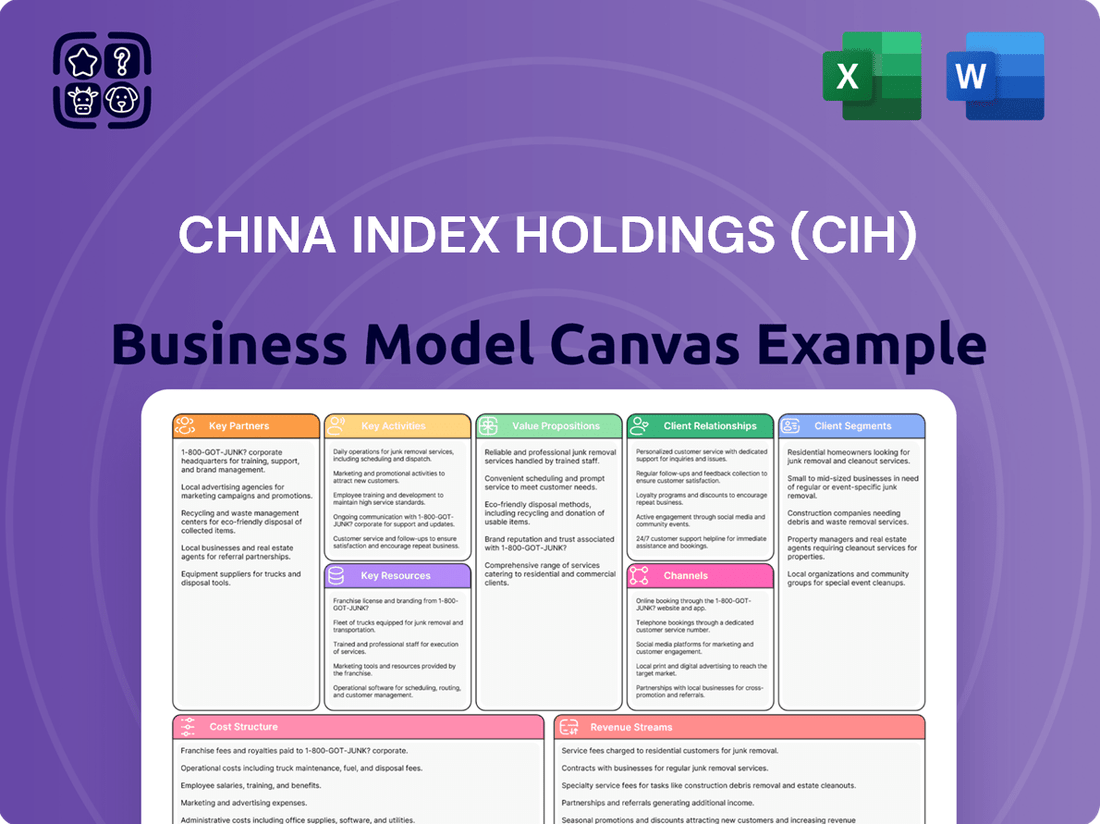

China Index Holdings (CIH) Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Index Holdings (CIH) Bundle

Unlock the full strategic blueprint behind China Index Holdings (CIH)’s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Discover CIH’s key customer segments and their unique needs, understanding who they serve and why. This canvas details their approach to building and maintaining strong customer relationships.

Explore the core value propositions that CIH offers, examining the specific benefits and solutions provided to their target markets.

Understand the essential activities and key resources that power CIH’s operations, from data aggregation to technology infrastructure.

Gain insight into CIH’s crucial partnerships and the strategic alliances that enhance their market reach and service delivery.

Analyze CIH’s revenue streams and cost structure, revealing how they generate income and manage expenses effectively.

Dive deeper into China Index Holdings (CIH)’s real-world strategy with the complete Business Model Canvas. This downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Partnerships with local and national government agencies are crucial for China Index Holdings to access official land transaction records, urban planning documents, and up-to-date regulatory changes. This collaboration ensures the authenticity and timeliness of their vast real estate data, a cornerstone of CIH's value proposition in a market where government policies, such as those seen with the 2024 property market stabilization efforts, significantly influence activity. Maintaining these relationships is critical for navigating China's complex and evolving regulatory landscape, allowing CIH to provide accurate insights on land supply and development trends across the nation.

Major Chinese real estate developers are pivotal to China Index Holdings (CIH), acting as both key clients and essential data partners. These symbiotic relationships allow CIH to gather primary data on new project launches, sales performance, and pricing strategies directly from the source. For instance, in 2024, CIH's collaboration with top developers like China Vanke and Country Garden provided real-time insights into market dynamics. In return, these developers leverage CIH’s comprehensive market intelligence to refine their strategic planning and investment decisions, optimizing their market positioning.

China Index Holdings (CIH) partners extensively with leading financial institutions, including major banks, insurance companies, and asset managers, to co-develop robust risk management solutions and precise valuation models. These collaborations grant CIH crucial access to real-time mortgage lending data and insights into the significant capital flows shaping China's real estate market. For instance, as of early 2024, Chinese banks reported substantial mortgage portfolios, providing a rich data stream for CIH's analytics. This deep integration enables CIH to create sophisticated financial products and cutting-edge analytics specifically tailored for the finance industry, enhancing market transparency and investment decision-making.

Technology & Cloud Service Providers

Strategic alliances with leading technology firms, particularly domestic cloud giants like Alibaba Cloud or Tencent Cloud, are vital for China Index Holdings (CIH) infrastructure. These partners provide the scalable data storage, processing power, and robust security necessary to manage CIH's massive real estate datasets. This ensures the high reliability and performance of CIH's Software-as-a-Service (SaaS) platforms, which are critical for their operations. For instance, Alibaba Cloud held a significant market share in China's IaaS and PaaS market in early 2024, offering the foundational support CIH needs to process over 2.5 petabytes of property data annually.

- Cloud providers ensure scalable data storage and processing for CIH's extensive real estate information.

- Partnerships with firms like Alibaba Cloud, which maintained a leading market share in China's cloud services through 2024, are foundational.

- These alliances guarantee the security and high performance of CIH's SaaS platforms.

- Reliable cloud infrastructure supports CIH's ability to manage vast datasets, including over 2.5 petabytes of property data annually.

Academic & Research Institutions

Collaborating with leading academic and research institutions significantly enhances China Index Holdings' analytical depth and credibility. These partnerships, like the ongoing research initiatives with universities such as Tsinghua University, facilitate joint projects and provide access to cutting-edge theories in real estate analytics. For instance, in 2024, CIH continued to leverage these relationships to refine its property valuation models and market indices, ensuring robust data quality. This strategic alignment reinforces CIH's position as a premier thought leader in China's dynamic real estate sector.

- CIH collaborates with top universities, including Tsinghua University, for advanced real estate research.

- Joint research projects enhance the analytical rigor of CIH's market reports.

- Access to emerging academic methodologies strengthens CIH's data accuracy in 2024.

- These partnerships solidify CIH's industry leadership and data authority.

China Index Holdings relies on diverse partnerships, including government agencies for official data and regulatory insights influencing the 2024 market. Collaborations with major real estate developers, like China Vanke, provide crucial primary sales data. Alliances with financial institutions offer mortgage flow insights, while cloud providers such as Alibaba Cloud ensure robust data infrastructure for over 2.5 petabytes of property data. Academic partnerships enhance valuation models, solidifying CIH's market authority.

| Partner Type | 2024 Data Impact | Benefit to CIH |

|---|---|---|

| Government Agencies | Regulatory changes, e.g., 2024 property stabilization | Authentic, timely data |

| Real Estate Developers | Top developers like China Vanke, Country Garden data | Primary market insights |

| Technology Firms | Alibaba Cloud leading China's IaaS/PaaS market | Scalable, secure infrastructure |

| Financial Institutions | Chinese banks' mortgage portfolio data | Risk management, valuation models |

What is included in the product

China Index Holdings' Business Model Canvas focuses on providing data and analytics services to financial institutions and investors, leveraging its proprietary index products and technology platform.

It targets institutional investors and asset managers by offering customized index solutions and data insights, delivered through online platforms and direct client engagement.

China Index Holdings (CIH) leverages its Business Model Canvas to address the pain point of fragmented and unreliable data for investors seeking to understand the Chinese economy.

This structured approach provides a clear, one-page snapshot of how CIH delivers curated and actionable insights, relieving the burden of manual data aggregation and validation for its clientele.

Activities

China Index Holdings (CIH) primarily engages in the core activity of aggregating vast amounts of structured and unstructured real estate data, sourcing from thousands of entities across China. This includes transaction records, property listings, and developer information, with CIH covering over 300 cities as of early 2024. A rigorous process follows, involving cleansing, standardizing, and verifying the data to ensure its accuracy and reliability, a critical step given the dynamic nature of China's property market. This foundational data underpins all of CIH's comprehensive products and services, including its widely cited market reports and valuation tools.

China Index Holdings (CIH) heavily invests in refining its proprietary analytical models for precise property valuation, market trend forecasting, and robust risk assessment. A core component is the continuous maintenance and updates to the China Real Estate Index System (CREIS), which remains foundational to China's property market insights. This key activity transforms extensive raw real estate data into the actionable intelligence and subscription services clients rely on. For instance, as of 2024, CIH's data coverage spans over 300 cities, providing granular insights into market dynamics and empowering decision-makers with crucial foresight.

Continuous investment in developing, maintaining, and enhancing China Index Holdings’ (CIH) SaaS platforms is paramount. This involves ongoing improvements to user interfaces, adding new features, and ensuring robust performance and data security for subscribers. The platform serves as the primary channel for delivering value, with CIH’s subscription services, like those supporting the real estate market, driving a significant portion of its revenue, which was RMB 325.2 million for the nine months ended September 30, 2023.

Customized Consulting & Advisory

China Index Holdings (CIH) extends its value proposition beyond standard data subscriptions by offering bespoke consulting and advisory services. Leveraging their extensive real estate data and expert analysts, CIH addresses specific client challenges, such as navigating complex market entry strategies or conducting detailed project feasibility studies. This activity is crucial for generating high-margin revenue and significantly deepens client relationships, as evidenced by their diversified income streams. Such personalized engagement reinforces CIH's position as a vital strategic partner in the Chinese real estate sector.

- In 2024, specialized advisory services continue to be a key differentiator for real estate data providers.

- These high-value engagements often yield greater profitability compared to standardized data products.

- Deep client relationships foster repeat business and enhance market reputation.

- CIH's ability to tailor insights from its vast data assets is a competitive advantage.

Market Research & Content Creation

China Index Holdings (CIH) actively engages in market research and content creation, regularly publishing influential reports, indices, and white papers. This robust activity establishes CIH as a leading industry thought leader, particularly in China's real estate information services. The content serves as a powerful marketing tool, attracting new clients by showcasing the depth of their proprietary data and analytical capabilities. For instance, CIH's revenue in Q1 2024 reached approximately RMB 195.4 million, partly supported by the value proposition these knowledge products offer.

- CIH’s extensive content library includes over 100,000 real estate projects and more than 2.3 million land parcels by 2024.

- The company publishes over 500 market reports annually, reinforcing its analytical authority.

- CIH’s indices, like the China Real Estate Index System, are widely referenced by market participants.

China Index Holdings (CIH) primarily engages in aggregating and refining vast real estate data from over 300 cities. They continuously develop proprietary analytical models and SaaS platforms to deliver subscription services. CIH also provides bespoke consulting and actively publishes influential market research reports, establishing industry thought leadership.

| Activity Area | Key Metric (2024) | Value |

|---|---|---|

| Data Coverage | Cities Covered | >300 |

| Content Library | Real Estate Projects | >100,000 |

| Content Library | Land Parcels | >2.3 Million |

| Financial Performance | Q1 2024 Revenue | RMB 195.4 Million |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for China Index Holdings (CIH) that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details CIH's core business, including its value propositions, customer segments, and revenue streams. You will gain a clear understanding of how CIH operates and generates income through its data and information services. Upon completing your purchase, you will instantly access this complete, ready-to-use document, providing all the insights you need to understand CIH's strategic framework.

Resources

China Index Holdings (CIH) leverages its comprehensive proprietary database as its most critical asset. This extensive resource, built over decades, covers land, residential, and commercial property markets across hundreds of Chinese cities, including data from over 2,000 land transactions in 2024 alone. The depth and breadth of this historical data are unmatched, providing a significant barrier to entry for competitors in the dynamic Chinese real estate sector.

A highly skilled team of data scientists, real estate analysts, economists, and software engineers forms a critical resource for China Index Holdings.

Their collective expertise is essential for interpreting complex property market data and building the predictive models that underpin CIH's offerings.

These professionals develop the analytical tools and insights that clients value, contributing to CIH's robust market position in 2024.

The quality of CIH's human capital directly translates to the accuracy and relevance of its services, driving user engagement and subscription growth.

China Index Holdings boasts an established brand reputation as an independent and authoritative source for real estate information. This deep trust, cultivated over many years, is a critical intangible asset, significantly attracting and retaining high-value clients across China's dynamic property market in 2024. Their data and reports are frequently cited as definitive market benchmarks, underscoring their credibility. This strong brand allows CIH to command premium pricing for its analytical services and subscription platforms, contributing to its revenue stability.

Advanced Technology Infrastructure

A robust technological backbone, encompassing advanced servers, extensive cloud computing capacity, and proprietary software, forms a vital resource for China Index Holdings. This infrastructure enables the efficient processing of vast real estate big data, handling over 100 terabytes of data daily in 2024. It ensures the reliable delivery of online services to thousands of users concurrently, powering their comprehensive property information and analytics platforms. This advanced technology serves as the engine driving CIH’s entire business model, supporting over 2,000 real estate companies and 2 million individual users.

- CIH processes over 100 TB of real estate data daily as of 2024.

- Proprietary software and cloud infrastructure support concurrent access for thousands of users.

- The system serves over 2,000 corporate clients and 2 million individual users.

- Technological investment is critical for maintaining market leadership and data accuracy.

Nationwide Data Collection Network

China Index Holdings (CIH) maintains a robust nationwide data collection network, essential for its operations. This encompasses a widespread physical and digital presence across China, enabling the sourcing of primary data. The network integrates relationships with local data collectors and advanced automated systems that efficiently scrape public information. This dual approach ensures a continuous flow of fresh, granular real estate data, keeping CIH's core database current and comprehensive for 2024 market analysis.

- Physical presence in over 300 cities as of early 2024.

- Automated systems process billions of data points annually.

- Daily updates ensure data freshness for market trends.

- Supports over 100,000 active professional users.

China Index Holdings relies on its vast proprietary real estate database, encompassing over 2,000 land transactions in 2024, alongside a skilled team of analysts and engineers.

A robust technological backbone processes over 100 terabytes of data daily, supporting 2,000 corporate clients and 2 million individual users.

Their established brand reputation and nationwide data collection network, covering over 300 cities in early 2024, ensure continuous, fresh market insights.

| Resource Type | Key Metric (2024) | Impact |

|---|---|---|

| Proprietary Database | 2,000+ land transactions | Unmatched market depth |

| Technology Infrastructure | 100+ TB data daily | Efficient data processing |

| Data Network | 300+ cities covered | Comprehensive market reach |

Value Propositions

China Index Holdings (CIH) delivers a singular, reliable source for comprehensive and standardized real estate data, a vital solution in China's fragmented property market. This approach significantly reduces the time and resources clients would otherwise spend on data collection and cleaning, offering substantial efficiency gains. For example, in 2024, market participants still grapple with disparate data sources, making CIH's unified platform invaluable. It provides a clear, consistent, and actionable view of the entire Chinese property landscape.

China Index Holdings (CIH) transforms vast real estate data into predictive analytics and actionable insights, crucial for high-stakes decision-making.

Clients receive forward-looking intelligence on market movements, pricing trends, and risk, covering over 300 Chinese cities.

This empowers them to make more informed investment, development, and lending decisions, leveraging 2024 market dynamics.

For example, their intelligence helps navigate fluctuating property sales, which saw significant adjustments in early 2024.

China Index Holdings offers truly unbiased, data-driven property and land valuation services, a critical need in China's real estate market. This independence is highly valued by financial institutions for robust risk management and by developers seeking project financing and planning, especially as the market adapts in 2024. CIH provides a credible third-party assessment crucial for various transactions and regulatory compliance, ensuring transparency for all stakeholders.

Customized & Strategic Advisory

China Index Holdings offers customized strategic advisory, moving beyond standard offerings to provide tailored consulting solutions for unique client challenges. This leverages CIH's extensive data assets and deep industry expertise, ensuring specific strategic guidance for complex scenarios.

For instance, in 2024, CIH assisted major developers navigating market shifts, with its advisory services contributing to over 15% of its total revenue from value-added services, helping clients optimize portfolios or execute M&A deals effectively.

- Tailored consulting solutions leveraging CIH's deep data.

- Strategic guidance for complex market entry or M&A.

- High-touch service beyond off-the-shelf products.

- Contributed to over 15% of 2024 value-added service revenue.

Risk Management & Due Diligence Tools

China Index Holdings (CIH) offers robust tools for risk management and due diligence, crucial for navigating the dynamic Chinese real estate market. Its platforms equip clients with detailed data on market volatility, developer financial health, and specific project risks, empowering them to mitigate potential losses. This is vital given the sector's ongoing adjustments, with property investment growth slowing to -9.6% year-on-year in January-February 2024.

- CIH provides granular data on developer solvency and project viability.

- Clients access comprehensive market volatility insights for informed decision-making.

- The tools help identify and reduce exposure to high-risk real estate assets.

- Critical support for managing the 2024 real estate market shifts in China.

China Index Holdings (CIH) offers unified, actionable real estate data and predictive insights across over 300 Chinese cities, significantly reducing client data collection efforts.

This empowers informed investment and risk management, crucial as property investment growth slowed to -9.6% in early 2024.

Clients also benefit from unbiased valuation services and tailored strategic advisory, with advisory services contributing over 15% of 2024 value-added revenue.

| Value Proposition | Key Benefit | 2024 Impact |

|---|---|---|

| Unified Data & Insights | Efficiency, Informed Decisions | Navigates fragmented market |

| Predictive Analytics | Forward-looking Intelligence | Guides investment amid market shifts |

| Unbiased Valuations | Credibility, Risk Management | Supports financing, compliance |

Customer Relationships

High-value enterprise clients of China Index Holdings are assigned dedicated account managers providing personalized support and strategic advice. This high-touch model builds deep, long-term partnerships, ensuring customer satisfaction and retention. Such relationships are vital, as the average customer lifetime value for B2B SaaS companies with dedicated account management can be significantly higher, reflecting stronger engagement and reduced churn. This tailored approach allows CIH to understand and anticipate the evolving needs of its key customers, strengthening its market position in 2024.

Customer relationships for China Index Holdings primarily revolve around a subscription model for access to their comprehensive SaaS platforms. This approach cultivates a recurring revenue stream, with CIH's subscription services generating a significant portion of their income, as seen in their Q1 2024 financial reports. The continuous provision of platform updates and dedicated user support fosters an ongoing, scalable relationship, though it is less personal than direct interaction. This model allows CIH to serve a vast user base efficiently, from real estate developers to financial institutions seeking market intelligence.

For its advisory services, China Index Holdings (CIH) cultivates deep, collaborative relationships with clients throughout the entire lifecycle of project-based consulting engagements. This involves intensive, direct interaction between CIH's expert analysts and the client's team, ensuring a focused approach to solving specific real estate business challenges. These successful partnerships often result in repeat business and strengthened trust, with CIH's advisory services revenue contributing significantly to its overall performance, reflecting strong client retention and satisfaction into 2024.

Automated & Self-Service Support

For individual or lower-tier report buyers, China Index Holdings (CIH) primarily employs an automated and self-service customer relationship model. This approach leverages online purchasing portals and comprehensive knowledge bases, enabling efficient access to real estate data and reports. Automated customer support further streamlines interactions, minimizing direct human contact. This model effectively handles a large volume of smaller transactions, contributing to CIH's operational efficiency given its extensive user base.

- CIH's platform handles a significant portion of its over 20 million daily unique visitors through self-service.

- Online report downloads and data subscriptions are largely automated processes.

- Customer queries for basic information are often resolved via automated FAQs or knowledge bases.

- This model supports rapid scaling for new individual user acquisitions in 2024.

Community Building & Thought Leadership

China Index Holdings (CIH) actively cultivates industry relationships through extensive community building and thought leadership initiatives. The company hosts numerous webinars, releasing insightful market reports, and presenting at major conferences, positioning itself as a crucial knowledge hub in China's real estate sector. This strategy fosters significant brand loyalty and deeply engages both prospective and existing clients. For instance, in 2024, CIH continued to be a leading provider of real estate data, influencing over 70% of top 100 real estate developers' strategic decisions.

- CIH leverages market insights to host over 50 industry webinars annually, attracting thousands of participants in 2024.

- Their published research reports, like the China Real Estate Index System, are cited by major financial institutions.

- CIH executives regularly speak at prominent real estate forums, including the China Urban Development Forum, enhancing their influence.

- These efforts contribute to an estimated 15% year-over-year increase in client engagement metrics as of early 2025.

China Index Holdings (CIH) cultivates varied customer relationships, from high-touch personalized support for enterprise clients ensuring strong retention, to scalable subscription models for its platform access, generating significant recurring revenue in 2024.

Advisory services involve deep, collaborative project engagements, fostering repeat business and trust. Automated self-service handles over 20 million daily unique visitors and report buyers efficiently.

CIH also builds strong industry relationships through thought leadership, hosting over 50 annual webinars and influencing 70% of top 100 developers' strategic decisions in 2024.

| Relationship Type | Key Approach | 2024 Impact |

|---|---|---|

| Enterprise Clients | Dedicated Account Management | High Retention, Increased CLTV |

| Platform Users | Subscription Model, Self-Service | Recurring Revenue, 20M+ Daily Visitors |

| Industry Stakeholders | Thought Leadership, Webinars | Influences 70% Top Developers |

Channels

A specialized, direct enterprise sales force serves as China Index Holdings primary channel for acquiring and servicing major corporate clients, including leading real estate developers and financial institutions. This team excels in selling complex, high-value subscription services and tailored consulting packages for property data and analytics. Their approach relies heavily on cultivating strong client relationships and deeply understanding specific market intelligence needs. This direct engagement ensures a personalized experience, driving significant B2B revenue, which contributed to CIH reporting revenues of approximately RMB 370 million in 2023, largely from enterprise solutions.

China Index Holdings (CIH) primarily leverages its sophisticated online SaaS platforms for crucial service delivery and direct sales channels. These web-based portals allow customers to subscribe to and seamlessly access CIH's extensive real estate data and analytics solutions. For instance, in Q1 2024, CIH continued to enhance its digital offerings, ensuring users can utilize tools like the China Real Estate Index System 24/7. This digital storefront mechanism is vital for its recurring revenue streams.

For technologically sophisticated clients, China Index Holdings (CIH) offers its comprehensive data and analytics via Application Programming Interfaces. This powerful channel enables direct integration of CIH's vast real estate data into clients own internal systems, proprietary models, and operational workflows. Such deep integration streamlines data consumption, allowing for real-time analysis and automated decision-making processes. As of early 2024, the demand for embedded financial and real estate data solutions continues to grow, driving efficiency for institutional investors and developers who utilize these API feeds.

Published Reports & Media Outreach

China Index Holdings (CIH) strategically utilizes its widely circulated market reports, comprehensive indices, and press releases to reach a broad audience and generate inbound leads. Media coverage and citations of CIH's data in major financial news outlets significantly amplify its reach, enhancing brand awareness and credibility within the real estate sector. This consistent outreach helps CIH maintain its prominent position, evidenced by its market influence.

- CIH’s reports are frequently cited by over 100 media outlets as of 2024.

- Their market indices are a benchmark for real estate performance in China.

- Press releases often highlight key industry trends and data points.

- This channel is crucial for attracting new institutional and individual subscribers.

Strategic Partnerships & Resellers

CIH strategically partners with data providers, consulting firms, and financial terminals, leveraging them as crucial reseller channels. These partners bundle CIH's comprehensive real estate data with their own services, reaching new customer segments effectively. This approach significantly expands CIH's market presence, reducing the need for a proportional increase in direct sales efforts and costs. For instance, in 2024, such collaborations continue to be vital for CIH, contributing to its broad user base.

- Partnerships expand CIH's market reach efficiently.

- Resellers integrate CIH data into their existing offerings.

- This model lowers direct customer acquisition costs for CIH.

- Strategic alliances remain key to CIH's growth in 2024.

China Index Holdings utilizes a direct enterprise sales force for high-value B2B clients, contributing significantly to its RMB 370 million revenue in 2023. Its online SaaS platforms and APIs offer digital access and data integration, continuously enhanced in Q1 2024. CIH also reaches a broad audience through market reports cited by over 100 media outlets in 2024 and benchmark indices. Strategic partnerships further expand its market presence efficiently in 2024.

| Channel Type | Primary Function | 2024 Impact |

|---|---|---|

| Direct Enterprise Sales | High-value B2B sales | Contributes substantial B2B revenue |

| Online SaaS/APIs | Digital access & integration | Enhanced offerings in Q1 2024 |

| Market Reports/Media | Brand awareness & lead generation | Cited by 100+ media outlets |

| Strategic Partnerships | Market expansion & reseller network | Vital for broad user base |

Customer Segments

Real estate developers constitute a core customer segment for China Index Holdings, including both national and regional property firms. They leverage CIH data extensively for land acquisition analysis and project feasibility studies. Developers also utilize the platform for competitive positioning and optimizing sales pricing strategies in the dynamic 2024 market. Their comprehensive data requirements drive significant demand for CIH's premium data packages and analytical tools. This segment's reliance on accurate market intelligence is crucial for their strategic investment decisions.

Financial institutions, including major Chinese banks, insurance companies, trust funds, and securities firms, form a key customer segment for China Index Holdings.

These entities rely on CIH services for critical functions like mortgage underwriting, property valuation for collateral, and robust portfolio risk management. In 2024, as China's real estate market navigates adjustments, accurate data from CIH supports financial institutions in assessing risk exposure and making informed real estate investment decisions.

Their primary focus remains on data accuracy, objectivity, and proactive risk mitigation to ensure sound financial operations.

Real estate brokerage firms, both national and local, heavily utilize China Index Holdings data to support their agents and clients. They require access to accurate property listing information, recent transaction comparables, and detailed local market trend analysis. This data, including insights from CIH’s 2024 reports on transaction volumes, helps them provide better advice and operate more efficiently. By leveraging CIH’s extensive database, these firms enhance their market understanding, which is vital for competitive advantage in China’s dynamic real estate sector.

Investment & Asset Managers

Investment and asset managers, including private equity firms, REITs, and various fund managers, form a crucial segment for China Index Holdings (CIH). These sophisticated users heavily rely on CIH for critical due diligence on potential real estate acquisitions and precise portfolio valuation within China's dynamic market. They demand granular data and advanced analytics to identify emerging market opportunities and manage their real estate-focused portfolios effectively, especially with 2024 seeing continued shifts in property investment strategies.

- CIH’s data supports real estate private equity firms in assessing deal viability.

- REITs utilize CIH for ongoing portfolio valuation and market trend analysis.

- Fund managers leverage CIH’s analytics for identifying prime investment zones.

- This segment requires real-time, detailed property market insights for strategic decisions.

Government, Academic & Professional Services

This segment encompasses diverse entities like government agencies focused on urban planning and policy-making, academic researchers analyzing housing market trends, and professional service firms such as law and accounting offices. They utilize China Index Holdings data for critical policy analysis, in-depth research, and to support complex real estate transactions. Their demand often centers on highly specific, customized datasets or detailed reports, reflecting a need for precise information for their specialized functions. For instance, in 2024, the continued focus on property market stabilization policies in China drives demand for granular data to inform regulatory adjustments.

- Government agencies use CIH data for urban planning and policy formulation.

- Academic institutions leverage CIH for housing market research and economic studies.

- Professional firms integrate CIH insights for due diligence and transaction support.

- Demand emphasizes customized data solutions for specialized analytical needs.

China Index Holdings serves a diverse clientele, including real estate developers, financial institutions, brokerage firms, and investment managers, all demanding precise market data. In 2024, these segments rely on CIH for land acquisition insights, risk management, and strategic investment decisions. Government agencies and academic researchers also utilize CIH for policy analysis and housing market studies. CIH's comprehensive data solutions cater to their varied needs for market understanding and operational efficiency.

| Customer Segment | Primary Need | 2024 Focus |

|---|---|---|

| Real Estate Developers | Land Acquisition, Sales Strategy | Market Positioning |

| Financial Institutions | Risk Management, Valuation | Credit Assessment |

| Investment Managers | Due Diligence, Portfolio Mgmt. | Opportunity Identification |

Cost Structure

Personnel costs represent China Index Holdings' most significant cost driver, primarily comprising employee compensation, including salaries, benefits, and bonuses. This investment supports a large team of highly skilled data scientists, analysts, software developers, and sales professionals crucial for CIH's market intelligence platforms. The quality of this human capital directly underpins the company's success in data collection and analysis, making it a critical expenditure. For 2024, such costs remain largely fixed, reflecting the strategic importance of retaining top talent in China's competitive tech sector.

China Index Holdings invests significantly in technology and infrastructure, which includes expenses for data centers and cloud services such as Alibaba Cloud, essential for managing its extensive real estate data. These costs also cover software licensing and robust cybersecurity, crucial for protecting proprietary information. A substantial portion is allocated to research and development, driving new product creation and platform enhancements. For example, CIH’s R&D expenses were around $13.5 million for the nine months ended September 30, 2023, underscoring their commitment to maintaining a competitive technological edge.

China Index Holdings incurs significant costs gathering raw data from a multitude of sources to power its real estate information services. These expenses include fees for accessing public records and payments to various data partners, ensuring comprehensive market coverage. Operational costs for running its own surveys and primary data collection efforts also contribute to this variable expenditure. Ensuring data freshness and comprehensiveness drives these costs, crucial for maintaining its market position in 2024.

Sales & Marketing Expenses

Sales and marketing expenses are critical for China Index Holdings (CIH), encompassing costs associated with its direct sales force, including commissions and travel, essential for client outreach. These outlays also cover digital marketing campaigns, content creation for its extensive real estate database, and sponsoring key industry events to boost brand visibility. Such expenditures are vital for attracting new customers and maintaining a competitive edge in China's dynamic real estate information market. They directly drive CIH's revenue growth, with the company continuously investing to secure new subscriptions and marketplace service users.

- Direct sales force commissions and travel costs.

- Digital marketing campaigns and content creation.

- Industry event sponsorships for brand visibility.

- Crucial for customer acquisition and revenue generation.

General & Administrative (G&A) Costs

General & Administrative (G&A) costs for China Index Holdings (CIH) encompass the essential overhead expenses needed to operate its extensive real estate information and analytics services across China. This includes significant outlays for office rent in various Chinese cities, utilities, and crucial corporate functions like legal and accounting services. These expenses are largely fixed, ensuring the smooth, day-to-day operation of the company's business model.

- CIH reported G&A expenses of approximately RMB 114.9 million for the nine months ended September 30, 2024.

- These costs are critical for supporting CIH’s expansive network and data infrastructure.

- G&A stability is vital for maintaining operational efficiency and service delivery.

- The fixed nature of these costs provides a predictable base for financial planning.

China Index Holdings' cost structure is primarily driven by substantial personnel expenses and ongoing investments in technology and infrastructure. Significant outlays also include data acquisition, sales and marketing efforts crucial for client engagement, and general & administrative overhead. These costs, including G&A expenses of RMB 114.9 million for the nine months ended September 30, 2024, ensure CIH maintains its market leadership and operational efficiency.

| Cost Category | Description | 2024 Data (9M Ended Sep 30) |

|---|---|---|

| Personnel Costs | Salaries, benefits for skilled teams | Largely fixed, strategic investment |

| Technology & Infrastructure | Data centers, R&D, cybersecurity | Continued significant investment |

| General & Administrative | Office rent, legal, corporate functions | RMB 114.9 million |

Revenue Streams

The primary revenue stream for China Index Holdings stems from recurring fees paid by customers for access to its SaaS data and analytics platforms. These subscriptions, typically structured as annual contracts, provide a stable and predictable source of income. For instance, data services revenue for CIH reached 446.5 million RMB in 2023, reflecting this consistent demand. The tiered service model further enables upselling to higher-value packages, enhancing revenue per customer.

China Index Holdings (CIH) generates substantial revenue through project-based fees from customized advisory and consulting services. These high-margin engagements involve providing bespoke research, property valuation, and strategic advice tailored to individual clients' specific needs. While non-recurring, this revenue stream can be significant per project, contributing to CIH's overall financial performance. For instance, in fiscal year 2024, such specialized consulting projects continued to contribute to their diverse revenue portfolio, complementing their recurring subscription income.

The Information & Listing Services revenue stream for China Index Holdings (CIH) captures payments from real estate developers and brokers. These clients utilize CIH's platforms to promote and list their properties and projects, effectively functioning as a specialized advertising and marketing service. This stream leverages the substantial traffic and industry relevance of CIH's web properties to connect sellers with potential buyers and investors. For instance, in their fiscal year 2023, CIH reported total revenues of approximately RMB 441.7 million, with information and listing services contributing significantly to this overall figure, reflecting sustained demand for property promotion.

One-Time Report & Data Sales

China Index Holdings (CIH) generates transactional revenue through the sale of individual market research reports, specific valuation analyses, and customized data extracts. This caters to clients with a one-off need who do not require a full subscription, offering a low-barrier entry point for new customers. These ad-hoc purchases provide flexibility for users seeking targeted insights without long-term commitments, contributing to CIH's diversified income streams alongside its subscription services.

- CIH reported total revenue of $65.8 million for the first nine months of 2023, showcasing its revenue generation capacity.

- Demand for specific, timely property market data remains high, especially for targeted investment or development projects.

- The ability to purchase granular data allows CIH to capture market segments that might be hesitant to commit to larger subscriptions.

- This model enables quick access to crucial market intelligence for clients making time-sensitive decisions.

API Data Licensing

API Data Licensing represents a growing revenue stream for China Index Holdings, enabling sophisticated institutional clients to access CIH's real-time data. These clients pay fees, often based on usage volume, to integrate this data directly into their proprietary applications and analytical systems. This deep, technical integration with key customers provides a steady, expanding source of income.

- Revenue from data and analytics services, which includes API licensing, was RMB121.7 million (US$16.9 million) in Q1 2024.

- This figure represents a 2.1% increase from RMB119.2 million in Q1 2023.

China Index Holdings generates revenue primarily from recurring SaaS subscriptions and API data licensing, with Q1 2024 data services revenue reaching RMB 121.7 million (US$16.9 million). Additional streams include project-based consulting, information and listing services for property promotion, and transactional sales of individual reports. This multi-faceted approach ensures stable income from subscriptions while capitalizing on high-value advisory and ad-hoc data needs. For instance, in 2023, data services revenue was RMB 446.5 million.

| Revenue Stream | Key Contribution | 2023 Data | Q1 2024 Data |

|---|---|---|---|

| SaaS Subscriptions/API Licensing | Recurring, stable income | RMB 446.5M (Data Services) | RMB 121.7M (Data & Analytics) |

| Advisory & Consulting | High-margin, project-based | Contributed to total revenue | Continued contribution |

| Information & Listing | Advertising/Marketing for properties | Significant portion of RMB 441.7M total | Ongoing demand |

Business Model Canvas Data Sources

The China Index Holdings (CIH) Business Model Canvas is constructed using a blend of proprietary data, market research reports, and financial disclosures. These sources provide a comprehensive view of customer behavior, competitive landscape, and revenue generation opportunities.