Chiba Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chiba Bank Bundle

Chiba Bank navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants. Understanding the intensity of rivalry and the influence of suppliers is crucial for its strategic positioning.

The complete report reveals the real forces shaping Chiba Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chiba Bank's reliance on technology providers for crucial digital transformation efforts, such as enhancing its mobile banking platform and implementing AI-driven services, highlights the suppliers' influence. The bank's commitment to digital advancement, with a planned ¥10 billion allocation for such initiatives in 2024, underscores this dependence.

The growing digital banking trend in Japan, anticipated to see a 25% expansion by 2025, fuels the demand for sophisticated banking software and infrastructure. This increasing market demand strengthens the bargaining power of specialized technology suppliers who can offer these essential, cutting-edge solutions.

Financial market infrastructure providers, like payment and interbank lending platforms, wield considerable power over Chiba Bank. Their services are essential for daily operations, meaning any price hike or service interruption directly affects the bank's transaction capabilities and liquidity management. For instance, fees associated with major payment systems can represent a significant operational cost.

The Bank of Japan's monetary policies, particularly concerning money market operations and bond purchases, also act as a powerful influence. These actions directly impact the cost and availability of funds for all banks, including Chiba Bank, effectively setting the stage for their borrowing costs and overall funding environment.

The availability of skilled labor, especially in cutting-edge fields like digital transformation, AI, and cybersecurity, directly influences Chiba Bank's operational efficiency and its ability to innovate. A scarcity of this specialized talent in Japan, exacerbated by demographic trends such as a declining and aging population, could significantly amplify the bargaining power of these highly sought-after employees. This scenario would likely translate into increased wage demands and higher labor costs for Chiba Bank.

Information and Data Providers

Information and data providers hold some sway over Chiba Bank. Access to dependable, current financial data, market analysis, and economic predictions is vital for the bank's investment and lending strategies. Suppliers offering unique or specialized data can leverage this to their advantage.

The quality and timeliness of information directly influence Chiba Bank's risk management and strategic planning. For instance, in 2024, the demand for real-time market data surged as volatility increased, giving major data providers like Bloomberg and Refinitiv enhanced bargaining power. These platforms are essential for banks to monitor market movements and make informed decisions, with subscription costs reflecting this critical reliance.

- Data providers offering exclusive or proprietary market insights can command higher prices due to their unique value proposition.

- The increasing reliance on AI and machine learning for financial analysis in 2024 has amplified the importance of high-quality, structured data, strengthening the position of leading data vendors.

- Chiba Bank's ability to negotiate terms with data suppliers is influenced by the availability of alternative data sources and the bank's internal data analytics capabilities.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, including legal, auditing, and specialized consulting firms, possess significant bargaining power over Chiba Bank. This power stems from the intricate and constantly changing regulatory environment governing Japanese financial institutions. For instance, in 2024, the Financial Services Agency (FSA) continued to emphasize stringent anti-money laundering (AML) and cybersecurity measures, requiring banks to invest heavily in compliance frameworks.

These specialized service providers, particularly those with deep knowledge of Japanese banking laws and international financial standards like Basel III, are crucial for Chiba Bank's operational integrity. Their expertise is indispensable for navigating these complexities, ensuring the bank avoids substantial fines and maintains its operating license. The scarcity of highly qualified compliance professionals in Japan further amplifies their leverage.

- High Switching Costs: Changing compliance service providers can be costly and time-consuming due to the need for knowledge transfer and system integration.

- Essential Services: The services offered are non-negotiable for maintaining regulatory adherence and avoiding severe penalties.

- Limited Number of Specialists: The pool of providers with specific expertise in Japanese financial regulations is relatively small.

- Reputational Risk: Non-compliance due to inadequate service can lead to significant reputational damage for Chiba Bank.

Chiba Bank's reliance on technology and data providers, especially for its digital transformation initiatives, grants these suppliers considerable bargaining power. The bank's planned ¥10 billion investment in digital services for 2024 underscores this dependence, as specialized software and infrastructure are critical. The growing Japanese digital banking market, projected to grow 25% by 2025, further enhances the leverage of these essential tech suppliers.

What is included in the product

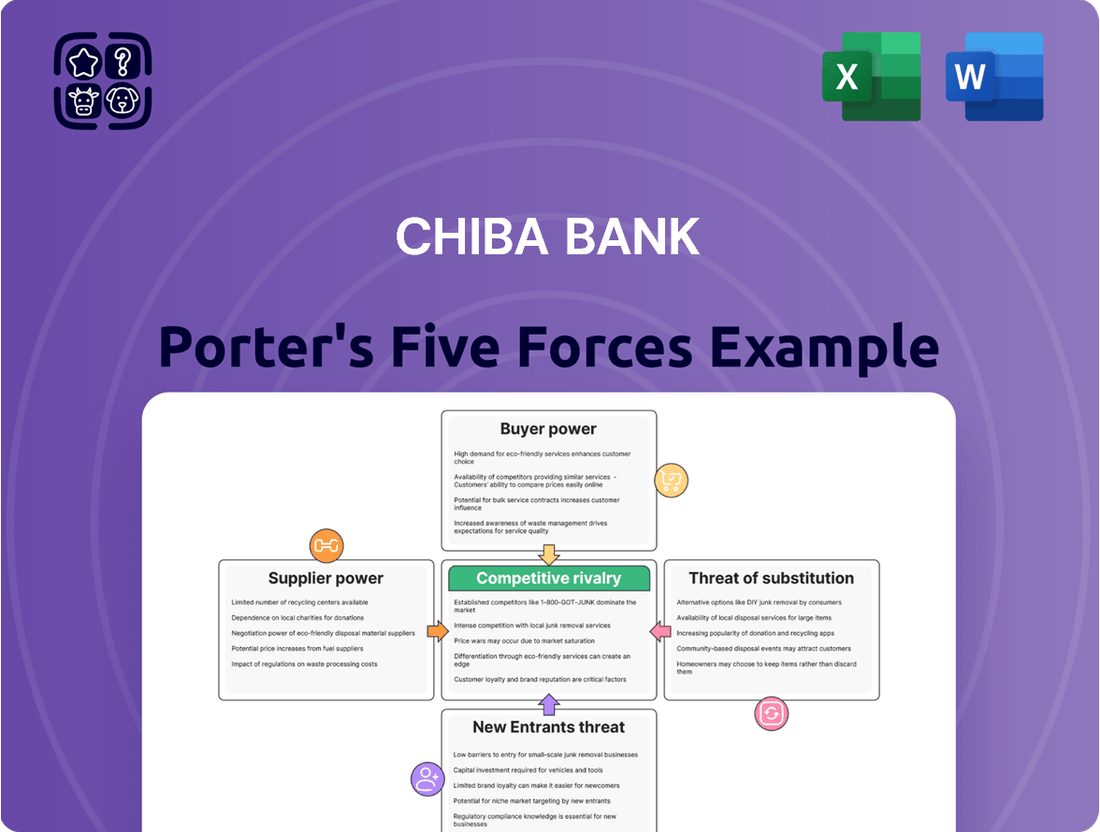

This analysis meticulously examines the five competitive forces impacting Chiba Bank, detailing the intensity of rivalry, the bargaining power of customers and suppliers, and the threats posed by new entrants and substitute products.

A clear, one-sheet summary of Chiba Bank's competitive landscape—perfect for quick strategic decision-making.

Instantly understand the competitive pressures on Chiba Bank with a powerful spider/radar chart, simplifying complex market dynamics.

Customers Bargaining Power

Individual retail customers typically possess limited bargaining power with banks like Chiba Bank. This is largely because banking products such as savings accounts and basic loans are quite standardized, and the effort involved in switching financial institutions, like updating direct debits or transferring funds, can be a deterrent, effectively raising switching costs.

However, this dynamic can shift. For instance, in periods of low interest rates, retail customers might exert more influence by actively seeking out banks offering more competitive deposit rates. The increasing prevalence and ease of use of digital banking platforms also empower customers by providing them with a wider array of choices and simplifying the process of moving their accounts, thereby incrementally boosting their bargaining leverage.

Small and Medium-sized Enterprises (SMEs) in the Chiba Prefecture, while numerous, often possess moderate bargaining power. Their financial sophistication can be limited, and they frequently have fewer alternative financing options compared to larger corporations, making them somewhat reliant on institutions like Chiba Bank for crucial loans and advisory services. This dependence solidifies Chiba Bank's leverage in its dealings with these businesses.

Large corporations and institutional clients wield considerable bargaining power with Chiba Bank. Their substantial transaction volumes, often in the billions of yen, give them leverage to negotiate favorable pricing on loans and other financial services. For instance, major Japanese corporations frequently secure syndicated loans with competitive interest rates, directly impacting bank profitability.

These sophisticated clients also have the financial acumen and resources to access diverse financial instruments and capital markets directly. This means they can bypass traditional banking channels if terms are not attractive, putting pressure on Chiba Bank to offer competitive rates and tailored solutions. In 2024, we've seen a trend of large Japanese companies increasingly issuing corporate bonds rather than relying solely on bank financing.

The ability for these clients to easily switch between major banks or explore alternative funding sources means Chiba Bank must constantly demonstrate value. This necessitates offering not just competitive pricing but also superior service quality, innovative products, and deep industry expertise to retain these crucial relationships.

Digital-Savvy Customers

Digital-savvy customers wield significant bargaining power. Their ease with online and mobile platforms allows them to effortlessly compare services and interest rates from numerous financial institutions, both established and emerging. This digital fluency compels Chiba Bank to prioritize and invest heavily in its digital transformation initiatives.

The increasing adoption of digital banking channels by consumers directly impacts Chiba Bank's competitive landscape. For instance, by the end of March 2024, Chiba Bank reported that approximately 70% of its retail customers were actively using its online and mobile banking services, a figure that has steadily climbed over the past few years. This trend highlights a clear shift in customer behavior towards digital interactions.

- Increased Price Sensitivity: Digital channels facilitate easy comparison of fees and interest rates, making customers more sensitive to pricing differences between banks.

- Demand for Convenience: Customers expect seamless, 24/7 access to banking services, pushing banks to enhance their digital platforms.

- Innovation Pressure: The availability of advanced digital tools from competitors pressures Chiba Bank to continuously innovate its product offerings and user experience.

- Switching Costs: While digital platforms can lower switching costs for customers, Chiba Bank aims to mitigate this by fostering strong digital relationships and loyalty programs.

Customers in a Rising Interest Rate Environment

As the Bank of Japan transitions away from negative interest rates and begins a gradual rate hike cycle, customers, particularly those holding deposits, might see their bargaining power increase. Banks may compete more aggressively for these deposits by offering slightly more attractive interest rates.

However, the extent to which this translates into higher deposit rates for customers, especially at regional banks, is uncertain. These institutions, often serving a predominantly retail customer base, may be more conservative in passing on rate increases to depositors.

- Increased Deposit Competition: Banks may raise deposit rates to attract and retain funds in a rising rate environment.

- Regional Bank Conservatism: Smaller banks might be slower to pass on rate hikes to depositors, potentially limiting customer gains.

- Customer Leverage: Depositors with significant balances could negotiate for better rates, especially if they have alternative options.

Chiba Bank faces varying levels of customer bargaining power. While individual retail customers generally have limited sway due to standardized products and switching costs, digital advancements empower them with more choices and easier account mobility. Large corporations, however, wield significant power, leveraging their transaction volumes to negotiate favorable terms and often opting for direct capital market access over traditional bank loans, as evidenced by the trend of increased corporate bond issuance in 2024.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Chiba Bank's Response Strategy |

|---|---|---|---|

| Individual Retail Customers | Low to Moderate | Standardized products, switching costs, digital platform adoption, interest rate sensitivity | Enhance digital offerings, loyalty programs, competitive basic rates |

| Small and Medium-sized Enterprises (SMEs) | Moderate | Limited financial sophistication, fewer alternative financing options, reliance on bank advisory | Tailored loan products, business advisory services, relationship management |

| Large Corporations & Institutional Clients | High | Large transaction volumes, access to capital markets, financial acumen, ease of switching | Competitive pricing, customized financial solutions, superior service quality, industry expertise |

Full Version Awaits

Chiba Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Chiba Bank Porter's Five Forces Analysis, detailing the competitive landscape of the banking sector. The document you see here is the exact, fully formatted analysis you will receive instantly upon purchase, providing actionable insights without any placeholders or surprises. You are looking at the actual document; once your purchase is complete, you’ll gain immediate access to this professionally written analysis, ready for your strategic planning needs.

Rivalry Among Competitors

Chiba Bank faces fierce rivalry within its home turf, Chiba Prefecture, primarily from other regional banks and national bank branches. This intense local competition means success hinges on cultivating strong community ties and offering highly personalized services to both businesses and individuals.

In 2024, the banking landscape in Japan, including Chiba, saw continued consolidation and digital transformation efforts, further intensifying the competitive environment. Regional banks like Chiba Bank must differentiate themselves through unique value propositions and robust customer engagement strategies to stand out amidst this crowded market.

Chiba Bank faces intense rivalry from Japan's three megabanks: Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group. These giants leverage their immense capital, nationwide branch presence, and broad product portfolios to attract a wide customer base, including larger corporations and digitally savvy individuals who might otherwise be Chiba Bank's target market.

The Japanese banking landscape is in the midst of a digital revolution, with established players like Chiba Bank and emerging fintech firms pouring resources into AI and mobile platforms. This intense focus on digital innovation is reshaping customer expectations and operational efficiency.

Fintech companies are particularly aggressive in the retail and payments arenas, introducing novel solutions that challenge traditional banking models. For instance, in 2024, the digital payment market in Japan continued its robust growth, with transaction volumes on mobile payment services like PayPay and Rakuten Pay seeing significant year-over-year increases, directly impacting traditional bank revenue streams.

Consolidation and M&A Activity among Regional Banks

The Japanese regional banking landscape is witnessing a significant uptick in mergers and acquisitions. This trend is fueled by a dual imperative: achieving greater scale to capitalize on potentially higher interest rates and addressing the challenges posed by a shrinking and aging population across many regions. These factors are pushing banks to seek consolidation for enhanced efficiency and broader market reach.

Chiba Bank is actively participating in this consolidation wave. A notable example is its acquisition of a stake in Chiba Kogyo Bank, signaling a strategic move to strengthen its regional presence and operational capabilities. Such actions are indicative of a broader industry shift towards fewer, but more robust and competitive banking entities.

- Industry Consolidation: Japanese regional banks are merging to gain scale, which is crucial for profitability in a low-growth environment.

- Chiba Bank's Strategy: Chiba Bank's investment in Chiba Kogyo Bank exemplifies this consolidation trend within the sector.

- Future Competition: This M&A activity is likely to result in a more concentrated market with larger, potentially more formidable regional competitors emerging.

Impact of Interest Rate Normalization

The Bank of Japan's move away from negative interest rates, a significant shift in monetary policy, directly influences competitive rivalry among Japanese banks. This normalization, expected to continue gradually through 2024 and beyond, presents both opportunities and challenges.

While an increase in interest rates generally boosts net interest margins for banks, regional institutions like Chiba Bank may find it harder to pass on higher costs to borrowers in highly competitive local markets. This could lead to a widening profitability gap compared to larger, national banks that possess greater pricing power.

- Interest Rate Environment: The Bank of Japan ended its negative interest rate policy in March 2024, marking a pivotal shift.

- Net Interest Margin Impact: Higher rates can improve profitability, but this benefit is unevenly distributed.

- Regional Bank Challenges: Smaller banks face pressure to maintain competitive loan pricing, potentially limiting margin expansion.

- Competitive Landscape: The rate normalization intensifies competition, particularly for regional banks needing to adapt their strategies.

Chiba Bank faces intense rivalry from both domestic megabanks and other regional financial institutions, exacerbated by ongoing industry consolidation and digital transformation. The push for scale through mergers, like Chiba Bank's stake in Chiba Kogyo Bank, aims to enhance competitiveness in a market increasingly shaped by fintech innovation and evolving monetary policies.

The Bank of Japan's policy shift away from negative interest rates in March 2024 also intensifies rivalry. While higher rates can boost net interest margins, regional banks like Chiba Bank may struggle to pass on costs in competitive local markets, potentially widening the profitability gap with larger national players. For instance, as of early 2024, the average lending rate for Japanese banks saw a slight uptick, but the spread remained under pressure in many regional areas.

| Competitor Type | Key Strengths | Impact on Chiba Bank |

|---|---|---|

| Megabanks (MUFG, SMFG, Mizuho) | Vast capital, nationwide reach, broad product offerings | Attracts large corporations and digitally savvy customers |

| Other Regional Banks | Strong local ties, personalized service | Direct competition for local market share |

| Fintech Companies | Agile digital platforms, innovative payment solutions | Disrupts traditional revenue streams, particularly in retail and payments |

SSubstitutes Threaten

Fintech companies and digital payment platforms like PayPay and LINE Pay are a substantial threat, directly substituting Chiba Bank's traditional payment and retail banking services. These digital alternatives provide unparalleled convenience and often boast lower transaction fees, making them highly attractive to consumers. Their seamless integration with the booming e-commerce sector further amplifies their appeal, posing a direct challenge to Chiba Bank's market share in everyday transactions and consumer lending.

For large corporations and sophisticated investors, direct access to capital markets like bond and equity issuance presents a significant substitute for traditional bank financing. In 2024, the global bond issuance market continued to be robust, with companies raising substantial capital directly from investors, bypassing banks for many funding needs. This trend directly challenges banks by offering alternative avenues for capital acquisition and investment, thereby diminishing reliance on bank-provided loans and products.

Peer-to-peer (P2P) lending and crowdfunding platforms are emerging as alternative funding sources in Japan, offering individuals and small to medium-sized enterprises (SMEs) ways to secure capital outside of traditional banking. While their market penetration in Japan is still developing, these platforms represent a potential substitute for conventional bank loans.

In 2023, the Japanese P2P lending market was valued at approximately ¥50 billion, with a projected compound annual growth rate (CAGR) of around 15% through 2028. This indicates a growing interest and adoption of these digital financing methods, which could gradually erode the market share of traditional lenders like Chiba Bank.

Non-Bank Financial Institutions (NBFIs)

The threat of substitutes for Chiba Bank comes from various non-bank financial institutions (NBFIs). These include credit companies, leasing firms, and specialized lending institutions that offer financial products capable of replacing traditional bank services.

These NBFIs often operate with different regulatory frameworks or possess specialized expertise, enabling them to compete effectively in specific market segments. For instance, in 2024, the Japanese fintech sector saw significant growth, with alternative lenders capturing a larger share of the SME loan market, demonstrating a direct substitution for traditional bank lending.

- Credit Companies: Offer consumer credit and personal loans, directly competing with bank credit cards and personal loan products.

- Leasing Firms: Provide equipment financing and leasing services, substituting for business loans used for capital expenditure.

- Specialized Lending Institutions: Focus on niche areas like real estate or venture capital, offering alternatives to commercial real estate loans or startup funding from banks.

Internal Financing and Corporate Bonds

Large, financially robust corporations increasingly bypass traditional bank lending by utilizing internal financing, such as retained earnings, or by issuing corporate bonds directly to a broad investor base. This strategic shift allows them to secure capital while often achieving lower financing costs and greater flexibility than relying on bank loans.

For instance, in 2024, the corporate bond market saw significant activity, with companies like Apple issuing bonds at competitive rates, demonstrating a clear alternative to bank financing. This trend directly impacts banks like Chiba Bank by reducing the pool of large corporate clients seeking traditional loans.

- Internal Financing: Companies leverage their own profits (retained earnings) to fund operations and growth, reducing the need for external debt.

- Corporate Bonds: Issuing debt securities directly to investors offers an alternative funding source, often with more favorable terms than bank loans for well-established companies.

- Reduced Dependence: These alternatives diminish corporate reliance on banks, thereby weakening the bargaining power of banks in lending negotiations.

The threat of substitutes for Chiba Bank is significant, encompassing digital payment platforms, direct capital markets access, P2P lending, crowdfunding, and various non-bank financial institutions. These alternatives offer convenience, lower costs, and specialized financing, directly challenging traditional banking services.

In 2024, the continued growth of fintech, particularly in areas like digital payments and alternative lending, presents a direct substitution threat. For example, the Japanese P2P lending market, projected to grow at a 15% CAGR through 2028, demonstrates a clear shift towards non-traditional funding sources.

| Substitute Type | Example | Impact on Chiba Bank | 2024 Relevance |

|---|---|---|---|

| Digital Payments | PayPay, LINE Pay | Reduces transaction volume and fees | Increasing adoption in daily transactions |

| Direct Capital Markets | Corporate Bonds | Bypasses bank loans for corporate funding | Robust issuance for large corporations |

| Alternative Lending | P2P Lending, Crowdfunding | Offers loans to SMEs and individuals | Growing market share in specific segments |

| Non-Bank Financial Institutions | Credit Companies, Leasing Firms | Provide specialized financial products | Competition in consumer credit and equipment finance |

Entrants Threaten

The Japanese banking sector is characterized by robust regulatory frameworks and substantial capital requirements, acting as a significant deterrent to potential new entrants. These stringent rules, overseen by the Financial Services Agency (FSA), necessitate considerable financial resources and adherence to complex compliance procedures, making market entry challenging for newcomers.

Established regional banks like Chiba Bank often command significant brand loyalty and deep-seated customer trust, particularly within their core operating regions. This trust is built over years of consistent service and community involvement, making it a formidable barrier for newcomers. For instance, in 2024, Chiba Bank reported a customer base that has been cultivated over decades, reflecting this ingrained loyalty.

Technological advancements, particularly in fintech, significantly lower the barrier to entry for new financial service providers. These agile startups can bypass the legacy infrastructure costs of traditional banks, allowing them to offer specialized services more efficiently. For instance, the rise of digital-only banks and innovative payment platforms demonstrates how technology empowers new entrants to attract customers with convenience and modern solutions, directly challenging established players like Chiba Bank.

Declining Population and Regional Market Saturation

Japan's demographic trends present a significant barrier to new entrants in the banking sector. The country's declining and aging population, especially pronounced in regional areas, restricts the potential for substantial market expansion. This demographic reality makes it less appealing for new players aiming for large-scale growth.

Furthermore, the regional banking landscape in Japan is already highly saturated. This intense competition focuses on retaining existing customers rather than attracting new ones, further deterring potential new entrants who would face an uphill battle for market share.

- Demographic Headwinds: Japan's population is projected to continue declining, with an increasing proportion of elderly citizens. By 2025, the population is expected to be around 123 million, down from over 125 million in recent years.

- Regional Saturation: Many regional banks already operate with significant market penetration in their respective areas, leaving limited room for new competitors to gain a foothold without aggressive strategies.

- Limited Growth Prospects: The lack of population growth, particularly in rural areas, caps the overall demand for banking services, reducing the attractiveness of these markets for new entrants.

Government Support for Regional Banks

The Japanese government's proactive stance on regional bank consolidation, including conditional subsidies for mergers, significantly strengthens incumbent institutions. This support makes it more challenging for new entrants to establish a foothold and compete effectively. For instance, in fiscal year 2023, the government allocated ¥100 billion (approximately $670 million USD) to support such mergers, signaling a commitment to a more robust regional banking sector.

This governmental backing acts as a barrier by reinforcing the competitive advantages of established regional banks, potentially through improved capital adequacy and operational efficiencies gained from consolidation. Such initiatives can deter potential new entrants who would face a more consolidated and government-supported competitor landscape.

- Government subsidies incentivize mergers, consolidating market share among existing players.

- Increased capital and efficiency for merged entities create higher barriers to entry.

- The regulatory environment favors consolidation, making new bank charters less likely.

The threat of new entrants for Chiba Bank is relatively low, primarily due to high capital requirements and stringent regulatory hurdles in Japan's banking sector. Established customer loyalty and brand recognition further solidify this position, making it difficult for newcomers to gain traction. While fintech innovations offer new avenues, the overall market structure and demographic challenges in regional Japan present significant barriers.

| Factor | Impact on New Entrants | Relevance to Chiba Bank |

| Regulatory Capital Requirements | High Barrier | Chiba Bank operates within a well-regulated environment, demanding substantial capital. |

| Customer Loyalty & Brand Recognition | High Barrier | Chiba Bank benefits from decades of trust and community presence in its operating regions. |

| Fintech Disruption | Moderate Threat (but also opportunity) | New entrants can leverage technology, but legacy banks are also adapting. |

| Demographic Trends | High Barrier (for growth-focused entrants) | Japan's aging and declining population limits market expansion potential. |

| Government Consolidation Support | High Barrier | Subsidies for mergers strengthen existing regional players like Chiba Bank. |

Porter's Five Forces Analysis Data Sources

Our Chiba Bank Porter's Five Forces analysis is built upon a foundation of verified data, including the bank's annual reports, financial disclosures, and filings with the Financial Services Agency. We also incorporate insights from industry publications and macroeconomic data to provide a comprehensive view of the competitive landscape.