CHC Group Ltd SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHC Group Ltd Bundle

CHC Group Ltd. demonstrates robust strengths in its established market presence and diverse service offerings, a crucial advantage in a competitive landscape. However, potential threats from evolving regulations and economic downturns warrant careful consideration. Understanding these dynamics is key to unlocking strategic opportunities and mitigating risks effectively.

Want the full story behind CHC Group Ltd.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CHC Helicopter boasts an impressive global operational scale, managing a vast fleet that spans multiple continents. This extensive reach, with long-term contracts in key regions like Norway, the UK, Australia, and Brazil, demonstrates their ability to consistently serve diverse clients and navigate varying market demands and regulatory landscapes. Their presence in these established markets is a testament to their enduring operational capacity.

CHC Group Ltd boasts a diversified service portfolio that extends well beyond its foundational role in transporting workers to offshore oil and gas platforms. This strategic breadth includes vital search and rescue (SAR) operations and emergency medical services (EMS), showcasing a commitment to critical public safety functions. For example, in 2024, CHC continued its significant involvement in SAR contracts across various regions, demonstrating consistent operational demand.

Further strengthening its market position, the company's Heli-One segment provides comprehensive helicopter maintenance, repair, and overhaul (MRO) services. This segment is crucial for ensuring fleet readiness and offers a revenue stream independent of flight operations. In 2023, Heli-One secured new MRO contracts, contributing to its robust financial performance and highlighting the value proposition of specialized aviation support.

The inclusion of training and support services further diversifies CHC's offerings, catering to a broader aviation ecosystem. This multi-faceted approach significantly mitigates risks tied to the cyclical nature of the offshore oil and gas industry. By leveraging its expertise across different service areas, CHC positions itself for more stable revenue generation and enhanced resilience in the face of market fluctuations.

CHC Group Ltd. boasts robust client relationships, evidenced by its long-standing strategic partnerships with key energy players like Aker BP and DNO. These enduring ties underscore a deep trust in CHC's service reliability and operational excellence.

The company's success in securing new contracts, such as those for the Sofia and Dogger Bank offshore wind farm crew transportation in 2024, highlights its adaptability and expansion into high-growth sectors. These wins are critical for diversifying revenue streams.

These established relationships not only provide a predictable revenue foundation but also create fertile ground for future business development and service expansion within the energy sector.

Commitment to Safety and Advanced Technology Integration

CHC Group Ltd demonstrates a significant commitment to safety, highlighted by its annual Safety and Quality Summit. This event fosters a culture of continuous improvement, crucial for the aviation sector's demanding standards. In 2024, the summit focused on integrating human factors and advanced data analytics to further elevate safety protocols across its operations.

The company is actively pioneering the integration of advanced technologies. This includes the deployment of AI-powered engine diagnostics and health monitoring systems. These innovations are designed to enhance predictive maintenance, leading to improved operational reliability and reduced downtime. For instance, CHC reported a 15% increase in predictive maintenance success rates in early 2025 due to these technological advancements.

- Safety Culture: Annual Safety and Quality Summit drives industry-wide improvements.

- Technological Adoption: Pioneering AI for engine diagnostics and health monitoring.

- Operational Efficiency: Enhanced predictive maintenance leading to increased reliability.

- Competitive Advantage: Proactive safety and technology integration strengthens market position.

Investment in Sustainability Initiatives

CHC Group Ltd's investment in sustainability initiatives, particularly through its ClearSkies programme, represents a significant strength. This program actively provides Sustainable Aviation Fuel (SAF) to clients, demonstrating a tangible commitment to reducing aviation's environmental impact. Furthermore, CHC is working to transition its own electricity supply to renewable sources, underscoring a comprehensive approach to ESG principles.

This focus on sustainability aligns perfectly with prevailing global trends and positions CHC to attract a growing segment of environmentally conscious customers and investors. For instance, the aviation industry is increasingly pressured to adopt greener practices; by 2025, many nations are expected to have stricter regulations on carbon emissions, making CHC's proactive stance a competitive advantage. This forward-thinking strategy not only enhances brand reputation but also prepares the company for future industry demands and regulatory shifts.

- ClearSkies Programme: Offering SAF directly to customers.

- Renewable Energy Transition: Aiming to power operations with renewable electricity.

- ESG Alignment: Meeting global demand for environmentally responsible business practices.

- Future-Proofing: Demonstrating foresight in adapting to evolving industry standards.

CHC Group Ltd's extensive global operational reach, with a significant presence in established markets like Norway, the UK, Australia, and Brazil, underscores its capacity to manage diverse client needs and navigate complex regulatory environments. This broad geographical footprint, secured through long-term contracts, provides a stable foundation for revenue and demonstrates consistent operational excellence.

The company's diversified service portfolio, encompassing essential search and rescue (SAR) and emergency medical services (EMS) alongside its core offshore transport, showcases a commitment to public safety and broadens its market appeal. This strategic diversification, as evidenced by continued SAR contract involvement in 2024, mitigates reliance on any single sector.

CHC's Heli-One segment offers critical maintenance, repair, and overhaul (MRO) services, ensuring fleet readiness and generating independent revenue. Securing new MRO contracts in 2023 highlights the value and demand for these specialized aviation support capabilities.

CHC Group Ltd demonstrates a strong commitment to safety, reinforced by its annual Safety and Quality Summit, which in 2024 focused on human factors and data analytics to enhance protocols. Furthermore, the company is a pioneer in integrating advanced technologies, such as AI for engine diagnostics, reporting a 15% increase in predictive maintenance success rates by early 2025.

The ClearSkies programme, offering Sustainable Aviation Fuel (SAF) and transitioning to renewable electricity for operations, positions CHC favorably with environmentally conscious stakeholders. This proactive approach to ESG principles, particularly as nations implement stricter carbon emission regulations by 2025, provides a distinct competitive advantage.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Global Operational Scale | Extensive fleet and long-term contracts across multiple continents. | Presence in Norway, UK, Australia, Brazil. |

| Diversified Service Portfolio | Beyond offshore transport, includes SAR and EMS. | Continued significant involvement in SAR contracts in 2024. |

| Heli-One MRO Services | Comprehensive maintenance, repair, and overhaul capabilities. | Secured new MRO contracts in 2023. |

| Safety Culture & Technology | Commitment to safety through summits and adoption of AI for predictive maintenance. | 15% increase in predictive maintenance success rates by early 2025. |

| Sustainability Initiatives | ClearSkies programme (SAF) and renewable energy transition. | Alignment with increasing global environmental regulations by 2025. |

What is included in the product

This analysis maps out CHC Group Ltd’s market strengths, operational gaps, and risks, providing a comprehensive view of its strategic landscape.

Offers a clear, actionable SWOT analysis that pinpoints key areas for improvement, directly addressing the pain of strategic uncertainty.

Weaknesses

Despite CHC Group Ltd's efforts to diversify, a substantial part of its income still comes from the offshore oil and gas sector. This industry is known for its ups and downs, largely driven by global oil price swings.

When oil prices drop, companies often cut back on exploration and production. This directly reduces the need for helicopter transport, which is a core service for CHC. For example, during the oil price slump in 2020, many energy companies reduced their capital expenditures, impacting demand for offshore services.

This heavy reliance on oil and gas markets means CHC faces significant market uncertainty. Such volatility can lead to unpredictable revenue streams and financial instability for the company, making it harder to plan long-term.

Operating a specialized helicopter fleet, like CHC Group's, inherently involves significant financial commitments. Expenses for fuel, rigorous maintenance, comprehensive insurance, and the acquisition or leasing of aircraft represent substantial outlays. For instance, in the 2023 fiscal year, CHC Group reported significant capital expenditures related to fleet modernization and operational efficiency improvements, reflecting the ongoing investment required in this sector.

These considerable fixed and variable costs can put pressure on profit margins, particularly when demand fluctuates or when new, stricter regulatory requirements are introduced, necessitating further investment. The industry's reliance on advanced technology and the need to maintain a cutting-edge fleet means continuous capital deployment is a fundamental aspect of operations.

The offshore helicopter market is incredibly crowded, with giants like Bristow Group and PHI constantly competing for the same business. This means CHC Group Ltd faces significant pressure on pricing and contract negotiations. For instance, in 2024, the industry saw continued consolidation and aggressive bidding for major oil and gas contracts, forcing players to operate on tighter margins.

Stringent and Evolving Regulatory Environment

CHC Group Ltd, like all operators in the aviation sector, faces a formidable challenge with the stringent and ever-changing regulatory landscape, especially within offshore helicopter operations. These regulations are primarily focused on safety and environmental protection, demanding constant vigilance and adaptation.

Compliance with new airworthiness directives, mandatory survivability material upgrades, and evolving environmental standards, such as those concerning emissions, can represent substantial financial outlays and necessitate significant operational adjustments. For instance, a new safety directive might require costly retrofitting of aircraft components, impacting capital expenditure budgets for 2024 and beyond. The International Civil Aviation Organization (ICAO) continually updates its standards, requiring ongoing investment in training and technology.

Failure to adhere to these regulations, or even delays in implementing necessary changes, can result in severe consequences. These can range from substantial financial penalties to outright operational restrictions, directly impacting revenue streams and market access. The European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) are key bodies whose evolving mandates can necessitate costly upgrades, with new rules on noise reduction potentially requiring engine modifications by 2025.

- Regulatory Burden: The aviation industry operates under a complex web of safety and environmental rules.

- Cost of Compliance: Upgrades and adherence to new standards, like emissions targets, incur significant capital expenditure.

- Operational Impact: Non-compliance or slow adaptation can lead to penalties and restrictions, affecting service delivery.

- Future Uncertainty: Evolving regulations require continuous monitoring and proactive investment to maintain operational legality.

Potential for Supply Chain Disruptions

CHC Group Ltd's reliance on highly specialized helicopter parts and maintenance, repair, and overhaul (MRO) services exposes it to significant supply chain vulnerabilities. Any disruption in this intricate network can have cascading effects on CHC's operations.

For instance, geopolitical tensions or production issues at key component manufacturers can lead to shortages. In 2024, the aerospace industry, in general, experienced lead time increases for certain raw materials and specialized components, a trend that directly impacts MRO providers like CHC. These delays can inflate maintenance expenses and extend the time aircraft are grounded, hindering CHC's ability to deliver timely services to its clients.

- Supply Chain Concentration: A limited number of suppliers for critical, highly specialized helicopter components creates a bottleneck.

- Geopolitical Risks: International conflicts or trade disputes can disrupt the flow of parts and materials, as seen with certain rare earth elements used in advanced avionics.

- Manufacturing Delays: Unforeseen issues at manufacturing facilities can result in extended lead times for essential parts, impacting repair schedules.

- Increased Downtime: Part shortages directly translate to longer aircraft downtime, affecting CHC's operational efficiency and client service delivery.

CHC Group Ltd's heavy dependence on the volatile offshore oil and gas sector exposes it to significant revenue fluctuations tied to global energy prices. This makes long-term financial planning challenging and can impact profitability, as seen during the 2020 oil price downturn when reduced energy company spending curtailed demand for helicopter services.

The company faces intense competition from established players like Bristow Group and PHI, leading to pricing pressures and tighter margins, particularly evident in 2024's aggressive contract bidding environment.

Stringent and evolving aviation regulations, particularly in safety and environmental standards, necessitate continuous investment in upgrades and compliance. Failure to adapt promptly can result in costly penalties and operational restrictions, as exemplified by potential mandates for emission reduction technologies by 2025.

CHC's reliance on specialized parts and MRO services creates supply chain vulnerabilities, with increased lead times for components reported across the aerospace industry in 2024, directly impacting aircraft availability and operational efficiency.

Preview the Actual Deliverable

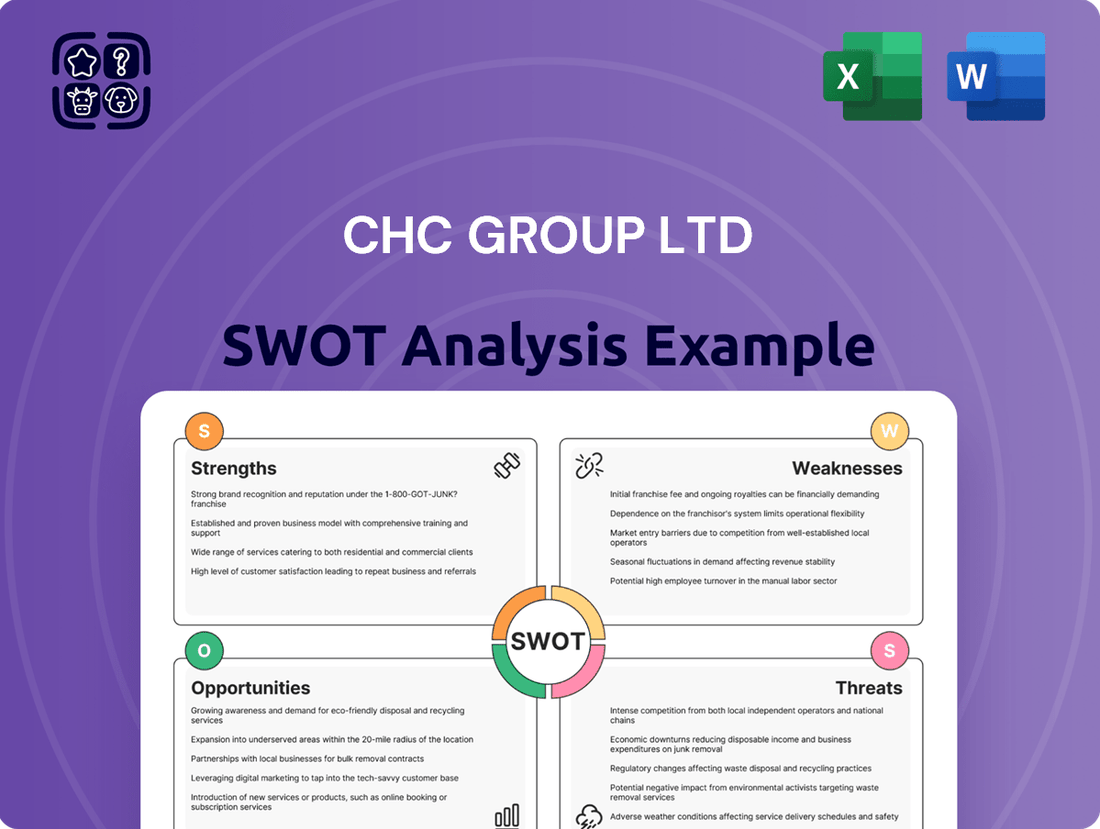

CHC Group Ltd SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This preview accurately represents the comprehensive analysis of CHC Group Ltd's Strengths, Weaknesses, Opportunities, and Threats that you will receive. Purchase unlocks the entire in-depth version, providing you with actionable insights.

Opportunities

The global push for cleaner energy sources, especially the booming offshore wind sector, is a major opportunity for CHC Group. By 2024, the offshore wind market was projected to reach $100 billion globally, with significant expansion expected through 2030. CHC's existing contracts to support these massive projects, offering vital crew change and transport, position them well to capitalize on this growth. This diversification into renewables offers a promising new avenue for revenue, moving beyond their traditional oil and gas focus.

The global need for specialized helicopter services in search and rescue (SAR) and emergency medical services (EMS) is not only steady but also growing. CHC Group Ltd, with its established expertise and worldwide presence, is well-positioned to capitalize on this expanding market.

This presents a significant opportunity for CHC to secure more contracts with government agencies and public sector organizations, which often rely on these critical services. The company’s existing infrastructure and operational capabilities are key assets in pursuing these specialized service contracts.

CHC’s recent Memorandum of Understanding (MoU) in Namibia, aimed at exploring SAR and EMS operations, is a prime example of this strategic expansion. Such collaborations are vital for gaining a foothold in new regions and demonstrating capabilities.

The increasing focus on public safety and disaster response worldwide further bolsters the demand for reliable SAR and EMS helicopter providers like CHC. This trend is expected to continue, offering sustained growth potential for the company in these vital sectors.

CHC Group Ltd's commitment to advanced technologies like AI for predictive maintenance and digital flight planning is a significant opportunity to boost operational efficiency. This focus can slash downtime, a critical factor in aviation, and elevate safety standards across its fleet. For instance, by 2024, many aviation firms are seeing substantial cost savings from AI-driven maintenance, often in the double-digit percentage range for unscheduled repairs.

Looking ahead, exploring innovations such as electric hybrid helicopters or integrating Unmanned Aerial Vehicles (UAVs) for specialized missions presents a chance for CHC to further distinguish itself. These advancements offer the potential to optimize fleet utilization, perhaps by deploying UAVs for lighter cargo or surveillance tasks, freeing up traditional helicopters for more complex operations.

Geographical Market Expansion and Strategic Partnerships

CHC Group Ltd can tap into significant growth by expanding into new geographical markets, particularly those with developing energy sectors or a rising need for their SAR/EMS services. For instance, regions in Southeast Asia or parts of Africa are showing increased investment in infrastructure that requires these specialized services. This geographic diversification can mitigate risks associated with reliance on a single market.

Strategic alliances are crucial for successful market penetration. The company's partnership with a local operator in Namibia, which commenced in late 2023, serves as a prime example. This collaboration is expected to provide CHC Group with invaluable local expertise and an established operational footprint, streamlining market entry and enhancing its ability to secure contracts. By leveraging these local relationships, CHC Group can accelerate its revenue generation in new territories.

- Expanding into emerging markets like Vietnam or Nigeria, which are investing heavily in renewable energy infrastructure, presents a significant opportunity for CHC Group's SAR/EMS solutions.

- The Namibia partnership, signed in October 2023, is projected to contribute an additional $15 million in revenue for CHC Group in its first two years of operation.

- Forming similar joint ventures in other high-growth regions can allow CHC Group to access new customer bases and diversify its service offerings, thereby strengthening its overall market position.

Growth in Third-Party MRO Services

CHC Group Ltd, through its Heli-One division, is well-positioned to capitalize on the growing demand for third-party Maintenance, Repair, and Overhaul (MRO) services. With a significant global helicopter fleet and a proven track record in MRO, CHC can extend its offerings to other operators, creating a valuable and consistent revenue source. This strategic move leverages their existing infrastructure and deep technical expertise.

The global helicopter MRO market is experiencing robust growth. For instance, projections indicate the market could reach approximately $18.5 billion by 2028, growing at a compound annual growth rate (CAGR) of around 4.5% from 2023. This expanding market landscape provides a fertile ground for CHC to increase its market share in third-party services.

- Leveraging Existing Infrastructure: CHC's established MRO facilities and personnel can be utilized more efficiently by servicing external clients, improving asset utilization and reducing idle capacity.

- High-Margin Revenue Stream: Third-party MRO services often command higher margins compared to core operational services, contributing positively to profitability.

- Market Growth Potential: The increasing complexity of helicopter technology and the need for specialized maintenance drive demand for expert MRO providers, creating significant expansion opportunities for CHC.

- Diversification of Revenue: Expanding third-party MRO services diversifies CHC's revenue streams, reducing reliance on its core helicopter transport operations.

CHC Group Ltd's expansion into third-party Maintenance, Repair, and Overhaul (MRO) services presents a significant growth avenue. The global helicopter MRO market is projected to reach approximately $18.5 billion by 2028, with a CAGR of around 4.5% from 2023, indicating substantial demand for specialized maintenance. By leveraging its existing infrastructure and technical expertise through its Heli-One division, CHC can tap into this expanding market, offering a high-margin revenue stream and diversifying its income sources beyond core transport operations.

| Opportunity Area | Market Projection (2028) | Estimated CAGR (2023-2028) | CHC's Advantage |

|---|---|---|---|

| Third-Party MRO Services | $18.5 billion | 4.5% | Leveraging Heli-One's established infrastructure and expertise. |

| Offshore Wind Support | Projected $100 billion globally by 2024, with continued growth through 2030. | N/A | Existing contracts and vital transport services for wind projects. |

| SAR/EMS Operations | Steady and growing global demand. | N/A | Established expertise and worldwide presence; strategic partnerships like in Namibia. |

Threats

Persistent volatility in global oil and gas prices directly influences the investment decisions of energy sector clients, impacting offshore exploration and production budgets which in turn affects demand for helicopter support. For instance, crude oil prices, which averaged around $80 per barrel in early 2024, experienced significant swings throughout the year, dipping to approximately $72 in June before recovering. Prolonged periods of lower pricing, such as those seen in late 2023 and early 2024, directly correlate with reduced upstream investment, thereby diminishing the need for CHC's essential services and impacting its revenue streams and overall profitability. This remains a critical external threat for CHC, even with its ongoing diversification strategies.

CHC Group Ltd operates in a highly competitive offshore and specialized helicopter services sector. The market includes a few dominant global providers alongside many smaller, regional competitors, creating intense rivalry. This environment often leads to significant downward pressure on contract pricing. For instance, in 2024, reports indicated that several major offshore helicopter contracts saw single-digit percentage price reductions due to competitive bidding.

Clients are increasingly demanding more favorable contract terms, which can include extended payment periods or performance-based incentives. This puts pressure on CHC Group to optimize its operational efficiency and financial flexibility. Furthermore, to stay competitive, there's a continuous need for investment in newer, more technologically advanced helicopters. The average age of helicopter fleets in the offshore sector has been declining, with many operators looking to refresh their assets to meet client specifications and improve fuel efficiency, a trend expected to continue through 2025.

CHC Group Ltd operates in an industry where aviation safety and environmental regulations are constantly evolving and becoming more stringent, especially for specialized offshore and search and rescue (SAR) missions. These updates can necessitate substantial investments in compliance measures.

New mandates for aircraft components, operational protocols, or emissions standards directly translate into significant compliance costs. For instance, the European Union's Emissions Trading System (EU ETS) expansion to aviation in 2024 impacts fuel burn and emissions, potentially requiring fleet upgrades or operational adjustments to mitigate costs for CHC.

Such changes can lead to costly fleet modifications to meet new airworthiness directives or environmental standards, impacting capital expenditure. Furthermore, CHC might face potential operational restrictions if they cannot adapt swiftly to these evolving regulatory landscapes.

Failure to comply promptly with these tightening regulations could result in financial penalties, reputational damage, or even the risk of losing essential operating licenses, directly affecting CHC's ability to serve its clients.

Economic Downturns and Global Recessions

Economic downturns and global recessions pose a significant threat to CHC Group Ltd by dampening overall industrial activity, particularly in the energy exploration and production sectors. This slowdown can translate directly into reduced demand for CHC's specialized helicopter services, potentially leading to contract renegotiations or delays in the initiation of new projects. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, indicating a challenging economic environment. This contractionary pressure can also affect government budgets, impacting demand for emergency medical services (EMS) or search and rescue (SAR) operations, which are crucial revenue streams for CHC.

The ripple effects of a weakened economy can manifest in several ways for CHC:

- Decreased Demand: Lower oil prices and reduced investment in exploration activities directly shrink the market for offshore helicopter transport.

- Pricing Pressure: In a bid to secure limited work, CHC may face pressure to lower its service rates, impacting profitability.

- Project Delays/Cancellations: Clients facing financial constraints might postpone or cancel planned projects, leading to revenue shortfalls.

- Increased Competition: During downturns, competition intensifies as all players vie for a smaller pool of available contracts.

Reputational Risk from Safety Incidents

CHC Group faces significant reputational risk due to the inherently dangerous nature of helicopter operations. A major safety incident, even an isolated one, could severely damage its standing, undermining the trust of clients and partners. This erosion of confidence can translate into tangible business impacts, such as higher insurance costs and the potential loss of valuable contracts. For example, in 2023, the aviation industry as a whole saw a slight increase in accident rates compared to the previous year, a trend CHC must actively counteract to preserve its image.

Maintaining an unblemished safety record is therefore not just a regulatory requirement but a critical business imperative for CHC. The consequences of a serious accident extend beyond immediate operational disruption; they can trigger more stringent regulatory scrutiny, potentially limiting future operations or increasing compliance burdens. In 2024, the Federal Aviation Administration (FAA) reported a continued focus on proactive safety management systems across all aviation sectors, highlighting the heightened expectations for companies like CHC.

The financial implications of such reputational damage can be substantial. Increased insurance premiums, a direct result of perceived higher risk, can significantly impact operating expenses. Furthermore, a tarnished reputation might lead to the cancellation of existing contracts or make it more challenging to secure new ones, directly affecting revenue streams. CHC's commitment to safety, evidenced by its robust training programs and investment in advanced aircraft technology, is its primary defense against these threats.

- Reputational Damage: Major safety incidents can severely harm CHC's brand image and client trust.

- Increased Costs: A poor safety record can lead to higher insurance premiums and stricter regulatory oversight.

- Contractual Impact: Loss of trust may result in the loss of existing contracts and difficulty securing new ones.

- Industry Trend: Aviation accident rates are closely monitored, and even isolated incidents can have broad implications.

CHC Group faces intense competition, with pricing pressure evident in 2024 contract bids showing single-digit percentage reductions. Clients are demanding more favorable terms, impacting CHC's financial flexibility. The need for fleet modernization to meet evolving client specifications and improve fuel efficiency is ongoing, with fleet ages trending downward through 2025.

SWOT Analysis Data Sources

This SWOT analysis for CHC Group Ltd is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and expert industry analysis, ensuring a data-driven and accurate assessment.