Chedraui Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chedraui Bundle

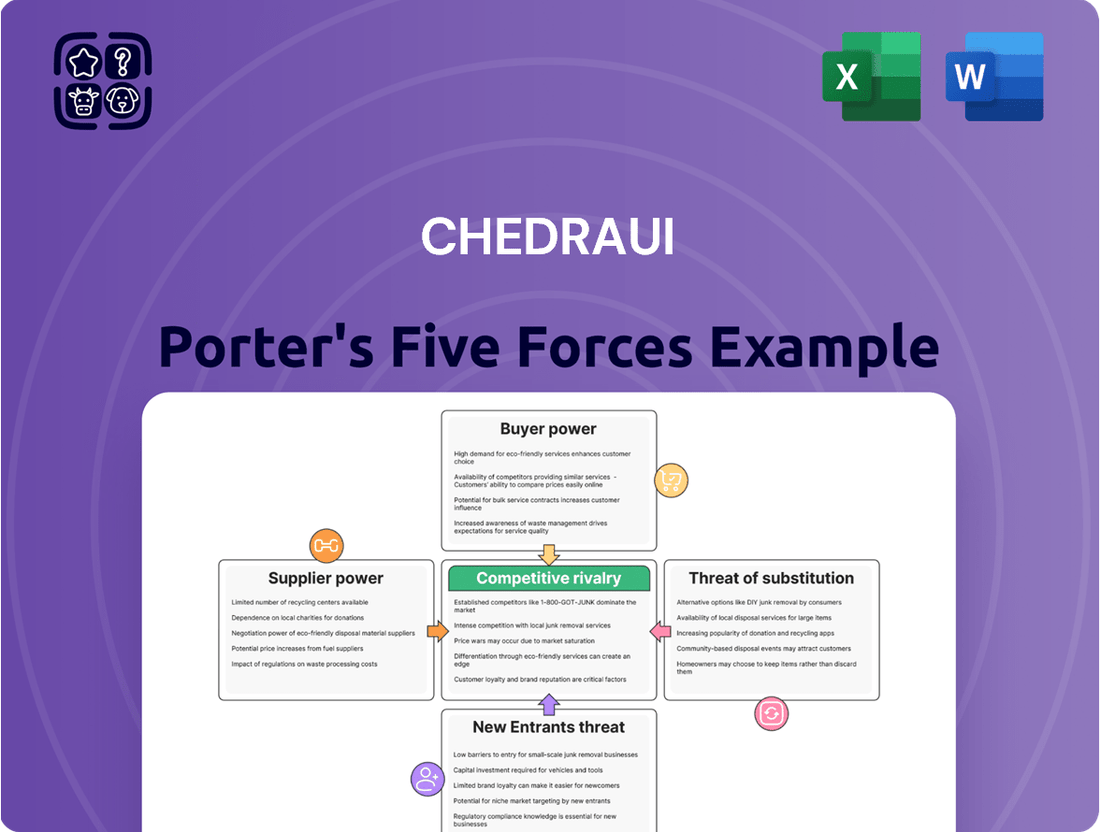

Chedraui faces a dynamic retail landscape shaped by intense rivalry and significant buyer power, as detailed in our Porter's Five Forces analysis. Understanding these forces is crucial for navigating the competitive pressures and identifying strategic opportunities within the grocery sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chedraui’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chedraui's extensive product range, encompassing everything from everyday groceries to electronics and clothing, naturally leads to a very diverse supplier network. This broad base of suppliers generally weakens the leverage of any individual supplier because Chedraui can often secure comparable products from alternative sources, particularly for common items like basic food staples.

For instance, in 2024, Chedraui's robust private label program further diversifies its sourcing, allowing it to negotiate more favorable terms with branded suppliers by having in-house alternatives readily available. This strategy is crucial in mitigating supplier power, especially in categories where brand loyalty is less pronounced.

Chedraui's bargaining power with its suppliers can be influenced by the concentration of suppliers for specific, unique product categories. For instance, if Chedraui sources a significant portion of its high-end electronics or specialized apparel from a limited number of dominant brands, those suppliers would possess greater leverage. This concentration can lead to less favorable terms for Chedraui if they are heavily reliant on these few key vendors for critical inventory, potentially driving up the cost of goods sold.

Chedraui faces varying supplier power across its product lines. For many staple goods, switching suppliers is relatively straightforward and inexpensive, giving Chedraui leverage. However, in areas like private label brands or products requiring specialized manufacturing processes, suppliers can exert more influence due to the higher costs and complexities involved in finding and onboarding alternatives.

The integration of suppliers into Chedraui's operations plays a crucial role in supplier power. When suppliers have developed proprietary systems or exclusive partnerships that are deeply embedded within Chedraui's supply chain, the cost and disruption of changing suppliers increase significantly. This can range from the effort to re-engineer logistics to the loss of unique product offerings that resonate with customers.

Supplier Power 4

The bargaining power of suppliers for Chedraui is generally moderate, with a key consideration being the threat of forward integration. For the vast majority of Chedraui's suppliers, particularly those providing everyday food items and general merchandise, the prospect of bypassing Chedraui to sell directly to consumers is unlikely due to the significant investment and infrastructure required for retail operations. This limits their leverage in price negotiations.

However, for suppliers of more specialized or private-label brands, the potential for them to establish their own direct-to-consumer sales channels, perhaps through e-commerce or dedicated physical stores, could increase their bargaining power. This is because they have a more unique offering that consumers might seek out directly, giving them more leverage in discussions regarding pricing and terms with Chedraui.

In 2024, Chedraui's extensive supplier network, especially for high-volume grocery items, means that many suppliers are reliant on Chedraui's distribution and customer reach. This dependency often keeps their individual power in check. For example, a major dairy supplier, while essential, typically has numerous other retail outlets to sell to, reducing their ability to dictate terms to a large retailer like Chedraui.

- Forward Integration Threat: Generally low for most suppliers of staple goods, but a potential concern for specialized or private-label brands.

- Supplier Dependence: Many suppliers, especially for high-volume items, depend on Chedraui's market access, limiting their individual bargaining power.

- Market Dynamics: The sheer scale of Chedraui's operations means it can often negotiate favorable terms due to bulk purchasing power.

Supplier Power 5

Chedraui's significant purchasing volume often grants it considerable bargaining power with its suppliers, especially those who rely heavily on the retailer for a substantial portion of their sales. For instance, in 2023, Chedraui's total revenue reached approximately MXN 202,720 million, indicating the scale of its operations and its importance as a client. This scale allows Chedraui to negotiate favorable terms, pricing, and delivery schedules.

However, the power dynamic shifts when dealing with very large, globally recognized brands or specialized suppliers whose products are unique and in high demand. For these suppliers, Chedraui might represent a smaller percentage of their overall business, diminishing Chedraui's individual leverage. This means Chedraui must carefully balance its purchasing power with the need to maintain strong relationships with all its suppliers to ensure a consistent and diverse product offering.

- Customer Importance: Chedraui's substantial revenue, exceeding MXN 202 billion in 2023, makes it a critical customer for many suppliers.

- Leverage with Smaller Suppliers: For smaller or specialized suppliers, Chedraui's large orders constitute a significant revenue stream, enhancing Chedraui's negotiating position.

- Reduced Power with Global Brands: Chedraui's influence is lessened with dominant global suppliers who have diversified customer bases.

- Strategic Sourcing: Chedraui must strategically manage supplier relationships to secure competitive pricing and product availability across its diverse product categories.

Chedraui's bargaining power with suppliers is generally moderate, largely due to its immense purchasing volume. For instance, in 2024, its extensive network of stores and robust supply chain allow it to negotiate favorable terms, particularly with suppliers of high-volume grocery items. Many of these suppliers depend significantly on Chedraui's market access, which inherently limits their individual leverage.

However, this power is diluted when dealing with dominant global brands or suppliers of niche, proprietary products. For these entities, Chedraui might represent a smaller fraction of their total sales, diminishing Chedraui's ability to dictate terms. The threat of forward integration by suppliers is low for most, but a growing concern for those with unique private-label offerings who could potentially develop direct-to-consumer channels.

| Factor | Impact on Chedraui's Supplier Bargaining Power | Supporting Data/Observation (2024 Focus) |

|---|---|---|

| Purchasing Volume | High | Chedraui's substantial revenue (MXN 202,720 million in 2023) makes it a key client for many suppliers. |

| Supplier Concentration (for specific goods) | Moderate to High (for niche items) | Reliance on a few dominant brands for electronics or specialized apparel can increase supplier leverage. |

| Availability of Substitutes | High (for staples) | Chedraui's diverse sourcing and private label programs offer alternatives for common goods. |

| Forward Integration Threat | Low (generally) | Most suppliers lack the infrastructure for direct-to-consumer retail, limiting their ability to bypass Chedraui. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Chedraui's grocery and retail operations.

Instantly identify and address competitive threats with a visual breakdown of Chedraui's market landscape, simplifying complex strategic challenges.

Customers Bargaining Power

Chedraui's customers, particularly those purchasing everyday necessities like groceries, exhibit significant price sensitivity. This characteristic directly translates into robust bargaining power, as consumers actively seek out the most advantageous prices and deals. Consequently, Chedraui faces continuous pressure to ensure its pricing remains competitive across its broad product range.

In 2023, Chedraui reported total revenue of MXN 257,938 million, highlighting the sheer volume of transactions and the importance of maintaining customer loyalty through attractive pricing strategies. The company's ability to offer value is a key factor in retaining this large customer base.

The bargaining power of customers for Chedraui is significantly high due to the sheer number of alternatives available in Mexico. Consumers have a wide array of choices, from other major supermarket chains like Walmart and Soriana to smaller specialty stores and the rapidly growing online retail sector. This abundance of options means customers can easily switch if they find better prices or quality elsewhere, putting pressure on Chedraui to remain competitive.

In 2024, the Mexican retail market is characterized by robust competition, with Chedraui facing direct challenges from both domestic and international players. For instance, Walmart de México y Centroamérica reported significant sales growth in early 2024, demonstrating the ongoing consumer demand for value and convenience across the sector. This competitive environment directly translates to increased customer leverage, as they can readily compare offerings and switch their spending based on price, promotions, and product availability.

Customers today have an unprecedented ability to research prices, product quality, and ongoing promotions across a wide range of retailers. This ease of access, fueled by online platforms, social media, and comparison applications, significantly empowers shoppers. For Chedraui, this means they must maintain a high degree of transparency and competitiveness in their pricing strategies and how they present their products to attract and retain customers.

In 2023, for instance, online retail sales in Mexico, Chedraui's primary market, continued their upward trajectory, with e-commerce penetration reaching approximately 12% of total retail sales, according to Statista. This digital shift means consumers can easily compare Chedraui's offerings with competitors, directly influencing their purchasing decisions and Chedraui's market position.

Bargaining Power of Customers 4

The bargaining power of customers for Chedraui is significant, primarily due to low switching costs in the retail grocery sector. Consumers can easily shift their purchases between Chedraui and its competitors for everyday items without incurring substantial financial or practical penalties.

This ease of switching forces Chedraui to remain competitive on price, quality, and customer experience to retain shoppers. For instance, in Mexico, where Chedraui has a strong presence, the competitive landscape includes numerous local and international grocery chains, intensifying this pressure.

Chedraui's ability to mitigate this power relies on building customer loyalty through various strategies:

- Loyalty Programs: Offering rewards and discounts can incentivize repeat business.

- Private Label Brands: Developing unique store brands provides differentiation and perceived value.

- Customer Service: Superior in-store experiences and convenience factors can foster loyalty.

- Omnichannel Presence: Integrating online and physical store offerings can enhance customer convenience and accessibility.

Bargaining Power of Customers 5

While individual customer transactions with Chedraui might seem small, the collective purchasing power of its vast customer base is substantial. This aggregate demand significantly influences Chedraui's pricing and product strategies.

Large corporate clients or wholesale buyers, though fewer in number, can exert more direct pressure due to their significant order volumes. However, Chedraui's success hinges on catering to millions of individual households, whose combined spending power ultimately shapes market dynamics.

- Aggregate Demand: Chedraui serves millions of customers, making their collective spending a powerful force.

- Price Sensitivity: Customers can switch to competitors if prices are perceived as too high, limiting Chedraui's pricing flexibility.

- Bulk Buyers: Large institutional buyers can negotiate better terms due to their volume.

- Information Availability: Customers have access to price comparisons and product information, increasing their bargaining power.

Chedraui's customers wield considerable bargaining power due to the highly competitive retail landscape in Mexico, characterized by numerous alternatives from major players like Walmart and Soriana, as well as a growing online sector. This ease of access to comparable products and pricing, amplified by readily available online information and comparison tools, compels Chedraui to maintain aggressive pricing and strong value propositions to retain its large customer base.

The sheer volume of individual transactions, coupled with low switching costs for everyday necessities, means that customer price sensitivity directly impacts Chedraui's profitability and strategic decisions. For instance, in 2023, Chedraui's revenue of MXN 257,938 million underscores the importance of appeasing millions of price-conscious shoppers who can easily shift their spending based on promotions or perceived value.

In 2024, the ongoing expansion of e-commerce, which accounted for approximately 12% of total retail sales in Mexico by 2023, further empowers consumers by facilitating effortless price and quality comparisons across all available retailers. This digital transparency significantly enhances customer leverage, forcing Chedraui to continuously innovate its offerings and pricing strategies to stay competitive.

| Factor | Impact on Chedraui | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Number of Competitors | High Bargaining Power | Mexico's retail market includes major players like Walmart de México y Centroamérica, Soriana, and numerous smaller retailers. |

| Switching Costs | High Bargaining Power | Low for everyday grocery items; customers can easily switch between stores for similar products. |

| Information Availability | High Bargaining Power | Online price comparison tools and social media provide consumers with extensive product and price data. |

| Price Sensitivity | High Bargaining Power | Chedraui's 2023 revenue of MXN 257,938 million reflects a large customer base sensitive to price and promotions. |

| Online Retail Growth | High Bargaining Power | E-commerce penetration reached ~12% of Mexican retail sales in 2023, increasing consumer options and price transparency. |

What You See Is What You Get

Chedraui Porter's Five Forces Analysis

This preview showcases the comprehensive Chedraui Porter's Five Forces Analysis, detailing the competitive landscape of the grocery retail industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights into Chedraui's strategic positioning.

Rivalry Among Competitors

The Mexican retail landscape is intensely competitive, featuring giants like Walmart de México, Soriana, and La Comer, alongside many regional players. This crowded market means Chedraui constantly battles for customer attention and market share.

The traditional retail sector in Mexico operates within a mature market, experiencing a moderate growth rate. This environment naturally fuels intense competition among established players like Chedraui, as they vie for a larger slice of the existing market rather than capitalizing on significant overall expansion. This dynamic forces Chedraui to continuously innovate its pricing strategies, promotional offers, and store formats to maintain and grow its market share.

Competitive rivalry within the supermarket and hypermarket sector, where Chedraui operates, is intense. Differentiating products is tough because many items are essentially commodities. In 2024, Chedraui, like its peers, focuses on non-price factors to stand out.

Chedraui's strategy to combat this rivalry involves leveraging prime store locations, enhancing the overall shopping experience, and developing strong private label brands. These elements, combined with excellent customer service and a wide array of products and services, including financial solutions, are key differentiators in a crowded market.

Competitive Rivalry 4

The retail sector, particularly for large-scale operations like Chedraui, is characterized by substantial fixed costs. These include investments in prime real estate, extensive inventory management systems, and complex logistics networks. These significant upfront and ongoing expenses create high exit barriers, making it difficult for companies to leave the market, even if they are struggling financially.

These high exit barriers mean that even less successful competitors tend to persist, leading to sustained and intense rivalry. Companies remain in the market to try and recoup their investments, intensifying competition as they fight for market share and operational viability. This dynamic can suppress profitability across the industry.

For instance, in 2024, the grocery retail sector in Mexico, a key market for Chedraui, continued to see aggressive pricing strategies. Major players often engaged in promotional activities and price matching to attract and retain customers, a direct consequence of the need to cover high operational costs and the difficulty of exiting the market.

- High Fixed Costs: Significant investments in real estate, inventory, and logistics create substantial financial commitments for retailers like Chedraui.

- Exit Barriers: The difficulty and cost associated with exiting the retail market compel even underperforming companies to remain, fostering continued competition.

- Sustained Rivalry: The presence of persistent competitors, driven by the need to recover costs, leads to ongoing price wars and promotional battles within the industry.

- Market Dynamics: In 2024, Mexican grocery retail experienced intense competition with frequent price adjustments and promotions as companies navigated these high exit barriers.

Competitive Rivalry 5

Competitive rivalry in the Mexican retail sector is intense, with Chedraui facing significant pressure from both domestic and international players. Walmart, a major global retailer, views Mexico as a key market for expansion, leading to substantial investments in pricing and store development.

The strategic importance of Mexico for these large companies fuels aggressive competition. Companies are prepared to engage in price wars and rapid expansion to capture market share and solidify their long-term presence.

- High Stakes: Mexico is a critical growth market for major retailers like Chedraui and Walmart.

- Aggressive Investment: Companies are investing heavily in pricing, expansion, and technology.

- Price Wars: The intensity of competition often leads to price battles to attract consumers.

- Market Share Focus: The primary goal is to secure and expand market share in this dynamic environment.

The intense competitive rivalry in Mexico's retail sector, particularly for Chedraui, is driven by the presence of formidable players like Walmart de México and Soriana. These giants, along with numerous regional competitors, create a crowded marketplace where gaining and retaining market share demands constant innovation in pricing, promotions, and store experience. In 2024, this rivalry is further intensified by high fixed costs and significant exit barriers, compelling companies to remain competitive even in challenging conditions.

| Competitor | Market Presence (Mexico) | 2023 Revenue (Approx. MXN Billions) | Key Strategy Focus |

|---|---|---|---|

| Chedraui | Extensive national presence, growing in the US | ~270 | Private labels, store experience, financial services |

| Walmart de México (Walmex) | Dominant market share across formats | ~800 | Everyday low prices, supply chain efficiency, omnichannel |

| Soriana | Strong presence, particularly in Northern Mexico | ~170 | Loyalty programs, private labels, diverse store formats |

SSubstitutes Threaten

The threat of substitutes for Chedraui is significant, primarily stemming from the expanding landscape of alternative shopping channels and formats. Online grocery delivery services, for instance, offer unparalleled convenience, allowing consumers to purchase goods without leaving their homes. In 2024, the global online grocery market continued its robust growth trajectory, with projections indicating a further increase in market share as more consumers embrace digital shopping experiences.

Beyond online options, specialized convenience stores and farmers' markets present distinct competitive pressures. Convenience stores cater to immediate needs with a focused product selection, while farmers' markets appeal to consumers seeking fresh, locally sourced products. Direct-to-consumer (DTC) models and subscription box services also chip away at traditional retail by offering curated experiences or direct access to specific product categories, potentially bypassing Chedraui's hypermarket model.

Shifting consumer preferences, like a growing demand for locally sourced, fresh produce or a preference for online grocery delivery, present a substantial threat of substitutes for Chedraui. For instance, the rise of direct-to-consumer farm boxes, which saw significant growth in 2024, bypasses traditional grocery store models entirely.

If consumers increasingly value the convenience of digital platforms and curated selections over the traditional brick-and-mortar supermarket experience, Chedraui's established physical footprint could face challenges. Reports from 2024 indicated that online grocery sales continued to expand, capturing a larger share of the overall food retail market.

For Chedraui's financial services, like money transfers and credit cards, the threat of substitutes is quite significant. Customers have a wide array of choices, from established banks to newer fintech companies and online payment systems. This means Chedraui faces stiff competition from many different angles, as these alternatives often provide similar or even more tailored financial solutions.

In 2024, the digital payment landscape continued to expand rapidly. For instance, the global digital payments market was projected to reach over $15 trillion by the end of 2024, showcasing the vast number of alternative providers and platforms available to consumers. This growth directly impacts Chedraui's ability to retain customers in its financial services offerings, as users can easily switch to more convenient or feature-rich alternatives.

Threat of Substitutes 4

The threat of substitutes for Chedraui stems from the fundamental trade-off between quality and price that influences consumer choice. Customers may shift their purchasing habits based on their immediate needs and budget constraints.

For instance, consumers seeking to minimize expenses on everyday items might turn to significantly cheaper discount retailers. Conversely, those prioritizing superior quality or unique products could opt for specialized, high-end boutiques. This dynamic directly impacts Chedraui's position by potentially drawing customers away from its mid-market, broad-assortment strategy. In 2024, the discount grocery sector in Mexico, a key market for Chedraui, continued to see robust growth, with players like Bodega Aurrerá often cited for aggressive pricing on staple goods, presenting a clear substitute for budget-conscious shoppers.

This creates a challenging environment where Chedraui must balance its value proposition. The availability of these alternatives means customers are not locked into Chedraui's offerings and can easily switch if they perceive a better deal elsewhere, either in terms of lower prices or higher perceived value in specialized offerings.

- Price Sensitivity: Consumers may switch to discount grocers for essential items to save money, impacting Chedraui's sales volume.

- Quality Focus: Shoppers seeking premium or niche products might bypass Chedraui for specialized stores, limiting its appeal in certain segments.

- Market Dynamics: The competitive landscape in 2024 showed continued strength in discount retail, indicating a persistent substitute threat for Chedraui's core customer base.

Threat of Substitutes 5

The threat of substitutes for Chedraui is significant, especially with the rise of integrated platforms. For example, meal kit delivery services are directly substituting for traditional grocery shopping, impacting Chedraui's core business. In 2023, the global meal kit delivery market was valued at approximately $15 billion and is projected to grow, indicating a clear shift in consumer behavior away from traditional grocery stores for certain needs.

Furthermore, broad e-commerce platforms that bundle retail with financial services or other conveniences can pull customers away. Imagine a single app where you can order groceries, pay bills, and manage investments – this kind of integrated offering presents a powerful substitute to Chedraui's more segmented approach. Such platforms can offer greater convenience and potentially better pricing through bundled deals, eroding customer loyalty across Chedraui's various business lines.

- Meal Kit Market Growth: The global meal kit delivery market reached an estimated $15 billion in 2023, signaling a substantial substitute for traditional grocery shopping.

- E-commerce Integration: The trend towards comprehensive e-commerce platforms offering diverse goods and financial solutions poses a threat by consolidating customer needs into a single digital experience.

- Convenience Factor: Substitutes often win by offering superior convenience, a key driver for consumers looking to streamline their purchasing habits.

The threat of substitutes for Chedraui is amplified by the increasing availability of specialized retail formats and digital alternatives. Consumers can now easily bypass traditional hypermarkets for niche products or convenience. For instance, the growth of discount retailers in Mexico, like Bodega Aurrerá, intensified in 2024, offering competitive pricing on essential goods, directly substituting Chedraui's value proposition for budget-conscious shoppers.

Furthermore, the expanding digital landscape presents a significant challenge. Online grocery delivery services and direct-to-consumer (DTC) models offer convenience and curated selections, capturing market share from traditional brick-and-mortar stores. In 2024, online grocery sales continued their upward trend, with projections indicating a sustained increase in consumer adoption of digital shopping for food and household items.

For Chedraui's financial services, fintech companies and digital payment platforms offer compelling substitutes. The global digital payments market, projected to exceed $15 trillion by the end of 2024, highlights the vast array of alternative providers. These platforms often provide more streamlined or feature-rich solutions, making it easy for customers to switch from Chedraui's offerings.

Meal kit delivery services also represent a direct substitute for traditional grocery shopping, catering to consumers seeking convenience and pre-portioned ingredients. The global meal kit market's continued growth, valued at approximately $15 billion in 2023, underscores this shift in consumer behavior.

| Substitute Type | Key Characteristics | Impact on Chedraui | 2024 Market Trend Example |

| Discount Retailers | Lower prices, focus on essentials | Price-sensitive customer diversion | Continued growth in Mexico's discount sector |

| Online Grocery Delivery | Convenience, home delivery | Erosion of foot traffic, digital competition | Sustained increase in online grocery sales share |

| Fintech & Digital Payments | Streamlined transactions, innovative features | Competition for financial service customers | Global digital payments market exceeding $15 trillion |

| Meal Kit Services | Convenience, pre-portioned ingredients | Reduced demand for raw ingredients | Global meal kit market valued at ~$15 billion (2023) |

Entrants Threaten

Entering Mexico's large-scale retail sector demands immense capital for land, construction, inventory, and supply chains. For instance, opening a hypermarket can easily cost tens of millions of dollars, a sum that deters many smaller players.

The significant upfront investment acts as a formidable barrier, leaving the market accessible primarily to well-capitalized corporations. This financial hurdle effectively limits the number of new competitors that can realistically challenge established retailers like Chedraui.

Established players like Chedraui enjoy significant economies of scale in purchasing, distribution, and marketing. This allows them to offer competitive pricing and a broader product range, making it challenging for newcomers to match these efficiencies. For instance, Chedraui's extensive store network and strong supplier relationships in 2024 likely translate to lower per-unit costs.

New entrants would face substantial hurdles in achieving comparable cost advantages, impacting their ability to compete on price and product variety. The capital investment required to build a comparable infrastructure and brand recognition is immense, acting as a significant barrier.

Chedraui benefits from significant brand recognition and deep customer loyalty, especially in the Mexican market. This established trust makes it difficult for newcomers to attract and retain customers.

New entrants must invest heavily in marketing and offer exceptionally attractive value propositions to even begin to sway Chedraui's loyal customer base. For instance, in 2023, Chedraui's revenue reached approximately MXN 277.7 billion, underscoring its substantial market presence and the financial barrier for new competitors.

Threat of New Entrants 4

The threat of new entrants for retailers like Chedraui is generally moderate to low. Establishing a strong presence requires significant capital investment and overcoming established operational efficiencies. For instance, securing prime retail locations in competitive markets can be extremely costly and difficult, as many desirable spots are already occupied by established players with long-term leases or ownership.

Newcomers face substantial hurdles in building the necessary infrastructure. Gaining access to prime retail locations, securing efficient logistics, and building reliable supply chain networks are critical for success in retail and represent considerable barriers to entry. Existing players like Chedraui have well-developed networks and long-standing relationships that are difficult for newcomers to replicate quickly. For example, in 2024, the average cost to open a new supermarket in a major metropolitan area can easily run into millions of dollars, encompassing real estate, inventory, and staffing.

- Capital Requirements: High initial investment needed for store setup, inventory, and marketing.

- Brand Loyalty: Established brands like Chedraui benefit from customer trust and repeat business, making it hard for new entrants to gain market share.

- Economies of Scale: Larger retailers achieve lower per-unit costs through bulk purchasing and efficient operations, a significant advantage over smaller new entrants.

- Distribution Channels: Access to established and efficient distribution networks is crucial and often controlled by existing players.

Threat of New Entrants 5

Government policies and regulations present a significant barrier for new entrants in Mexico's retail sector. Zoning laws, stringent licensing requirements, and complex labor regulations can significantly increase the initial investment and time-to-market for aspiring businesses. For instance, navigating import/export regulations for merchandise adds another layer of complexity and cost, deterring smaller or less experienced players.

These regulatory hurdles contribute to the overall cost of entry, making it more challenging for new competitors to challenge established players like Chedraui. The need for specialized legal and compliance expertise further elevates the financial commitment required to establish a presence. This environment favors companies with the resources and experience to manage these complexities effectively.

Key regulatory considerations for new entrants in Mexico include:

- Licensing and Permits: Obtaining necessary operating licenses and permits can be a lengthy and bureaucratic process.

- Labor Laws: Compliance with Mexican labor laws, including minimum wage, benefits, and hiring practices, requires careful attention.

- Import/Export Regulations: Navigating customs duties, tariffs, and documentation for imported goods is crucial for retailers stocking international products.

- Zoning and Land Use: Local zoning ordinances can restrict the location and size of retail establishments.

The threat of new entrants for Chedraui in Mexico is generally considered moderate to low. The sector demands substantial capital for store development, inventory, and establishing efficient supply chains, with hypermarket openings easily costing tens of millions of dollars. Furthermore, established players benefit from significant economies of scale in purchasing and distribution, allowing for competitive pricing that newcomers find difficult to match.

Brand loyalty and established customer trust present another considerable barrier, requiring new entrants to invest heavily in marketing and offer compelling value propositions to gain market share. For instance, Chedraui's 2023 revenue of approximately MXN 277.7 billion highlights its strong market position. Securing prime retail locations is also a challenge, as many desirable spots are already occupied by established retailers.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment for stores, inventory, and marketing. | Deters smaller players; favors well-capitalized corporations. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and efficient operations. | Makes it hard for newcomers to compete on price and product variety. |

| Brand Loyalty | Established customer trust and repeat business. | Requires significant marketing investment to attract and retain customers. |

| Distribution Channels | Access to established, efficient logistics and supply networks. | Difficult for newcomers to replicate existing players' networks. |

Porter's Five Forces Analysis Data Sources

Our Chedraui Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Chedraui's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific research from market intelligence firms and analysis of competitor activities to provide a robust understanding of the retail landscape.