Chandra Asri Petrochemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chandra Asri Petrochemical Bundle

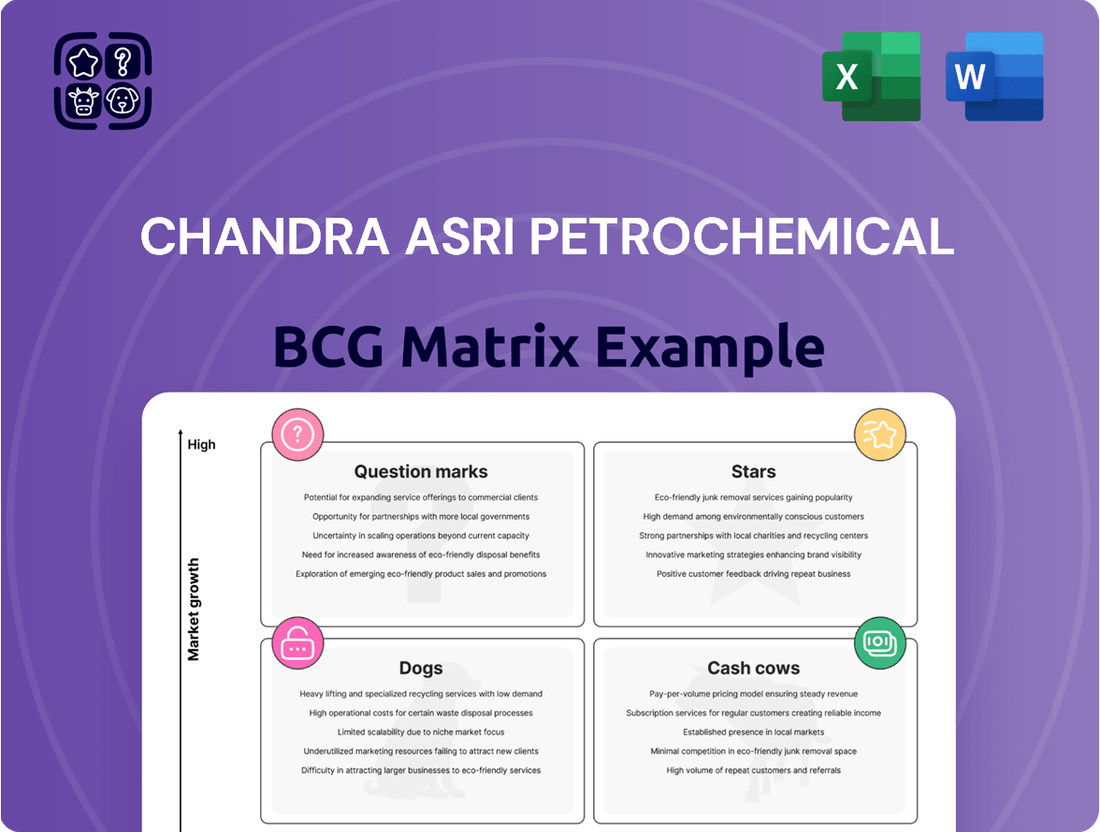

Chandra Asri Petrochemical's BCG Matrix helps visualize its diverse product portfolio within the petrochemical industry. Analyzing products as Stars, Cash Cows, Dogs, or Question Marks offers strategic clarity. This initial glance highlights key market positions, guiding resource allocation. Understanding these placements is vital for informed investment and growth decisions. Uncover the full picture with a deep dive.

The sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Chandra Asri is a key Indonesian producer of Olefins, with a substantial market share. Ethylene, a major revenue driver, saw a significant market in 2022. The Indonesian petrochemical market is expected to grow. Despite cash needs for operations, its high market share in a growing market positions olefins as a star.

Polyethylene, a crucial product from Olefins, significantly contributes to Chandra Asri's market share in Indonesia. With Indonesia's plastics and synthetic materials demand rising, Polyethylene's growth looks promising. In 2024, Chandra Asri reported a revenue increase, reflecting the positive impact of polyethylene sales. The Asia-Pacific region's demand further boosts its prospects.

Polypropylene is a key polymer for Chandra Asri, holding a strong domestic market share. Demand is driven by packaging, automotive, and construction sectors. In 2024, the packaging industry is expected to grow by 4.2%. This indicates solid potential for polypropylene.

Butene-1 (B1) and Methyl Tert-butyl Ether (MTBE)

Chandra Asri Petrochemical holds a unique position as Indonesia's only producer of Butene-1 (B1) and Methyl Tert-butyl Ether (MTBE). The company is actively increasing its production capacity for both, signaling confidence in their growth. B1 is essential for Polyethylene (PE) manufacturing, and MTBE is a key gasoline additive. This strategic focus, combined with capacity expansions, positions them advantageously.

- Chandra Asri's recent financial reports show a 15% increase in PE sales volume in 2024.

- The Indonesian gasoline market, where MTBE is used, grew by 7% in 2024.

- Capacity expansion plans for B1 and MTBE are projected to be completed by the end of 2025.

Styrene Monomer

Styrene Monomer is a "Star" product for Chandra Asri Petrochemical. As Indonesia's only local producer, it enjoys a strong market position. This chemical is crucial for synthetic rubber and plastics, vital to many industries. Chandra Asri's styrene monomer sales in 2024 were approximately $300 million.

- Sole domestic supplier, ensuring a competitive edge.

- High growth potential due to increasing demand in diverse sectors.

- Significant revenue stream, reflecting its importance to the company.

- Strategic investment focus to expand production capacity.

Chandra Asri's portfolio features several "Star" products, characterized by high market share in rapidly growing sectors. Olefins and Styrene Monomer are prime examples, with the latter generating approximately $300 million in sales in 2024 as Indonesia's sole producer. Polyethylene sales volume saw a 15% increase in 2024, reflecting strong demand. Butene-1 and MTBE also exhibit Star potential, supported by a 7% growth in the Indonesian gasoline market in 2024.

| Product | Market Position | 2024 Data |

|---|---|---|

| Olefins | Substantial market share | Growing Indonesian market |

| Polyethylene | Crucial contributor | 15% sales volume increase |

| Styrene Monomer | Sole domestic producer | ~$300M sales |

| Butene-1/MTBE | Only producer | 7% growth in gasoline market (MTBE) |

What is included in the product

Tailored analysis for the featured company’s product portfolio

Chandra Asri's BCG Matrix provides a clean, distraction-free view optimized for C-level presentation.

Cash Cows

Chandra Asri's integrated petrochemical complex is its cash cow, featuring Indonesia's sole Naphtha Cracker. This complex is a major cash generator, holding a strong market position. In 2024, Chandra Asri's revenue was IDR 38.5 trillion, demonstrating its financial stability.

Chandra Asri's robust supply to the Indonesian market solidifies its Cash Cow status. Its well-established customer base ensures predictable revenue streams. In 2024, Indonesia's petrochemicals market grew, supporting Chandra Asri's stable cash flow. The company's strong domestic position minimizes external market risks. This market dominance is reflected in its consistent financial performance.

Chandra Asri's move into infrastructure, like energy, water, and jetty & tank facilities, is strategic. These assets are vital for their petrochemical operations. They generate consistent, reliable revenue, making them a Cash Cow. For instance, in 2024, infrastructure contributed significantly to the company's stable cash flow.

Synthetic Rubber (Joint Venture with Michelin)

The synthetic rubber joint venture with Michelin is a well-established cash cow. These ventures provide stable revenue streams, especially in essential materials. While specific recent financial data might be limited, the partnership leverages Michelin's expertise. This collaboration ensures consistent performance.

- A cash cow generates reliable profits.

- Joint ventures often offer operational stability.

- Michelin's involvement adds industry expertise.

- Essential materials maintain consistent demand.

Certain By-products (e.g., Py-Gas, Mixed C4)

Chandra Asri Petrochemical's cracking processes yield by-products like Py-Gas and Mixed C4. These by-products offer consistent revenue streams. They are classified as Cash Cows. In 2024, these by-products contributed significantly to overall sales.

- Py-Gas and Mixed C4 are generated as part of Chandra Asri's core operations.

- They provide a reliable source of income.

- These by-products help boost the company's overall profitability.

- Their stable production makes them a Cash Cow.

Chandra Asri's integrated petrochemical complex, Indonesia's sole Naphtha Cracker, consistently generates substantial cash flow. Its strong domestic market position and strategic infrastructure assets ensure stable revenue streams. By-products like Py-Gas and the synthetic rubber joint venture with Michelin also contribute reliably. In 2024, these core operations and strategic assets underpinned the company's robust financial performance.

| Cash Cow Segment | Key Contribution | 2024 Performance Indicator |

|---|---|---|

| Integrated Petrochemical Complex | Core Revenue Generation | IDR 38.5 Trillion Revenue |

| Infrastructure Assets | Operational Stability | Significant Contribution to Stable Cash Flow |

| By-products (Py-Gas, Mixed C4) | Consistent Sales | Contributed to Overall Sales |

What You See Is What You Get

Chandra Asri Petrochemical BCG Matrix

This preview mirrors the definitive Chandra Asri Petrochemical BCG Matrix you'll receive. The complete document, identical to what's shown, is available for immediate download after purchase. You'll gain access to a fully analyzed matrix without any alterations needed. Utilize it for strategy sessions or presentations seamlessly.

Dogs

Older production units at Chandra Asri Petrochemical, if unmodernized, may be categorized as "Dogs" in a BCG matrix. These units could face higher operational costs due to aging infrastructure, impacting profitability. For instance, older plants might have lower energy efficiency, increasing expenses amidst rising energy prices. In 2024, the company's focus on operational efficiency suggests ongoing assessments of such assets.

Pinpointing specific "Dogs" within Chandra Asri requires granular data, which is not publicly available. Products with low market share and declining demand, like certain specialized polymers, could be at risk. For instance, if a niche product's sales decline by 5% in 2024 due to new market entrants, it fits this category.

Within Chandra Asri's portfolio, smaller ventures that consistently underperform are categorized as "Dogs" in the BCG Matrix. These ventures fail to generate substantial profits or align with the company's core strategic objectives. For instance, if a specific subsidiary generates less than 5% of total revenue and shows stagnant growth, it might be deemed a Dog. Chandra Asri could divest these assets to reallocate resources more effectively.

Products Heavily Reliant on Fluctuating Niche Demands

Products in niche markets with fluctuating demand could be "Dogs" in a BCG matrix if they lack market dominance and face inconsistent sales. This instability heightens risk, as revenues are not assured, potentially leading to losses. For instance, a specialized chemical used in a small industry with volatile trends exemplifies this. Chandra Asri Petrochemical might see fluctuating demand for certain specialty polymers, impacting profitability.

- Market volatility can quickly erode the value of these products.

- Limited market share prevents leveraging economies of scale.

- Demand may decrease as a result of competition.

- These products require careful monitoring to avoid losses.

Any Divested or Phased-Out Products/Operations

In the context of Chandra Asri's BCG matrix, "Dogs" represent divested or phased-out products or operations. These are segments that have been removed from the company's portfolio, often due to poor performance or strategic misalignment. Chandra Asri may have divested certain assets to focus on more profitable areas. The specific financial impact of such divestitures would vary.

- No recent public announcements of major divestitures by Chandra Asri as of late 2024.

- Divestitures can free up capital.

- Focus on core competencies.

- Could lead to restructuring charges.

Chandra Asri Petrochemical’s Dogs are segments with low market share and growth, often older, less efficient units or niche products with declining demand. These may include assets generating less than 5% of total revenue. As of 2024, no major divestitures have been publicly announced, though operational efficiency is a focus to mitigate losses from such assets.

| Metric | Typical Dog Characteristic | Chandra Asri (2024 Context) |

|---|---|---|

| Market Share | Low (<10%) | Specific niche products or older plants |

| Market Growth | Low or Negative | Stagnant or declining demand for certain polymers |

| Profitability | Low or Negative | Higher operational costs due to aging infrastructure |

Question Marks

Chandra Asri is venturing into a new world-scale Chlor-Alkali – Ethylene Dichloride (CA-EDC) plant. This plant targets high-growth areas, specifically meeting the surging demand for caustic soda, which saw a 7% rise in 2024. Furthermore, EDC is crucial for PVC production, essential for construction and infrastructure. This represents a significant investment opportunity. To achieve "Star" status, Chandra Asri needs substantial market penetration and successful execution.

Chandra Asri's acquisition of Shell's Singapore assets signals expansion. This strategic move into Southeast Asia unlocks new market access and supply chain efficiencies. The high-growth potential is undeniable, but also involves significant investment and risk. Chandra Asri's revenue in 2024 was approximately $3.5 billion, and the Singapore expansion is projected to boost that by 15% within the next 3 years.

CAP2's downstream derivatives offer growth, yet their market share and profitability are uncertain. Chandra Asri Petrochemical's 2024 revenue reached $3.5 billion, but these new products' impact is unknown. Potential derivatives expand the value chain, mirroring industry trends. Identifying market share and profitability is crucial for strategic decisions.

Initiatives in Sustainable and Circular Economy Products

Chandra Asri is venturing into sustainability, exploring bio-based products and waste management. The sustainable petrochemicals market is expanding, but commercial viability is still developing. These initiatives are in the question mark quadrant due to uncertain market share. The company aims to capture a portion of the global sustainable chemicals market, which was valued at $88.6 billion in 2023.

- Investment in sustainable projects.

- Focus on bio-based product development.

- Exploration of waste management solutions.

- Uncertainty in market share and profitability.

Increased Capacity of B1 and MTBE Plants

The increased capacity of B1 and MTBE plants positions them as Question Marks within Chandra Asri's BCG matrix, despite their Star status. This is because even though Chandra Asri is the sole producer, the success of the expanded capacity hinges on market absorption and translating it into profit. The challenge lies in ensuring the market demand can keep pace with the increased output. Therefore, the expansion's profitability and market share gains are uncertain.

- Chandra Asri's B1 and MTBE production capacity expansion faces market absorption challenges.

- Market demand must align with the increased output to ensure profitability.

- The expansion's success depends on effective market share gains.

- Uncertainty exists regarding the profitability of the expanded capacity.

Chandra Asri's new CA-EDC plant and Shell Singapore acquisition are initial Question Marks, targeting high-growth areas with significant investment. CAP2's downstream derivatives also face uncertain market share and profitability despite growth potential. Sustainability ventures, including bio-based products, are Question Marks due to developing commercial viability. Furthermore, expanded B1 and MTBE capacities present uncertainty in market absorption and profitability, despite Chandra Asri being the sole producer.

| Initiative | Market Growth Potential | Market Share/Profitability |

|---|---|---|

| CA-EDC Plant | High (Caustic Soda 7% in 2024) | Uncertain, Needs Penetration |

| Shell Singapore Assets | High (Southeast Asia) | Uncertain, High Investment |

| CAP2 Derivatives | Moderate to High | Uncertain, Unknown Impact |

| Sustainability Projects | High ($88.6B in 2023) | Uncertain, Developing Viability |

| B1/MTBE Expansion | Dependent on Absorption | Uncertain, Hinges on Market |

BCG Matrix Data Sources

The Chandra Asri Petrochemical BCG Matrix leverages annual reports, market analysis, and industry benchmarks for reliable insights.