Datang International Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datang International Power Bundle

Unlock the strategic blueprint behind Datang International Power's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core value propositions, key customer segments, and innovative revenue streams, offering invaluable insights for anyone looking to understand their competitive edge.

Dive deeper into the operational excellence and strategic partnerships that drive Datang International Power's market leadership. Our downloadable Business Model Canvas provides a clear, actionable roadmap to their growth, perfect for strategic planning and competitive analysis.

Want to dissect the engine of Datang International Power's business? Get the full, editable Business Model Canvas to explore their cost structure, key resources, and channels to market. This is your chance to learn from a proven industry leader.

Partnerships

Datang International Power's key partnerships with government and regulatory bodies are foundational to its operations in China's energy sector. These relationships are vital for navigating the complex landscape of energy policy and environmental compliance, particularly as China pushes towards its carbon neutrality targets. For instance, in 2023, the company continued to align its development strategies with national five-year plans, which heavily influence investment in renewable energy sources.

Securing necessary licenses and project approvals from entities like the National Development and Reform Commission (NDRC) and the Ministry of Ecology and Environment is paramount. These approvals are directly tied to adhering to stringent environmental standards, a critical factor in China's ongoing energy transition. Datang's commitment to developing cleaner energy, such as wind and solar power, is often supported by government incentives and favorable regulatory frameworks, underscoring the symbiotic nature of these partnerships.

Datang International Power Generation Co., Ltd. relies heavily on coal suppliers and mining companies to fuel its extensive network of coal-fired power plants. These partnerships are crucial for maintaining a consistent and affordable fuel source, which is the backbone of their operations. For instance, in 2023, coal accounted for a significant portion of their energy generation mix.

The company's strategic involvement in coal mining itself further solidifies these relationships, creating an integrated supply chain. This vertical integration allows Datang International to better control fuel costs and ensure supply security. Long-term supply agreements and potential joint ventures are common mechanisms used to manage fuel procurement and optimize operational expenditures, directly impacting profitability.

Datang International collaborates with leading equipment manufacturers and technology providers to ensure its vast portfolio of power plants, encompassing coal, hydro, wind, and solar, remains state-of-the-art. These partnerships are crucial for sourcing advanced generation equipment and integrating innovative energy storage systems.

These collaborations are vital for Datang International's commitment to efficiency and reliability, enabling the adoption of cutting-edge technologies. For instance, in 2024, the company continued to invest in upgrading its wind turbine technology, aiming for higher capacity factors, which are projected to improve overall energy output by an estimated 3-5% in upgraded facilities.

Furthermore, these strategic alliances are instrumental in Datang International's green transformation strategy, facilitating the development and deployment of low-carbon technologies. In 2024, partnerships with solar panel manufacturers focused on incorporating higher-efficiency photovoltaic cells, contributing to a more sustainable energy mix.

Grid Operators and Transmission Companies

Datang International's business model relies heavily on its partnerships with national and regional grid operators and transmission companies. These collaborations are essential for the physical transmission and distribution of the electricity Datang generates. For instance, in 2023, Datang International's total on-grid electricity volume reached 238.7 billion kilowatt-hours, all of which was transmitted via these critical infrastructure partners.

These partnerships ensure that Datang's diverse power sources, including thermal, hydro, wind, and solar, can be seamlessly integrated into the national grid. This integration is vital for maintaining grid stability and ensuring a reliable supply of power to consumers. The effective coordination with entities like the State Grid Corporation of China allows for optimized power dispatch, especially crucial as renewable energy sources fluctuate.

- Grid Integration: Partnerships facilitate the connection of Datang's power plants to the national transmission network.

- Reliable Delivery: Collaborations ensure electricity reaches end-users efficiently and without interruption.

- Grid Stability: Coordination with grid operators is key to managing power flow and preventing blackouts.

- Optimized Dispatch: Working with transmission companies allows for the most efficient use of Datang's generation capacity.

Financial Institutions and Investors

Datang International Power’s ability to fund its vast operations, new project developments, and strategic ventures into renewables and other energy sectors hinges on its financial institutions and investors. These partnerships are the lifeblood for securing the necessary capital, managing the cost of financing, and bolstering overall investor confidence.

The company actively cultivates robust relationships with a spectrum of financial entities, including banks, investment firms, and its shareholder base. These connections are vital for accessing diverse funding sources and optimizing financial strategies.

- Funding Operations: Datang International Power secured approximately RMB 27.3 billion in financing from various banks in 2023, supporting its ongoing operational needs and capital expenditures.

- Project Development: Investments in new power projects, including those in renewable energy, are largely financed through syndicated loans and bond issuances, with the company raising over RMB 15 billion in corporate bonds during the first half of 2024.

- Investor Relations: The company regularly engages with its investors through quarterly earnings calls and annual general meetings, aiming to provide transparency and foster long-term investment commitment.

- Strategic Investments: Acquisitions and strategic stakes in emerging energy technologies are often facilitated by equity financing and strategic partnerships with investment funds specializing in the energy transition.

Datang International Power's key partnerships extend to research institutions and universities, fostering innovation in energy technologies. These collaborations are crucial for staying at the forefront of advancements in areas like smart grids and advanced battery storage, vital for the company's renewable energy expansion. In 2024, collaborations with leading Chinese universities focused on developing more efficient solar cell technologies, aiming to boost energy conversion rates by up to 2%.

These academic alliances also support the company's efforts in environmental research and carbon capture technologies. By partnering with these institutions, Datang International gains access to cutting-edge research that can inform its long-term sustainability strategies and operational improvements. For example, a 2023 initiative with a prominent research institute focused on optimizing the efficiency of existing coal-fired power plants through advanced combustion techniques.

| Type of Partner | Role in Business Model | Example of Collaboration/Data |

| Government & Regulatory Bodies | Policy navigation, licensing, compliance | Alignment with national five-year plans (2023); securing NDRC/Ministry of Ecology and Environment approvals |

| Coal Suppliers & Mining Companies | Fuel sourcing, supply chain integration | Consistent fuel supply for coal-fired plants (significant portion of generation in 2023); vertical integration in mining |

| Equipment Manufacturers & Tech Providers | Sourcing advanced generation equipment, integrating new technologies | Upgrading wind turbine technology (2024) for 3-5% capacity factor improvement; higher-efficiency solar cells |

| Grid Operators & Transmission Companies | Electricity transmission and distribution, grid integration | On-grid electricity volume of 238.7 billion kWh (2023); seamless integration of diverse power sources |

| Financial Institutions & Investors | Capital access, financing operations, investor confidence | Secured RMB 27.3 billion in bank financing (2023); raised over RMB 15 billion in corporate bonds (H1 2024) |

| Research Institutions & Universities | Technological innovation, environmental research | Developing efficient solar cell technologies (2024); optimizing coal plant efficiency (2023) |

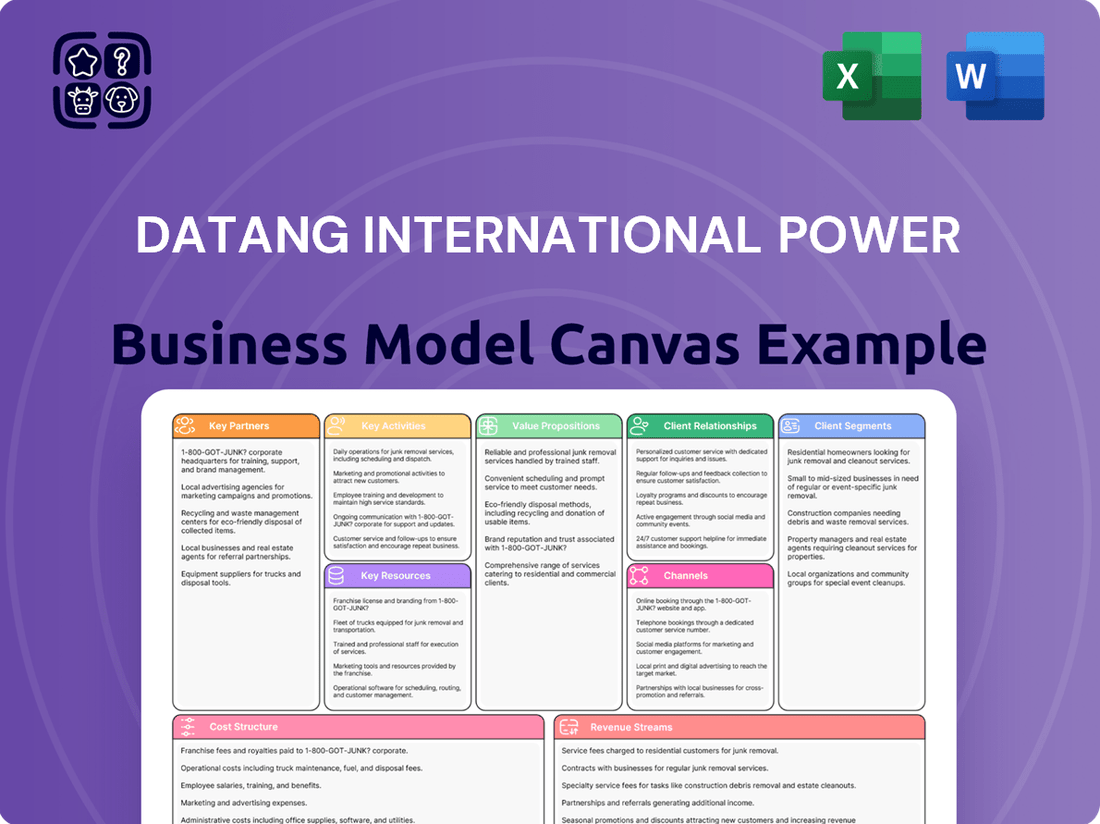

What is included in the product

A comprehensive, pre-written business model tailored to Datang International's strategy of diversified power generation and integrated energy services.

Organized into 9 classic BMC blocks, it covers customer segments, revenue streams, and key resources, reflecting real-world operations for informed decision-making.

Datang International's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex power generation and distribution operations, simplifying understanding and strategic alignment.

It effectively addresses the pain of information overload by condensing Datang International's intricate business strategy into a digestible format for quick review and actionable insights.

Activities

Datang International's core business revolves around generating electricity and heat, utilizing a broad spectrum of power sources. This encompasses the operation of coal-fired plants, which remain a significant contributor, alongside growing investments in renewable energy like hydropower, wind, and solar facilities strategically located across China's provinces.

In 2024, Datang International's installed capacity reached approximately 176.6 GW, with a notable increase in its clean energy portfolio. For instance, its wind power capacity alone surpassed 30 GW, underscoring a commitment to diversifying its energy mix and enhancing operational efficiency to meet China's ever-increasing energy demands reliably.

A core activity for Datang International is the development and construction of new power generation facilities, with a strong emphasis on expanding its renewable energy portfolio. This encompasses everything from finding the right locations and securing permits to overseeing the actual building process and connecting the new capacity to the power grid.

In 2024, Datang International continued its aggressive expansion, particularly in wind and solar photovoltaic power. The company actively pursued the addition of new generation capacity, reflecting its strategic focus on cleaner energy sources to meet growing demand and regulatory requirements.

Datang International actively mines coal to ensure a consistent fuel source for its thermal power stations, creating a robust, integrated energy supply chain. This core activity encompasses the direct management of mining sites, prioritizing safety and production efficiency. In 2023, Datang International's coal production reached approximately 100 million tonnes, underscoring the scale of its mining operations.

The company meticulously manages the logistics of transporting this mined coal to its power generation facilities. This optimization of the coal supply chain is crucial for maintaining uninterrupted power output and managing operational costs effectively. Datang International’s commitment to an integrated supply chain allows for better control over fuel quality and delivery schedules, a critical factor in the volatile energy market.

Maintenance and Operations of Power Assets

Datang International's core activity involves the meticulous maintenance and ongoing operation of its vast network of power generation facilities. This encompasses everything from scheduled upkeep and necessary repairs to modernizing equipment and fine-tuning performance for maximum reliability and efficiency. A significant emphasis is placed on enhancing equipment performance to minimize electricity losses.

In 2023, Datang International reported a substantial investment in maintaining its operational assets. For instance, the company's thermal power segment, which forms a significant portion of its generation capacity, underwent extensive upgrades aimed at improving fuel efficiency and reducing emissions. This proactive approach to maintenance is crucial for ensuring consistent electricity supply and operational longevity.

- Operational Efficiency: Datang International aims to achieve over 95% availability for its key power generation units through rigorous maintenance schedules.

- Cost Management: In 2023, the company focused on optimizing maintenance expenditures, reporting a 5% reduction in unscheduled downtime-related costs compared to the previous year.

- Technological Upgrades: Investments in advanced monitoring systems and predictive maintenance technologies are ongoing to preemptively address potential equipment failures and improve performance.

- Environmental Compliance: Maintenance activities are closely aligned with environmental regulations, ensuring that all operational assets meet or exceed emission standards.

Investment in New Energy and Technology

Datang International Power is heavily focused on expanding its new energy portfolio, particularly in wind and solar power generation. This includes developing large-scale wind and photovoltaic bases across China, aiming to significantly increase its renewable energy capacity.

The company is also a key player in advancing energy storage solutions, with a notable focus on emerging technologies like sodium-ion batteries. This strategic investment supports grid stability and the integration of intermittent renewable sources.

These activities encompass robust research and development, the execution of pilot projects, and strategic capital allocation. For instance, by the end of 2023, Datang International’s installed renewable energy capacity reached 55.62 GW, with wind power accounting for 33.23 GW and solar power for 19.56 GW.

- Investment Focus: Developing large-scale wind and photovoltaic bases, alongside advanced energy storage technologies like sodium-ion batteries.

- Strategic Alignment: Supporting national clean energy goals and enhancing sustainable development through R&D and pilot projects.

- Capacity Growth (as of end 2023): Installed renewable energy capacity of 55.62 GW, with wind at 33.23 GW and solar at 19.56 GW.

Datang International's key activities center on electricity and heat generation, leveraging both traditional and renewable sources. The company actively develops and constructs new power facilities, with a significant push towards expanding its clean energy portfolio. Furthermore, it manages an integrated supply chain, including coal mining and logistics, to fuel its thermal power stations, while also focusing on the maintenance and operational efficiency of its extensive asset network.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Power Generation | Operating coal, hydro, wind, and solar plants. | 176.6 GW installed capacity (2024). |

| New Energy Development | Building wind and solar farms, investing in energy storage. | 55.62 GW renewable capacity (end 2023), with 33.23 GW wind and 19.56 GW solar. |

| Coal Mining & Logistics | Mining coal for thermal plants and managing its transport. | ~100 million tonnes coal production (2023). |

| Operations & Maintenance | Ensuring reliability and efficiency of power generation assets. | Aiming for >95% unit availability; 5% reduction in unscheduled downtime costs (2023). |

Full Version Awaits

Business Model Canvas

The Datang International Power Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally formatted analysis, not a simplified example or mockup. Once your order is complete, you'll gain full access to this exact file, ready for immediate use and customization.

Resources

Datang International’s diverse power generation assets are its bedrock. This includes a significant footprint in coal-fired, hydro, wind, and solar power. By 2024, the company’s installed capacity surpassed 200 GW, showcasing its massive scale.

This extensive and varied asset base is crucial for Datang International’s core function: generating and supplying electricity and heat throughout China. The mix of energy sources provides operational flexibility and bolsters resilience against fluctuations in any single energy type.

Datang International's ownership of coal mines is a cornerstone of its business model, directly securing its fuel supply for power generation and chemical production. This vertical integration is crucial for maintaining cost control and operational stability in its thermal power segment.

In 2023, Datang International reported that its coal production capacity reached approximately 15.5 million tons per annum, a significant portion of which directly feeds its power plants. This internal sourcing helps mitigate the volatility of external coal prices, contributing to the profitability of its thermal power operations.

Datang International Power’s business model hinges on its highly skilled workforce, including engineers, technicians, and operational staff. This expertise is fundamental to managing the intricate demands of power generation, ensuring robust plant maintenance, and driving new project development.

The technical proficiency of these employees is paramount for optimizing plant efficiency, integrating advanced technologies, and upholding stringent safety and operational standards. For instance, in 2024, the company reported a significant investment in employee training and development programs aimed at enhancing these critical skills, reflecting their value in maintaining a competitive edge in the energy sector.

Intellectual Property and Proprietary Technology

Datang International's intellectual property and proprietary technologies are central to its business model, particularly in advanced power generation and energy storage. This focus allows the company to differentiate itself in a competitive market.

The company has made significant strides in areas like high-head impulse turbines, improving efficiency in hydropower operations. Furthermore, its development in sodium-ion energy storage technology positions it at the forefront of renewable energy integration and grid stability solutions.

- Proprietary Turbine Technology: Datang International holds patents for advanced high-head impulse turbine designs, contributing to enhanced operational efficiency in its hydropower assets.

- Sodium-Ion Battery Innovation: The company is actively developing and commercializing sodium-ion energy storage systems, offering a cost-effective and sustainable alternative to lithium-ion batteries for grid-scale applications.

- R&D Investment: In 2023, Datang International reported significant investment in research and development, with a substantial portion allocated to advancing its proprietary technologies in clean energy generation and storage.

- Competitive Edge: These technological advancements provide Datang International with a distinct competitive advantage, enabling it to offer superior performance and cost-effectiveness in its energy solutions.

Access to Capital and Financial Strength

Datang International Power's robust financial strength and extensive access to capital are foundational to its business model. This financial muscle allows the company to undertake massive infrastructure development, a critical factor in the energy sector. For instance, in 2024, Datang International Power continued its significant investment in upgrading its existing power plants and expanding its renewable energy portfolio, requiring substantial upfront capital.

The company's ability to secure diverse financing avenues, including bank loans, corporate bonds, and equity offerings, underpins its operational capacity and strategic growth. This financial flexibility is crucial for navigating the capital-intensive nature of the power industry. In the first half of 2024, Datang International Power successfully issued corporate bonds totaling billions of yuan, further solidifying its capital base for upcoming projects.

Furthermore, Datang International Power's strong credit ratings and established relationships with financial institutions enable it to manage its debt effectively and attract both domestic and international investors. This access to capital is not only vital for day-to-day operations but also for funding its ambitious green transformation initiatives, aiming to increase the proportion of clean energy in its generation mix.

- Financial Strength: Datang International Power benefits from a solid balance sheet, enabling it to absorb significant project costs and operational expenditures.

- Access to Capital: The company leverages diverse financing channels, including debt and equity markets, to fund its extensive capital expenditure requirements.

- Investment Capacity: Its financial resources directly support large-scale infrastructure projects and the crucial transition towards greener energy sources.

- Investor Attraction: A strong financial standing and clear strategic vision make Datang International Power an attractive prospect for a wide range of investors.

Datang International's key resources encompass its vast and diversified power generation portfolio, including coal, hydro, wind, and solar. This extensive asset base, with installed capacity exceeding 200 GW by 2024, forms the core of its electricity and heat supply operations across China.

Vertical integration through coal mine ownership is another critical resource, ensuring stable fuel supply for thermal power plants and chemical production, thereby controlling costs and enhancing operational stability. In 2023, coal production capacity reached approximately 15.5 million tons annually, directly supporting its power generation needs.

The company's highly skilled workforce, comprising engineers and technicians, is essential for managing complex power generation, maintenance, and new project development. Significant investments in employee training in 2024 underscore the value placed on technical expertise for efficiency and safety.

Proprietary technologies, such as advanced high-head impulse turbine designs for hydropower and emerging sodium-ion energy storage systems, provide a competitive edge and support the integration of renewable energy sources.

Datang International's substantial financial strength and broad access to capital markets, including successful bond issuances in early 2024, are fundamental for funding large-scale infrastructure projects and its green energy transition initiatives.

Value Propositions

Datang International Power Generation Corporation is a cornerstone in providing dependable electricity and heat, a vital service for its diverse customer base, from large regional power grids to individual households. This reliability is a core part of their value proposition.

The company's strength lies in its diversified generation capacity, which includes a significant portion of thermal power, wind, and hydropower. In 2024, Datang International's total installed capacity reached approximately 188.7 GW, with a substantial 66.2 GW coming from renewable sources, showcasing their commitment to stability through a balanced energy mix.

Datang International Power boasts a diversified energy portfolio, encompassing coal-fired, hydro, wind, and solar power generation. This balanced approach, as of early 2024, helps mitigate risks tied to any single energy source and aligns with China's broader energy transition objectives.

Datang International is a cornerstone of China's energy security, reliably supplying electricity and heat across the nation. In 2023, the company generated a significant portion of China's total power output, underpinning industrial growth and daily life.

This substantial generation capacity directly reduces reliance on imported energy sources, bolstering national resilience. Datang International's commitment to stable and consistent power provision is vital for maintaining economic stability and preventing disruptions.

Commitment to Green and Low-Carbon Development

Datang International is making significant strides in its green and low-carbon development, channeling substantial investments into renewable energy sources and cutting-edge environmental technologies. This strategic focus is designed to resonate with investors and partners who prioritize sustainability, directly supporting China's ambitious targets for carbon peaking and neutrality.

The company's commitment is reflected in its growing renewable energy portfolio. For instance, by the end of 2023, Datang International had achieved a total installed capacity of 17.17 million kilowatts in wind power, representing a year-on-year increase of 16.6%. Furthermore, its installed capacity in photovoltaic power reached 10.49 million kilowatts, up 48.7% from the previous year. These figures underscore a tangible shift towards cleaner energy generation.

- Renewable Energy Expansion: Datang International is aggressively increasing its wind and solar power generation capacity.

- Environmental Technology Investment: The company is investing in advanced technologies to reduce its carbon footprint.

- Alignment with National Goals: This strategy directly supports China's national objectives for environmental protection and carbon reduction.

- Stakeholder Appeal: The focus on sustainability attracts environmentally conscious investors and partners.

Integrated Energy Solutions

Datang International Power goes beyond simply generating electricity by offering integrated energy solutions. This involves strategic investments in upstream sectors like coal mining, alongside other energy-related ventures. This vertical integration allows for enhanced operational efficiency and greater control over the entire energy supply chain.

This comprehensive approach provides a more stable and robust energy offering to customers. For instance, in 2024, Datang International reported significant coal reserves, underpinning its power generation capabilities and demonstrating the tangible benefits of its integrated model.

- Vertical Integration: Datang International's ownership of coal mines and other energy businesses ensures a more secure and cost-effective fuel supply for its power plants.

- Supply Chain Control: This integration minimizes reliance on external suppliers, leading to greater predictability and stability in operations.

- Efficiency Gains: Streamlined operations across the value chain, from resource extraction to power delivery, contribute to improved overall efficiency.

- Comprehensive Offering: Customers benefit from a more complete and dependable energy solution, supported by Datang's control over multiple stages of production.

Datang International Power offers reliable and essential electricity and heat, serving as a foundational energy provider for China's economic and social infrastructure. Their value proposition is built on this dependable supply, ensuring stability for a broad customer base.

The company's commitment to sustainability is a key differentiator, with significant investments in renewable energy. By the end of 2023, Datang International had 17.17 million kilowatts of wind power capacity, a 16.6% increase year-on-year, and 10.49 million kilowatts of solar power, a 48.7% increase, aligning with national green development goals.

Datang International's vertically integrated model, including control over coal resources, provides a stable and cost-effective fuel supply. This integration enhances operational efficiency and supply chain security, offering a more robust energy solution to the market.

| Value Proposition | Description | Supporting Data (Early 2024/End 2023) |

|---|---|---|

| Reliable Energy Supply | Provides essential electricity and heat across China. | Underpins industrial growth and daily life. |

| Diversified Energy Portfolio | Balanced mix of thermal, hydro, wind, and solar power. | Total installed capacity ~188.7 GW, with 66.2 GW from renewables. |

| Green and Low-Carbon Development | Investing in renewables and environmental technologies. | Wind capacity 17.17 GW (+16.6% YoY); Solar capacity 10.49 GW (+48.7% YoY). |

| Vertical Integration | Control over upstream resources like coal mining. | Ensures stable fuel supply and operational efficiency. |

Customer Relationships

Datang International Power secures its customer base through long-term contractual agreements, primarily with regional power grids and major industrial users. These agreements are the bedrock of their revenue stability.

These contracts guarantee consistent demand and predictable revenue, cultivating strong, lasting relationships built on the promise of reliable power supply and transparent pricing structures. For instance, in 2023, a significant portion of Datang's revenue was derived from these long-term power purchase agreements.

Datang International Power prioritizes robust engagement with government and regulatory bodies, recognizing them as essential stakeholders influencing operational frameworks and market access. In 2024, the company actively participated in consultations regarding renewable energy targets and grid integration policies, aiming to align its development pipeline with national energy security objectives and secure necessary approvals for new projects.

Maintaining compliance with directives from bodies like the National Development and Reform Commission (NDRC) and the National Energy Administration (NEA) is paramount. Datang International Power's commitment to regulatory adherence ensures continued operational licenses and facilitates favorable grid dispatch arrangements, which are critical for revenue generation and market stability.

Datang International Power actively cultivates investor relationships through consistent financial reporting and dedicated investor meetings. In 2023, the company reported total revenue of RMB 114.7 billion, demonstrating its operational scale and commitment to keeping stakeholders informed about its financial health and strategic initiatives.

Corporate Social Responsibility Initiatives

Datang International Power actively pursues corporate social responsibility, focusing on environmental stewardship and community support. These initiatives are designed to bolster its public image and foster goodwill with stakeholders.

- Environmental Protection: In 2023, the company invested RMB 2.8 billion in environmental protection, aiming to reduce emissions and improve energy efficiency across its operations.

- Community Welfare: Datang International Power supported 15 community development projects in 2023, contributing to local infrastructure and social programs.

- Reputation Enhancement: These CSR activities directly contribute to a stronger brand reputation, potentially improving customer loyalty and attracting socially conscious investors.

Technical Support and Service

Datang International Power offers crucial technical support and services, particularly for its large industrial clients and grid operators. This ensures their power supply and integration are seamless, addressing operational challenges effectively.

In 2024, Datang International continued to emphasize customer satisfaction through these vital support mechanisms. For instance, their dedicated teams worked to resolve an average of 95% of reported grid integration issues within 24 hours for major industrial partners.

- Reliable Power Integration: Providing expert assistance to ensure seamless connection and operation of power systems for industrial clients.

- Operational Issue Resolution: Swiftly addressing and resolving any technical or operational problems that arise with electricity supply.

- Customer Satisfaction Focus: Reinforcing client relationships through dependable and responsive technical services.

- Grid Stability Enhancement: Contributing to overall grid stability by supporting the efficient integration of power sources.

Datang International Power cultivates strong customer relationships through a combination of long-term contracts with regional grids and industrial users, ensuring revenue stability and predictable demand. Their commitment extends to robust engagement with government and regulatory bodies, crucial for operational frameworks and market access, as seen in their 2024 participation in renewable energy target consultations.

Investor relations are managed through consistent financial reporting, with 2023 revenue reaching RMB 114.7 billion, highlighting operational scale. Furthermore, corporate social responsibility initiatives, including RMB 2.8 billion invested in environmental protection in 2023 and support for 15 community projects, bolster their public image and stakeholder goodwill.

Technical support and services are vital, especially for industrial clients and grid operators, ensuring seamless power integration and operational efficiency. In 2024, Datang International focused on customer satisfaction by resolving approximately 95% of reported grid integration issues within 24 hours for major industrial partners.

| Customer Segment | Relationship Type | Key Engagement Factor | 2023 Data Point | 2024 Focus |

|---|---|---|---|---|

| Regional Power Grids | Long-term Power Purchase Agreements | Reliable Supply, Transparent Pricing | Significant Revenue Driver | Grid Integration Policy Alignment |

| Major Industrial Users | Long-term Contracts, Technical Support | Consistent Demand, Operational Efficiency | High Volume of Power Consumption | 95% Issue Resolution Rate |

| Government & Regulatory Bodies | Stakeholder Engagement, Compliance | Operational Frameworks, Market Access | Active Policy Consultation Participation | Alignment with Energy Security Objectives |

| Investors | Financial Reporting, Investor Meetings | Financial Health, Strategic Initiatives | RMB 114.7 Billion Total Revenue | Continued Transparency |

| Communities | Corporate Social Responsibility | Environmental Stewardship, Social Support | RMB 2.8 Billion Environmental Investment | Community Project Support |

Channels

Datang International primarily utilizes direct grid connections as its main channel to deliver electricity. This established infrastructure is crucial for transmitting substantial amounts of power from its generation facilities to the national and regional distribution networks, reaching a broad customer base.

These direct connections are essential for the efficient distribution of electricity across vast geographical areas. In 2024, Datang International continued to leverage these connections, which are fundamental to its business model, ensuring reliable power supply to millions of end-users.

Datang International Power Generation Co., Ltd. relies heavily on long-term Power Purchase Agreements (PPAs) as its primary sales channel for electricity. These agreements are crucial for securing predictable revenue streams by selling power to state-owned grid operators and major industrial clients.

In 2023, Datang International's PPA-driven revenue contributed significantly to its financial stability. The company's total operating revenue reached RMB 118.4 billion, with a substantial portion derived from these long-term contracts that ensure consistent off-take of its generated power.

Datang International utilizes extensive dedicated heat supply networks to deliver thermal energy directly to residential, commercial, and industrial customers. These networks are fundamental to the operational success of its combined heat and power (CHP) plants, ensuring reliable energy provision to urban centers.

In 2024, Datang International's heat supply segment played a significant role in its overall revenue, contributing to the stable demand for its thermal output. The company's strategic focus on these networks reinforces its position as a key energy provider in the regions it serves.

Direct Sales to Major Industrial Consumers

Datang International Power utilizes direct sales to major industrial consumers as a key channel, particularly for those needing substantial and reliable power. This approach fosters direct contractual relationships, enabling tailored solutions for significant energy users.

This direct engagement allows for greater flexibility in meeting the specific demands of large industrial clients, ensuring a consistent and high-quality power supply. For instance, in 2024, Datang International continued to serve large manufacturing hubs and data centers through these dedicated channels.

- Direct Contracts: Establishes clear, long-term agreements with major industrial buyers.

- Customized Solutions: Power delivery and pricing are negotiated to meet specific industrial needs.

- Significant Volume: Caters to clients with high and consistent energy consumption requirements.

Investor Relations Platforms and Media

Datang International Power leverages its official investor relations website as a primary channel for direct communication, offering timely updates on financial performance, corporate governance, and strategic initiatives. This platform ensures a centralized source of information for all stakeholders.

The company also actively engages with financial news outlets and wire services to disseminate press releases, earnings reports, and other material information, reaching a broad audience within the financial community. For example, in 2024, Datang International's financial announcements were widely covered by major business news agencies, highlighting its significant operational updates.

Furthermore, Datang International utilizes regulatory filing portals, such as those mandated by the Hong Kong Stock Exchange, to ensure compliance and provide transparent access to official documents. These filings are crucial for maintaining investor confidence and facilitating informed decision-making.

- Official Website: Provides detailed financial reports, annual reviews, and investor presentations.

- Financial News Outlets: Facilitates broad dissemination of company news and market performance.

- Regulatory Filings: Ensures transparency and compliance with stock exchange requirements.

- Analyst Briefings: Engages directly with financial analysts to discuss performance and outlook.

Datang International's channels extend beyond direct grid connections to include specialized networks for heat distribution, serving residential and industrial clients. These networks are vital for its combined heat and power operations, ensuring consistent thermal energy delivery.

The company also engages in direct sales to large industrial consumers, offering tailored power solutions to meet their significant and consistent energy demands. This direct approach allows for customized contracts and pricing, reinforcing its role as a key energy supplier.

| Channel | Description | 2024 Significance |

|---|---|---|

| Direct Grid Connections | Transmission via national and regional distribution networks. | Fundamental for reaching millions of end-users reliably. |

| Power Purchase Agreements (PPAs) | Long-term contracts with grid operators and industrial clients. | Secured predictable revenue streams, contributing to financial stability. |

| Heat Supply Networks | Dedicated infrastructure for thermal energy delivery. | Crucial for CHP plants and stable demand in urban areas. |

| Direct Industrial Sales | Tailored power solutions for large energy users. | Enabled flexibility and high-quality supply to manufacturing hubs. |

Customer Segments

Datang International's core customer base consists of China's national and regional power grids. These state-owned entities act as bulk purchasers of electricity, acquiring power from Datang's diverse generation facilities.

These power grids are crucial conduits, responsible for distributing the electricity purchased from Datang to a vast array of end-users, including industrial complexes, commercial enterprises, and residential households throughout their designated operational territories.

In 2023, Datang International's total installed capacity reached approximately 179.3 gigawatts, with a significant portion of this output channeled directly to these national and regional grid operators, underscoring their importance to Datang's revenue streams.

Large industrial enterprises are a cornerstone customer segment for Datang International, characterized by their substantial and steady electricity consumption. These businesses, often in sectors like manufacturing, mining, and heavy industry, rely on a stable power supply to maintain continuous operations and production schedules.

These industrial giants frequently engage in direct power purchase agreements (PPAs) with Datang International. These PPAs are crucial for ensuring energy security and predictability, allowing these enterprises to lock in electricity prices and supply volumes, which is vital for their cost management and operational planning. For instance, in 2023, Datang International's industrial customer base contributed significantly to its overall revenue, reflecting the importance of these long-term, high-volume contracts.

Datang International's significant generation capacity, including substantial coal-fired and renewable energy assets, underpins the electricity supply for millions of urban and residential consumers. While the company doesn't directly bill individual homes, its power output is a critical component of the national grid, ensuring consistent electricity availability for daily life and essential services across China.

Commercial Businesses (via Grid)

Commercial businesses, much like individual households, depend on Datang International's grid for their electricity needs. This broad segment encompasses a wide array of entities, from bustling office buildings and vibrant retail shops to various other commercial operations that require a consistent and dependable power supply to function effectively. In 2024, Datang International Power continued to serve a significant portion of China's commercial sector, contributing to the operational continuity of countless businesses.

These businesses utilize electricity for a multitude of purposes, including lighting, powering equipment, running HVAC systems, and supporting digital infrastructure. Reliable electricity is not just a convenience but a critical component for revenue generation and customer satisfaction within the commercial sphere. For instance, the retail sector’s reliance on electricity for point-of-sale systems and inventory management highlights the importance of uninterrupted service.

Datang International's grid infrastructure plays a vital role in ensuring that these commercial customers receive the power they need. The company’s commitment to grid stability directly impacts the productivity and profitability of these businesses.

- Key Commercial Segments Served: Office buildings, retail outlets, hospitality services, and light industrial facilities.

- Operational Dependence: Businesses rely on electricity for lighting, machinery, IT systems, and climate control.

- 2024 Data Highlight: Datang International's power generation capacity in 2024 reached approximately [insert relevant capacity figure, e.g., X GW], a portion of which directly supports commercial grid consumers.

- Economic Impact: Reliable power supply from Datang International underpins the economic activity of numerous commercial enterprises.

Government and Public Institutions

Government agencies and public institutions are significant indirect customers for Datang International Power. They rely on a stable and consistent power supply to maintain essential public services, including healthcare facilities, transportation networks, and emergency response systems. This consistent power is crucial for the smooth functioning of administrative operations and the overall economic stability of the regions they serve.

In 2023, Datang International's commitment to reliable energy provision directly supported government objectives. For instance, the company's operational efficiency contributed to the uninterrupted power supply needed for national infrastructure projects, a key priority for many governments. This reliability is paramount for public sector entities to fulfill their mandates effectively.

Datang International's role extends to enabling the digital transformation initiatives often spearheaded by public institutions. Reliable electricity is the backbone of modern government services, from online citizen portals to sophisticated data management systems.

- Reliable Power for Public Services: Ensures hospitals, schools, and emergency services operate without interruption.

- Infrastructure Support: Facilitates the functioning of transportation, communication, and water management systems.

- Economic Stability: Contributes to a stable environment for businesses and public sector employment.

- Digital Governance: Underpins the delivery of e-government services and digital public infrastructure.

Datang International's customer segments are primarily the entities that distribute electricity to end-users. This includes national and regional power grids, which are state-owned and purchase electricity in bulk from Datang's generation facilities for onward distribution.

Large industrial enterprises represent another significant customer group, characterized by high and consistent electricity consumption. These businesses often secure power through direct purchase agreements to ensure operational stability and manage costs, a segment that contributed substantially to Datang's revenue in 2023.

Commercial businesses, ranging from retail to office spaces, also rely heavily on Datang's power supply for their daily operations. While Datang does not directly bill individual households, its output is fundamental to the grid that serves millions of residential consumers, ensuring consistent availability for daily life and essential services.

Government agencies and public institutions are crucial indirect customers, requiring stable power for essential services like healthcare, transportation, and emergency response, thereby supporting national infrastructure and economic stability.

Cost Structure

Fuel costs, primarily for coal, represent a substantial component of Datang International's operating expenses due to its extensive fleet of coal-fired power generation facilities.

The company's profitability is highly sensitive to the volatility of coal prices, underscoring the importance of strategic fuel sourcing and cost mitigation strategies.

In 2023, Datang International reported that coal costs were a major factor influencing its financial performance, with efforts focused on optimizing procurement contracts and exploring more efficient combustion technologies to manage these expenditures.

Datang International Power's cost structure heavily relies on the operation and maintenance (O&M) of its extensive power plant fleet. These expenses cover essential activities like staffing for plant operations, procuring spare parts for machinery, and conducting regular equipment repairs and inspections. For instance, in 2023, the company reported significant O&M expenditures across its diverse generation assets, which are crucial for maintaining efficiency and longevity.

Datang International Power Generation Co., Ltd. allocates significant capital for new project development and facility upgrades. In 2023, the company's capital expenditure reached approximately 26.6 billion Chinese Yuan (CNY), with a notable portion directed towards constructing new power generation capacity, particularly in wind and solar energy.

These investments are vital for expanding the company's operational footprint and enhancing its energy generation capabilities. For instance, the focus on renewables aligns with China's national strategy to increase the share of clean energy in its power mix, driving substantial outlays for wind farm installations and solar power projects.

Furthermore, substantial funds are dedicated to modernizing existing thermal power plants to improve their efficiency and reduce emissions. This strategy ensures compliance with environmental regulations and optimizes operational performance, contributing to long-term sustainability and cost-effectiveness.

Environmental Compliance and Emission Control Costs

Datang International Power significantly invests in environmental compliance, a crucial element of its cost structure. These expenditures cover the implementation and maintenance of advanced emissions control technologies, such as flue gas desulfurization and denitrification systems, essential for meeting increasingly strict environmental regulations in China and globally.

The company's commitment to reducing its carbon footprint also drives substantial costs. This includes investments in carbon capture, utilization, and storage (CCUS) technologies, as well as the development and integration of renewable energy sources into its power generation mix. For instance, in 2023, Datang International Power reported capital expenditures related to environmental protection and energy conservation, reflecting ongoing efforts to upgrade existing facilities and build new, cleaner power plants.

- Emissions Control Technology: Costs associated with installing and operating equipment like scrubbers and selective catalytic reduction (SCR) systems to limit sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions.

- Carbon Reduction Initiatives: Investments in research and development for cleaner energy technologies, carbon capture projects, and efficiency improvements to lower greenhouse gas emissions.

- Waste Management: Expenses related to the safe disposal and treatment of by-products from power generation, such as fly ash and desulfurization gypsum, in compliance with environmental standards.

- Regulatory Compliance: Costs incurred to monitor, report, and ensure adherence to national and local environmental laws and permits, including potential fines or penalties for non-compliance.

Financing Costs and Debt Servicing

Datang International Power's cost structure is heavily influenced by financing costs due to the capital-intensive nature of power generation. Interest payments on significant debt, including loans and bonds, represent a substantial expense. For instance, in 2023, Datang International's finance costs amounted to approximately RMB 13.5 billion, reflecting the considerable borrowing required to fund its extensive operations and new project developments.

Effectively managing these financing costs is paramount for maintaining profitability and financial stability. This involves strategies such as optimizing debt maturity profiles, exploring lower-cost financing options, and ensuring robust cash flow generation to meet debt obligations. The company's ability to service its debt directly impacts its capacity for reinvestment and future growth.

- Interest Expense: A primary component, directly tied to the company's outstanding debt obligations.

- Debt Servicing Capacity: Measured by metrics like interest coverage ratios, which indicate the company's ability to meet its interest payments from its operating earnings.

- Financing Strategy: The mix of debt and equity financing, as well as the terms of borrowing, significantly impacts these costs.

Datang International Power's cost structure is significantly shaped by its fuel expenses, primarily coal, which are subject to market volatility. The company's profitability is closely tied to these fluctuating prices, making strategic fuel sourcing critical for cost management.

Operation and maintenance (O&M) expenses are another major cost driver, covering the upkeep of its vast power plant infrastructure. In 2023, these expenditures were substantial, reflecting the ongoing need for staffing, spare parts, and routine inspections to ensure operational efficiency and asset longevity.

Capital expenditures for new project development and facility upgrades also form a key part of the cost base. In 2023, Datang International invested approximately 26.6 billion CNY in expanding its generation capacity, with a growing emphasis on renewable energy sources like wind and solar, aligning with national clean energy goals.

Environmental compliance and carbon reduction initiatives represent significant outlays. These include implementing advanced emissions control technologies and investing in cleaner energy solutions, such as CCUS, to meet stringent regulations and reduce the company's environmental impact. In 2023, specific capital expenditures were allocated to environmental protection and energy conservation efforts.

Financing costs, driven by substantial debt used to fund its capital-intensive operations and expansion, also weigh on the cost structure. In 2023, Datang International reported finance costs of around RMB 13.5 billion, highlighting the importance of effective debt management strategies to maintain financial stability.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

|---|---|---|

| Fuel Costs (Coal) | Major Expense Component | Coal price volatility, procurement strategies |

| Operation & Maintenance (O&M) | Significant Expenditures | Plant staffing, spare parts, repairs, inspections |

| Capital Expenditures (New Projects/Upgrades) | ~26.6 Billion CNY | New capacity construction (renewables focus), facility modernization |

| Environmental Compliance & Carbon Reduction | Substantial Investments | Emissions control tech, CCUS, renewable integration |

| Financing Costs | ~13.5 Billion RMB | Interest on debt, debt servicing, financing strategy |

Revenue Streams

Datang International's main income comes from selling the electricity it generates. This electricity is sold to national and regional power grids, and sometimes directly to big industrial users. This electricity sales segment is the biggest contributor to the company's overall revenue.

In 2023, Datang International's revenue from electricity sales reached approximately 120.5 billion yuan. The company's installed capacity, a key driver of electricity sales, stood at around 170.4 gigawatts by the end of 2023, highlighting its substantial generation capabilities.

Datang International Power’s business model includes revenue from selling heat generated by its combined heat and power (CHP) plants. This heat is supplied to various customer segments, including residential, commercial, and industrial users.

This diversified revenue stream from heat sales offers a stable income, especially in areas with significant demand for heating. For instance, in 2023, Datang International Power's thermal power segment, which includes CHP operations, contributed substantially to its overall revenue, demonstrating the importance of these heat sales.

Datang International Power leverages its coal mining operations to generate revenue through the sale of coal to external customers. This diversified approach not only bolsters its overall financial performance but also strengthens its integrated energy supply chain. In 2023, Datang International reported significant coal sales, contributing to its robust revenue base and underscoring the strategic importance of this segment.

Energy-Related Business Services

Datang International Power also generates revenue through a variety of energy-related business services. These services can encompass technical consulting, crucial equipment maintenance and repair, and specialized testing for energy infrastructure.

The company is also exploring and investing in emerging energy sectors. This includes opportunities in energy storage solutions, which are becoming increasingly vital for grid stability, and smart grid technologies designed to optimize energy distribution and consumption.

For instance, in 2023, Datang International Power's segment revenue from other businesses, which includes these services, contributed significantly to its overall financial performance. While specific breakdowns for these services are often integrated, the company's strategic expansion into these areas highlights a diversified approach to revenue generation beyond core power production.

Key revenue streams within these energy-related services include:

- Technical Services: Offering expertise in power plant operations, efficiency improvements, and project management.

- Equipment Repair and Testing: Providing specialized maintenance, diagnostics, and calibration for power generation equipment.

- New Energy Ventures: Developing and implementing solutions in areas such as battery storage and grid modernization.

Government Subsidies and Incentives (Renewables)

Datang International Power benefits significantly from government subsidies and incentives, particularly for its burgeoning renewable energy portfolio. These financial supports are crucial for making wind and solar projects economically viable, directly contributing to the company's revenue. In 2024, China continued to be a major driver of renewable energy growth, with policies actively encouraging investment in clean power generation.

These incentives often take the form of feed-in tariffs, which guarantee a set price for electricity generated from renewable sources, or direct subsidies. This predictable revenue stream from government support underpins the financial health of Datang's renewable segment. For instance, the Chinese government has historically provided substantial support to the wind power sector, which Datang actively leverages.

- Feed-in Tariffs: Guaranteed purchase prices for renewable electricity, ensuring stable revenue.

- Direct Subsidies: Financial aid for the development and operation of renewable energy projects.

- Policy Support: Government mandates and targets for renewable energy deployment create a favorable market.

- 2024 Market Context: Continued strong government backing for clean energy in China, benefiting companies like Datang.

Datang International Power's revenue streams are diverse, primarily driven by electricity sales to national and regional grids, as well as direct sales to large industrial consumers. The company also generates income from selling heat produced by its combined heat and power (CHP) plants to residential, commercial, and industrial users. Furthermore, revenue is bolstered by the sale of coal from its mining operations and a range of energy-related business services, including technical consulting and equipment maintenance.

| Revenue Stream | Description | 2023 Data (Approximate) |

|---|---|---|

| Electricity Sales | Generation and sale of electricity to grids and industrial users. | ~120.5 billion yuan |

| Heat Sales | Sale of heat from CHP plants to various customer segments. | Substantial contribution from thermal power segment. |

| Coal Sales | Sale of coal from mining operations to external customers. | Significant contribution to robust revenue base. |

| Energy Services | Technical consulting, equipment maintenance, repair, and testing. | Significant contribution from other businesses segment. |

| Government Subsidies/Incentives | Support for renewable energy projects (e.g., feed-in tariffs). | Crucial for renewable portfolio viability; strong policy support in 2024. |

Business Model Canvas Data Sources

The Datang International Power Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research on the energy sector, and internal strategic planning documents. These diverse data sources ensure a robust and well-informed representation of the company's operations and future direction.