Charter Communications SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charter Communications Bundle

Charter Communications, a giant in the broadband and cable industry, boasts significant strengths like its extensive network infrastructure and strong brand recognition. However, it also faces considerable threats from evolving technologies and increasing competition, alongside opportunities for expansion in new services.

Want the full story behind Charter's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Charter Communications, operating under the Spectrum brand, boasts an expansive network infrastructure that is a cornerstone of its operations, delivering essential services like cable television, high-speed internet, and voice across a broad geographical footprint. This vast network is a significant competitive moat, allowing Spectrum to serve millions of customers and provide a bundled offering of services.

The company's commitment to enhancing this infrastructure is evident in its substantial investments. For instance, Charter is actively deploying DOCSIS 4.0 technology and Distributed Access Architecture (DAA) to boost broadband speeds and improve service reliability. These upgrades are crucial for meeting growing consumer demand for faster and more consistent internet access.

Looking ahead, Charter has ambitious goals for its network capabilities. The company aims to make 5 Gbps internet speeds available to approximately 85% of its service areas by the close of 2025. This aggressive rollout of next-generation speeds underscores their strategy to maintain a technological edge and capture market share in the increasingly competitive broadband landscape.

Charter Communications' mobile segment, Spectrum Mobile, has shown impressive expansion, adding more than 2 million mobile lines throughout 2024. This rapid growth solidifies its standing as one of the fastest-growing mobile service providers in the United States.

The success of Spectrum Mobile is largely attributed to its effective bundling strategy. By offering attractive mobile plans to its existing broadband customer base, Charter not only enhances customer loyalty but also successfully creates a converged service offering that appeals to a broad audience.

Charter Communications demonstrates robust financial performance, evidenced by a 1.6% year-over-year revenue increase to $13.9 billion in Q4 2024. This positive momentum continued into Q1 2025 with a 0.4% revenue rise to $13.7 billion.

The company's financial health is further underscored by growth in net income and adjusted EBITDA across these periods. This indicates effective cost management strategies and successful revenue generation, solidifying its strong market position.

Strategic Investments in Network Evolution and Expansion

Charter is making substantial, multi-year investments to enhance its network capabilities. These strategic expenditures are crucial for staying competitive in the evolving telecommunications landscape. For instance, capital expenditures are anticipated to reach approximately $12 billion in 2025, underscoring the scale of this commitment.

These investments are specifically targeted at upgrading broadband infrastructure, aiming to deliver faster and more reliable internet services. Key technological advancements include the deployment of DOCSIS 4.0 and Distributed Access Architecture (DAA) to offer symmetrical and multi-gigabit speeds. This focus on next-generation technology positions Charter to meet growing consumer demand for high-speed connectivity.

Furthermore, Charter is actively working to expand its network reach into unserved and underserved rural areas. This expansion not only broadens its customer base but also addresses the digital divide, providing essential broadband access to more communities. This strategic move is vital for long-term growth and market penetration.

- Network Modernization: Investing in DOCSIS 4.0 and DAA for symmetrical multi-gigabit speeds.

- Expansion Initiatives: Targeting unserved and underserved rural markets.

- Capital Allocation: Projecting around $12 billion in capital expenditures for 2025.

- Future-Proofing: Enhancing infrastructure to meet increasing data demands and maintain a competitive edge.

Comprehensive Service Bundling and Customer Value Proposition

Charter Communications is actively enhancing its customer value by bundling services under its 'Life Unlimited' initiative. This strategy involves integrating popular streaming applications such as Max, Disney+, and Peacock directly into their Spectrum TV packages. This move aims to provide greater value and encourage customers to utilize both connectivity and entertainment offerings more effectively.

These bundled offerings are designed to attract and retain customers by simplifying access to a wider range of content. For instance, by including major streaming services, Charter can differentiate itself in a competitive market. This approach is crucial for driving growth and increasing the overall utilization of their broadband and entertainment products.

The company's focus on innovative pricing and packaging strategies, exemplified by these bundles, is a key strength. By securing these content deals, Charter is positioning itself to capitalize on the growing demand for integrated entertainment solutions. This comprehensive service bundling directly addresses customer desires for convenience and value.

- Bundling Strategy: Integration of streaming apps like Max, Disney+, and Peacock into Spectrum TV packages.

- Brand Platform: Focus on 'Life Unlimited' to communicate enhanced value and convenience.

- Growth Driver: Aim to increase utilization of connectivity and entertainment products through bundled offerings.

Charter's extensive, high-capacity network infrastructure is a significant competitive advantage, enabling it to serve millions of customers with bundled services. The company is actively investing in network upgrades, such as DOCSIS 4.0 and Distributed Access Architecture (DAA), to enhance broadband speeds and reliability. By 2025, Charter aims to make 5 Gbps internet speeds available to approximately 85% of its service areas, positioning itself for future demand.

Spectrum Mobile's rapid expansion, adding over 2 million lines in 2024, highlights its success as a fast-growing mobile provider. This growth is fueled by an effective bundling strategy that leverages its broadband customer base, fostering loyalty and creating a compelling converged offering.

Charter's financial performance remains strong, with revenue increasing by 1.6% year-over-year to $13.9 billion in Q4 2024 and a further 0.4% rise to $13.7 billion in Q1 2025. This financial health is supported by growth in net income and adjusted EBITDA, reflecting efficient operations and revenue generation.

The company's commitment to future-proofing its services is demonstrated by substantial capital expenditures, projected at around $12 billion for 2025. These investments are focused on network modernization, including DOCSIS 4.0 and DAA, to deliver multi-gigabit speeds and expand into underserved rural markets.

Charter's 'Life Unlimited' initiative, integrating streaming services like Max, Disney+, and Peacock into its TV packages, enhances customer value and encourages greater product utilization. This bundling strategy aims to differentiate Charter in a competitive market by offering convenience and value.

| Metric | Q4 2024 | Q1 2025 | 2025 Projection |

|---|---|---|---|

| Revenue Growth (YoY) | 1.6% | 0.4% | N/A |

| Spectrum Mobile Lines Added (2024) | > 2 million | N/A | N/A |

| Capital Expenditures | N/A | N/A | ~$12 billion |

| 5 Gbps Availability Target | N/A | N/A | ~85% of service areas |

What is included in the product

Highlights Charter Communications' significant market presence and network infrastructure as strengths, while acknowledging potential weaknesses in customer service and high debt levels.

Offers a clear, actionable framework to address Charter's competitive challenges and leverage its market strengths for improved customer retention and service delivery.

Weaknesses

Charter Communications has seen a notable drop in its traditional video subscriber base, losing 123,000 customers in the fourth quarter of 2024 and an additional 181,000 in the first quarter of 2025. While the pace of these losses has moderated, it still represents a significant challenge.

The company's internet services also experienced a decline in total customer numbers during both Q4 2024 and Q1 2025. This downturn is partly linked to the conclusion of the FCC's Affordable Connectivity Program, which provided subsidies to eligible households, and the impact of natural disasters affecting service areas.

Charter Communications carries a substantial debt burden, with total debt reaching $93.6 billion as of March 31, 2025. This high level of financial obligation, reflected in a leverage ratio of 4.1 times Adjusted EBITDA, could limit the company's capacity for future strategic investments or acquisitions. The significant debt may also constrain its financial flexibility, potentially impacting its ability to respond to market changes or economic downturns without incurring further financial risk.

Charter operates in a fiercely competitive U.S. broadband landscape. The market is experiencing a significant shift with the aggressive expansion of fiber optic networks and the growing adoption of fixed wireless access (FWA) services, often powered by 5G technology. This dynamic environment presents a constant challenge to Charter's ability to attract and retain subscribers.

While Charter is actively investing in upgrading its own network infrastructure to remain competitive, the rapid deployment of fiber by rivals and the increasing capabilities of FWA solutions put pressure on its market share. As consumer demand for higher speeds and more reliable internet continues to rise, Charter must navigate this evolving competitive terrain to maintain its growth trajectory.

Dependence on Legacy Cable Infrastructure

Charter's reliance on its existing hybrid fiber-coaxial (HFC) network, even with upgrades like DOCSIS 4.0, presents a challenge. Pure fiber-to-the-home (FTTH) providers often have an edge in offering symmetrical multi-gigabit speeds more readily. This legacy infrastructure can also mean higher per-passing costs for new build deployments compared to FTTH.

For instance, while Charter continues to invest in its network, the inherent architectural differences of HFC compared to FTTH can limit its ability to scale to the highest symmetrical speeds as easily as competitors building out entirely new fiber networks. This technological gap could become more pronounced as demand for ultra-high-speed, symmetrical internet services grows.

- HFC limitations: While DOCSIS 4.0 enhances HFC capabilities, it still faces inherent bandwidth and latency limitations compared to full fiber.

- FTTH advantage: Competitors with FTTH networks can more easily deliver symmetrical multi-gigabit speeds, a growing market demand.

- Deployment costs: Upgrading HFC infrastructure for future-proofing can sometimes be less cost-effective for new build areas than deploying FTTH from scratch.

Regulatory and Policy Challenges

Charter Communications operates within a dynamic telecommunications landscape, facing significant regulatory hurdles. Evolving rules around retail tariffs, consumer protection, and foreign ownership can necessitate costly adjustments and impact operational flexibility.

The potential conclusion of government subsidy programs, such as the FCC's Affordable Connectivity Program (ACP), presents a direct threat to subscriber growth and revenue streams. For instance, the ACP provided crucial support for low-income households to afford broadband services, and its discontinuation could lead to a measurable drop in Charter's customer base.

- Evolving Regulations: Telecommunications firms like Charter must navigate a complex web of changing retail tariff rules and consumer protection mandates.

- Foreign Ownership Scrutiny: Government oversight on foreign investment can influence strategic partnerships and capital raising efforts.

- Impact of Program Endings: The cessation of programs like the Affordable Connectivity Program (ACP) directly affects subscriber acquisition and retention, potentially impacting revenue figures.

Charter's legacy HFC network, even with DOCSIS 4.0 upgrades, faces inherent limitations compared to pure fiber-to-the-home (FTTH) networks, particularly in delivering symmetrical multi-gigabit speeds. This technological gap could hinder its competitive edge as demand for higher, symmetrical bandwidth increases.

The company's substantial debt of $93.6 billion as of March 31, 2025, with a leverage ratio of 4.1 times Adjusted EBITDA, could restrict its financial flexibility for crucial investments and acquisitions. This financial leverage may also limit its ability to adapt to market shifts or economic downturns.

Charter is grappling with a decline in its traditional video subscriber base, losing 123,000 customers in Q4 2024 and another 181,000 in Q1 2025. Its internet services also saw a dip in total customers during these periods, partly due to the end of the FCC's Affordable Connectivity Program.

| Metric | Q4 2024 | Q1 2025 |

|---|---|---|

| Video Subscribers Lost | 123,000 | 181,000 |

| Total Debt (as of March 31, 2025) | $93.6 billion | |

| Leverage Ratio (Adj. EBITDA) | 4.1x | |

What You See Is What You Get

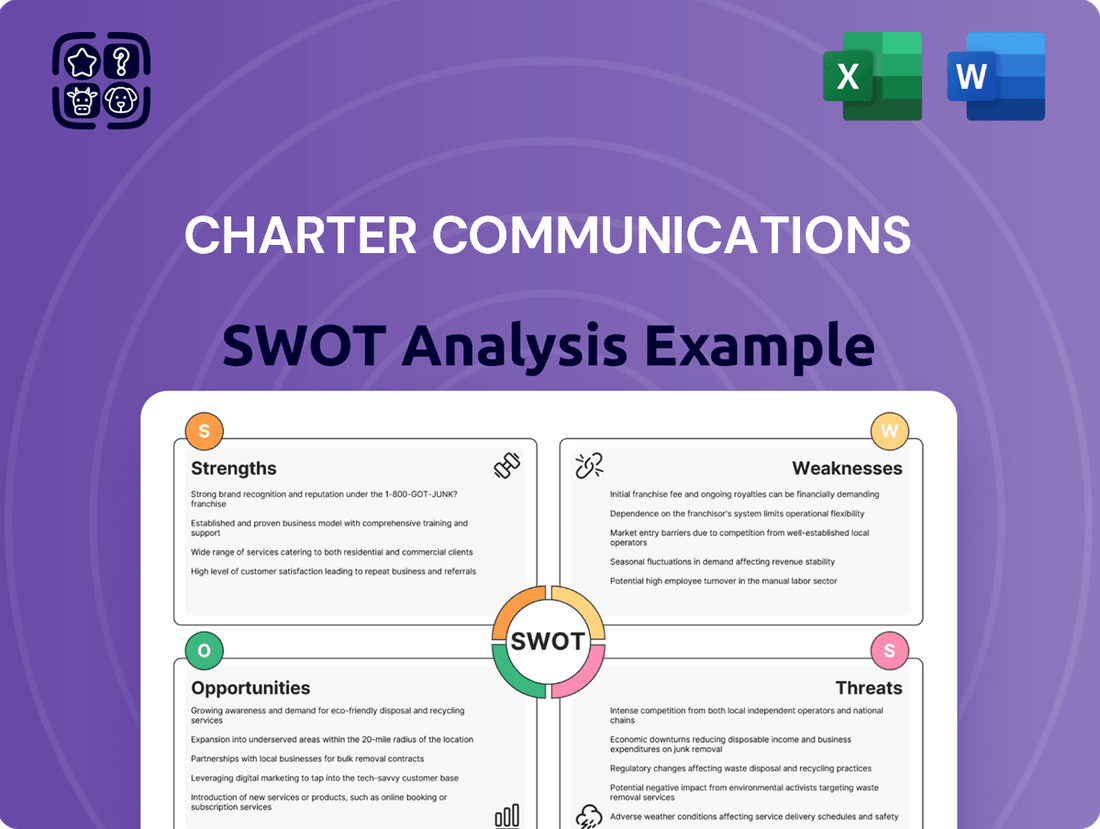

Charter Communications SWOT Analysis

This is the actual Charter Communications SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details their Strengths, Weaknesses, Opportunities, and Threats in a comprehensive format.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview of Charter Communications.

Opportunities

Charter's Spectrum Mobile is a key growth avenue, with its bundling strategy with broadband services proving effective. This convergence aims to offer customers a seamless connectivity experience, enhancing customer loyalty and average revenue per user.

The partnership with T-Mobile, particularly for business clients, accelerates Charter's wireless expansion. This allows for rapid, cost-efficient scaling of mobile services, leveraging T-Mobile's network infrastructure to deliver competitive wireless plans.

Charter Communications is strategically leveraging government-backed programs, including the Rural Digital Opportunity Fund (RDOF) and various state-level broadband expansion projects. These initiatives are designed to bring high-speed internet to areas historically lacking adequate service.

This focus on rural broadband expansion presents a significant avenue for Charter to acquire new subscribers and increase its market share in previously untapped territories. The demand for reliable internet in these regions remains high, making these expansion efforts a key growth driver.

As of early 2024, the RDOF alone committed billions in federal funding to bridge the digital divide, with companies like Charter poised to benefit from these investments by building out infrastructure in eligible rural areas. This directly translates to potential revenue growth and expanded customer base for the company.

Charter's strategic network upgrades, including the rollout of DOCSIS 4.0 and Distributed Access Architecture (DAA), are on track to deliver multi-gigabit and symmetrical speeds across its service areas by 2025. This significant investment positions Charter to effectively challenge fiber competitors and cater to the escalating demand for robust internet connectivity.

By achieving these advanced speeds, Charter aims to enhance its competitive edge, capture a larger share of the high-speed internet market, and potentially onboard new subscribers who prioritize superior bandwidth capabilities. This evolution is crucial for maintaining market relevance and driving future revenue growth.

Leveraging AI and Automation for Operational Efficiency and Customer Experience

Charter Communications has a significant opportunity to enhance its operations and customer interactions by embracing artificial intelligence (AI) and automation. The telecom sector is rapidly integrating these technologies to streamline network management, elevate customer service, and boost overall operational efficiency. By investing in AI-driven solutions, Charter can expect to see a tangible reduction in operational costs.

Furthermore, the implementation of AI can lead to a marked improvement in customer satisfaction. This is achieved through more responsive and personalized customer support, as well as the optimization of network performance, ensuring a reliable service for its subscribers. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human agents for more complex issues, thereby improving response times and overall customer experience.

- Cost Reduction: AI can automate routine tasks in network monitoring and maintenance, potentially lowering operational expenditures.

- Enhanced Customer Experience: Personalized service offerings and faster issue resolution through AI-powered support channels.

- Network Optimization: Predictive maintenance and intelligent traffic management can improve service reliability and performance.

- Data Analytics: AI can analyze vast amounts of customer data to identify trends and opportunities for service improvement.

Strategic Partnerships and Content Integration

Charter's strategic alliances with leading content providers are a significant opportunity. By integrating popular streaming applications directly into its Spectrum TV packages, Charter is enhancing the appeal of its core video service. This move, which includes offering complimentary access to ad-supported streaming apps, directly addresses the evolving consumer demand for bundled entertainment solutions.

This integration strategy is crucial for customer retention in the increasingly fragmented video market. It differentiates Charter from competitors by providing a more cohesive and value-added entertainment experience. For instance, by offering bundled streaming options, Charter aims to mitigate cord-cutting and solidify its position as a comprehensive entertainment provider.

Key aspects of this opportunity include:

- Enhanced Value Proposition: Offering integrated streaming apps makes Spectrum TV packages more attractive to consumers seeking convenience and variety.

- Customer Retention: This strategy directly combats cord-cutting by providing a compelling reason for subscribers to stay with Charter's video services.

- Competitive Differentiation: Charter can stand out in a crowded market by bundling popular streaming content, offering a unique selling proposition.

- Potential for New Revenue Streams: While focused on retention, these partnerships could also open avenues for revenue sharing or premium tier offerings in the future.

Charter's expansion into mobile services, particularly through bundling with its broadband, presents a significant growth opportunity. By Q1 2024, Charter reported over 6.3 million mobile customers, showcasing strong adoption of its converged offerings.

Leveraging partnerships, such as the one with T-Mobile, allows Charter to scale its wireless business efficiently, reaching more customers with competitive plans. This strategy is crucial for capturing market share in the growing mobile sector.

Charter is actively pursuing government funding for rural broadband expansion, including programs like the Rural Digital Opportunity Fund (RDOF). These initiatives are projected to inject billions into infrastructure development, enabling Charter to connect underserved areas and acquire new subscribers.

The company's ongoing network upgrades, including DOCSIS 4.0 and Distributed Access Architecture (DAA), are set to deliver multi-gigabit speeds by 2025. This technological advancement positions Charter to compete effectively with fiber providers and meet increasing consumer demand for high-performance internet.

AI and automation offer substantial opportunities for Charter to reduce operational costs and enhance customer experience. By implementing AI for network management and customer support, Charter can improve efficiency and customer satisfaction, as seen in the telecom industry's broader adoption of these technologies.

Strategic alliances with content providers, integrating streaming applications into Spectrum TV packages, enhance Charter's video service value. This approach aims to boost customer retention by offering a more comprehensive and convenient entertainment solution, directly addressing evolving consumer preferences.

| Opportunity Area | Key Driver | 2024/2025 Data/Projection |

|---|---|---|

| Mobile Service Expansion | Bundling with Broadband | Over 6.3 million mobile customers (Q1 2024) |

| Rural Broadband Expansion | Government Funding (RDOF) | Billions in federal funding committed to bridge the digital divide |

| Network Technology Upgrades | DOCSIS 4.0 & DAA Rollout | Multi-gigabit speeds by 2025 |

| AI & Automation | Operational Efficiency & Customer Experience | Industry-wide trend towards cost reduction and improved service |

| Content Integration | Streaming App Bundling | Enhancing video package appeal and customer retention |

Threats

Charter faces escalating competition in the broadband sector, notably from fiber optic providers who boast superior symmetrical speeds. This technological advantage allows fiber to offer a more robust performance, potentially drawing subscribers away from Charter's existing infrastructure.

Furthermore, the rise of 5G Fixed Wireless Access (FWA) presents a significant alternative, offering a competitive pricing or convenience factor that could further erode Charter's internet subscriber base. For instance, T-Mobile reported over 2.6 million home internet customers by the end of Q1 2024, showcasing the rapid adoption of FWA.

Charter must effectively differentiate its services or enhance its network capabilities to counter these threats and mitigate potential subscriber losses. Failing to adapt could lead to continued pressure on its market share in the increasingly dynamic broadband landscape.

The persistent trend of consumers ditching traditional cable TV for streaming services, often called 'cord-cutting,' remains a significant challenge for Charter Communications' video revenue. This shift directly impacts the subscriber base for their legacy video offerings.

While Charter is actively working to incorporate streaming applications into its services, a prolonged decrease in traditional video customers could exert downward pressure on the company's overall revenue and profitability metrics. For instance, in Q1 2024, Charter reported a net loss of 24,000 video customers, a continuation of a trend that saw a decline of 112,000 video customers in the full year 2023.

Charter Communications, like all major telecommunications providers, operates within a landscape of evolving regulatory scrutiny. Potential policy shifts concerning retail tariffs and consumer protection measures could directly influence pricing strategies and service offerings, impacting revenue streams.

Furthermore, increasing focus on data privacy and network security presents ongoing compliance challenges and potential costs. For instance, the Federal Communications Commission (FCC) continues to review broadband privacy rules, which could necessitate further investments in data protection infrastructure.

High Capital Expenditure and Investment Requirements

Charter's aggressive network modernization and expansion efforts necessitate substantial capital outlays. The company anticipates capital expenditures to reach approximately $12 billion in 2025, marking a significant investment peak.

While these investments are crucial for maintaining a competitive edge and future growth, the high expenditure levels could place a strain on Charter's financial flexibility. This is particularly true if subscriber acquisition and retention do not align with projections, potentially impacting short-term free cash flow generation.

- Network Upgrades: Significant investment in fiber optic expansion and 5G integration.

- Capital Intensity: The telecommunications sector inherently demands high upfront investment for infrastructure.

- Financial Strain Risk: Potential pressure on free cash flow if revenue growth doesn't offset expenditures.

Technological Disruption and Evolving Consumer Demands

Technological disruption, particularly with the progression to 5G Advanced and the anticipation of 6G, presents a significant threat. The growing consumer appetite for applications demanding ultra-low latency, such as advanced gaming and real-time augmented reality, directly challenges current infrastructure and service offerings.

Charter must aggressively innovate and adapt its technologies and service models to align with these shifting consumer expectations. This necessitates substantial and sustained investment in research and development, alongside keen strategic foresight to anticipate future market needs and technological shifts. For instance, the global 5G services market was valued at approximately $37.4 billion in 2023 and is projected to grow significantly, highlighting the competitive pressure to keep pace.

- 5G Advanced and 6G Rollout: The ongoing development and eventual deployment of these next-generation mobile technologies will require substantial capital investment and could alter the competitive landscape by enabling new services and potentially bypassing traditional broadband providers for certain applications.

- Ultra-Low Latency Demand: Increasing consumer and enterprise demand for near-instantaneous data transfer for applications like immersive gaming, VR/AR, and autonomous systems places pressure on Charter's network capabilities and service delivery.

- Innovation Imperative: Failure to continuously innovate and integrate new technologies could lead to a loss of market share to more agile competitors or new entrants offering superior low-latency solutions.

The increasing adoption of 5G Fixed Wireless Access (FWA) by competitors like T-Mobile, which already serves over 2.6 million home internet customers as of Q1 2024, poses a direct threat to Charter's broadband market share by offering a compelling alternative. Additionally, the ongoing trend of cord-cutting, evidenced by Charter's loss of 112,000 video customers in 2023 and a further 24,000 in Q1 2024, continues to erode its traditional video revenue base.

Charter must navigate evolving regulatory landscapes, where potential changes to retail tariffs and consumer protection rules could impact pricing and service offerings, alongside the substantial capital expenditures of approximately $12 billion anticipated for 2025 to fund network upgrades. This high investment, while necessary for competitiveness against emerging technologies like 5G Advanced and future 6G, risks straining financial flexibility if subscriber growth doesn't keep pace with expenditure.

| Threat Category | Specific Threat | Impact on Charter | Supporting Data/Trend |

|---|---|---|---|

| Competition | 5G Fixed Wireless Access (FWA) | Erosion of broadband subscriber base | T-Mobile had over 2.6 million home internet customers by end of Q1 2024 |

| Market Shift | Cord-Cutting | Decline in video revenue and subscribers | Charter lost 112,000 video customers in 2023 and 24,000 in Q1 2024 |

| Technological Disruption | Advancement to 5G Advanced/6G | Need for continuous, costly innovation; potential for new low-latency services to bypass traditional broadband | Global 5G services market valued at ~$37.4 billion in 2023, indicating rapid growth and investment |

| Financial/Operational | High Capital Expenditures | Potential strain on financial flexibility and free cash flow | Anticipated capital expenditures of ~$12 billion in 2025 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Charter's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.