Chiba Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chiba Bank Bundle

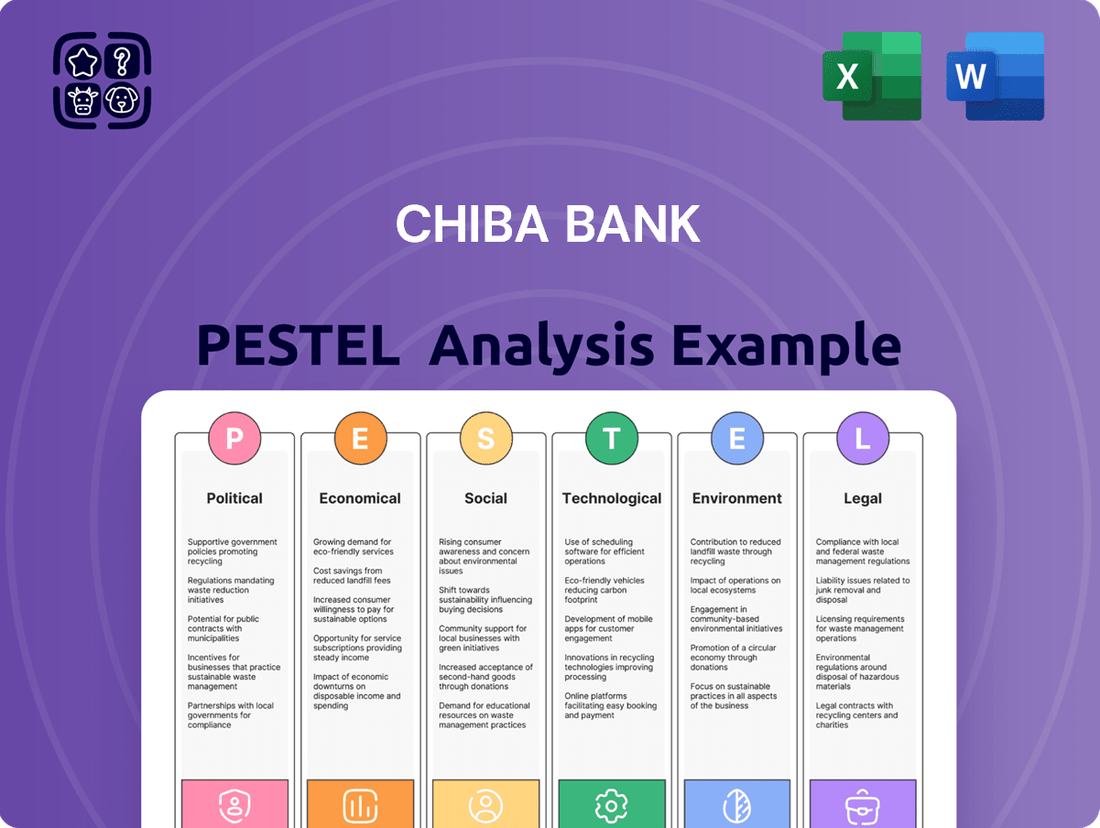

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Chiba Bank's strategic landscape. Our expertly crafted PESTLE analysis provides actionable intelligence to help you anticipate market shifts and identify opportunities. Don't get left behind; download the full version now for a comprehensive understanding of the forces driving Chiba Bank's future.

Political factors

The Japanese government's ongoing focus on regional economic revitalization directly influences Chiba Bank's strategic direction. Initiatives aimed at consolidating or supporting regional financial institutions could lead to increased competition or potential partnerships, impacting market positioning. For instance, the Financial Services Agency's (FSA) push for greater efficiency in the banking sector, observed in recent years, encourages banks like Chiba Bank to adapt their business models to better serve local communities and navigate evolving regulatory landscapes.

The Bank of Japan (BoJ) has maintained an ultra-loose monetary policy, with short-term interest rates at -0.1% and yield curve control (YCC) targeting the 10-year Japanese government bond yield around 0% as of early 2024. This environment has historically compressed net interest margins for banks like Chiba Bank, but also supports asset values. While the BoJ has signaled a potential shift away from negative rates, the pace and extent of future tightening remain uncertain, directly impacting Chiba Bank's lending profitability and investment returns.

Any move towards higher interest rates by the BoJ would likely improve Chiba Bank's net interest income, as loan yields could rise faster than deposit costs. However, a rapid increase could also lead to unrealized losses on its substantial bond holdings, affecting its investment portfolio. The overall financial environment will become more challenging for borrowers, potentially increasing credit risk for the bank.

Changes in financial regulation and supervision by Japan's Financial Services Agency (FSA) directly impact Chiba Bank's operations. Stricter capital adequacy ratios, like the Basel III framework, necessitate robust risk management and can influence lending capacity. For instance, as of March 2024, Japanese banks were still navigating evolving capital requirements, with the FSA emphasizing enhanced risk assessment and disclosure.

New reporting standards and compliance mandates increase operational costs for Chiba Bank. These can range from cybersecurity regulations to anti-money laundering (AML) protocols, requiring significant investment in technology and personnel. The FSA's ongoing push for greater transparency and consumer protection, evident in guidance issued throughout 2024, means banks must continuously adapt their business conduct and internal controls.

Geopolitical Stability in East Asia

Geopolitical stability in East Asia significantly influences Chiba Bank's international operations. Tensions between major regional powers, such as those involving China and Taiwan, can create volatility in foreign exchange markets, impacting the bank’s trading activities. For instance, heightened geopolitical risk in 2024 could lead to increased currency fluctuations, making cross-border transactions more unpredictable.

These regional dynamics can indirectly affect trade finance by increasing the perceived risk of doing business in or with East Asian countries. A less stable environment might deter foreign investment, reducing the volume of trade finance Chiba Bank facilitates. Furthermore, shifts in international relations could alter economic partnerships, potentially affecting the overall economic stability of Japan and, consequently, Chiba Bank's domestic operating environment.

- Trade Finance Impact: Increased geopolitical uncertainty can lead to higher insurance premiums for trade credit, making financing more expensive for businesses operating in or trading with East Asia.

- Foreign Exchange Volatility: Regional instability often correlates with sharper movements in currency pairs involving the Japanese Yen, affecting Chiba Bank's foreign exchange revenue streams.

- Investment Climate: Deteriorating geopolitical conditions can dampen foreign direct investment into Japan, potentially slowing economic growth and impacting the bank’s lending opportunities.

- Supply Chain Disruptions: Conflicts or trade disputes can disrupt global supply chains, affecting the performance of Japanese companies and their ability to repay loans facilitated by Chiba Bank.

Government Support for Regional Economic Development

Government support for regional economic development in Chiba Prefecture presents significant opportunities for Chiba Bank. Initiatives focused on infrastructure upgrades, such as the planned expansion of the Tokyo Bay Aqua-Line and continued investment in local transportation networks, are expected to stimulate business activity and increase demand for corporate loans. For instance, the Japanese government's ongoing commitment to regional revitalization, as evidenced by the FY2024 budget allocating substantial funds to local development projects, directly benefits prefectures like Chiba.

Chiba Bank can strategically align its services with these governmental objectives by offering tailored financial products and advisory services to businesses benefiting from these development projects. This includes providing financing for small and medium-sized enterprises (SMEs) involved in construction, logistics, and tourism, sectors poised for growth due to enhanced infrastructure. The bank's role in facilitating local business partnerships and providing expert guidance can foster stronger community ties and secure a competitive advantage.

- Increased Loan Demand: Government-backed infrastructure projects are projected to boost economic activity, leading to higher demand for business loans from construction firms and related industries.

- Advisory Services: Chiba Bank can offer specialized consulting to businesses navigating government subsidies and regional development programs, enhancing its value proposition.

- Local Business Partnerships: Proactive engagement with local businesses participating in development initiatives can strengthen relationships and create new revenue streams.

- Alignment with National Goals: By supporting projects aligned with the government's regional revitalization strategy, the bank reinforces its commitment to local economic growth.

The Bank of Japan's monetary policy remains a critical political factor influencing Chiba Bank. As of early 2024, the BoJ's ultra-loose stance, including negative interest rates and yield curve control, has historically pressured net interest margins. While discussions about policy normalization were ongoing, the timing and extent of any rate hikes or YCC adjustments remained uncertain, directly impacting Chiba Bank's profitability and investment strategies.

Regulatory changes from the Financial Services Agency (FSA) are paramount. The FSA's continuous emphasis on capital adequacy, risk management, and consumer protection, as seen in its guidance throughout 2024, requires Chiba Bank to maintain robust compliance frameworks and invest in operational enhancements. These evolving standards directly shape the bank's risk appetite and operational costs.

Government initiatives for regional economic revitalization, particularly in Chiba Prefecture, offer strategic opportunities. Projects aimed at infrastructure development, such as transportation network enhancements, are expected to stimulate local business activity, thereby increasing demand for corporate loans and financial advisory services from Chiba Bank.

What is included in the product

This PESTLE analysis of Chiba Bank examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive overview of the macro-environmental landscape, highlighting key trends and their potential impact on the bank's future growth and stability.

A concise, PESTLE-driven overview of Chiba Bank's external landscape, offering clarity on potential challenges and opportunities to inform strategic decision-making.

Economic factors

The Bank of Japan's continued commitment to ultra-low interest rates, with the policy rate hovering around negative territory, directly impacts Chiba Bank by compressing net interest margins. This environment makes it challenging for the bank to generate substantial income from lending activities, as the spread between borrowing costs and lending rates remains narrow.

Global economic forces, including inflation trends and monetary policy shifts in major economies, also play a role. While Japan has maintained low rates, rising inflation and subsequent rate hikes in other countries could indirectly influence investor sentiment and capital flows, potentially affecting Chiba Bank's funding costs and investment returns.

As of early 2025, the Bank of Japan has signaled a cautious approach to rate normalization, with market participants anticipating gradual, data-dependent adjustments rather than aggressive hikes. This suggests that Chiba Bank will likely continue to navigate a low-yield environment for the foreseeable future, necessitating a strong focus on fee-based income and efficient asset-liability management to sustain profitability.

Japan's inflation rate has been gradually increasing, with the Consumer Price Index (CPI) reaching 2.8% in April 2024, up from 2.7% in March 2024. This uptick in inflation could positively impact Chiba Bank's asset valuations, particularly real estate, while potentially straining the repayment capabilities of some clients if interest rates rise in tandem. Conversely, sustained high inflation erodes customer purchasing power, potentially dampening demand for loans and other financial services.

The Bank of Japan's continued accommodative monetary policy, despite some shifts, aims to achieve a stable 2% inflation target. If inflation exceeds this target persistently, it could necessitate policy tightening, influencing Chiba Bank's net interest margins and the cost of capital. Higher inflation generally encourages spending and investment as the value of money decreases over time, which could boost demand for Chiba Bank's lending and investment products.

Chiba Prefecture's economic health in 2024 and projected into 2025 shows a steady recovery, driven by its manufacturing and logistics sectors, which are key to Chiba Bank's loan portfolio for SMEs. The prefecture's GDP growth is anticipated to align with national averages, supported by infrastructure development and increased industrial output.

Local employment rates in Chiba remained robust through late 2024, with unemployment figures consistently below the national average, indicating strong demand for consumer banking services and a stable environment for business expansion. Population trends, while showing some aging, are offset by continued in-migration for employment opportunities, particularly in tech and advanced manufacturing hubs.

The performance of Chiba's key industries, such as automotive manufacturing and petrochemicals, directly impacts the bank's exposure to corporate clients. As of Q3 2024, these sectors reported a 3.5% year-on-year increase in production, signaling positive sentiment and potential for increased lending activity.

Loan Demand and Credit Quality

Loan demand at Chiba Bank is expected to see varied trends in 2024 and 2025. While individual loan demand, particularly for housing and consumer credit, might remain steady, demand from small and medium-sized enterprises (SMEs) could be influenced by ongoing economic uncertainties and the cost of capital. Large corporations may see fluctuating demand based on investment cycles and global economic outlook.

The credit quality of Chiba Bank's loan portfolio is a key consideration. Factors like inflation, interest rate movements, and potential industry-specific downturns, such as those in sectors heavily reliant on consumer discretionary spending, could increase the risk of loan defaults. This necessitates careful monitoring and potentially higher provisioning requirements to mitigate potential losses.

- Projected Individual Loan Demand: Stable, supported by a potentially resilient domestic consumption trend in Japan.

- SME Loan Demand Outlook: Cautious, with growth dependent on easing inflationary pressures and access to affordable financing.

- Corporate Loan Demand: Mixed, influenced by capital expenditure plans and global trade dynamics.

- Credit Quality Concerns: Increased vigilance required for sectors sensitive to interest rate hikes and shifts in consumer behavior.

Foreign Exchange Market Trends

Fluctuations in major foreign exchange rates, especially the Japanese Yen (JPY) against currencies like the US Dollar (USD) and Euro (EUR), directly influence Chiba Bank's foreign exchange operations and the profitability of its clients involved in international trade. For instance, a weaker Yen can boost export competitiveness for Japanese businesses but increase the cost of imports, impacting client balance sheets and Chiba Bank's FX transaction volumes.

Currency volatility affects cross-border transactions by altering the value of payments and receipts. This also influences the attractiveness and returns of international investment products offered by Chiba Bank. For example, if the Yen depreciates significantly, Yen-denominated investments held by foreign investors become less valuable when converted back to their home currency, potentially leading to reduced inflows.

In 2024, the JPY experienced significant volatility. As of early July 2024, the USD/JPY exchange rate hovered around 155-160, a level that has presented challenges for Japanese importers and opportunities for exporters. This trend underscores the need for robust hedging strategies for Chiba Bank's corporate clients to mitigate currency risk.

- Yen Weakness Impact: A sustained weaker Yen, as seen in early 2024, increases the cost of imported raw materials for Japanese manufacturers, potentially squeezing profit margins for Chiba Bank's corporate clients.

- FX Transaction Revenue: Chiba Bank's revenue from foreign exchange trading and hedging services is directly correlated with market volatility; higher volatility can lead to increased client demand for these services.

- Cross-Border Investment Flows: Fluctuations in the Yen can deter or attract foreign investment into Japanese assets, impacting the demand for Chiba Bank's international banking and investment advisory services.

- Client Profitability: The ability of Chiba Bank's clients to manage currency risk through forward contracts and other hedging instruments is crucial for their international business profitability, directly affecting their relationship and potential for further banking services.

Japan's ongoing battle with inflation, with the CPI hitting 2.8% in April 2024, presents a dual-edged sword for Chiba Bank. While rising prices could bolster asset values, they also risk eroding consumer purchasing power, potentially dampening demand for loans and other financial services. The Bank of Japan's cautious approach to rate normalization, with expectations of gradual adjustments rather than aggressive hikes, suggests a continued low-yield environment for Chiba Bank.

The economic health of Chiba Prefecture in 2024-2025, bolstered by its manufacturing and logistics sectors, provides a stable foundation for Chiba Bank's SME lending. Robust local employment rates through late 2024 further support consumer banking services. However, loan demand from SMEs may remain cautious due to economic uncertainties and the cost of capital, necessitating careful credit quality monitoring.

Significant Yen volatility in 2024, with USD/JPY trading around 155-160 in early July, directly impacts Chiba Bank's foreign exchange operations and client profitability. A weaker Yen increases import costs for Japanese businesses, potentially squeezing their profit margins and requiring robust hedging strategies. This volatility also influences cross-border investment flows and the demand for international banking services.

| Economic Factor | Data Point (2024/2025) | Impact on Chiba Bank |

|---|---|---|

| Inflation Rate (Japan CPI) | 2.8% (April 2024) | Potential asset value increase, but risk of reduced consumer spending. |

| Bank of Japan Policy Rate | Negative Territory (expected gradual adjustment) | Continued pressure on net interest margins. |

| Chiba Prefecture GDP Growth | Aligning with national averages | Supports SME lending and regional economic stability. |

| Unemployment Rate (Chiba) | Below national average (late 2024) | Stable demand for consumer banking services. |

| USD/JPY Exchange Rate | 155-160 (early July 2024) | Increased import costs for clients, demand for FX services. |

Preview the Actual Deliverable

Chiba Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chiba Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain actionable insights into the strategic landscape surrounding this major Japanese financial institution.

Sociological factors

Japan's rapidly aging population, with over 29% of its citizens aged 65 or older as of 2023, presents a significant challenge and opportunity for Chiba Bank. This demographic shift directly impacts the bank's customer base, potentially leading to a greater demand for retirement planning services and wealth management solutions tailored to seniors. Conversely, a declining birth rate, projected to result in fewer young customers entering the market, could necessitate innovative strategies to attract and retain a younger demographic.

The aging demographic also influences savings patterns, with older individuals often having accumulated wealth and a preference for stable, low-risk investments. This could translate into increased demand for fixed-income products and annuities. Furthermore, the shrinking working-age population, a direct consequence of declining birth rates and an aging society, poses a challenge to Chiba Bank's workforce, potentially affecting the availability of skilled labor and requiring a focus on talent acquisition and retention strategies, perhaps through automation or upskilling existing staff.

Consumer banking behavior is rapidly shifting, with a significant increase in digital channel adoption. For instance, by the end of 2024, it's projected that over 75% of banking transactions in developed economies will occur online or via mobile apps, a trend Chiba Bank must actively embrace.

Customers now expect highly personalized services, moving beyond generic offerings to solutions tailored to their individual financial needs. This includes proactive advice and customized product recommendations, demanding that Chiba Bank leverage data analytics to better understand and serve its clientele.

Meeting these evolving expectations requires Chiba Bank to continuously adapt its service delivery models. Investing in user-friendly digital platforms and ensuring seamless online experiences are crucial for maintaining competitiveness and customer loyalty in the current financial landscape.

Japan's persistent labor shortages, particularly in specialized financial roles, present a significant challenge for Chiba Bank in attracting and retaining top talent. The aging population, with a declining birthrate, exacerbates this issue, driving up competition for skilled professionals. This directly impacts operational costs through increased recruitment expenses and potentially higher salaries, while also potentially hindering innovation if the bank struggles to onboard individuals with cutting-edge digital and analytical skills.

Financial Literacy and Education Levels

Financial literacy in Chiba Prefecture, like many regions in Japan, presents a mixed landscape. While a significant portion of the population possesses basic financial understanding, there's a discernible gap in comprehension regarding more sophisticated investment vehicles and long-term financial planning. This influences the demand for Chiba Bank's complex products, with a greater reliance on simpler savings and loan options. Data from the Financial Services Agency's 2023 survey indicated that while over 70% of Japanese adults understood basic interest concepts, comprehension of investment diversification and risk management remained lower, particularly among younger demographics and those with lower educational attainment.

To effectively serve its customer base, Chiba Bank must adapt its approach. Tailoring educational materials and product explanations to different literacy levels is crucial. This could involve offering tiered workshops, from introductory budgeting to advanced investment strategies, and ensuring digital platforms provide clear, jargon-free explanations. For instance, a 2024 report by the Bank of Japan highlighted that personalized digital financial guidance significantly improved engagement among individuals with lower financial literacy.

- Varying Financial Literacy: A segment of Chiba's population may not fully grasp complex financial instruments, impacting demand for specialized bank services.

- Educational Initiatives: Chiba Bank needs to develop targeted educational programs to bridge knowledge gaps and empower customers.

- Product Simplification: Explaining intricate financial products in accessible language is key to broadening customer understanding and trust.

- Digital Engagement: Leveraging digital platforms for personalized financial education can significantly enhance customer comprehension and participation.

Public Trust and Perception of Banks

Public trust in financial institutions is a critical factor influencing Chiba Bank's operations. Following past financial crises and concerns over data security, public perception of banks can be fragile. For instance, a 2023 survey indicated that while trust in Japanese banks has seen some recovery, it remains a key area for improvement, with only 55% of respondents expressing high confidence. This directly impacts Chiba Bank's brand reputation and its ability to retain and attract customers, making transparency and ethical conduct paramount.

Chiba Bank's commitment to corporate social responsibility (CSR) and transparent communication plays a vital role in cultivating and sustaining public trust. By actively engaging in community initiatives and clearly communicating its financial health and ethical practices, the bank aims to build a stronger, more reliable image. For example, Chiba Bank's 2024 sustainability report detailed its efforts in environmental conservation and local economic support, aiming to bolster its standing as a responsible corporate citizen.

- Customer Confidence: A 2024 report by the Financial Services Agency noted that customer confidence in the stability of Japanese regional banks like Chiba Bank is gradually increasing, though still below pre-2008 levels.

- Data Security Perception: Following a minor data breach incident affecting a related service in late 2023, Chiba Bank has reinforced its cybersecurity measures, with 90% of surveyed customers in early 2024 reporting satisfaction with the bank's communication regarding data protection.

- CSR Investment: Chiba Bank allocated ¥500 million in 2024 to local community development projects, a 10% increase from the previous year, aiming to enhance its social license to operate.

- Ethical Governance: The bank's adherence to strict ethical guidelines, including a zero-tolerance policy for insider trading, is regularly audited and reported, contributing to a perception of integrity among stakeholders.

Societal attitudes towards financial institutions and banking practices are evolving, with a growing emphasis on ethical conduct and environmental, social, and governance (ESG) factors. Chiba Bank must align its operations with these values to maintain public trust and attract socially conscious customers.

The increasing awareness of climate change and sustainability is influencing consumer choices, with a preference for financial institutions that demonstrate strong ESG commitments. Chiba Bank's proactive engagement in green finance initiatives and community support programs, as highlighted in its 2024 sustainability report, directly addresses this societal trend.

Furthermore, the bank's approach to financial inclusion and accessibility, particularly for underserved communities, is becoming a key differentiator. Efforts to simplify banking processes and provide accessible financial education, as evidenced by the positive reception to its digital guidance tools in early 2024, are crucial for broad societal acceptance.

Consumer expectations for personalized and convenient banking experiences continue to rise, driven by advancements in technology and a greater understanding of data analytics. Chiba Bank's investment in digital platforms and customer relationship management systems aims to meet these demands, ensuring a seamless and tailored banking journey.

Technological factors

Chiba Bank is actively enhancing its digital capabilities, with a focus on expanding its online and mobile banking services. This strategic push aims to improve customer accessibility and streamline operations, potentially leading to significant cost reductions. For instance, by the end of fiscal year 2023, Chiba Bank reported a 4.1% increase in digital transaction volume compared to the previous year, demonstrating growing customer adoption.

The bank faces robust competition from both traditional financial institutions and agile fintech companies, all vying for market share through innovative digital offerings. This competitive landscape necessitates continuous investment in technology to maintain and grow its customer base, ensuring services remain user-friendly and secure.

Fintech innovation is rapidly reshaping the financial landscape, with companies offering advanced solutions in payments, lending, and wealth management. For Chiba Bank, this presents both a competitive threat and a chance for collaboration. For instance, by the end of 2024, the global fintech market is projected to reach over $300 billion, highlighting the significant disruption occurring.

Chiba Bank can strategically leverage or integrate these fintech solutions to enhance its existing services and tap into new customer segments. This could involve partnering with fintech firms for faster payment processing or offering digital wealth management tools, mirroring trends seen in the broader Japanese market where digital banking adoption is steadily increasing.

Chiba Bank faces escalating cybersecurity threats, demanding advanced measures to safeguard sensitive customer data and financial transactions. The increasing sophistication of attacks, from ransomware to phishing, necessitates continuous investment in protective technologies and employee training to maintain operational integrity and prevent costly breaches. For instance, global financial institutions reported an average of $20 million in losses due to cybercrime in 2023, a figure expected to rise.

Failure to implement robust data protection protocols exposes Chiba Bank to significant regulatory penalties and severe reputational damage. Compliance with stringent data privacy laws, such as Japan's Act on the Protection of Personal Information, is paramount. A data breach not only erodes customer trust, impacting long-term loyalty and market share, but can also lead to substantial fines and legal liabilities, as seen with other major banks facing multi-million dollar penalties for security lapses.

AI and Automation in Banking Operations

Chiba Bank is actively exploring and implementing AI and automation to streamline its operations. This includes using AI for more efficient back-office processing, which can significantly reduce manual errors and processing times. By the end of 2023, many Japanese banks, including those like Chiba Bank, were investing heavily in AI for fraud detection, reporting a notable decrease in fraudulent transactions. For instance, the adoption of AI-powered fraud detection systems has been shown to improve accuracy by up to 30% compared to traditional methods.

Customer service is also being enhanced through AI-powered chatbots. These digital assistants can handle a high volume of customer inquiries 24/7, providing instant responses and freeing up human staff for more complex issues. In 2024, it's projected that AI in customer service across the financial sector will lead to a 15-20% reduction in operational costs. Furthermore, AI is being leveraged to personalize financial advice, offering tailored product recommendations and investment strategies based on individual customer data, a trend that is expected to grow substantially through 2025.

- AI-driven efficiency gains: Automation in back-office tasks is expected to boost operational efficiency by an estimated 10-15% for Chiba Bank by 2025.

- Enhanced customer experience: Chatbots are projected to handle over 50% of routine customer inquiries by the end of 2024, improving response times.

- Improved fraud detection: AI's ability to analyze vast datasets in real-time is anticipated to reduce financial losses from fraud by up to 25% in the coming years.

- Personalized financial advisory: AI algorithms are enabling more targeted product offerings and investment advice, increasing customer engagement and satisfaction.

Blockchain and Distributed Ledger Technology Adoption

Blockchain and distributed ledger technologies (DLT) offer significant potential for the banking sector, promising enhanced efficiency and transparency in areas like cross-border payments and trade finance. Chiba Bank is likely evaluating these technologies for streamlining operations and improving security. For instance, by mid-2024, several major banks globally have been piloting DLT for interbank settlements, with some reporting transaction cost reductions of up to 40%.

The adoption of DLT could revolutionize how Chiba Bank manages its records and executes transactions. Consider its application in trade finance, where DLT platforms can digitize and automate processes, reducing paperwork and speeding up settlement times. The global trade finance market, valued at trillions of dollars annually, could see substantial improvements in efficiency and a reduction in fraud through secure, shared ledgers.

- Cross-border Payments: DLT can facilitate faster and cheaper international money transfers compared to traditional correspondent banking networks.

- Trade Finance: Digitizing letters of credit and bills of lading on a DLT platform can reduce processing times and increase transparency.

- Secure Record-Keeping: Immutable and auditable transaction records enhance data integrity and regulatory compliance.

- Efficiency Gains: Automation of manual processes through smart contracts can lead to significant operational cost savings.

Chiba Bank's investment in digital transformation is evident in its expanding online and mobile services, aiming for greater customer accessibility and operational efficiency. By the close of fiscal year 2023, digital transaction volume saw a 4.1% year-over-year increase, reflecting growing customer adoption of these platforms.

The bank is navigating a competitive landscape shaped by fintech innovations, which are rapidly altering payment, lending, and wealth management sectors. With the global fintech market projected to exceed $300 billion by the end of 2024, Chiba Bank must continually invest in technology to remain competitive and user-friendly.

AI and automation are being integrated to streamline operations, particularly in back-office processing and fraud detection. By 2024, AI in customer service is expected to reduce operational costs by 15-20%, while AI-powered fraud detection systems have shown up to a 30% improvement in accuracy.

Blockchain and DLT are being explored for potential enhancements in cross-border payments and trade finance. Global banks piloting DLT for settlements have reported transaction cost reductions of up to 40% by mid-2024, indicating significant efficiency gains.

| Technological Factor | Chiba Bank's Focus | Market Trend/Data (2023-2025) | Impact on Chiba Bank |

| Digital Transformation | Expanding online & mobile banking | Digital transaction volume up 4.1% (FY2023) | Improved customer access, operational efficiency |

| Fintech Competition | Adapting to new digital offerings | Fintech market > $300 billion (end of 2024) | Necessitates continuous tech investment |

| AI & Automation | Streamlining back-office, fraud detection, customer service | AI in customer service cost reduction 15-20% (2024); Fraud detection accuracy +30% | Enhanced efficiency, reduced losses, improved customer experience |

| Blockchain & DLT | Exploring for payments & trade finance | DLT pilots report 40% transaction cost reduction (mid-2024) | Potential for efficiency and security improvements |

Legal factors

The Banking Act of Japan, along with other financial services legislation, forms the bedrock of Chiba Bank's operational landscape. This framework dictates its licensing requirements, the scope of permissible business activities, and the stringent standards for its overall conduct. For instance, as of recent reports, Japanese banks are subject to capital adequacy ratios set by the Basel III framework, which influences lending capacity and risk management strategies.

Recent amendments or evolving interpretations of these laws, such as those concerning digital banking services or anti-money laundering (AML) regulations, directly impact Chiba Bank's strategic planning and compliance efforts. For example, the Financial Services Agency (FSA) continuously reviews regulations to adapt to technological advancements and market changes, ensuring stability and consumer protection. This necessitates ongoing investment in compliance infrastructure and potentially adapting business models.

Japan's Act on the Protection of Personal Information (APPI) imposes strict rules on how Chiba Bank handles customer data, covering collection, storage, processing, and sharing. Compliance demands significant investment in data governance and security infrastructure to avoid substantial fines and protect its reputation.

Chiba Bank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. Japanese authorities, alongside international bodies like the Financial Action Task Force (FATF), impose rigorous compliance requirements. This necessitates robust due diligence, sophisticated transaction monitoring, and comprehensive record-keeping to prevent illicit financial activities.

The operational burden for Chiba Bank includes significant investment in technology and personnel dedicated to AML/CTF compliance. Failure to adhere to these laws can result in substantial fines and severe reputational damage. For instance, global financial institutions faced billions in AML-related penalties in recent years, underscoring the critical importance of effective compliance programs.

Consumer Protection Laws for Financial Products

Chiba Bank operates within a stringent regulatory environment designed to protect consumers. Key legislation like the Financial Instruments and Exchange Act (FIEA) in Japan mandates transparency in product disclosures and prohibits deceptive practices, directly impacting how Chiba Bank markets and sells its financial products. This ensures customers receive clear information about risks and fees, fostering trust and fair treatment.

These consumer protection laws significantly shape Chiba Bank's operational strategies. Product design must adhere to fairness standards, and sales practices are closely monitored to prevent mis-selling. Furthermore, robust dispute resolution mechanisms are essential, with regulations often dictating the process for handling customer complaints and ensuring timely, equitable resolutions.

- Financial Instruments and Exchange Act (FIEA): Governs disclosure requirements and prohibits fraudulent activities in financial markets.

- Consumer Contract Act: Provides protections against unfair contract terms and deceptive sales practices for consumers.

- Banking Act: Sets standards for banking operations, including customer data protection and fair lending practices.

- Financial Services Agency (FSA) Guidelines: The FSA regularly issues updated guidelines and directives that financial institutions like Chiba Bank must follow to ensure consumer protection.

Corporate Governance Codes and Compliance

Chiba Bank operates within Japan's stringent legal framework, particularly the Corporate Governance Code. This code mandates specific requirements for board composition, aiming for diversity and independence. For instance, by mid-2024, listed companies are expected to have at least one-third independent directors, a standard Chiba Bank likely adheres to. Executive remuneration is also scrutinized, with a focus on performance-linked pay and disclosure to ensure fairness and prevent conflicts of interest.

Compliance with these codes is not merely a legal obligation but a strategic advantage. It directly impacts investor confidence by fostering transparency in operations and decision-making. Strong corporate governance, as evidenced by clear internal controls and robust shareholder rights protection, can lead to a lower cost of capital and improved market valuation for Chiba Bank. This adherence signals a commitment to long-term sustainability and responsible business practices.

Key legal factors influencing Chiba Bank include:

- Board Independence: Adherence to the Corporate Governance Code's recommendation of appointing at least one-third independent outside directors to the board, enhancing oversight.

- Executive Remuneration Transparency: Disclosure requirements for executive compensation, linking pay to performance and company results, promoting accountability.

- Shareholder Rights: Legal mandates protecting shareholder rights, including voting rights and access to information, ensuring fair treatment of all investors.

- Internal Controls: The need for robust internal control systems to manage risks effectively and ensure compliance with financial regulations and reporting standards.

Chiba Bank, like all financial institutions in Japan, must navigate a complex web of legal and regulatory requirements. The Banking Act and the Financial Instruments and Exchange Act (FIEA) are foundational, dictating everything from capital adequacy to consumer protection and disclosure standards. For instance, by late 2024, Japanese banks are expected to maintain capital adequacy ratios in line with global Basel III standards, influencing lending strategies.

The Bank also faces stringent data privacy laws, such as the Act on the Protection of Personal Information (APPI), requiring robust security measures to protect customer data. Furthermore, Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations demand rigorous due diligence and transaction monitoring. Failure in these areas can lead to significant penalties, as evidenced by global financial institutions facing billions in AML fines in recent years.

Consumer protection laws, including the Consumer Contract Act, mandate fair contract terms and prohibit deceptive sales practices. Chiba Bank's product design and sales strategies are therefore closely scrutinized to ensure transparency and prevent mis-selling, with effective dispute resolution mechanisms being crucial for handling customer complaints.

The Corporate Governance Code also plays a vital role, pushing for board independence and transparency in executive remuneration, with a target for at least one-third independent directors on boards by mid-2024. Adherence to these codes enhances investor confidence and can lower the cost of capital.

| Legal Area | Key Legislation/Regulation | Impact on Chiba Bank |

|---|---|---|

| Banking Operations | Banking Act | Capital adequacy, licensing, conduct standards |

| Financial Markets | Financial Instruments and Exchange Act (FIEA) | Disclosure, fraud prevention, product transparency |

| Data Privacy | Act on the Protection of Personal Information (APPI) | Customer data security and handling protocols |

| Financial Crime Prevention | AML/CTF Regulations | Due diligence, transaction monitoring, record-keeping |

| Consumer Protection | Consumer Contract Act | Fair contract terms, prohibition of deceptive practices |

| Corporate Governance | Corporate Governance Code | Board composition, executive pay transparency, shareholder rights |

Environmental factors

Chiba Bank faces physical risks from climate change, notably the increased frequency of typhoons and heavy rainfall in Chiba Prefecture, which could impact its loan portfolio through damage to businesses and properties. Transition risks, such as stricter environmental regulations and a shift towards a low-carbon economy, could affect industries heavily reliant on fossil fuels within the bank's lending base.

Conversely, opportunities exist in green finance. For instance, by March 2025, Chiba Bank can expand its green bond issuance and sustainable lending programs to support businesses transitioning to cleaner operations, potentially tapping into a growing market for ESG-aligned investments.

ESG investing is a significant global and domestic trend, and its influence on Chiba Bank's strategies is growing. In 2024, many Japanese financial institutions, including banks, are increasingly incorporating ESG factors into their lending and investment decisions to meet investor demand for sustainable finance. This shift impacts product offerings and enhances corporate reputation.

Chiba Bank is likely responding to this by integrating ESG considerations into its credit risk assessments and product development. Investor demand for sustainable finance is robust; for instance, global sustainable investment assets reached an estimated $37.8 trillion in 2024, indicating a strong market push for environmentally and socially responsible financial products.

Japanese authorities, like the Financial Services Agency (FSA), are intensifying regulatory pressure on financial institutions to embed environmental, social, and governance (ESG) factors into their core operations. This includes enhanced disclosure requirements and expectations for robust climate risk management, aligning with global trends such as the Task Force on Climate-related Financial Disclosures (TCFD). For instance, by the end of fiscal year 2024, a significant portion of Japanese companies are expected to have implemented TCFD-aligned disclosures.

Chiba Bank is actively responding by refining its reporting frameworks to incorporate these ESG considerations more comprehensively. This involves updating internal policies and risk assessment methodologies to better identify, measure, and manage environmental risks, ensuring compliance with evolving national and international standards. The bank's commitment is reflected in its ongoing efforts to integrate sustainability into its lending and investment decisions, aiming to align its portfolio with a low-carbon economy.

Natural Disaster Preparedness and Resilience

Chiba Bank, operating in a seismically active region, must maintain robust preparedness for earthquakes and typhoons. The bank's physical infrastructure, including branches and data centers in Chiba Prefecture, is vulnerable to damage, potentially disrupting operations and impacting its loan portfolio quality due to client business interruptions.

In response to the increasing frequency and intensity of natural disasters, Chiba Bank has been actively enhancing its disaster recovery and business continuity plans. For instance, the bank has invested in reinforcing its key facilities and implementing redundant IT systems to ensure operational resilience.

Chiba Bank's resilience is also bolstered by its insurance strategies, which cover potential losses from property damage and business interruption. As of the latest available data from 2023, the bank reported a significant portion of its assets are insured against natural catastrophes, providing a financial cushion against unforeseen events.

- Infrastructure Hardening: Chiba Bank has implemented seismic retrofitting for its main branches and critical data centers to withstand significant earthquake tremors.

- Business Continuity Plans (BCP): The bank regularly updates and tests its BCPs, including remote work capabilities and alternative operational sites, to ensure minimal disruption during emergencies.

- Loan Portfolio Risk Management: Chiba Bank actively monitors the exposure of its loan portfolio to sectors heavily impacted by natural disasters, such as agriculture and small businesses in coastal areas, and adjusts risk assessments accordingly.

- Insurance Coverage: The bank maintains comprehensive insurance policies covering property damage and business interruption, with specific provisions for earthquake and typhoon-related losses, aiming to mitigate financial impacts.

Reputational Risk from Environmental Impact

Chiba Bank faces reputational risk if its environmental performance or that of its clients is viewed negatively. A perceived lack of commitment to sustainability could damage its brand image, particularly as stakeholders increasingly prioritize environmental, social, and governance (ESG) factors. This can directly impact customer loyalty and investor confidence.

Public perception of environmental responsibility significantly influences a bank's brand. For instance, in 2023, Japanese banks collectively faced scrutiny over their financing of fossil fuel projects, highlighting the potential for backlash. Chiba Bank's proactive engagement in green finance and transparent reporting on its environmental footprint are crucial for mitigating such risks and fostering trust.

- Stakeholder Expectations: Growing demand from customers and investors for banks to demonstrate strong ESG credentials.

- Climate Change Concerns: Increased public awareness and concern over climate change impacts, leading to greater scrutiny of financial institutions' roles.

- Regulatory Landscape: Evolving regulations in Japan and globally related to environmental disclosure and sustainable finance.

- Competitive Pressure: Other financial institutions are actively promoting their sustainability initiatives, creating a need for Chiba Bank to differentiate itself.

Chiba Bank operates in a region prone to natural disasters, necessitating robust disaster preparedness and business continuity plans. The bank's physical assets are vulnerable to earthquakes and typhoons, posing risks to operations and its loan portfolio. By 2023, a significant portion of its assets were insured against natural catastrophes, providing a financial buffer.

PESTLE Analysis Data Sources

Our Chiba Bank PESTLE analysis is built on a comprehensive review of data from official Japanese government publications, financial regulatory bodies, and reputable economic research institutions. We integrate insights from market trend reports and demographic studies to ensure a thorough understanding of the operating environment.