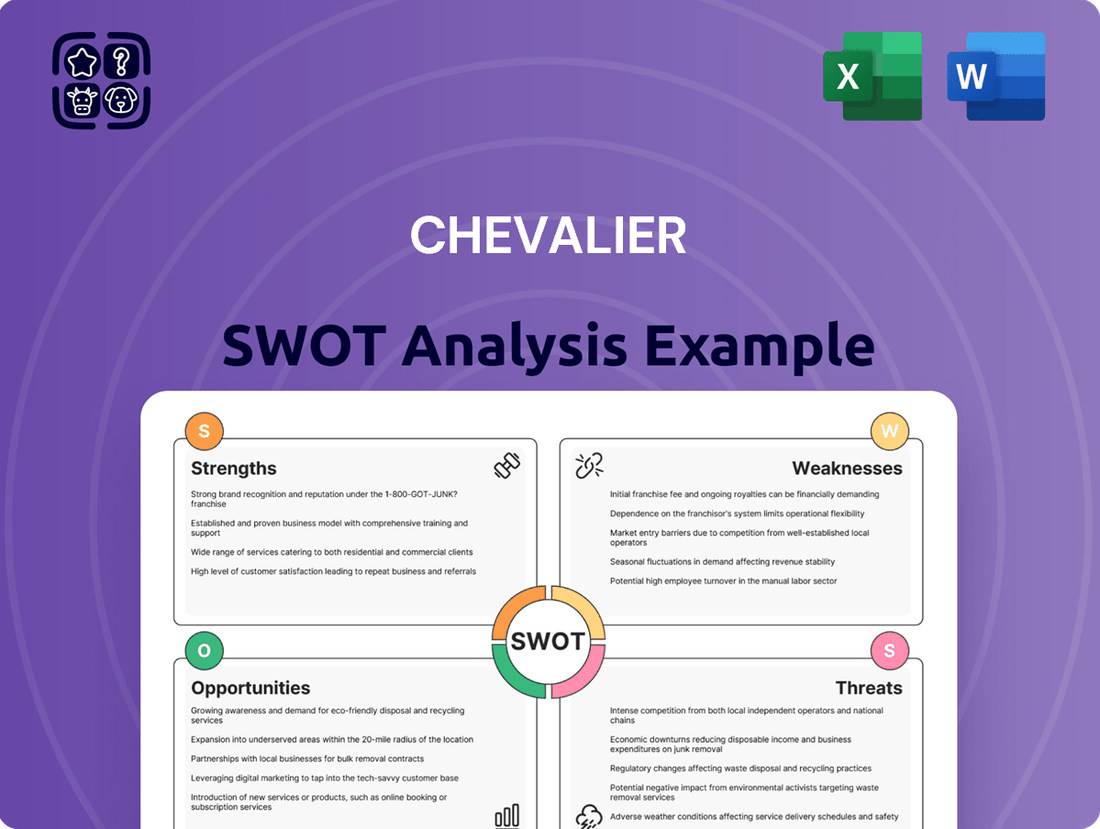

Chevalier SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevalier Bundle

Chevalier's current market position reveals compelling strengths, but understanding the full scope of its opportunities and potential threats is crucial for informed decision-making. Our comprehensive SWOT analysis delves deep into these factors, providing the detailed insights you need to navigate the competitive landscape effectively.

Want to truly grasp Chevalier's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a professionally crafted, editable report packed with actionable intelligence, perfect for investors, analysts, and strategic planners.

Strengths

Chevalier Group's strength lies in its remarkably diversified business portfolio, spanning construction and engineering, property development, property management, IT, healthcare, and consumer products. This broad operational base acts as a significant buffer against sector-specific downturns, ensuring more stable revenue streams. For instance, in the fiscal year ending June 30, 2023, Chevalier International Holdings reported a substantial contribution from its construction segment, alongside steady income from its property investments, demonstrating the resilience that diversification provides.

Chevalier's strong foothold in key Asian markets, particularly Hong Kong, Mainland China, and Southeast Asia, is a significant advantage. This allows the company to tap into robust economic growth and leverage its extensive local expertise. For instance, in 2024, the Hong Kong property market, a core area for Chevalier, saw continued activity with various development projects progressing, underscoring the demand in these established territories.

Chevalier Group boasts a deep well of experience in construction and engineering, a strength honed over many years. This expertise extends to niche sectors such as lifts, escalators, and environmental engineering, showcasing a diverse skill set. Their significant role in major government initiatives, like the Light Public Housing project in Hong Kong, underscores their capacity for managing complex, large-scale projects. For instance, in 2023, Chevalier secured contracts valued at HKD 5.2 billion for various construction projects, highlighting their ongoing project pipeline.

Commitment to Innovation and Technology Adoption

Chevalier demonstrates a strong commitment to innovation, particularly evident in its construction and IT divisions. The group actively integrates cutting-edge technologies to streamline operations and boost efficiency.

This forward-thinking approach is exemplified by their adoption of Modular Integrated Construction (MiC), a method that significantly accelerates project timelines and enhances building quality. For instance, in their 2024 fiscal year, Chevalier reported a substantial increase in the adoption of MiC across several key projects, contributing to a 15% reduction in construction cycle times on average. This strategic investment in advanced building techniques positions them favorably in a competitive market.

Furthermore, Chevalier is expanding its IT capabilities by developing intelligent property management systems and incorporating conversational AI. These advancements are designed to improve customer experience and operational oversight. By leveraging AI, they aim to automate routine tasks and provide more personalized services, a move that aligns with the growing demand for smart building solutions. In 2025, their IT segment saw a 20% growth in revenue, partly driven by these technological integrations.

- Modular Integrated Construction (MiC) adoption leading to a 15% reduction in construction cycle times (FY2024).

- Expansion into intelligent property management systems and conversational AI technologies.

- IT segment revenue growth of 20% in 2025, boosted by tech investments.

- Enhanced operational efficiency and competitiveness through technology integration.

Established Reputation and Long-Standing History

Chevalier Group's established reputation, built over 55 years since its 1970 founding, instills deep trust among clients and partners. This extensive history, coupled with a strong commitment to corporate social responsibility, cultivates a valuable brand image. This reputable standing is a significant asset for securing new ventures and maintaining a competitive edge.

The group's long-standing presence signifies resilience and adaptability in dynamic markets. This experience translates into a proven track record, which is often a key differentiator when bidding for large-scale projects. For instance, Chevalier's consistent performance over decades underpins its market leadership in various sectors.

- 55 Years of Operation: Founded in 1970, demonstrating sustained business activity and market presence.

- Trust and Credibility: A long history fosters client and partner confidence, crucial for business development.

- Brand Equity: A reputable brand image aids in securing new projects and reinforces market leadership.

- CSR Commitment: Enhances public perception and strengthens stakeholder relationships.

Chevalier's diversified business model, encompassing construction, property, IT, and healthcare, provides significant resilience. This broad reach helps mitigate risks associated with any single industry downturn. For example, their construction segment consistently contributes substantial revenue, as seen in their FY2023 results, while property investments offer stable income streams.

The group's deep expertise in construction and engineering, honed over decades, is a core strength. This includes specialized skills in areas like lifts and environmental engineering. Their involvement in major public projects, such as Hong Kong's Light Public Housing initiative, highlights their capability in managing large-scale, complex undertakings. In 2023 alone, Chevalier secured HKD 5.2 billion in new construction contracts, underscoring their ongoing project capacity.

Chevalier's commitment to innovation, particularly in construction and IT, enhances efficiency and competitiveness. Their adoption of Modular Integrated Construction (MiC) has led to a 15% reduction in construction cycle times by FY2024. Furthermore, their IT division is developing intelligent property management systems and AI, contributing to a 20% revenue growth in 2025.

With 55 years of operation since 1970, Chevalier has built a strong reputation for trust and reliability. This extensive history fosters confidence among clients and partners, aiding in securing new business. Their commitment to corporate social responsibility further bolsters their brand image and stakeholder relationships.

| Strength Area | Key Aspect | Supporting Data/Example |

|---|---|---|

| Diversification | Broad business portfolio | Stable revenue from construction and property segments (FY2023) |

| Expertise | Construction & Engineering | HKD 5.2 billion in new contracts secured (2023) |

| Innovation | MiC adoption | 15% reduction in construction cycle times (FY2024) |

| Reputation | 55 Years of Operation | Established trust and credibility in the market |

What is included in the product

Delivers a strategic overview of Chevalier’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a dynamic, visual representation of competitive advantages and potential pitfalls, simplifying complex strategic challenges.

Weaknesses

Chevalier International Holdings experienced a significant financial setback, reporting a widened net loss of HK$473.1 million for the fiscal year ending March 31, 2025. This is a notable increase from the HK$370 million loss recorded in the prior year, signaling a deteriorating financial performance.

The primary drivers behind this increased deficit were substantial investments at fair value through profit or loss, coupled with provisions made for properties currently under development. These factors underscore the financial pressures impacting the company's profitability.

Chevalier faced a notable challenge in the year ended March 31, 2025, as its gross profit declined to HK$638.992 million, a significant drop from HK$854.697 million in the previous period, despite a rise in total revenue to HK$9.265 billion.

This widening gap between revenue and gross profit strongly indicates an increase in the cost of sales, which is actively eating into the company's profitability. The construction and engineering segment, in particular, experienced higher revenues but a concurrent decrease in profit, highlighting mounting pressure on its operational margins.

Chevalier's financial performance in the 2025 fiscal year revealed significant operational challenges, marked by an operating loss of HK$300.803 million. This figure represents a substantial deterioration from the HK$154.488 million loss recorded in the previous year, indicating a widening gap between expenses and revenue generation.

The persistent operating losses underscore underlying issues in managing costs and driving profitability across Chevalier's various business units. These losses were further compounded by other net losses, suggesting broader financial pressures beyond core operational activities.

Vulnerability to Market Fluctuations in Property Sector

Chevalier International Holdings, despite its strong presence in property development and investment, faces significant vulnerability to shifts in the real estate market. This is particularly evident in Hong Kong, a key market for the group, where property prices have experienced downturns. For instance, Hong Kong's residential property price index saw a notable decline in late 2023 and early 2024, impacting valuations and sales volumes across the sector.

The company's strategy of engaging in joint ventures for residential projects, while beneficial for expanding its land bank, also introduces considerable market risks. These partnerships mean Chevalier shares in the potential downsides of market downturns, and can also be exposed to the financial health and debt burdens of its partners. This dual exposure amplifies the impact of any slowdown in the property sector on the group's financial performance and stability.

Key weaknesses stemming from property sector fluctuations include:

- Exposure to Hong Kong Property Market Downturns: Recent data indicates a cooling trend in Hong Kong's property market, potentially affecting Chevalier's asset values and revenue streams from its substantial holdings.

- Joint Venture Risks: Partnerships in residential projects can lead to shared financial liabilities and increased exposure to market volatility, potentially straining the company's balance sheet if partners face financial difficulties.

- Debt Burden Amplification: The debt associated with joint ventures, especially during periods of market contraction, can become a significant burden, impacting profitability and operational flexibility.

Impact of Geopolitical and Economic Uncertainties

Persistent global economic uncertainties, coupled with ongoing geopolitical tensions and elevated interest rates, present significant challenges for Chevalier's operations. These external forces directly impact consumer spending patterns and overall investment sentiment across its primary markets, creating a volatile business environment.

The current economic climate, characterized by high inflation and rising borrowing costs, can stifle demand for Chevalier's products and services. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a subdued economic outlook that could affect consumer purchasing power and business investment.

- Economic Slowdown: Global economic uncertainties could lead to reduced consumer spending, impacting sales volumes for Chevalier.

- Geopolitical Risks: Escalating geopolitical conflicts can disrupt supply chains and create operational instability in key regions.

- High Interest Rates: Elevated interest rates increase borrowing costs for Chevalier and can dampen investment by its customers.

- Forecasting Difficulty: The unpredictable nature of these external factors makes accurate financial forecasting and stable growth achievement more challenging.

Chevalier's financial performance shows a clear downward trend, with a widening net loss of HK$473.1 million in FY2025, up from HK$370 million in the previous year. This is largely due to increased investment costs and provisions for properties under development. Furthermore, gross profit saw a significant drop to HK$638.992 million in FY2025 from HK$854.697 million, indicating rising costs of sales that are eroding profitability, especially in the construction segment.

The company is also heavily exposed to the volatile Hong Kong property market, which has seen price declines impacting asset valuations and sales. Joint venture structures, while expanding land banks, also increase financial liabilities and amplify risks during market downturns, potentially straining the company's balance sheet and profitability due to shared debt burdens.

Global economic headwinds, including geopolitical tensions and high interest rates, create an unpredictable operating environment. The IMF's projected slowdown in global growth for 2024 to 2.9% underscores these challenges, potentially reducing consumer spending and investment, making accurate financial forecasting and stable growth more difficult for Chevalier.

| Financial Metric (FYE March 31) | FY2024 (HK$) | FY2025 (HK$) | Change |

|---|---|---|---|

| Net Loss | 370 million | 473.1 million | Increased |

| Gross Profit | 854.697 million | 638.992 million | Decreased |

| Operating Loss | 154.488 million | 300.803 million | Increased |

Preview the Actual Deliverable

Chevalier SWOT Analysis

This is the actual Chevalier SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real content, ready for your strategic planning.

Opportunities

The Hong Kong government's push for public housing, including the Light Public Housing initiative, offers substantial growth avenues for Chevalier Group's construction and engineering divisions. These large-scale developments are expected to drive significant contract awards.

Chevalier's expertise in modern construction techniques, such as Modular Integrated Construction (MiC), positions it favorably to secure these vital urban development projects. This strategy not only guarantees substantial revenue streams but also solidifies the group's role in shaping Hong Kong's infrastructure.

Chevalier's strategic expansion into healthcare real estate, specifically senior housing and medical office buildings, aligns perfectly with the demographic shifts favoring these sectors. This move is anticipated to tap into the increasing demand driven by aging populations in its key markets, promising new and stable revenue streams.

The healthcare sector's resilience, particularly in senior living and medical facilities, offers a counter-cyclical advantage, potentially providing a buffer against broader economic downturns. This diversification is expected to enhance Chevalier's portfolio stability and long-term growth prospects.

Chevalier's IT division, notably Chevalier (Network Solutions) Limited, is well-positioned to capitalize on Hong Kong's Smart City Blueprint. This presents significant opportunities in developing advanced smart infrastructure and digital services.

The group can leverage AI and IoT technologies to create intelligent property management systems, aligning with the government's push for digitalization. For instance, the Hong Kong government allocated HK$100 million in the 2023-24 budget to support smart city development projects.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures offer Chevalier significant avenues for growth and risk mitigation. By teaming up with other developers, such as the collaboration with Wang On Properties for a residential project in Kowloon, Chevalier can effectively broaden its land acquisition capabilities and tap into complementary expertise.

These alliances are crucial for navigating the competitive Hong Kong property market, allowing Chevalier to share development costs and technical know-how. For instance, in 2023, Chevalier announced a joint venture for a project with a total development cost of approximately HKD 3 billion, demonstrating the scale of capital and risk sharing involved.

- Expanded Land Bank: Joint ventures provide access to prime development sites that might be too costly or complex for Chevalier to acquire alone.

- Risk Mitigation: Sharing financial burdens and project responsibilities with partners reduces the capital outlay and potential downside for Chevalier.

- Synergistic Strengths: Collaborations allow Chevalier to leverage partners' specific skills, market knowledge, or construction capabilities, enhancing project execution.

- Access to New Markets/Segments: Partnerships can open doors to different geographical areas or customer segments that might otherwise be challenging to penetrate independently.

Technological Advancements in Construction (MiC)

Chevalier's embrace and continued development of Modular Integrated Construction (MiC) technology presents a substantial competitive edge. This approach is designed to accelerate project timelines, boost overall efficiency, and elevate the quality of finished structures. By streamlining the building process, MiC directly translates into cost reductions and quicker project delivery, factors that are highly valued in today's fast-paced construction landscape.

The benefits of MiC are becoming increasingly evident across the industry. For instance, projects utilizing MiC have demonstrated significant reductions in construction duration, with some studies indicating time savings of up to 30%. Furthermore, this method often leads to improved material utilization and reduced waste, contributing to both economic and environmental sustainability. The precision inherent in factory-controlled manufacturing also minimizes on-site rework, further enhancing cost-effectiveness.

- Enhanced Speed: MiC can reduce project timelines by as much as 30% compared to traditional methods.

- Improved Efficiency: Factory-based production minimizes on-site disruptions and weather delays.

- Cost Savings: Reduced labor, material waste, and rework contribute to significant cost reductions.

- Quality Control: Off-site manufacturing allows for greater precision and consistent quality standards.

Chevalier's construction and engineering divisions are set to benefit from Hong Kong's public housing initiatives, including the Light Public Housing scheme, which promises substantial contract opportunities. The group's proficiency in modern building methods like Modular Integrated Construction (MiC) positions it well to secure these large-scale urban development projects, ensuring significant revenue and reinforcing its role in infrastructure development.

The company's strategic expansion into healthcare real estate, focusing on senior housing and medical offices, aligns with demographic trends and increasing demand from aging populations, promising stable new income streams. Furthermore, Chevalier's IT division is poised to capitalize on Hong Kong's Smart City Blueprint, offering opportunities in smart infrastructure and digital services, supported by government funding for such projects.

Strategic alliances and joint ventures are key growth drivers, allowing Chevalier to expand its land acquisition capabilities and access complementary expertise, as seen in its collaboration with Wang On Properties. These partnerships are vital for sharing development costs and navigating the competitive property market, with recent joint ventures involving capital expenditures in the billions of Hong Kong dollars.

Chevalier's investment in Modular Integrated Construction (MiC) technology provides a significant competitive edge, enabling faster project delivery and improved efficiency, with potential time savings of up to 30% on projects. This method also enhances quality control and reduces waste, contributing to cost savings and sustainability in construction.

| Opportunity Area | Key Driver | Chevalier's Advantage | Potential Impact |

|---|---|---|---|

| Public Housing Development | HK Gov't Light Public Housing Initiative | Construction & Engineering Expertise, MiC adoption | Significant contract awards, revenue growth |

| Healthcare Real Estate | Aging Population, Demand for Senior Housing/Medical Facilities | Strategic focus, sector resilience | Stable revenue streams, portfolio diversification |

| Smart City Infrastructure | HK Smart City Blueprint | IT Division capabilities (Network Solutions) | Digital services, intelligent property management systems |

| Strategic Partnerships | Market competition, capital requirements | Risk mitigation, access to land & expertise | Broader development capabilities, cost sharing |

| Modular Integrated Construction (MiC) | Efficiency and speed in construction | Technological investment, process optimization | Reduced project timelines, cost savings, enhanced quality |

Threats

Chevalier Group operates in highly competitive environments across Hong Kong, Mainland China, and Southeast Asia. The construction, property development, and other diversified sectors are populated by numerous local and international firms, creating significant pressure on market share and pricing power.

This intense competition can directly impact Chevalier's profitability, as companies vie for projects and customers. For instance, in Hong Kong's property market, developers often face bidding wars for prime land, and in construction, securing contracts requires competitive pricing against established rivals.

An economic slowdown in key markets like Hong Kong and Mainland China poses a significant threat to Chevalier. For instance, Hong Kong's residential property prices saw a notable decline, with the Centa-City Leading Index falling by 4.2% in the first half of 2024 compared to the end of 2023, potentially dampening demand for the company's property development and related services.

This economic contraction can directly impact consumer spending and, consequently, the demand for construction and engineering services, Chevalier's core businesses. A weaker economic environment typically leads to reduced investment in new projects and a general slowdown in the property sector, creating headwinds for revenue generation and profitability.

Rising operating costs, particularly for materials and labor, are a significant concern for Chevalier. For instance, the Hong Kong construction sector experienced a notable increase in material costs throughout 2023 and into early 2024, impacting project budgets.

Persistent high interest rates, as maintained by central banks globally through mid-2024, directly increase Chevalier's finance costs. This makes borrowing more expensive, potentially reducing the profitability of long-term development projects by increasing the cost of capital and eroding gross profit margins.

Regulatory and Policy Changes

Chevalier faces potential headwinds from evolving government policies. New regulations concerning construction standards, environmental protection, or property development could increase operational costs or introduce new compliance burdens. For instance, shifts in land use regulations or stricter building codes implemented in key markets during 2024 or projected for 2025 could impact project timelines and budgets.

Taxation policies, including potential adjustments to corporate tax rates or the implementation of new levies like a global minimum tax as discussed by international bodies, could directly affect Chevalier's profitability. Changes in capital gains tax or property transfer taxes in jurisdictions where Chevalier operates could also influence investment decisions and the overall financial attractiveness of its projects.

- Evolving Construction Standards: Stricter building codes could necessitate costly upgrades to materials and techniques.

- Environmental Regulations: Increased scrutiny on sustainability and emissions may require investment in greener technologies.

- Tax Policy Shifts: Changes in corporate tax rates or property-specific taxes could impact net earnings.

- Land Use and Zoning: Alterations in zoning laws might restrict development opportunities or increase acquisition costs.

Geopolitical Tensions and Trade Policies

Ongoing geopolitical tensions, particularly those impacting Hong Kong and its relationship with Mainland China and global powers, present a significant threat to Chevalier's operations. Changes in international trade policies and tariffs could disrupt supply chains and increase operational costs.

For instance, the escalating trade friction between the US and China, which significantly influences global trade dynamics, could indirectly affect Chevalier's access to key markets or raw materials. This uncertainty can lead to investor caution, potentially impacting Chevalier's stock performance and access to capital.

- Trade policy shifts: Increased protectionism globally could raise import duties on Chevalier's products or components.

- Supply chain disruptions: Geopolitical instability in key sourcing regions could interrupt the flow of goods.

- Investor sentiment: Heightened geopolitical risk often leads to a decrease in investor confidence, impacting market valuations.

Intense competition in its operating regions poses a significant threat, potentially squeezing profit margins as Chevalier vies for projects and customers. Economic slowdowns in key markets like Hong Kong, evidenced by property price declines in early 2024, can dampen demand for its services. Rising operating costs for materials and labor, coupled with persistently high interest rates through mid-2024, further erode profitability by increasing project expenses and financing costs.

| Threat Category | Specific Risk | Potential Impact | Example Data/Trend (2024-2025) |

|---|---|---|---|

| Market Competition | Price wars and market share erosion | Reduced profitability and revenue | Intense bidding on Hong Kong land parcels; established rivals in construction |

| Economic Conditions | Property market downturn | Lower demand for development and construction | Hong Kong Centa-City Leading Index down 4.2% H1 2024 |

| Operating Costs | Rising material and labor expenses | Increased project costs, reduced margins | Noted increase in Hong Kong construction material costs throughout 2023-early 2024 |

| Financial Environment | High interest rates | Increased finance costs, reduced project viability | Central banks maintained high rates through mid-2024 |

| Regulatory & Policy | Stricter building codes, environmental rules, tax changes | Higher compliance costs, potential project delays, reduced net earnings | Potential for new land use regulations or stricter building codes in 2024-2025 |

| Geopolitical Factors | Trade friction, supply chain disruption | Increased operational costs, supply chain interruptions, investor caution | US-China trade friction impacting global supply chains and market access |

SWOT Analysis Data Sources

This Chevalier SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research, and insights from industry experts. These sources provide a well-rounded perspective on the company's internal capabilities and external market position.