Chedraui SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chedraui Bundle

Chedraui's robust supply chain and strong brand loyalty are key strengths, but they face intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any investor or strategist looking to navigate the retail landscape.

Want the full story behind Chedraui's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chedraui's strength lies in its diverse store formats, from large hypermarkets to convenient Supercito proximity stores, allowing it to serve a wide range of customer needs and reach a broad demographic. This adaptability is key in capturing market share across different shopping occasions.

The company's extensive product offering, encompassing groceries, apparel, electronics, and home goods, creates a one-stop-shop experience. This comprehensive selection enhances customer loyalty and increases average transaction value, a significant advantage in competitive retail environments.

Chedraui consistently outpaces industry benchmarks, achieving nineteen consecutive quarters of same-store sales growth exceeding the ANTAD average in Mexico. This sustained outperformance highlights a strong customer connection and effective strategic execution.

The company's robust growth trajectory is further evidenced by a 14.8% year-over-year increase in consolidated net sales during Q1 2025. This impressive figure, fueled by strong performance in both its Mexican and U.S. operations, underscores Chedraui's expanding market footprint and operational efficiency.

Chedraui's 'Mi Chedraui' loyalty program is a powerful asset, boasting 13.3 million identified members by Q1 2025, which translates to a remarkable 75% of its Mexican sales. This extensive reach allows for deep customer engagement and provides a rich dataset for personalized marketing and pricing strategies.

The program's success in fostering customer relationships directly contributes to increased store traffic and sales. By understanding member behavior through advanced analytics, Chedraui can continually refine its offerings, ensuring a superior customer experience that solidifies its market position.

Strategic Expansion and Investment in Infrastructure

Chedraui's strategic expansion is a key strength, evident in its aggressive store rollout. In 2024 alone, the company opened 84 new stores in Mexico and 6 in the United States, with plans for 15 more in Mexico during the first quarter of 2025. This growth is supported by significant capital investments.

The company allocated MX$10 billion in capital expenditure for 2024, with a substantial portion dedicated to expansion initiatives. A major focus is on the Supercito format, which has proven successful in reaching a wider customer base. This investment in physical presence underpins its market penetration strategy.

Furthermore, Chedraui is optimizing its operational efficiency through infrastructure investments. The development of the new Rancho Cucamonga Distribution Center in California is a prime example, designed to enhance supply chain capabilities and support its growing U.S. operations. These moves demonstrate a commitment to long-term growth and operational excellence.

- Aggressive Store Openings: 84 new stores in Mexico and 6 in the U.S. in 2024, with 15 planned for Mexico in Q1 2025.

- Significant Capital Allocation: MX$10 billion invested in 2024 for expansion and infrastructure.

- Focus on Supercito Format: Strategic expansion of this high-potential store format.

- Supply Chain Optimization: Investment in infrastructure like the Rancho Cucamonga Distribution Center to improve logistics.

Solid Financial Performance and Operational Efficiencies

Chedraui demonstrates robust financial health, highlighted by an 8.8% consolidated EBITDA growth in the first quarter of 2025, reaching an EBITDA margin of 8.4%. This strong performance is underpinned by effective operational strategies.

Key to this success is Chedraui Mexico's improved EBITDA margin, which rose to 9.5%, reflecting diligent cost management. The company's focus on optimizing inventory and promotions has directly contributed to enhanced profitability and a solid net debt to EBITDA ratio.

- Strong EBITDA Growth: Consolidated EBITDA grew by 8.8% in Q1 2025.

- Healthy Margins: Achieved an EBITDA margin of 8.4%, with Chedraui Mexico reaching 9.5%.

- Operational Efficiency: Effective cost management, inventory, and promotion strategies are driving profitability.

- Sound Financial Structure: Maintains a healthy net debt to EBITDA ratio.

Chedraui's market leadership is built on a foundation of strategic expansion and customer engagement. The company's ability to consistently open new stores, with 84 in Mexico and 6 in the U.S. during 2024 and 15 more planned for Mexico in Q1 2025, demonstrates its commitment to growth. This expansion is backed by substantial investment, with MX$10 billion allocated in 2024 for development and infrastructure, including the crucial Supercito format and the Rancho Cucamonga Distribution Center.

The 'Mi Chedraui' loyalty program is a significant strength, boasting 13.3 million members by Q1 2025, representing 75% of Mexican sales and driving customer loyalty through personalized engagement. This, combined with a diverse store portfolio and extensive product range, creates a compelling one-stop-shop experience that resonates with a broad customer base.

Financially, Chedraui is performing exceptionally well, with consolidated net sales up 14.8% year-over-year in Q1 2025 and EBITDA growing 8.8% to reach an 8.4% margin. Chedraui Mexico's EBITDA margin improved to 9.5%, showcasing effective cost management and operational efficiency.

| Metric | Value (Q1 2025) | Previous Year (Q1 2024) | Change |

|---|---|---|---|

| Consolidated Net Sales Growth | 14.8% | N/A | N/A |

| Consolidated EBITDA Growth | 8.8% | N/A | N/A |

| Consolidated EBITDA Margin | 8.4% | N/A | N/A |

| Chedraui Mexico EBITDA Margin | 9.5% | N/A | N/A |

| 'Mi Chedraui' Loyalty Members | 13.3 million | N/A | N/A |

What is included in the product

Delivers a strategic overview of Chedraui’s internal and external business factors, highlighting its market strengths and operational gaps.

Offers a clear, actionable framework to identify and address Chedraui's competitive challenges and leverage its market strengths.

Weaknesses

Chedraui's transition to its new Rancho Cucamonga Distribution Center (RCDC) has presented a notable weakness, with significant transition costs impacting recent financial performance. These expenses have directly contributed to a decline in consolidated net income and a reduction in gross margin during the recent quarters.

While these costs are understood to be temporary, the immediate financial strain is evident. For instance, during the first quarter of 2024, Chedraui reported that these transition costs negatively affected earnings per share by approximately $0.02, underscoring the short-term financial pressure associated with such large-scale operational shifts.

Chedraui's significant presence in the U.S. exposes its consolidated financial reporting to the volatility of exchange rates between the Mexican Peso (MXN) and the U.S. Dollar (USD). This means that currency movements can directly influence reported sales and profits.

For instance, a weakening of the Mexican Peso, as observed in the first quarter of 2025, can boost reported consolidated sales when U.S. dollar earnings are translated back into pesos. However, this same currency fluctuation introduces an element of unpredictability into the company's overall financial performance, making forecasting more challenging.

While Chedraui has historically managed labor cost pressures through operational efficiencies, the retail landscape, especially in Mexico and the U.S., continues to see upward trends in wages. For instance, minimum wage increases in Mexico have been a recurring factor, impacting overall labor expenditures.

Sustained escalation in labor expenses poses a risk to Chedraui's profitability. If these cost increases outpace the company's ability to generate further operating leverage or implement effective pricing adjustments, margins could be negatively affected.

Competition in the Proximity Store Format

Chedraui's aggressive rollout of its Supercito proximity stores puts it directly against entrenched competitors like Oxxo in Mexico. This convenience store sector is intensely competitive, demanding substantial and ongoing investment to carve out a meaningful market share. Success hinges on smart site selection and pricing strategies that can effectively challenge established brands.

The proximity store segment is characterized by high volume and tight margins, making differentiation crucial. Chedraui faces the challenge of not only attracting new customers but also retaining them against well-known brands that have built strong loyalty. For instance, Oxxo, a dominant player, reported over 20,000 stores across Latin America by the end of 2023, highlighting the scale of competition Chedraui is up against.

- Intense Rivalry: Chedraui's Supercito format directly challenges established convenience store chains, particularly Oxxo, which boasts a significant presence in Mexico.

- Market Saturation: The proximity store segment is highly competitive, making it difficult to gain substantial market share without significant differentiation.

- Investment Demands: Achieving competitive positioning requires continuous investment in store locations, inventory, and pricing strategies to stand out.

- Brand Loyalty: Overcoming existing customer loyalty to established brands like Oxxo is a key hurdle for Supercito's success.

Sustainability Performance Lags Behind Peers

Grupo Comercial Chedraui's sustainability performance currently trails its competitors, especially in crucial areas such as governance, strategy, ecosystem protection, and social equity. This underperformance can translate into tangible risks, including potential non-compliance with emerging environmental regulations and increased pressure from investors who are increasingly prioritizing Environmental, Social, and Governance (ESG) factors. Furthermore, a weaker sustainability profile might alienate a growing segment of consumers who favor brands demonstrating a commitment to responsible business practices.

For instance, while specific comparative ESG scores for 2024 and early 2025 are still being finalized across the industry, preliminary reports from late 2023 indicated that Chedraui's scores in certain ESG categories were below the median for large retail operators in Latin America. This gap highlights a need for strategic improvements in how the company integrates sustainability into its core operations and reporting.

- Governance and Strategy: Chedraui's approach to integrating sustainability into its long-term business strategy and corporate governance structures is perceived as less robust compared to industry leaders.

- Ecosystems and Biodiversity: The company's initiatives and performance related to protecting natural ecosystems and biodiversity are areas where it lags behind peer benchmarks.

- Social Inclusion: Efforts in promoting social inclusion, fair labor practices, and community engagement are also noted as areas needing enhancement to meet evolving stakeholder expectations.

Chedraui's operational efficiency is hampered by the substantial costs associated with its transition to the new Rancho Cucamonga Distribution Center. These one-time expenses directly impacted its consolidated net income and gross margin in recent quarters, with first quarter 2024 earnings per share being reduced by approximately $0.02 due to these costs.

Preview the Actual Deliverable

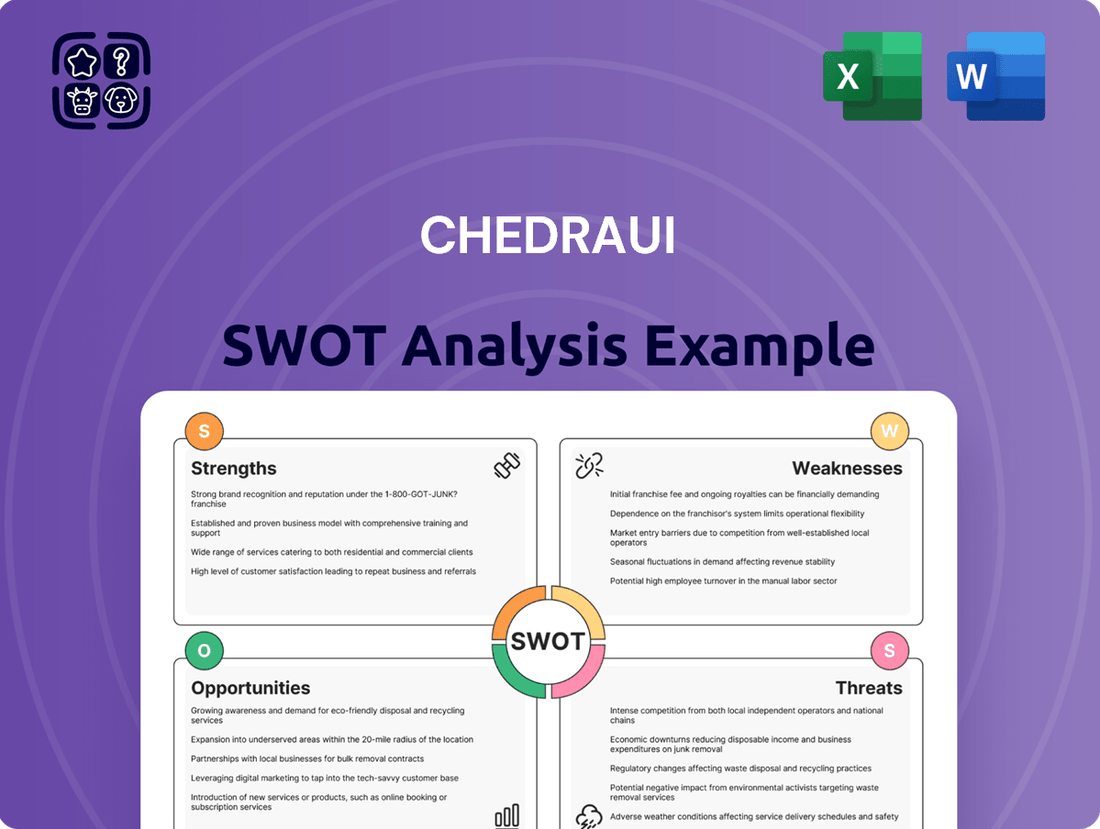

Chedraui SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing the key insights into Chedraui's strategic position. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

Opportunities

Mexico's e-commerce market is booming, with projections indicating continued strong growth through 2025. This expansion, fueled by rising smartphone adoption and improved internet access, offers Chedraui a prime opportunity to bolster its digital presence and omnichannel strategies. By investing in user-friendly online platforms and seamless integration between its physical stores and digital channels, Chedraui can capture a larger share of this expanding market.

Chedraui's U.S. banner, including El Super and Fiesta Mart, has demonstrated robust performance with positive same-store sales growth and enhanced customer foot traffic. This momentum suggests a strong reception to their strategy in the U.S. market.

By continuing to emphasize a wide selection of fresh goods at attractive price points, coupled with ongoing store modernization, Chedraui is well-positioned to deepen its penetration within the U.S. Hispanic consumer base and attract a broader customer demographic.

Chedraui's extensive 'Mi Chedraui' loyalty program, boasting millions of active members, provides a treasure trove of customer data. In 2024, the program's growth continued, with a significant increase in digital engagement, allowing for more granular tracking of purchasing behaviors and preferences.

By employing sophisticated data analytics, Chedraui can craft hyper-personalized marketing campaigns and product recommendations. This data-driven approach, already showing positive impacts in pilot programs, is projected to boost conversion rates by an estimated 15-20% in key segments by late 2025, directly translating to increased sales and deeper customer loyalty.

Optimization and Efficiency Gains from New Distribution Centers

The integration of the RCDC in California is a significant opportunity for Chedraui, poised to unlock substantial operational efficiencies. This strategic move is anticipated to further reduce transition costs, a process that has already shown positive results, and pave the way for the gradual realization of planned improvements across its U.S. operations. The company expects these enhancements to translate into tangible benefits, potentially boosting EBITDA margins for its American retail banners.

Maximizing the utilization of this new distribution infrastructure presents a clear path to significant cost savings. By streamlining operations and optimizing logistics, Chedraui can achieve a more efficient supply chain, which is critical in the competitive retail landscape. This focus on efficiency is not just about cutting expenses; it’s about enhancing overall performance and competitiveness.

- Cost Reduction: Continued reduction in transition costs from RCDC integration, contributing to improved profitability.

- Operational Efficiency: Realization of planned operational benefits, leading to a more streamlined supply chain.

- Margin Improvement: Potential for enhanced EBITDA margins within Chedraui's U.S. retail segments as efficiencies are fully captured.

Capitalizing on Favorable Mexican Retail Market Trends

Mexico's retail sector presents a significant opportunity, driven by a burgeoning middle class and increasing urbanization. This trend is expected to continue, with projections indicating robust growth through 2033. Chedraui is well-positioned to benefit from these favorable macroeconomic conditions.

To fully capitalize on this, Chedraui can focus on several key strategies:

- Strategic Store Expansion: Increase physical presence in high-growth urban centers and emerging markets within Mexico.

- Product Assortment Optimization: Tailor product offerings to align with the evolving preferences and purchasing power of the Mexican consumer.

- Investment in High-Potential Regions: Allocate resources to geographic areas demonstrating the strongest demographic and economic growth indicators.

- Leveraging Digital Channels: Enhance e-commerce capabilities to capture a larger share of the digitally-savvy consumer base.

Chedraui's robust performance in the U.S. market, particularly with banners like El Super and Fiesta Mart, presents a significant opportunity for continued growth. By focusing on fresh offerings and competitive pricing, Chedraui can further solidify its appeal to the growing Hispanic consumer base and attract a wider demographic. The company's substantial loyalty program, 'Mi Chedraui', offers invaluable data insights, which, when leveraged through advanced analytics, can drive personalized marketing and boost conversion rates, potentially by 15-20% in key segments by late 2025.

The ongoing integration of the RCDC in California is poised to unlock substantial operational efficiencies, leading to reduced transition costs and potential EBITDA margin improvements in its U.S. operations. This streamlined supply chain, a direct result of optimized logistics and infrastructure, is critical for enhancing overall performance and competitiveness in the dynamic retail landscape.

Mexico's expanding middle class and increasing urbanization, projected to continue through 2033, create a fertile ground for Chedraui's expansion. Strategic store growth in high-potential urban centers, tailored product assortments, and enhanced digital capabilities will allow Chedraui to capitalize on these favorable macroeconomic trends.

| Opportunity | Description | Potential Impact |

| E-commerce Growth | Leveraging Mexico's booming e-commerce market through enhanced digital platforms and omnichannel strategies. | Capture larger market share, increased sales, deeper customer loyalty. |

| U.S. Market Penetration | Capitalizing on strong performance of U.S. banners (El Super, Fiesta Mart) by emphasizing fresh goods and competitive pricing. | Increased customer foot traffic, deeper penetration of Hispanic consumer base and broader demographics. |

| Data Monetization | Utilizing the 'Mi Chedraui' loyalty program data for hyper-personalized marketing and product recommendations. | Projected 15-20% boost in conversion rates by late 2025, driving sales and loyalty. |

| RCDC Integration Efficiencies | Realizing operational efficiencies and cost savings from the new distribution infrastructure in California. | Potential EBITDA margin improvements in U.S. retail segments, reduced operational costs. |

| Mexican Market Expansion | Benefiting from Mexico's growing middle class and urbanization through strategic store expansion and digital channel enhancement. | Robust growth, increased market share in high-potential regions. |

Threats

Chedraui operates in a fiercely competitive retail landscape across both Mexico and the United States. Established giants like Walmart, Soriana in Mexico, and Costco, with their significant market presence and aggressive pricing strategies, pose a constant challenge. This environment necessitates Chedraui to constantly innovate and manage costs effectively to avoid margin erosion and retain its customer base.

Economic slowdowns and persistent inflation pose significant threats to Chedraui's performance. For instance, in 2023, while Mexico's economy showed some growth, inflation remained a concern, impacting purchasing power. A substantial economic downturn in either Mexico or the United States could lead to reduced consumer spending, particularly on non-essential goods, thereby affecting Chedraui's sales volumes and overall profitability.

Global supply chain vulnerabilities remain a significant threat. For instance, in early 2024, ongoing shipping disruptions in the Red Sea led to increased transit times and freight costs for many retailers, potentially impacting Chedraui's inventory management and product sourcing.

Geopolitical tensions, including trade policy shifts, could further exacerbate these issues. Changes to agreements like the USMCA might influence import costs and the availability of certain goods, directly affecting Chedraui's operational expenses and product assortment.

These disruptions can lead to higher operational costs due to increased shipping fees and potential inventory shortages. Ultimately, this could translate into higher prices for consumers or reduced product availability, impacting customer satisfaction and Chedraui's market position.

Evolving Consumer Preferences and Digital Disruption

Chedraui faces a significant threat from rapidly evolving consumer preferences, particularly the surge in online shopping and the demand for highly personalized customer journeys. Failure to adapt quickly to these shifts can alienate shoppers.

The company must invest heavily in e-commerce capabilities and cutting-edge retail technologies to avoid losing ground to nimbler competitors. For instance, global e-commerce sales are projected to reach $8.1 trillion by 2024, highlighting the critical importance of a strong digital presence.

- Increased Competition: Agile online retailers and digitally native brands are capturing market share.

- Digital Transformation Lag: Slow adoption of new technologies can make Chedraui seem outdated.

- Personalization Gap: Inability to offer tailored experiences may drive customers to competitors.

- Investment Needs: Significant capital is required for e-commerce infrastructure and innovative solutions.

Regulatory Changes and Compliance Risks

Chedraui faces significant threats from evolving regulatory landscapes in both Mexico and the United States. Changes in government policies, labor laws, or environmental standards can directly impact operational expenses and require substantial capital outlays for compliance. For example, the growing emphasis on sustainability and stricter environmental regulations, particularly in the U.S. market where Chedraui operates a significant portion of its business, could necessitate costly overhauls of supply chain practices and reporting mechanisms.

These regulatory shifts can also introduce compliance risks, potentially leading to fines or operational disruptions if not adequately addressed. For instance, new data privacy regulations, like those being considered or implemented in various jurisdictions, could require significant investments in IT infrastructure and data management protocols. In 2024, the retail sector, in general, has seen increased scrutiny on labor practices and wage laws, which could affect Chedraui's cost structure if new mandates are introduced.

- Increased operational costs due to new environmental regulations, potentially impacting Chedraui's sustainability initiatives and reporting.

- Compliance risks associated with evolving labor laws in Mexico and the U.S., affecting wage structures and employment practices.

- Potential for significant investments in technology and data management to meet new data privacy and security standards.

Intensified competition from established players and agile online retailers presents a significant threat, potentially eroding market share and margins. Chedraui's ability to adapt to rapidly evolving consumer preferences, particularly the demand for seamless digital experiences and personalization, is crucial. Failure to invest adequately in e-commerce and technology could lead to a competitive disadvantage, especially as global e-commerce sales are projected to reach $8.1 trillion by 2024.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Chedraui's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic perspective.