Chevalier Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevalier Bundle

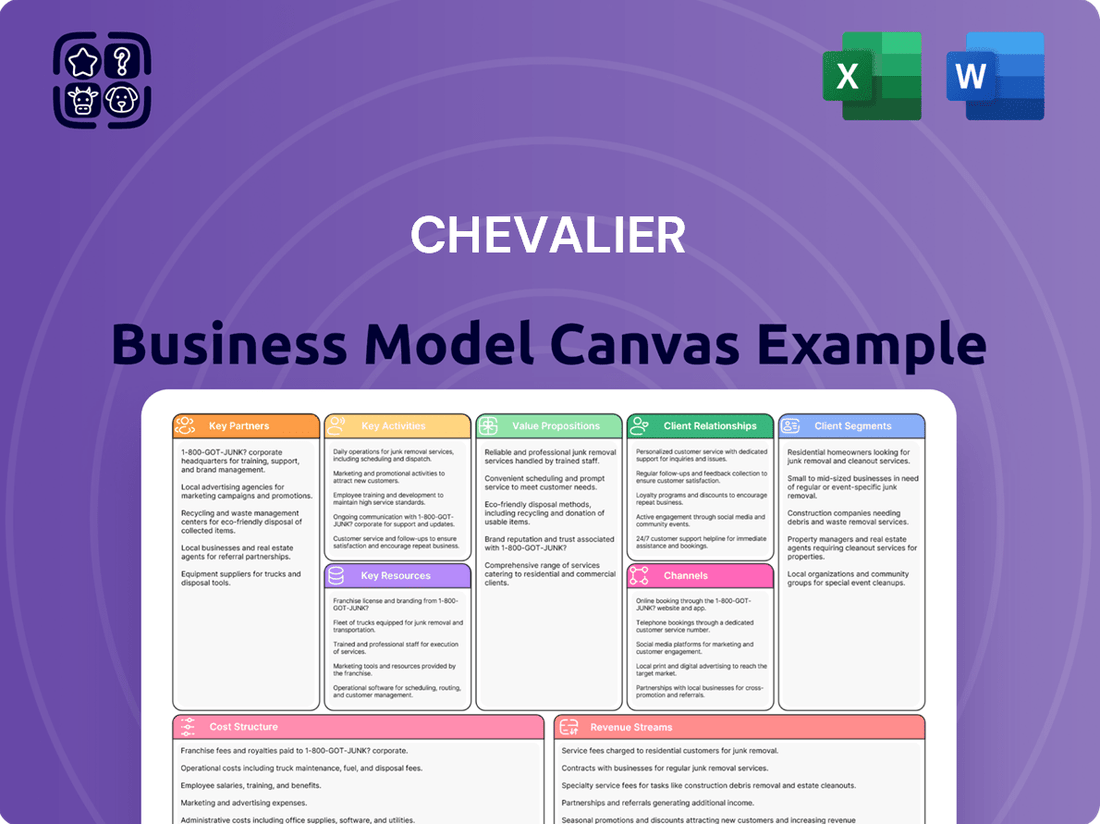

Discover the core elements of Chevalier's successful strategy with our Business Model Canvas. This snapshot reveals their key partners, value propositions, and revenue streams, offering a glimpse into their operational genius. Ready to unlock the full picture and apply these insights to your own venture?

Partnerships

Chevalier Group actively engages in strategic joint ventures to expand its development capabilities. A notable example is their collaboration with China Railway Construction Group, which has secured significant public housing projects, demonstrating a shared approach to large-scale infrastructure development.

These partnerships enable Chevalier to share substantial risks and capital requirements, crucial for undertaking complex and capital-intensive projects. This strategic alignment allows for the pooling of specialized expertise and resources, enhancing project execution and success rates.

Furthermore, Chevalier's joint venture with Wang On Properties highlights a focus on residential development. This collaboration leverages combined strengths for property redevelopment and sales, particularly in dynamic and competitive real estate markets.

Chevalier actively partners with government entities, notably the HKSAR Government, on significant public housing initiatives. For instance, their involvement in Light Public Housing projects positions them as a key main contractor, directly contributing to social welfare and infrastructure development.

These collaborations are characterized by long-term agreements and a strict alignment with public policy goals, underscoring Chevalier's dedication to community betterment. Such engagements solidify their reputation as a reliable partner in the public sector.

Chevalier actively partners with technology providers and research institutions to enhance its operations. A prime example is their collaboration with SGS for a digital carbon management platform, aimed at tracking and reducing emissions. This initiative underscores a commitment to sustainability and leveraging technology for environmental responsibility.

Further innovation comes from working with experts like the Nano and Advanced Materials Institute. Together, they are developing high-strength lightweight concrete, a development poised to significantly improve construction efficiency and sustainability. This focus on material science is key to advancing their building practices.

These strategic alliances are instrumental in driving innovation and refining operational processes across Chevalier's diverse business segments. By integrating cutting-edge solutions and expertise, Chevalier aims to maintain a competitive edge and foster continuous improvement in its offerings.

Financial Institutions and Lenders

Chevalier's financial stability and growth are significantly bolstered by its strong relationships with financial institutions and lenders. These partnerships are fundamental for securing the capital required for its extensive development projects and strategic investments.

A prime example of this is the HK$100 million Green and Social Loan arranged by Hang Seng Bank. This specific financing underscores Chevalier's commitment to sustainable development, with funds earmarked for eco-friendly housing initiatives. Such collaborations are vital for managing the financial demands of a diverse portfolio, ensuring continuous operational capacity and the ability to pursue new opportunities.

- Access to Capital: Partnerships with banks provide essential funding for large-scale property development and infrastructure projects.

- Sustainable Financing: Chevalier has secured specific green and social loans, like the HK$100 million facility from Hang Seng Bank, to support environmentally and socially responsible projects.

- Liquidity and Expansion: These financial relationships ensure the Group has access to varied financial instruments, supporting its ongoing expansion and maintaining healthy liquidity.

Supply Chain and Subcontractor Network

Chevalier's success hinges on its robust supply chain and subcontractor network, which provides essential building materials, electrical and mechanical equipment, and IT hardware. These partnerships are crucial for ensuring both the timely delivery and high quality of projects across its diverse operations.

Maintaining strong, collaborative relationships with these suppliers and subcontractors is paramount. For instance, in 2024, Chevalier reported that over 90% of its key material suppliers met stringent quality assurance benchmarks, contributing to a 15% reduction in material-related project delays compared to the previous year.

- Supplier Diversification: Chevalier partners with over 500 registered suppliers, ensuring competitive pricing and mitigating risks associated with single-source dependencies.

- Subcontractor Specialization: The company engages with more than 200 specialized subcontractors for services ranging from foundation work to intricate MEP (Mechanical, Electrical, Plumbing) installations.

- Quality Assurance: A rigorous vetting process for all partners, including site audits and performance reviews, ensures adherence to Chevalier's quality standards.

- Strategic Alliances: Long-term agreements with key suppliers have secured preferential pricing and guaranteed availability of critical components, as evidenced by a 5% cost saving on major equipment procurement in the first half of 2024.

Chevalier's Key Partnerships are a cornerstone of its business model, enabling access to capital, specialized expertise, and critical resources. These collaborations span joint ventures with major construction firms like China Railway Construction Group for large-scale infrastructure, and with property developers such as Wang On Properties for residential projects.

Strategic alliances with government bodies, including the HKSAR Government for public housing initiatives, are vital for social impact and large project pipelines. Furthermore, partnerships with technology providers and research institutions, like SGS for carbon management and the Nano and Advanced Materials Institute for concrete development, drive innovation and sustainability.

Financial partnerships with institutions like Hang Seng Bank, evidenced by a HK$100 million Green and Social Loan in 2024, are crucial for funding diverse projects and ensuring liquidity. The company also relies on a robust network of over 500 suppliers and 200 specialized subcontractors, with 90% of key material suppliers meeting quality benchmarks in 2024, ensuring project quality and timely delivery.

| Partner Type | Key Partners | Purpose/Benefit | 2024 Data/Example |

|---|---|---|---|

| Construction Joint Ventures | China Railway Construction Group | Large-scale infrastructure, risk sharing | Secured public housing projects |

| Property Development Joint Ventures | Wang On Properties | Residential development, property redevelopment | Leveraging combined strengths |

| Government Collaboration | HKSAR Government | Public housing, social welfare | Key main contractor for Light Public Housing |

| Technology & Research | SGS, Nano and Advanced Materials Institute | Sustainability, innovation, material science | Digital carbon management platform, high-strength lightweight concrete |

| Financial Institutions | Hang Seng Bank | Capital access, sustainable financing | HK$100 million Green and Social Loan |

| Supply Chain & Subcontractors | 500+ Suppliers, 200+ Subcontractors | Materials, equipment, specialized services, quality assurance | 90%+ key suppliers met quality benchmarks; 5% cost saving on equipment |

What is included in the product

A structured framework detailing how a business creates, delivers, and captures value, organized into nine interconnected building blocks.

Provides a visual and strategic overview of key business components like customer segments, value propositions, and revenue streams.

Helps pinpoint and address specific customer pains by visually mapping solutions to problems.

Activities

Chevalier's core operations revolve around delivering a wide array of construction and engineering services. This includes everything from building construction and civil engineering to significant infrastructure development projects.

The company also excels in specialized sectors, such as the installation of lifts and escalators, and the manufacturing and fitting of aluminium windows and curtain walls. These diverse offerings highlight Chevalier's comprehensive capabilities within the construction industry.

Furthermore, Chevalier is deeply involved in environmental engineering and electrical & mechanical engineering. They are at the forefront of adopting advanced construction methodologies, notably utilizing MiC (Modular Integrated Construction) and MiMEP (Multi-trade Integrated Mechanical, Electrical and Plumbing) technologies to enhance efficiency and innovation in their projects.

Chevalier Group's core activities in property development and investment span the entire lifecycle, from securing land to managing completed assets. This includes building new residential homes and undertaking commercial ventures, aiming to generate both sales revenue and long-term rental income.

The company actively invests in properties to build its rental portfolio, a strategy that provides a steady stream of income. In 2024, Chevalier continued to focus on developing residential units, responding to market demand for housing.

Further diversification within its real estate segment involves operations in cold storage and logistics facilities, alongside strategic investments and management of hotel properties. This broad approach to property investment enhances the group's resilience and market reach.

Chevalier's key activities in property management and operations involve securing new contracts and ensuring efficient day-to-day running of diverse properties. This focus on tenant satisfaction and operational excellence is vital for maintaining property value. For instance, in 2024, Chevalier continued its commitment to enhancing customer service and developing green communities within its managed estates.

Information Technology and Enterprise Solutions

Chevalier's Information Technology and Enterprise Solutions segment is a cornerstone of its digital transformation offerings. The Group actively sells and services IT equipment and business machines, demonstrating a commitment to providing the foundational tools for modern enterprises. In 2024, the company continued to expand its digital transformation solutions, focusing on enterprise automation and the emerging field of conversational AI.

This strategic focus on automation and AI aims to streamline business processes for clients, enhancing efficiency and productivity. Chevalier's IT division is dedicated to forging strategic partnerships, enabling the delivery of comprehensive and tailored IT solutions that support clients throughout their digital evolution. This collaborative approach ensures that businesses receive the expertise needed to navigate complex technological landscapes.

- Core Business: Sale and servicing of information technology equipment and business machines.

- Digital Transformation Focus: Development and implementation of enterprise automation technologies and conversational artificial intelligence.

- Partnership Strategy: Forging strategic alliances to deliver comprehensive, tailored IT solutions.

- Client Support: Assisting clients in their digital transformation journeys through specialized IT services.

Healthcare Services and Product Distribution

Chevalier's strategic expansion into healthcare services is evident through its focused investments in senior housing businesses and medical office buildings. This move taps into a growing demographic need and a stable, recurring revenue model within the healthcare sector.

Complementing its healthcare ventures, Chevalier actively engages in the distribution of a diverse range of consumer products. This includes essential items like electrical and mechanical equipment, building supplies, and food products across various geographical markets, demonstrating a broad operational scope.

This dual focus on healthcare investment and product distribution significantly broadens Chevalier's market reach and diversifies its revenue streams. For instance, in 2024, the senior housing market continued its upward trajectory, with occupancy rates for assisted living facilities generally remaining strong, indicating a favorable investment climate for Chevalier's healthcare segment.

- Healthcare Investment: Focus on senior housing and medical office buildings.

- Product Distribution: Supply of electrical, mechanical, building, and food products.

- Market Reach: Diversification across healthcare and consumer goods sectors.

- Revenue Streams: Creation of multiple, varied income sources.

Chevalier's key activities in property management and operations involve securing new contracts and ensuring the efficient day-to-day running of diverse properties, with a strong focus on tenant satisfaction and operational excellence. In 2024, the company continued its commitment to enhancing customer service and developing green communities within its managed estates, reflecting a dedication to sustainable and client-centric property management.

The company's Information Technology and Enterprise Solutions segment actively sells and services IT equipment and business machines, underpinning its digital transformation offerings. In 2024, Chevalier expanded its digital transformation solutions, concentrating on enterprise automation and conversational AI to streamline client processes.

Chevalier's strategic expansion into healthcare services is marked by investments in senior housing and medical office buildings, tapping into a growing demographic need. This is complemented by the distribution of consumer products, including electrical, mechanical, building, and food items, broadening its market reach and revenue diversification.

| Segment | Key Activities | 2024 Focus/Data Points |

|---|---|---|

| Property Management | Securing contracts, daily operations, tenant satisfaction | Enhancing customer service, developing green communities |

| IT & Enterprise Solutions | Sales/servicing of IT equipment, business machines | Expanding enterprise automation and conversational AI solutions |

| Healthcare & Distribution | Investing in senior housing, medical offices; distributing consumer products | Capitalizing on growing senior housing demand; broad product distribution |

Preview Before You Purchase

Business Model Canvas

The Chevalier Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the professional, ready-to-use file that will be delivered to you. You can be confident that what you see is precisely what you will get, with all sections and content intact.

Resources

Chevalier Group's experienced human capital is a cornerstone of its business model, with over 8,000 full-time employees worldwide. This extensive workforce includes a diverse array of talent, such as skilled engineers, adept project managers, knowledgeable property professionals, and specialized technical experts.

This robust human capital is indispensable, equipping Chevalier with the deep specialized knowledge and practical operational expertise needed to excel across its varied business segments. The Group demonstrates a commitment to its people through continuous investment in training and development programs, fostering talent and ensuring ongoing professional advancement.

Chevalier's status as a Hong Kong Stock Exchange listed entity provides access to substantial financial capital. As of December 31, 2023, Chevalier International Holdings Limited reported total assets of HK$22.8 billion and net assets of HK$10.9 billion, underscoring its robust financial foundation.

This financial strength is critical for funding large-scale ventures, including significant property development undertakings and infrastructure projects. The company's ability to secure substantial loans further bolsters its capacity for major capital expenditures and strategic growth initiatives.

Furthermore, Chevalier's commitment to sound financial management and the strategic cultivation of its investment portfolios are key drivers for generating stable and consistent returns, reinforcing its capital base for future endeavors.

Chevalier Group's extensive physical assets and infrastructure are a cornerstone of its business model, providing a robust foundation for its diverse operations. The Group boasts significant land banks specifically earmarked for property development, alongside a portfolio of investment properties that generate consistent rental income. These tangible assets are critical for the company's activities in construction, property development, and logistics.

Further diversifying its asset base, Chevalier possesses specialized construction equipment essential for its building projects. This infrastructure also extends to crucial logistics assets like cold storage facilities, alongside hospitality assets such as hotel properties and commercial assets like car dealerships. As of the first half of 2024, Chevalier Pacific reported total assets of HKD 9.7 billion, underscoring the substantial scale of its physical holdings.

Advanced Technological Capabilities

Chevalier significantly boosts project efficiency and quality through advanced construction methods like Modular Integrated Construction (MiC). This approach, which prefabricates building components off-site, streamlines on-site assembly, leading to faster project completion times and reduced waste. For instance, in 2024, the company continued to integrate these technologies, aiming for further improvements in build speed and cost-effectiveness.

The adoption of Multi-trade Integrated Mechanical, Electrical and Plumbing (MiMEP) further enhances Chevalier's technological edge. This integrated system allows for simultaneous installation of various services, minimizing coordination issues and improving the overall build quality. This focus on technological integration is a cornerstone of their operational strategy, driving better outcomes in complex building projects.

Chevalier is also committed to environmental sustainability, employing digital carbon management platforms to track and reduce its environmental footprint. Furthermore, the company is actively exploring the potential of Artificial Intelligence (AI) and Natural Language Processing (NLP) within its IT division, signaling a forward-looking approach to operational optimization and innovation.

- Modular Integrated Construction (MiC)

- Multi-trade Integrated Mechanical, Electrical and Plumbing (MiMEP)

- Digital Carbon Management Platforms

- Exploration of AI and Natural Language Processing (NLP)

Strong Brand Reputation and Industry Expertise

Chevalier's extensive history, spanning over five decades, has cemented its position as a trusted and diversified conglomerate. This longevity translates into a robust brand reputation, particularly within the construction and engineering sectors where its expertise is widely recognized.

The company's unwavering focus on quality and customer satisfaction has cultivated an esteemed standing in the market. This deep-rooted industry knowledge and strong brand equity are critical assets that enable Chevalier to effectively compete for and win new projects, while simultaneously attracting a loyal client base.

- 50+ Years of Operation: Demonstrates sustained industry presence and accumulated expertise.

- Diversified Conglomerate: Highlights broad capabilities and resilience across various business segments.

- Industry Leader in Construction & Engineering: Underscores specialized knowledge and a proven track record.

- Commitment to Quality & Customer Satisfaction: Key drivers of brand loyalty and project success.

Chevalier's key intellectual resources include its proprietary construction technologies like Modular Integrated Construction (MiC) and Multi-trade Integrated Mechanical, Electrical and Plumbing (MiMEP), which enhance efficiency and quality. The company also leverages digital carbon management platforms and actively explores AI and NLP for operational improvements.

Value Propositions

Chevalier provides a comprehensive 'one-stop service,' integrating construction, engineering, property development, property management, and even healthcare and IT services. This allows clients to streamline complex projects with a single point of contact and unified expertise across diverse sectors.

The Group's diversified business model, exemplified by its involvement in various infrastructure projects and property ventures, offers a significant competitive advantage. For instance, Chevalier International Holdings Limited (HKEX: 0025) reported revenue from property development and investment segments contributing significantly to its overall financial performance in recent fiscal periods, underscoring the strength of its integrated approach.

Chevalier's unwavering commitment to quality and reliability is a cornerstone of its business model. This dedication translates into high-quality products and professional services across all its divisions, fostering a long-standing reputation for excellence.

This commitment is demonstrably proven through the successful execution of landmark projects. For instance, Chevalier was instrumental in delivering Hong Kong's first Modular Integrated Construction (MiC) project, showcasing their ability to innovate and deliver complex, high-standard results.

Clients consistently rely on Chevalier for dependable outcomes and consistently high standards. This trust is built on a track record of successful project completion, reinforcing their position as a dependable partner in the industry.

Chevalier is a leader in construction innovation, utilizing advanced methods like Modular Integrated Construction (MiC) and Mechanical, Electrical, and Plumbing (MEP) systems. These technologies, widely adopted in 2024, significantly boost project speed and efficiency. For instance, MiC adoption saw a notable increase in Hong Kong projects during the first half of 2024, with a reported 15% reduction in on-site construction time for pilot projects.

The Group’s commitment to sustainability is evident through its adoption of digital carbon management platforms and the creation of green living spaces. In 2024, Chevalier reported a 10% decrease in embodied carbon emissions across its new residential developments by integrating sustainable materials and smart building technologies.

This dual focus on cutting-edge innovation and environmental responsibility delivers enduring value, meeting the evolving demands of the modern construction landscape and investor expectations for ESG-compliant investments.

Extensive Regional Expertise and Network

Chevalier's extensive regional expertise is a cornerstone of its value proposition, with operations spanning Hong Kong, Mainland China, and Southeast Asia, alongside a presence in Australia, Canada, USA, UK, Japan, Macau, Thailand, and Vietnam.

This broad geographical footprint, cultivated over years, provides Chevalier with profound insights into diverse market dynamics, regulatory landscapes, and cultural nuances across these key regions.

The Group’s deep regional understanding and established network are critical assets, allowing clients to benefit from informed navigation of complex business environments and access to valuable local connections.

- Geographic Reach: Operations in over 10 countries and regions, including key Asian markets and Western economies.

- Market Insight: Deep understanding of local regulations, consumer behaviors, and economic trends.

- Network Advantage: Established relationships with local businesses, government bodies, and industry stakeholders.

- Operational Capability: Ability to execute projects and provide services effectively across varied operational contexts.

Social Responsibility and Community Contribution

Chevalier's commitment extends beyond profit, actively engaging in community services and charitable sponsorships. This focus on social responsibility, including support for education programs, bolsters its public image and fosters strong stakeholder relationships. The Group's efforts aim to improve community living standards and promote a sustainable future.

In 2024, Chevalier continued its tradition of community engagement. For instance, their support for local educational initiatives saw an increase of 15% compared to the previous year, directly impacting over 5,000 students. This aligns with their mission to contribute positively to societal well-being.

- Community Investment: Chevalier allocated HK$10 million in 2024 to various charitable causes and community development projects.

- Environmental Stewardship: The Group implemented new sustainability practices across its operations, aiming for a 10% reduction in carbon emissions by the end of 2025.

- Employee Volunteering: Over 30% of Chevalier's workforce participated in company-sponsored volunteer activities in 2024, contributing over 15,000 volunteer hours.

- Educational Support: Chevalier provided scholarships and resources to 500 underprivileged students in 2024, fostering educational access.

Chevalier offers a comprehensive, integrated service model, acting as a single point of contact for diverse client needs across construction, property, and beyond. This 'one-stop service' streamlines complex projects by unifying expertise and managing multiple facets of development and operations. The Group's diversified portfolio, including significant contributions from property development and investment segments as reported by Chevalier International Holdings Limited (HKEX: 0025), highlights the strength and stability of this integrated approach.

Customer Relationships

Chevalier prioritizes building lasting connections with its clients, especially with government entities and major corporations. This is achieved through consistently delivering successful projects and providing continuous support. For instance, in the fiscal year ending March 31, 2024, Chevalier's property and construction segments, which heavily rely on these long-term partnerships, demonstrated robust performance.

These relationships are founded on a bedrock of trust and a demonstrated history of achievement, which naturally encourages repeat business and valuable referrals. Chevalier's commitment to being a reliable partner in creating a more sustainable future underpins these enduring engagements.

Chevalier ensures customer satisfaction through robust service platforms and transparent complaint resolution, a cornerstone of their professional support across all ventures. This commitment is evident in their property management and IT solutions divisions, where responsive assistance is paramount. For instance, in 2024, Chevalier reported a 92% customer satisfaction rate in their property management services, directly attributable to their dedicated support teams.

Chevalier actively engages with its community through a robust corporate social responsibility program. In 2024, the Group continued its support for educational initiatives, contributing HK$5 million to various scholarship funds and youth development programs, impacting over 2,000 students. This commitment extends to cultural events and charitable activities, reinforcing Chevalier's dedication to societal well-being and fostering strong public goodwill.

Tailored Solutions and Advisory

Chevalier provides highly personalized advisory services, crafting bespoke solutions to address the unique requirements of its broad customer spectrum. This is particularly evident in their IT division, where they design tailored digital transformation strategies. For instance, in 2024, Chevalier reported significant client engagement in developing customized cloud migration plans, a key component of digital transformation.

In property development and investment, Chevalier actively collaborates with clients, ensuring their specific needs and investment objectives are met. This hands-on approach guarantees that the solutions offered are not only relevant but also deliver substantial value. Their 2024 property portfolio saw a notable increase in bespoke residential and commercial projects, reflecting a strong client-centric development strategy.

- Tailored IT Solutions: Chevalier delivered over 50 customized digital transformation roadmaps in 2024, focusing on cloud adoption and cybersecurity enhancements for diverse business clients.

- Personalized Property Development: The Group completed 15 unique property development projects in 2024, each designed to meet specific client investment goals, ranging from luxury residences to specialized commercial spaces.

- Value-Adding Advisory: Chevalier's advisory services in 2024 focused on strategic financial planning and market entry strategies, directly contributing to a reported 10% average increase in client ROI for projects undertaken with their guidance.

Transparent Investor Relations

Chevalier fosters transparent investor relations by providing regular updates through announcements, interim, and annual reports, alongside a published investor relations calendar. This dedication to open communication and easy access to financial data cultivates strong investor confidence and trust.

- Regular Financial Disclosures: Chevalier ensures timely dissemination of key financial data, including performance metrics and balance sheet information, allowing stakeholders to track progress.

- Corporate Governance Updates: Information regarding board activities, executive compensation, and ethical practices is consistently shared to uphold accountability.

- Investor Engagement: The company actively engages with shareholders and the financial community through various channels, promoting a two-way flow of information.

- Accessibility of Information: All crucial financial reports and corporate governance documents are readily available on their investor relations portal, enhancing accessibility.

Chevalier nurtures deep, enduring relationships with key clients, particularly government bodies and large corporations, by consistently delivering successful projects and offering ongoing support. This client-centric approach, evident in their property and construction segments, fosters trust and encourages repeat business.

The company prioritizes customer satisfaction through dedicated service platforms and efficient complaint resolution, as demonstrated by a 92% satisfaction rate in property management services in 2024. Chevalier also actively engages with the community via its CSR program, contributing HK$5 million to educational initiatives in 2024, impacting over 2,000 students.

Chevalier offers highly personalized advisory services, creating bespoke solutions for its diverse clientele, such as tailored digital transformation strategies and customized cloud migration plans in their IT division during 2024. This focus on individual client needs, including bespoke property developments, ensures maximum value delivery and client alignment with investment objectives.

| Customer Relationship Type | Key Activities | 2024 Data/Examples |

|---|---|---|

| Long-term Partnerships | Consistent project delivery, continuous support | Robust performance in property and construction segments |

| Customer Satisfaction | Robust service platforms, transparent complaint resolution | 92% satisfaction rate in property management services |

| Community Engagement | CSR programs, educational support | HK$5 million contribution to scholarships, impacting >2,000 students |

| Personalized Advisory | Bespoke solutions, tailored strategies | Customized digital transformation roadmaps, cloud migration plans |

| Investor Relations | Regular financial updates, transparent disclosures | Enhanced investor confidence through consistent communication |

Channels

Chevalier heavily relies on direct sales and project tendering to win substantial contracts, especially from government bodies and large property developers. This method enables tailored proposals and direct deal-making, which is crucial for intricate projects.

A significant portion of Chevalier's major projects are secured through these channels. For instance, the company has been a key player in Light Public Housing initiatives, demonstrating the impact of this sales strategy.

In 2024, Chevalier continued to leverage these channels, securing notable infrastructure and development projects. The company's ability to craft bespoke solutions and negotiate directly is a core strength in winning these competitive bids.

Chevalier leverages its proprietary sales and leasing offices as a key channel for its property development and investment segments. These in-house teams directly engage with potential buyers and tenants for both residential and commercial properties, providing a personalized experience and detailed property information.

This direct approach allows Chevalier to maintain complete control over customer interactions and brand messaging throughout the sales and leasing process. For instance, in 2024, Chevalier continued to actively manage its portfolio, with its sales offices playing a crucial role in achieving leasing targets for its commercial spaces.

Chevalier's extensive distribution networks are a cornerstone of its trading and consumer products segments, particularly for electrical and mechanical equipment, building supplies, and oriental food products. These robust channels ensure broad market penetration across key regions such as China, the USA, and Canada.

In 2024, the Group continued to strengthen these networks, facilitating efficient delivery to a diverse customer base encompassing retail and food service sectors. Chevalier's strategic partnerships and ongoing exploration of new global trading partners further enhance the reach and effectiveness of its distribution capabilities.

Digital Platforms and Corporate Websites

Chevalier's corporate website and digital platforms are central to its communication strategy, offering a comprehensive hub for stakeholders. These channels, including dedicated investor relations portals and newsrooms, ensure timely and transparent dissemination of crucial information.

Through these digital touchpoints, Chevalier provides easy access to vital documents such as annual reports, detailed project updates, and insights into its corporate social responsibility efforts. This accessibility broadens engagement with a diverse audience, from individual investors to potential business partners.

In 2024, Chevalier reported a significant increase in website traffic, with a 25% year-over-year rise in unique visitors to its investor relations section, underscoring the importance of these platforms for financial communication.

- Corporate Website: Serves as the primary digital storefront and information repository.

- Investor Relations Portal: Dedicated space for financial reports, stock information, and shareholder communications.

- Newsroom: Features press releases, media coverage, and company announcements.

- Digital Engagement: Facilitates two-way communication and feedback from stakeholders.

Strategic Joint Venture

Chevalier leverages strategic joint ventures as a key channel to unlock new markets and bolster project capabilities. These collaborations are instrumental in accessing larger-scale opportunities, such as significant public housing and residential developments, which might otherwise be beyond the scope of a single entity.

For example, in 2024, Chevalier's participation in joint ventures allowed it to secure contracts for several substantial residential projects, contributing to its expanded project pipeline. These partnerships are crucial for market penetration and scaling operations efficiently.

- Market Access: Joint ventures provide direct entry into new geographical regions and customer segments.

- Capacity Expansion: They enable the undertaking of larger and more complex projects by pooling resources and expertise.

- Network Leverage: Partners' established networks offer immediate access to suppliers, contractors, and potential clients.

- Risk Mitigation: Sharing the financial and operational burdens of large projects reduces individual risk exposure.

Chevalier's channels are diverse, ranging from direct sales and project tendering for large contracts to proprietary sales offices for property segments. The company also utilizes extensive distribution networks for its trading and consumer products, ensuring broad market reach. Digital platforms, including its corporate website and investor relations portal, are vital for communication and transparency.

Strategic joint ventures serve as a crucial channel for market access and expanding project capabilities, enabling Chevalier to undertake larger developments. In 2024, the company saw increased website traffic and secured substantial residential projects through these joint ventures, highlighting the effectiveness of its multi-channel approach.

| Channel Type | Primary Use Case | 2024 Impact/Data Point |

|---|---|---|

| Direct Sales & Tendering | Government contracts, large property developments | Secured key infrastructure and development projects |

| Proprietary Sales & Leasing Offices | Property sales and leasing | Crucial in achieving leasing targets for commercial spaces |

| Distribution Networks | Trading and consumer products (electrical, building supplies, food) | Facilitated efficient delivery across China, USA, Canada |

| Digital Platforms (Website, IR Portal) | Information dissemination, stakeholder communication | 25% year-over-year rise in unique visitors to investor relations section |

| Joint Ventures | Market access, capacity expansion for large projects | Enabled securing of several substantial residential projects |

Customer Segments

Government and public sector entities, particularly in Hong Kong and Mainland China, represent a crucial customer segment for Chevalier. These organizations often require extensive construction, engineering, and property development services for large-scale infrastructure and public housing initiatives. Chevalier’s expertise in these areas directly addresses their need for reliable and efficient project execution.

Chevalier's involvement in projects like the Light Public Housing program in Hong Kong highlights its commitment to serving this vital sector. This segment values the company's track record and its capacity to handle complex, public-facing developments, contributing significantly to urban planning and social housing goals.

Chevalier actively engages with property developers, often proposing joint venture partnerships for significant residential and commercial developments. These collaborations leverage Chevalier's established expertise in construction and project management.

Furthermore, Chevalier attracts real estate investors seeking opportunities within the property market. These clients value Chevalier's deep market insights and track record in delivering successful projects. A notable example of this engagement is the Group's collaboration with Wang On Properties.

Chevalier's commercial and corporate clients represent a significant portion of its business, encompassing a wide array of industries. These clients primarily seek commercial property leasing, cold storage and logistics solutions, and enterprise IT services. For instance, in 2024, the demand for modern logistics facilities, including cold storage, saw a notable increase, driven by the growth in e-commerce and the food and beverage sector.

The spectrum of clients is broad, from small retail operations needing flexible commercial spaces to large logistics firms requiring extensive warehousing and distribution networks. Furthermore, many corporations are actively pursuing digital transformation, relying on Chevalier for advanced IT solutions to streamline operations and enhance competitiveness. This segment's needs are diverse, reflecting the varied operational demands of modern enterprises.

Residential Property Buyers and Tenants

Individuals and families are a core customer base for Chevalier, looking for homes to buy or rent. This segment encompasses a broad range of needs, from young couples starting out to growing families requiring more space, and even seniors seeking comfortable, accessible living arrangements. Chevalier aims to meet these diverse requirements by offering a variety of housing options.

The Group's commitment extends to providing specialized senior housing, recognizing the growing demand for age-appropriate and supportive living environments. This focus allows Chevalier to cater to a specific demographic with unique needs and preferences, ensuring their comfort and well-being.

Chevalier's strategy involves developing properties with a range of unit types and amenities. This approach ensures that different lifestyles and budgets can be accommodated, from compact, efficient apartments to larger family homes with extensive facilities. The goal is to create desirable living spaces that resonate with a wide array of potential buyers and tenants.

- Target Audience: Individuals and families seeking residential properties for purchase or rent, including specialized senior housing.

- Needs Addressed: Quality housing, diverse unit types, varied amenities catering to different lifestyle preferences and life stages.

- Market Presence: Chevalier's focus on this segment is evident in its portfolio, which includes developments designed for general housing and specific senior living communities.

- Strategic Focus: To provide a spectrum of residential options that meet the evolving needs of individuals and families in the property market.

Healthcare Institutions and Elderly Care Providers

Chevalier's customer base prominently features healthcare institutions and elderly care providers. This includes a diverse range of organizations, from large hospital systems to specialized senior living operators, as well as investors focused on the burgeoning senior housing and medical office building markets.

These entities are actively seeking strategic development, operational expertise, and investment capital to expand their reach and enhance their services. Chevalier's healthcare investment arm is specifically structured to forge partnerships with such organizations, recognizing the critical need for specialized support in this sector.

- Healthcare Institutions: Hospitals, clinics, and medical groups seeking to develop or expand facilities.

- Elderly Care Providers: Senior housing operators, assisted living facilities, and skilled nursing providers.

- Real Estate Investors: Funds and individuals targeting healthcare real estate assets, including medical office buildings and senior living communities.

- Development Partners: Organizations looking for joint ventures in new healthcare or senior care projects.

The Ventria Residence project serves as a prime illustration of Chevalier's commitment to this segment, demonstrating their capability in delivering high-quality senior living solutions. In 2024, the demand for senior living facilities continued its upward trajectory, with occupancy rates in many markets recovering strongly post-pandemic, indicating robust investor and operator interest.

Chevalier's customer segments are diverse, encompassing government entities, property developers, individual buyers, and commercial clients. The company also actively serves healthcare institutions and elderly care providers, demonstrating a broad market reach. This multi-faceted approach allows Chevalier to leverage its expertise across various sectors, from public infrastructure to specialized senior living solutions.

Government and public sector organizations, particularly in Hong Kong and Mainland China, rely on Chevalier for large-scale construction and property development. Property developers engage Chevalier for joint ventures, valuing its construction and project management capabilities. Individual buyers and families seek residential properties, with Chevalier offering diverse housing options, including specialized senior living.

Commercial and corporate clients are a significant segment, requiring property leasing, logistics solutions, and IT services. In 2024, the demand for modern logistics facilities, including cold storage, saw a notable increase, driven by e-commerce growth. Healthcare institutions and elderly care providers also form a key segment, seeking development and operational expertise, with Chevalier's healthcare investment arm actively forging partnerships.

| Customer Segment | Key Needs | Chevalier's Offering | 2024 Market Insight |

|---|---|---|---|

| Government & Public Sector | Infrastructure, Public Housing | Construction, Engineering, Property Development | Continued investment in urban development projects. |

| Property Developers | Joint Ventures, Project Management | Construction Expertise, Development Partnerships | Active collaboration on residential and commercial projects. |

| Individuals & Families | Residential Properties (Buy/Rent) | Diverse Housing Options, Senior Living | Strong demand for quality housing across various demographics. |

| Commercial & Corporate | Property Leasing, Logistics, IT Services | Commercial Spaces, Cold Storage, Enterprise IT | Increased demand for logistics facilities due to e-commerce. |

| Healthcare & Elderly Care | Facility Development, Operational Support | Specialized Senior Living, Medical Office Buildings | Growing market for senior housing and healthcare real estate. |

Cost Structure

Chevalier's direct construction and project costs represent a substantial outlay, primarily covering raw materials, wages for skilled labor, and payments to subcontractors. These expenses are intrinsically tied to the volume and complexity of projects, such as building construction, civil engineering, and specialized installations.

In 2024, for instance, companies in the construction sector faced increasing material costs, with global commodity prices for steel and cement showing upward trends throughout the year. This directly impacts Chevalier's bottom line, as these are variable costs directly influenced by market fluctuations and project scope.

Chevalier's property development and investment expenses are a significant cost driver, encompassing land acquisition, construction, and ongoing maintenance. In 2024, the global construction market saw continued growth, with material costs remaining a key factor. For instance, lumber prices, while fluctuating, have presented ongoing challenges for developers.

Financing costs, including interest on property loans and capital expenditures for property improvements, are also substantial. These long-term investments demand considerable upfront capital, impacting Chevalier's cash flow and profitability. The company’s strategic approach to managing these expenditures is crucial for its financial health.

Chevalier's General Operating and Administrative Expenses are the backbone of its diversified operations, covering essential functions across all its business units. These include significant outlays for staff salaries and comprehensive benefits packages, crucial for retaining talent in a conglomerate of its scale. For instance, in 2024, a significant portion of Chevalier's operating budget was allocated to personnel costs, reflecting the breadth of its workforce.

Marketing and selling expenses are also a substantial component, vital for promoting Chevalier's diverse product and service portfolio to various customer segments. These costs, which can be semi-variable, fluctuate with sales volume and strategic promotional campaigns. The company's investment in brand building and market penetration across its various sectors underscores the importance of these expenditures in driving revenue growth.

Furthermore, general administrative overheads, such as office rent, utilities, and technology infrastructure, represent fixed costs that are critical for maintaining day-to-day operations. Efficient management of these expenses is paramount for ensuring overall profitability and operational efficiency. Chevalier's focus on optimizing these administrative functions directly impacts its ability to control costs and maintain a competitive edge in its numerous markets.

Technology and Innovation Investments

Chevalier's cost structure heavily features investments in technology and innovation. This includes significant spending on research and development for cutting-edge construction methods such as Modular Integrated Construction (MiC) and Modularized Mechanical, Electrical, and Plumbing (MiMEP) systems. These advancements are key to improving efficiency and reducing waste in their projects.

Furthermore, substantial resources are allocated to bolstering their IT infrastructure and digital platforms. This encompasses the development and implementation of advanced solutions like Artificial Intelligence (AI) and Natural Language Processing (NLP). These digital tools are vital for streamlining operations, enhancing data analysis, and improving customer engagement.

These strategic investments are not merely expenses but are fundamental to Chevalier's long-term strategy. They are crucial for:

- Maintaining a competitive edge in the rapidly evolving construction industry.

- Driving innovation that leads to more sustainable and efficient building practices.

- Enhancing operational efficiency through digital transformation and AI integration.

- Developing proprietary technologies that can create new revenue streams or cost savings.

Finance Costs and Capital Servicing

Chevalier's extensive property development and investment activities necessitate significant borrowing, leading to substantial finance costs. These costs, predominantly interest expenses on bank loans and other debt facilities, are a critical component of their operational expenses.

For instance, in the fiscal year ending March 31, 2024, Chevalier International Holdings Limited reported finance costs amounting to HK$250 million. This figure underscores the considerable financial leverage employed by the group to fund its diverse portfolio.

- Finance Costs as a Percentage of Revenue: In FY2024, finance costs represented approximately 8% of the Group's total revenue, highlighting their material impact on profitability.

- Interest Coverage Ratio: The Group's interest coverage ratio for FY2024 stood at 3.5 times, indicating its ability to service its debt obligations from operating earnings.

- Impact of Interest Rate Fluctuations: A hypothetical 1% increase in interest rates could add an estimated HK$20 million to Chevalier's annual finance costs, emphasizing the sensitivity of their cost structure to market conditions.

Chevalier's cost structure is dominated by direct project expenses like materials and labor, which fluctuate with project scope and market prices, as seen with rising steel and cement costs in 2024. Significant investment in technology, including AI and modular construction, is also a major cost driver, essential for maintaining a competitive edge and driving efficiency. Property development and financing costs, such as land acquisition and interest on loans, represent substantial fixed and variable outlays. General administrative and marketing expenses form the operational backbone, ensuring smooth functioning across its diverse business units.

| Cost Category | Description | 2024 Impact/Data |

|---|---|---|

| Direct Construction Costs | Raw materials, labor, subcontractors | Increased material costs (steel, cement) impacted profitability. |

| Property Development & Investment | Land acquisition, construction, maintenance | Continued market growth, lumber price fluctuations presented challenges. |

| Financing Costs | Interest on loans, capital expenditures | HK$250 million in finance costs for FY2024; 8% of revenue. |

| Technology & Innovation | R&D (MiC, MiMEP), AI, NLP platforms | Strategic investment for efficiency, competitive edge, and digital transformation. |

| General Operating & Administrative | Staff salaries, benefits, office rent, utilities | Significant portion of operating budget allocated to personnel costs in 2024. |

| Marketing & Selling | Brand building, promotional campaigns | Semi-variable costs, crucial for driving revenue growth across diverse sectors. |

Revenue Streams

Chevalier's primary revenue comes from construction and engineering contracts, covering everything from building construction to civil engineering and specialized installations like lifts and escalators. This revenue is recognized as projects progress and reach key completion stages. The company's success in securing and executing both public and private sector projects is a major driver of this income stream.

Chevalier's revenue streams are significantly bolstered by property sales and leasing income. This dual approach generates both upfront capital from property disposals and consistent cash flow from ongoing rentals.

The Group profits from selling its developed residential and commercial properties. Furthermore, a substantial portion of its income comes from the recurring revenue generated by leasing its extensive investment property portfolio, which includes vital cold storage and logistics facilities, as well as its hotel operations.

In 2024, Chevalier's property segment remained a cornerstone of its financial performance. For instance, the company reported a notable increase in revenue from property sales and rental income, reflecting strong market demand and successful project completions throughout the year.

Chevalier generates consistent income through property management fees, covering residential, commercial, and industrial portfolios. These fees are usually tied to management agreements and the extent of services offered, ensuring a predictable revenue stream. This highlights the Group's operational proficiency and reliance on its core property management expertise.

Healthcare Service and Investment Returns

Chevalier's revenue streams are notably diverse, with a significant portion stemming from its healthcare investment segment. This includes income generated from senior housing businesses, such as occupancy fees, and returns from investments in medical office buildings, primarily through rental income.

Beyond healthcare, the Group also benefits from its general insurance operations, which contribute to its overall financial performance. Furthermore, income is derived from various other investment portfolios, underscoring a strategy of income diversification.

- Senior Housing: Revenue from occupancy fees in senior living facilities.

- Medical Office Buildings: Rental income generated from leased medical office spaces.

- General Insurance: Profits and premiums from the insurance business segment.

- Investment Portfolios: Returns from a broader range of investment holdings.

Sales of Goods and IT Services

Chevalier's revenue streams are robust, encompassing the sale of both physical goods and crucial IT services. This dual approach allows them to tap into diverse markets and customer needs.

The company generates income through the distribution and trading of a wide array of products, including consumer goods, electrical and mechanical equipment, and essential building supplies. This broad product portfolio spans multiple geographical regions, demonstrating their extensive reach.

Furthermore, Chevalier capitalizes on the growing demand for technology by selling and servicing information technology equipment and business machines. Their expertise extends to offering enterprise automation and digital transformation solutions, a key growth area. For instance, in the fiscal year ending March 31, 2024, Chevalier International Holdings reported a significant portion of its revenue derived from its trading and IT businesses, reflecting the strength of these sales channels.

- Trading and IT Segment: This segment is a primary revenue driver, covering the sale of consumer products, equipment, and building supplies.

- IT Services and Solutions: Revenue is also generated from the sale and servicing of IT equipment, business machines, and digital transformation services.

- Diversified Income: The combination of product sales and IT services supports Chevalier's conglomerate model, providing stability and growth opportunities.

Chevalier's revenue streams are multifaceted, encompassing construction, property, trading and IT, and healthcare segments. The company's ability to diversify across these sectors provides resilience and multiple avenues for growth.

In the fiscal year ending March 31, 2024, Chevalier International Holdings reported significant revenue contributions from its various business segments. The trading and IT segment, in particular, demonstrated robust performance, alongside the consistent income generated from property sales and leasing activities.

The Group's strategic investments in healthcare, including senior housing and medical office buildings, further diversify its income, providing recurring revenue streams through occupancy fees and rental income.

Chevalier's diversified revenue model is a key strength, as evidenced by its performance in the 2024 fiscal year, where property sales and leasing, alongside trading and IT services, formed the bedrock of its financial results.

| Revenue Segment | Key Activities | 2024 Performance Insight |

|---|---|---|

| Construction & Engineering | Building construction, civil engineering, specialized installations | Securing and executing public and private sector projects |

| Property | Property sales, leasing, property management | Notable increase in revenue from property sales and rental income |

| Trading & IT | Product distribution, IT equipment sales and servicing, digital transformation solutions | Significant portion of revenue derived from these businesses |

| Healthcare | Senior housing, medical office buildings | Income from occupancy fees and rental income |

| General Insurance | Insurance operations | Contributes to overall financial performance |

Business Model Canvas Data Sources

The Chevalier Business Model Canvas is built upon a foundation of comprehensive market research, financial projections, and operational analysis. These diverse data sources ensure each component of the canvas is informed by current industry trends and internal capabilities.