Chandra Asri Petrochemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chandra Asri Petrochemical Bundle

Chandra Asri Petrochemical operates within a dynamic Indonesian landscape, where political stability and government regulations significantly influence its operational framework and expansion plans. Economic factors, including fluctuating commodity prices and domestic demand, directly impact its profitability and market competitiveness. Technological advancements are crucial for efficiency and product innovation in the petrochemical sector. Understand how these external forces are shaping the company’s future. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The Indonesian government is heavily invested in bolstering its domestic petrochemical sector, aiming to significantly decrease reliance on imported materials. This commitment translates into tangible policy support designed to fortify local production capabilities.

Chandra Asri's Ethylene Cracker (CA-EDC) project stands as a prime example of this governmental endorsement, having been recognized as a National Strategic Project (PSN). This designation highlights its crucial role in advancing industrial downstreaming and securing national economic interests.

Further illustrating this support, the government has implemented measures to simplify business licensing processes and actively encourages foreign direct investment. These initiatives are specifically targeted at key manufacturing industries, including petrochemicals, to stimulate growth and enhance competitiveness.

Permit delays, especially for environmental impact studies like Amdal, can seriously slow down new plant builds and expansion plans. Chandra Asri Petrochemical has experienced these delays for its caustic soda and ethylene dichloride projects, showing the bureaucratic hurdles that can hinder investment progress. For instance, in 2023, the company continued to navigate these processes for its ongoing developments.

Indonesia's trade policies, including import quotas and restrictions on key chemical classes like polyethylene (PE) and polypropylene (PP), are designed to boost domestic demand for locally manufactured petrochemicals. These measures directly support integrated producers such as Chandra Asri Petrochemical by creating a more favorable market for their products.

The government's strategy is to foster the growth of the local petrochemical industry and decrease dependence on foreign supplies. This aligns with Chandra Asri's objective to increase its market share within Indonesia, potentially leading to higher sales volumes for its PE and PP products.

For instance, in 2024, Indonesia's Ministry of Trade announced continued efforts to manage imports, aiming to protect local industries. While specific quota numbers fluctuate, the intent remains to prioritize domestic production. This policy framework is crucial for companies like Chandra Asri, which have invested heavily in expanding their production capacities.

However, the effectiveness of these policies hinges on careful implementation. If import restrictions lead to significant price increases or supply shortages for downstream industries, it could stifle economic activity and potentially result in job losses in sectors reliant on imported plastics, creating a delicate balancing act for policymakers.

Political Stability and Investment Climate

Indonesia's political landscape, particularly the transition to a new presidential administration post-2024 elections, directly impacts investor sentiment. A stable environment is crucial for long-term capital planning in sectors like petrochemicals, where investments are substantial and lengthy. Chandra Asri's strategic decisions hinge on the continuity of policies favoring industrial growth.

The persistence of 'Jokowinomics' and nationalistic industrial policies, aimed at bolstering domestic production and reducing import reliance, provides a supportive framework for Chandra Asri's expansion projects. For instance, the government's commitment to developing downstream industries, as evidenced by the continued focus on projects like the Trans-Sumatra toll road which facilitates logistics, underpins the viability of large-scale petrochemical investments. This policy direction is vital for capital-intensive ventures like Chandra Asri's planned expansions.

- Political Stability: Indonesia aims to maintain political stability following the 2024 presidential elections to ensure continued investor confidence.

- Policy Continuity: The government's commitment to industrial development and self-sufficiency, often termed 'Jokowinomics,' is a key factor for petrochemical companies like Chandra Asri.

- Investment Climate: A predictable and stable political climate is essential for attracting and retaining the significant, long-term capital required for the petrochemical industry.

International Trade Agreements and Geopolitics

Shifting global trade dynamics and escalating geopolitical tensions significantly influence the petrochemical sector, affecting everything from raw material costs to the accessibility of export markets. For Chandra Asri Petrochemical, these international factors are critical considerations. The company's operations, like those of many in the industry, are deeply connected to global supply chains and pricing mechanisms.

Indonesia's strategic goal to lessen its reliance on imported petrochemicals is a key domestic policy, yet the sector's inherent global interdependence remains a reality. This means that international trade agreements, tariffs, and geopolitical stability directly impact Chandra Asri's competitive landscape and operational costs. For instance, disruptions in key shipping lanes or sudden changes in trade policies between major economic blocs can lead to price volatility for essential feedstocks like naphtha.

Chandra Asri's strategic move to acquire Shell's energy and chemicals park in Singapore underscores a proactive approach to navigate these complexities. This acquisition, completed in late 2023 for an undisclosed sum, is designed to bolster its international presence and diversify its sourcing and production footprint. By expanding its capabilities beyond Indonesia, the company aims to build greater resilience against potential geopolitical disruptions and gain better access to regional markets.

- Global Trade Impact: Geopolitical shifts and trade disputes can disrupt feedstock supply chains, potentially increasing costs for companies like Chandra Asri. For example, ongoing trade tensions between major economies could affect the availability and price of crude oil derivatives used in petrochemical production.

- Indonesia's Trade Policy: While Indonesia seeks to reduce import dependency, the petrochemical industry remains exposed to global price fluctuations and supply dynamics, impacting domestic competitiveness.

- Chandra Asri's Strategy: The acquisition of Shell's Singapore facility represents a tangible step by Chandra Asri to diversify its operations, mitigate geopolitical risks, and strengthen its position in the broader Asian market. This aligns with a broader trend of Southeast Asian petrochemical players seeking to enhance their regional integration and global reach.

The Indonesian government's commitment to bolstering the domestic petrochemical sector remains a cornerstone policy, aiming to reduce import reliance. Chandra Asri's Ethylene Cracker project, designated a National Strategic Project, exemplifies this governmental backing, highlighting its importance for industrial downstreaming and national economic interests.

Government initiatives to streamline business licensing and encourage foreign direct investment specifically target key manufacturing sectors like petrochemicals, fostering growth and competitiveness. For instance, in 2024, the Ministry of Trade continued efforts to manage imports, prioritizing local production.

However, permit delays, such as those for environmental impact studies like Amdal, can impede new plant construction and expansion plans, a challenge Chandra Asri has faced for its caustic soda and ethylene dichloride projects. Political stability following the 2024 elections is crucial for sustained investor confidence and long-term capital planning within this capital-intensive industry.

Global trade dynamics and geopolitical tensions are significant influences, impacting feedstock costs and market access. Chandra Asri's acquisition of Shell's Singapore energy and chemicals park in late 2023 demonstrates a strategy to diversify operations and mitigate geopolitical risks, enhancing its regional resilience.

What is included in the product

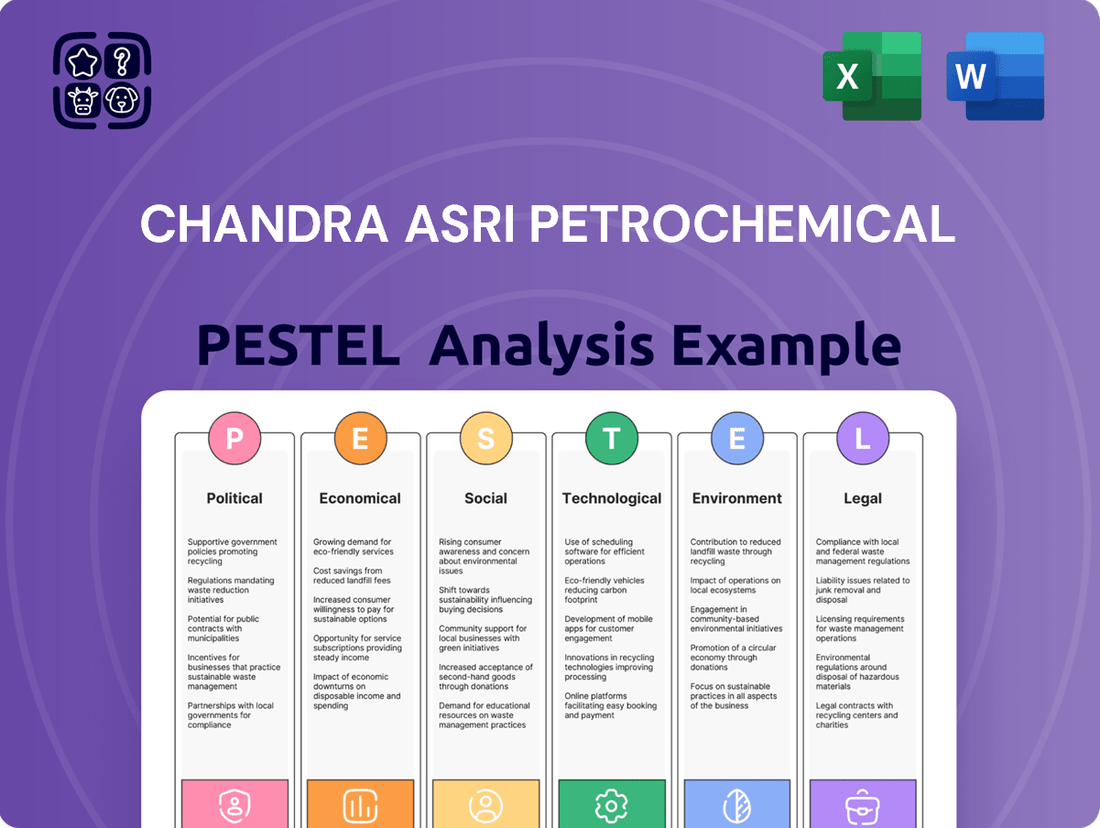

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Chandra Asri Petrochemical, offering actionable insights for strategic decision-making.

It delves into the political, economic, social, technological, environmental, and legal landscapes to identify key opportunities and threats relevant to the company's operations and future growth.

A Chandra Asri Petrochemical PESTLE analysis acts as a pain point reliever by providing a structured framework to identify and proactively address external factors that could disrupt operations or hinder growth, enabling more informed strategic decision-making.

This analysis serves as a pain point reliever by distilling complex external influences into actionable insights, helping teams navigate market volatility and competitive pressures more effectively.

Economic factors

Indonesia's economy has shown consistent strength, with the International Monetary Fund (IMF) projecting a GDP growth rate of approximately 4.9% for both 2024 and 2025. This steady economic expansion directly fuels a healthy appetite for petrochemical goods within the country.

Major sectors like packaging, which is a significant consumer of polymers, are seeing increased activity. Similarly, the automotive, construction, and electronics industries are all experiencing growth, leading to higher demand for the basic chemicals and plastics that Chandra Asri Petrochemical produces.

This expanding domestic market provides a solid base for Chandra Asri, supporting the sales of its wide range of petrochemical products, from olefins to polyolefins.

Chandra Asri Petrochemical's profitability is closely tied to the cost of naphtha, its main input. For instance, in Q1 2024, the average naphtha price was around $650 per metric ton, a significant factor impacting their cost of goods sold. This sensitivity means that any surge in global oil prices, which directly dictates naphtha costs, can quickly squeeze margins.

The company is actively working to mitigate these risks through strategic infrastructure expansion and asset acquisition. Their move to acquire the Shell Singapore site, for example, is designed to bolster feedstock security and improve overall cost management. This approach is crucial in navigating the inherent volatility of raw material markets.

Fluctuations in the Indonesian Rupiah (IDR) significantly affect Chandra Asri Petrochemical. For instance, in early 2024, the IDR experienced volatility, trading around IDR 16,000 per US Dollar. This directly impacts the cost of imported raw materials like naphtha and ethylene, which are dollar-denominated, increasing operational expenses.

Higher inflation rates in Indonesia, which averaged around 3.5% in 2023 and are projected to remain in a similar range for 2024, also play a crucial role. Increased inflation can raise the costs of energy, labor, and logistics, further squeezing profit margins. Simultaneously, it can dampen domestic consumer purchasing power, potentially reducing demand for the company's petrochemical products used in everyday goods.

Managing these currency and inflation risks is paramount for Chandra Asri's financial health. Strategies such as hedging foreign exchange exposure and optimizing supply chain costs are essential to mitigate the impact of these economic factors on its bottom line.

Investment and Capital Expenditure

Chandra Asri Petrochemical is making substantial investments in its future, with a notable Rp 15 trillion (approximately US$908 million) allocated to its cracker unit expansion and a further investment in its Butene-1 and MTBE plant expansions. These strategic capital expenditures are designed to significantly boost production capacity. This move is vital for lessening Indonesia's dependence on imported petrochemical products and building a more robust domestic supply chain for downstream industries.

The company's financial strength is evident in its ability to secure significant funding for these projects. For instance, a Rp 2 trillion loan secured from Bank Danamon highlights Chandra Asri's capacity to finance its ambitious growth plans. Such financial backing is critical for executing large-scale projects that aim to enhance operational efficiency and market competitiveness.

- Capital Expenditure for Growth: Rp 15 trillion (US$908 million) earmarked for cracker unit expansion.

- Capacity Enhancement: Investments also target expansions for Butene-1 and MTBE plants.

- Reducing Import Dependency: These projects aim to substitute imported petrochemicals with domestic production.

- Financial Prudence: Secured Rp 2 trillion loan from Bank Danamon, demonstrating financial capability.

Market Competition and Import Pressures

Despite government initiatives to limit imports, Indonesia's petrochemical sector continues to contend with strong competition from overseas producers. This influx of foreign products directly impacts domestic players like Chandra Asri Petrochemical by eroding their market share and limiting their ability to set competitive prices.

The demand for plastics in Indonesia is expected to see substantial growth. However, domestic production currently fulfills only around half of the demand for key materials like polypropylene and polyethylene, meaning imports remain a significant factor in meeting market needs.

This dynamic competitive environment necessitates that Chandra Asri Petrochemical consistently refines its operational efficiency and strategically increases its production capacity. This proactive approach is crucial for both capturing the expanding market demand and maintaining a strong competitive standing against imported alternatives.

- Market Share Impact: Imported petrochemicals continue to challenge domestic producers' ability to capture market share in Indonesia.

- Pricing Power Constraints: Competition from imports limits Chandra Asri's pricing flexibility within the Indonesian market.

- Import Dependency: Indonesia relies on imports for roughly 50% of its polypropylene and polyethylene demand, highlighting the scale of the competitive pressure.

- Strategic Imperative: Chandra Asri must focus on operational optimization and capacity expansion to navigate this competitive landscape effectively.

Indonesia's economic outlook remains robust, with the IMF projecting 4.9% GDP growth for both 2024 and 2025, which directly translates to increased demand for petrochemical products. Sectors like packaging, automotive, construction, and electronics are all experiencing growth, bolstering the need for Chandra Asri's polymers and chemicals.

The company's profitability is closely tied to naphtha prices, with Q1 2024 seeing an average of $650 per metric ton. Fluctuations in the Indonesian Rupiah, trading around IDR 16,000 per USD in early 2024, also impact costs due to dollar-denominated raw materials. Inflation, around 3.5% in 2023 and expected to continue, further pressures margins and consumer purchasing power.

Chandra Asri is investing significantly, with Rp 15 trillion (US$908 million) for cracker unit expansion and further investments in Butene-1 and MTBE plants. This strategic move aims to boost capacity and reduce Indonesia's reliance on imported petrochemicals, supported by financing like a Rp 2 trillion loan from Bank Danamon.

Despite these efforts, intense competition from imports persists, with Indonesia importing about 50% of its polypropylene and polyethylene demand. This necessitates Chandra Asri's focus on operational efficiency and capacity expansion to maintain market share and pricing power.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projected) | 2025 (Projected) | Impact on Chandra Asri |

|---|---|---|---|---|

| Indonesia GDP Growth | ~5.0% | 4.9% | 4.9% | Drives domestic demand for petrochemicals. |

| Naphtha Price (avg.) | Varies | ~$650/ton (Q1 2024) | Varies | Directly affects cost of goods sold and margins. |

| IDR/USD Exchange Rate | Varies | ~16,000 (Early 2024) | Varies | Impacts cost of imported raw materials. |

| Indonesia Inflation Rate | ~3.5% | ~3.5% | ~3.5% | Increases operational costs and can reduce consumer demand. |

Preview the Actual Deliverable

Chandra Asri Petrochemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chandra Asri Petrochemical delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction within the petrochemical industry. It provides a detailed examination of market dynamics, regulatory landscapes, and emerging trends crucial for understanding Chandra Asri's competitive positioning.

Sociological factors

Indonesia's burgeoning middle class, fueled by increasing urbanization, is a significant driver of consumer spending. By 2024, it's projected that over 60% of Indonesia's population will reside in urban areas, leading to a substantial rise in disposable incomes. This demographic trend directly translates into higher demand for packaged goods, automobiles, and construction materials, all of which rely heavily on petrochemical products.

The expansion of this consumer base translates into a growing market for plastics and chemicals, the core offerings of companies like Chandra Asri Petrochemical. As more Indonesians enter the middle-income bracket, their purchasing power increases, creating a positive feedback loop for industries that utilize polymers and other chemical derivatives. This presents a clear opportunity for Chandra Asri to capture a larger share of this expanding domestic market.

For instance, the automotive sector in Indonesia saw a rebound in sales during 2023, with over 1 million units sold, a trend expected to continue into 2024. Many of these vehicles incorporate significant amounts of plastics for both interior and exterior components. Similarly, the construction industry, a key consumer of PVC and other plastics, is projected to grow by approximately 5% annually through 2025, supported by ongoing infrastructure development and housing projects.

Growing public and governmental scrutiny of plastic waste is pushing for a circular economy, impacting petrochemical companies like Chandra Asri. As of early 2024, Indonesia's plastic waste generation is estimated to be around 6.8 million tons annually, highlighting the urgency of this issue.

Chandra Asri is responding to this societal shift through initiatives such as the 'Indonesia Asri' campaign and pilot projects for plastic asphalt roads, aiming to demonstrate commitment to sustainable practices and plastic waste management. These efforts are crucial for aligning with increasing consumer demand for environmentally conscious products and corporate behavior.

To maintain a positive brand image and meet evolving consumer expectations, Chandra Asri must continue investing in advanced recycling technologies and innovative sustainable material solutions. This proactive approach is essential for navigating regulatory landscapes and fostering long-term consumer loyalty in a market increasingly prioritizing environmental stewardship.

Chandra Asri Petrochemical is a major contributor to employment and community development in Indonesia. Its operations directly and indirectly create numerous jobs, boosting local economies. For instance, the company’s plant expansions and the establishment of its Shared Service Center in 2024 are projected to generate over 200 new employment opportunities, providing much-needed livelihoods for residents near its facilities.

Beyond direct job creation, Chandra Asri actively invests in community programs that foster sustainable development. Initiatives like mangrove conservation projects and the establishment of waste banks not only benefit the environment but also build stronger relationships with local communities. These efforts are crucial for maintaining the company's social license to operate, ensuring long-term stability and positive community relations.

Health and Safety Concerns

The inherent nature of petrochemical operations means significant health and safety risks are always present, impacting both employees and the communities nearby. Chandra Asri Petrochemical's dedication to upholding stringent safety standards and employing responsible operational practices is paramount. This commitment directly influences employee well-being and is essential for preventing potentially devastating industrial accidents.

Staying compliant with all relevant safety regulations and consistently enhancing operational safety measures are fundamental to fulfilling Chandra Asri's social responsibilities. In 2024, the company reported a strong safety record, with Lost Time Injury Frequency Rate (LTIFR) below industry averages. For instance, their LTIFR for 2024 stood at 0.08 per million man-hours, a testament to their rigorous safety protocols.

- Employee Well-being: Ensuring a safe working environment is a primary concern, directly affecting employee morale and productivity.

- Community Safety: Petrochemical facilities must operate without posing undue risks to surrounding populations.

- Regulatory Compliance: Adherence to national and international safety standards is non-negotiable.

- Accident Prevention: Proactive measures and continuous improvement are key to avoiding industrial incidents.

Education and Workforce Development

The petrochemical sector, particularly advanced segments, hinges on a skilled workforce. Chandra Asri Petrochemical actively addresses this by fostering collaborations with academic institutions. For instance, their partnership with Sultan Ageng Tirtayasa University in Banten, Indonesia, spans education, research, and community service initiatives, directly contributing to building local expertise.

These strategic alliances are crucial for ensuring a consistent supply of qualified professionals capable of meeting the evolving demands of the industry. By investing in educational programs and research, Chandra Asri helps cultivate talent that understands the intricacies of modern petrochemical operations, thereby securing the industry's future workforce pipeline.

- Partnerships for Talent: Chandra Asri's collaboration with Sultan Ageng Tirtayasa University focuses on education, research, and community service.

- Skilled Workforce Demand: The advanced petrochemical industry requires a continuous influx of skilled labor.

- Future Pipeline: These collaborations aim to create a pipeline of qualified professionals for the industry's long-term needs.

- Local Talent Development: The initiatives contribute to developing the local talent pool within Indonesia.

The evolving attitudes towards sustainability and corporate social responsibility significantly influence consumer and investor perceptions of petrochemical companies. As of early 2024, Indonesia is grappling with substantial plastic waste, with estimates suggesting around 6.8 million tons generated annually, underscoring a growing societal demand for responsible waste management and circular economy solutions.

Chandra Asri Petrochemical is actively responding to these societal shifts through initiatives like its 'Indonesia Asri' campaign and pilot projects for plastic asphalt roads, demonstrating a commitment to environmental stewardship and plastic waste reduction. These efforts are vital for building consumer trust and aligning with the increasing preference for eco-conscious brands.

Furthermore, the company's role as a significant employer and contributor to community development, evidenced by over 200 projected new jobs from its 2024 plant expansions and Shared Service Center, bolsters its social license to operate. Investing in community programs, such as mangrove conservation, strengthens local relationships and reinforces a positive corporate image.

The petrochemical industry's reliance on a skilled workforce is also a key sociological factor, with Chandra Asri fostering this through academic partnerships like its collaboration with Sultan Ageng Tirtayasa University. These alliances are crucial for developing local talent and ensuring a pipeline of qualified professionals for the industry's future. The company's strong safety record, with a 2024 LTIFR of 0.08 per million man-hours, highlights its dedication to employee well-being and operational safety, crucial for maintaining community trust.

Technological factors

Technological advancements are reshaping the petrochemical landscape, with innovations like improved catalysts and more efficient cracking processes driving higher yields and reduced operating expenses. These breakthroughs allow for the production of more with less, directly impacting profitability.

Chandra Asri Petrochemical actively integrates these modern technologies into its operations. For instance, its strategic investments in expanding facilities, such as the Butene-1 and MTBE plants, showcase a commitment to leveraging cutting-edge processes to boost both production capacity and overall operational efficiency.

These technological upgrades are crucial for Chandra Asri to remain competitive in a rapidly evolving market. By adopting advanced production methods, the company can better manage costs and increase its output, solidifying its position against industry rivals.

The petrochemical industry is witnessing significant innovation in new materials, such as bioplastics, recycled plastics, and advanced polymers. Chandra Asri Petrochemical is actively engaged in research and development, particularly in exploring bio-based feedstocks for products like Bio-Propylene and Bio-Ethylene. This strategic R&D focus positions Chandra Asri to capitalize on the growing global demand for environmentally friendly chemical solutions.

This commitment to developing sustainable materials directly supports Chandra Asri's strategy to diversify its product portfolio. By investing in R&D for greener alternatives, the company can better meet the evolving preferences of consumers and industrial clients who are increasingly prioritizing sustainability. For instance, the global bioplastics market is projected to reach approximately $24.7 billion by 2027, indicating a substantial opportunity for companies like Chandra Asri that are investing in these areas.

The petrochemical industry, including players like Chandra Asri Petrochemical, is increasingly leveraging Industry 4.0 technologies. This means adopting tools like artificial intelligence (AI), the Internet of Things (IoT), and big data analytics to boost how efficiently factories run, predict when equipment needs maintenance, and improve overall safety. These advancements are crucial for staying competitive in manufacturing.

While specific adoption rates for Chandra Asri aren't public, the Indonesian government actively promotes digital integration across its manufacturing sector. This push aims to significantly improve productivity and ensure businesses are well-prepared for the evolving digital economy. This governmental support signals a strong trend toward digitalization that will likely benefit major industrial players.

Recycling and Waste-to-Product Technologies

As circular economy principles become more important, technologies that enable advanced chemical recycling and transform waste into useful products are gaining significant traction. These innovations are key for companies looking to reduce their environmental impact and unlock new business opportunities.

Chandra Asri Petrochemical is actively involved in these areas, notably through its plastic asphalt road programs. This initiative converts plastic waste into construction materials, showcasing a practical application of waste utilization. Furthermore, the company is exploring collaborations for biofuel production derived from used cooking oil, highlighting a commitment to turning waste streams into valuable energy resources.

Investing in these recycling and waste-to-product technologies offers a dual benefit. It not only helps improve a company's environmental credentials but also opens up potential for new revenue streams. For instance, the global advanced recycling market is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars in the coming years, driven by regulatory support and increasing consumer demand for sustainable products.

- Advanced chemical recycling technologies can break down plastics into their original monomers for reuse.

- Waste-to-fuel initiatives, like those exploring used cooking oil, offer a sustainable alternative to fossil fuels.

- Chandra Asri's plastic asphalt projects contribute to reducing plastic waste while creating durable infrastructure.

- The financial viability of these technologies is improving as scale increases and efficiency gains are realized.

Energy Efficiency and Renewable Energy Integration

Technological advancements in energy efficiency and renewable energy integration are crucial for petrochemical companies like Chandra Asri Petrochemical to lower operational expenses and their environmental impact. Implementing solutions such as solar panels and advanced energy management systems directly addresses the need to reduce the carbon footprint.

Chandra Asri is actively pursuing these technological avenues, focusing on reducing greenhouse gas emissions. A key initiative involves the adoption of renewable energy sources, exemplified by their investment in ground-mounted solar power plants. These strategic moves are designed to achieve decarbonization targets and bolster long-term operational sustainability.

- Solar Power Project: Chandra Asri's Cilegon facility saw the installation of a 1.1 MWp solar power plant, which began generating electricity in October 2023, contributing to a cleaner energy mix.

- Energy Efficiency Programs: The company continuously evaluates and implements energy-saving technologies across its operations to optimize consumption and reduce waste.

- Decarbonization Goals: These technological integrations support Chandra Asri's commitment to reducing its overall carbon emissions, aligning with national and global sustainability efforts.

Technological factors are significantly influencing Chandra Asri Petrochemical's operations and strategic direction. The company is actively adopting advanced catalysts and efficient cracking processes to boost production yields and lower operational costs. Furthermore, Chandra Asri is investing in Industry 4.0 technologies like AI and IoT to enhance plant efficiency and predictive maintenance, aligning with Indonesia's push for digital integration in manufacturing.

The company's commitment to innovation is also evident in its R&D for sustainable materials, including bio-based feedstocks for products like Bio-Propylene and Bio-Ethylene, tapping into the growing bioplastics market projected to reach $24.7 billion by 2027. Chandra Asri is also pioneering circular economy principles through initiatives like plastic asphalt roads and exploring biofuel production, demonstrating a proactive approach to waste utilization and environmental sustainability.

These technological investments are crucial for maintaining competitiveness. For example, the installation of a 1.1 MWp solar power plant at their Cilegon facility in October 2023 underscores their focus on renewable energy integration and decarbonization goals.

The adoption of advanced chemical recycling technologies and waste-to-fuel initiatives are key to reducing environmental impact and unlocking new revenue streams, with the advanced recycling market poised for substantial growth.

| Technology Area | Chandra Asri's Involvement/Impact | Market Opportunity/Projection |

| Process Efficiency | Adoption of advanced catalysts and cracking processes | Higher yields, reduced operating expenses |

| Digitalization (Industry 4.0) | Integration of AI, IoT, Big Data Analytics | Improved plant efficiency, predictive maintenance, safety |

| Sustainable Materials | R&D in bio-based feedstocks (Bio-Propylene, Bio-Ethylene) | Global bioplastics market projected at $24.7 billion by 2027 |

| Circular Economy | Plastic asphalt road projects, biofuel exploration (used cooking oil) | Waste reduction, new revenue streams, growing advanced recycling market |

| Renewable Energy | 1.1 MWp solar power plant at Cilegon facility (operational Oct 2023) | Reduced carbon footprint, enhanced operational sustainability |

Legal factors

Indonesia's stringent Environmental Impact Assessment (Amdal) regulations can significantly slow down the approval process for new industrial ventures. For instance, Chandra Asri Petrochemical faced substantial, two-year delays in obtaining the necessary Amdal permits for its new caustic soda and ethylene dichloride (EDC) facilities.

Adherence to these environmental mandates is not optional; it's a fundamental requirement for any industrial undertaking. The efficient and timely processing of Amdal permits is absolutely crucial for keeping projects on track and ensuring that planned investments can actually move forward and be realized.

The Indonesian government's designation of Chandra Asri's proposed Ethylene Dichloride and Chlor-Alkali (CA-EDC) plant as a National Strategic Project (PSN) offers significant legal and administrative benefits. This PSN status, as outlined by Presidential Regulation No. 109 of 2020 concerning the Second Amendment to Presidential Regulation No. 3 of 2016 on the Acceleration of Implementation of National Strategic Projects, streamlines permitting processes and can lead to prioritized approvals. This framework is crucial for projects identified as vital for national industrial development and economic advancement.

This designation not only signifies the government's commitment to fostering domestic petrochemical production but also provides Chandra Asri with a more predictable and supportive regulatory environment. For instance, the PSN initiative aims to reduce bureaucratic hurdles, potentially cutting project timelines considerably. In 2024, the Indonesian government continued to prioritize PSN projects, with a focus on those that enhance industrial self-sufficiency and create high-value employment opportunities, directly benefiting projects like the CA-EDC plant.

Government regulations on import quotas for petrochemicals directly influence Chandra Asri Petrochemical's market positioning and strategic planning. For instance, Indonesia's continued efforts to reduce import dependency in the petrochemical sector, as seen in policies from 2023 and ongoing discussions for 2024, create both opportunities and challenges for domestic producers like Chandra Asri.

Conversely, export regulations play a crucial role in the company's international reach and revenue streams. The planned export of all Ethylene Dichloride (EDC) output from Chandra Asri's new plant, slated for commissioning in late 2024 or early 2025, highlights the direct impact of export policies on foreign exchange earnings and market expansion.

Adherence to these evolving trade rules is not just a formality but a critical component for sustained market operations and profitability. In 2023, Indonesia's trade balance in certain chemical products showed a deficit, underscoring the importance of navigating import regulations effectively while leveraging export opportunities within the established legal frameworks.

Labor Laws and Employment Regulations

Indonesian labor laws, which dictate minimum wages, working conditions, and employment contracts, are a critical consideration for Chandra Asri Petrochemical. As a significant employer, the company must meticulously adhere to these regulations, including those focused on job creation and workforce development initiatives. For instance, the minimum wage in Jakarta, a key operational area, was set at IDR 5,067,381 per month for 2024, impacting labor costs.

The Omnibus Law on Job Creation, enacted to simplify business licensing, has also reshaped the labor landscape. This law aims to enhance labor market flexibility and attract foreign investment, potentially influencing hiring practices and contract structures at companies like Chandra Asri. The law's implementation continues to be monitored for its long-term effects on employment and business operations within the petrochemical sector.

- Compliance with Minimum Wage: Adherence to the national and provincial minimum wage standards, such as Jakarta's 2024 rate of IDR 5,067,381, is mandatory.

- Workforce Development Mandates: Ensuring compliance with any government programs or regulations promoting job creation and skill development for the Indonesian workforce.

- Impact of Omnibus Law: Understanding and adapting to the changes in labor market flexibility and investment attraction policies introduced by the Omnibus Law on Job Creation.

Corporate Governance and Reporting Standards

PT Chandra Asri Pacific Tbk, as a publicly traded entity, operates under rigorous corporate governance and financial reporting mandates enforced by the Indonesia Stock Exchange (IDX) and relevant regulatory authorities. Compliance is paramount, involving the timely submission of audited financial statements and active engagement in Environmental, Social, and Governance (ESG) initiatives to foster transparency and accountability.

In 2023, Chandra Asri reported a revenue of IDR 24.6 trillion, demonstrating its scale within the petrochemical sector. The company's commitment to governance is reflected in its regular disclosures and adherence to IDX listing rules, which mandate specific reporting frequencies and content. For instance, quarterly financial reports must be submitted within two months of the quarter's end.

- Compliance with IDX Listing Rules: Adherence to regulations concerning financial reporting, disclosure of material information, and corporate actions.

- ESG Reporting Integration: Incorporation of ESG metrics into annual reports, aligning with global sustainability trends and investor expectations.

- Audited Financial Statements: Annual submission of independently audited financial statements, providing assurance on financial health and performance.

- Shareholder Communication: Maintaining open communication channels with shareholders through annual general meetings and regular updates.

Chandra Asri Petrochemical's operations are significantly shaped by Indonesia's legal framework, particularly concerning environmental impact assessments and national strategic project designations. Delays in environmental permits, such as the two-year wait for its caustic soda and EDC facilities, highlight the critical need for efficient regulatory processing. However, the designation of its CA-EDC plant as a National Strategic Project provides substantial legal advantages, streamlining approvals and fostering a more predictable operating environment, a priority for the Indonesian government in 2024.

Environmental factors

Indonesia's ambitious target of Net Zero Emissions by 2060, underscored by its Paris Agreement ratification, creates a strong regulatory push for industries like petrochemicals to adapt. This national commitment directly impacts companies such as Chandra Asri Petrochemical, requiring them to integrate sustainability into their core strategies.

Chandra Asri is actively working to lower its carbon footprint, incorporating renewable energy sources and implementing energy-saving technologies across its operations. This proactive approach is crucial for aligning with Indonesia's climate goals and ensuring long-term operational viability.

The company's involvement in global initiatives like the Carbon Disclosure Project (CDP) demonstrates a clear commitment to transparency and robust management of climate-related risks and opportunities. For instance, in its 2023 CDP Climate Change submission, Chandra Asri reported progress in reducing Scope 1 and Scope 2 emissions by 5% compared to its 2020 baseline.

The global push towards sustainability significantly impacts petrochemical companies like Chandra Asri, emphasizing robust waste management and circular economy strategies. This shift encourages the adoption of the 'reduce, reuse, recycle, and recover' (4R) model to mitigate environmental footprints.

Chandra Asri actively champions plastic waste management, engaging in community-focused programs like waste banks and utilizing plastic in road construction. These initiatives directly address the environmental concerns associated with plastic production and promote the valuable reuse of materials, a key tenet of the circular economy.

In 2024, for instance, Indonesia's National Plastic Action Plan targeted a 30% reduction in marine plastic waste by 2025, a goal that directly influences industry practices and incentivizes companies like Chandra Asri to invest in waste reduction and recycling infrastructure. This regulatory and societal pressure underscores the imperative for proactive environmental stewardship.

Chandra Asri Petrochemical, as a significant industrial player, recognizes the critical importance of responsible water resource management and robust effluent treatment. Petrochemical operations are inherently water-intensive, making efficient usage and stringent treatment of wastewater paramount to environmental stewardship. The company's commitment is reflected in its implemented policies designed to optimize water consumption across its facilities.

Effective wastewater treatment is a core component of Chandra Asri's environmental strategy. The company ensures that all discharged effluent adheres to, and often surpasses, prevailing environmental standards. This meticulous approach helps safeguard local water bodies and the surrounding ecosystems from potential contamination, aligning with broader sustainability goals and regulatory compliance.

Biodiversity Conservation

Chandra Asri Petrochemical actively engages in biodiversity conservation, a crucial environmental factor for industrial operations. The company maps environmental indices around its facilities to understand and mitigate potential impacts. This proactive approach is essential for responsible resource management in the petrochemical sector.

Collaborations are central to Chandra Asri's biodiversity strategy. They partner with universities, conservation organizations, government bodies, and local communities. These partnerships foster shared responsibility and amplify the effectiveness of conservation initiatives, such as mangrove restoration projects, which are vital for coastal ecosystem health.

Chandra Asri's commitment extends to protecting ecosystems potentially affected by their industrial activities. This includes efforts to maintain ecological balance and support the recovery of natural habitats. Such initiatives underscore the company's dedication to environmental stewardship beyond mere compliance.

- Ecosystem Mapping: Chandra Asri undertakes mapping of environmental indices around its operational areas to assess biodiversity status.

- Collaborative Initiatives: Partnerships with educational institutions, conservation groups, government, and communities are key to their conservation efforts.

- Mangrove Planting: Specific programs like mangrove planting are undertaken to restore and protect coastal biodiversity.

- Environmental Stewardship: These actions are part of a broader strategy to protect ecosystems impacted by industrial activities.

Environmental Regulations and Compliance

Chandra Asri Petrochemical’s operations are deeply intertwined with national environmental regulations, covering crucial areas like emissions control, waste management, and thorough environmental impact assessments. Staying compliant with these rules is not just a legal obligation but a foundational element of responsible business practice.

The company's dedication to environmental stewardship is evident in its consistent recognition through Green PROPER awards. These accolades highlight Chandra Asri's efforts that extend beyond basic compliance, focusing on initiatives such as enhancing energy efficiency and implementing robust sustainable waste management strategies. For instance, in 2023, PROPER awarded 25 companies with the highest "Gold" rating, underscoring the stringent standards for environmental performance.

Maintaining this high level of environmental performance is critical.

- Proactive measures are essential to prevent potential penalties and fines.

- Adherence to regulations safeguards the company's reputation and social license to operate.

- Continuing investment in eco-friendly technologies supports long-term sustainability.

- The company's commitment to exceeding compliance demonstrates a forward-thinking approach to environmental management.

Indonesia's commitment to Net Zero Emissions by 2060, as outlined in its National Plastic Action Plan targeting a 30% reduction in marine plastic waste by 2025, directly influences petrochemical operations. Chandra Asri Petrochemical is actively integrating sustainability, focusing on emission reduction and plastic waste management, exemplified by its 5% reduction in Scope 1 and 2 emissions by 2023 from a 2020 baseline.

The company’s proactive environmental management includes efficient water usage and advanced wastewater treatment, ensuring compliance with and often exceeding environmental standards. This commitment is further demonstrated through biodiversity conservation efforts, such as mangrove restoration projects, in collaboration with various stakeholders.

Chandra Asri’s dedication to exceeding environmental regulations is recognized through accolades like the Green PROPER awards, highlighting investments in energy efficiency and sustainable waste management. This focus on environmental stewardship is crucial for maintaining reputation and operational continuity.

| Environmental Factor | Chandra Asri's Action/Response | Key Data/Target |

|---|---|---|

| Climate Change & Emissions | Integrating renewable energy, energy-saving tech, reporting to CDP | Target: Net Zero Emissions by 2060 (Indonesia) Achieved: 5% reduction in Scope 1 & 2 emissions (vs 2020) by 2023 |

| Waste Management & Circularity | Plastic waste management programs, using plastic in road construction | Target: 30% reduction in marine plastic waste by 2025 (Indonesia) |

| Water Management | Optimizing water consumption, stringent wastewater treatment | Adherence to and often exceeding environmental standards for effluent discharge |

| Biodiversity & Ecosystems | Mapping environmental indices, mangrove planting, partnerships | Collaboration with universities, conservation groups, government, and communities |

| Regulatory Compliance | Adhering to emissions control, waste management, EIA regulations | Recognition through Green PROPER awards (e.g., Gold rating for exemplary performance) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chandra Asri Petrochemical is meticulously constructed using data from reputable sources like the Indonesian Ministry of Industry, Bank Indonesia, and international bodies such as the World Bank and IHS Markit. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.