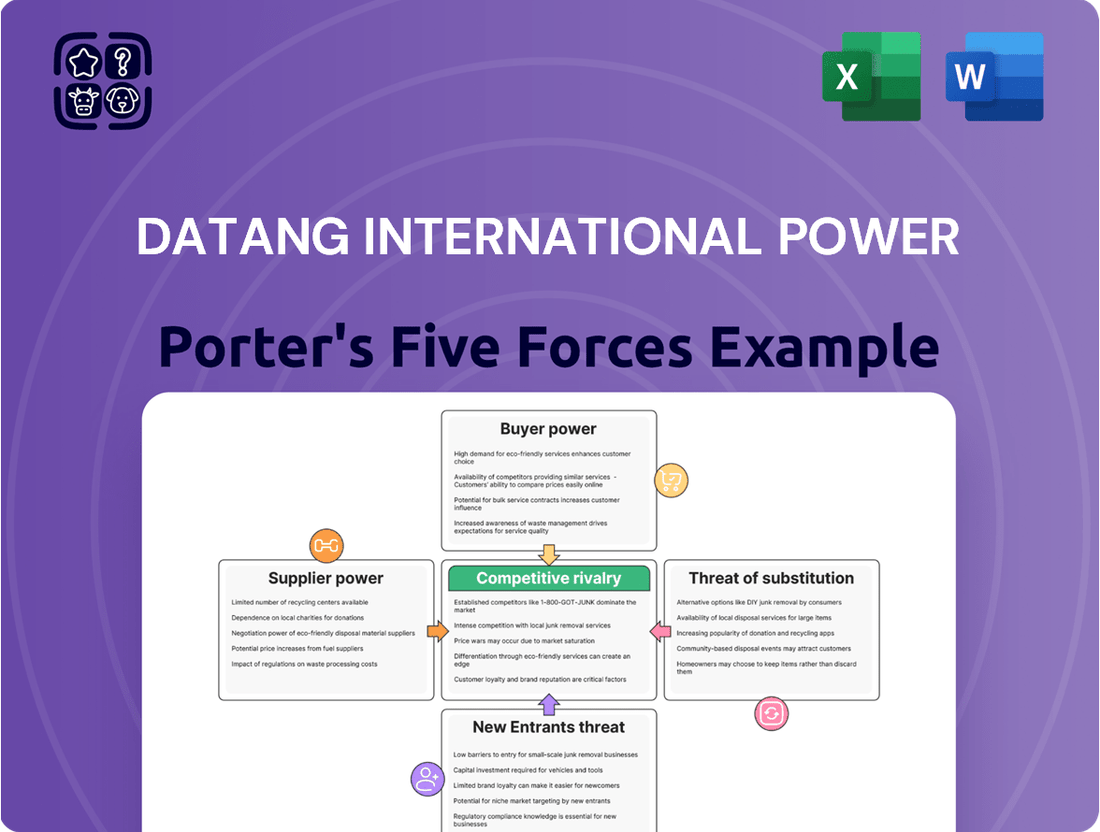

Datang International Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Datang International Power faces significant competition, with moderate buyer and supplier power influencing its profitability. The threat of new entrants is tempered by high capital requirements, but substitute products pose a growing concern.

The complete report reveals the real forces shaping Datang International Power’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Datang International Power's reliance on capital-intensive equipment like turbines and generators grants suppliers significant bargaining power. Despite China's manufacturing prowess, Datang's vast operational scale necessitates dependence on a limited number of major equipment providers for its diverse power generation assets.

The immense demand driven by China's aggressive renewable energy expansion, evidenced by the 357 GW of wind and solar capacity added in 2024, further strengthens the position of these specialized suppliers. This high demand can translate into less favorable pricing and contract terms for Datang.

Datang International Power Generation Co., Ltd. benefits from some vertical integration through its coal mining interests, which helps to lessen the bargaining power of external coal suppliers for a portion of its fuel requirements. This internal supply provides a degree of stability and cost control.

Despite this, coal remains a cornerstone of China's energy landscape, powering 59% of the nation's thermal electricity generation in 2024. This heavy reliance means that external coal suppliers still wield considerable influence over Datang's operations and costs.

While projections indicate an increase in China's domestic coal production for 2025, potentially reducing the need for imports, government policies are actively steering power plants toward greater reliance on domestically sourced fuel. Mandates to decrease imports and build up stockpiles of Chinese coal can significantly shape contract terms and pricing dynamics with suppliers.

For advanced power generation technologies, Datang International Power might face supplier power from a select group of technology providers. This is especially true for specialized components crucial for large-scale renewable energy projects or emerging technologies. If these technologies are proprietary and require continuous support or upgrades, the suppliers' leverage increases.

China's strategic focus on energy security and technological self-sufficiency is a significant factor. This national drive could reshape the landscape of technology supply in the coming years, potentially influencing the bargaining power of foreign or domestic licensors and manufacturers in the power sector.

Labor and Expertise

The bargaining power of suppliers for Datang International Power, particularly concerning labor and expertise, is significant. Highly skilled professionals like engineers, plant operators, and maintenance specialists are essential for the efficient and safe operation of Datang's extensive power generation facilities. A scarcity of such specialized talent, especially in emerging energy sectors, can empower the workforce or external service providers, potentially driving up labor costs.

The ongoing expansion and technological upgrades within the power grid further amplify the demand for a skilled labor pool. For instance, as of early 2024, the global shortage of experienced renewable energy technicians was a growing concern, impacting project timelines and operational efficiency across the industry. Datang's reliance on these specialized skills means that disruptions in labor supply or increased wage demands from these groups can directly affect its operational costs and project execution.

- Skilled Workforce Dependency: Datang requires specialized engineers, operators, and maintenance staff for its diverse power plant types, including thermal, hydro, and renewable energy sources.

- Talent Shortages: A lack of qualified personnel, particularly for advanced technologies like smart grids and next-generation renewable energy systems, can elevate the bargaining power of available talent.

- Infrastructure Modernization: Continuous grid modernization and expansion projects necessitate a growing demand for a highly skilled and adaptable workforce, potentially increasing labor costs.

Regulatory and Environmental Compliance Suppliers

Suppliers of environmental control technologies and services are gaining leverage, especially in China, due to the nation's aggressive energy saving and carbon reduction goals. These specialized providers are crucial for power companies needing to meet increasingly strict regulations.

China's 2024-2025 action plan, for instance, targets a 2.5% reduction in energy consumption and a 3.9% decrease in CO2 intensity for 2024. This necessitates significant investment in solutions like emissions reduction and waste management technologies, thereby strengthening the bargaining power of suppliers offering these critical services.

- Increased Demand for Environmental Solutions: China's push for sustainability drives demand for advanced environmental control technologies.

- Regulatory Compliance as a Driver: Stringent energy saving and carbon reduction targets empower suppliers of compliance-enabling technologies.

- Supplier Leverage: The need for specialized environmental services gives these suppliers considerable bargaining power over power generation firms.

Datang International Power faces significant supplier bargaining power due to its reliance on specialized, capital-intensive equipment like turbines and generators. China's rapid renewable energy expansion, adding 357 GW of wind and solar capacity in 2024, amplifies the leverage of key equipment providers, potentially leading to less favorable pricing for Datang.

While Datang's coal mining interests offer some fuel cost control, coal remains critical, powering 59% of China's thermal electricity in 2024. Government policies prioritizing domestic coal and stockpiling in 2025 will further influence contract terms and pricing with external coal suppliers.

Suppliers of advanced environmental control technologies and services hold considerable sway, driven by China's aggressive energy saving and carbon reduction targets. For example, the 2024-2025 action plan aims for a 2.5% reduction in energy consumption and a 3.9% decrease in CO2 intensity, making these specialized providers essential and strengthening their negotiating position.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Datang |

|---|---|---|

| Equipment Manufacturers (Turbines, Generators) | High capital intensity, limited specialized providers, strong demand from renewable energy growth (357 GW added in 2024) | Potential for less favorable pricing and contract terms |

| Coal Suppliers | Continued reliance on coal (59% of thermal generation in 2024), government policies favoring domestic sourcing and stockpiling | Significant influence on fuel costs and operational stability |

| Environmental Technology Providers | Strict energy saving and carbon reduction goals (e.g., 2.5% energy reduction target for 2024), increasing demand for compliance solutions | Increased leverage due to critical role in regulatory adherence |

What is included in the product

This analysis delves into the competitive forces impacting Datang International Power, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the power generation sector.

Instantly visualize competitive pressures on Datang International Power, highlighting key threats and opportunities for strategic advantage.

Customers Bargaining Power

Datang International Power's primary customers are state-owned grid companies in China. This structure means Datang has limited direct customer interaction, and its sales are largely dictated by these large, regulated entities.

The Chinese government heavily regulates the power sector, setting electricity prices and dictating offtake volumes through long-term power purchase agreements (PPAs). For instance, in 2023, the average on-grid electricity price for thermal power in China remained controlled, reflecting the government's influence over pricing, which directly impacts Datang's revenue streams.

This regulatory environment grants significant bargaining power to the state-owned grid companies. They are essentially guaranteed supply through PPAs and have a strong hand in negotiating terms, which can limit Datang's pricing flexibility and profitability.

China's electricity demand is expected to see significant growth, with a projected increase of 6.5% in 2024 and 6.2% in 2025. By 2025, total consumption is anticipated to reach 10.3 trillion kilowatt-hours. This robust demand creates a stable market for power generation companies like Datang, which can help to temper the bargaining power of individual customers.

Datang International Power's customer base is remarkably broad, encompassing industrial giants, commercial entities, and residential consumers, though these relationships are primarily mediated through the national power grid. This wide distribution of demand, rather than direct engagement with Datang for many, dilutes the individual bargaining power of any particular customer segment. For instance, while a large industrial user might have some negotiating clout with the grid operator, the sheer volume and variety of other users prevent any single group from exerting significant collective pressure on Datang's overall revenue streams.

Market Reforms and Spot Markets

China's ongoing power market reforms, particularly the expansion of spot markets and adjustments to capacity pricing, are introducing more market-driven price discovery. This shift, while intended to enhance efficiency, can expose generators like Datang to greater price volatility. For instance, periods of low demand coupled with oversupply from coal and renewable sources can lead to negative pricing, as observed in some European markets. This increased transparency and flexibility can empower larger, more informed customers by giving them greater leverage in price negotiations.

The growing sophistication of these spot markets means customers can more readily compare prices and switch suppliers, thereby increasing their bargaining power. This is particularly true for industrial consumers who have the scale to negotiate directly or participate in energy trading. As of early 2024, the development of these mechanisms is still evolving, but the trend points towards a more customer-centric pricing environment.

- Market Reforms: China's power sector is actively implementing reforms to liberalize pricing and introduce competition.

- Spot Market Growth: The proliferation of power spot markets allows for real-time price discovery, increasing transparency.

- Customer Empowerment: Greater transparency and market flexibility can shift bargaining power towards informed, larger customers.

- Price Volatility: Reforms can expose generators to price swings, particularly negative pricing during oversupply conditions.

Energy Efficiency Initiatives

The Chinese government's aggressive push for energy efficiency and carbon reduction, aiming to cut energy consumption intensity by 13.5% and CO2 intensity by 14.0% by 2025 compared to 2020 levels, influences customer behavior. This policy environment encourages end-users to adopt more efficient technologies and practices.

While this focus on conservation might temper the growth in energy demand from individual sources, it doesn't directly translate into enhanced bargaining power for customers against large utility providers like Datang International Power. The company's role in meeting overall grid demand remains paramount.

However, the incentive for customers to optimize their energy usage means they are more likely to seek out and potentially negotiate for more favorable terms or explore alternative energy solutions if available, indirectly impacting Datang's market position.

- Government Mandates: China's 14th Five-Year Plan (2021-2025) sets clear targets for energy intensity reduction.

- Customer Behavior: Increased awareness and incentives for energy saving among consumers and industries.

- Datang's Position: Continues to be a primary supplier for system-wide energy needs, mitigating direct customer bargaining power.

- Indirect Influence: Customer optimization efforts can lead to shifts in demand patterns and a greater focus on cost-effectiveness.

Datang International Power's customers are primarily state-owned grid companies, limiting direct negotiation power. However, China's evolving power market reforms, including the growth of spot markets, are introducing more price discovery and transparency. This shift can empower larger, more informed industrial customers who can leverage these new mechanisms to negotiate better terms.

While the government's energy efficiency mandates encourage conservation, Datang's role as a fundamental grid supplier remains strong, mitigating the direct bargaining power of most customers. The sheer scale of demand and the regulated nature of the sector still provide Datang with a degree of stability.

| Customer Type | Bargaining Power Factors | Impact on Datang |

| State-Owned Grid Companies | Government Regulation, Long-term PPAs | High, limits pricing flexibility |

| Large Industrial Consumers | Spot Market Participation, Energy Trading Sophistication | Increasing, potential for negotiation leverage |

| Residential/Small Commercial | Mediated through Grid, Limited Direct Interaction | Low, minimal individual impact |

Preview Before You Purchase

Datang International Power Porter's Five Forces Analysis

This preview showcases the complete Datang International Power Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the power generation industry. You are viewing the exact, professionally formatted document that will be delivered to you immediately upon purchase, ensuring no surprises. This comprehensive analysis is ready for immediate download and application to your strategic decision-making.

Rivalry Among Competitors

Datang International Power Generation Co., Ltd. operates within a highly competitive landscape dominated by major state-owned enterprises in China's power sector. This oligopolistic structure means intense rivalry for market share and project development among key players.

Competition spans various generation technologies, from traditional thermal power to the rapidly growing renewable energy sector. For instance, in 2023, China's total installed power generation capacity reached approximately 2,920 gigawatts, with state-owned giants like China Huaneng Group and China Datang Corporation holding significant portions of this capacity.

China's renewable energy sector is booming, with solar and wind capacity hitting a remarkable 1,407 GW by the end of 2024. This figure surpasses the nation's 2030 target years ahead of schedule, showcasing an aggressive push towards decarbonization.

This rapid expansion significantly heightens competitive rivalry. For established players like Datang International Power, heavily reliant on coal, this means an increasing need to adapt and operate more flexibly to accommodate the growing influx of variable renewable energy sources.

Competitive rivalry in the power sector remains intense, particularly for Datang International Power, as coal continues to be a dominant energy source in China. In 2024, coal generation still represented a substantial 62% of the nation's total electricity output. This enduring reliance, coupled with approximately 200 GW of new coal capacity either under construction or already permitted, points towards a looming overcapacity situation.

This potential oversupply is already manifesting in some regional spot markets, where negative electricity prices are being observed. Such conditions intensify the competition for dispatch priority and revenue streams between traditional coal-fired power plants and the rapidly expanding renewable energy sector. Consequently, Datang's thermal power assets face direct pressure from both existing coal competitors and the growing influence of renewables, impacting their operational efficiency and profitability.

Government Policy and Market Reforms

Government policies are significantly altering the competitive dynamics within the power sector. China's 'dual carbon' goals, aiming for carbon peaking before 2030 and carbon neutrality before 2060, are a prime example. These directives necessitate a substantial shift away from fossil fuels, directly impacting companies like Datang International Power by encouraging investment in renewable energy sources and penalizing high-emission operations. The 'New Power System' framework further promotes market-oriented reforms, introducing new pricing mechanisms for electricity, including for renewable energy and ancillary services, which can affect profitability and strategic planning.

The ongoing evolution of power market and pricing systems directly influences competitive strategies. For instance, the gradual implementation of market-based pricing for electricity, moving away from fixed tariffs, introduces greater volatility but also opportunities for more efficient players. Datang International Power, like its peers, must adapt to these changes, which include how renewable energy is integrated and compensated, as well as the pricing of essential grid services. This reform landscape means that companies that can effectively manage market risks and capitalize on new revenue streams from services like grid stabilization will gain a competitive edge.

- Dual Carbon Goals: China's commitment to carbon peaking before 2030 and carbon neutrality by 2060 drives a structural shift towards cleaner energy.

- New Power System: This framework promotes market-based reforms, including market-oriented pricing for electricity and ancillary services.

- Renewable Energy Integration: Policies are shaping how renewable energy sources are compensated and integrated into the grid, affecting profitability.

- Market Reforms Impact: Ongoing refinements in power market and pricing systems necessitate strategic adjustments for companies to remain competitive.

Diversification and Integrated Energy Supply

Datang International Power's diverse portfolio, spanning coal-fired, hydro, wind, and solar power, coupled with its coal mining operations, positions it to compete across multiple energy market segments. This diversification is crucial as other major energy players are also expanding into integrated supply chains, intensifying rivalry beyond just power generation.

The competitive landscape is characterized by a race towards flexible generation capabilities, essential for managing the intermittency of renewable energy sources. Companies are investing heavily in technologies that can quickly adjust output to complement wind and solar power. For instance, in 2024, China's installed renewable energy capacity continued its rapid expansion, with wind and solar power accounting for a significant portion of new additions, creating a dynamic environment for all power producers.

- Diverse Asset Base: Datang's mix of thermal, hydro, wind, and solar assets provides resilience and market reach.

- Integrated Operations: Owning coal mines offers a degree of supply chain control, a competitive advantage.

- Industry Trend: Competitors are also diversifying, leading to broader market battles.

- Flexibility is Key: Investments in flexible generation are crucial for balancing renewables, a trend evident in 2024 energy infrastructure plans.

Competitive rivalry is fierce in China's power sector, with state-owned giants like Datang International Power facing intense competition. The nation's installed power generation capacity reached approximately 2,920 GW in 2023, with major players holding substantial shares. This competition is amplified by the rapid growth of renewables; by the end of 2024, China's solar and wind capacity hit a remarkable 1,407 GW, surpassing 2030 targets and intensifying the need for all generators, including coal-reliant ones like Datang, to adapt.

The dominance of coal, representing 62% of China's electricity output in 2024, and the addition of approximately 200 GW of new coal capacity, points to potential overcapacity. This is already causing negative prices in some regional spot markets, intensifying the competition for dispatch priority and revenue between traditional and renewable sources. Consequently, Datang's thermal assets face direct pressure, impacting their efficiency and profitability.

| Energy Source | 2024 Capacity (GW) | Growth Driver | Competitive Impact |

|---|---|---|---|

| Solar & Wind | 1,407 | Decarbonization push | Increased competition for dispatch |

| Coal | Substantial portion of 2,920 GW total | Ongoing reliance, new capacity | Potential overcapacity, price pressure |

SSubstitutes Threaten

Distributed renewable generation, especially rooftop solar, presents a significant threat to traditional, centralized power producers like Datang International Power. As more consumers, both residential and commercial, adopt these self-generation technologies, their reliance on grid-supplied electricity diminishes. This shift directly impacts the demand for power from large-scale plants.

China's strong policy support for distributed renewables further amplifies this threat. By 2023, China's installed capacity for distributed solar power had reached impressive levels, with new capacity additions consistently breaking records. This growth means a growing portion of electricity demand can be met locally, bypassing traditional utility providers.

The declining costs of solar photovoltaic (PV) technology are a key driver behind this trend. As solar panels become more affordable and efficient, the economic case for distributed generation strengthens, making it an increasingly attractive alternative to purchasing power from the grid. This erosion of demand could impact Datang's revenue streams and market share.

Advances in energy efficiency technologies and practices pose a substantial threat of substitution for electricity consumption. China's commitment, as evidenced by its 2024-2025 action plan for energy saving and carbon reduction, aims to lower energy consumption per unit of GDP, directly impacting demand for power generation.

For instance, improved building insulation, the adoption of more efficient appliances, and the optimization of industrial processes can significantly curb the growth of electricity demand. This trend could directly affect Datang International Power's sales volumes and revenue streams as end-users find more cost-effective ways to meet their energy needs without increasing their reliance on traditional electricity sources.

Datang International Power's heat supply business faces a threat from alternative heating solutions like heat pumps, geothermal systems, and direct solar heating. These substitutes are gaining traction, particularly in urban environments, driven by increasing environmental awareness and technological improvements.

Government incentives for adopting cleaner heating technologies further bolster the viability of these alternatives. For instance, in 2024, many regions continued to offer subsidies for residential solar installations and energy-efficient heat pump upgrades, directly impacting the demand for traditional district heating.

Energy Storage Solutions

The growing availability of energy storage solutions, especially battery technology, presents a significant threat to traditional power generators like Datang International Power. These solutions allow consumers and businesses to store electricity, potentially reducing their reliance on continuous grid supply.

While the primary impact today is on grid stability and integrating renewable energy sources, the increasing cost-effectiveness and efficiency of storage could empower large consumers to achieve greater energy independence. This shift could directly diminish the demand for power from traditional generators.

For instance, by mid-2024, the global energy storage market was projected to reach hundreds of billions of dollars, with battery storage leading the charge. This expansion directly translates to more options for end-users to manage their energy consumption independently.

- Growing Battery Adoption: Residential and commercial battery installations are on the rise globally, offering consumers a buffer against grid reliance.

- Grid Independence Potential: Advanced storage systems can enable microgrids and self-sufficient energy solutions for large industrial users.

- Falling Storage Costs: The declining cost of battery technology, a trend expected to continue through 2025, makes these solutions increasingly economically viable for a wider range of users.

- Renewable Integration Driver: Energy storage is crucial for integrating intermittent renewables, but it also allows the stored renewable energy to be used directly, bypassing traditional supply.

Demand-Side Management and Smart Grids

Smart grids and sophisticated demand-side management (DSM) programs are emerging as significant substitutes for traditional power generation. These advancements empower consumers to optimize their electricity usage, shifting demand away from peak periods or responding to dynamic pricing. This flexibility effectively reduces the need for new, often expensive, power plants.

China's commitment to grid modernization is a key factor here. By 2024, the nation has been actively investing in upgrading its power infrastructure to better accommodate the integration of variable renewable energy sources. This strategic investment in grid intelligence directly enhances the effectiveness of DSM, further solidifying its role as a substitute for conventional generation capacity.

- Smart Grid Development: Enables more efficient electricity consumption and load shifting, reducing reliance on peak generation.

- Demand-Side Management (DSM): Empowers customers to respond to price signals and reduce consumption during high-demand periods.

- China's Grid Modernization: Significant investment in grid upgrades by 2024 to integrate variable renewable energy, enhancing DSM capabilities.

- Substitution Effect: Increased adoption of smart grids and DSM effectively substitutes for the need for additional power generation capacity.

The threat of substitutes for Datang International Power is substantial, driven by distributed renewable generation, energy efficiency, alternative heating, energy storage, and smart grid technologies. These substitutes directly reduce the demand for traditional, centralized power and heating services.

For instance, by the end of 2023, China's distributed solar capacity had grown significantly, with new installations consistently breaking records, directly impacting grid reliance. Furthermore, China's 2024-2025 energy saving plans aim to lower energy intensity, curbing overall electricity demand.

The global energy storage market, projected to be worth hundreds of billions by mid-2024, also offers consumers more energy independence, diminishing reliance on grid supply. These evolving alternatives collectively challenge Datang's market position.

| Substitute Technology | Impact on Datang | Key Trend/Data Point (as of mid-2024/early 2025) |

|---|---|---|

| Distributed Solar PV | Reduced demand for grid electricity | China's distributed solar capacity saw record additions through 2023. |

| Energy Efficiency | Lower overall electricity consumption | China's 2024-2025 plans target reduced energy intensity per GDP. |

| Alternative Heating (Heat Pumps, etc.) | Decreased demand for district heating | Government incentives for clean heating technologies are increasing. |

| Energy Storage | Potential for grid independence | Global energy storage market projected to reach hundreds of billions by mid-2024. |

| Smart Grids & DSM | Reduced need for new generation capacity | China's grid modernization investments enhance DSM effectiveness. |

Entrants Threaten

The sheer scale of investment needed to build and operate power generation facilities, especially traditional ones like coal, hydro, or nuclear, presents a formidable hurdle for potential newcomers. For instance, constructing a new large-scale coal-fired power plant can easily cost billions of dollars. This immense capital requirement inherently limits the number of companies that can realistically enter this sector, thereby protecting established players like Datang International Power.

China's power sector operates under a highly regulated framework, with government bodies like the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) dictating project approvals, licensing, and operational standards. This stringent oversight acts as a significant barrier, making it difficult for new companies, particularly foreign or smaller domestic entities, to enter the market. For instance, obtaining the necessary generation licenses and navigating the complex approval processes can take years and substantial investment.

The threat of new entrants in China's power generation sector is significantly dampened by the dominance of state-owned enterprises (SOEs). Datang International Power Generation Co., Ltd., along with other major SOEs, controls a vast majority of the installed capacity, leveraging decades of infrastructure development and strong government backing. For instance, as of the end of 2023, SOEs accounted for over 80% of China's total installed power generation capacity, making it exceptionally challenging for new, independent players to compete.

Access to Grid Infrastructure

New power generators face a significant barrier in securing access to the national grid for transmitting and distributing electricity. While China's grid infrastructure is undergoing rapid expansion and modernization, obtaining reliable and cost-effective grid connections remains a challenge for newcomers.

The integration of variable renewable energy sources, such as solar and wind, introduces further complexities related to grid stability and dispatch management. For instance, as of 2023, China's installed renewable energy capacity surpassed 1.3 billion kilowatts, highlighting the increasing need for sophisticated grid management to accommodate these intermittent sources.

- Grid Access Requirements: New entrants must navigate regulatory approvals and technical standards for grid connection.

- Infrastructure Costs: The investment required for grid connection infrastructure can be substantial.

- Grid Stability Concerns: Integrating new capacity, especially renewables, requires careful planning to maintain grid reliability.

Government Support for Existing Players and Policy Direction

While China is aggressively pushing renewable energy, the government also prioritizes energy security. This can translate into ongoing support for established coal power plants or significant state-backed projects, potentially creating hurdles for new market entrants. For instance, in 2023, China's coal-fired power generation capacity saw continued growth, adding to the installed base that existing players leverage.

New entrants must therefore navigate a complex policy environment where established companies, particularly state-owned enterprises, may benefit from preferential treatment or existing long-term contracts. This dynamic can influence the cost of capital and market access for newcomers aiming to compete in the power generation sector.

- Government policies balance renewable growth with energy security needs.

- Established players may receive preferential treatment or have existing agreements.

- Continued investment in traditional power sources by the state impacts market dynamics.

The threat of new entrants in China's power sector is significantly low due to massive capital requirements, stringent government regulations, and the entrenched dominance of state-owned enterprises like Datang International Power. These factors create substantial barriers to entry, protecting incumbent players.

For instance, constructing a new large-scale power plant can cost billions, a prohibitive sum for most potential newcomers. Furthermore, navigating China's complex licensing and approval processes, overseen by bodies like the NDRC and NEA, can take years and considerable resources. This regulatory environment, coupled with the fact that SOEs controlled over 80% of China's installed power capacity by the end of 2023, makes it exceedingly difficult for new entities to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High upfront investment for plant construction. | Limits the number of potential entrants. | Billions of USD for a single large power plant. |

| Government Regulation | Strict licensing, approvals, and operational standards. | Increases time and cost to enter the market. | Years to secure generation licenses and navigate approvals. |

| SOE Dominance | Established infrastructure and government backing. | Creates an uneven playing field for new players. | SOEs held >80% of China's installed capacity in 2023. |

| Grid Access | Navigating connection standards and infrastructure costs. | Can be a significant hurdle for transmission. | Substantial investment needed for grid connection. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Datang International Power leverages data from the company's annual reports, SEC filings, and industry-specific research from organizations like the International Energy Agency. This ensures a comprehensive understanding of the competitive landscape and key market drivers.