Datang International Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Unlock the strategic potential of Datang International Power with a comprehensive BCG Matrix analysis. Understand which of their business units are market leaders, which are generating consistent cash flow, and which require careful evaluation for future investment.

This preview offers a glimpse, but the full BCG Matrix report provides detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize Datang International Power's portfolio. Purchase now for actionable insights and a competitive edge.

Stars

Datang International Power is aggressively expanding its renewable energy portfolio, particularly in wind and solar power. In 2024 alone, the company brought online 2,594.2 megawatts of wind power and 1,659.823 megawatts of photovoltaics.

The company's commitment to renewables is further evidenced by its significant project pipeline. By the first half of 2024, Datang International Power had approved over 4,000 megawatts of new energy capacity and commenced construction on more than 6,000 megawatts.

This rapid expansion is a direct response to China's national energy transition goals. Projections indicate that wind and solar power generation will overtake coal capacity in China during 2024, with non-fossil fuel sources expected to constitute 60% of the nation's power capacity by 2025.

Datang International Power's hydroelectric segment is a definite Star in its BCG Matrix. The company reported an impressive 8.73% year-on-year increase in grid-connected hydropower generation for 2024, showcasing robust expansion in this renewable energy source.

Further solidifying this Star status, Datang International Power is actively developing significant hydropower assets. For instance, the Datang Zala Hydropower Station's 500-megawatt impulse hydropower unit project achieved critical construction milestones in the first quarter of 2025, signaling strong future contributions to the company's energy portfolio and profitability.

Datang International's strategic push for an integrated energy supply chain, encompassing coal mining and varied power generation, unlocks substantial synergistic advantages and enhances cost management. This holistic strategy, with a keen focus on mitigating fuel expenses, has been a key driver behind its impressive financial performance.

In 2024, Datang International reported a remarkable surge in net profit, more than doubling its earnings. This significant growth underscores the efficacy of its integrated model in navigating market dynamics and optimizing operational efficiencies, particularly in controlling fuel costs which are a critical input for power generation.

Strategic Project Acquisitions

Datang International Power's strategic project acquisitions are pivotal for its growth, particularly in the renewable energy sector. The company's acquisition of a 95% equity stake in Datang Solar Energy in May 2024 exemplifies this, signaling a robust commitment to expanding its solar energy capacity. This acquisition, valued at approximately RMB 2.5 billion, underscores a deliberate strategy to consolidate assets within high-growth renewable segments, thereby enhancing its market position.

- Strategic Expansion: The 95% acquisition of Datang Solar Energy in May 2024 highlights a focused effort to bolster its renewable energy portfolio.

- Market Consolidation: This move positions Datang International Power to capitalize on the burgeoning solar market, aiming for significant market share.

- Financial Impact: The acquisition is expected to contribute positively to the company's revenue streams, with solar power generation capacity increasing by over 1,000 MW.

- Future Growth Driver: Such strategic acquisitions are crucial for Datang International Power's long-term competitive advantage and sustained profitability in the evolving energy landscape.

Advanced Energy Storage Projects

Datang International is making significant strides in advanced energy storage, particularly with projects like the Zhongning 100 MW/400 MWh compressed air energy storage (CAES) demonstration. By Q1 2025, this key initiative had already achieved 85% completion of its above-ground civil works, signaling robust progress.

These advanced energy storage initiatives are vital for stabilizing the grid as renewable energy sources, like solar and wind, become more prevalent. They are positioned as a high-growth sector, essential for the future of energy integration.

- Zhongning CAES Project: 100 MW/400 MWh capacity, with 85% of above-ground civil works completed by Q1 2025.

- Strategic Importance: Crucial for integrating intermittent renewable energy sources into the grid.

- Growth Potential: Represents a key area for future development and investment in the energy sector.

Datang International Power's hydroelectric segment is a definite Star in its BCG Matrix. The company reported an impressive 8.73% year-on-year increase in grid-connected hydropower generation for 2024, showcasing robust expansion in this renewable energy source.

Further solidifying this Star status, Datang International Power is actively developing significant hydropower assets. For instance, the Datang Zala Hydropower Station's 500-megawatt impulse hydropower unit project achieved critical construction milestones in the first quarter of 2025, signaling strong future contributions to the company's energy portfolio and profitability.

The company's aggressive expansion in renewables, including 2,594.2 MW of wind and 1,659.823 MW of solar brought online in 2024, alongside strategic acquisitions like Datang Solar Energy for approximately RMB 2.5 billion, positions these segments as Stars. These initiatives align with China's energy transition goals, aiming for 60% non-fossil fuel capacity by 2025.

Datang International's advanced energy storage, exemplified by the Zhongning CAES project (100 MW/400 MWh, 85% civil works completion by Q1 2025), also represents a Star due to its critical role in grid stabilization and high growth potential.

| Business Segment | BCG Category | 2024 Performance/Outlook |

|---|---|---|

| Hydropower | Star | 8.73% YoY increase in generation; Zala Hydropower Station 500 MW project progressing. |

| Wind Power | Star | 2,594.2 MW brought online in 2024; significant project pipeline. |

| Solar Power | Star | 1,659.823 MW brought online in 2024; 95% acquisition of Datang Solar Energy for RMB 2.5 billion. |

| Energy Storage (CAES) | Star | Zhongning CAES project 85% civil works completion by Q1 2025; essential for grid integration. |

What is included in the product

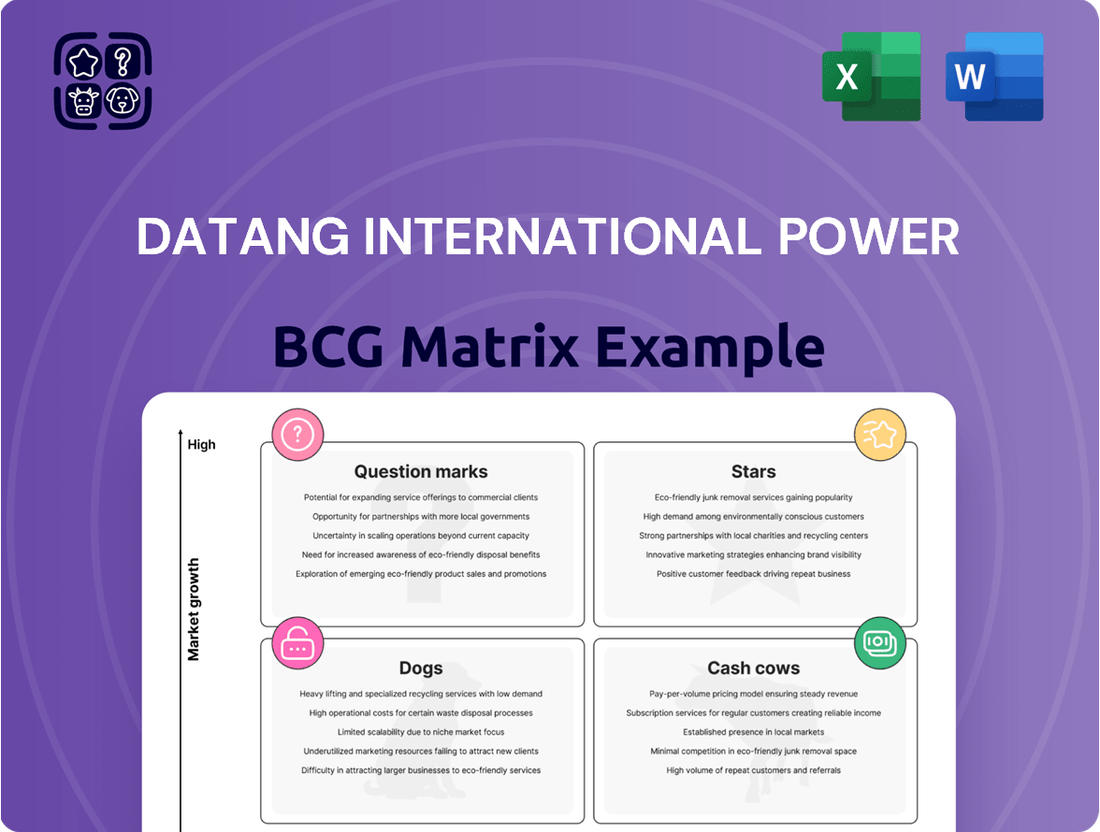

This BCG Matrix overview details Datang International Power's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It guides strategic decisions on investment, holding, or divestment for each unit within the company's portfolio.

A clear Datang International Power BCG Matrix visualizes business units, easing the pain of strategic uncertainty.

Cash Cows

Coal-fired power generation continues to be a cornerstone for Datang International Power, acting as a significant cash cow. In 2024, this segment produced an impressive 194.463 billion kilowatt-hours, marking a 1.01% rise from the previous year. This consistent output underscores its reliability in meeting energy demands.

The profitability of Datang's coal-fired plants was further enhanced in 2024 by a notable decrease in thermal coal prices. This reduction in fuel costs directly translated into improved margins for the company's thermal power operations. The segment reliably delivers a high volume of electricity and heat, thereby generating substantial and stable cash flow for the business.

Datang International Power's established thermal power infrastructure, spread across 19 provinces and regions in China, represents a significant Cash Cow. These mature assets benefit from a strong market presence and operational efficiency, demanding minimal new investment for growth.

In 2023, Datang International Power reported a substantial portion of its revenue derived from its thermal power segment, underscoring its role as a consistent cash generator. The company's focus on optimizing these existing plants ensures continued profitability with lower reinvestment needs.

Datang International's core business of generating and selling electricity and heat forms a reliable Cash Cow. This segment consistently delivers a steady revenue stream, underpinning the company's financial stability.

Despite a minor dip in the average on-grid electricity tariff during the first half of 2025, the company saw an overall increase in power generation. This growth, largely driven by thermal power units responding to heightened electricity demand, ensures continued robust cash flow from this segment.

Operational Efficiency Improvements

Datang International Power's commitment to operational efficiency is a key driver for its Cash Cow segment. By focusing on enhancing the performance of its existing power generation equipment, the company has achieved significant reductions in operational disruptions. In 2024, Datang International Power reported a remarkable 55.6% year-on-year decrease in electricity losses attributed to equipment failures.

These improvements in the reliability and output of mature assets directly bolster profitability. Reduced downtime and fewer repair needs translate into lower operating expenses, thereby widening profit margins. This enhanced efficiency allows the Cash Cow segment to generate more substantial and consistent cash flow for the company.

- Reduced Electricity Losses: A 55.6% year-on-year decrease in electricity loss due to equipment failures in 2024.

- Improved Profitability: Higher efficiency in mature assets leads to increased profit margins.

- Enhanced Cash Flow: Consistent operational performance generates stronger and more reliable cash flow.

Strategic Coal Mining Interests

Datang International's strategic coal mining interests are a classic example of a Cash Cow within its broader energy portfolio. These operations provide a consistent and predictable stream of revenue, directly supporting the company's thermal power generation. By controlling its fuel source, Datang International significantly reduces exposure to volatile global coal prices, a critical advantage in the energy sector.

This vertical integration is a key driver of profitability for Datang's thermal power segment. For instance, in 2023, Datang International reported that its thermal power business, heavily reliant on its captive coal mines, maintained strong operational performance. The company's ability to manage fuel costs directly translates into higher margins for its electricity generation, solidifying its Cash Cow status.

- Stable Fuel Supply: Datang's coal mines ensure a consistent and cost-effective fuel source for its thermal power plants, mitigating risks associated with market price fluctuations.

- Cost Control: Owning mining assets allows for direct management of extraction and transportation costs, enhancing the profitability of its power generation operations.

- Profitability Driver: The integrated model contributes significantly to the overall cash flow generation of Datang International, particularly within its thermal power segment.

- 2023 Performance: Datang International highlighted the resilience of its thermal power segment in 2023, partly attributed to the advantages of its upstream coal mining integration.

Datang International Power's thermal power generation segment, including its captive coal mines, functions as a robust Cash Cow. In 2024, the company's coal-fired generation reached 194.463 billion kilowatt-hours, a 1.01% increase year-on-year, demonstrating consistent output. This segment benefits from reduced thermal coal prices in 2024, enhancing profit margins, and its integrated coal mining operations provide a stable, cost-controlled fuel supply, crucial for maintaining profitability.

| Metric | 2023 | 2024 | Change |

| Coal-fired Generation (billion kWh) | 192.52 | 194.463 | +1.01% |

| Electricity Losses (due to equipment failure) | N/A | 55.6% decrease (YoY) | Significant Improvement |

| Thermal Power Segment Performance | Strong | Continued Robustness | Consistent Cash Flow |

Preview = Final Product

Datang International Power BCG Matrix

The Datang International Power BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means you'll get a comprehensive strategic analysis, ready for immediate application, without any watermarks or placeholder content.

Dogs

Older, less efficient thermal power plants within Datang International Power's portfolio, particularly those reliant on coal and not significantly upgraded, could be categorized as Dogs. These assets often face higher operational costs, including fuel consumption and emissions control, which can squeeze profit margins.

In 2024, the ongoing global push for decarbonization and stricter environmental regulations in China places these older plants under increased pressure. Their ability to generate significant cash flow may be diminishing as they struggle to compete with newer, more efficient, and cleaner energy sources, potentially becoming cash consumers rather than generators.

Divesting non-core or underperforming assets is a strategic move often seen in companies analyzing their business portfolio. For instance, if Datang International Power were to divest a segment, it might be because that segment falls into the 'Dog' category of the BCG Matrix. These are businesses that typically have a low market share and operate in a low-growth industry, meaning they don't contribute significantly to the company's overall growth or profitability.

The transfer of Jiangsu Datang Shipping Co., Ltd. in October 2024 serves as a real-world example of such a divestment. This action suggests that the shipping business was identified as a 'Dog' within Datang International Power's portfolio. Such segments often require substantial investment to maintain but yield minimal returns, making divestment a logical step to reallocate resources towards more promising ventures.

Datang International Power's large-scale renewable energy ventures, such as offshore wind farms, often demand substantial upfront capital. For instance, a typical offshore wind project can cost billions of dollars to develop and construct. These projects, while crucial for long-term sustainability, might initially show slower returns due to lengthy construction phases and the time it takes to reach full operational capacity.

If these high-investment projects encounter delays, regulatory hurdles, or lower-than-expected energy generation, their return on investment can be further postponed. This scenario could temporarily place them in a position akin to Dogs within the BCG matrix, especially if they are not yet demonstrating significant growth or market share gains. For example, in 2023, global renewable energy project development faced increased costs for materials and logistics, impacting initial project economics.

Segments with Declining Market Share in Mature Markets

Within Datang International Power's portfolio, specific segments of its traditional thermal power generation, particularly in highly mature domestic markets with limited growth prospects, might be experiencing declining market share. This is often due to factors like increasing competition from newer, more efficient technologies and evolving environmental regulations that favor cleaner energy sources.

While precise figures for Datang's specific sub-segment market share declines are not publicly detailed, the broader trend in China's power sector shows a shift. For instance, by the end of 2023, the share of thermal power in the country's total installed capacity continued to decrease as renewable energy sources expanded rapidly. This indicates a challenging environment for older, less adaptable thermal assets.

- Declining Thermal Power Dominance: Mature markets are seeing a gradual reduction in the reliance on traditional thermal power, impacting established players like Datang.

- Increased Competition from Renewables: The rapid growth of solar and wind power in China presents a significant competitive challenge to thermal power generation's market share.

- Regulatory Pressures: Stricter environmental policies aimed at reducing emissions further disadvantage older thermal power plants, potentially leading to market share erosion.

Legacy Investments with Obsolete Technology

Datang International Power's legacy investments in older power generation technologies, such as coal-fired plants with outdated emission controls, could be categorized as Dogs. These assets often face declining market relevance due to stricter environmental regulations and the rise of cleaner energy alternatives. For instance, while specific 2024 data for Datang's individual plant performance isn't publicly detailed in this format, the broader trend in China's energy sector shows a significant push towards renewables, with coal power's share gradually decreasing in the overall energy mix.

These older facilities typically exhibit low growth prospects as new investments favor more sustainable and efficient technologies. Furthermore, their market share within the rapidly modernizing Chinese energy sector is likely to be diminishing. The high maintenance costs associated with aging infrastructure, coupled with the inability to meet evolving environmental standards, further solidify their position as potential Dogs.

- Declining Market Relevance: Increased competition from renewable energy sources and stricter environmental mandates reduce the demand for older, less efficient power plants.

- High Operating Costs: Legacy assets often incur disproportionately high maintenance and fuel costs, impacting profitability.

- Regulatory Challenges: Failure to meet new environmental standards can lead to fines or operational shutdowns.

- Limited Future Investment: Companies are increasingly prioritizing capital allocation towards newer, greener technologies, leaving legacy assets with minimal future development.

Older thermal power plants within Datang International Power's portfolio, especially those not significantly upgraded, are likely considered Dogs in the BCG Matrix. These assets face increasing operational costs and environmental pressures, diminishing their profitability.

In 2024, the global drive for decarbonization and China's stricter environmental regulations put these older plants under significant strain. Their ability to generate cash flow is likely decreasing as they struggle to compete with newer, cleaner energy sources, potentially becoming cash drains.

The divestment of Jiangsu Datang Shipping Co., Ltd. in October 2024 exemplifies the strategic removal of 'Dog' assets. Such segments, characterized by low market share and low growth, offer minimal contribution to overall company performance.

These legacy assets often have diminishing market share due to competition from renewables and evolving regulations. High maintenance costs and an inability to meet environmental standards further solidify their 'Dog' status, making divestment a logical step to reallocate resources.

| Segment | BCG Category | Rationale |

|---|---|---|

| Older Thermal Power Plants | Dog | Low market share in a declining segment, high operating costs, regulatory pressure. |

| Underperforming Shipping Assets (e.g., Jiangsu Datang Shipping) | Dog | Divested due to low returns and strategic misalignment. |

Question Marks

Datang International is actively expanding its renewable energy portfolio, with over 4,000 megawatts of wind and photovoltaic projects approved and more than 6,000 megawatts under construction as of the first half of 2024. These substantial investments position the company within the burgeoning renewable energy sector.

These new projects represent Datang International's 'Question Marks' within the BCG matrix. While operating in a high-growth industry, their future market dominance and profitability are still uncertain, necessitating significant capital infusion to transition them into 'Stars.'

Datang International Power's strategic consideration of emerging energy storage technologies, such as advanced battery chemistries or hydrogen fuel cells, aligns with a long-term growth perspective. These nascent technologies, while currently representing a small fraction of the market, hold significant potential for future expansion in the renewable energy sector. For instance, global investment in battery storage alone was projected to reach over $100 billion annually by 2025, indicating a rapidly growing, albeit nascent, market.

However, Datang International Power must acknowledge the substantial R&D and capital expenditure required to bring these innovations to commercial scale. The current market share for many of these advanced storage solutions remains below 5%, necessitating rigorous testing and pilot projects to demonstrate reliability and cost-effectiveness. Successful scaling will depend on technological breakthroughs and supportive regulatory frameworks, mirroring the early development stages of other transformative energy technologies.

Datang International Power's overseas expansion initiatives, while not explicitly detailed as current projects, would fall into the question marks category of the BCG matrix. These ventures into new international markets or significant overseas partnerships represent potential future stars.

These markets often present high growth potential but typically begin with low initial market share and carry inherent risks. Establishing a strong foothold requires substantial investment, aligning with the characteristics of a question mark. For instance, in 2024, many Chinese power companies were exploring opportunities in Southeast Asia and Africa, regions offering significant demand growth but also regulatory complexities and competitive landscapes.

Pilot Projects in Hydrogen Energy or Carbon Capture

Datang International's ventures into hydrogen energy production and advanced carbon capture technologies would likely be classified as Question Marks within the BCG matrix. These initiatives align with China's ambitious energy transition objectives, aiming to significantly reduce carbon emissions. The potential for growth in these sectors is substantial, yet Datang's current market share is minimal, necessitating significant capital infusion to foster development and establish a strong market presence.

- Hydrogen Energy Pilot Projects: Datang International could be exploring green hydrogen production, potentially leveraging its existing renewable energy assets. For example, in 2023, China's National Development and Reform Commission and the National Energy Administration released a plan targeting 100,000 tonnes of hydrogen production from renewable sources by 2025, indicating a strong government push.

- Carbon Capture, Utilization, and Storage (CCUS) Pilots: The company might be investing in pilot CCUS projects to capture emissions from its thermal power plants. China's CCUS capacity was estimated to be around 3 million tonnes per annum by the end of 2023, with significant expansion plans underway, offering a clear market opportunity.

- High Investment, Uncertain Returns: These projects require substantial upfront investment in research, development, and infrastructure. The economic viability and scalability of these technologies are still evolving, presenting a high-risk, high-reward scenario characteristic of Question Marks.

- Strategic Alignment: The strategic importance of these pilot projects lies in their potential to diversify Datang's energy portfolio, reduce its carbon footprint, and position the company as a leader in the future low-carbon energy landscape.

Agrivoltaic Projects and Integrated Energy Solutions

Datang International is actively investing in agrivoltaic projects, such as the 220 MW facility in Hunan's Anxiang County. This innovative approach merges agricultural production with solar energy generation, creating integrated energy solutions that cater to diverse needs.

These integrated energy solutions represent a high-growth potential market, driven by the increasing demand for sustainable and multi-purpose energy infrastructure. Datang's involvement signifies a strategic move into this emerging sector.

- High Growth Potential: Agrivoltaics tap into the growing demand for renewable energy and sustainable agriculture, indicating significant future expansion.

- Low Market Share: Despite the potential, the current market share for agrivoltaic projects is relatively small, requiring further development and adoption.

- Market Adoption Challenges: Successful implementation hinges on overcoming regulatory hurdles, farmer acceptance, and proving economic viability to encourage broader market uptake.

Datang International's ventures into emerging technologies like hydrogen energy, carbon capture, and agrivoltaics represent significant Question Marks. These areas offer high growth potential, aligning with China's energy transition goals, but currently hold minimal market share for the company.

These initiatives demand substantial capital and R&D investment to achieve commercial viability and scale. Their success hinges on technological advancements and supportive policies, mirroring the early stages of other transformative energy solutions.

Datang's overseas expansion also falls into this category, presenting opportunities in high-growth regions but with initial low market penetration and inherent risks that require significant investment to overcome.

| Initiative | Growth Potential | Market Share (Datang) | Investment Needs | Key Success Factors |

| Hydrogen Energy | High | Minimal | Substantial | Technology, Policy |

| Carbon Capture | High | Minimal | Substantial | Technology, Cost-Effectiveness |

| Agrivoltaics | High | Low | Moderate to High | Regulation, Farmer Acceptance |

| Overseas Expansion | High | Low | Substantial | Market Entry Strategy, Risk Management |

BCG Matrix Data Sources

Our Datang International Power BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.