Charter Communications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Charter Communications Bundle

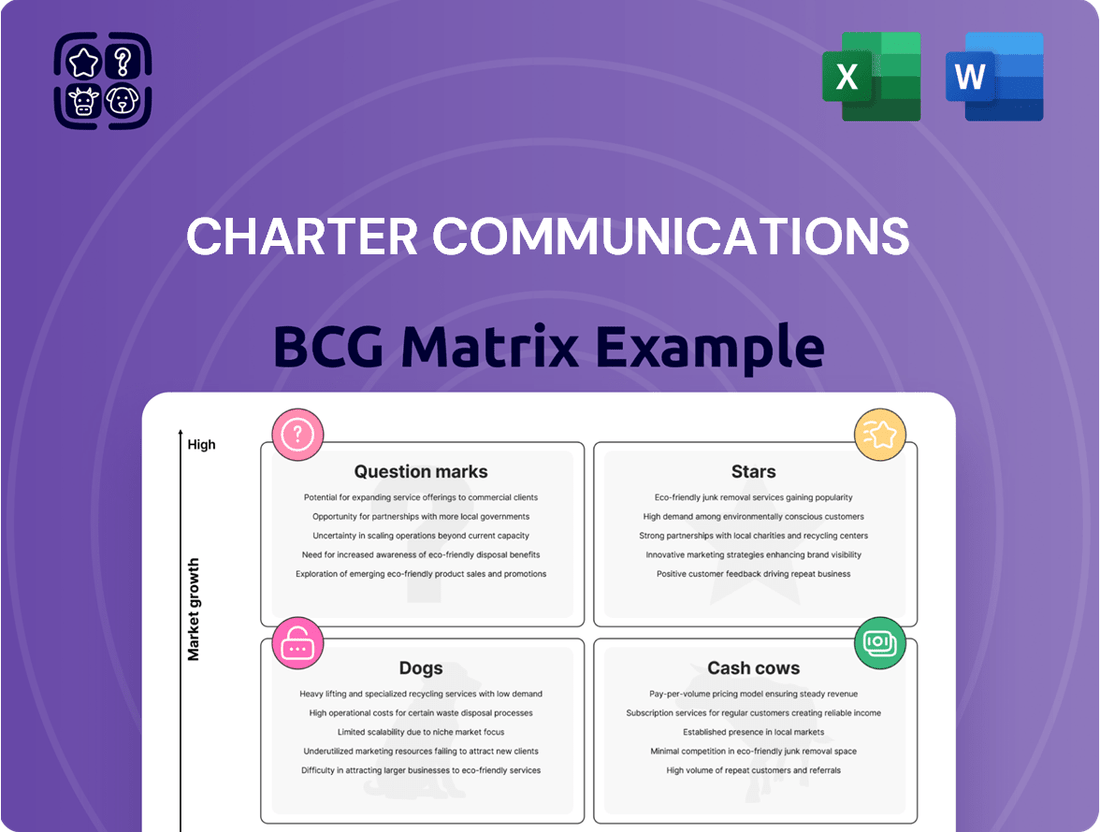

Explore the strategic positioning of Charter Communications' diverse product portfolio through its BCG Matrix. Understand which services are generating significant revenue, which require substantial investment, and which may be underperforming in the market.

This preview offers a glimpse into Charter's market dynamics, but the full BCG Matrix unlocks a comprehensive understanding of its Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report for actionable insights and a clear roadmap to optimize your investment and product strategies.

Don't miss out on the detailed quadrant analysis and data-driven recommendations that will empower you to make informed decisions about Charter's offerings. Get the full BCG Matrix today and gain a competitive edge.

Stars

Spectrum Mobile, a part of Charter Communications, is positioned as a star in the BCG matrix. It boasts a high market share within the expanding mobile virtual network operator (MVNO) sector, capitalizing on Charter's robust broadband network and strategic MVNO partnerships.

This strategic advantage has fueled rapid subscriber growth, with Spectrum Mobile surpassing 10 million mobile lines in early 2024. The company consistently adds hundreds of thousands of new lines each quarter, solidifying its role as a crucial revenue growth engine for Charter.

Charter's high-speed internet, bolstered by DOCSIS 4.0, is a definite Star. Despite a recent dip in overall subscriber growth, this investment in symmetrical multi-gigabit speeds is a game-changer. The company's commitment to delivering up to 10 Gbps across its service areas highlights its strong market position and future potential in a competitive landscape.

Charter Communications' rural broadband expansion represents a significant investment in a high-growth sector. This initiative is fueled by substantial private capital and government subsidies, aiming to connect unserved and underserved areas with advanced fiber-optic technology. In 2024, Charter continued its aggressive build-out, adding hundreds of thousands of new potential customer connections annually through this program.

Spectrum Business (Mid-Market and Large Business)

Spectrum Business, encompassing Charter's mid-market and large business offerings, is a clear Star in the BCG Matrix. This segment is experiencing robust revenue expansion, a testament to its strong position within the expanding enterprise connectivity landscape. Charter's strategic emphasis on delivering customized solutions and dependable services to businesses fuels this segment's growth and suggests significant potential for future market penetration.

In 2024, Charter reported substantial revenue increases in its business services, driven by demand from mid-market and enterprise clients. This growth reflects the increasing need for high-speed, reliable internet and advanced communication solutions for businesses of all sizes.

- Strong Revenue Growth: Charter's business services segment consistently shows double-digit year-over-year revenue growth, outperforming many industry averages.

- Expanding Market Share: The company is capturing a larger share of the business internet and connectivity market, particularly in its service areas.

- Investment in Infrastructure: Ongoing investments in network upgrades and fiber expansion directly support the high-capacity demands of enterprise clients.

- Tailored Solutions: Charter offers a range of specialized products, including dedicated internet access, Ethernet services, and managed Wi-Fi, catering to the diverse needs of larger businesses.

Bundled Services (Spectrum One)

Spectrum One, a bundled offering of internet, advanced WiFi, and mobile services, is a prime example of a Star product within Charter Communications' BCG Matrix. This strategy has proven effective in drawing in and keeping customers due to its competitive pricing and added value. In the first quarter of 2024, Charter reported that Spectrum One drove a significant portion of new customer additions, contributing to a total of 39,000 residential customer relationships added during the period.

The success of Spectrum One stems from its ability to leverage Charter's existing infrastructure and customer base. By combining essential services, Charter enhances customer loyalty and creates a more compelling value proposition compared to standalone offerings. This strategic bundling directly supports subscriber growth and strengthens Charter's market position.

- Spectrum One's bundled approach drives customer acquisition and retention.

- The offering combines internet, advanced WiFi, and mobile services for enhanced value.

- In Q1 2024, Spectrum One contributed significantly to Charter's residential customer growth.

- This strategy capitalizes on Charter's core competencies to boost subscriber numbers.

Spectrum Mobile is a star, showing rapid subscriber growth and exceeding 10 million mobile lines by early 2024. This growth is a key revenue driver for Charter.

Charter's high-speed internet, especially with DOCSIS 4.0 enabling up to 10 Gbps, is a star despite recent subscriber dips. This investment solidifies its competitive edge.

Spectrum Business is a star, experiencing robust revenue growth in the enterprise connectivity sector. Charter's focus on tailored business solutions fuels this expansion.

Spectrum One, a bundled offering, is a star product. It significantly contributed to new customer additions in Q1 2024, enhancing customer loyalty and value.

| Product | BCG Category | Key Growth Driver | 2024 Data Point |

|---|---|---|---|

| Spectrum Mobile | Star | High market share in expanding MVNO sector, leveraging broadband network | Exceeded 10 million mobile lines in early 2024 |

| High-Speed Internet (DOCSIS 4.0) | Star | Investment in multi-gigabit speeds (up to 10 Gbps) | Commitment to symmetrical multi-gigabit speeds |

| Spectrum Business | Star | Robust revenue expansion in enterprise connectivity | Substantial revenue increases in business services |

| Spectrum One | Star | Bundled offering driving customer acquisition and retention | Contributed significantly to residential customer growth in Q1 2024 |

What is included in the product

This BCG Matrix analysis of Charter Communications highlights strategic growth opportunities and areas for potential divestment within its diverse service offerings.

A clear Charter Communications BCG Matrix overview helps identify underperforming "Dogs" and "Cash Cows" to divest or optimize, relieving the pain of resource misallocation.

Cash Cows

Charter's existing residential high-speed internet subscriber base, despite recent fluctuations in net additions, continues to be a robust cash cow.

This segment boasts a substantial market share within a mature industry, consistently delivering significant recurring revenue.

In the first quarter of 2024, Charter reported approximately 31.4 million broadband customers, underscoring the sheer scale of this established revenue stream.

The essential nature of broadband, coupled with Charter's pricing power, ensures strong and predictable cash flow generation from this core business.

Spectrum Advanced WiFi, Charter Communications' offering for optimized home networks and enhanced control, functions as a cash cow within their business portfolio. This service directly complements their core internet offerings, providing customers with added value and, crucially, helping to reduce customer churn. In 2023, Charter reported that its Spectrum Internet customers reached 30.7 million, with a significant portion likely benefiting from these advanced networking solutions.

While not positioned as a primary driver of new growth, Spectrum Advanced WiFi significantly boosts the stickiness of Charter's main broadband product. The consistent revenue generated from these value-added services contributes reliably to the company's overall financial health. This strategy of enhancing existing services with features like advanced WiFi helps maintain a strong customer base and predictable income streams.

Charter's advertising sales, leveraging its vast video and digital footprint, function as a significant cash cow within its business portfolio. The company commands a substantial market share in local and regional advertising, a testament to its reach and influence.

In 2023, Charter's advertising and sales revenue reached $3.3 billion, demonstrating the segment's robust contribution to the company's financial performance. This consistent revenue stream, even amidst evolving video consumption habits, underscores its stability and profitability.

Existing Network Infrastructure

Charter Communications' extensive network infrastructure, spanning over 950,000 miles, is a prime example of a cash cow within its business portfolio. This robust foundation allows for efficient and profitable delivery of its core services.

The sheer scale of this network provides a significant competitive moat, enabling Charter to operate with high profit margins due to economies of scale. This established asset generates consistent and substantial cash flow, funding other strategic initiatives.

- Network Miles: Over 950,000 miles of owned and operated network infrastructure.

- Competitive Advantage: Enables efficient service delivery and cost advantages.

- Profitability: High profit margins driven by the established infrastructure.

- Investment Focus: Continued investment in supporting infrastructure to enhance efficiency and cash flow generation.

Small Business Internet

Charter Communications' small business internet segment is a prime example of a cash cow within their business. While the residential internet market might be experiencing more challenges, this particular division is thriving, especially with the introduction of more adaptable service packages tailored for businesses.

These essential connectivity services are crucial for businesses, and they typically command higher pricing compared to residential plans. Furthermore, the churn rate, meaning the percentage of customers who stop using the service, is notably lower in the small business segment, contributing to predictable and consistent revenue streams.

In 2024, Charter's Spectrum Business, which serves this segment, continued to demonstrate robust performance. For instance, as of the first quarter of 2024, Charter reported that its business services revenue, which includes small and medium-sized businesses, grew by a healthy percentage, underscoring the stability and profitability of this market.

- Stable Revenue: Small business internet provides a reliable income source for Charter.

- Higher Pricing Power: Businesses often pay more for dedicated and robust internet solutions.

- Lower Churn: Businesses are less likely to switch internet providers compared to residential customers.

- Essential Service: Connectivity is fundamental for modern business operations, ensuring consistent demand.

Charter's extensive fiber optic network, a critical asset, functions as a significant cash cow. This infrastructure underpins their high-speed internet services, generating substantial and predictable revenue.

The company's investment in this network, exceeding 950,000 miles, allows for efficient service delivery and cost advantages, leading to high profit margins. This established asset consistently generates strong cash flow, supporting other business ventures.

Charter's advertising sales, leveraging its broad viewership across video and digital platforms, represent another key cash cow. In 2023, this segment alone brought in $3.3 billion in revenue, highlighting its profitability and market influence.

The small business internet segment also acts as a reliable cash cow, with businesses often willing to pay premium prices for essential connectivity. This segment benefits from lower churn rates, ensuring consistent income for Charter.

| Segment | Role in BCG Matrix | Key Financial Indicator (2023/Q1 2024) | Rationale |

|---|---|---|---|

| Residential Broadband | Cash Cow | ~31.4 million customers (Q1 2024) | Mature market, high market share, consistent recurring revenue. |

| Advertising Sales | Cash Cow | $3.3 billion revenue (2023) | Leverages existing footprint, strong market share in local/regional advertising. |

| Network Infrastructure | Cash Cow | >950,000 miles | Enables efficient service delivery, economies of scale, high profit margins. |

| Small Business Internet | Cash Cow | Growing business services revenue (Q1 2024) | Essential service for businesses, higher pricing power, lower churn. |

Preview = Final Product

Charter Communications BCG Matrix

The Charter Communications BCG Matrix preview you are viewing is the definitive document you will receive immediately after your purchase, offering a complete and unwatermarked strategic analysis. This preview accurately represents the final, professionally formatted report, ensuring you get precisely what you need for in-depth business planning and competitive assessment. You can be confident that the detailed breakdown of Charter's business units within the BCG framework is ready for immediate application, without any alterations or missing sections. This is the exact, analysis-ready file you'll download, empowering you to make informed strategic decisions with confidence.

Dogs

Traditional cable television is a definite 'Dog' for Charter Communications. Subscriber numbers have been consistently dropping as people increasingly cut the cord in favor of streaming services.

Despite attempts to stem this tide through revised pricing and bundling streaming apps, video revenue continues its downward trajectory. This segment operates in a low-growth market where Charter's share is shrinking.

In the first quarter of 2024, Charter reported a net loss of 226,000 video subscribers, continuing a trend seen throughout 2023 where they lost over 1 million video customers.

Wireline voice services represent a classic 'Dog' within Charter Communications' portfolio. This segment has seen a steady decrease in both its customer base and overall revenue. For instance, in 2023, Charter reported a continued decline in its residential voice subscribers, reflecting a broader industry trend.

The market for traditional wireline voice is characterized by low growth and a mature stage, with consumers increasingly opting for mobile phone plans and Voice over Internet Protocol (VoIP) alternatives. This shift significantly erodes the demand for legacy landline services.

Consequently, investments in wireline voice are not expected to generate substantial returns for Charter. The strategic approach here often involves minimizing operational costs and potentially divesting the service if feasible, rather than pursuing growth initiatives.

Legacy product bundles, excluding mobile services, are often categorized as Dogs in the BCG Matrix. These offerings, heavily reliant on traditional video and voice, face declining demand as consumers increasingly adopt newer, more integrated solutions. Charter Communications, like many in the industry, sees these bundles struggle to gain traction in a market that is moving away from standalone cable and landline services.

These "Dog" bundles are characterized by their low market share within a shrinking market segment. As consumers migrate to mobile-first communication and streaming entertainment, these traditional packages become less appealing, contributing to customer churn. For instance, while Charter's overall broadband subscriber growth remained robust in 2024, the decline in traditional video subscribers highlights the challenge faced by these legacy bundles.

Outdated Equipment/Services

Older, less efficient equipment or services that don't meet current customer demands for speed, reliability, or advanced features can be considered a Dogs category for Charter Communications. Continuing to support these might become a cash trap, diverting resources without generating substantial returns or offering a competitive edge in the fast-changing telecom market.

For instance, legacy cable modem technology, while still functional for some, struggles to compete with the gigabit speeds increasingly offered by fiber competitors. Charter's investment in upgrading its network infrastructure, aiming for widespread gigabit availability, highlights the strategic shift away from older, less capable services.

- Outdated Equipment: Older modems and set-top boxes that do not support the latest Wi-Fi standards or offer advanced streaming capabilities.

- Less Efficient Services: Legacy cable TV packages with fewer channels or lower resolution compared to modern IPTV offerings.

- Customer Demand Mismatch: Failure to align service offerings with growing consumer expectations for higher bandwidth and seamless connectivity.

- Resource Drain: Maintaining older infrastructure can tie up capital and technical expertise that could be better utilized in developing and deploying next-generation technologies.

Specific Niche/Low-Demand Video Packages

Specific niche or low-demand video packages represent Charter Communications' potential Dogs in the BCG matrix. These offerings, characterized by low market share and minimal revenue contribution, often struggle to align with evolving consumer preferences and Charter's strategic shift towards integrated streaming services.

These packages likely incur programming costs that outweigh subscriber interest, leading to a negative cash flow. For instance, as of early 2024, Charter has been actively streamlining its video product portfolio, aiming to shed underperforming legacy offerings to focus resources on growth areas.

- Low Market Share: These niche packages typically serve a very small segment of Charter's customer base.

- Minimal Revenue Contribution: Their limited subscriber numbers translate to insignificant revenue generation for the company.

- High Programming Costs: The cost of licensing content for these packages often exceeds the revenue they produce.

- Strategic Misalignment: They do not fit with Charter's broader strategy of offering unified, modern entertainment solutions.

Traditional wireline voice services are a clear 'Dog' for Charter Communications, experiencing a steady decline in subscribers and revenue. This segment operates in a mature, low-growth market where consumers are increasingly opting for mobile and VoIP alternatives.

Legacy product bundles, excluding mobile, also fall into the 'Dog' category. These offerings, reliant on declining video and voice services, struggle against newer, integrated solutions, contributing to customer churn as consumers shift to streaming and mobile-first communication.

Outdated equipment and less efficient services, such as older modems or legacy cable TV packages, are considered 'Dogs.' These offerings fail to meet current customer demands for speed and features, potentially becoming a resource drain without offering a competitive edge.

Niche or low-demand video packages also represent 'Dogs.' These packages have low market share, minimal revenue, and often high programming costs that exceed their subscriber interest, leading Charter to streamline these underperforming offerings.

| Service Segment | BCG Category | Key Challenges | 2024 Performance Indicator |

|---|---|---|---|

| Traditional Video | Dog | Declining subscribers due to cord-cutting, low market growth. | Net loss of 226,000 video subscribers in Q1 2024. |

| Wireline Voice | Dog | Eroding demand from mobile and VoIP, declining customer base. | Continued decline in residential voice subscribers throughout 2023. |

| Legacy Bundles (excl. Mobile) | Dog | Low appeal in a market shifting to integrated solutions, customer churn. | Struggling to gain traction as broadband growth continues. |

| Outdated Equipment/Services | Dog | Inability to meet speed/feature demands, potential resource drain. | Strategic shift towards gigabit network upgrades. |

Question Marks

Charter's response to the rising threat of Fixed Wireless Access (FWA) from competitors like T-Mobile and Verizon is categorized as a 'Question Mark' within the BCG Matrix. This classification highlights the uncertainty surrounding Charter's ability to maintain its market position against the aggressive growth of FWA services.

While Charter generally offers faster broadband speeds, the increasing adoption of FWA, largely fueled by its attractive pricing strategies, presents a significant challenge to Charter's market share. For instance, T-Mobile reported over 4 million FWA customers by the end of 2023, demonstrating the rapid uptake of this technology.

To counter this trend and prevent further erosion of its customer base, Charter must make substantial investments in enhancing its existing broadband infrastructure and developing more competitive pricing models. Strategic initiatives are crucial to solidify its standing in a rapidly evolving connectivity landscape.

IoT and smart home services are a classic Question Mark for Charter Communications. This sector is experiencing rapid expansion, with the global smart home market projected to reach over $170 billion by 2025, and continuing strong growth anticipated through 2030. Charter's current presence in this high-growth area, while present, is likely smaller than that of dedicated technology companies, placing it in a position where significant strategic investment is crucial to gain traction.

To elevate these offerings from Question Marks to potential Stars, Charter needs to strategically invest in developing and marketing its smart home solutions. This involves enhancing its service portfolio, potentially through partnerships or acquisitions, and clearly communicating the value proposition to consumers. Without a focused approach and substantial capital allocation, Charter risks being outpaced by more specialized competitors in this dynamic market.

Charter's foray into offering à la carte streaming apps to its broadband-only customers positions this strategy as a Question Mark in the BCG Matrix. This move is a direct response to the persistent trend of cord-cutting, aiming to retain customers who might otherwise abandon traditional cable bundles.

The success of these standalone streaming options is uncertain, heavily dependent on consumer adoption rates and Charter's ability to attract a new segment of users who prefer flexible, unbundled entertainment. Significant marketing investment and strategic partnerships will be crucial for this initiative to gain meaningful market share.

Enterprise-level AI/Cloud Solutions

Charter Communications' enterprise-level AI/Cloud Solutions could be a question mark in the BCG matrix. While the telecom sector is experiencing rapid AI integration for network optimization and enhanced customer service, representing a significant growth avenue, Charter's current market penetration and investment in these specific advanced offerings might be in early stages. This necessitates considerable strategic focus and resource allocation to build a strong competitive position and capture market share.

- High Growth Potential: The global AI in telecom market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially, driven by demand for predictive maintenance and personalized customer interactions.

- Nascent Market Position: Charter's specific market share and established offerings in enterprise AI/Cloud solutions are still developing, requiring strategic investment to compete effectively.

- Investment Requirement: Capturing this high-growth segment will demand significant capital expenditure for research, development, and talent acquisition in AI and cloud technologies.

Wholesale Services

Charter Communications' wholesale services, where it offers network access to other providers, could be categorized as a Question Mark in the BCG Matrix. While the company possesses a strong, established network infrastructure, which is a significant asset, the wholesale market segment itself may represent a high-growth opportunity. However, Charter's current market share within this specific niche might be relatively low, necessitating substantial investment to capture a larger portion of this expanding sector.

This positioning suggests that while the foundational network assets are robust and likely generate consistent revenue, the wholesale business unit requires careful strategic consideration. To move this segment from a Question Mark towards a Star, Charter would need to focus on increasing its market penetration. This could involve strategic partnerships with smaller internet service providers or content delivery networks, alongside targeted investments in sales and marketing efforts tailored to the wholesale market.

For instance, in 2024, the demand for wholesale broadband capacity continued to rise as more companies sought to leverage existing robust fiber networks to expand their own service offerings without the capital expenditure of building out their own infrastructure. Charter's ability to capitalize on this trend depends on its strategic approach to pricing, service level agreements, and its capacity to innovate in offering tailored wholesale solutions.

- Network Strength: Charter's extensive fiber network forms a strong base, akin to a Cash Cow, providing reliable infrastructure.

- Market Potential: The wholesale services market is seen as a high-growth area, attracting new entrants and expanding service needs.

- Market Share: Charter's current penetration in the wholesale segment may be limited, indicating a need for strategic growth initiatives.

- Strategic Imperative: Significant investment and potential partnerships are required to scale operations and improve market position in wholesale services.

Charter's expansion into the Internet of Things (IoT) and smart home services represents a classic Question Mark. This market is experiencing robust growth, with global smart home market projections exceeding $170 billion by 2025 and continued strong expansion anticipated through 2030.

While Charter has a presence, its market share in this high-growth sector is likely smaller than specialized tech firms, necessitating significant investment to gain traction and move from a Question Mark to a potential Star.

To achieve this, Charter must strategically invest in developing and marketing its smart home solutions, potentially through partnerships or acquisitions, and clearly communicate its value proposition to consumers.

Charter's strategy of offering à la carte streaming apps to broadband-only customers is also a Question Mark, aiming to combat cord-cutting.

Success hinges on consumer adoption and Charter's ability to attract users preferring unbundled entertainment, requiring substantial marketing and strategic partnerships.

Charter's enterprise-level AI/Cloud Solutions are another Question Mark, despite the telecom sector's rapid AI integration for network optimization and customer service, a significant growth avenue.

Charter's current market penetration and investment in these advanced offerings may be in early stages, demanding considerable strategic focus and resource allocation to build a competitive position.

The global AI in telecom market was valued at approximately $3.5 billion in 2023, with substantial growth projected, driven by demand for predictive maintenance and personalized customer interactions.

Charter's wholesale services, offering network access to other providers, are also a Question Mark. While Charter has a strong network infrastructure, the wholesale market segment itself is a high-growth opportunity, but Charter's current market share might be low, requiring significant investment.

In 2024, demand for wholesale broadband capacity continued to rise as companies sought to leverage robust fiber networks, making Charter's strategic approach to pricing, service level agreements, and innovation crucial for capturing market share.

| Business Area | BCG Category | Key Considerations | Growth Potential | Market Share |

|---|---|---|---|---|

| IoT & Smart Home | Question Mark | High market growth, but Charter's current position is nascent. Requires significant investment in development and marketing. | Very High | Low |

| À la Carte Streaming Apps | Question Mark | Addresses cord-cutting trend. Success depends on consumer adoption and marketing effectiveness. | Moderate to High | Developing |

| Enterprise AI/Cloud Solutions | Question Mark | Rapidly growing sector in telecom. Charter's early stage requires substantial strategic focus and investment. | Very High | Low |

| Wholesale Services | Question Mark | Leverages strong network infrastructure. High market growth potential, but requires increased market penetration through partnerships and targeted efforts. | High | Limited |

BCG Matrix Data Sources

Our Charter Communications BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research on broadband and cable, and expert commentary on market trends.