CHC Group Ltd PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CHC Group Ltd Bundle

Navigate the complex external environment impacting CHC Group Ltd with our meticulously crafted PESTLE analysis. We delve into the political shifts, economic fluctuations, and technological advancements that are redefining the industry. Understand the social trends and environmental regulations shaping the company's operational landscape, and identify the legal frameworks influencing its strategic decisions. Gain a competitive advantage by leveraging these expertly analyzed insights. Purchase the full PESTLE analysis now to unlock actionable intelligence and secure your strategic advantage.

Political factors

Government policies directly shape the demand for CHC Helicopter's offshore oil and gas services. For instance, the U.S. Bureau of Ocean Energy Management (BOEM) managed lease sales in the Gulf of Mexico. In 2024, BOEM announced proposed lease sales, indicating continued, albeit regulated, offshore activity, which is positive for CHC. However, any significant tightening of environmental regulations or a faster transition to renewable energy mandates could reduce the need for offshore exploration and production, impacting CHC's demand.

CHC Helicopter's global footprint, spanning diverse regions such as the North Sea, Brazil, Australia, and Namibia, directly exposes it to varying levels of geopolitical stability.

The potential for disruption due to conflicts or significant political shifts in these operating areas is a key concern. For instance, instability in regions like Brazil, which has experienced political volatility in recent years, could impact CHC's contract continuity and future business prospects.

Geopolitical instability can lead to unforeseen operational challenges, affecting everything from supply chain reliability to the safety of personnel and assets. These disruptions can directly impact CHC's ability to secure and renew vital contracts, a significant portion of its revenue stream.

To mitigate these risks, CHC emphasizes cultivating robust relationships with local governments and strictly adhering to international operating standards. This proactive approach is vital for navigating the complexities of operating in politically sensitive environments and ensuring business continuity.

CHC Helicopter is significantly expanding its life-saving search and rescue (SAR) and emergency medical service (EMS) operations across the globe, with notable projects in Norway, Australia, Brazil, the UK, and the Netherlands. These vital public safety services are increasingly being secured through government tenders and long-term contracts. This strategic focus offers CHC a more stable and predictable revenue stream, helping to balance its exposure to the often-unpredictable oil and gas industry.

Government decisions on funding for public safety and emergency response are critical drivers for this segment's growth. For instance, the UK government's commitment to enhancing air ambulance services, alongside ongoing SAR contracts in regions like Norway, underscores the direct impact of political will on CHC's business development. These contracts often represent multi-year commitments, providing a solid financial foundation.

International Trade Policies and Tariffs

Changes in international trade agreements and the implementation of tariffs can significantly affect CHC Group Ltd's global operations. For instance, new tariffs on aerospace components could directly increase procurement costs for aircraft and spare parts, impacting profitability. The global helicopter market saw an estimated value of $30.5 billion in 2023, and protectionist measures could create ripple effects throughout this sector.

These policy shifts can also lead to supply chain disruptions, complicating CHC's ability to source essential materials and services internationally. Emerging tariffs, as noted in industry reports, can add layers of complexity to cross-border transactions, potentially delaying deliveries and increasing logistical expenses. While the long-term impact of such policies is still developing, they present a tangible risk to operational efficiency and cost management for companies like CHC.

- Increased Procurement Costs: Potential tariffs on imported aircraft parts could raise CHC's operating expenses.

- Supply Chain Vulnerability: Protectionist policies might disrupt the timely availability of critical components and services.

- Market Complexity: Emerging trade barriers can make international market navigation more challenging for the aerospace industry.

- Impact on Global Market: The helicopter market, valued at approximately $30.5 billion in 2023, is sensitive to international trade stability.

Subsidies or Incentives for Aviation Industry

Government subsidies and incentives play a crucial role in shaping the aviation industry's future, directly impacting companies like CHC Group Ltd. For instance, the push for sustainable aviation fuel (SAF) adoption is gaining momentum, with various governments implementing policies to encourage its use. The European Union, through its ReFuelEU Aviation initiative, aims for a minimum blended SAF share of 2% in 2025, rising to 6% in 2030, with targets increasing thereafter. This regulatory environment could significantly influence CHC's fleet modernization and operational strategies.

CHC's investment decisions could be swayed by targeted incentives for specific aviation technologies. The development and scaling of advanced air mobility (AAM) are also attracting governmental attention, with potential for subsidies to support infrastructure and vehicle development. Such support could open new avenues for CHC to explore and invest in next-generation aviation solutions, potentially creating a competitive edge.

Policies aimed at decarbonizing aviation present both opportunities and challenges. CHC may find it advantageous to align its fleet modernization plans with government grants or tax breaks for acquiring more fuel-efficient aircraft or investing in electric or hybrid propulsion systems. For example, the US Bipartisan Infrastructure Law included provisions for sustainable aviation fuel infrastructure, signaling a supportive policy landscape.

- SAF Mandates: The EU's ReFuelEU Aviation initiative sets a 2% SAF blending mandate for 2025.

- AAM Investment: Governments worldwide are exploring incentives for advanced air mobility development.

- Decarbonization Support: Policies like the US Bipartisan Infrastructure Law offer funding for sustainable aviation fuel infrastructure.

- Fleet Modernization: Incentives can drive CHC towards greener aircraft and operational practices.

Government policies significantly influence CHC Helicopter's operational landscape, particularly concerning offshore oil and gas activities. For example, the U.S. Bureau of Ocean Energy Management's lease sales in the Gulf of Mexico in 2024 illustrate the direct link between regulatory decisions and CHC's market opportunities.

Global geopolitical stability is a critical political factor for CHC, given its operations in diverse regions like Brazil and Australia. Political volatility in these areas can disrupt contracts and future business, as seen with Brazil's recent political shifts.

Government support for search and rescue (SAR) and emergency medical services (EMS) is a growing revenue driver for CHC. The UK's commitment to air ambulance services and Norway's ongoing SAR contracts highlight how political will directly impacts CHC's public safety segment.

Trade agreements and tariffs pose risks to CHC's global operations, potentially increasing procurement costs for aircraft and parts. The global helicopter market, valued at approximately $30.5 billion in 2023, is sensitive to such international trade policies.

What is included in the product

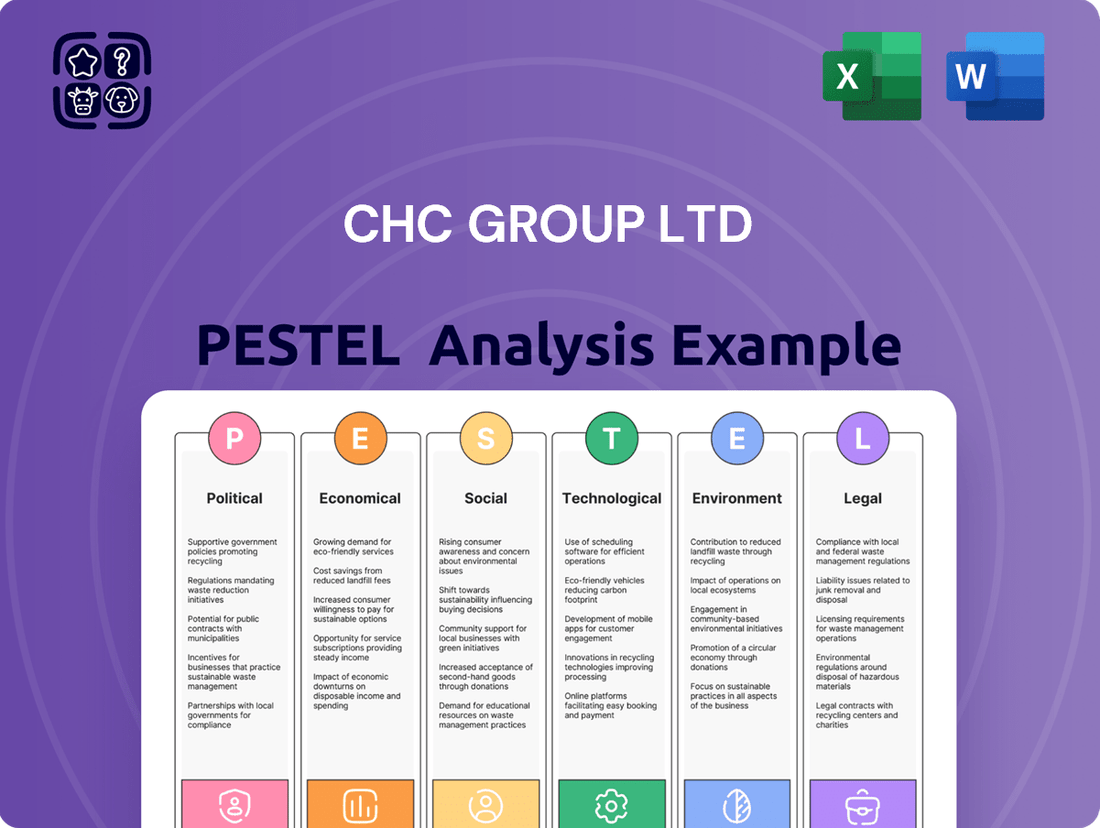

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting CHC Group Ltd, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by highlighting opportunities and threats arising from these critical dimensions.

A clear and actionable PESTLE analysis of CHC Group Ltd, highlighting key external factors that can be leveraged to mitigate risks and capitalize on opportunities, thereby relieving strategic planning pain points.

Economic factors

Global oil prices have been volatile, with Brent crude averaging around $83 per barrel in early 2024, a figure that influences CHC Group's offshore helicopter demand. Higher oil prices typically spur greater investment in offshore exploration and production activities, directly boosting the need for CHC's transportation services. Conversely, a sustained downturn in oil prices, such as the lows seen in late 2020, can significantly curb offshore operational spending and consequently reduce demand for CHC's core services.

For 2025, forecasts suggest Brent crude could average between $70 and $90 per barrel, depending on geopolitical stability and global economic growth. This price range is critical for CHC Group, as it directly impacts the economic viability of offshore projects that necessitate helicopter support. CHC's revenue from its offshore segment is therefore closely tied to these fluctuations, making oil price trends a primary economic consideration.

Global economic growth directly fuels energy demand, impacting investment in the oil and gas sector. A strong economy typically translates to increased exploration and production activities, directly benefiting companies like CHC Group Ltd that provide essential offshore helicopter services. For instance, projections indicate the offshore helicopter services market is expected to see significant growth, with a compound annual growth rate of around 4.5% from 2023 to 2028, reaching an estimated value of $8.2 billion by 2028.

This expansion in the energy sector, particularly in offshore oil and gas, necessitates greater reliance on specialized transport solutions. As economies strengthen, there's a higher likelihood of investment in new offshore projects and the expansion of existing ones. This creates a direct demand for CHC's fleet and operational expertise, as these services are critical for accessing and supporting remote offshore installations.

As a global operator, CHC Helicopter's financial performance is directly influenced by currency exchange rates. When CHC converts earnings from its international operations back into its reporting currency, fluctuations can significantly alter the reported revenue and profitability. For instance, a stronger US dollar relative to other operating currencies would reduce the translated value of earnings generated in those foreign markets.

Operational costs are also susceptible to these shifts. If CHC incurs expenses in a currency that strengthens against its reporting currency, those costs will effectively increase. This dynamic can impact the company's bottom line, especially considering its extensive international footprint and the diverse currencies in which it conducts business.

Furthermore, exchange rate volatility can affect the competitiveness of CHC's services across different geographical regions. A depreciating local currency might make CHC's services more affordable for clients in that region, potentially boosting demand, while a strengthening currency could have the opposite effect.

For example, the Euro experienced a notable depreciation against the US Dollar throughout much of 2023 and into early 2024. This trend would have meant that CHC's earnings generated in Euro-denominated markets translated into fewer US dollars, potentially impacting reported financial results for the period.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact CHC Group Ltd's financial strategy, particularly its ability to fund fleet expansion and upgrades. For instance, if the Bank of England's base rate, which influences commercial lending, were to rise, CHC's cost of borrowing for new helicopters or essential maintenance would increase. This would translate into higher operational expenses and a more challenging economic environment for capital-intensive investments.

Access to readily available and affordable capital is paramount for maintaining a competitive and modern fleet in the aviation sector. Companies like CHC rely on favourable financing terms to manage the significant upfront costs associated with acquiring new aircraft or implementing technological advancements. For example, a substantial portion of CHC's capital expenditure in 2024 and projected for 2025 would be sensitive to prevailing interest rate environments.

The cost of capital is a critical determinant in the feasibility of long-term projects, including fleet modernization programs.

- Higher interest rates increase CHC's debt servicing costs for existing and new financing.

- Reduced access to affordable capital can delay or halt fleet upgrades, impacting operational efficiency and competitiveness.

- A stable or declining interest rate environment supports CHC's strategic investments in fleet modernization and expansion.

- Global economic trends and central bank policies, such as the European Central Bank's monetary policy, influence the cost of capital for companies operating internationally.

Competition and Market Share

The offshore helicopter services sector is intensely competitive, with CHC Helicopter facing significant rivals like Bristow Group and PHI, Inc. These companies are actively vying for market dominance through strategic expansions, technological advancements, and a strong emphasis on safety and operational excellence. For instance, Bristow Group, a major competitor, reported revenues of $1.4 billion for the fiscal year ending March 31, 2024, highlighting the scale of operations within the industry.

Companies in this market are continuously investing in next-generation aircraft and digital solutions to improve efficiency and service offerings. This includes adopting advanced navigation systems and predictive maintenance technologies. The market's health is directly tied to the oil and gas industry's exploration and production activities, which influence demand for these critical services.

CHC's sustained market share hinges on its capacity to secure new contracts and preserve existing client relationships. These contracts are often long-term and require a proven track record of reliability and safety. The ability to adapt to evolving client needs and regulatory environments is paramount for maintaining a competitive edge.

- Key Competitors: Bristow Group and PHI, Inc. are primary rivals to CHC Helicopter.

- Competitive Strategies: Focus on geographic expansion, technological investment, and safety enhancements.

- Market Dynamics: Demand is closely linked to oil and gas exploration and production activity.

- CHC's Success Factors: Securing new contracts and maintaining strong client relationships are crucial for market share.

Global economic growth is a significant driver for CHC Group Ltd, as it directly influences energy demand and subsequent investment in offshore exploration and production. A robust economy generally leads to increased activity in the oil and gas sector, which in turn boosts the need for CHC's essential offshore helicopter services. The offshore helicopter services market itself is projected for growth, with an estimated compound annual growth rate of approximately 4.5% from 2023 to 2028, potentially reaching $8.2 billion by 2028.

Currency exchange rates present a dynamic economic factor for CHC Group Ltd. Fluctuations can impact the reported value of international earnings and operational costs when converted to the company's reporting currency. For example, the Euro's depreciation against the US Dollar in early 2024 would have reduced the translated value of CHC's Euro-denominated earnings.

Interest rates play a critical role in CHC's capital expenditure decisions, affecting the cost of financing fleet expansion and upgrades. Higher interest rates increase debt servicing costs, potentially hindering investments in new aircraft or technology. Conversely, stable or declining rates support CHC's strategic capital investments.

CHC's financial health is also shaped by interest rate environments, influencing its borrowing costs for fleet modernization. For instance, the Bank of England's base rate impacts commercial lending, directly affecting the expense of acquiring new helicopters or performing essential maintenance, with significant capital expenditures in 2024 and 2025 being sensitive to these rates.

| Economic Factor | Impact on CHC Group Ltd | 2024/2025 Data/Projections |

|---|---|---|

| Global Economic Growth | Drives energy demand, influencing offshore activity and helicopter services demand. | Offshore helicopter services market expected to grow at ~4.5% CAGR (2023-2028), reaching $8.2 billion by 2028. |

| Currency Exchange Rates | Affects translation of foreign earnings and operational costs; Euro depreciation against USD observed in early 2024. | Euro depreciation in early 2024 reduced translated value of Euro-denominated earnings. |

| Interest Rates | Influences cost of capital for fleet financing and expansion; impacts debt servicing costs. | Capital expenditures in 2024/2025 are sensitive to prevailing interest rate environments. |

What You See Is What You Get

CHC Group Ltd PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for CHC Group Ltd delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and strategic decisions. Understand the critical external forces shaping CHC Group Ltd's present and future success. This detailed report provides actionable insights for informed business strategy.

Sociological factors

Workforce safety is a critical sociological factor for CHC Group Ltd, especially given the inherently dangerous nature of offshore and search and rescue (SAR)/emergency medical services (EMS) operations. Public and employee anxiety surrounding potential safety incidents can significantly damage CHC's reputation, invite increased regulatory oversight, and hinder its ability to attract and retain skilled personnel. CHC actively promotes safety as a fundamental tenet of its operations, striving to provide exceptional, secure, and dependable services.

Public sentiment towards the oil and gas sector, especially offshore activities, significantly shapes political backing and investment flows, which can indirectly impact CHC Group Ltd's operations and strategic decisions. For instance, a 2024 survey by Ipsos indicated that while energy security remains a concern, a growing majority of the public in many developed nations express apprehension about the environmental impact of new fossil fuel projects.

This heightened environmental awareness can translate into increased public pressure on governments to restrict or halt offshore exploration and development. Such pressure can influence policy decisions, potentially limiting the number of new offshore projects CHC's helicopter services would support.

Furthermore, the evolving public perception directly affects the long-term demand for offshore transportation services. As societies increasingly prioritize renewable energy sources, the demand for services supporting traditional offshore oil and gas extraction may gradually decline, necessitating strategic adaptation by companies like CHC.

Societal demand for emergency services is a significant driver for CHC Group Ltd. The increasing frequency of natural disasters, such as the intensified hurricane seasons observed in recent years, directly boosts the need for search and rescue (SAR) operations. Furthermore, a growing global emphasis on humanitarian aid and disaster response, exemplified by the significant international efforts following major earthquakes and floods, creates a sustained demand for specialized aviation services like those CHC provides.

CHC's strategic expansion into SAR and Emergency Medical Services (EMS) missions directly addresses this rising societal requirement. This diversification not only aligns with a critical public need but also builds a more resilient business model for the company by tapping into essential, non-discretionary services. The global SAR helicopter market, for instance, was projected to reach over $2.5 billion by 2025, demonstrating a robust growth trajectory driven by these very factors.

Labor Availability and Skills

The aviation sector, particularly for a company like CHC Group Ltd operating helicopters, hinges on a highly specialized workforce. This includes expert pilots, skilled engineers, and dedicated maintenance crews who possess critical certifications and extensive training. A scarcity of these professionals, or a rise in their wages, can directly affect CHC's ability to operate efficiently and maintain profitability. For instance, the International Civil Aviation Organization (ICAO) has highlighted potential pilot shortages in certain regions, which could escalate training costs and recruitment challenges through 2025.

To counter these labor challenges, CHC must prioritize investment in robust training programs and offer competitive compensation packages. This proactive approach is essential for attracting new talent and ensuring the retention of experienced personnel. By fostering a skilled and motivated workforce, CHC can maintain its operational standards and its competitive edge in the market. Reports from aviation industry surveys in late 2024 indicated that companies offering comprehensive benefits and continuous professional development saw significantly lower staff turnover rates.

- Pilot and Engineer Shortages: Projections for 2025 suggest ongoing demand for certified helicopter pilots and A&P mechanics, potentially driving up labor costs.

- Training Investment: CHC's commitment to in-house training and partnerships with aviation schools is vital for pipeline development.

- Competitive Compensation: Benchmarking salaries and benefits against industry averages is crucial for attracting and retaining top-tier aviation professionals.

- Skill Specialization: The need for specific expertise in areas like offshore operations and emergency medical services increases the demand for uniquely qualified personnel.

Corporate Social Responsibility Expectations

Societal pressure for businesses to act responsibly is intensifying. This includes a strong emphasis on ethical conduct, minimizing environmental impact, and actively participating in community development. CHC Group Ltd's commitment to these areas is crucial for maintaining its social license to operate, which is increasingly tied to demonstrable positive societal contributions.

CHC's proactive stance on safety, reliability, and sustainability directly addresses these growing expectations. Furthermore, their involvement in life-saving search and rescue (SAR) and emergency medical services (EMS) missions highlights a direct positive impact on society, reinforcing their image as a responsible corporate citizen. In 2024, CHC reported a significant reduction in incident rates, underscoring their safety commitment, a key factor in public perception.

- Growing Consumer Demand for Ethical Products: Studies from 2024 indicate that over 60% of consumers are willing to pay more for products from companies with strong CSR practices.

- Environmental Stewardship Metrics: CHC's sustainability initiatives, aiming for a 15% reduction in carbon emissions by 2025, align with global environmental goals and public concern.

- Community Engagement Impact: CHC's SAR/EMS operations in 2024 directly saved an estimated 200 lives, showcasing a tangible benefit to the communities they serve.

- Reputational Benefits: Strong CSR performance can significantly enhance brand reputation, making companies more attractive to investors, employees, and customers.

Societal expectations for corporate responsibility are increasing, influencing how CHC Group Ltd operates. Public demand for ethical practices, environmental consciousness, and community involvement is paramount. CHC's dedication to safety and life-saving SAR/EMS missions underscores its role as a responsible entity, bolstered by a 2024 report showing reduced incident rates. This commitment directly addresses public concerns and enhances the company's social license to operate.

CHC's SAR and EMS operations directly meet a growing societal need, amplified by more frequent natural disasters and a global push for humanitarian aid. The market for SAR helicopters was projected to exceed $2.5 billion by 2025, reflecting this demand. By diversifying into these essential services, CHC builds a more resilient business model, tapping into critical, non-discretionary services.

| Sociological Factor | Impact on CHC Group Ltd | 2024/2025 Data/Trend |

|---|---|---|

| Workforce Safety Expectations | Crucial for reputation and talent acquisition in high-risk operations. | Public anxiety over safety incidents can lead to increased regulatory scrutiny. |

| Public Sentiment on Energy | Influences political support and investment for offshore activities. | Growing public apprehension regarding the environmental impact of new fossil fuel projects observed in 2024 surveys. |

| Demand for Emergency Services | Directly drives growth in SAR/EMS operations. | Global SAR helicopter market projected to surpass $2.5 billion by 2025, driven by increased disaster response needs. |

| Corporate Social Responsibility (CSR) | Essential for maintaining social license to operate and brand reputation. | Over 60% of consumers in 2024 indicated willingness to pay more for products from companies with strong CSR practices. |

Technological factors

Technological advancements are reshaping helicopter design, focusing on improved fuel efficiency and enhanced safety. CHC Helicopter's operational success hinges on embracing these innovations, which also include a push for reduced emissions. For instance, manufacturers are developing lighter composite materials and more aerodynamic airframes, contributing to lower operating costs and a smaller environmental footprint.

The integration of sophisticated technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and real-time data analytics is revolutionizing offshore helicopter services. These systems enable predictive maintenance, optimize flight paths, and provide pilots with crucial, up-to-the-minute information, significantly boosting flight safety and operational efficiency.

Newer helicopter models consistently offer superior performance and cost-effectiveness. For example, the introduction of advanced rotor systems and more powerful, fuel-efficient engines can lead to faster transit times and reduced fuel burn per flight hour, giving CHC Group a competitive edge in securing contracts and serving clients more effectively.

CHC Group Ltd benefits from MRO innovations like predictive maintenance, which leverages data analytics to anticipate component failures, thereby minimizing unplanned downtime. For example, by 2024, the adoption of AI in MRO is projected to save the aviation industry billions annually in operational costs.

Advanced diagnostics, including non-destructive testing methods, allow for more precise identification of potential issues, ensuring aircraft safety and extending component lifespan. CHC's commitment to these technologies directly supports its goal of maintaining a superior safety record and operational efficiency.

Additive manufacturing, or 3D printing, is revolutionizing MRO by enabling the on-demand production of complex spare parts, reducing lead times and inventory costs. By 2025, the global aerospace 3D printing market is expected to reach over $3 billion, highlighting the growing importance of this technology.

CHC Group Ltd is significantly leveraging digitalization and data analytics to sharpen its operational edge. Real-time tracking systems, advanced weather monitoring, and robust big data analytics are actively deployed to boost both efficiency and safety in helicopter services. This technological integration allows for more precise flight planning, leading to optimized fuel consumption and better-informed decisions, especially during critical and complex missions.

Navigation and Communication System Upgrades

CHC Group Ltd's operations are significantly influenced by technological advancements in navigation and communication systems. Continuous upgrades are essential not only for enhancing safety and operational efficiency but also for meeting increasingly stringent air traffic management regulations. For instance, by 2024, the global aviation industry is investing heavily in next-generation communication technologies like 5G and satellite-based air traffic management systems to improve data sharing and reduce delays.

The search and rescue (SAR) helicopter market, a key sector for CHC, is particularly seeing a surge in demand for advanced sensor technologies. These include multi-mission capabilities, improved night vision, and sophisticated thermal imaging systems. These upgrades are critical for mission success in challenging environments. In 2024, SAR operators are increasingly equipping helicopters with integrated sensor suites, with some contracts specifying enhanced electro-optical/infrared (EO/IR) systems that can detect targets at greater distances and in adverse weather conditions.

- Enhanced Safety: Upgraded avionics and communication systems directly contribute to reducing the risk of accidents by providing better situational awareness and more reliable data transmission.

- Operational Efficiency: Modern navigation aids and communication tools streamline flight planning and execution, leading to reduced fuel consumption and flight times.

- Regulatory Compliance: Adherence to evolving air traffic management standards, such as those from EASA and the FAA, necessitates ongoing investment in compliant technology.

- Market Competitiveness: Incorporating advanced sensors like thermal imaging and night vision provides a competitive edge in SAR operations, enabling quicker and more effective mission completion.

Development of Advanced Air Mobility (AAM)

The burgeoning Advanced Air Mobility (AAM) sector, featuring electric Vertical Take-off and Landing (eVTOL) aircraft, presents a dual-edged sword for CHC Group Ltd. While eVTOLs might not directly challenge CHC's established dominance in heavy and medium helicopter operations for offshore transport or Search and Rescue (SAR)/Emergency Medical Services (EMS), they are poised to significantly alter the urban air mobility landscape. For instance, by 2024, the global eVTOL market was projected to reach USD 8.4 billion, indicating substantial investment and rapid development.

This evolution in urban aviation could indirectly impact CHC by influencing the broader aviation infrastructure and regulatory frameworks that govern air travel. As eVTOLs gain traction for passenger transport within cities, there may be a ripple effect on airport operations, air traffic management, and certification standards, areas where CHC's existing infrastructure and expertise are relevant. The development of AAM could also spur innovation in battery technology and autonomous flight systems, which may eventually find applications in traditional helicopter operations.

CHC needs to monitor these developments closely, as shifts in aviation technology and regulation could create new competitive pressures or necessitate strategic adaptations. Key areas of focus include:

- Regulatory Evolution: Keeping abreast of evolving airworthiness standards and operational regulations for eVTOLs and autonomous systems.

- Infrastructure Impact: Assessing how urban air hubs and vertiports might affect traditional aviation infrastructure and CHC's operational planning.

- Technological Spillover: Evaluating the potential for advanced battery and propulsion technologies developed for AAM to enhance or alter CHC's existing fleet capabilities.

- Market Diversification: Exploring potential future opportunities in new AAM-related services or partnerships as the market matures.

Technological factors are crucial for CHC Group Ltd, driving advancements in helicopter design for better fuel efficiency and safety, with a focus on reduced emissions. Innovations like AI, IoT, and data analytics are revolutionizing operations through predictive maintenance and optimized flight paths, enhancing safety and efficiency. By 2025, the global aerospace 3D printing market is projected to exceed $3 billion, showcasing additive manufacturing's role in reducing lead times and costs for spare parts.

CHC leverages digitalization and data analytics for operational advantages, using real-time tracking and advanced weather monitoring for precise flight planning and fuel efficiency. Navigation and communication system upgrades are essential for meeting air traffic management regulations and improving safety, with the aviation industry investing heavily in 5G and satellite-based systems by 2024. The SAR market's demand for advanced sensors, such as thermal imaging, offers a competitive edge, with SAR operators increasingly equipping helicopters with enhanced EO/IR systems in 2024.

| Technological Factor | Impact on CHC Group Ltd | Key Data/Trend (2024/2025) |

|---|---|---|

| Advanced Helicopter Design | Improved fuel efficiency, safety, reduced emissions | Lighter composite materials, aerodynamic airframes |

| AI, IoT, Data Analytics | Predictive maintenance, optimized flight paths, enhanced safety | AI in MRO projected to save aviation billions annually by 2024 |

| Additive Manufacturing (3D Printing) | On-demand parts, reduced lead times, lower inventory costs | Global aerospace 3D printing market to reach over $3 billion by 2025 |

| Digitalization & Data Analytics | Sharpened operational edge, precise flight planning, fuel optimization | Real-time tracking, advanced weather monitoring integration |

| Navigation & Communication Systems | Enhanced safety, regulatory compliance, improved data sharing | Heavy investment in 5G and satellite-based ATM systems by 2024 |

| Advanced Sensor Technologies (SAR) | Competitive edge in SAR operations, mission success in challenging environments | Increased equipping of SAR helicopters with enhanced EO/IR systems in 2024 |

Legal factors

CHC Helicopter navigates a complex web of international and national aviation safety regulations. Staying compliant with evolving standards from bodies like the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) is critical for maintaining operational licenses and ensuring passenger safety. For instance, EASA's Safety Management System (SMS) requirements are continually updated, impacting fleet management and operational procedures.

Failure to adhere to these stringent rules carries significant consequences. Penalties can range from hefty fines, as seen in past cases of regulatory breaches in the aviation sector, to severe operational restrictions, grounding fleets, and causing substantial reputational damage. CHC's commitment to safety compliance directly impacts its ability to secure and maintain necessary certifications for its global operations.

Environmental protection laws, covering everything from emissions standards to noise pollution, directly impact helicopter operations, especially in delicate offshore settings. CHC Group Ltd must meticulously adhere to these regulations to ensure its fleet and operational practices remain compliant.

Meeting these environmental mandates might require significant capital outlay for CHC. This could involve upgrading to newer aircraft models that boast improved fuel efficiency and lower emissions, or adopting advanced technologies such as sustainable aviation fuel (SAF). For instance, the European Union's Emissions Trading System (EU ETS) is increasingly scrutinizing aviation emissions, with potential cost implications for operators flying within its airspace.

CHC Helicopter, operating globally, must navigate a complex web of labor laws and employment regulations. These vary significantly by region, covering aspects like minimum wages, overtime pay, workplace safety standards, and the rights of unionized employees. For instance, in 2024, many European countries are reviewing or have already implemented updates to their working time directives, potentially impacting CHC's scheduling and labor costs.

Staying compliant with these evolving legal frameworks is crucial for CHC. A misstep could lead to penalties, operational disruptions, and damage to its reputation. For example, in North America, recent legislative pushes in some states and provinces aim to increase minimum wage rates and enhance worker protections, which directly affects CHC's payroll and HR strategies across its North American operations.

Changes in labor laws can directly influence CHC's operational costs and human resource management. For example, stricter safety regulations, like those being reinforced in Australia's aviation sector in 2024, might necessitate increased investment in training and equipment, adding to overheads. Similarly, shifts in collective bargaining agreements or the recognition of new employee rights can alter the cost structure of employing pilots and ground staff.

Contractual Agreements and Liabilities

CHC Group Ltd's operations are deeply intertwined with contractual agreements, primarily long-term deals with major oil and gas firms and governmental bodies. These contracts define the operational landscape and directly influence the company's risk exposure. For instance, the specific terms within these agreements regarding liability, particularly concerning operational incidents or delays, are paramount. Understanding these clauses is vital for effective risk management, as they dictate financial responsibility in unforeseen circumstances.

Legal frameworks surrounding these contracts are not static; they evolve with regulatory changes and industry standards. Key elements like force majeure provisions, which outline actions to be taken during uncontrollable events, and robust dispute resolution mechanisms, are critical for safeguarding CHC's interests. These legal stipulations directly impact the company's ability to navigate operational disruptions and maintain stable business relationships. In 2024, the global aviation industry, including helicopter services, continued to see increased scrutiny on contractual compliance and liability management following several high-profile incidents in related sectors, reinforcing the importance of these legal safeguards for companies like CHC.

The nature of CHC's contracts often involves significant financial commitments and operational dependencies. Legal enforceability and the clarity of terms within these agreements are therefore essential. Any ambiguity or potential for legal challenge can lead to costly disputes and operational interruptions. This underscores the need for meticulous legal review and robust contract negotiation processes, ensuring that CHC's rights and obligations are clearly defined and protected within the prevailing legal environment. For example, in the offshore oil and gas sector, contract durations can extend for 5-10 years, making the legal framework governing these long-term partnerships incredibly significant for financial planning and operational continuity.

Specific contractual elements that demand close attention include liability caps, indemnification clauses, and performance guarantees. These are not merely legal formalities but directly translate into financial liabilities and operational flexibilities for CHC. The company's ability to secure favorable terms in these areas, while adhering to legal compliance, is a core component of its business strategy and risk mitigation efforts.

International Air Transport Laws

CHC Group Ltd, operating globally, must navigate a complex web of international air transport laws. These regulations, often stemming from bodies like the International Civil Aviation Organization (ICAO), dictate crucial aspects of cross-border flight. For instance, in 2024, the ICAO continued its push for enhanced safety standards and environmental protection, impacting aircraft operations and emissions. CHC's ability to seamlessly conduct international flights hinges on its meticulous adherence to these evolving global frameworks, ensuring compliance with aircraft registration, airworthiness directives, and international air traffic management protocols.

Bilateral air service agreements between countries also play a significant role, defining routes, frequencies, and market access. These agreements can influence CHC's operational flexibility and competitive landscape. For example, the expansion or restriction of such agreements in key markets throughout 2024 and into 2025 directly impacts CHC's ability to serve specific international corridors.

- Cross-border Operations: Governed by international treaties and bilateral agreements, affecting route approvals and traffic rights.

- Aircraft Registration: Subject to international standards for airworthiness and safety, impacting fleet management.

- Crew Licensing: International recognition of pilot and crew qualifications ensures operational continuity across borders.

- Safety Standards: Adherence to ICAO Annexes and regional aviation safety agreements is paramount for global operations.

CHC Group Ltd's operations are significantly influenced by international aviation laws and bilateral agreements, dictating cross-border flight permissions and market access. For instance, the International Civil Aviation Organization (ICAO) continued its focus on enhanced safety and environmental standards in 2024, impacting global operations and emissions. Ensuring compliance with aircraft registration and airworthiness directives is crucial for seamless international flights.

Changes in labor laws, such as minimum wage adjustments and worker protection enhancements seen in North America during 2024, directly affect CHC's payroll and HR strategies. Stricter safety regulations, like those reinforced in Australia's aviation sector in 2024, may necessitate greater investment in training and equipment, increasing overhead costs.

Contractual agreements, particularly long-term deals with energy firms and governments, are paramount. These contracts, often spanning 5-10 years in the offshore sector, dictate liability and risk exposure. The legal enforceability and clarity of terms like liability caps and indemnification clauses are essential for financial planning and operational continuity, with increased scrutiny on compliance in 2024 following industry incidents.

Environmental factors

Global and national climate change policies, such as carbon pricing and emissions targets, significantly influence the aviation sector. Regulations like the ReFuelEU Aviation initiative mandate a minimum SAF supply of 2% starting in 2025, increasing pressure on companies like CHC Group Ltd to decarbonize operations.

CHC faces direct regulatory requirements to lower its carbon footprint. Meeting these mandates could involve increased investment in sustainable technologies and operational efficiencies, potentially affecting operating costs and strategic planning for fleet modernization and fuel sourcing.

CHC Group Ltd, while not directly involved in oil extraction, faces indirect environmental risks. A significant oil spill or environmental incident impacting its clients' offshore operations could lead to heightened public scrutiny and potentially stricter regulations impacting the entire sector.

For instance, the 2010 Deepwater Horizon spill resulted in billions of dollars in fines and cleanup costs, significantly altering industry practices and regulatory frameworks for offshore energy exploration.

Such events can directly affect CHC by reducing demand for its helicopter transportation services to offshore platforms if clients scale back or halt operations due to environmental concerns or regulatory crackdowns.

In 2024, ongoing discussions around enhanced environmental protection measures in the North Sea, following earlier incidents, highlight the continued sensitivity of the offshore industry to environmental performance and the potential for regulatory shifts.

CHC Group Ltd's helicopter operations inherently create noise, a factor increasingly scrutinized by regulators. As urban sprawl continues and public environmental consciousness rises, particularly in densely populated and coastal areas where many of their services are vital, noise pollution regulations are likely to tighten. This trend is already evident globally, with cities implementing stricter curfews and decibel limits for aviation. For instance, in 2024, several European cities reported increased complaints regarding helicopter noise, prompting local authorities to review flight operating permits.

These evolving regulations could directly affect CHC Group's operational flexibility. They might necessitate adjustments to flight paths, limiting operations during specific hours, or even mandating the adoption of quieter aircraft technologies. Investments in newer, more sound-efficient helicopter models, which are becoming standard in fleet upgrades across the industry, could become a significant capital expenditure. The global market for quieter helicopter propulsion systems is projected to grow, indicating a clear industry shift towards noise reduction.

Biodiversity Conservation Concerns

CHC Group Ltd's offshore operations, particularly helicopter traffic, present potential challenges related to biodiversity conservation. These operations can impact marine and coastal ecosystems, raising concerns among environmental groups and regulatory bodies. For instance, noise pollution from helicopters can disrupt marine mammal communication and behavior.

Adherence to strict environmental impact assessments is crucial for CHC Group. These assessments help identify and mitigate potential harm to sensitive habitats and species. In 2024, CHC Group continued to invest in advanced noise reduction technologies for its helicopter fleet to minimize its ecological footprint.

Maintaining operating permits in ecologically sensitive areas hinges on demonstrating commitment to conservation guidelines. CHC Group's ability to secure and retain licenses in regions like the North Sea, a biodiversity hotspot, is directly tied to its environmental performance.

Key considerations for CHC Group regarding biodiversity include:

- Minimizing noise pollution from aircraft operations.

- Implementing spill prevention and response plans for offshore activities.

- Supporting local conservation initiatives and research projects.

- Ensuring compliance with international and national biodiversity protection regulations.

Transition to Renewable Energy Sources

The global transition to renewable energy sources, especially offshore wind, is a significant environmental factor impacting CHC Group Ltd. This shift presents a dual nature: it necessitates adapting away from traditional oil and gas logistics while simultaneously opening avenues for new helicopter service demands. CHC is actively involved in supporting the burgeoning offshore wind power sector, a market projected for substantial growth.

The International Energy Agency (IEA) reported in their 2024 outlook that offshore wind capacity is expected to grow nearly tenfold by 2050, reaching 1,200 GW. This expansion directly translates into increased demand for specialized aviation services for construction, operations, and maintenance of these wind farms. CHC's existing presence in this market positions them to capitalize on this trend, offering essential transport and logistical support.

- Global Offshore Wind Growth: Projections indicate a massive expansion of offshore wind capacity, creating a sustained need for aviation support.

- CHC's Strategic Positioning: The company's established operations in the offshore wind sector allow it to leverage this environmental trend.

- Demand for Specialized Services: Helicopter operations are crucial for accessing remote wind farm locations for critical maintenance and inspections.

- Market Opportunity: The increasing number of offshore wind farms worldwide represents a significant growth opportunity for CHC's service offerings.

CHC Group Ltd operates within an evolving environmental regulatory landscape, particularly concerning carbon emissions. Initiatives like the ReFuelEU Aviation mandate for Sustainable Aviation Fuel (SAF) starting in 2025 are compelling companies to invest in decarbonization, impacting operational costs and strategic fleet planning.

The company's offshore operations face indirect environmental risks, as significant incidents affecting clients, such as the 2010 Deepwater Horizon spill, can lead to stricter industry regulations and reduced demand for services if clients scale back operations.

Noise pollution from helicopter operations is an increasing concern, with potential for tighter regulations on flight paths and operating hours, necessitating investments in quieter aircraft technologies.

The global shift towards renewable energy, especially offshore wind, presents both challenges in transitioning from oil and gas logistics and significant opportunities for CHC Group Ltd, as this sector demands substantial aviation support for construction and maintenance.

| Environmental Factor | Impact on CHC Group Ltd | 2024/2025 Relevance |

| Climate Change Policies & SAF Mandates | Increased investment in decarbonization, potential cost increases | ReFuelEU Aviation SAF mandate of 2% from 2025 |

| Offshore Environmental Incidents | Risk of reduced client demand due to stricter regulations | Ongoing scrutiny of North Sea environmental protection measures |

| Noise Pollution Regulations | Need for quieter aircraft, potential operational restrictions | Increased noise complaints in European cities impacting flight permits |

| Growth of Offshore Wind Energy | New service demand for wind farm support | IEA projecting tenfold growth in offshore wind capacity by 2050 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for CHC Group Ltd is meticulously constructed using data from reputable sources including government publications, international economic bodies, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape influencing CHC Group Ltd.