Chedraui Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chedraui Bundle

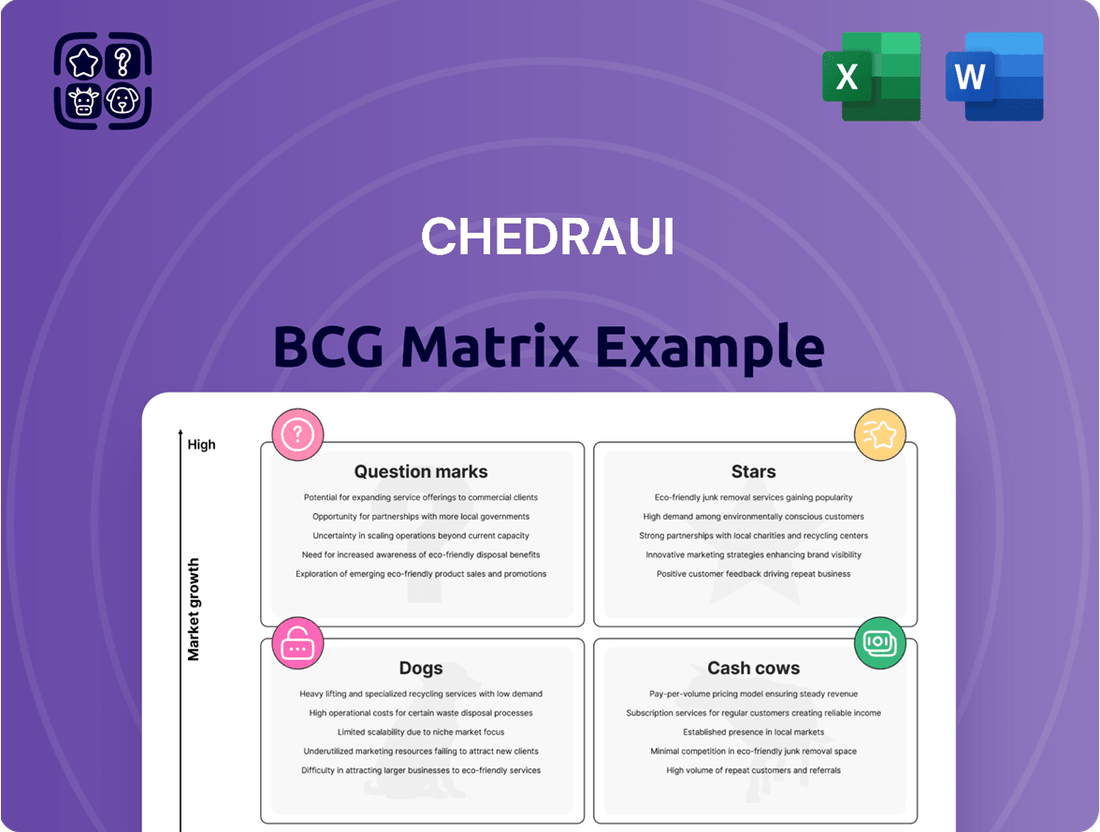

Understanding Chedraui's product portfolio through the BCG Matrix is crucial for strategic decision-making. This powerful tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market share and growth potential.

Unlock the full potential of Chedraui's strategic positioning by purchasing the complete BCG Matrix. Gain detailed insights into each product's quadrant, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable intelligence within the full Chedraui BCG Matrix. This comprehensive report provides the strategic clarity needed to optimize your business and capitalize on market opportunities.

Stars

Chedraui's performance in Mexico is truly impressive, with its same-store sales growth outperforming the ANTAD benchmark for an incredible twenty consecutive quarters. This consistent win streak shows they're not just holding their ground but actively gaining market share. For instance, in the first quarter of 2024, Chedraui reported a 9.5% increase in same-store sales in Mexico, significantly higher than the industry average.

This sustained expansion is a direct result of Chedraui's sharp focus on its customers. By offering competitive prices and a well-curated product selection, they're clearly resonating with shoppers, leading to increased loyalty and a stronger position in the Mexican retail market.

Supercito's aggressive expansion is a cornerstone of Chedraui's growth strategy. The company plans to open 130 new Supercito stores in Mexico during 2025, building on the 100 new locations opened in 2024. This rapid rollout demonstrates a clear intent to capture significant market share in the burgeoning proximity store segment.

Chedraui's e-commerce channel is a clear Star in its BCG matrix, demonstrating robust growth. Its market penetration climbed from 3.2% to 3.9% in Q2 2025, signaling strong customer adoption of online grocery shopping.

The company is strategically expanding its digital footprint by partnering with key third-party platforms such as Rappi and Mercado Libre. These collaborations allow Chedraui to reach a wider customer base and accommodate varied online purchasing behaviors.

This aggressive push into digital channels, especially within the booming online grocery sector, firmly establishes e-commerce as a significant driver of Chedraui's future revenue and market share.

'Mi Chedraui' Loyalty Program

The 'Mi Chedraui' loyalty program is a key driver of Chedraui's success in Mexico, showcasing its position as a star in the BCG matrix. This program has achieved impressive market penetration, with 13.3 million members by the first quarter of 2025.

These members are responsible for a substantial 75% of Chedraui's sales in Mexico, highlighting the program's significant contribution to market share. The extensive customer data gathered enables highly targeted promotions and boosts customer loyalty, further solidifying its star status.

- Program Membership: 13.3 million members by Q1 2025.

- Sales Contribution: Accounts for 75% of Mexican sales.

- Strategic Impact: Enhances customer insight and retention.

- BCG Matrix Status: Positions 'Mi Chedraui' as a Star.

El Super and Fiesta Mart Banners (USA)

El Super and Fiesta Mart, key banners within Chedraui's U.S. operations, are demonstrating significant strength. These formats are not only driving overall sales growth but are also consistently showing positive same-store sales trends. This performance highlights their ability to resonate with their target customer base and adapt to market demands.

The robust EBITDA margins achieved by El Super and Fiesta Mart underscore their strong market positioning and operational efficiency. These healthy margins indicate that Chedraui is effectively managing costs while capitalizing on revenue opportunities within their respective segments of the U.S. grocery market. For instance, in 2023, Chedraui's U.S. division, which includes these banners, saw a notable increase in revenue, reflecting the success of their strategies.

Strategic investments, such as the ongoing store remodels for Fiesta Mart, are proving effective in attracting increased customer traffic and boosting profitability. These enhancements aim to improve the shopping experience, which in turn translates to higher sales per store. Chedraui's commitment to modernizing its store portfolio is a clear indicator of its confidence in the long-term potential of these banners.

- Strong Same-Store Sales: El Super and Fiesta Mart consistently report positive same-store sales growth, indicating healthy customer demand.

- Robust EBITDA Margins: Both banners contribute significantly to Chedraui's profitability through efficient operations and strong market presence.

- Strategic Store Remodels: Investments in updating Fiesta Mart locations are enhancing customer experience and driving traffic.

- U.S. Division Growth: Chedraui's U.S. segment, driven by banners like El Super and Fiesta Mart, experienced substantial revenue growth in 2023.

Chedraui's e-commerce operations are performing exceptionally well, solidifying their position as a Star in the BCG matrix. The company's market penetration in online grocery shopping grew from 3.2% to 3.9% by the second quarter of 2025, demonstrating strong customer adoption.

Strategic partnerships with platforms like Rappi and Mercado Libre are expanding Chedraui's digital reach, catering to diverse online purchasing habits. This aggressive expansion into digital channels, particularly in the rapidly growing online grocery sector, marks e-commerce as a crucial revenue and market share driver for Chedraui's future.

The 'Mi Chedraui' loyalty program is another clear Star, boasting 13.3 million members by the first quarter of 2025. This program accounts for a significant 75% of Chedraui's sales in Mexico, underscoring its immense impact on market share and customer retention through data-driven insights and targeted promotions.

El Super and Fiesta Mart in the U.S. are also Stars, consistently achieving positive same-store sales growth and robust EBITDA margins. Strategic investments, such as the ongoing remodels for Fiesta Mart, are enhancing customer experience and driving increased traffic and profitability, as reflected in the U.S. division's substantial revenue growth in 2023.

| Business Unit | BCG Category | Key Performance Indicators |

| E-commerce (Mexico) | Star | Market penetration grew to 3.9% (Q2 2025); Partnerships with Rappi, Mercado Libre |

| Mi Chedraui Loyalty Program | Star | 13.3 million members (Q1 2025); Drives 75% of Mexican sales |

| El Super & Fiesta Mart (U.S.) | Star | Positive same-store sales; Robust EBITDA margins; U.S. revenue growth in 2023 |

What is included in the product

The Chedraui BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

A clear BCG Matrix visualizes Chedraui's portfolio, easing the pain of understanding strategic resource allocation.

Cash Cows

Chedraui's established Mexican hypermarket and supermarket formats are firmly positioned as Cash Cows within its business portfolio. These traditional stores operate in a mature, yet dominant, segment of the Mexican retail landscape, where Chedraui commands a significant and stable market share.

These mature formats are reliable engines of cash generation, consistently delivering substantial profits with predictable, albeit lower, growth rates. For instance, in 2023, Chedraui reported total revenue of MXN 267.7 billion, with its Mexican operations being the primary contributor, underscoring the enduring strength of these established formats.

The robust cash flow generated by these Cash Cows is crucial, acting as the financial backbone that fuels Chedraui's strategic investments in newer, higher-growth ventures, such as its expanding e-commerce presence and international market penetration. This financial stability allows for continued innovation and expansion without jeopardizing the core business.

Chedraui's Real Estate Division operates as a strong cash cow, demonstrating remarkable stability. Its high occupancy rates, hitting 98.3% in Q3 2024, underscore its consistent performance.

This division generates dependable rental income, offering predictable, though moderate, growth. The reliable cash flow it provides is crucial for Chedraui's overall financial health and supports other business ventures.

Chedraui's core grocery and staples product categories hold a significant market share within a mature, low-growth sector. These items are the bedrock of consumer purchasing, driving consistent sales and predictable profit margins for the company.

These foundational products are crucial for generating stable cash flow, providing the financial fuel for Chedraui's other business ventures. For instance, in 2024, grocery and staples sales continued to be the largest revenue driver, demonstrating their enduring importance to the company's financial health.

Overall Chedraui USA Operations (excluding Smart & Final)

Chedraui USA, operating under banners like El Super and Fiesta Mart, is a substantial player in the U.S. grocery sector, notably ranking as the fourth-largest grocer in California. These established operations consistently deliver strong revenue and cash flow, positioning them as a key cash cow for the parent company.

The mature U.S. grocery market presents a stable, albeit competitive, environment for Chedraui's U.S. banners. Their significant market presence ensures a reliable income stream, contributing heavily to the overall financial health of Chedraui’s international portfolio.

- Market Position: Fourth-largest grocery retailer in California.

- Revenue Generation: Generates substantial and consistent revenue.

- Cash Flow: Acts as a significant source of cash for the group.

- Operational Stability: Benefits from a mature and stable market environment.

Mature Supply Chain and Logistics Infrastructure

Chedraui's mature supply chain and logistics infrastructure in Mexico and established U.S. markets represent a significant cash cow. This well-honed network, developed over decades, efficiently handles high sales volumes, ensuring smooth inventory management and distribution.

This operational efficiency directly translates into strong profit margins, allowing Chedraui to consistently generate substantial cash flow from these mature segments. The infrastructure's effectiveness means minimal additional investment is needed to maintain current performance levels in these core areas.

- Optimized Distribution: Chedraui's extensive distribution network is a key asset, facilitating rapid and cost-effective movement of goods.

- Inventory Management: Advanced inventory systems minimize waste and stockouts, contributing to higher operational margins.

- Cost Efficiency: The scale and maturity of the logistics operations allow for significant cost savings, bolstering cash generation.

- Consistent Cash Flow: This segment reliably provides a steady stream of cash, supporting other business initiatives and investments.

Chedraui's established Mexican hypermarket and supermarket formats are firmly positioned as Cash Cows. These traditional stores operate in a mature, yet dominant, segment of the Mexican retail landscape, where Chedraui commands a significant and stable market share.

These mature formats are reliable engines of cash generation, consistently delivering substantial profits with predictable, albeit lower, growth rates. For instance, in 2023, Chedraui reported total revenue of MXN 267.7 billion, with its Mexican operations being the primary contributor, underscoring the enduring strength of these established formats.

The robust cash flow generated by these Cash Cows is crucial, acting as the financial backbone that fuels Chedraui's strategic investments in newer, higher-growth ventures. This financial stability allows for continued innovation and expansion without jeopardizing the core business.

Chedraui's Real Estate Division operates as a strong cash cow, demonstrating remarkable stability. Its high occupancy rates, hitting 98.3% in Q3 2024, underscore its consistent performance.

This division generates dependable rental income, offering predictable, though moderate, growth. The reliable cash flow it provides is crucial for Chedraui's overall financial health and supports other business ventures.

Chedraui's core grocery and staples product categories hold a significant market share within a mature, low-growth sector. These items are the bedrock of consumer purchasing, driving consistent sales and predictable profit margins for the company.

These foundational products are crucial for generating stable cash flow, providing the financial fuel for Chedraui's other business ventures. For instance, in 2024, grocery and staples sales continued to be the largest revenue driver, demonstrating their enduring importance to the company's financial health.

Chedraui USA, operating under banners like El Super and Fiesta Mart, is a substantial player in the U.S. grocery sector, notably ranking as the fourth-largest grocer in California. These established operations consistently deliver strong revenue and cash flow, positioning them as a key cash cow for the parent company.

The mature U.S. grocery market presents a stable, albeit competitive, environment for Chedraui's U.S. banners. Their significant market presence ensures a reliable income stream, contributing heavily to the overall financial health of Chedraui’s international portfolio.

| Business Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Mexican Hypermarkets & Supermarkets | Cash Cow | Dominant market share, mature market, stable revenue | Significant, consistent cash flow |

| Real Estate Division | Cash Cow | High occupancy (98.3% Q3 2024), stable rental income | Reliable income stream, moderate growth |

| Core Grocery & Staples | Cash Cow | Largest revenue driver, mature sector, consistent sales | Foundation for stable cash generation |

| Chedraui USA (El Super, Fiesta Mart) | Cash Cow | 4th largest grocer in California, established presence | Substantial revenue and cash flow |

Full Transparency, Always

Chedraui BCG Matrix

The Chedraui BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after your purchase. This ensures you're acquiring a complete, analysis-ready document without any watermarks or placeholder content. You can confidently expect the same level of detail and professional presentation in the downloadable version, ready for your strategic planning needs.

Dogs

Smart & Final, within the Chedraui portfolio, exhibits characteristics of a 'Dog' in the BCG matrix. Its recent performance highlights a low market share and a challenging growth environment.

In the fourth quarter of 2024, the company saw a slight dip in sales. This was primarily due to a lower average transaction value and a decrease in sales directed towards small businesses, signaling a weakening customer base.

The struggles continued into the second quarter of 2025, with a notable decline in same-store sales. This trend suggests that despite strategic initiatives, Smart & Final is finding it difficult to significantly improve its market position or attract more customers.

Certain Chedraui individual store locations, especially older or smaller formats not aligned with strategic growth initiatives like Supercito, could be classified as Dogs. These locations often show consistent underperformance in sales and profitability, representing a drain on capital and resources without contributing meaningfully to the company's expansion or market position.

Legacy IT systems and outdated operational processes at Chedraui, if not fully addressed by their digital transformation, could be categorized as Dogs. These systems, such as older inventory management software or manual checkout processes, can significantly increase operational costs. For instance, maintaining outdated hardware and software can cost businesses up to 70% more than modern solutions.

Non-Strategic or Underutilized Assets

Non-strategic or underutilized assets within Chedraui might include smaller, niche product lines or regional store formats that consistently show low sales volume or profit margins. These could also encompass underperforming physical locations or distribution centers that are not efficiently utilized. In 2023, Chedraui's overall revenue reached approximately MXN 360.6 billion, with a significant portion driven by its core grocery and retail operations. Identifying and potentially divesting or repurposing these less productive assets is crucial for optimizing capital allocation and management focus.

These assets often represent a drag on financial performance, consuming resources without generating commensurate returns. For instance, if a particular product category, like specialized home goods, consistently accounts for less than 1% of total sales and requires significant inventory management, it could be considered underutilized. The company's strategy typically prioritizes high-volume, high-turnover categories to maximize efficiency and profitability.

- Low-turnover product categories: e.g., specialized electronics or seasonal apparel with minimal sales contribution.

- Underutilized physical assets: Such as vacant retail spaces or warehouses not operating at full capacity.

- Minor business lines: Smaller ventures or subsidiaries that do not align with the company's core retail strategy.

- Assets with low ROI: Investments in projects or divisions that consistently fail to meet profitability targets.

Certain B2B Sales Channels with Declining Demand

Certain B2B sales channels, particularly those serving smaller businesses, may be classified as Dogs within Chedraui's portfolio. For instance, Smart & Final reported lower sales to small businesses in the fourth quarter of 2024. This decline, if coupled with a low market share in this specific segment, signals a potential Dog.

If these B2B channels continue to underperform and revitalization efforts fail to yield positive results, they represent a drain on resources. Companies like Chedraui must carefully evaluate such segments, considering the opportunity cost of continued investment versus divesting or reallocating those resources to more promising areas of the business.

- Declining B2B Demand: Reports of lower sales to small businesses in 4Q 2024 at Smart & Final suggest a potential weakening in this specific B2B segment.

- Low Market Share Indicator: If this B2B channel also holds a low market share within Chedraui's overall operations, it strengthens the classification as a 'Dog'.

- Resource Consumption: Continued investment in underperforming B2B channels that fail to improve can consume valuable resources without generating commensurate returns.

Smart & Final, a part of Chedraui, exemplifies a 'Dog' in the BCG matrix due to its low market share and stagnant growth. Its performance in Q4 2024 showed a sales dip, attributed to reduced average transaction values and fewer sales to small businesses. This trend persisted into Q2 2025 with declining same-store sales, indicating persistent challenges in improving market position.

Certain Chedraui store formats, particularly older or smaller ones not aligned with growth strategies like Supercito, can be classified as Dogs. These locations consistently underperform in sales and profitability, acting as a drain on resources. For example, Chedraui's 2023 revenue was around MXN 360.6 billion, highlighting the importance of optimizing all contributing units.

Legacy IT systems and outdated operational processes at Chedraui, if not fully modernized, also fall into the 'Dog' category. These can significantly increase operational costs, with maintaining old hardware and software potentially costing up to 70% more than newer solutions. Identifying and addressing these underperforming assets is key for Chedraui's capital allocation strategy.

Underperforming B2B sales channels, especially those serving smaller businesses, can also be Dogs. Smart & Final’s Q4 2024 report of lower sales to small businesses, combined with a low market share in this segment, points to this classification. Continued investment in such channels without improvement represents a drain on valuable resources.

| Business Unit/Asset | BCG Category | Market Share | Market Growth | Performance Indicator |

| Smart & Final | Dog | Low | Low | Declining same-store sales (Q2 2025) |

| Older/Smaller Store Formats | Dog | Low | Low | Consistent underperformance in sales/profitability |

| Legacy IT Systems | Dog | N/A | N/A | Increased operational costs (up to 70% higher than modern solutions) |

| Underperforming B2B Channels | Dog | Low | Low | Lower sales to small businesses (Q4 2024) |

Question Marks

The new Rancho Cucamonga Distribution Center (RCDC), a US$120 million investment, commenced operations in the third quarter of 2024 and finalized its transition in May 2025. This facility is positioned as a Question Mark in Chedraui's BCG Matrix due to its substantial investment and high growth potential, yet its full impact on EBITDA margins, projected for 2026, is still unfolding.

Despite the long-term growth prospects and anticipated EBITDA margin improvements by 2026, the RCDC incurred significant transition costs throughout 2024 and early 2025. This investment represents a strategic bet on future efficiency and market expansion, characteristic of a Question Mark, where the outcome of substantial capital outlay remains uncertain until full operational efficiencies are achieved.

Following a period of struggle, Chedraui implemented a new perishable pricing strategy for Smart & Final in the latter half of 2024. This move is designed to boost customer traffic and enhance brand visibility.

This initiative falls into the 'Question Mark' category of the BCG Matrix. It represents a high-growth strategy targeting an asset with a currently low market share. The ultimate impact of this strategy on Smart & Final's performance remains to be seen, although early indicators showed a 1.5% rise in customer traffic in the second quarter of 2025.

Chedraui's ambitious plan to invest over 3.6 billion pesos in opening 16 new branches in Yucatan over the next five years highlights a significant push into new geographic territories. This expansion strategy is characteristic of a 'question mark' in the BCG Matrix, as these regions likely represent a low market share for Chedraui currently.

The substantial investment signals a belief in the future growth potential of Yucatan, aiming to build market share in a potentially untapped or underserved area. Success in these ventures will depend on effective market penetration and achieving profitability, transforming these question marks into stars or cash cows over time.

Developing Financial Service Offerings

Chedraui's financial service offerings, such as money transfers and credit cards, can be viewed as potential question marks within their broader business portfolio. While specific market share and growth figures for these services are not readily available in recent public disclosures, their nature suggests they might be in an early stage of development or targeting niche segments.

If these financial services are indeed in their nascent stages, they would align with the characteristics of a question mark in the BCG matrix. This means they likely possess a low market share but operate in a high-growth market. The key challenge and opportunity lie in Chedraui's ability to invest and scale these operations effectively to capture a more significant portion of the market.

- Nascent Offerings: Financial services like money transfers and credit cards may represent new ventures for Chedraui.

- Low Market Share: Currently, their penetration in the broader financial services sector is likely limited.

- High Growth Potential: The financial services industry, especially in emerging markets, often exhibits strong growth prospects.

- Strategic Investment Needed: Success hinges on Chedraui's commitment to investing in technology, marketing, and customer acquisition to drive growth.

Advanced Data Analytics and AI-Driven Personalization

Chedraui is increasingly using advanced data analytics, especially from its 'Mi Chedraui' loyalty program, to create targeted promotions. This focus on personalization is a key strategy in the evolving retail landscape. The effectiveness and competitive edge of these AI-driven efforts are still being solidified, placing this initiative in the 'Question Mark' category.

The retail technology sector, where personalized customer experiences are paramount, is experiencing rapid growth. Chedraui's investment in this area aims to boost sales and customer engagement. However, the full impact and widespread adoption of these advanced analytical tools across Chedraui's entire customer base are yet to be fully realized, making its long-term market position uncertain.

- Loyalty Program Data: Chedraui's 'Mi Chedraui' program provides a rich source of customer data, enabling sophisticated segmentation and targeted offers.

- AI-Driven Personalization: The company is leveraging AI to analyze purchasing patterns and preferences, tailoring promotions for individual shoppers.

- Market Impact Uncertainty: While the potential for increased sales and customer retention is high, the actual market share gains and competitive moat from these initiatives are still developing.

- Retail Tech Growth: This investment aligns with a broader trend in retail, where data analytics and AI are becoming crucial for differentiation and growth.

Question Marks in Chedraui's portfolio represent strategic initiatives with high growth potential but uncertain market positions. These ventures require significant investment to develop and capture market share. The success of these 'question marks' hinges on Chedraui's ability to execute effectively and adapt to market dynamics, potentially transforming them into future stars or cash cows.

The new Rancho Cucamonga Distribution Center, a US$120 million investment operational in Q3 2024, exemplifies a question mark due to its high growth potential and ongoing transition costs, with EBITDA margin impact expected by 2026. Similarly, the new perishable pricing strategy for Smart & Final, implemented in late 2024, targets low market share but high growth, showing early signs of success with a 1.5% customer traffic increase in Q2 2025.

Chedraui's expansion into Yucatan with a 3.6 billion peso investment for 16 new branches over five years also fits the question mark profile, aiming to build market share in new territories. Furthermore, its nascent financial services and AI-driven loyalty program initiatives, while promising high growth, currently hold limited market share, underscoring their question mark status.

BCG Matrix Data Sources

Our Chedraui BCG Matrix leverages official company financial reports, detailed market share data, and consumer spending trends to provide an accurate strategic overview.