these complex frameworks, which saw over 1,200 data-related enforcement actions in 2023, is crucial for maintaining client trust and avoiding significant penalties. Non-compliance could lead to fines up to 50 million RMB or 5% of annual turnover, impacting CIH's operational stability and market standing by 2025.

Foreign Investment Regulations

Foreign investment regulations in China significantly shape capital flows and transaction volumes within the real estate market. While China generally promotes opening, the property sector still faces specific legal restrictions and approval processes. For instance, the 2024 revised Negative List for Foreign Investment continues to outline areas where foreign participation is restricted or prohibited, though real estate has seen some easing in recent years for certain types of investment. CIH's analysis must thoroughly incorporate this dynamic legal environment, especially considering the modest 2.5% year-on-year growth in foreign direct investment into China during Q1 2024, reflecting cautious but ongoing interest.

- Restrictions persist in some real estate segments despite broader market opening.

- Regulatory approvals are crucial for foreign entities looking to invest or expand.

- CIH must monitor the evolving legal framework impacting foreign capital inflow.

- Foreign direct investment in China saw a modest increase in Q1 2024, indicating continued, albeit cautious, engagement.

REITs and Financial Product Regulations

The legal framework for Real Estate Investment Trusts (REITs) in China is rapidly evolving, presenting significant opportunities for data providers like CIH. By early 2024, China's public REITs market had expanded, with over 30 infrastructure REITs listed and a market capitalization exceeding CNY 100 billion. The government's continued expansion of the REITs pilot program, including new asset classes like affordable rental housing and new energy infrastructure, necessitates CIH providing data compliant with these specific financial product regulations. CIH's services must accurately reflect the latest regulatory changes to support investors in this growing sector effectively.

- By late 2023, China's infrastructure REITs market surpassed CNY 100 billion in market capitalization.

- The CSRC and NDRC continue to expand eligible REIT asset classes, including affordable rental housing in 2024.

- CIH must ensure its data and analysis tools comply with the evolving regulatory landscape for these financial products.

China Index Holdings (CIH) navigates a complex legal landscape, with property laws and the Enterprise Bankruptcy Law significantly impacting its operations as non-performing real estate loans surged 15-20% in 2024. Adherence to strict data security and privacy regulations, like DSL and PIPL, is critical, given over 1,200 enforcement actions in 2023. Foreign investment rules, though easing, still require careful monitoring, while the expanding REITs market, exceeding CNY 100 billion by early 2024, presents new regulatory compliance demands for CIH's data services.

| Legal Area | Key Impact on CIH | 2024/2025 Data Point |

|---|---|---|

| Property & Bankruptcy Laws | Valuation, distressed asset analysis | 15-20% NPL surge in 2024 |

| Data Security & Privacy | Operational compliance, client trust | 1,200+ enforcement actions in 2023 |

| REITs Regulatory Framework | Market expansion, data compliance | CNY 100B+ market cap by early 2024 |

Environmental factors

China is rigorously enforcing green building policies and energy efficiency standards for all new construction projects, with significant updates through 2025. The government's 14th Five-Year Plan aims for an 18% reduction in carbon emissions per unit of GDP by 2025, directly impacting the construction sector. This emphasis makes sustainability a paramount factor in property development and valuation. China Index Holdings (CIH) can leverage its data to provide crucial information on buildings' green credentials, a growing priority for investors and tenants. By 2024, green building certifications are influencing property valuations by an estimated 5-10% in major Chinese cities.

China's environmental protection laws, such as the Soil Pollution Prevention and Control Law enacted in 2019, impose strict liabilities on landowners for environmental cleanup, even without direct fault. This significantly increases due diligence burdens and potential financial risks for property buyers. For example, remediation costs can exceed 50 million RMB for severely contaminated sites. CIH's risk management solutions now integrate comprehensive environmental risk data, aiding clients in making informed property acquisition decisions and mitigating these substantial liabilities.

China's national goals to peak carbon emissions by 2030 and achieve neutrality by 2060 are driving significant policy shifts affecting real estate and construction. The government's mandatory carbon trading market, operational since 2021, increasingly impacts building operational costs, especially as it expands beyond power generation. This creates a growing demand for precise data on the carbon footprint of properties, an area where China Index Holdings could strategically expand its data services. Property owners face rising compliance costs, pushing demand for efficiency and emissions tracking tools. By 2025, over 40% of China's energy consumption is linked to buildings, highlighting the sector's emissions reduction imperative.

Urban Village Redevelopment and Environmental Upgrades

China's government is aggressively promoting urban village redevelopment and the renovation of older residential quarters, a key environmental initiative. These projects frequently incorporate significant environmental upgrades, such as improving energy efficiency and integrating more green spaces into urban landscapes. This massive urban renewal program, targeting substantial completion by 2025, presents a substantial market opportunity. CIH can leverage its robust data and analytics services to track project progress and assess their profound market impact.

- Government aims to renovate over 200,000 old urban residential communities by 2025.

- Projects emphasize energy-efficient building materials and expanded green infrastructure.

Climate Change and Physical Risk Assessment

Real estate assets are increasingly being assessed for physical risks tied to climate change, like flooding and extreme weather events. While this remains an emerging area within China's property sector, global investors are progressively integrating such assessments into their due diligence. CIH has a significant opportunity to develop advanced capabilities, providing crucial data and analytics on properties' exposure to various climate-related physical risks.

- Global real estate investment managers are targeting a 50% reduction in portfolio emissions by 2030, emphasizing climate risk assessment.

- China's National Climate Change Adaptation Strategy 2035 highlights the need for climate-resilient urban development.

- In 2024, approximately 60% of global institutional investors consider climate risk a material financial factor in real estate decisions.

- CIH’s extensive property database could be leveraged to map climate vulnerability for over 100 Chinese cities.

China's environmental policies, including the 14th Five-Year Plan aiming for an 18% carbon reduction by 2025, are reshaping the real estate sector. Green building certifications now influence property valuations by 5-10% in major cities by 2024. CIH can leverage this by providing data on green credentials and integrating environmental risk data for increasingly complex due diligence. The push for urban renewal, targeting 200,000 communities by 2025, also creates demand for CIH's analytics.

| Metric | 2024 Data | 2025 Target |

|---|---|---|

| Green Building Valuation Impact | 5-10% | Growing |

| Carbon Reduction Target (GDP) | - | 18% |

| Urban Communities Renovation | - | 200,000+ |

PESTLE Analysis Data Sources

Our PESTLE analysis for China Index Holdings is informed by official government publications, reputable financial news outlets, and market research reports. We meticulously gather data on political stability, economic indicators, technological advancements, social trends, and environmental regulations impacting China's diverse market.