Chevalier PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chevalier Bundle

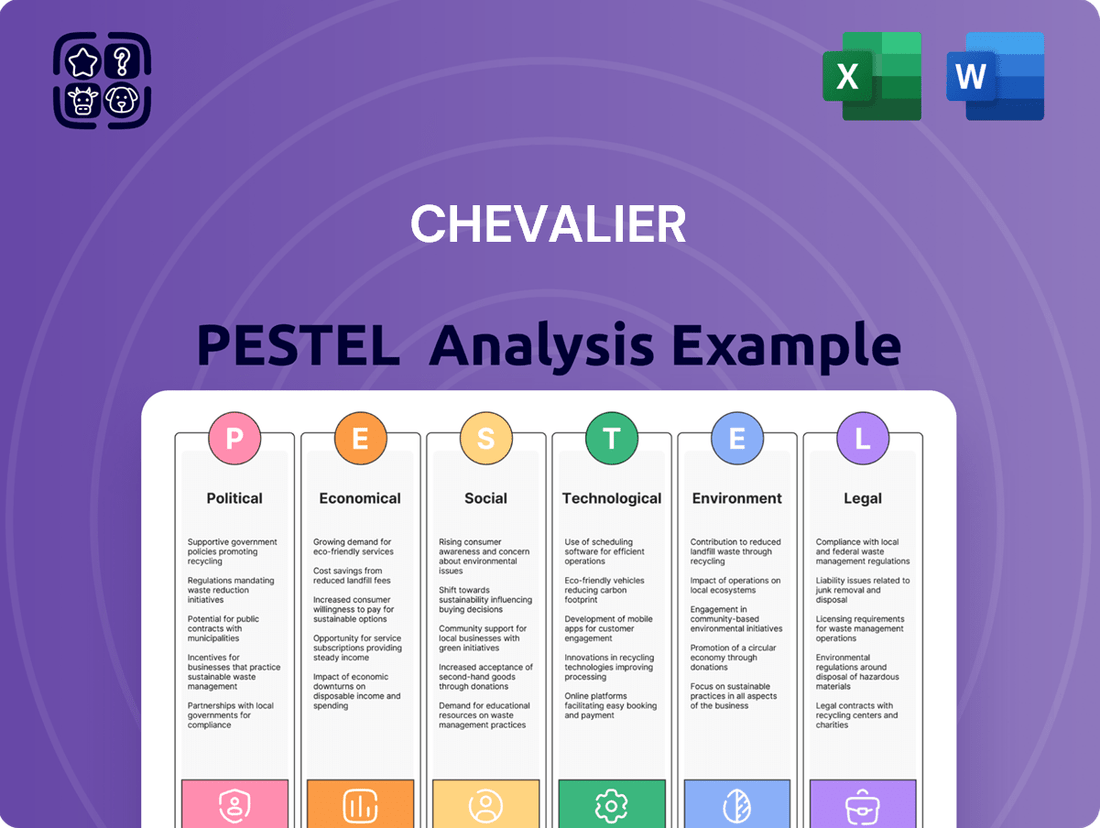

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Chevalier's market. Our expertly crafted PESTLE analysis provides actionable insights to anticipate challenges and seize opportunities. Download the full report to gain a strategic advantage and drive informed decision-making.

Political factors

Government policies profoundly shape Chevalier Group's core businesses in construction, property development, and healthcare. Initiatives like Hong Kong's housing supply targets and Mainland China's urban planning directly affect the group's project pipeline and revenue potential. For instance, the Hong Kong government's 2024-2025 budget allocated HK$11.5 billion for public housing construction, a key area for Chevalier.

Shifts in regulations concerning land supply and infrastructure development in both regions are critical. Chevalier's profitability hinges on how these policies, such as those impacting large-scale infrastructure projects, translate into business opportunities. The ongoing development of the Greater Bay Area, for example, presents significant opportunities for cross-border construction and property ventures.

Furthermore, Hong Kong's push towards smart city development, with significant investment planned for digital infrastructure upgrades through 2025, influences Chevalier's adoption of new technologies in its projects. This policy direction encourages innovation in building management systems and sustainable construction practices, potentially boosting efficiency and project appeal.

Geopolitical stability across Hong Kong, Mainland China, and Southeast Asia significantly impacts Chevalier Group. For instance, the ongoing trade tensions between the US and China, which intensified in 2023 and continued into early 2024, create uncertainty for cross-border investments and market access, potentially affecting Chevalier's property development and consumer goods distribution.

Shifts in regional relations, such as those observed in the South China Sea, can disrupt supply chains and increase operational costs for businesses with a strong regional footprint like Chevalier. These tensions might also influence foreign direct investment flows into the region, impacting the pace of development projects.

The trend of global companies increasing their focus on localized operations within China, a strategy observed throughout 2023 and projected to continue into 2024-2025, could necessitate Chevalier adapting its business model to better serve domestic market demands and navigate evolving regulatory landscapes.

Chevalier Group's expansion into healthcare services in Southeast Asia exposes them to the region's evolving healthcare policies and public health initiatives. Government spending on healthcare is a key driver; for instance, many Southeast Asian nations are increasing their healthcare budgets. In 2024, several countries in the region allocated over 10% of their national budgets to healthcare, aiming to improve access and quality.

Regulatory frameworks for healthcare providers and incentives for private sector participation directly influence Chevalier's growth and profitability in this sector. Many governments are actively encouraging private investment, offering tax breaks and streamlined licensing processes to boost healthcare infrastructure and services. This is particularly evident in areas like Medtech innovation and digital health, where the region is witnessing significant government support and investment, with digital health spending projected to grow by over 15% annually through 2025.

Construction Industry Regulations and Standards

Chevalier Group's construction operations are subject to a complex web of building codes, safety protocols, and environmental regulations across its various markets. For instance, China's 14th Five-Year Plan, which spans 2021-2025, places a significant emphasis on developing greener, smarter, and safer construction practices, requiring companies like Chevalier to adapt their methodologies and potentially invest in new technologies. These evolving regulatory landscapes, such as mandates for sustainable building materials or enhanced worker safety measures, directly influence project expenditures and scheduling, demanding agile responses from the company.

The impact of these regulatory shifts is substantial. For example, stricter environmental standards can increase the cost of materials and waste disposal, while new safety regulations might necessitate additional training or equipment. Chevalier Group must remain vigilant in monitoring these changes, as non-compliance can lead to significant penalties and project delays. The group's ability to navigate and integrate these evolving requirements will be a key determinant of its success in the construction sector.

Key regulatory considerations for Chevalier Group include:

- Adherence to evolving green building standards: This impacts material sourcing and design specifications, potentially increasing upfront costs but offering long-term operational benefits and market appeal.

- Compliance with updated safety regulations: Ensuring worker safety is paramount, requiring ongoing investment in training, equipment, and site management practices to meet or exceed legal requirements.

- Environmental impact assessments and mitigation: Meeting stricter environmental protection laws necessitates careful planning for emissions, waste management, and resource utilization throughout the project lifecycle.

Data Privacy and Cybersecurity Regulations in China

Chevalier Group's significant presence in China's information technology and healthcare sectors means they are directly impacted by the nation's increasingly stringent data privacy and cybersecurity landscape. The implementation of China's Personal Information Protection Law (PIPL) and the Network Data Security Management Regulations, effective from January 1, 2025, mandates rigorous compliance for how data is handled, from collection to cross-border movement.

These new regulations are designed to bolster data security and protect personal information, presenting both challenges and opportunities for companies like Chevalier. Non-compliance can lead to substantial fines, with potential penalties reaching up to 5% of a company's annual turnover or RMB 50 million, alongside reputational damage, making adherence paramount for continued operations and business integrity within the Chinese market.

- PIPL and Network Data Security Management Regulations: These laws, effective January 1, 2025, set new benchmarks for data handling in China.

- Cross-border Data Transfer Scrutiny: Chevalier must navigate complex rules for transferring data outside of China, impacting its IT and healthcare service delivery models.

- Compliance Costs: Significant investment in technology and legal expertise will be required to meet these evolving regulatory demands, estimated to increase compliance budgets for many businesses operating in China.

- Market Access and Trust: Demonstrating robust data protection practices is crucial for maintaining customer trust and ensuring continued market access in China.

Government policies significantly influence Chevalier Group's operations. Hong Kong's 2024-2025 budget, for instance, included HK$11.5 billion for public housing construction, directly benefiting Chevalier's property development arm. China's emphasis on green building standards, as outlined in its 14th Five-Year Plan (2021-2025), mandates updated construction practices, impacting project costs and timelines for Chevalier.

Regional geopolitical stability is also a key factor. Ongoing trade tensions, evident in early 2024, create market uncertainties for Chevalier's cross-border ventures. Furthermore, evolving healthcare policies in Southeast Asia, with many nations increasing healthcare budgets by over 10% in 2024, present growth opportunities for Chevalier's healthcare services.

Chevalier faces stringent data regulations in China, with the Personal Information Protection Law (PIPL) and Network Data Security Management Regulations effective January 1, 2025. Non-compliance can result in fines up to 5% of annual turnover, necessitating significant investment in data security and legal compliance for Chevalier's IT and healthcare divisions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chevalier, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and strategic advantages.

Provides a clear, actionable framework that simplifies complex external factors, reducing the overwhelm and uncertainty often associated with strategic planning.

Economic factors

Chevalier Group's property focus means it's directly impacted by real estate trends. In Hong Kong, residential prices are expected to see a modest recovery of 0% to 5% in 2025, supported by potential interest rate cuts and increased rental needs.

However, the Kowloon office sector faces headwinds, with projections indicating a rent decrease of 2% to 4% for 2025, highlighting a mixed property market outlook for the company.

Chevalier Group's performance is closely tied to the economic vitality of its operating regions, particularly Hong Kong, Mainland China, and Southeast Asia. In 2024, Hong Kong's GDP growth was projected to be around 2.5-3.5%, supported by tourism recovery and government stimulus, which should bolster consumer spending on Chevalier's diverse offerings.

Mainland China's economic trajectory, with a projected GDP growth of approximately 5.0% in 2024, presents significant opportunities for increased demand in property development and consumer goods. However, potential headwinds from global trade tensions could temper this growth.

Southeast Asia, a key growth engine, is experiencing robust economic expansion, with countries like Vietnam and Indonesia showing GDP growth rates exceeding 5% in 2024. This rising affluence is directly translating into higher consumer spending power, especially in sectors like healthcare, benefiting Chevalier's healthcare services segment.

Interest rate shifts directly influence Chevalier Group's property ventures, altering borrowing expenses for new developments and the appeal of property as an investment. For instance, if central banks maintain or lower benchmark rates in 2024-2025, this could reduce the cost of capital for Chevalier's substantial projects.

Easing borrowing costs, such as a potential decrease in mortgage rates to around 4-5% in key markets by late 2024, can stimulate housing demand. This increased demand benefits Chevalier by potentially boosting sales in both new developments and the resale market.

Furthermore, Chevalier's access to competitive financing, including specialized green and social loans which saw significant growth in issuance in 2023 and are projected to continue their upward trend, is vital. These financing avenues can support their large-scale, sustainability-focused projects, potentially offering better terms and attracting environmentally conscious investors.

Inflation and Cost of Materials and Labor

Inflationary pressures are a significant concern for Chevalier, directly impacting the cost of essential construction materials, skilled labor, and overall operational expenses. These rising costs can compress profit margins, especially for projects with fixed-price contracts that extend over longer periods, making cost management crucial.

The availability and cost of skilled labor remain a critical factor in the construction and engineering sectors. For instance, China's construction industry experienced an 8.4% year-on-year investment growth in the first quarter of 2024, indicating robust demand that could further strain labor resources and drive up wages.

- Rising Material Costs: Increased inflation directly translates to higher prices for cement, steel, and other key building components.

- Labor Shortages and Wages: A tight labor market can lead to increased wage demands, impacting project profitability.

- Fixed-Price Contract Risks: Projects secured at pre-inflation prices face margin erosion if costs escalate unexpectedly.

- Operational Expense Increases: Higher energy and transportation costs also contribute to the overall financial strain.

Foreign Exchange Rate Volatility

Chevalier Group's international operations expose it to significant foreign exchange rate volatility. Fluctuations between the Hong Kong Dollar, Chinese Yuan, and currencies across Southeast Asia can materially affect reported earnings, the cost of goods sourced internationally, and the valuation of overseas assets.

For instance, a stronger Hong Kong Dollar against the Yuan could reduce the translated value of Chinese revenues for Chevalier. In 2024, the Hong Kong Dollar has shown relative stability against the US Dollar, trading within a narrow band, but its movement against other regional currencies remains a key consideration for businesses with substantial cross-border transactions.

- Impact on Translation: Overseas profits are worth less when converted back to the home currency if the home currency strengthens.

- Cost of Imports: A depreciating local currency makes imported materials more expensive, impacting Chevalier's cost of sales.

- Investment Value: The value of foreign direct investments can be significantly altered by currency shifts, affecting Chevalier's balance sheet.

- 2024 Regional Trends: Many Southeast Asian economies experienced currency pressures in early 2024 due to global interest rate differentials, creating a dynamic FX environment for Chevalier's regional subsidiaries.

Chevalier Group's performance is intrinsically linked to the economic health of its operating regions. Hong Kong's projected GDP growth of 2.5-3.5% in 2024, bolstered by tourism, should support consumer spending. Mainland China's estimated 5.0% GDP growth in 2024 offers substantial opportunities, though global trade tensions pose a risk. Southeast Asia, with countries like Vietnam and Indonesia expected to grow over 5% in 2024, presents a key growth avenue, particularly for Chevalier's healthcare services.

Interest rate movements directly affect Chevalier's property ventures by influencing borrowing costs and investment appeal. Lowering benchmark rates in 2024-2025 could reduce capital costs for projects. Easing mortgage rates to around 4-5% by late 2024 could stimulate housing demand, benefiting Chevalier's sales. The company's access to specialized green and social loans, which saw issuance growth in 2023 and is projected to continue, is crucial for sustainability-focused projects.

Inflationary pressures are a significant concern, escalating costs for construction materials and labor, potentially squeezing profit margins on fixed-price contracts. Labor shortages in sectors like China's construction industry, which saw 8.4% investment growth in Q1 2024, could further drive up wages and impact project profitability.

Foreign exchange volatility poses a risk to Chevalier's international operations. Fluctuations between regional currencies can impact reported earnings and the cost of imported goods. While the Hong Kong Dollar has been stable against the US Dollar in 2024, its movement against other regional currencies is critical for cross-border transactions.

| Economic Factor | 2024 Projection/Trend | Impact on Chevalier |

|---|---|---|

| Hong Kong GDP Growth | 2.5% - 3.5% | Supports consumer spending on diverse offerings. |

| Mainland China GDP Growth | ~5.0% | Significant opportunities in property and consumer goods; potential trade tension headwinds. |

| Southeast Asia GDP Growth (e.g., Vietnam, Indonesia) | >5% | Drives consumer spending power, benefiting healthcare services. |

| Interest Rates (Key Markets) | Potential decreases in 2024-2025 | Reduces capital costs for property development; stimulates housing demand if mortgage rates fall to 4-5%. |

| Inflation | Rising costs for materials and labor | Compresses profit margins, especially on fixed-price contracts; increases operational expenses. |

| Labor Market (China Construction) | 8.4% investment growth (Q1 2024) | Potential strain on labor resources and wage increases. |

| Foreign Exchange (HKD vs. Regional Currencies) | Regional currency pressures in early 2024 | Affects translation of overseas earnings, cost of imports, and investment valuations. |

Same Document Delivered

Chevalier PESTLE Analysis

The preview you see here is the exact Chevalier PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will get a comprehensive breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Chevalier brand.

The content and structure shown in the preview is the same Chevalier PESTLE Analysis document you’ll download after payment, providing you with a complete strategic tool.

Sociological factors

Demographic shifts are a powerful force shaping Chevalier Group's market landscape. For instance, Southeast Asia's aging population, with a projected increase in those over 65 in countries like Singapore and Malaysia, directly fuels the demand for Chevalier's expanding Medtech and senior housing offerings. This demographic trend is a key driver for their strategic investments in healthcare-related services.

Concurrently, ongoing urbanization, particularly in major hubs like Hong Kong and key cities in Mainland China, continues to propel demand for Chevalier's core competencies in construction and property development. As more people move to urban centers, the need for new residential, commercial, and infrastructure projects remains robust, creating sustained opportunities for the group.

Consumer preferences are shifting, impacting Chevalier's property and consumer product businesses. For instance, the demand for smart home technology is projected to reach over $53 billion globally by 2025, a significant increase from previous years, indicating a strong market for integrated living solutions. Similarly, sustainable living spaces are gaining traction, with a growing segment of buyers prioritizing eco-friendly features and materials in their property choices.

In the healthcare sector, there's a clear trend towards personalized and precision-driven health solutions. The digital health market alone was valued at over $200 billion in 2023 and is expected to continue its robust growth, reflecting a consumer desire for tailored wellness programs and accessible virtual care.

Growing health consciousness is a significant societal shift, directly fueling demand for healthcare services. People are more proactive about their well-being, leading to increased utilization of medical facilities and preventative care.

This trend benefits companies like Chevalier Group, which can capitalize on the rising need for both traditional and innovative healthcare solutions. The digital health and wellness coaching market in Southeast Asia, for instance, is expected to expand at a compound annual growth rate of 8.57% between 2024 and 2029, highlighting a clear opportunity.

Talent Attraction and Retention

Chevalier Group, operating across diverse sectors like engineering, property, IT, and healthcare, faces the critical challenge of attracting and retaining skilled professionals. Labor market dynamics, including potential shortages and heightened competition for specialized skills, directly influence operational effectiveness and the execution of growth plans. For instance, the demand for skilled IT professionals in Hong Kong, Chevalier's primary market, has seen significant increases, with average salaries for senior software engineers rising by an estimated 8-10% in 2024 compared to the previous year.

The company's strategic investments in corporate social responsibility (CSR) initiatives, such as offering scholarships and vocational training programs, play a vital role in building its employer brand. These efforts not only foster goodwill but also create a pipeline of future talent. Chevalier's scholarship programs, which have supported over 500 students in STEM fields since their inception, are a key differentiator in a competitive talent landscape, aiming to cultivate loyalty from an early stage.

- Talent Demand: Chevalier needs engineers, IT specialists, property managers, and healthcare professionals, with demand for IT roles particularly high in 2024.

- Labor Market Impact: Shortages or intense competition for talent can hinder Chevalier's operational efficiency and strategic growth.

- CSR for Attraction: Scholarships and training programs are crucial for Chevalier's talent attraction strategy, enhancing its employer appeal.

- Scholarship Reach: Chevalier's commitment to education is demonstrated by supporting over 500 STEM students through its scholarship initiatives.

Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility (CSR) are increasingly shaping how companies like Chevalier Group are perceived. Consumers and investors alike are looking for businesses that actively contribute to societal well-being, not just profit. This growing emphasis on CSR directly impacts Chevalier's reputation and its relationships with various stakeholders, from customers to employees.

Chevalier demonstrates its commitment to social responsibility through tangible actions. For instance, their involvement in social housing projects, such as the Jockey Club Key House in Hong Kong, highlights a dedication to addressing community needs. Beyond housing, their participation in numerous community and charity programs further solidifies this commitment, showcasing a desire to give back.

These CSR initiatives can translate into significant business advantages. By actively engaging in social causes, Chevalier can enhance its brand image, making it more attractive to a wider audience. This positive perception is particularly valuable in attracting socially conscious investors who prioritize ethical and sustainable business practices, potentially leading to increased investment and financial support.

- Growing CSR Expectations: A 2024 survey indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

- Community Project Impact: Chevalier's role in the Jockey Club Key House project, completed in 2023, provided housing for over 100 families in need.

- Brand Enhancement: Companies with strong CSR programs often see a 15% higher brand loyalty compared to those with weaker programs, according to industry reports.

- Investor Attraction: Socially responsible investing (SRI) assets under management globally are projected to reach $50 trillion by 2025, underscoring the financial appeal of ethical practices.

Societal attitudes towards health and wellness are increasingly influencing consumer behavior, directly benefiting Chevalier Group's healthcare ventures. The global digital health market, valued at over $200 billion in 2023, continues its upward trajectory, reflecting a growing demand for accessible and personalized healthcare solutions.

Furthermore, a heightened awareness of environmental sustainability is shaping consumer choices across Chevalier's property and consumer product segments. For instance, the market for green building materials is projected to grow significantly, with a notable increase in demand for eco-friendly construction practices and materials in urban developments.

Chevalier's commitment to corporate social responsibility (CSR) is becoming a key differentiator, aligning with growing societal expectations. A 2024 survey revealed that 70% of consumers consider a company's social and environmental impact when making purchasing decisions, highlighting the business imperative of strong CSR programs.

The company's engagement in community projects, such as the Jockey Club Key House providing housing for over 100 families in 2023, enhances its brand reputation and stakeholder relationships. This focus on social impact is also attracting socially conscious investors, with global SRI assets projected to reach $50 trillion by 2025.

| Societal Factor | Impact on Chevalier Group | Supporting Data (2024/2025) |

|---|---|---|

| Health & Wellness Awareness | Increased demand for healthcare services and wellness programs. | Global digital health market valued at over $200 billion (2023), projected growth. |

| Environmental Sustainability | Preference for eco-friendly products and construction in property. | Growing market for green building materials, increased adoption of sustainable practices. |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation and appeal to conscious consumers/investors. | 70% of consumers consider social/environmental impact (2024); SRI assets to reach $50 trillion by 2025. |

| Community Engagement | Strengthened stakeholder relations and positive societal contribution. | Jockey Club Key House project provided housing for over 100 families (2023). |

Technological factors

Technological advancements are reshaping the construction and engineering landscape, offering significant benefits for companies like Chevalier Group. Innovations such as Building Information Modeling (BIM), prefabrication, and the increasing use of automation and construction robots are key drivers for enhanced efficiency, cost reduction, and improved project quality.

China's commitment to technological integration is evident in its 14th Five-Year Plan, which targets the widespread application of information technologies and construction robots by 2025. This national push underscores the growing importance of these technologies in the sector, creating a favorable environment for Chevalier Group to leverage these advancements in its operations.

Hong Kong's commitment to smart city development, fueled by significant investment in AI, big data, and IoT, creates a fertile ground for Chevalier Group. Initiatives like smart lampposts gathering real-time city data and the iAM Smart app for streamlined digital government services directly align with Chevalier's potential to offer advanced smart building technologies and integrated property management solutions.

Technological advancements are profoundly reshaping the healthcare landscape. Chevalier Group's strategic positioning within this sector allows it to capitalize on the burgeoning digital transformation, marked by the widespread adoption of telemedicine, AI-driven diagnostic tools, and advanced wearable health monitoring devices.

These innovations are not merely incremental; they represent a fundamental shift in how healthcare services are delivered and experienced. By integrating these technologies, Chevalier can significantly enhance patient care, optimize operational efficiency, and broaden its service accessibility, particularly in underserved regions.

The economic implications are substantial. For instance, the Southeast Asian telehealth market is anticipated to surge to US$21.8 billion by 2030, underscoring a massive growth opportunity for companies like Chevalier that are prepared to invest in and leverage these digital health solutions.

Information Technology and Cybersecurity Solutions

Chevalier Group's increasing reliance on information technology and digital solutions necessitates a strong IT infrastructure and robust cybersecurity. This is crucial as the company expands its IT sector and integrates these technologies across its diverse business operations.

Protecting sensitive data and systems from cyber threats is a top priority, especially with the evolving landscape of digital vulnerabilities. Chevalier must invest in secure data management systems and advanced cybersecurity protocols to safeguard its operations and customer information.

The company faces stricter data privacy regulations, particularly in China, which requires meticulous compliance. For instance, China's Personal Information Protection Law (PIPL), implemented in November 2021, imposes significant obligations on data handling and cross-border data transfers, impacting how Chevalier manages its digital assets and customer data.

Key technological considerations for Chevalier include:

- Enhanced Cybersecurity Investments: Allocating resources to advanced threat detection, prevention, and response systems. In 2024, global cybersecurity spending was projected to reach over $200 billion, highlighting the increasing importance of this area.

- Secure Cloud Infrastructure: Migrating and managing data on secure, compliant cloud platforms to ensure data integrity and accessibility.

- Data Privacy Compliance: Implementing strict data governance policies aligned with international and regional regulations like PIPL.

- Digital Transformation Enablement: Leveraging IT to drive innovation and efficiency across all business units, from construction to watch and jewelry retail.

Innovation in Property Management and Smart Homes

Technological advancements are fundamentally reshaping property management. The integration of smart home devices, such as connected thermostats and security systems, is becoming a key differentiator, enhancing convenience and appeal for residents. Chevalier Group can leverage these innovations to offer premium services.

Internet of Things (IoT) enabled building management systems are also gaining traction, allowing for real-time monitoring and control of building functions like HVAC and lighting. This not only boosts operational efficiency but also contributes to significant cost savings. For instance, smart building technology can reduce energy consumption by up to 30% in commercial properties, a benefit Chevalier can pass on to its clients.

Furthermore, the application of data analytics in property management provides invaluable insights into building performance and resident behavior. This data can inform strategic decisions, from predictive maintenance to optimizing space utilization. By analyzing usage patterns, Chevalier can proactively address potential issues and tailor services to meet evolving resident needs, thereby improving overall satisfaction and retention rates.

Chevalier Group's strategic adoption of these technological factors can lead to enhanced resident experiences and optimized building performance across its portfolio. This includes:

- Implementing IoT sensors for predictive maintenance, reducing downtime and repair costs.

- Offering integrated smart home solutions as a standard feature in new developments.

- Utilizing data analytics to personalize resident services and improve building energy efficiency.

- Streamlining property management operations through digital platforms and automation.

Technological advancements are a critical driver for Chevalier Group's operations, particularly in construction and property management. Innovations like BIM and prefabrication are boosting efficiency and cost savings in construction, while smart building technologies and IoT are enhancing property management by reducing energy consumption, potentially by up to 30% in commercial properties. The company's expansion into IT also necessitates a robust cybersecurity infrastructure to protect sensitive data, with global cybersecurity spending projected to exceed $200 billion in 2024.

Legal factors

Chevalier Group operates within a stringent legal framework, with construction and property laws significantly impacting its operations. These include zoning ordinances, building codes, land use policies, and property transfer regulations, all of which demand meticulous adherence. For instance, in Hong Kong, the Buildings Department enforces strict building codes, and any non-compliance can lead to substantial fines or project halts.

Navigating these diverse legal landscapes across Hong Kong, Mainland China, and Southeast Asia presents a significant challenge. Chevalier's ability to successfully manage projects hinges on its understanding and compliance with local regulations, such as China's land use rights and property laws, which differ considerably from Hong Kong's. Failure to comply can result in costly legal battles, project delays, and reputational damage.

The evolving nature of these laws also requires continuous monitoring and adaptation. For example, changes in environmental regulations or safety standards, which are increasingly common in 2024 and projected to continue into 2025, necessitate proactive adjustments in Chevalier's construction practices to ensure ongoing legality and operational efficiency.

As a significant employer, Chevalier Group is bound by diverse labor laws and employment regulations across its operating regions. These laws dictate crucial aspects like minimum wages, workplace safety standards, mandated employee benefits, and procedures for contract termination. Staying compliant is essential for operational continuity and managing employee relations effectively.

A key recent development impacting Chevalier is the abolition of the MPF offsetting mechanism in Hong Kong, effective May 1, 2025. This regulatory shift directly affects how long service payments are calculated and paid out, potentially increasing Chevalier's financial liabilities in this specific area. The company must adapt its financial planning and HR policies to accommodate this change.

New regulations in Mainland China, including the Personal Information Protection Law (PIPL) and Network Data Security Management Regulations, effective January 1, 2025, will significantly impact Chevalier Group's data handling. These laws mandate explicit consent for data collection and require security assessments for any cross-border data transfers. For operators of critical information infrastructure, data localization will be a key requirement.

Failure to comply with these stringent data privacy and protection laws can result in substantial financial penalties. For instance, under PIPL, violations related to data processing or cross-border transfers can incur fines up to 50 million yuan or 5% of the previous year's annual turnover, whichever is higher, alongside other corrective measures.

Environmental Regulations and Compliance

Chevalier Group's operations in construction and engineering face a landscape of environmental regulations. These laws govern critical areas like air pollution, waste management, and noise levels. For instance, in Hong Kong, adherence to the Air Pollution Control Ordinance and the Waste Disposal Ordinance is paramount to mitigate environmental harm and sidestep legal penalties.

Compliance with these environmental mandates is not just a legal necessity but also crucial for maintaining Chevalier's reputation and operational sustainability. The company must actively manage its environmental footprint, ensuring that its projects align with Hong Kong's commitment to international environmental protection conventions.

- Air Pollution Control: Chevalier must manage emissions from construction machinery and activities to comply with Hong Kong's Air Pollution Control Ordinance.

- Waste Disposal: Proper handling and disposal of construction waste are mandated by the Waste Disposal Ordinance, requiring efficient waste management strategies.

- Noise Control: Construction sites must adhere to noise control regulations, particularly during sensitive hours, to minimize disruption to surrounding communities.

- International Conventions: Chevalier's environmental practices are also influenced by Hong Kong's adoption of international environmental protection agreements.

Healthcare Regulatory Frameworks

Chevalier Group's healthcare operations in Southeast Asia are deeply embedded within a complex web of legal and regulatory requirements. These frameworks dictate everything from the licensing of medical professionals and facilities to stringent patient data privacy protocols that often go beyond general data protection laws. For instance, in Singapore, the Personal Data Protection Act (PDPA) and specific healthcare guidelines from the Ministry of Health govern how patient information is handled, with potential fines for breaches.

Adherence to quality of care standards is paramount, with regulatory bodies setting benchmarks for patient safety and treatment efficacy. In Vietnam, for example, the Ministry of Health oversees the quality of healthcare services, impacting Chevalier's hospital and clinic operations. Furthermore, regulations surrounding pharmaceuticals and medical devices, including import, distribution, and marketing, present another layer of legal complexity that Chevalier must meticulously navigate for its healthcare product offerings.

- Regulatory Compliance Costs: In 2024, companies in the healthcare sector often allocate significant budgets, sometimes exceeding 10% of operating expenses, towards ensuring compliance with evolving medical licensing, data privacy (like PDPA in Singapore), and quality of care standards across Southeast Asia.

- Data Privacy Fines: Non-compliance with patient data privacy laws can result in substantial penalties; for example, a significant breach under Singapore's PDPA could lead to fines of up to S$1 million.

- Pharmaceutical Import Tariffs: Import tariffs on medical devices and pharmaceuticals can vary widely by country, impacting Chevalier's supply chain costs and pricing strategies in markets like the Philippines or Thailand.

- Evolving Healthcare Laws: Governments in the region are continuously updating healthcare legislation, with an anticipated increase in focus on telemedicine regulations and digital health data security throughout 2024 and 2025.

Chevalier Group must navigate a complex web of legal requirements across its diverse operations. Recent and upcoming legislation, particularly concerning data privacy and labor laws, demands proactive adaptation. For instance, the abolition of Hong Kong's MPF offsetting mechanism in May 2025 will impact long service payment calculations.

China's new data protection laws, including PIPL effective January 1, 2025, impose strict consent requirements for data collection and cross-border transfers, with potential fines up to 5% of annual turnover for violations.

Environmental regulations, such as Hong Kong's Air Pollution Control Ordinance, also necessitate careful management of construction activities to avoid penalties and maintain corporate reputation.

The healthcare sector faces stringent licensing, patient data privacy (e.g., Singapore's PDPA with potential S$1 million fines), and quality of care standards, with ongoing legislative updates anticipated through 2025.

Environmental factors

Chevalier Group's extensive property and construction portfolio faces growing threats from climate change. Extreme weather events, such as increasingly severe typhoons, pose a direct risk to infrastructure in regions like Hong Kong and Southeast Asia. Rising sea levels, particularly in coastal areas where many assets are located, also present a long-term challenge, potentially impacting property values and necessitating costly adaptation measures.

These environmental shifts directly influence operational costs and investment strategies. Chevalier's commitment to aligning with Hong Kong's 2050 carbon neutrality target means investing in resilient design and construction, which can increase upfront costs but mitigate future climate-related damages. This focus on sustainability is becoming crucial for maintaining property values and managing insurance premiums in an evolving risk landscape.

The construction and engineering sectors, core to Chevalier Group's operations, are inherently dependent on a consistent supply of natural resources. As global demand rises, the availability of key materials like concrete aggregates, steel, and timber faces increasing pressure, potentially driving up procurement costs and creating supply chain vulnerabilities. This trend is becoming more pronounced as we approach 2025.

In response to these pressures, Chevalier Group is actively integrating sustainable sourcing strategies. For instance, their commitment to utilizing green building materials, such as recycled steel and sustainably harvested timber, aims to mitigate the impact of resource scarcity. Furthermore, their investment in digital carbon management platforms, which track and reduce the environmental footprint of projects, demonstrates a proactive approach to managing these evolving environmental factors.

Chevalier faces significant environmental challenges related to waste management and pollution control, particularly given its construction and operational activities. The generation of construction waste and potential air and water pollution are key concerns. For instance, in 2023, construction and demolition waste in Hong Kong, a key market for Chevalier, reached approximately 2.1 million tonnes, highlighting the scale of waste management required.

Compliance with stringent waste disposal ordinances and air pollution control regulations is paramount, especially in densely populated urban centers like Hong Kong. Failure to comply can result in substantial fines and reputational damage. The Environmental Protection Department in Hong Kong actively enforces these regulations, with penalties for non-compliance often running into tens of thousands of Hong Kong dollars.

Ongoing efforts to improve recycling networks and promote waste reduction are critical for Chevalier's sustainability. Initiatives like the Construction Waste Charging Scheme in Hong Kong, implemented in 2014, aim to incentivize waste reduction at source. Chevalier's commitment to these practices is essential for mitigating its environmental footprint and ensuring long-term operational viability.

Energy Efficiency and Green Building Standards

There's a noticeable push towards making buildings more energy-efficient and adhering to green building principles. This trend is driven by both environmental concerns and the potential for long-term financial benefits. Chevalier Group's pursuit of BEAM Plus Platinum certification for projects like the Jockey Club Key House highlights their proactive approach to these evolving standards. Such certifications not only align with regulatory expectations but also contribute to reduced operational costs and increased property desirability.

Hong Kong's regulatory landscape actively supports this shift, with measures like the Building (Energy Efficiency) Regulation setting benchmarks for energy performance in new developments and major renovations. This regulation mandates specific energy efficiency requirements for building envelopes and air-conditioning systems, encouraging developers to invest in sustainable design and technologies. For instance, the regulation sets limits on factors like the overall thermal transfer value (OTTV) for building envelopes, pushing for better insulation and reduced heat gain.

- Growing Emphasis: Increased global and local focus on reducing carbon footprints in the built environment.

- Regulatory Framework: Hong Kong's Building (Energy Efficiency) Regulation mandates energy performance standards.

- Chevalier's Alignment: Projects like Jockey Club Key House achieving BEAM Plus Platinum certification demonstrate commitment to green building.

- Financial Benefits: Energy efficiency leads to lower operating costs and potentially higher property valuations.

Biodiversity and Land Use Impacts

Chevalier Group's property development and construction activities, particularly in urban and peri-urban areas, directly influence local biodiversity and land use patterns. For instance, projects in Singapore, a city-state with limited land, require careful consideration of green spaces and ecological corridors. In 2023, Singapore's Land Authority managed over 6,000 hectares of state land, with a portion allocated for development, necessitating stringent environmental impact assessments to minimize habitat disruption.

The company must actively assess and mitigate these impacts. This involves conducting thorough Environmental Impact Assessments (EIAs) before commencing new projects, as mandated by regulations in many of its operating regions. For example, in Hong Kong, Chevalier's projects are subject to the Environmental Impact Assessment Ordinance, requiring detailed studies on potential effects on flora, fauna, and ecosystems. Responsible land development practices, such as incorporating green building designs and preserving natural features, are crucial for offsetting negative consequences.

Chevalier Group's commitment to conservation efforts and adherence to international conventions like the Convention on Biological Diversity (CBD) is also paramount. The CBD aims to conserve biological diversity, sustainably use its components, and fairly share the benefits arising from the use of genetic resources. By aligning its practices with these global standards, Chevalier can enhance its reputation and ensure long-term sustainability in its land development ventures. For example, in 2024, the group continued to implement its corporate sustainability framework, which includes targets for reducing its environmental footprint and contributing to biodiversity conservation in project areas.

Key considerations for Chevalier Group include:

- Minimizing habitat fragmentation: Implementing development strategies that maintain ecological connectivity between remaining natural areas.

- Implementing biodiversity offsets: Investing in conservation projects elsewhere to compensate for unavoidable impacts.

- Adhering to evolving land use regulations: Staying abreast of and complying with national and international policies on land management and conservation.

Environmental factors significantly impact Chevalier Group's operations, from climate change risks like extreme weather events to the increasing pressure on natural resources. The company's sustainability efforts, including adopting green building materials and investing in digital carbon management, are crucial for mitigating these challenges and ensuring long-term viability.

The construction industry's environmental footprint, particularly waste generation and pollution, demands strict adherence to regulations. Chevalier's focus on waste reduction and compliance with ordinances like Hong Kong's Construction Waste Charging Scheme is vital for responsible operations.

Energy efficiency and green building principles are increasingly important, driven by environmental concerns and financial benefits. Chevalier's pursuit of certifications like BEAM Plus Platinum demonstrates a commitment to these evolving standards, aligning with regulations such as Hong Kong's Building (Energy Efficiency) Regulation.

Land use and biodiversity are also key considerations. Chevalier must conduct thorough Environmental Impact Assessments and implement strategies to minimize habitat disruption, adhering to regulations and global conventions to ensure responsible land development.

PESTLE Analysis Data Sources

Our Chevalier PESTLE Analysis is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry analysis firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, social trends, and legal frameworks to provide a comprehensive view.